Refractory Minerals Forum 2021 ONLINE Review

Outlook | China | India | Magnesia | Dolomite | Bauxite | Andalusite | Graphite | Chromite

As we head towards the halfway mark of what has proved to be another most challenging year for refractory minerals supply, we review the highlights and key take-aways of IMFORMED’s inaugural Refractory Minerals Forum 2021 ONLINE which took place 16-17 March 2021.

Title Image Hot Topics: a typical sample of andalusite from one of Imerys’ operations showing characteristic chiastolite crystals; although demand is healthy, suppliers face a range of challenges; (inset) Phil Edwards and Chris Parr, Imerys, discuss raw material selection trends with Mike O’Driscoll. Courtesy Imerys

Leading players from the international refractories market attended the two-day Forum listening to and networking with a high profile panel of expert speakers presenting on a range of key refractory mineral topics, with views on how the industry should evolve.

“I got a lot out of it. I found it very informative and a number of the presentations were directly relevant to my role”

Paul Wain, Purchasing Manager, DSF Refractories & Minerals Ltd, UK“It was a great experience to connect with all the global experts and have insightful discussions on refractory raw material and the recycling business”

Avinash Nigam, Corporate Commercial, JSW Steel Ltd, India“Great event… great content! My folks who attended had rave reviews”

Carol R. Jackson, Chairman and CEO, HarbisonWalker International, USA“Thanks to IMFORMED for another excellent and professionally run event, giving the global refractory community an opportunity to come together when we need it most”

Phil Edwards, Marketing Director – Refractory Producers, Imerys Refractories, Abrasives, Constructions, France

Free Refractory Minerals Forum 2021 ONLINE Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations plus access to live recording maybe purchased.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Like our delegates, we can’t wait until we can return to providing our usual high quality in-person Forums in 2022.

However, we know it is imperative to keep in contact and conversation. So, until then, we are determined to offer the industry an online alternative with which to assess the latest trends and developments, and provide an opportunity to pose questions and comment to our panel of experts.

Coming up in 2021

Fluorine Forum 2021 ONLINE 20 October

China Refractory Minerals Forum 2021 ONLINE 3 November

CALL FOR PAPERS!

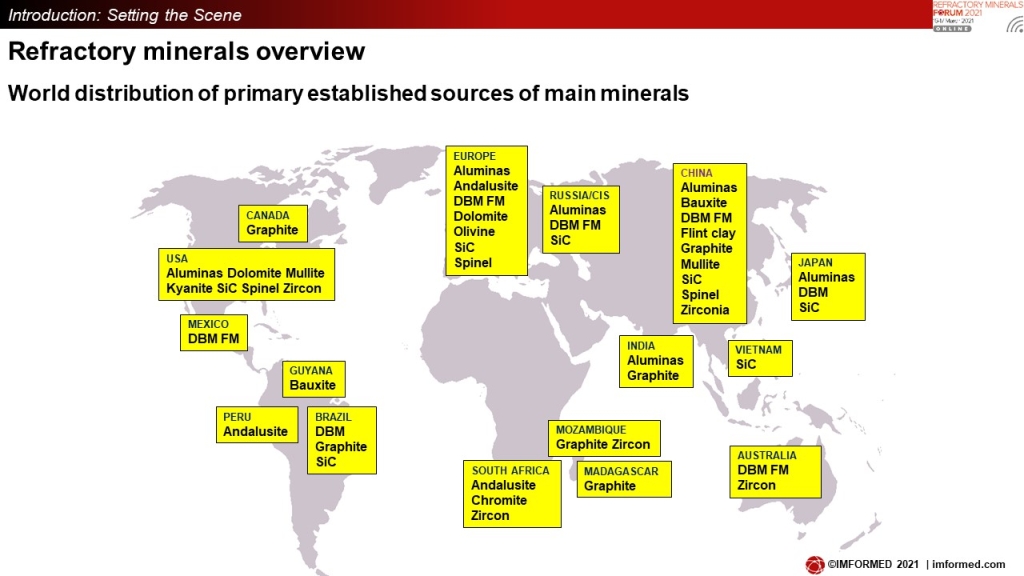

Refractory minerals overview: Setting the scene

Mike O’Driscoll, Director, IMFORMED

In introducing the Forum the scene was set by Mike O’Driscoll highlighting the role and importance of refractory minerals, their main sources and markets, and primary influencing factors on the market going forward.

Shaping the industry overall are the following factors and trends:

- COVID-19 impact on GDP and markets: in recovery, uncertain future.

