Non-fluorspar sources – evolving & utilised; FSA a game changer?

The shape of things to come? Buss ChemTech’s third plant for Wengfu Group converting FSA to AHF; installed with 20,000 tpa AHF capacity in 2012 at Hubei Wengfu Lantian Fluorchem Co. Ltd, Hubei; Buss ChemTech completed a fifth plant in 2019. Courtesy Buss ChemTech

As we examined in Part 1, new fluorspar deposit developments in North America are showing signs of increased activity (see Part 1: North American mineral prospects – so who’s doing what?).

In Part 2, we examine the progress with alternative fluorine sources such as fluorosilicic acid (FSA), depleted uranium hexafluoride (DUHF), mine tailings, and bauxite which are receiving equal attention.

PLEASE NOTE

We are pleased to announce that we will run Fluorine Forum ONLINE 2020 this year:

Fluorine Forum ONLINE 2020

13 October 2020

Full Details

AHF/HF from fluorosilicic acid (FSA) – Nutrien/Arkema | Wengfu Group

Of all the potential alternatives to fluorspar, the one that is ahead of the pack and has most recently hit the fluorine market headlines, and a wake-up call for fluorspar exporters to the USA, is fluorosilicic acid (FSA).

For some decades, there has been much debate about the pros and cons of sourcing hydrofluoric (HF) acid and anhydrous hydrogen fluoride (AHF) from the FSA waste produced from phosphoric acid production.

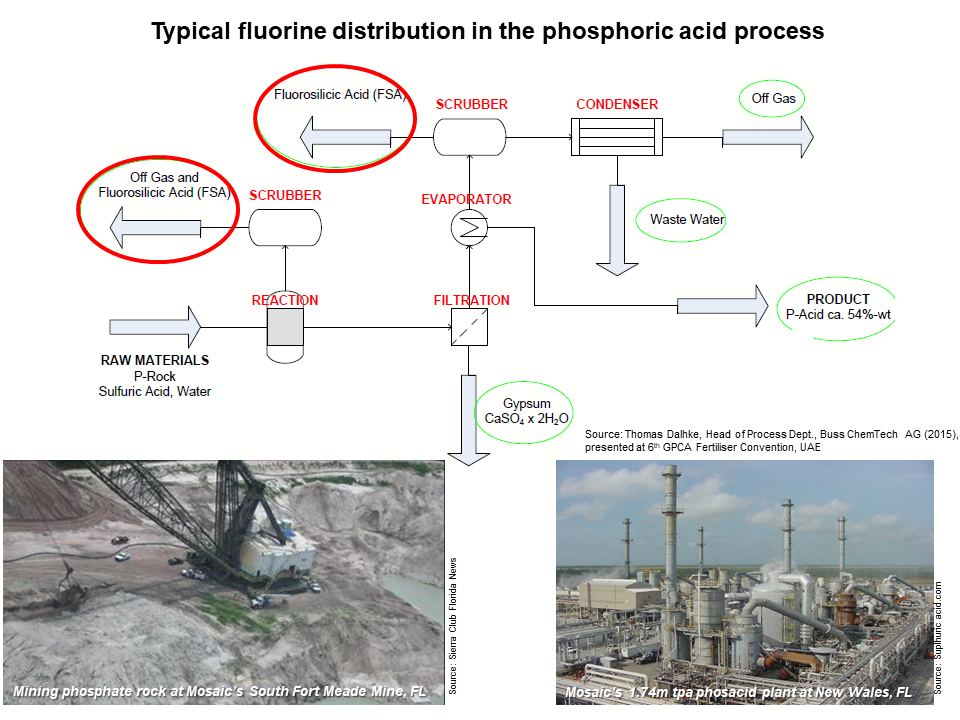

In the huge volume phosphate rock supply sector for fertilisers (around 240m tonnes produced globally in 2019), the ore is reacted with sulphuric acid to produce phosphoric acid with silicon tetrafluoride and hydrogen fluoride formed as by-products. These gases are usually scrubbed with water, forming fluorosilicic acid, H2SiF6 (FSA) as a waste stream.

