Introduction to Mining Engineering’s IM Annual Review July 2024 by Mike O’Driscoll*

The importance of industrial minerals to the world economy and everyday lives always used to be a hard sell to the uninitiated.

Just having to explain what they are and how they are characterised in the context of the world mining industry was often a steep learning curve for some (especially start-up newcomers and those from the metallic minerals sector wishing to diversify for a quick buck).

Title Image Critical Harvest: industrial minerals such as salt, shown here being harvested from sea salt pans in Walvis Bay, Namibia, and fluorspar, are now recognised as important raw material feedstocks for products required in Na-ion and Li-ion batteries, respectively. Fluorspar image courtesy Giovanni Dall’Orto.

Often misunderstood, their value frequently underestimated, and even disparaged as “the third world” of the mining industry, industrial minerals have not always had an easy ride.

But that was then, and this is now. 2023 might be considered the year that (finally) marked the decade of industrial mineral criticality recognition.

So, is the “criticality” of industrial minerals finally being understood?

We know that industrial minerals are the building blocks of our economy and essential to our everyday life, but owing to several factors (eg. supply chain vulnerability exposed by Covid-19 pandemic, shipping crises, Russia-Ukraine war, overreliance on China, new technologies), the last few years have seen a growing awareness of industrial minerals’ importance in the mainstream – ie. not just by the wider industry, but crucially, from state governments and the public sector.

Even the Industrial Minerals Association-North America (IMA-NA), after having represented the industrial mineral mining industry since 2002, decided to rebrand in 2023 and change its name to the Essential Minerals Association (EMA). It was decided that IMA-NA simply “did not fit the mission and nature of the industry”.

Industrial minerals to the rescue – national defence role

Nothing sharpens a government’s mind more than issues surrounding a state’s defence capabilities.

In a recent article for IMFORMED, Nicholaus Rohleder, Co-Founder, Climate Commodities, eloquently made the case that the nexus between industrial minerals and national security is a topic of paramount importance, often overlooked in broader discussions about defence readiness and strategic autonomy (see The crucial role of industrial minerals in defence & national security).

Refractories, materials that are resistant to heat and wear and composed of specific industrial minerals, are indispensable in industries that require high-temperature processes, such as steelmaking, a vital component in military hardware production.

Key minerals, such as bauxite, alumina, andalusite, magnesite, and graphite, are not just commodities; they are strategic assets that empower nations with the capability to produce armour, weaponry, and other critical military infrastructures.

Similarly, the abrasive market, which includes materials used for cutting, grinding, and polishing, depends on minerals like fused alumina, silicon carbide, garnet, and diamond.

Precision manufacturing and maintenance processes for military equipment require the highest-quality abrasives to ensure performance and reliability under the most extreme conditions. These minerals’ strategic importance is also reflected in the geopolitical dynamics of supply and demand, with nations now increasingly aware of the need to secure reliable sources.

China remains a mainstay of world refractory mineral supply – but times are changing. Find out the latest first hand by attending

Confirmed Speakers | Early Bird Rates | Visit to Haimag

Full Details

Revolutionary drivers from the energy sector

In this author’s career of some 35 years in the industry there have been several notable industry milestones.

But in recent times perhaps the two most significant stand-out gamechangers, and that remain ongoing, which have helped spotlight industrial minerals have been unconventional oil/gas resource development by hydraulic fracturing (fracking), and the new battery “revolution” as part of our fledgling energy transition.

Interestingly, and maybe unsurprising to some, their common denominator is our demand for energy sources (although, often easily forgotten in the hot air of debate, oil is also a raw material feedstock for the massive petrochemical industry).

Fracking had been around since 1949, was further developed in the 1980s, then in the early-mid 2000s came the phenomenal boom in fracking, the “shale gale”. This was facilitated by developments in horizontal drilling techniques, using massive volumes of improved mineral-based proppants (mainly silica sand, but also kaolin and bauxite for ceramic proppants) to exploit much needed cheap shale gas and oil from otherwise earlier unexploitable resources (mainly in North America, but also elsewhere).

