Review of Salt Forum 2023

Supply & Demand Trends | New Source Projects | Southern Africa | Senegal | Europe | APAC | India | Australia | Processing | Logistics

IMFORMED has organised its acclaimed industrial mineral Forums in many interesting locations, and one of the most remote, adventurous, and spectacular venues was for Salt Forum 2023, in Swakopmund, Namibia, 6-9 November.

Born out of discussions and support with lead sponsor Walvis Bay Salt during Salt Forum 2022 in Hamburg, IMFORMED was delighted to run its first African event, and brought to Namibia its first international salt conference, all round an unforgettable few days for those in attendance.

Title Image Salt’s the Star: delegates at IMFORMED’s Salt Forum 2023 were able to see first hand how Walvis Bay Salt harvests raw product from its solar sea salt ponds at Walvis Bay, Namibia, the largest solar salt producer in Sub-Saharan Africa at 1.1m tpa.

A superb panel of speakers covering salt market supply and demand in southern African, Senegal, Europe, APAC, Australia and India, complemented by talks on the global bulk freight market, salt as a critical mineral, and salt processing stimulated the 70 attendees drawn from across the world salt industry (full review of presentations below).

We were also grateful to be welcomed and addressed by Veston Malango, CEO, The Chamber of Mines of Namibia, and Bryan Eiseb, Executive Director, Ministry of Mines & Energy of Namibia.

What our delegates thought about Salt Forum 2023

A valuable addition to producers like us to meet global salt partners; a professionally organised event

Surendra Singe Ahlawat, Chief Manager Operations, Chowgule & Co. (Salt) Pvt Ltd, India

Good focus highlighting various opportunities and hurdles; as expected, excellent organisation

Alastair John, Category Manager, SLB, USA

Excellent programme and venue, covered the relevant topics with interesting insights

Moistehpi Serato, Sales & Marketing Manager, Botswana Ash (Pty) Ltd, Botswana

Excellent all round; a very international programme and relevant discussions, punctual and effectively moderated

Olavi Hangula, Relationship Manager, RMB Corporate & Investment Bank, NamibiaFree Salt Forum 2023 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

ANNOUNCING

Confirmed speakers

Salt global supply overview & Asian chlor-alkali market

Dr Stefan Schlag, Managing Director, Salt Market Information, Switzerland

SEASALT Europe: Challenges & opportunities of a unique industry

Gonzalo Diaz Caicoya, President, SEASALT Europe & General Manager, Bras del Port, Spain

Solar salt works & technology developments on increasing salt yield & quality with sustainability

Dr Bhoomi Andharia, Senior Scientist, Salt and Marine Chemicals Division, CSIR-CSMCRI, India

Advancements in solar salt industry: a comprehensive exploration of automation for enhanced efficiency and sustainability

Param H Dave, Manager, Tata Chemicals Ltd, India

Status of Pakistan salt supply, markets & future prospects

Ismail Suttar, Chief Executive Officer, HubSalt, Pakistan

The California Supreme Salt project

Vladimir Sedivy, President, Salt Partners Ltd, Switzerland

The potential of sodium-ion batteries & salt requirements

Sean Hoffman, Critical Minerals Research Analyst, Project Blue, South Africa

Crystallizer pilot study to produce high-purity NaCl salt from monovalent-ion dominant concentrated desalination brine

Dr Christopher Fellows, Researcher, Saline Water Conversion Corp., Saudi ArabiaEARLY BIRD RATES | FULL DETAILS