Impact of COVID-19 on the fluorspar industry and discussion on threat of alternatives to fluorspar

Webinar organised by

| panel participation by

Thursday 25 June 2020

Roskill will present its latest views and insights on the fluorspar industry and the entire F-supply chain, examining the challenges caused by COVID-19 given the impact the pandemic is having globally and what the future may have in store based on Roskill’s in-house macroeconomic outlook.

The webinar will also host a panel with special guest Mike O’Driscoll of IMFORMED; and Adam Coggins and Kerry Satterthwaite, Fluorspar Analysts at Roskill, with a deeper look at the fundamentals of the acidspar and metspar markets in light of the global economy, and how supply chains may be reshaped to reduce risk from future pandemics or similar events.

Asia and Oceania

0800 AM BST

REGISTER HEREEurope, Africa and Americas

03:30 PM BST

REGISTER HEREThere will be an opportunity for Q&As at the end of the call.

To submit questions in advance, please contact Kerry Satterthwaite: kerry@roskill.com

Until now, most FSA was neutralised or disposed, and commercial use limited to drinking water fluorination and in the production of aluminium fluoride (AlF3).

According to the USGS, in 2019 an estimated 17,000 tonnes FSA, equivalent to about 27,000 tonnes of fluorspar grading 100%, was recovered from four US phosphoric acid plants processing phosphate rock, and used primarily in water fluorination.

However, recent years have seen growing interest in using FSA as a fluorine source, driven by high price spikes of fluorspar, shrinking supply capacity, Chinese supply unpredictability, coupled with consumer corporate strategies leaning towards “green” raw material supply chains, ie. using renewable sources and recycled materials from waste.

The writing was indelibly on the wall on 3 June 2020 when leading Paris-based fluorochemical manufacturer Arkema announced a long-term FSA-sourced AHF supply deal with Nutrien Ltd, the world’s largest integrated agricultural company.

Nutrien, formed from the megamerger of Agrium Inc. and Potash Corp. of Saskatchewan Inc. sealed in January 2018, produces >25m tpa of potash, nitrogen and phosphate. The group operates large integrated phosphate mining and processing facilities at Aurora, North Carolina, and White Springs, Florida. In 2008, the Aurora plant commissioned two phosphoric acid evaporators for producing FSA.

Arkema is to invest US$150m in a new 40,000 AHF plant at Nutrien’s phosphate facility in Aurora. The AHF plant is scheduled to start up in the first half of 2022 and supply Arkema’s Calvert City, Kentucky plant; about 50% output will be used for the production of high added value polymers and fluoro-derivatives, and the remainder for the production of low-GWP (global warming potential) fluorogases.

Nutrien’s vast phosphate complex at Aurora, North Carolina with production capacity for 5.4m tpa phosphate concentrate, 1.2m tpa phosphoric acid, and 0.8m tpa DAP/MAP. By 2022 a new 40,000 tpa FSA-to-AHF plant will be installed to supply Arkema, replacing an equivalent of roughly 88,000 tonnes of acid grade fluorspar supply. Image source: Google Earth

This project ticks many boxes for Arkema: it helps meet its long-signalled objective of securing competitive, long-term supplies of strategic raw materials; supports the growth of fluoropolymers in water treatment, electronics and Li-ion batteries; and offers a favourable impact on the environment.

The announcement also included a statement that will stand out and be felt among the fluorspar supply sector, Arkema noted: “In a context of growing tensions regarding mined fluorspar and AHF supply, it

Arkema is the world number three in fluorogases, its main competitors being Chemours, Koura Global, Honeywell and several Chinese players – all large consumers of fluorspar.

Will this be the start of more fluorine consumers switching from fluorspar to FSA-sourced fluorine products?

The 40,000 tpa AHF to be supplied to Arkema by Nutrien represents the equivalent of roughly 88,000 tonnes of acid grade fluorspar, a not inconsiderable volume, at say US$350-450/t FOB.