- Revision of raw material sourcing, security, supply chain strategies; “decoupling” from China; select innovation & investment to “be ready”

- Corporate readjustment: rationalisation, consolidation; increase in M&A as companies restructure to survive

- More government policy input & drive, regions (eg. EC) to stimulate resource development & security; infrastructure projects to stimulate economies from COVID recession

- Environment to have greater and significant influence on market development and thus mineral demand; climate, CO2 reduction, energy use

- More “education” and profile on “essentiality” of refractory minerals

- More recycling from refractory waste + mine waste

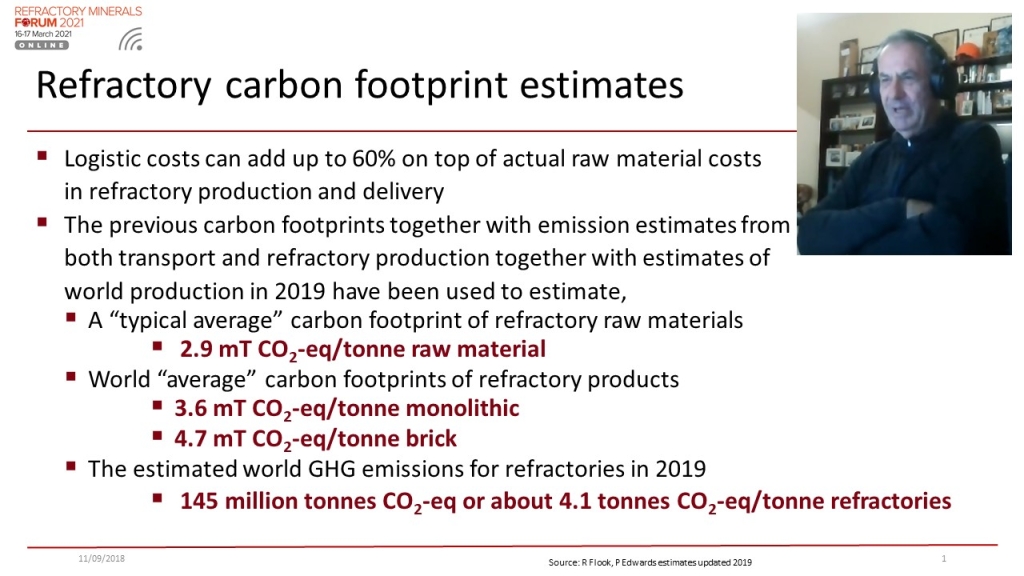

Refractory futures: the Circular Economy, climate change & its effect on refractory mineral markets

Dr Richard Flook, Managing Director, Mosman Resources, Australia

Richard Flook demonstrated how the significant factors of climate change and the Circular Economy are linked in their impact on refractory mineral markets, and covered in detail the refractory markets of steel, cement, mineral processing, then carbon capture (use) and storage (CC(U)S), hydrogen, and refractory raw materials.

Steel and cement producers are planning for increased CC(U)S and alternative fuels; particularly hydrogen and particularly for steel production which will require refractory reformulation, though it is too early to be specific about impact of hydrogen on refractory raw materials and refractory demand.

Iron ore producers could be a significant new group of refractory customers while EAF steel production (and refractories) will be the highest growth sector from a combination of recycling, emission reduction and potential hydrogen route.

Refractories have a low contribution to steel and cement CO2 emissions (~3% & <1% respectively) and there is a low incentive to reduce high CO2 emission refractory raw materials.

Increased cost/performance will remain the main refractory customer consideration. In some cases, lower burning temperatures may allow use of lower performance refractories and refractory raw materials.

Other factors to impact refractory raw materials include increased costs from reduction of CO2 emissions and/or potential cost of carbon and/or potential carbon border taxes; increased emphasis by customers on local and/or multiple supply routes (also from COVID19); and clinker substitutions in cement, increased EAF and higher steel prices from green hydrogen will reduce overall growth of refractory demand.

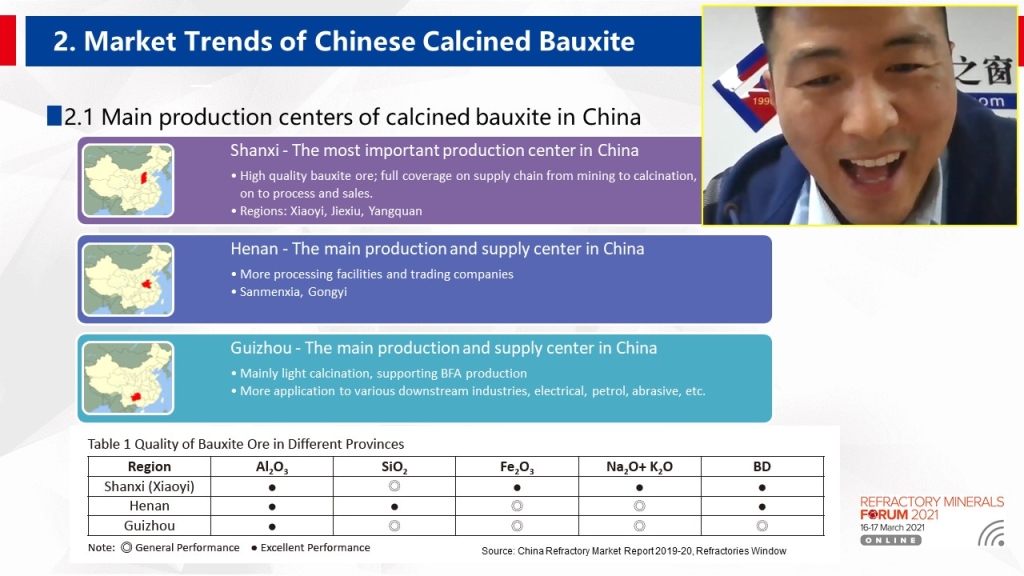

Latest supply trends for Chinese refractory minerals

Vincent Wong, Market Analyst, Refractories Window, China

Vincent Wong discussed the latest situation and outlook for the Chinese supply of refractory grade bauxite and magnesite.