Salt Forum 2023 Review

The world of salt supply & demand

Mike O’Driscoll, Director, IMFORMED, UK

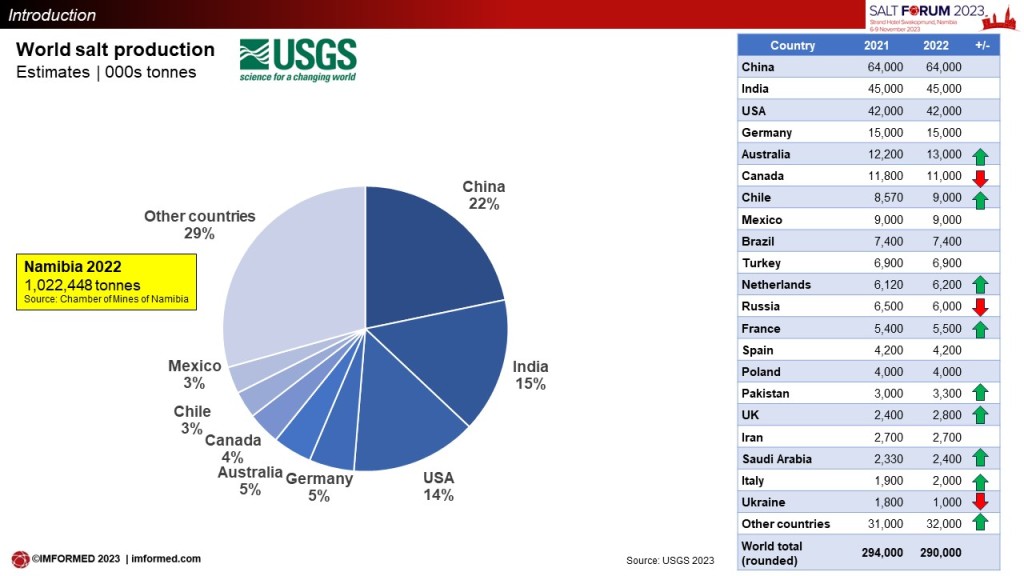

O’Driscoll opened proceedings with a brief overview of global salt supply, trade and demand, highlighting the diverse sources of salt and reminding that some 300m tpa salt is produced worldwide with 50m tpa exported by >50 countries, and for most salt applications, there are no economic substitutes or alternatives.

China, India and the USA were noted as the leading salt producers, with notable increases recorded for Australia and Chile (see chart). The main exporters were India, Chile and Canada, and importers were the USA, China and Japan.

Demand from chloralkali industry was expected to increase as demand for caustic soda and PVC increases globally, especially in Asia.

Salt exports from Australia and especially India have increased in recent years to meet the rising demand in China.

Attention was drawn to potential new sources in Australia, Canada, Spain, Saudi Arabia, and Pakistan, as well as the impact of decarbonisation in the industry, and the potential of sodium ion solid state batteries (NaCl + Ni cathode) in the future of energy transition.

Southern African & Walvis Bay Salt Development & Production

Andre Snyman, MD, Walvis Bay Salt, Namibia

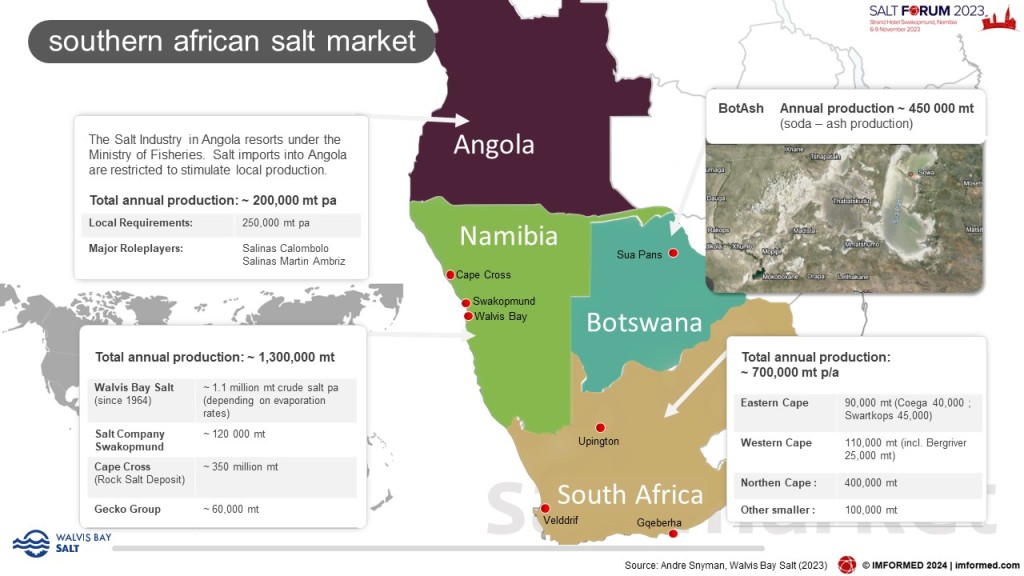

Snyman opened with a review of Namibia before providing an excellent review of the southern African salt supply situation (see chart). Salt is Namibia’s biggest export product in terms of volume, and exports through the port of Walvis Bay alone are 800-900,000 tpa.

Walvis Bay Salt, part of the Bud Group of companies, was established in 1964 and is the largest solar salt producer in Sub-Saharan Africa at 1.1m tpa.

The company’s solar salt process was explained, utilising some 90m cubic metres of seawater each year and lagoons and evaporation ponds covering some 5,000 hectares.

The Walvis Bay Salt system is fed by the Benguella current which is one of the most unpolluted sources of seawater with low levels of micro plastics, oils and industrial effluents).

Two major phases of expansion have been recently completed: in 2016 a 32% increase in the size of the salt field from 3,800 to 5,000 ha to increase salt output from 0.75m tpa to > 1.0m tpa; and in 2019 bringing on stream a new 220 tph wash plant which reduced washing losses from 20% to <9%.

A Wirtgen W210F salt harvester was acquired and commissioned during May 2022, enabling salt crop cuts with high precision.

Future projects include a new Walvis Bay Port Warehouse of 18,000m2 to minimise dust pollution; recycling of 900,000m3 bitterns waste stream into magnesium chloride or magnesium metal for export; and an 11km salt slurry pipeline loop to Port, with saturated brine as the carrier material.