It represents almost 24% of the USA’s estimated 370,000 tonnes of imported acidspar in 2019 (there is no domestic production of acidspar in the USA, which relies 100% on imports: Mexico, 66%; Vietnam, 13%; South Africa, 8%; China, 6%; and other, 7%, according to the USGS).

This is not the first time that Arkema has eyed the idea of securing raw material supply: in 2011 the group invested $100m in a 20% stake in Canada Fluorspar Inc. (CFI) and 50% in a joint venture, Newspar, to start up the St Lawrence mine in Newfoundland. CFI was subsequently acquired by Golden Gate Capital in 2014, and Arkema sold its stake to CFI in 2016. CFI started operations in 2018 (see Fluorspar supply: trade trends & new sources).

Investment in a FSA-sourced AHF plant is the first of its kind in the USA, and will represent the largest single such plant in the world.

The only other FSA-to-AHF plants are located in China. From 2008 to 2019, Buss ChemTech AG, Switzerland, which commercialised its HF from FSA process in the mid-2000s, completed five such plants for phosphate giant Guizhou Wengfu Group Co. Ltd (totalling 115-120,000 tpa AHF capacity).

Last year Wengfu merged with Guizhou Kailin Holdings (Group) Co. Ltd to become China’s phosphate leader with a combined >10m. tpa capacity and phosphate reserves of around 1.5bn tonnes (40% of China’s total). The group is looking to expand further, which may include more AHF capacity requirements.

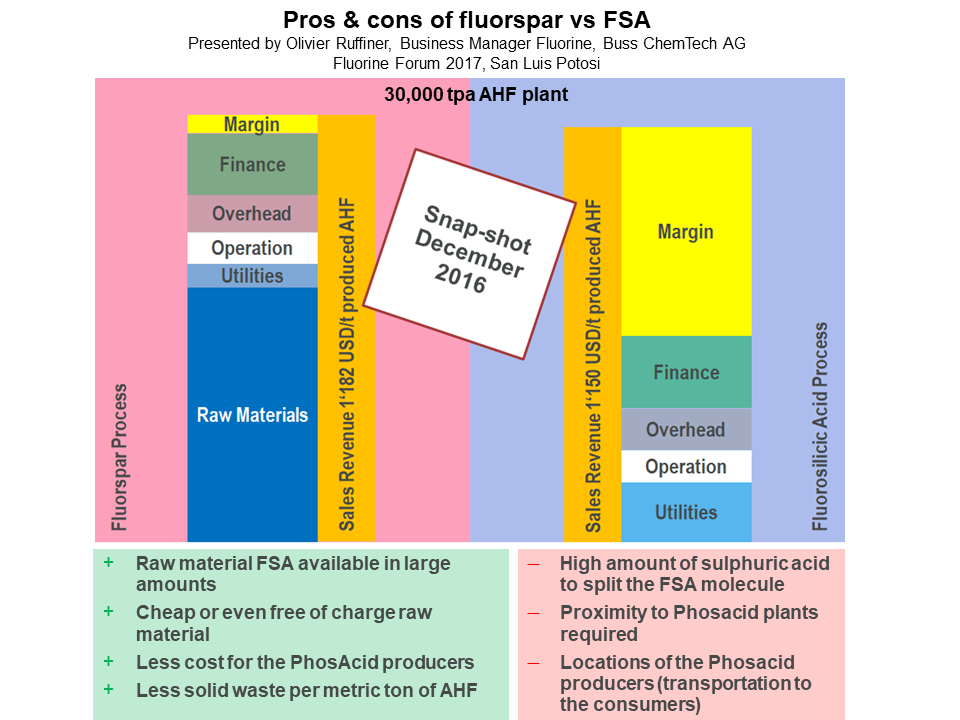

Olivier Ruffiner, Business Manager Fluorine, Buss ChemTech, told IMFORMED: “I seriously believe this [Arkema-Nutrien] announcement will bring movement in the market because the production costs of AHF are significantly lower and this gives an advantage to the companies going for this path. Additionally they can claim to produce ‘green’ AHF from naturally occurring fluorine.”

