Global minerals distributor enters new era with new management team

IMFORMED reviews Cofermin’s journey and interviews Managing Director Andreas Pabst

In its 2015 announcement of the launch of two subsidiaries, Essen-based Cofermin Rohstoffe GmbH & Co. KG quoted the US author of success principles, Robert Collier: “If you don’t make things happen, things will happen to you”.

Well, Cofermin has stuck by this mantra, and in its 21st year, as global markets seek recovery after a pandemic-ravaged 2020, the company announced a major change of senior management, which may be described as more of a transition. Certainly a changing of the guard.

The founding partners of the award-winning international marketing and distribution group for speciality raw materials have made way for a new generation of senior management to take the group forward for at least another two decades or more of success.

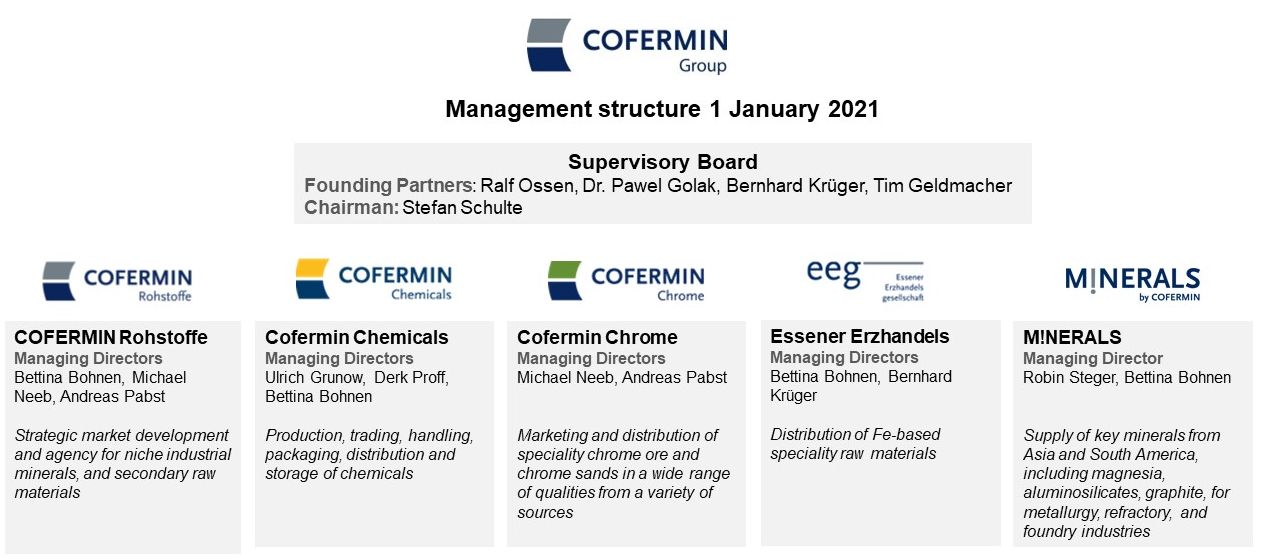

From the 1 January 2021 all four founding partners of Cofermin (Ralf Ossen, Dr. Pawel Golak, Bernhard Krüger and Tim Geldmacher) moved onto the Group’s newly established Supervisory Board.

Their managerial responsibilities and duties have been transferred to their successors, the new management team comprising: Bettina Bohnen (Commercial & Risk Management, HR and Organisation), Michael Neeb (Operations, Sales and IT), Andreas Pabst (Strategy, Business Development and Marketing), as managing directors, and Jens Massenberg, as the Group’s Chief Financial Officer (Finance, Controlling and Compliance).

Cofermin commented: “Managing a smooth generation change is probably one of the most important challenges a mature company can face. The decision of who will lead the organisation into the future is key to its continuing success. For us at Cofermin Group it was highly important to ensure a new and fresh approach to future challenges and opportunities, whilst preserving the DNA that has been at the core of our organisation and a major pillar of our positive development in the past.”

Building from ashes to solid foundation

Cofermin emerged from the ashes of the global trading giant Frank & Schulte Group (F&S), which in its final, somewhat diminished incarnation was a division of Stinnes AG, Germany.

In its heyday during the 1980s and 1990s, F&S was one of the world’s dominant raw material trading groups until its demise in 1999.