Since 2017, non-metallurgical bauxite supply has significantly changed in China due to environmental protection regulations and activities which will continue in the coming years.

Wong expects regular bauxite production restriction and mine restrictions to continue with production costs increasing and profits will be further suppressed. Shortage of high grades of calcined bauxite will also be ongoing; ore supply cannot be solved in at least the coming 2-3 years, as sustainable supply becomes more and more important.

Regarding magnesia, Wong expected 2021 to be “a hard year full of uncertainties”.

Chief among the influences on Chinese magnesia will be Liaoning Government’s Action Plan: resource integration, establishment of two or three magnesite mining groups by 2030, and overall to strengthen the bargaining power of magnesia participants.

Wong described the plan as “Challengeable tasks with huge difficulties to push forward because it involves too many interests on different sides.”

Meanwhile, already in January 2021, the Liaoning Government had released the news of Baowu Steel to merge Haicheng Magnesite Corp.

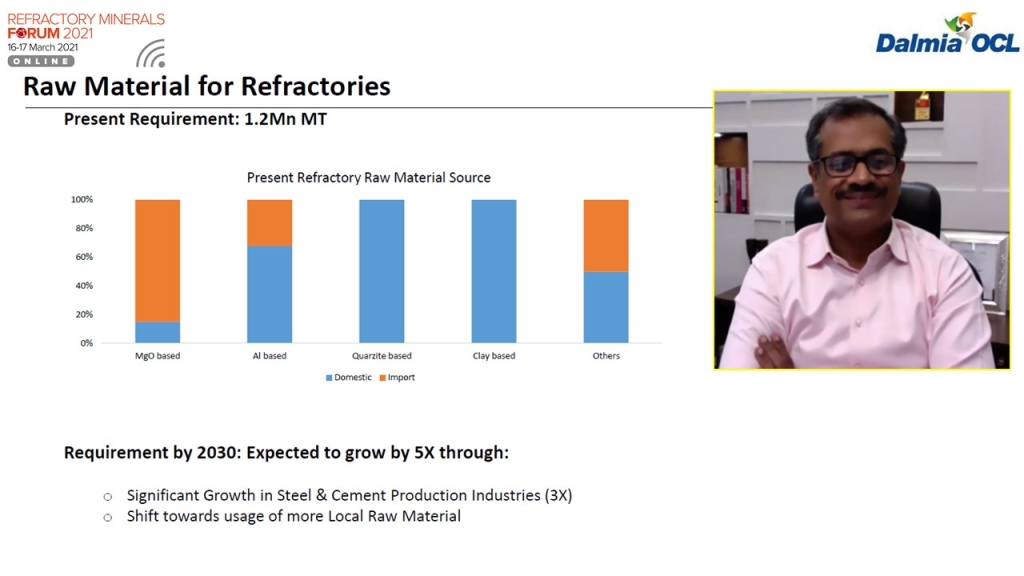

India’s response to refractory raw material supply & demand

Sameer Nagpal, CEO, Dalmia-OCL, India

The Indian refractory market is one of the world’s major consumers of refractory raw materials, and potential growth prospects are well recognised.

Sameer Nagpal provided an excellent review of the state of Indian economy, the Indian steel industry, the Indian refractory industry, raw materials for refractories, the challenges and opportunities for the sector and the way forward.

Challenges in refractory supply include a high dependence for imports on China; the geopolitical situation causes frequent disruptions in the supply chain; China’s environmental strategy also causes fluctuations in supply; a lack of a transparent price mechanism for refractory raw material; and logistics uncertainty leads to further complexity.

The way forward for India, considered Nagpal, must include a diversification of supply base beyond China and accelerating exploration of minerals in India.

Nagpal concluded that India continues to be a high growth market for the refractory industry and it was the right time to invest in India for the setting up of raw material processing units.

Short term response against potential disruption lies in alternative sources beyond China, with a technological push required for increasing recycling and utilisation of locally available minerals. Partnerships will be the key to success.

Overview of dolomite activities within RHI Magnesita

Thomas Frömmer, Senior VP Mining, RHI Magnesita, Austria

After a brief introduction to RHI Magnesita, which as well as a major magnesia producer is also the world’s leading producer of refractory dolomite, Thomas Froemmer presented on doloma in general, before focusing on the facilities and development of the York, USA, Chizhou, China, and Valenciennes/Flaumont, France, and Hochfilzen, Austria production centres.

Underpinning RHI Magnesita’s strategy is an investment of €85m over four years to secure the raw material supply and fulfil the dolomite demand.