Nutrien is not the only US phosacid producer (1.74m tpa) with FSA availability: there is The Mosaic Co. (5.32m tpa), JR Simplot Co. (0.92m tpa), and Itafos (0.349m tpa). Mosaic is the world’s largest combined producer of phosphates and potash, with 16.1m tpa phosphate capacity (and 10.5m tpa potash capacity). In late 2019, Univar Solutions Inc., a leading supplier to the US water treatment acquired “certain assets” of Mosaic’s FSA business.

The question will be if, or perhaps rather when, other phosacid producers will follow the FSA-to-AHF trail and join forces with other fluorochemical majors.

Since 2017, IMFORMED’s Fluorine Forums have engendered spirited debate over fluorspar versus FSA, and those claiming that FSA would pose little or no threat to fluorspar producers might now wish to re-evaluate the situation. This sets the scene nicely for a continued discussion on the subject at Fluorine Forum 2020 REVISED, 12-13 October 2020, Grand Hotel Huis ter Duin (Noordwijk), Amsterdam – FULL DETAILS.

Our Fluorine Forum event in Hanoi originally scheduled for October this year has been moved to next year as Fluorine Forum 2021, Pan Pacific Hanoi, 18-21 October 2021 (include visit to lead sponsor Masan Resources’ Nui Phao operation) – FULL DETAILS

Olivier Ruffiner, Business Manager Fluorine, Buss ChemTech presented on the merits of using FSA over fluorspar and the company’s process at IMFORMED’s Fluorine Forum 2017, San Luis Potosi, Mexico. For a review see: Fluorspar feel-good factor in Mexico

Datta Umalkar, Technical Consultant, Chenco GmbH, Germany, presented on FSA’s challenges and opportunities at IMFORMED’s Fluorine Forum 2019, Prague. For a review see: Fluorspar outlook: Pitch perfect in Prague

HF/AHF from depleted uranium hexafluoride – JSC Electrochemical Plant | New Chemical Products | Mid-America Conversion Services

An alternative source of HF and AHF which although not a recent innovation is nevertheless gaining interest, is from depleted uranium hexafluoride (DUF6).

In essence, DUF6 is an unstable waste product of uranium enrichment, which requires conversion to the more stable uranium oxide through a process of defluorination. The process recovers HF as a by-product.

In Russia, JSC Electrochemical Plant (ECP) is a uranium enrichment enterprise of Rosatom, the State Atomic Energy Corp., and is expanding capacity.

JSC Electrochemical Plant’s 10,000 tpa DUF6 conversion plant at Zelenogorsk, Krasnoyarsk; a new plant on site will double capacity in 2023. Courtesy JSC Electrochemical Plant

ECP was the first in Russia to master the industrial processing of DUF6 into uranium oxide using technology proposed by French nuclear scientists. The first and only plant in Russia, called W-ECP, was established at Zelenogorsk in Krasnoyarsk, and started up in December 2009 with a capacity of 5,000 tpa, increasing to 10,000 tpa in 2011.

HF and AHF produced at the W-ECP plant are used in various industries, including nuclear. To transport the products to consumers, ECP has a unit for filling railway tanks. The company is now established as a reliable participant in the Russian fluorinated products market.

May 2020 marked a milestone as ECP completed the processing of 100,000 tonnes of DUF6 since W-ECP’s start up.

Of significance is that the success of the W-ECP plant led to a decision at the end of 2019 to install a second plant, W2-ECP, to be built (again) by Orano Group, France, representing an investment of US$44m.

Start up of W2-ECP is scheduled for 2023, and will double ECP’s overall capacity to 20,000 tpa.

Also in Russia, New Chemical Products LLC (NCP) was founded in 2003 by a team of scientists and engineers in St Petersburg to develop highly efficient processes to recover high purity AHF from DUF6 and to extract 100% AHF from 25% hexafluorosilicic acid.

Since 2015, NCP has received funding from the Skolkovo Foundation and a number of private investors which culminated in a 250 tpa pilot plant completed in mid-2018.

