Leading world magnesia and refractories producer RHI Magnesita (RHIM) plans to acquire US diverse refractory product and mineral producer Resco Group for US$430m.

The move, announced by the Vienna-based group on 30 March 2024, marks a reinforcing of RHIM’s position in the USA following last year’s opening of its regional head office in Tampa, Florida, serving as the North American corporate hub for the company’s current infrastructure in the USA, Canada, and Mexico.

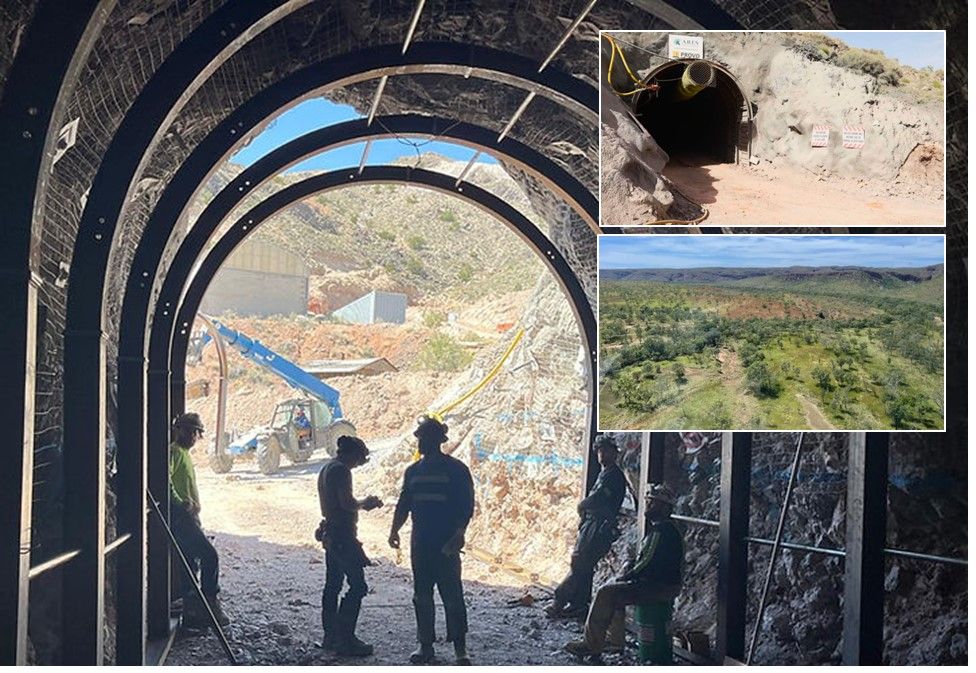

Title Image Aluminosilicates from Above: aerial view of Piedmont Minerals’ mine at Hillsborough, NC, mining a unique assemblage of andalusite-pyrophyllite-quartz for refractory and ceramic applications (Source: Google Maps); inset: refractory bricks and monolithics produced by Resco (Source: Resco).

Interestingly, from a refractory raw material perspective, the acquisition brings with it Resco’s long-established US mining operations for the refractory aluminosilicate minerals fireclay and pyrophyllite-andalusite (and naturally Resco’s alumina-based refractory products).

RHIM already has a vast portfolio of captive magnesite and dolomite operations in Europe, the USA, Brazil, and China. However, the Resco buy will now add a significant aluminosilicate strand (RHIM also has some other refractory mineral sources in Brazil, including clays, pyrophyllite, chromite, and graphite).

RHIM stated: “The acquisition continues RHI Magnesita’s strategic growth trajectory in alumina-based refractories by providing US customers with an improved product offering.”

Also notable is the fact that some 50% of RHIM’s US sales are not produced in the country, thus RHIM intends to shift “significant volumes” of production from non-US plants to Resco’s US plants.

The other benefit to RHIM is that the move will facilitate a much needed penetration of the US petrochemical, cement and aluminium industries, Resco’s key strengths, where RHI Magnesita has had very little business so far.

The acquisition is subject to customary closing conditions including merger control authority approval and is expected to be completed in H2 2024.

China refractory minerals supply & demand

What’s going on? Find out at

We are delighted to be returning to China with a Forum after a five-year absence, and a Field Trip to Haimag, Haicheng.