While there are important upgrades at York and a revival and upgrade at Chizhou, it is perhaps the new plant and infrastructure (including a 1,185 metre conveyor tunnel from mine to plant) at Hochfilzen which is sparking most interest, with RHI Magnesita expecting dead burned dolomite production to commence there by the end of 2021.

A Year in Transition: 2021 Global Refractories Outlook

Carol Jackson, President, World Refractories Association & CEO, HarbisonWalker International, USA

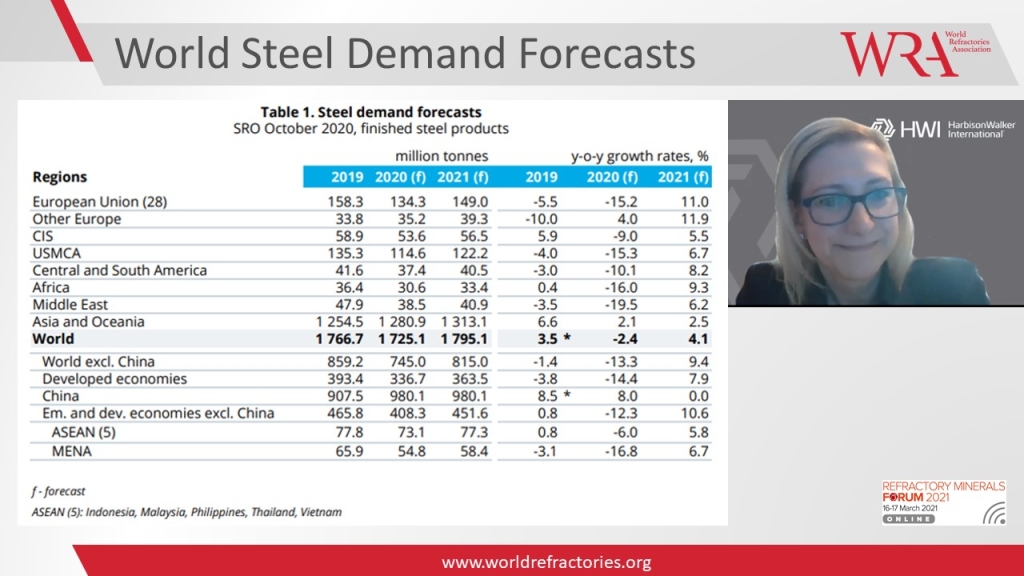

Carol Jackson’s talk, introduced as “a perspective through the lens of COVID 19”, centred on refractory manufacturing outlook and the downstream markets, as well as some insights and updates about the World Refractories Association (WRA), along with HWI’s industry outlook.

Jackson revisited the start of the pandemic in early 2020 when it became apparent that many policymakers and others had no idea that many products could not be produced without refractories.

Thus it became immediately necessary for the WRA to communicate that refractories were indeed an essential industry and vital to the manufacturing of countless goods that ensure the safety and security of our global community.

The industry has responded to an overall economic downturn, “And it is likely we won’t return to a pre‐COVID business environment until 2022” said Jackson.

Government policies and spending will have an impact, as infrastructure spending can boost refractory end markets and refractory demand, though we are likely to have different spending levels by region and country, depending on specific policies.

Refractory demand recovery from the pandemic will correlate with GDP and industrial recovery by region. Growth is expected for 2021, but different situations with the pandemic regionally will have different impacts. For instance, the US is expected to bounce back faster than Europe, which is continuing to experience new lockdowns in some countries. In emerging markets and developing economies, China and India are set to recover more quickly than countries in South America, such as Brazil.

Jackson extolled that it is incumbent upon refractory producers to maintain and even increase flexibility in operations “…so we can respond when industries need us. Our role is not changing, and we must be there and be ready when our customers need us…if

Refractory magnesia supply review (ex-China)

Mike O’Driscoll, Director, IMFORMED, UK

Mike O’Driscoll reviewed refractory minerals and magnesia, world refractory magnesia supply and trade, trends & developments, before concluding with his outlook.

While magnesia remains one of the most important refractory raw materials for the industry, accounting for 25-30% by volume of total refractory mineral demand, it is notable that overall, outside China, there are few primary refractory DBM/FM producing companies.

Indeed, these are mostly natural sourced magnesia and integrated with refractories production or refractories owner. There are very few independents, which are all synthetic sourced magnesia producers.

O’Driscoll summarised a raft of recent developments, including investments and expansions by Refratechnik, RHI Magnesita, Magnezit, Erdemir, Timab, and Possehl Erzkontor.

In conclusion, the outlook is likely to be shaped by the following trends:

- Ex-China magnesia producers strengthening resources, capabilities, vertical integration for supply security

- Continuing interest in developing alternative sources outside China, even as captive sources

- Interest in trade in crude MgCO3 ore; and developing crude ex-China MgCO3 ore sources/options

- Refractories industry to evaluate use of new & alternative materials & product formulations – increasing development of dolomite and synthetic minerals

- Dolomite resurgence? RHIM drive; Imerys’ 60% stake in Haznedar, Turkey (Aug. 2020) leaves independent Vardar Dolomit, North Macedonia (RHIM dolomite divestments to Intocast 2017)

- Increased refractory recycling and use of recycled material, eg. in 2020 RHIM initiated first recycling solutions contract with Chinese steelmaker and started recycling initiatives in Americas.