In September 2019, agreement was reached to build a large scale plant to recover AHF from DUF6. Multiple patents have been filed and received for NCP’s FSA-to-AHF process, and results of further development and test work completed in Q2 2020 were described as “very successful, exceeding expectations”.

Bob Welch, Sales Director, NCP, USA, presented on the company’s progress at IMFORMED’s Fluorine Forum 2019 in Prague (see Fluorspar outlook: Pitch Perfect in Prague).

In the USA, the US Dept. of Energy started construction of two DUF6 conversion facilities in 2004 at Paducah, Kentucky, and Portsmouth, Ohio, which came on stream in 2011 (to run for 34 to 44 years) and 2010 (for 22 to 32 years), respectively. Since 2017, the two plants have been managed and operated by Mid-America Conversion Services LLC.

US DoE DUF6 conversion plants at Paducah, KY, (left) and Portsmouth, OH, (bottom right) whose mission is to tackle the stock of 63,000 DUF6 cyclinders (top right) have been in operation since 2010; a new process line is planned at Portsmouth. Courtesy Mid-America Conversion Services

The plants were built to convert a 765,000 tonne inventory of DUF6 contained in some 63,000 cylinders, a legacy by-product of the uranium enrichment processes at the former Paducah and Portsmouth gaseous diffusion plants in operation for more than 60 years of operations, closing in 2013 and 2001, respectively.

During the conversion process approximately 11,000 tpa of HF is recovered at Paducah and 8,300 tpa HF at Portsmouth. Smaller amounts of fluorite (CaF2) are also recovered but their contamination marks them for waste disposal.

On 23 January 2020, it was decided that a fourth DUF6 conversion line will be installed at Portsmouth, expected to be operational by October 2022.

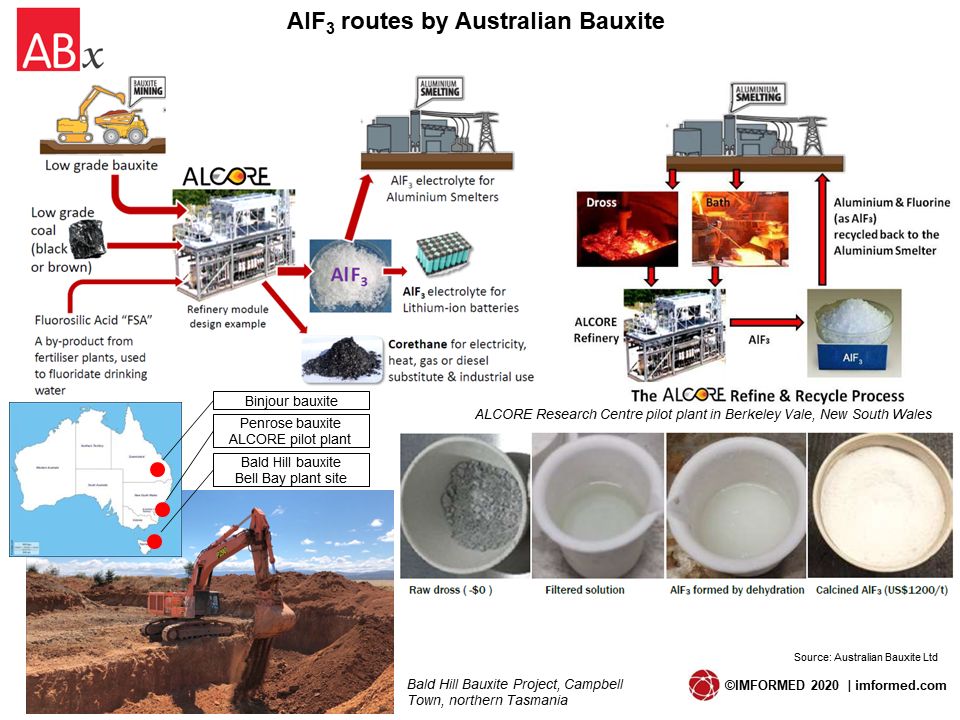

Aluminium fluoride from bauxite & dross – Australian Bauxite

Aluminium fluoride (AlF3) is one of main markets for fluorine, derived from mainly fluorspar (but also FSA) via reaction with hydrofluoric acid (HF) and alumina trihydrate (ATH).