Confirmed speakers include

China’s refractories industry: status, key challenges, influencing factors, & demand outlook

Dr Wang Zhanmin, VP Manufacturing, Sinosteel Luonai Materials Technology Co. Ltd, China

Exploring refractory raw material procurement from China: potential and challenges

Devang Chowdhary, Director, Thyme Corp., Germany

Refractories without China?

Dr Richard Flook, Managing Director, Mosman Resources, Australia

Evolving performance needs for alumina raw materials in China’s refractories market

Chris Parr, VP Science & Technology, Imerys Refractories, Abrasives, Construction, France

Resco diversity built through acquisitions

Resco operates seven refractory plants and two raw material sites, with two plants also located in the UK and Canada (see map).

Since 1946, the company has grown steadily to become one of North America’s most diverse refractories producers, making acidic and basic products, both bricks and monolithics, and serving a wide range of markets including the petrochemical, cement, non-ferrous metals, steel, lime, incinerator, and glass industries.

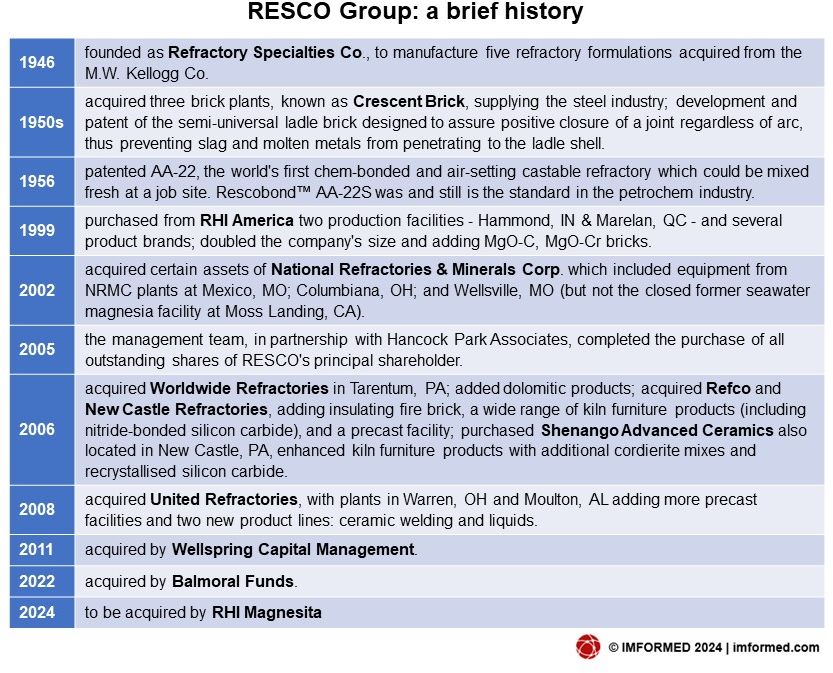

A look at the history of the company illustrates its beginnings but also shows its rapid expansion, and growth in product diversity, through a string of US acquisitions from 1999 to 2008.

And RHIM has somewhat come full circle now in “reclaiming” its Indiana and Quebec plants that it had to divest to Resco back in 1999 (see table).