- India, Russia, China, India, NMEA and Asia Pacific seen as growth markets for magnesia, dolomite refractories

- Slow/flat steel market in West may increase magnesia diversification into speciality markets, push alternative processing/calcining technologies

Evolution of raw material selection for refractory applications

Phil Edwards, Refractory Market Director, & Chris Parr, VP Science & Technology, Imerys Refractories, Abrasives and Construction, France

Phil Edwards presented this co-authored paper with Chris Parr covering applications and material selection, external market forces and impact, and the next lines of raw materials.

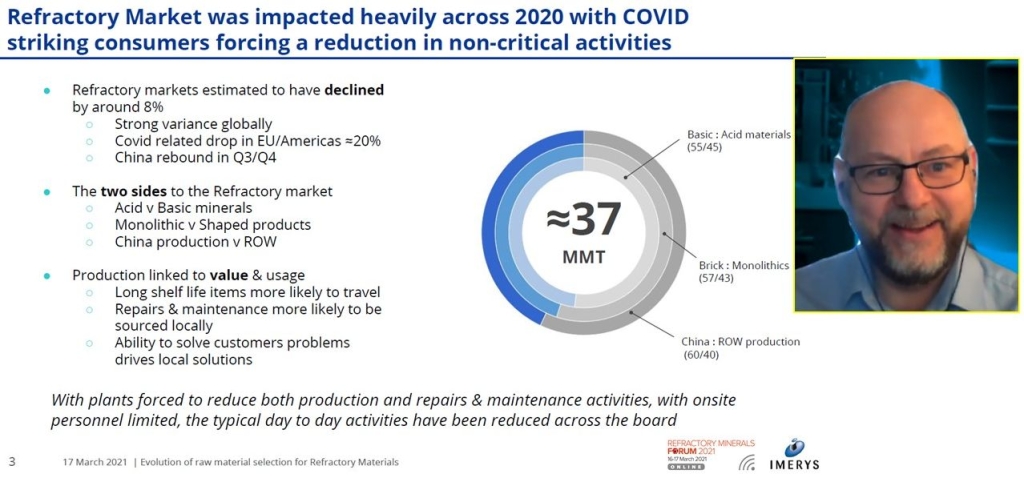

Edwards considered that refractory markets were estimated to have declined by around 8% worldwide, with a strong variance globally, a Covid related drop in EU/Americas by around 20%, and with a China rebound in Q3/Q4 2020.

Understanding where and how refractory products are used is critical to grasping their market dynamics. The value proposition of refractories create multiple solutions to what is considered a unique application.

Refractory customers have by necessity been the first adopters of the circular economy, with efforts to reuse and consume less, this has been at the heart of the “optimal solution”.

Refractory producers are seeing increasing consumer awareness and targets for the whole value chain around CO2 footprints, creating a new variable to the evaluation process.

Edwards concluded that history has proven that changes in the political and social landscape impact the value proposition for refractory products and will have an impact on the “optimal solution”: historically with labour costs and Installation methodology; how raw materials are used and consumed geographically; and now, supply chain and process methodology of those raw materials.

Imerys is aligning its innovation efforts within plants, processes and products to deliver refractory raw materials that are sustainable and offer the most flexibility to customers to achieve the “optimal solution”.