F&S was not the only casualty of those times, it marked the end of an era for the large, multi-national mineral trading houses, as mineral trading transformed into a much more streamlined, sophisticated, and multi-service provider business.

The initial upshot saw a plethora of small trading companies staffed by ex-members of the dissolved trading groups vie for position in the new mineral trading landscape. Not all would survive, and many would change hands and swap staff.

But Cofermin, established by ex-F&S experts in marketing and distribution, processing and trading of ores and minerals, swiftly carved a niche for itself in the new generation of traders, initially with a particular focus on central Europe and the CIS. The rest, as they say, is history.

But one aspect has always stood out clearly with Cofermin: its people, the nourishment of staff as its most important asset, and its use of that talent. The company motto “We give raw materials a personality” says it all.

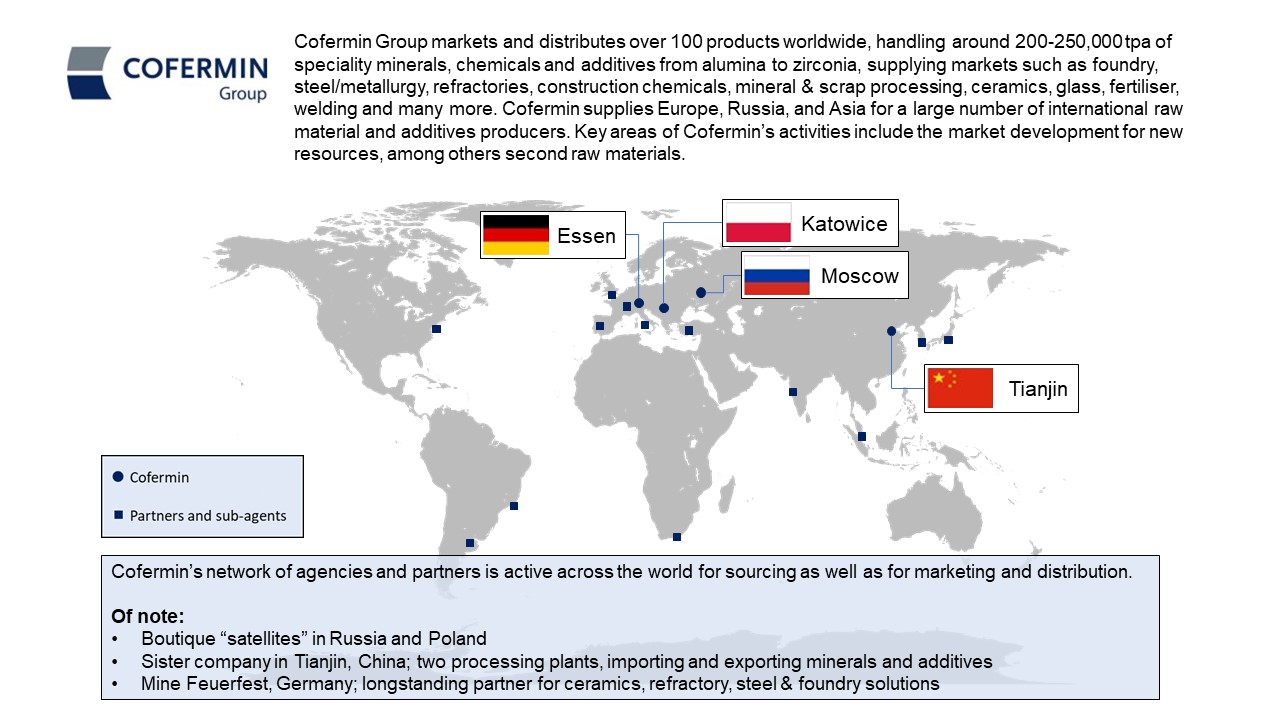

With €120-130m turnover and maintaining a lean profile (just 55 core staff), Cofermin is one of the world’s leading industrial mineral and chemical distributors – or, as it prefers: “a niche player and servicer provider” – and now stands ready for the next 20 years of market change and challenge.

IMFORMED asked Managing Director Andreas Pabst about Cofermin’s journey and its take on the market

Why has Cofermin decided this management transition now?

In 2020 the Cofermin Group was not only faced with the unfolding Corona crisis, but also with the withdrawal of its four founders – Bernhard Krueger, Dr Pawel Golak, Ralf Ossen and Tim Geldmacher – from the day-to-day management of the Group and their move onto a newly founded supervisory board.