Wisconsin was turned into a frac sand mine! Now since superseded by west Texas. In the USA at least, the humble silica sand has never looked back.

Sand Storm: This year, frac sand demand in the Permian Basin, Texas and New Mexico, is expected to hold steady at 70m tonnes. Some 24m lbs sand per horizontal well is consumed, at a frac sand intensity of around 2,200 lbs sand per foot. Shown here is Atlas Energy Solutions Inc.’s Kermit, Texas, frac sand operation, an example of an in-basin sand facility in the Permian of west Texas, which has largely dominated demand over previously favoured “northern white” sands from the Mid-West such as Jordan Sandstone, Wisconsin (top right), and St Peter Sandstone, Minnesota (bottom right; Courtesy of Atlas Energy Solutions & Mark Zdunczyk).

From the early 2000s it was obvious that a new era for battery development was occurring with R&D and then commercial manufacturing of Li-ion batteries for all kinds of high-tech consumer and industrial devices, plus municipal storage.

This has opened up a huge, and ongoing market for a range of minerals (eg. lithium, graphite, nickel, cobalt, manganese) and, most recently, massively raised awareness of their vulnerabilities in availability, sourcing and supply chains.

The battery market continues to evolve with new battery chemistries and applications for more minerals used in niche components of the Li-ion battery (eg. fluorspar, high purity aluminas), and demand for more commercially developed sources of those industrial minerals.

All this has led to the advent of “Critical Raw Materials” (CRM) and their mainstream recognition by media and state governments.

Although, frankly speaking, CRM have always been around and recognised in other industries over the last three decades: rare earth minerals for example.

But it’s not all about just lithium and graphite, other industrial minerals are emerging onto the CRM stage, such as salt and fluorspar which are worth looking at as examples.

Salt – a critical mineral in the wings?

Since around the mid-2000s, various organisations and states have used criteria to define their respective CRM lists, commonly entailing compilation of a criticality matrix with supply risk and economic importance as key parameters.

Last year, speaking at IMFORMED’s Salt Forum 2023, in Namibia, Jack Bedder, Founder & Director, Project Blue, highlighted the energy transition as requiring both the “usual” and “unusual suspects” as essential, and postulated that salt may play a part if sodium-ion batteries take off.

Salt is certainly of economic importance, although not a supply risk, though some countries do rely on imports for their salt requirements (the USA has a 25% net import dependency on salt, sources are Canada, Chile, Mexico, and Egypt).

Things are heating up for Na-ion batteries, especially in China. In 2022, HiNa Battery commissioned the first GWh scale Na-ion battery production line Anhui. There are another 35 plants being built. Meanwhile, Chery, a Chinese carmaker, is using CATL’s Na-ion battery alongside some Li-ion batteries, in its new icar brand, launched in April 2023.

In Project Blue’s high case scenario, the salt required to process and produce sodium-ion batteries in 2050 would approach 3m tonnes, which is roughly 1% of the current total production of processed salt in 2023.

This scale of potential sodium-ion demand could elevate sodium, and the salt required to produce it, into critical material status for delivering energy transition.

Find out the latest trends & developments in salt supply & demand at

Confirmed speakers including “The potential of sodium-ion batteries & salt requirements” by Sean Hoffman, Critical Minerals Research Analyst, Project Blue, South Africa

Full Details Here

Fluorspar – finally achieving recognition

Fluorspar had already made the CRM lists of the EU and the USA (only added in 2018), and in December 2023 it was added to Australia’s CRM list.

Fluorspar is essential as the primary feedstock for hydrofluoric acid (HF) manufacture (the precursor to a wide range of fluorochemicals), and is vital in steel and aluminium production.

However, its “criticality” has been “raised” owing to its projected demand for use in Li-ion battery, solar panel, and semiconductor manufacturing.