Conceptional salt products: Salicornia

Hennie Roets, Independent Consultant, NamibiaSalicornia is a genus of succulent, halophytic (salt tolerant) flowering plants in the family Amaranthaceae that grow in salt marshes, on beaches, and among mangroves. Salicornia species are native to North America, Europe, central Asia, and southern Africa. Common names for the genus include glasswort, pickleweed, picklegrass, and marsh samphire.

Historically, ashes of glasswort and saltwort plants were long used as a source of soda ash for glassmaking and soapmaking. Today, it finds applications in cooking recipes, animal feed, pharmacology (treating high blood pressure and fatty liver disease), and environment (extracts selenium from soil).

Hennie Roets (left; next to Ismene Clarke (centre) and Alison Saxby (right)) is developing a Salicornia business, cultivating the plant on the marshes of the Walvis Bay Salt ponds.

Salt market overview: trends & outlook

Stefan Schlag, Salt Market Information, Switzerland

Dr Schlag covered globalisation of the salt market, with a focus on logistics and the carbon footprint, and then secondary sources, with a focus on salt caverns for hydrogen storage, seawater desalination, and zero liquid discharge – salt from waste streams.

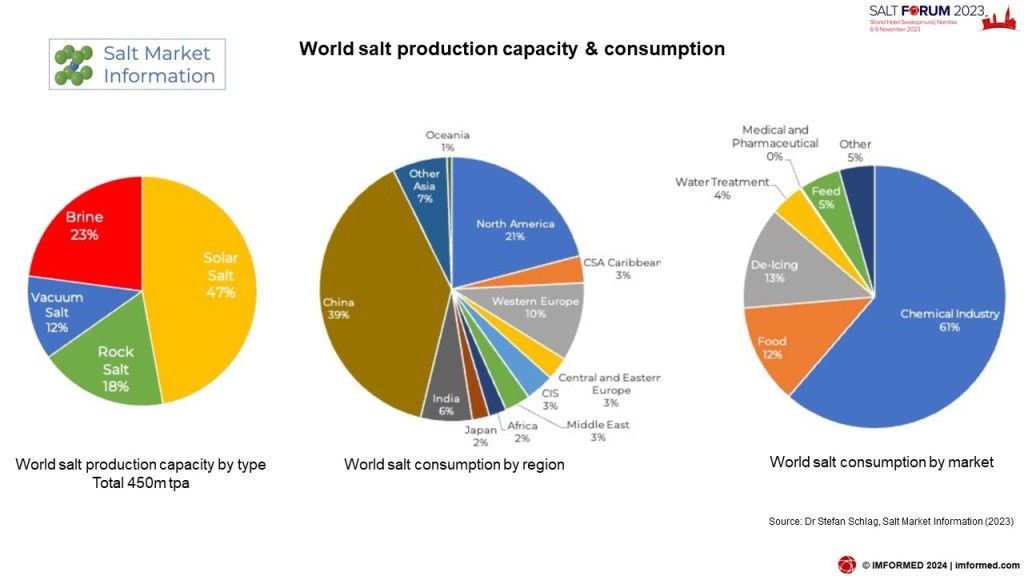

He broke down the main salt type production capacities, most from solar salt (47%), and the main consuming markets by type and region (see chart), before examining trade and price trends.

In summary, Schlag concluded that:

- salt is mostly a regional market, but a small portion of ca. 10% is traded between world regions

- the global portion of the market has been growing slowly in the past decades, but further growth is limited because the window of economic and ecologic feasibility is narrow

- volumes of salt from secondary sources could become important

- salt cavern space is required for the storage of “Green Hydrogen”

- the use of brine in the chemical industry is a disposal option.

- methods to recycle salt from waste streams are being developed with efforts towards a circular economy and “zero liquid waste”

Global bulk freight market overview

Simon Lester, Managing Director, Dry Cargo, Clarksons South Africa (Pty) Ltd, South Africa

In the first part of his talk, Lester covered a range of important factors impacting the freight market. These included:

- China centric – will we see a significant improvement in demand and exports going forward?

- Ukraine and Israeli conflicts

- USA’s demise as “world policeman”

- Is the US Dollar under attack as the reserve currency?