Refractory bauxite trends

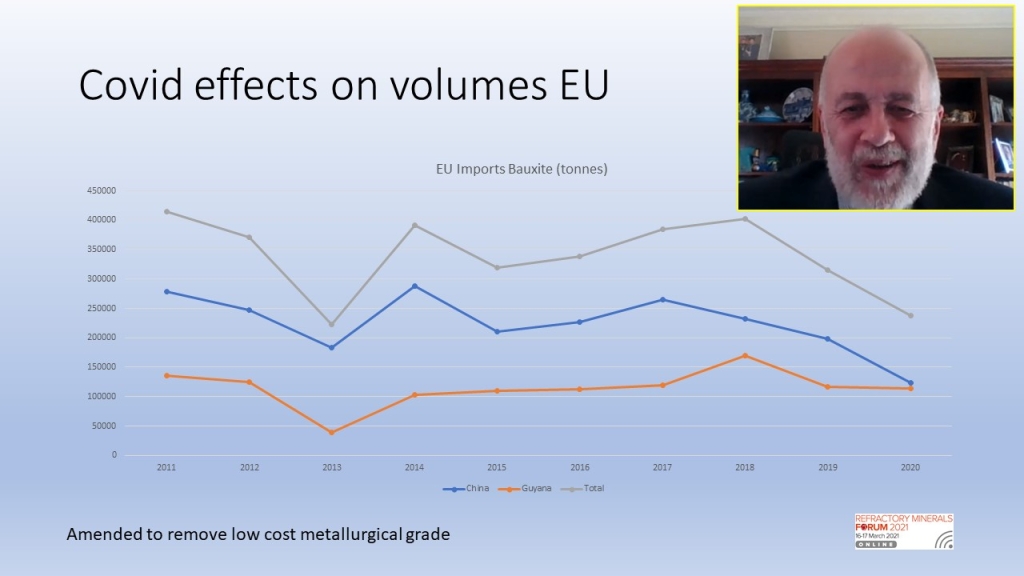

Ted Dickson, TAK Industrial Mineral Consultancy, UK

Ted Dickson covered bauxite supply, logistics, trade patterns, prices, Covid impact, before concluding with an outlook.

In supply, key highlights included continuing uncertainty about Chinese supply; existing Guyanese production expanding; new production from Guyana; Brazilian developments; and Indian production with upgrading.

Dickson noted that greater use of high alumina refractories in recent years using tabular alumina, WFA and calcined alumina, may have reduced demand for calcined bauxite and BFA.

Overall, supply from China remains uncertain, especially for higher grades, and logistics costs maybe expected to return to more normal levels possibly in 2022, but concerns about long supply chain are likely to remain.

Supply from Guyana seems likely to grow from both existing calcination plants and from raw washed bauxite exports with eventual local calcination

There is potential for further availability of refractory grades from Brazil, higher in iron but low in titanium and potentially greater use of local bauxites for refractories in India.

“If recovery from the pandemic is strong, supply may struggle to meet demand in the short term, especially if there is a short term “catch-up” surge” said Dickson.

Update on First Bauxite’s high grade bauxite supply from Guyana

John Karson, VP Sales and Marketing, First Bauxite LLC, USA

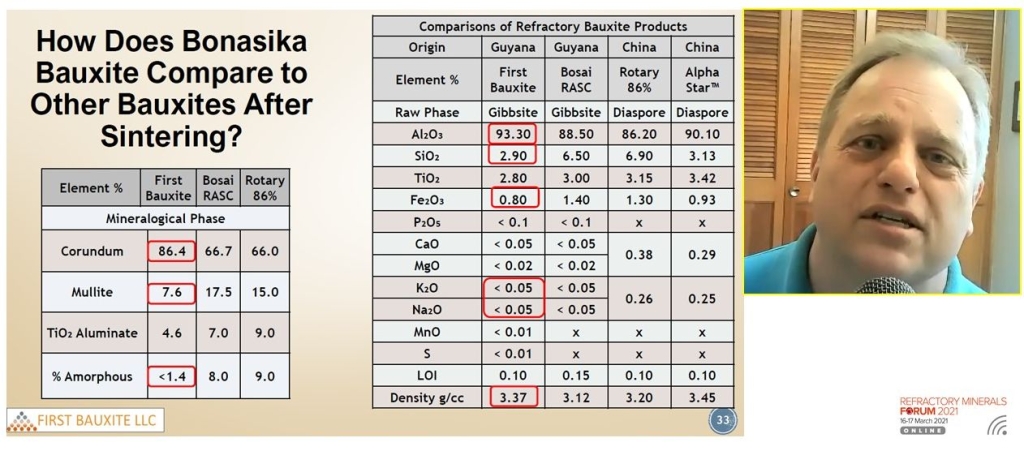

Focusing specifically on First Bauxite’s (FBX) Bonasika, Guyana bauxite, John Karson presented the latest news and development outlook for the emerging new force in refractory bauxite outside China.

A well-illustrated talk included detail on the new washing plant: thorough washing results in very little clay contamination, especially silica; the smallest bauxite crystal size is 140 microns, and largest clay particle size 60 microns.

Karson described how just one grade of raw gibbsitic ore is available which is excellent for use in aluminium sulphate (alum for water treatment), abrasives, steel slag flux, oil well proppants, road friction surface treatment and as welding rod flux; and most effective for use in refractories where high alumina, low alkalis, low silica and low iron are favoured.

Sintering trials have been completed in North America, China, India, Europe, Africa, and South America, while “India is on verge of major conversion to FBX” said Karson.

In North America, an Alabama facility has developed two grades of Bonasika sintered bauxite and has the most converted customers, though logistics is the biggest issue for the refractory market in this region.

However, Karson acknowledged that perhaps the FBX bauxite is perhaps too good: “Low alkalis, low iron, high alumina and so on are great, but not when recipes have been re-designed to make lower grades.”

FBX plans to introduce selected blends to provide correct product for the correct application; studies are currently underway and “may involve” a new kiln facility, ideally 50-70 metres in length and using natural gas – Karson noted that Guyana was now the world’s fastest growing oil producer and the high potential for a local source of cheap natural gas would certainly help any rotary kiln development.