In Li-ion batteries, fluorspar is the feedstock source for lithium hexafluorophosphate (LiPF6) used as an electrolyte, and for polyvinylidene fluoride (PVDF) used as separators, coatings, and binders. PVDF is also used in backing sheets for solar panels.

In semiconductor manufacturing, >99.99% purity HF is required in the etching process for semiconductors and for removing impurities from the final silicon chip.

World sources of fluorspar are limited. The USA has no established domestic source of fluorspar, and is 100% net import reliant, supplied by Mexico, Vietnam, China, and South Africa.

While Canada Fluorspar Inc. is yet to restart operations in Newfoundland, a new US fluorspar mine is in development by Ares Strategic Mining Inc. near Delta, Utah (mine and plant construction underway), which will provide an interesting, and for US consumers, much needed alternative source. New sources are also being evaluated in Europe and Australia.

Find out the latest trends & developments in fluorspar supply & demand at

Confirmed speakers covering new sources in Mongolia, Australia, Pakistan, USA and market demand in Li-ion batteries and electronics | Visit to Mongolczechmetall

Early Bird Rates | Full Details Here

USA & Europe response

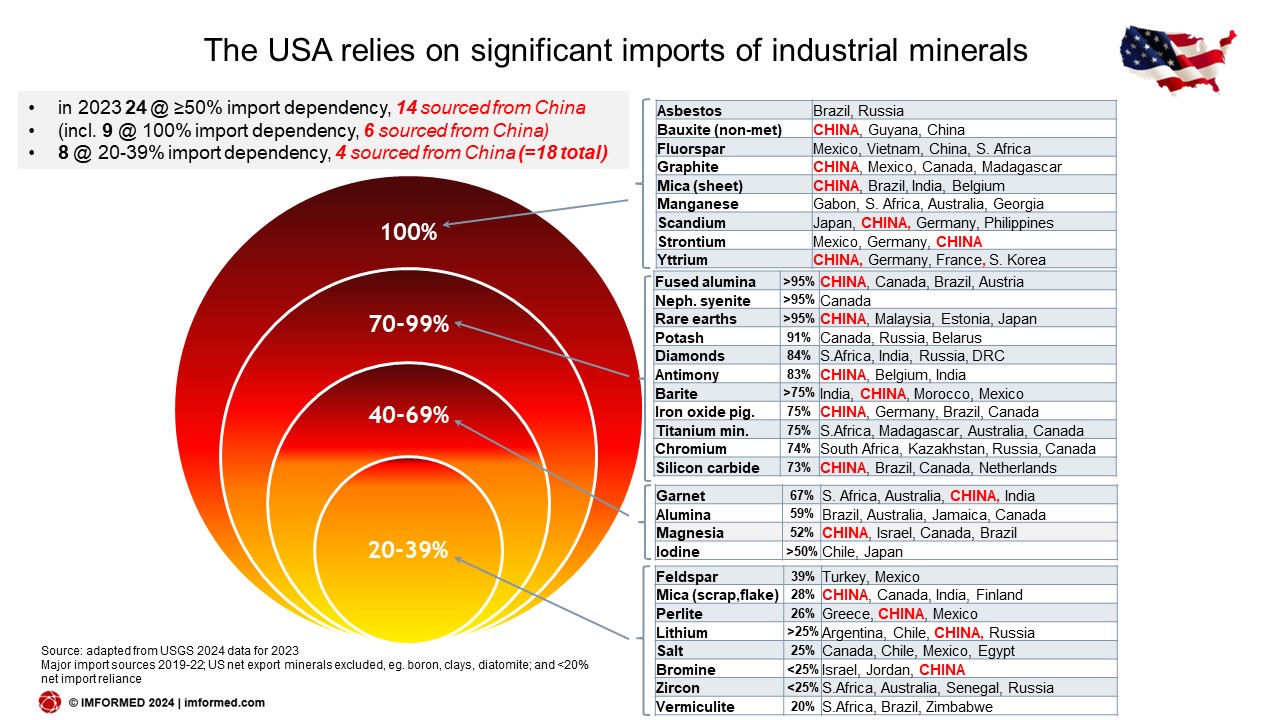

The USA relies on significant imports of industrial minerals: in 2023, according the USGS, 32 industrial minerals had ≥20% net import dependency, of which 24 industrial minerals were at ≥50% import dependency (including 9 at 100%).