- Emergence of BRICS+

- GHG emission requirements and IMO regulations coming into effect

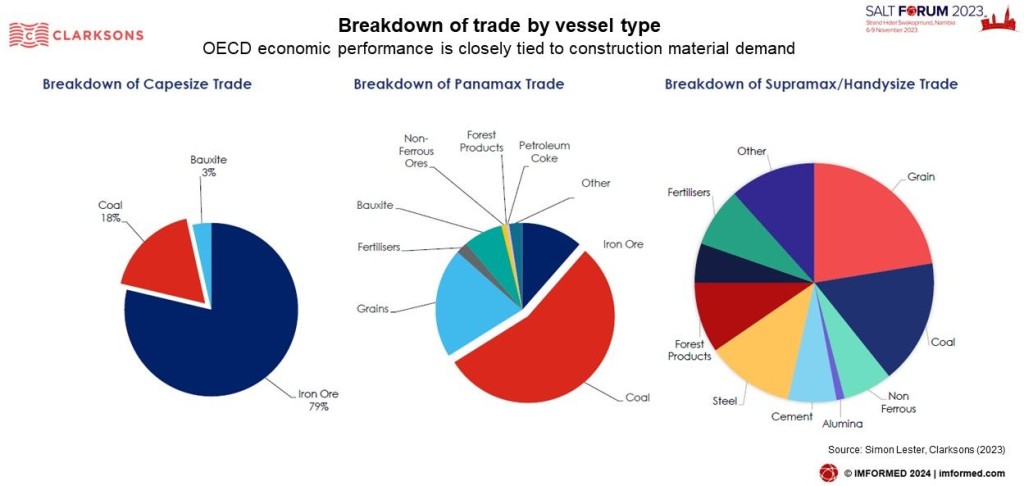

This was followed with a detailed review of the Supramax and Handysize market and its outlook.

The geared fleet growth is set to hover between 2-4% over the next three years, with demand growth expected to hit similar levels.

Grain trade is expected to boost significantly over the next few years while construction demand is to recover from a low base and return to 2021 levels by 2026.

Growth will be concentrated in the emerging economies from 2025 and beyond as economic pressures begin to unwind. Emerging commodity types are unlikely to grow at the same pace as existing trades (grains and construction materials into emerging markets).

Upside Risks: End of Russia’s invasion, continued growth of coal volumes, strong economic rebound in Western economies, further environmental policy stringency.

Downside Risks: Further easing of congestion, continued economic weakness out to 2025, weak environmental legislation/enforcement.

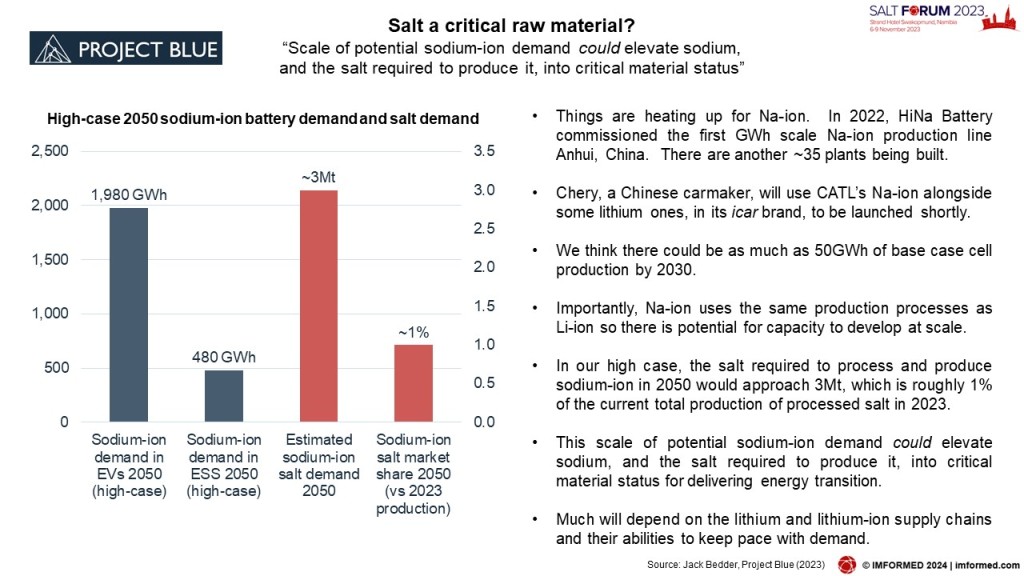

Is salt a potential Critical Raw Material?

Jack Bedder, Founder & Director, Project Blue, South Africa

What are critical raw materials (CRM) and their definition was covered first, followed by an assessment of salt as a potential critical raw material.

Bedder began with an intriguing history of CRM before explaining how various organisations and states used criteria to define their respective CRM.

These commonly entailed compilation of a criticality matrix with supply risk and economic importance as key parameters.

Supply risk usually includes country-level analysis of concentration of production, and factors including governance, substitutability, import reliance and sustainability.

Economic importance usually looks in detail at the allocation of raw materials to end-uses based on industrial applications.

Bedder highlighted the energy transition as requiring both the “usual” and “unusual suspects” as essential, and that salt may play a part if sodium-ion batteries take off.

Technical and practical considerations for salt as a CRM were weighed. Salt is certainly of economic importance, although not a supply risk, though some countries do rely on imports for their salt requirements.

In Project Blue’s high case, the salt required to process and produce sodium-ion batteries in 2050 would approach 3m tonnes, which is roughly 1% of the current total production of processed salt in 2023.

This scale of potential sodium-ion demand could elevate sodium, and the salt required to produce it, into critical material status for delivering energy transition.