One of those events alone can be enough to thoroughly shake an organisation. But it’s not like we just suddenly came up with the idea last year. It was the culmination of a well thought-out plan of our founders and we saw it through.

Did we pause and ask ourselves if we should hit the breaks due to Corona? Of course we did, but after careful consideration it made sense to continue with this transition – the benefits simply outweighed the potential downside.

Cofermin’s founding partners recognised early on that there would come a point when the Group would have to renew itself, stay up to date with the demands of the current times so-to-speak.

People change, industries change, markets change, and management and leadership also have to change if you want to give an organisation a good chance to continue to evolve and adapt successfully to all these ever changing circumstances.

Bettina Bohnen, Managing Director and Speaker of the Management: Commercial & Risk Management, HR and Organisation (Left); Andreas Pabst, Managing Director: Marketing, Business Development and Strategy (Right).

The new Supervisory board – what will be its role and objectives?

True management succession and change can only be successful if the succeeding management is given the freedom to act, to unfold and to test new ideas, which is why the four founding partners changed their responsibilities from day-to-day management to that of a supervisory and advisory function, with no involvement in daily management as such.

It is important to note at this stage that they have not divested from the business. They still retain their shareholding, and therefore maintain a vested interested in Cofermin Group.

The supervisory board’s role and function largely revolves around: advisory input, budget approval and confirmation of the overall Group strategy.

Daily management responsibilities now fully rests with the managing directors, who are also shareholders in the business.

Cofermin mentions “preserving the DNA of our organization” – can you briefly explain this “DNA” and perhaps the overall secret of Cofermin’s success?

We don’t chase growth purely for growth’s sake. Our priority is clearly on steady and sustainable growth, rather than going for the quick buck. Very much according to the saying: “That which grows fast, withers rapidly. That which grows slow, endures.”

Our approach to risk is conservative. We are very measured, always cover our positions, don’t take large exposures and rather let a business pass than going in for a gamble/pure speculation. So we always seek growth and improvement, whether internally through optimisation or externally through new business, but not at any cost.

Also, when it comes to the way we handle our business, I think it’s easiest to use a loose football analogy: there are teams out there who have their celebrated wingers and strikers, their star players who reap most of the glory. We have those too of course, but we put almost no emphasis on the individual scorer. We don’t care who shoots the goal, all that matters is that the goals are scored and we reward this across the board, across the whole organisation. We don’t typically elevate goal scorers above the rest and everyone participates in our Group’s success.

We have managed to preserve this DNA by largely growing and developing the new management from within our Group. Of course we always try to maintain a good mix between talent from the outside, in order to bring in new ideas and viewpoints, and through personnel growth from inside the organisation.

Today we retain a very good generational mix, and our middle management is very strong on many levels, which is important because if things break they often do so in the middle.

Additionally, we previously enabled equity participation in large parts of our different management levels, on top of which everyone at the Cofermin family participates in the Group’s overall success, which gives people a lot of security even in these uncertain times, when some areas perform better than others.

What do you consider to be the key milestones in the company’s history?

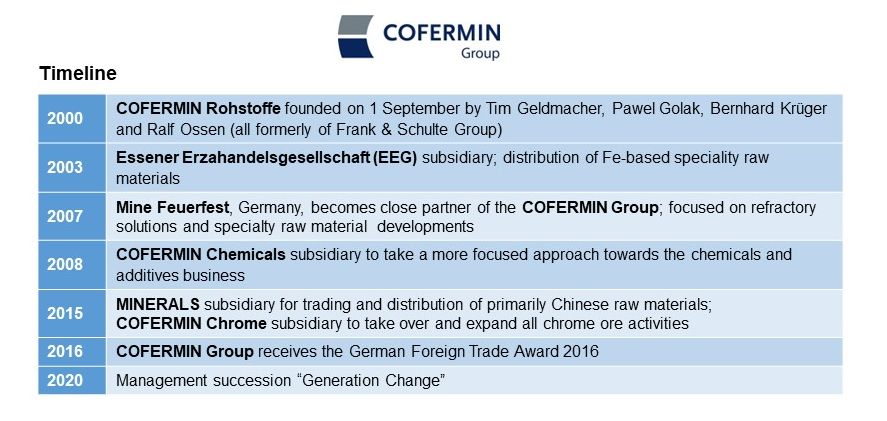

2003: Silica fume project: our first proper foray into secondary raw materials and an opportunity outside of refractories. We recycle, together with our business partners, an old sizeable stockpile of silica fume. Today we still supply this into the construction industry and have delivered this material as far away as Kazakhstan for the construction of airport runways.

