And then there were…still three producers of andalusite!

Andalusite Resources mining andalusite at Maroeloesfontein, Limpopo province, South Africa.

The long-awaited decision by South African authorities has appeared to have finally quashed Imerys’ hopes of amalgamating one of the world’s two independent producers of the refractory mineral andalusite.

In a statement issued today the South African Competition Tribunal announced that it has prohibited the proposed acquisition by Imerys South Africa (Pty) Ltd of Andalusite Resources (Pty) Ltd (for background and more details on andalusite see Imerys move to buy Andalusite Resources quashed).

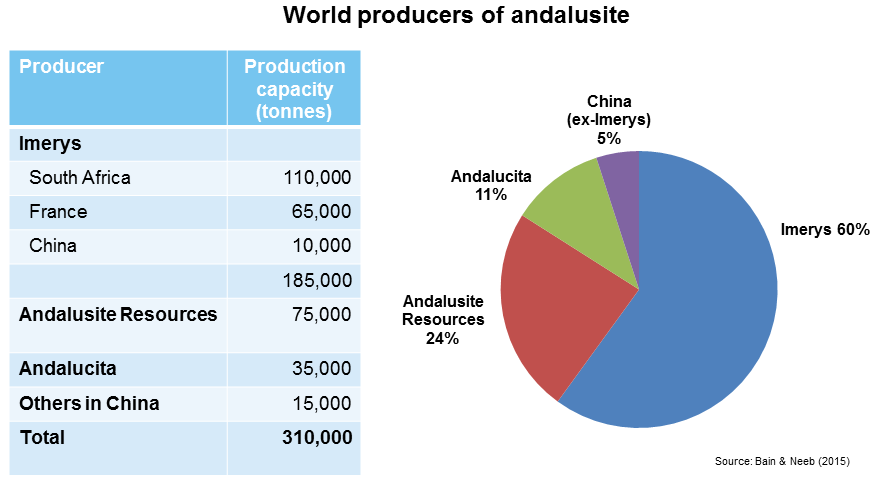

This leaves the primary andalusite supply market still dominated by Imerys’ operations (around 60%, see chart), but retaining independents Andalusite Resources in South Africa and Andalucita SA in Peru.

According to the Commission, the merging parties proposed certain “behavioural conditions” in an attempt to address the concerns raised by the Commission’s initial investigation during 2015.

However, these were considered inadequate by the Commission and did not address the structural market change that was feared to materialise from the proposed transaction.

Moreover, the proposed behavioural conditions were also considered to be impractical from a monitoring and compliance perspective, and would have been “unduly onerous” on the Commission to effectively monitor.

The Commission found that the proposed acquisition represented a so-called “two to one” merger, leading to a monopoly in the mining, processing and sale of andalusite in South Africa, and also a near-monopoly in the global sale of andalusite.

No further details were released by the Commission, and the Tribunal is expected to issue its full reasons for prohibiting the proposed transaction in the coming weeks.

Although South Africa and France are its main andalusite sources, Imerys also has a smaller operation at Ku’erle, Yanji, Xinjiang, China

Road to prohibition

Termed an “intermediate merger”, the deal was first notified to the Competition Commission in January 2015.

In terms of the proposed transaction, Imerys intended acquiring the entire issued share capital of Andalusite Resources. Imerys South Africa (Pty) Ltd is a subsidiary of Imerys Refractory Minerals Glomel SA (formerly known as Damrec SAS).

Both companies mine and supply fine and medium grain sizes (0-3mm) to refractory producers in South Africa and overseas, although in South Africa only Imerys supplies premium coarse grains (>4mm).

During its subsequent investigation the Commission received numerous concerns from both producers and end-users of andalusite-based refractories regarding the effects of the proposed merger.

In particular, the Commission found that producers and users were concerned that should the merger proceed, they would be deprived of a competitive choice between Imerys and Andalusite Resources.

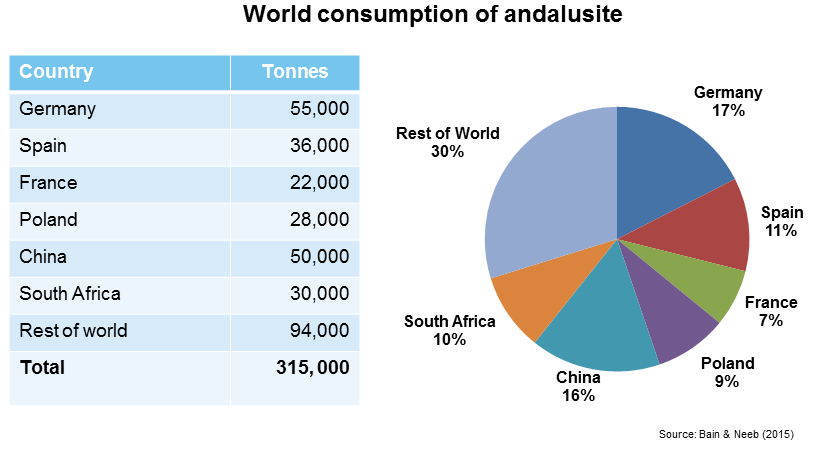

Indeed, there were fears expressed that the merged entity would increase the price of andalusite and/or divert andalusite sales from South Africa to export markets.

After the initial investigation, the Commission prohibited implementation of the merger on 16 April 2015.

Then on 4 May 2015, the merging parties referred the matter to the Tribunal requesting the consideration of the prohibited merger.

The hearing took place over several months in 2015 and 2016 and the last submissions from the merging parties were filed on 24 August 2016.

The Tribunal has now prohibited the transaction.

What next? Opportunities for others?

The result cannot have come as a complete surprise, given the somewhat forthright wording of the initial response from the Competition last year, and the clear fact that there are extremely limited commercially developed world sources of andalusite.

Despite the outcome, and awaiting more details on the Commission’s reasoning, Andalusite Resources told IMFORMED that it remains business as usual, and staff will be in attendance at next week’s 59th International Colloquium on Refractories at Aachen 28-29 September 2016.

Imerys’ failure to secure one of its main competitors will most likely be well received in the refractories market.

Indeed, the news may also be welcomed by other parties keen to gain traction in the refractory raw material supply sector, including investors, private equity funds, and perhaps even established players in the refractories sector.

Imerys meanwhile will most likely cast its net elsewhere to further expand its aluminosilicate mineral portfolio, although options are rather limited. Would a certain kyanite producer be on the French group’s radar?

With Imerys swallowing S&B Industrial Minerals and getting the fused and tabular alumina assets of Alteo over the course of the last two years, anything is possible!

Please drop in and see us at our booth at the 59th International Colloqium on Refractories in Aachen next week, 28-29 September 2016.

Pick up a complimentary copy of our new Refractory Raw Material World Sources Map®

Find out more about Graphite Supply Chain 2016, 13-15 November 2016, Newport Beach – the world’s new meeting place for the natural graphite industry

Leave A Comment