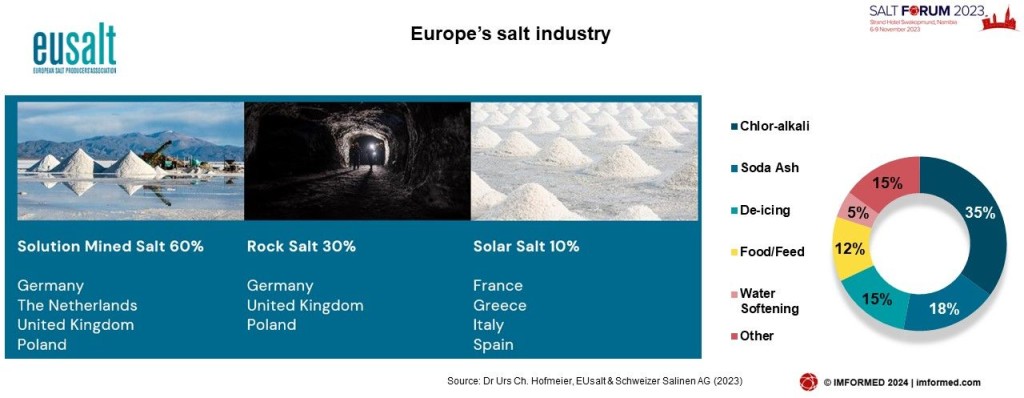

The European salt market & role of EUsalt

Dr Urs Ch. Hofmeier, President, EUsalt & CEO, Schweizer Salinen AG, Switzerland

Dr Hofmeier outlined the key characteristics of the European salt industry, the second largest salt producing region in the world, with a pedigree going back to Roman times.

Many of Europe’s major salt producers produce salt for captive consumption in chemical production. Chlor-alkali and soda ash are the main salt markets (53% combined) followed by deicing, food, water softening and other uses (see chart).

60% of salt produced in Europe is from solution mining, followed by rock salt (30%) and solar salt (10%).

EUsalt comprises 18 members and 10 associate members, accounting for 77% of Europe’s salt production. It is the authoritative voice of the salt industry in Europe in advocacy and to educate and communicate the values and benefits of salt as an essential building block for the chemical industry and the energy sector and as a vital mineral for health, safety and nutrition.

The key focus topics for EUsalt are: the circular economy; safety; food; and the environment.

Hofmeier concluded with some comments on Swiss Salt Works (Schweizer Salinen AG – Salines Suisses SA), which operates three vacuum saltworks supplying 400-650,000 tpa to Switzerland.

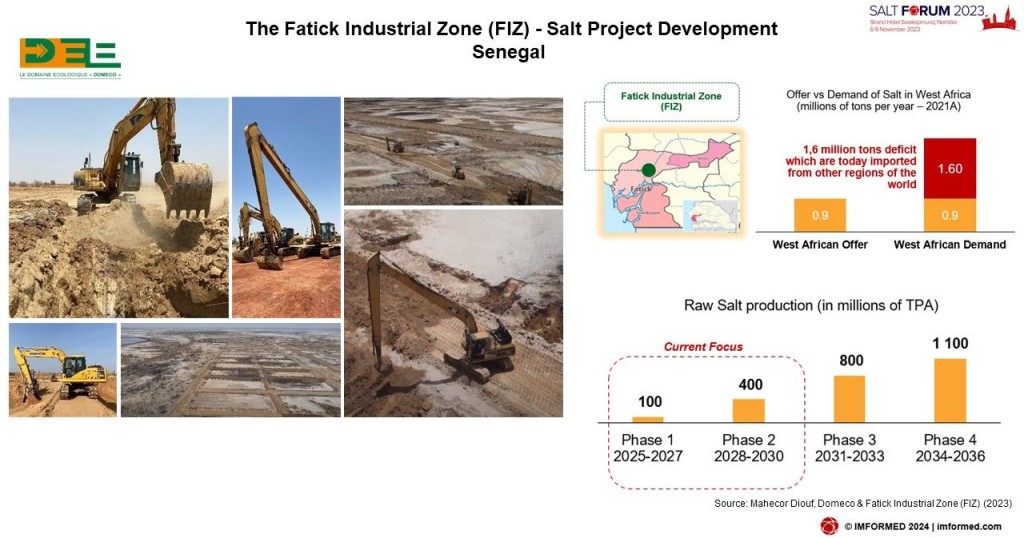

Salt project development in Senegal

Mahecor Diouf, Managing Director, Domeco & Fatick Industrial Zone (FIZ), Senegal

The landscape, hydrography, climate and salinisation of the soil in Fatick and Kaolack make Senegal the leading sea salt producer in West and Central Africa with 550,000 tpa.

Based on available suitable land for salt production, Senegal could potentially produce 3m tpa of salt and become a key international player.

The Fatick Industrial Zone (FIZ) – Salt Project Development envisages raw salt production of 400,000 tpa (1,600 ha of saltworks) within five years. FIZ is to offer a full range of salt products: raw salt, washed salt, refined salt & others.