2005 Andalusite Resources agency: becoming marketing agent for Andalusite Resources on an international scale. Our business model had evolved from being largely a trader and distributor to that of also being a service provider, in that a raw material producer could outsource their marketing and sales function to us. All in transparency with our principal supplier, who knows all customers, understands and approves our sales strategy, knows the market prices, and we in turn can present their name, brand and product to the market, which gives our customers assurance with regards to the origin and quality of the supplied product (see Andalusite Resources to emerge from Business Rescue with new ownership).

2007 Mine Feuerfest collaboration: up to this point we were not strong on the technical side of our business. Our cooperation with Mine Feuerfest opened new possibilities to develop and handle business opportunities which would have been outside of our expertise up to that point.

2008 Cofermin Chemicals formed: an important step in our growth and diversification strategy. We found the right people who knew the ins and outs of the chemical business, which is very different to that of dealing in minerals. That’s how Uli Grunow joined the Cofermin Group, now shareholder and managing director. And we recently managed to also strengthen Cofermin Chemicals’ setup by recruiting Derk Proff as director and newest shareholder in our set-up.

2009 Lanxess chromium oxide: We have marketed LANXESS chromium oxide into the refractory industry since 2009. Refractories is a niche market that’s harder to serve, due to mostly smaller offtakes from a more fragmented client base. Cofermin Chemicals has set up a suitable supply chain system over several years and today we are one of the largest partners of Lanxess’ chromium oxide business. We managed to prove that we can even add value to companies like Lanxess who have their own capable sales teams, by helping them deliver into markets and niches which are not easy to reach.

2015 Cofermin Chrome and M!nerals formed: Robin Steger and Andre Vollers, two well-known and highly regarded guys in the industrial minerals industry, joined the Cofermin family. Together with them we formed the Cofermin Chrome and the M!NERALS companies as part of Cofermin Group. The former combined our existing speciality chrome sand business with theirs, and the latter’s purpose was to grow and develop our sourcing channels for industrial minerals from the Far East. Robin and Andre have really enriched the Group and built a successful business in its own right as part of the Cofermin family.

2016 German Foreign Trade Award winner: This award – given out by Germany’s federal association of foreign trade, the federation of German industry and the association of German chamber of commerce and industry – is given to “Mittelstand” firms who show extraordinary entrepreneurial engagement and in recognition of their sustained economic success. We were proud and happy to receive this award as it confirmed that we were on the right track with the way Cofermin managed its affairs and grew its business.

2020: Management transition & recruitment: Further to the management transition (discussed above) we recruited Tim Scholten (formerly at thyssenkrupp Materials Trading) to assist in taking over the running of our chrome sand business. Additionally, Miroslaw Shuk (Almatis) joined us to manage our business in the Russian speaking markets. Further wonderful additions in the recent past were Mrs Haixia Pan (Minmetals) to develop our growing business in China, and Joanna Stawowska (Sibelco) who is now managing parts of our business and certain key-accounts in Poland and other markets of Central/Eastern Europe. Gaining these new colleagues is proving to be a real win for us and has showed again that we can attract really good talent in our industry. And thinking a few years into the future, we see these colleagues as providing overall enrichment to Cofermin Group, by potentially growing beyond their current scope of responsibilities.

Jens Massenberg, Group CFO: Finance, Controlling and Compliance (Left); Michael Neeb, Managing Director: Operations, Sales and IT(Right).

How do you view Cofermin’s evolving role in the minerals industry going forward into the 2020s?

We remain strong in our core segments and are lean and agile enough to prosper in markets/industries where there’s limited growth, and even where the proverbial cake is predictably getting smaller over time.

The role of the classical trader, a person that buys low and sells high so-to-speak, from 20 or more years ago, is diminishing fast, if not disappeared altogether. But that’s nothing new. We’ve been seeing this for years. And so we’ve been moving beyond this for a while now.

The ones that are still around have successfully evolved and are good at adapting. And for the rest, unfortunately their days are truly numbered.

As agents, we are the extended arm of the producer. We are service providers, more and more so, and our transformation towards this is ongoing. We help our customers to source the right materials at the best conditions at any point in time. And we assist our principals and suppliers to bring their products to market in an optimal and economically sustainable manner.