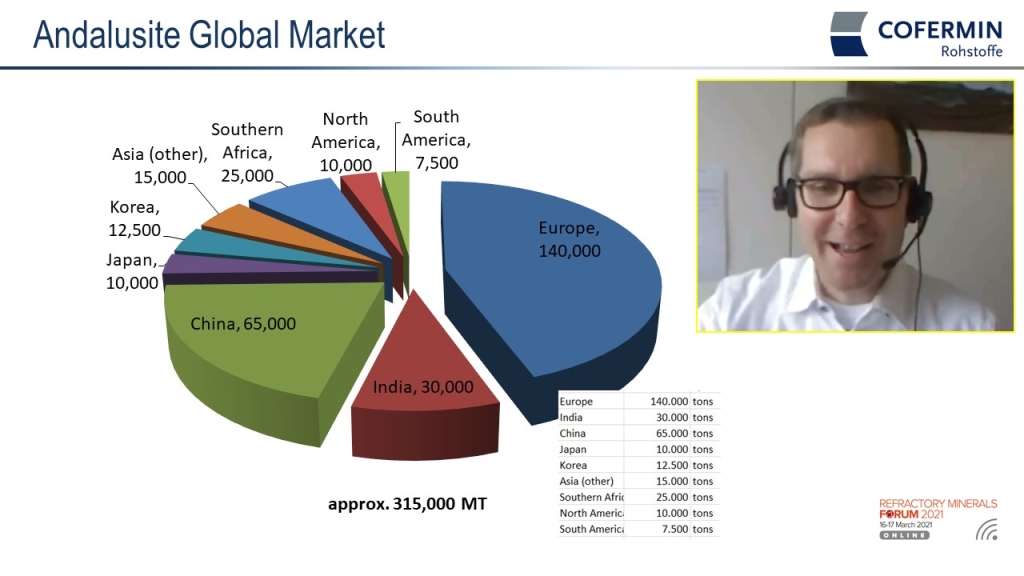

Andalusite supply outlook

Dirk Auge, Sales Manager, Cofermin Rohstoffe GmbH & Co. KG, Germany

Continuing the theme of aluminosilicate minerals, Dirk Auge, provided a superb overview of andalusite, its properties, occurrence, applications, producers, and global market characteristics.

Occurrences of industrial importance are limited to just South Africa, France, Peru, China, Spain, and Iran – though the first three are the primary sources.

Almost 50% of world production is centred in the Thabazimbi area of South Africa, hosting operations of Imerys (Rhino mine) and Andalusite Resources (Maroeloesfontein).

The total world market is about 315,000 tonnes, of which Europe accounts for 140,000 tonnes.

Challenges for 2021 and beyond include COVID 19 uncertainty; freight issues of costs, availability, and transit time; stronger demand; issues related to extreme climate; and power cuts in South Africa.

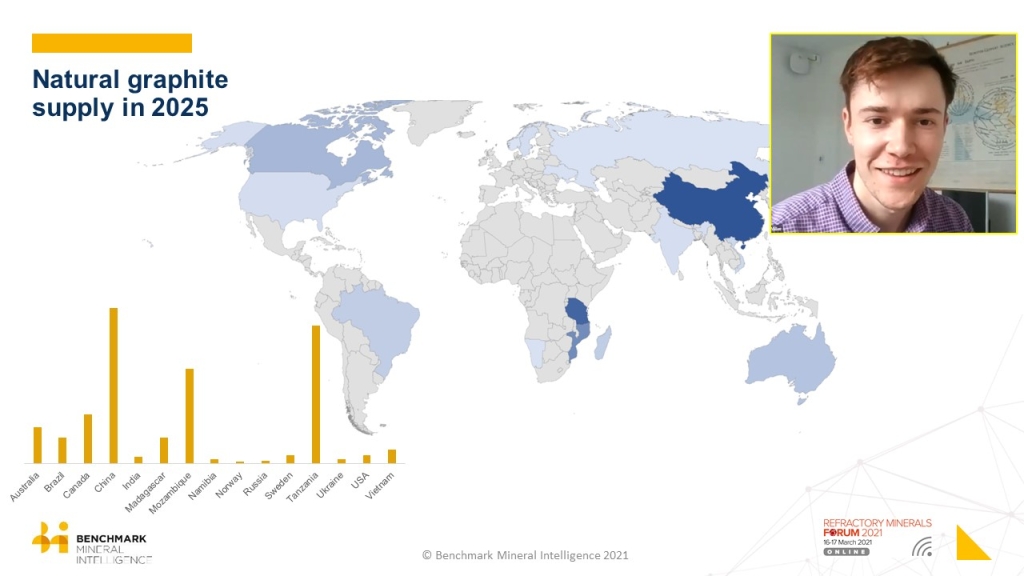

The graphite supply chain: a strategic review

George Miller, Analyst, Benchmark Mineral Intelligence, UK

George Miller took attendees through the outlook for graphite market demand and its probable supply trend to 2030, including total supply by mesh size versus demand.

Though refractories remain a primary market outlet for graphite, the evolution and high growth potential of graphite anodes in lithium ion batteries (LIB) for electric vehicles (EV) is driving graphite developments worldwide and may influence feedstock availability.