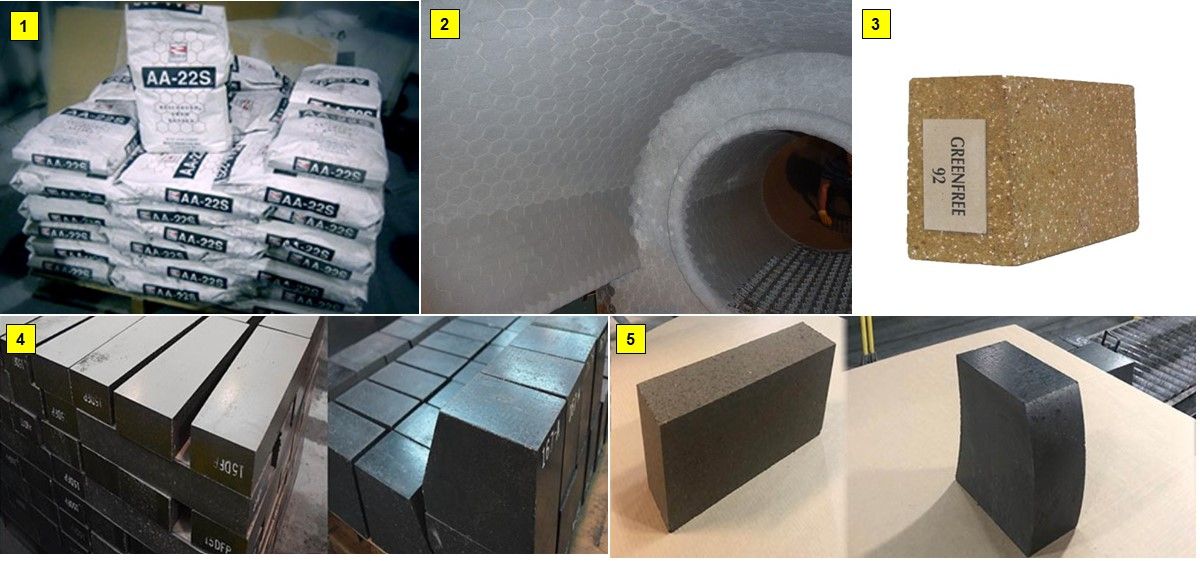

Innovations have been key to Resco’s long success, including the RESCOBOND product AA-22S. Since it was first developed and patented in 1956, it has been the petrochemical industries’ standard in erosion resistant castables for cyclone, and other highly erosive areas.

Resco recorded unaudited revenues of US$252m in the year to 31 December 2023, with Profit before Tax of US$20m and had Gross Assets of US$191m at 31 December 2023.

Examples of Resco’s diversity of refractory products: 1&2: since the AA-22S alumina castable was first developed in 1956, it has been the petrochemical industries’ standard; 3: magnesia-spinel brick; 4: magnesia-carbon bricks; 5: dolomite bricks Source: Resco

Fireclay & pyrophyllite-andalusite mines

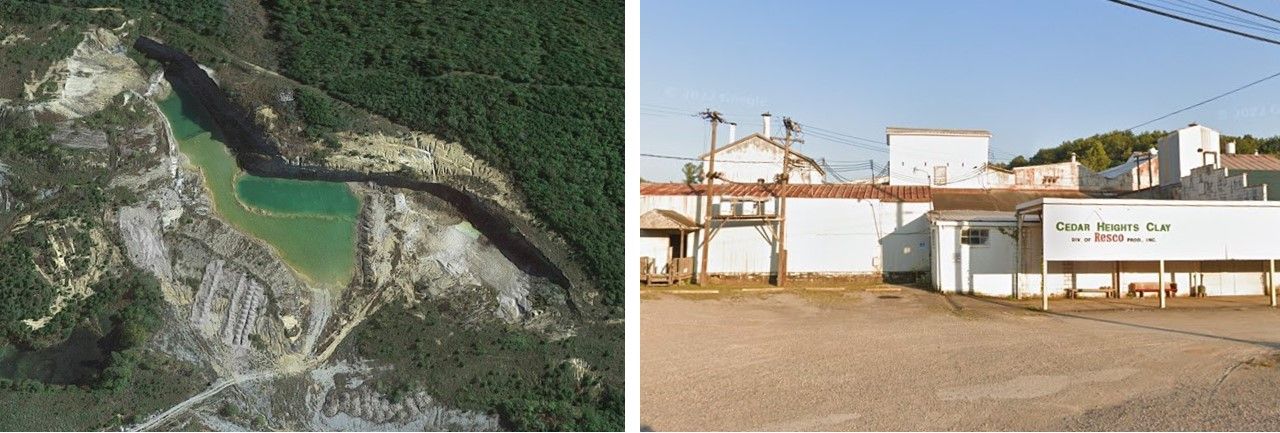

Resco operates two distinct refractory mineral operations: fireclay in Ohio, and a pyrophyllite-andalusite mixed ore in North Carolina.

According to its website, Resco also offers CM95-35, a crushed and screened dead burned magnesite, presumably imported.

The Cedar Heights Clay Co. subsidiary has been mining and processing clays in southern Ohio from the Oak Hill operations since 1924. The refractory clays from Resco offer a wide range of colours and textures for every firing method in use today.

According to the US Geological Survey, in 2023, the USA produced 660,000 tonnes of fireclay, mostly produced in Missouri and Ohio, but also smaller volumes from Colorado, Texas, and North Carolina. Some 140,000 tonnes was exported. Most recent data for Ohio production was 116,000 tonnes in 2019.