In the relationship between buyers and sellers – regardless of whether we’re talking about chemicals or minerals – we are the buffer and the grease, depending on what circumstances and times demand from us, in order to get the best results for all involved.

In order to meet future challenges and stay relevant for our principals and customers we’ve put together a diverse team of really good people, and will continue to build on that.

And we keep on diversifying horizontally into other niche segments and markets, as this allows us to take our well-working system and replicate it, with slight adjustments, into new markets and industries. That way we grow by doing what we know best.

Andalusite Resources’ operation in South Africa, with (inset) Andreas Pabst (right) and Michael Neeb (left) on a visit; Cofermin became its international marketing agent in 2005. “Our business model had evolved from being largely a trader and distributor to that of also being a service provider, in that a raw material producer could outsource their marketing and sales function to us.” said Pabst.

Have you seen any particular change in demands from customers?

For many minerals the requirements of good and stable quality as well as punctual deliveries have remained the same.

Where we have noticed a change, particularly in the last five years or so, is that we’re seeing less and less long-term frame contracts. Due to higher volatility many clients have become more worried about being locked into a contract when left and right their competitors could instead be in a position to be able to respond more suddenly to changing market conditions.

Of course I am generalising a bit here, but overall we’ve clearly observed this trend emerging in recent years of this need for short-term flexibility influencing our customers’ buying behaviour.

Putting aside the obvious impact of Covid-19, which would you highlight as today’s main typical challenges facing companies such as Cofermin and why?

First of all, challenges change all the time. One year it’s sourcing and quality, next year it’s logistics, the year after it’s regional or political, and it carries on and on.

Of course, at this moment we’re seeing logistics as one of the major challenges, this is not just Cofermin’s challenge, it’s everyone’s.

Another challenge is the limited visibility re. Covid’s consequences. Who on the supply and on the demand side will make it? Who will fall by the wayside? And how do we as Cofermin manage this risk?

Otherwise a typical challenge for us is to remain agile and flexible enough to keep on adapting to these changing circumstances. Every few months it’s something new, it’s something else.

For example, every couple of years its all about vertical integration of one’s supply chain and you see companies acquiring and merging. A couple of years later they’re divesting again because they didn’t manage to integrate the acquired assets properly, didn’t manage to generate the sought-after synergies or because they’ve gotten too cumbersome. And then a few years later the cycle starts again.

How do you see Cofermin’s main markets performing for 2021-22? Can you see a recovery trend kicking in at any specific period?

Quite frankly, most of our markets for chemicals and additives have performed well despite Corona. Growth slowed noticeably in 2019 and of course in 2020. We saw a decline in some areas, foundry for instance, but then an extraordinary performance in others, such as refractory minerals and also overall in our chemical business.

Now going into 2021 shows us that we must remain resilient and flexible. Being diversified and essentially having around two-thirds of your business outside of your home country helps in this regard.

In our traditional markets such as refractory and foundry we’re already seeing clear signs of recovery. The question is how sustainable this trend is.

There is a visible uptick in demand and we’re expecting increasing prices in quite a lot of mineral and chemical products. This is already becoming more apparent since the start of the year.

Covid caused a reduction on the supply side, not only from winding down capacities but also putting a stop to most capacity expansions that were perhaps in the pipeline. And due to a general situation of uncertainty and limited visibility for planning any reactions from the market will be quicker and more jerky than usual.

So upticks in demand may not be met as quickly by the recovering supply sector. For instance, many a mining and processing operation that’s been managed down on purpose to run at say 50% of its design capacity and minimal maintenance in order to endure the Covid-crisis, may take several months before its back running at full output capacity again.

So I think it’s hard to say when a sustainable recovery trend is to be expected. We should be ready for a bit of a roller coaster ride of ups and downs.

IMFORMED plans to post follow-up articles focusing on the individual divisions and activities of Cofermin

If you enjoyed reading this article…

Like the idea of an objective, well-written and researched article about your company or products?

Perhaps you are pursuing new markets, launching new products and innovations, or just need some profile as you recharge or emerge onto the market?

Let IMFORMED’s experience in writing and reach in markets assist your business going forward.

Please feel free to discuss ideas, options, needs.

Contact: Mike O’Driscoll, Director, IMFORMED

mike@imformed.com

T: +44 (0)1372 450 652; M: +44 (0)7985 986255

Leave A Comment