AlF3 is used in primary aluminium production to help lower bath operating temperature, replace losses of fluorine, and maintain the cryolite (Na3AlF6) ratio. The global market for AlF3 is about 1.5m tonnes.

The main cost components in AlF3 production are the raw materials, with fluorspar and ATH accounting for 41% and 24%, respectively. So any competitively priced alternative fluorine source and process attracts attention and may influence future fluorspar demand.

On 27 May 2020, Australian Bauxite Ltd announced that 89%-owned subsidiary Alcore Ltd had achieved its latest milestone in producing aluminium fluoride (AlF3) that was sufficiently pure to be saleable grade for aluminium smelters.

The commercial grade AlF3, processed at the Alcore Research Centre pilot plant in Berkeley Vale, New South Wales, was made from 30% aluminium smelter dross waste and 70% gibbsite (trihydrate bauxite mineral); typical specifications are: >90% AlF3, 0.05% Fe2O3, 0.28% SiO2, 0.60% Na2O, 0.09% CaO, 0.035% P2O5, 0.003% MgO.

Australian Bauxite is developing bauxite deposits in Queensland, New South Wales and Tasmania (including “refractory-abrasive grade” bauxite from its white bauxite deposit at Penrose 90km inland of Port Kembla, New South Wales).

Alcore plans to be the first southern hemisphere producer of AlF3 with an output of approximately 10,000 tpa of AlF3, increasing five-fold as demand grows, supplying domestic and overseas markets.

Plans are underway to build a production plant at Bell Bay, northern Tasmania near to an aluminium smelter, a manganese smelter and an aluminium powder plant, all powered by hydroelectricity. The company is finalising the process flow diagram and has commenced engineering design work.

Alcore has also established its “Refine & Recycle” process: manufacturing AlF3 from aluminium-rich and fluorine-rich by-product waste streams from aluminium smelters so as to increase recycling credits for aluminium smelting.

According to Australian Bauxite, over the last year Australasian aluminium smelters have imported more than 30,000 tonnes AlF3 from China at an average price of US$1,370/tonne.

Paul Lennon, Chairman, Australian Bauxite said in the latest results review: “A domestic producer of AlF3 should increase security of supply for aluminium smelters in Australasia and elsewhere in the southern hemisphere.”

Alcore is now in the process of progressing commercial grade AlF3 for testing by prospective AlF3 customers, and making high purity AlF3 from gibbsite that can be used in lithium ion batteries.