The objective is to achieve 70% exports and 30% local sales to respond to national demand. This will be helpful synergies with development of port activities.

At present, Phase 1 is under development: 400 ha of solar saltworks under construction, a production capacity of 100,000 tpa, expected to start in 2025; an additional 1,200 ha to be developed, targeting total production capacity of 300,000 tpa.

However, Diouf said that technical assistance was required to complete the 400ha design, follow construction, build an operational plan, recruit and train the team, and develop an expansion strategy.

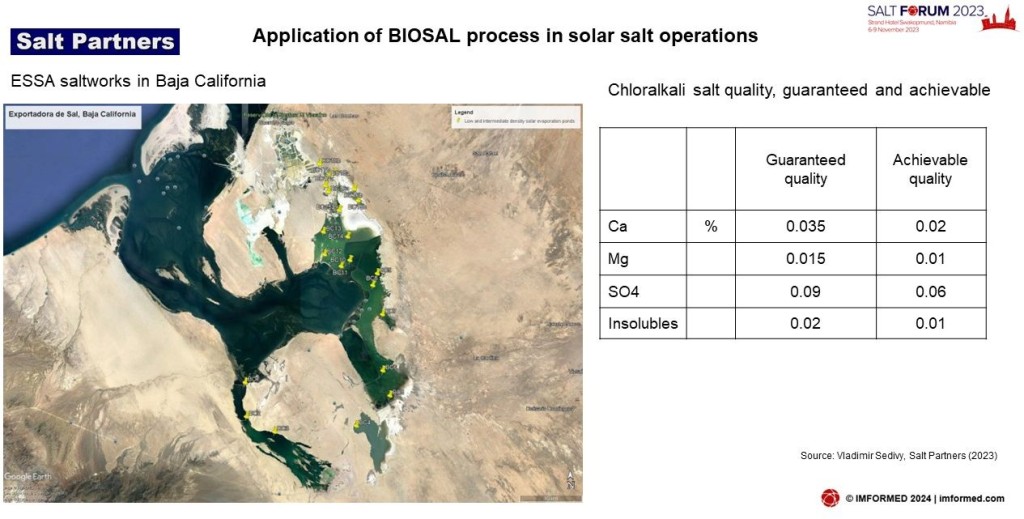

Production technology for best quality solar sea salt for the chloralkali industry

Vladimir Sedivy, President, Salt Partners Ltd, Switzerland

Sedivy focused on highlighting salt impurities from different sources and the costs entailed in salt and brine treatment, before introducing the BIOSAL process.

Quality improvements are achieved by application of BIOSAL biological management techniques. A case study at the ESSA saltworks in Baja California, Mexico was described.

In such biologically well-managed solar saltworks, the available nutrients (phosphorous and nitrogen) are being consumed by algae and sequestered by Artemia Salina as fecal pellets.

By using such a process, Sedivy concluded that solar salt can reach the quality of vacuum salt at a fraction of vacuum salt cost and carbon footprint.

APAC salt market supply & demand

Alison Saxby, Research Director, Project Blue, UK

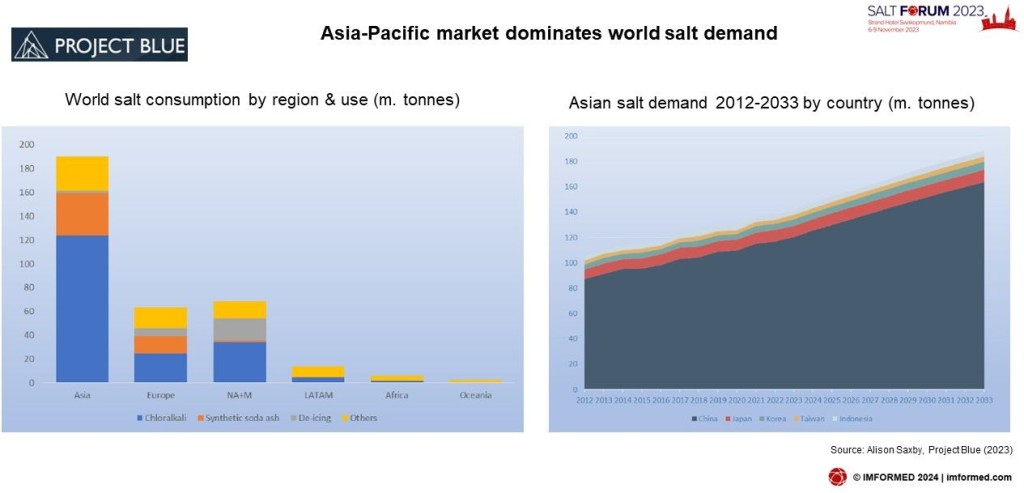

This presentation covered setting the scene, world supply and China, Australia, demand, main markets, trade, and future trends.