Over 50% of the minerals (18) were sourced from China (6 at 100%, 8 at >50%, and 4 at 20-28%). Graphite, fluorspar, refractory bauxite are in the 100% category; fused alumina at >95%.

A series of actions by the US government during 2018-23 have addressed domestic supply-chain vulnerabilities for CRM, with the Inflation Reduction Act of 2022 foremost among these.

Several investments were announced in 2023 to address the domestic availability and supply of CRM, including lithium and graphite projects.

Most recently, in May 2024, the US government announced increased import tariffs on Chinese goods including EVs, Li-ion batteries, graphite, and other “critical minerals”, including “aluminum ores & concentrates”.

Over the pond, at the same time, the European Council formally adopted the Critical Raw Materials Act (CRMA), to establish a framework to ensure a secure and sustainable supply of CRM by identifying 34 critical and 17 strategic materials crucial for green and digital transitions, defence, and space industries.

How these actions will unfold and assist desired rapid Western development of CRM remains to be seen – there are many doubters out there.

The USGS Critical Minerals List is due for revision in 2025, it will be interesting to see if any further industrial minerals make the so-called CRM grade.

* IMFORMED is once again both honoured and delighted to be invited to write the introduction to Mining Engineering’s annual review of industrial minerals in its July 2024 issue.

For a PDF copy of ME article pages click here

Edited each year by Jim Norman, VP, Tetra Tech Inc., the IM Annual Review 2023 covers 38 industrial minerals, summarising supply and demand trends.

Bill Gleason, Editor, ME writes: “Each year, the July issue features the Industrial Minerals Review. I’d like to thank Mike O’Driscoll for his summary of the industrial minerals sectors. O’Driscoll keeps his finger on the pulse of this interesting, yet sometimes overlooked, sector of the mining industry. In his introduction to the section, O’Driscoll writes that while the sector has sometimes been called “the third world” of the industry, now might be the time for industrial minerals to gain the rightful recognition of their importance.”

Great article Mike. I share your passion for the industrial minerals sector which in my opinion is far more exciting than the other mineral sectors for two reasons. Firstly it involves active sales and marketing which is still an art and secondly one can never know everything so there is both a challenge and the satisfaction of mastering a new material or application. After nearly a lifetime in the business I am still learning. One thing I have learnt is that geologists make excellent salesmen/marketers for industrial minerals. Perhaps their optimism for the next discovery allows them to be always optimistic for the next sale.

Looking forward to seeing both you and Ismene at your Fluorine Forum in Mongolia and then your China Refractory Minerals Forum in Dalian in October and that reminds me that the great people one meets in the industry are the other significant benefit.

Many thanks kind comments Richard, and I totally agree. Very much looking forward to meeting up again!

Great one, Mike, as always. I agree with you and Richard’s comments as well. Wonder if there is a new generation geologists already appearing ? Also wonder if the industry is supported and lobbyed for., I have the impression, that IMA Europe is making no noise at all for the European side of the story.

Yes, many minerals are critical these days. But pls do not forget the huge challenges which are lying in front of us regarding logistics. Europe is getting grey hair like me, we are missing labour the coming years at all places in the supply chain / logistics. Geopolitics, war and many types of crisis will have an impact on transport, on any logistics which , as you know are of vital importance for any industrial mineral, from the mine to the market. Not easy to cope with all these challenges …

Yes Robert, totally agree on the importance of logistics underpinning all these new mineral projects. Logistics due diligence is so often underestimated or even at worse, ignored until too late!