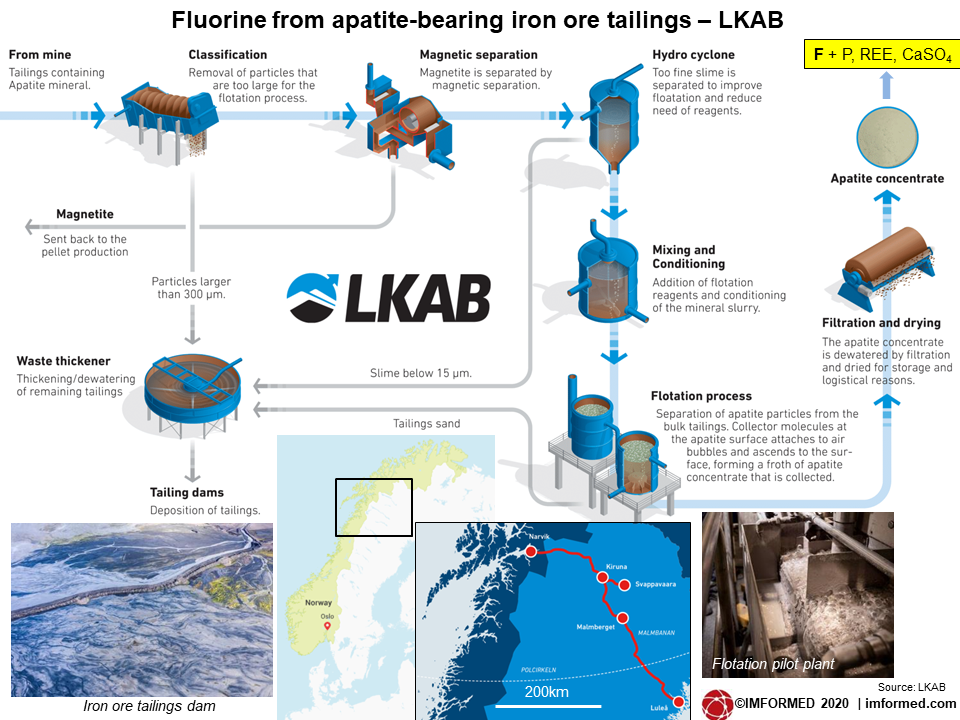

Fluorine from iron ore tailings – LKAB

Leading iron ore producer LKAB, Sweden, is developing technology to recycle its mine waste to produce phosphorus mineral fertilisers, rare earth elements (REEs), gypsum, and fluorine.

The project is called ReeMAP, which was highlighted at IMFORMED’s Mineral Recycling Forum 2020 earlier this year by David Högnelid, Chief Marketing & Communications Officer, Special Products Division, LKAB (see Recycling Industrial Minerals: Challenges, Solutions & Opportunities).

From its mobile pilot plant, built on container platforms so that it can shuttle between LKAB’s production plants in Malmberget and Kiruna, northern Sweden, LKAB announced in May 2020 that it had successfully produced an apatite concentrate from mine tailings, the first stage of the process from which other the products can be derived.

The focus is now to test, verify and plan this production thoroughly to obtain the right yield and cost of production. The process has multiple steps, with flotation applied to separate the apatite from the non-valuable tailings. This is repeated in several steps to obtain a high purity product with the right specification for further processing using innovative chemical treatment.

LKAB estimates that full scale production from Malmberget and Kiruna will produce around 400,000 tpa of apatite concentrate in two plants that will be of similar size to its existing iron ore concentrating plants.

Apatite can vary in its composition, although on average, fluorine content in apatite can range 2-4% by weight. So LKAB’s estimated annual apatite concentration production could possibly yield approximately 8-16,000 tpa F.

Wrap-up

The move by a major fluorochemical producer to switch to securing its fluorine requirements from an FSA plant hosted by a phosacid producer may well prove to be a game changer.

Just to recap: by 2022 Wengfu and Arkema/Nutrien will be producing a combined total of 150,000 tpa AHF from FSA, translating to a reduction in fluorspar consumption by approximately 330,000 tpa.

A wealth of phosacid plants presents an attractive FSA feedstock, although key among the questions will be the location of the plants to fluorochemical consumers.

And should more fluorspar capacity outside China come on stream in the near future, and at competitive pricing, this would also create more debate for consumers.

Although cost is important, it might just boil down to what’s likely to represent the most stable security for long term supply in consistent volumes and quality.

We hope to be debating these issues at IMFORMED’s upcoming Fluorine Forum 2020 REVISED, 12-13 October 2020, Grand Hotel Huis ter Duin (Noordwijk), Amsterdam – FULL DETAILS.

Our Fluorine Forum event in Hanoi originally scheduled for October this year has been moved to next year as Fluorine Forum 2021, Pan Pacific Hanoi, 18-21 October 2021 (include visit to lead sponsor Masan Resources’ Nui Phao operation) – FULL DETAILS

If you are interested in presenting or participating as discussion host at either Fluorine Forum 2020 or Fluorine Forum 2021 please contact Mike mike@imformed.com

PLEASE NOTE

We are pleased to announce that we will run Fluorine Forum ONLINE 2020 this year:

Fluorine Forum ONLINE 2020

13 October 2020

Brilliant summary Mike, thank you. Looking forward to continued “spirited debate” in Amsterdam!