World salt demand is underpinned by Asian chloralkali demand. Synthetic soda ash is important in Asia, particularly in China. Elsewhere, other salt applications include deicing, and food processing which are more important in North America and Europe proportionally.

It was explained how salt demand has increased markedly in China, Japan, Indonesia, South Korea, and Taiwan.

The Asian salt market is dominated by Chinese demand for use in chloralkali and synthetic soda ash processes, which will drive the volume growth overall.

In all five markets the increase in salt demand will need to be met largely through the import markets for high-grade salt produced in India, Australia and Mexico (which amounted to 27m tonnes in 2022, a record high).

Asian salt imports will continue to grow over the next five years, with some new capacity beginning to come online, particularly in Australia.

The largest share of that new seaborne salt trade will be required to meet demand growth in China.

Mardie Salt & Potash Project: status & outlook

David Boshoff, Managing Director, BCI Minerals Ltd, Australia

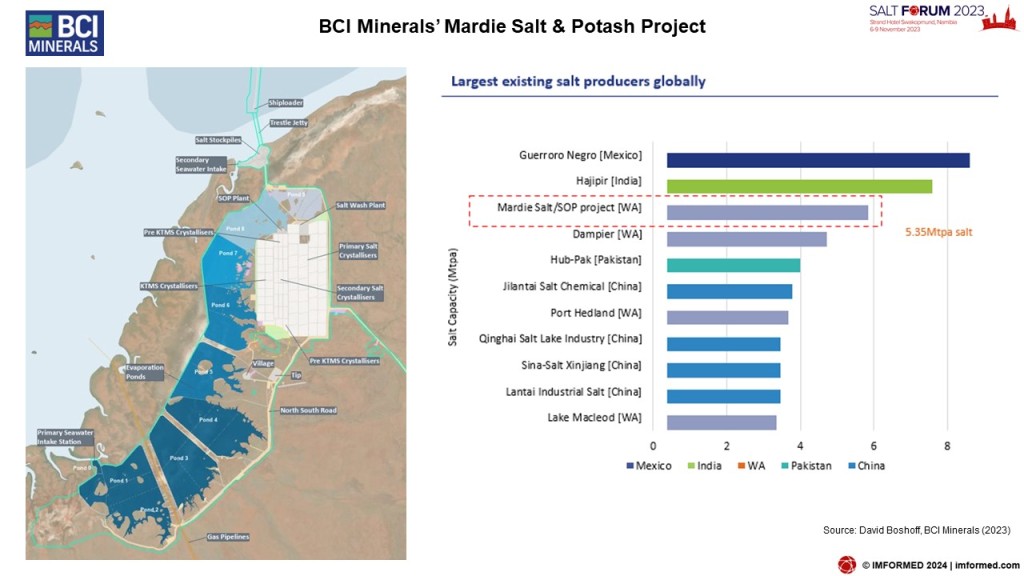

Nicely complementing Saxby’s paper was a presentation on an new emerging salt source in Australia by David Boshoff; he covered a company and project overview, key project highlights, sustainability, stakeholder engagement, market positioning, and the focus for 2024.

BCI Minerals is a Western Australian-based mineral resources company developing the Mardie salt and potash project, claimed as one of the highest quality, largest scale new salt projects globally.

Located on WA’s north-west coast between Onslow and Karratha, Mardie is exposed to ideal climate and conditions to produce high purity salt, and well-positioned to directly supply key Asian markets with an estimated total production of 5.35m tpa salt and 140,000 tpa sulphate of potash.

As of 30 September 2023, almost 27% of construction was complete including the primary seawater intake station, ponds 1-5, Mardie accommodation village, and almost all the highway infrastructure. Marine infrastructure construction is ongoing, and ponds 6-9 were having their contracts awarded.

On coming to fruition, Mardie will become the world’s third largest salt producer. A key competitive advantage is the ability to deploy the larger ocean going vessels (ie. >80kDWT, up to 180kDWT vessels) as part of its distribution network, which will provide a direct freight advantage.

BCI is continuing to focus on completing full funding for Mardie. During 2024, BCI aims to enter into binding offtake agreements for salt production as well as progressing approvals.