The Cedar Heights fireclay plant and mine at Oak Hill, Ohio, operating since 1924. Source: Google Maps

In North Carolina, Resco subsidiary Piedmont Minerals Co. has been exploiting the Hillsborough deposit and its “selective mined high andalusite ores” since it opened in 1958.

The deposit hosts a unique mix of andalusite and massive grain pyrophyllite, which increases the heat resistance of the natural combination raising the melting point.

The purity of this unusual pyrophyllite-andalusite-quartz ore makes it an excellent source for alumina and silica in Resco’s high temperature formulations for refractories and ceramics. The raw material is shipped by bag, super sack, pneumatic tanker truck, and railcar.

The crushed and screened grades produced typically contain 20% alumina, 70-75% silica, and 0.4% iron. Production is estimated at <50,000 tpa.

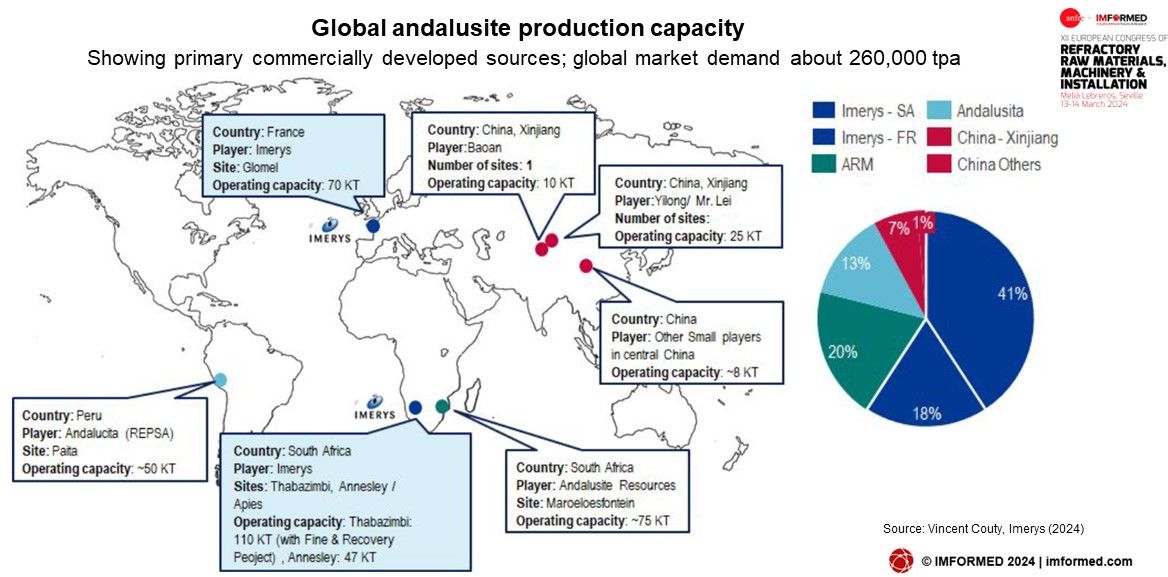

While the Hillsborough deposit is far from a pure andalusite occurrence and has a much lower alumina content, it is of significance since there are very few commercially developed andalusite deposits worldwide: in just France (1 operation), South Africa (3), and Peru (1) which trade globally (plus smaller players in China and Iran serving local/regional markets).

Imerys maintains a strong position in the market accounting for about 41% of world production capacity, with operations in France and South Africa (see map).

RHI Magnesita will be sharing its insights on refractory recycling and decarbonisation at these upcoming IMFORMED Forums

Mineral Recycling Forum 2024, Dubrovnik, 22-24 April

Beyond green boundaries: MIRECO & RHI Magnesita – Pioneers of refractory recycling

Alexander Leitner, Recycling Technology & Innovation Specialist, RHI Magnesita, Austria & Lucas Zimmermann, Head of Project Management, MIRECO, Germany

Overcoming challenges of recycling in North America: the transformation of a maturing recycling market

Celio Cavalcante, Head of M&S, R&D and Sustainability NAM, RHI Magnesita, USAMagForum 2024, 13-15 May, Halkidiki

Decarbonisation developments & objectives

Andreas Drescher, VP Decarbonisation, RHI Magnesita, Austria

I don’t know, perhaps its sentiment, but have no good feelings on such large mineral companies. Alike Imerys

It leads to monopolies and all that comes with it