Miller explained China’s grip on the mine to EV battery supply chain. China currently controls 71.3% of worldwide natural graphite supply, 65.0% of worldwide synthetic graphite supply, and at present 100% of worldwide spherical graphite supply (grade used in LIB, derived from natural flake graphite).

Primarily, production is based in Heilongjiang and Shandong provinces. China’s central government has been increasingly involved in the country’s graphite production, including encouraging the intervention of local government and state-owned enterprises.

The relevance of environmentally friendly production in the anode supply chain has become clear, encouraging producers to develop increasingly environmentally friendly purification methods (eg. not using hydrofluoric acid in graphite processing).

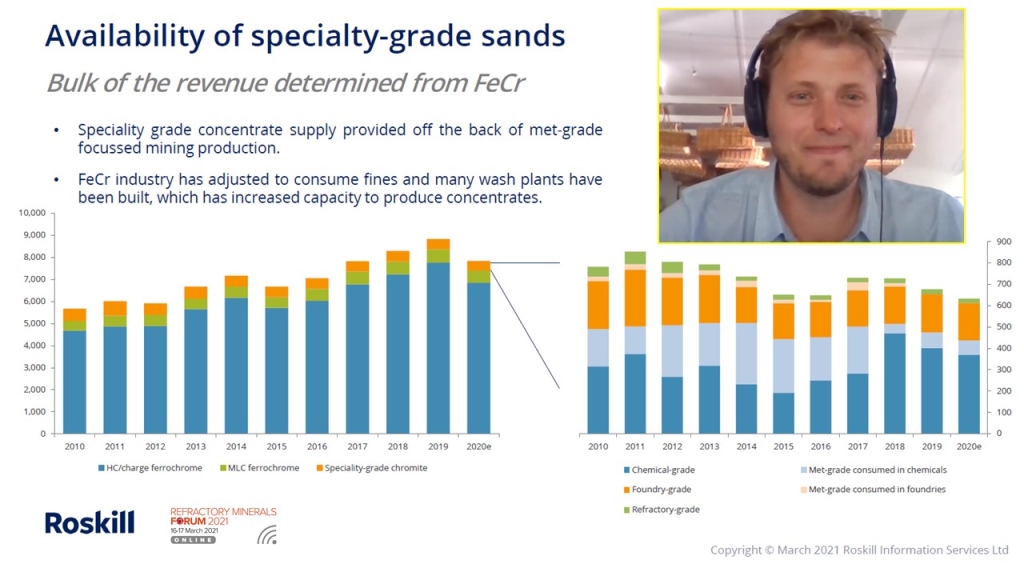

Speciality grade chromite: the trends & impacts from mainstream ferrochrome demand

Dr Nils Backeberg, Manager Steel Alloys, Roskill, UK

Nils Backeberg straightaway placed the non-met chromite market in context: speciality grade markets make up a niche 4% share of the chromium industry, with refractory grades accounting for just 0.2% of that!

Trends in ferrochrome used in stainless steel underpins chromium market performance, with main demand in China, which has developed ferrochrome capacity.

Backeberg outlined the source of speciality grades in South Africa and refractory mineral and market demand outlook in general, before detailing just where refractory grade chromite is used.

Chromium is consumed in refractories in two forms: chromite consumed in mag-chrome and chrome-mag refractories; and refractory grade chromium oxide consumed in chromium oxide, chrome-corundum and alumina-chrome refractories.

Consumption of chromium in refractories declined after 2011, following continued substitution to reduce hexavalent chromium, increasing recycling rates of refractory materials reducing primary requirements and increased use of monolithic refractories.

There followed an excellent analysis of availability of speciality grades, and how this was influenced by demand from metallurgical grades.

Backeberg concluded that chromite sands for refractories used to catch a premium on foundry grades, but that premium has eroded since 2017. With continued growth in low cost concentrate availability, this picture is not likely to change in the short to medium term.

Special thanks to Nils for enduring a power cut forcing a relocation to conduct the presentation at a local cheese factory in which he was molested by dogs – nothing a selected speaker for IMFORMED cannot handle – well done!

Thank you and “see” you again soon!

Under these challenging conditions for home and business at this time, we are indebted to the support and participation of our sponsor Imerys Refractories, Abrasives & Construction, and all our partners, speakers, and delegates for making Refractory Minerals Forum 2021 ONLINE such a success, and ensuring a fruitful and convivial time was had by all.

We are grateful for all the completed feedback surveys and please continue to provide us with your thoughts and suggestions.

We very much look forward to meeting you again at another of our Forums, and of course, hopefully in person as soon as possible.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Free Refractory Minerals Forum 2021 ONLINE Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations plus access to live recording maybe purchased.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Coming up…

FULL DETAILS HERE

Great summary Mike.2020 and 2021 have been difficult years for many people but to catch up even by zoom for a short time was good for the soul. Hopefully we can all catch up in person in 2022.

Cheers Richard, couldn’t agree more; we all can’t wait to meet up, but in the meantime we can just do what we can do – probably why MagForum 2021 ONLINE is attracting a good crowd already.