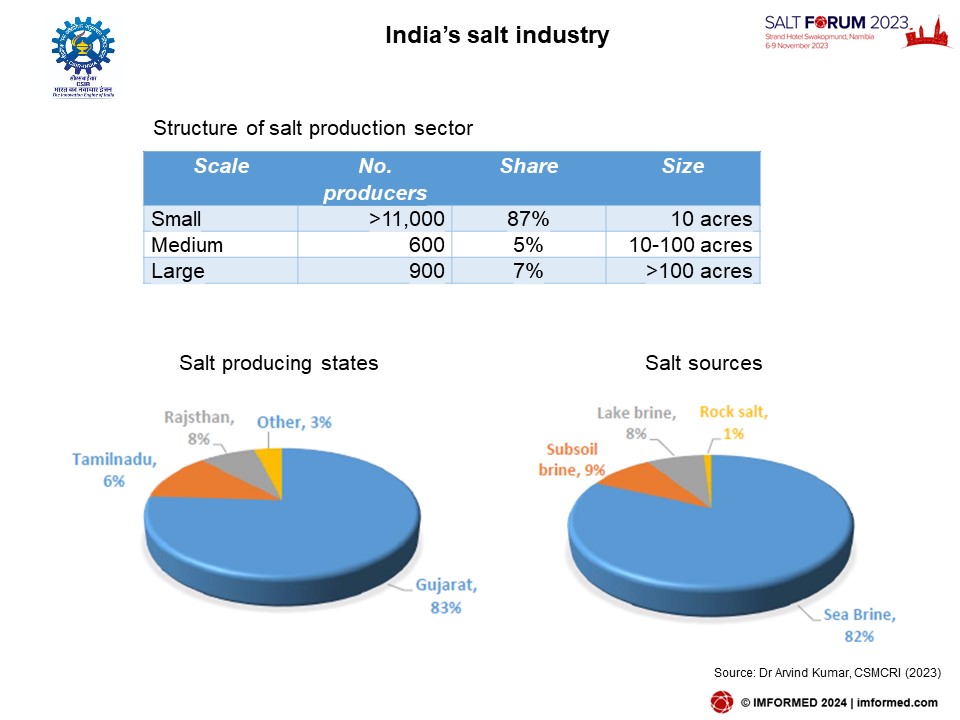

India’s salt industry & role of CSMCRI in improving quality & yield of solar salt through technological interventions

Dr Arvind Kumar, Chief Scientist, Central Salt & Marine Chemicals Research Institute, India

Dr Kumar began with outlining the vision and mission of CSMCRI, ie. to facilitate India to become the second largest salt producer in the world by 2032 through technologies, processes and models developed; increasing production capacity from 30m tpa salt at present, to 50m tpa by 2032.

The Indian salt sector was described in the context of the global market followed by analysis of India’s sea water composition and minerals abundance.

Some of the key projects of the CSMCRI were highlighted, including fundamental studies understanding solubility, ionic interactions and phase equilibrium in brines for recovery of high purity salts and marine chemicals; recent scientific developments for improving quality and yield of solar salt; salt for speciality applications crystal habit modified salt, vegetable salt , low sodium salt and double fortified salt, and recovery of marine chemicals K and Mg salts.

Kumar concluded with some of the major challenges facing India’s salt industry:

- India has limited saline land for salt production 6 lakhs acres) and demand is increasing

- Therefore, productivity need to be increased in existing land area (per acre yield from current 60 tons to higher than 90 100 tons)

- Indian salt production is mostly manual, traditional, and lacks mechanisation, therefore there are issues of purity and yield, and health hazards

- Energy efficiency in solar salt production, effective utilisation of solar energy and implementation of semi or fully mechanised salt operations, mitigation of climatic change effects and climatic threats rains, cyclones etc.

More quality in salt harvesting by using high-performance cold milling machines

Bernd Holl, Product Manager – Cold Milling Machines, Wirtgen Group, South Africa

Holl provided a summary of the main Wirtgen surface mining machines and their various applications, with a focus on the Cold Milling Machine W 210 F which is used in salt harvesting.

Key to the equipment is Wirtgen’s cutting technology such as optimised wear protection at the milling drum unit. Wear segments attached to the side plates in a detachable fashion can be turned about 180° so that both sides can be used and the lifespan doubled.

Also the extremely hard wearing HT22 quick-change toolholder system. Fitted with the HT22 quick-change toolholder system, the milling drums on offer for the W 210 F are the ideal candidates for complex, challenging milling applications.

Case studies using Wirtgen machines in salt harvesting in Mexico, Australia, Namibia, and Turkey were described.

Efficient salt drying with fluid bed dryers

Mark Kragting, Sales & Process Manager, TEMA Process BV, Netherlands

In his talk, Kragting focused on efficiency of water removal, enhancement of product quality, and sustainability, in the use of fluid bed dryers for salt processing.

Regarding sustainability, using fluid bed dryers offers benefits in reduction of emissions and consumptions:

- Fluid bed drying air is recycled, reduces the emission of CO2

- Reduces the energy consumption

- Use of clean energy sources like natural gas or propane

- Use of a bag house filter reduces the emission of fine dust

And it offers a low carbon footprint:

- Design of low temperature dryer

- Integration of heat-pump as an alternative heating source compared to a burner, or reduce the burner capacity

- Exhaust gases are used as a heat-source to avoid loss of energy

Thanks & hope to see you at Salt Forum 2024!

We are especially indebted to the support and participation of our lead sponsor Walvis Bay Salt who organised a superb field trip, as well as an unforgettable dinner evening in the desert, our sponsors Wirtgen Group and RMB Bank, supporting partners, speakers, and delegates for making this unique event such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience later this year at our Salt Forum 2024, Abu Dhabi, 18-20 November.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Free Salt Forum 2023 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Leave A Comment