US demand tight | International growth | Frac sand surge | Barite India & Nigeria

The oilfield market for industrial minerals – such as barite, bentonite, silica sand, calcium carbonate, graphite, and bauxite – used in a range of applications including drilling fluids, stimulation, and well cementing – appears to be entering a period of strong demand.

As leading US oilfield service companies report on very healthy financials for Q1 2022, their market forecasts chime together in anticipating an upbeat performance for the rest of 2022 and beyond regarding drilling activity and thus oilfield mineral demand.

In North America, market tightness is reported across all service segments. In Q1 2022, the average US rig count increased 14% sequentially, and is up 62% year-on-year.

The vast majority of currently active rigs are in the Permian Basin, but other areas are also seeing increased focus.

All the latest trends and developments in oilfield mineral supply and demand will be covered at IMFORMED’s upcoming Oilfield Minerals & Markets Forum 2022, Houston, 23-25 May – see link for full details.

FULL DETAILS HERE

Confirmed speakers

Oilfield market outlook: where’s it heading?

Uday Turaga, CEO, ADI Analytics LLC, USAThe Biden Administration’s view on oil and mining: a reality check

Chris Greissing, President, Industrial Minerals Association – North America, USAThe minerals supply chain from an oilfield service company perspective

Schlumberger Ltd, USAOilfield Barite: The definition of Insanity

Albert Wilson, COO, CIMBAR Performance Minerals, USABarite global overview

John Newcaster, Principal, IMPACT Minerals, USABarite supply developments in China & Mexico

Liao Ying, General Manager, Baribright International Inc., ChinaMorocco barite developments & outlook

Youssef Laghzali, Sales Manager, Broychim, MoroccoUS frac sand market trends & forecast

Joseph Triepke, Founder & Principal Research Analyst, Infill Thinking LLC, USANew source of high grade bauxite ceramic proppants

John Karson, VP Sales & Marketing, First Bauxite LLC, USALeonardite and its use in the oilfield market

Hugh Parker, Sales Manager, Leonardite Products LLCNorth American logistics for oilfield minerals

Richard Dodd, President, RDC Logistics, USAA global shipping storm: Covid and its ramifications

Jesper Hoppe, Managing Director & Sebastian Syran, Chartering Manager, Viking Shipping Company AS, NorwayPLUS Roundtable Breakout: Barite | Logistics | Proppants | Due Diligence & Valuation | Processing

DUC wells, security, rising prices drive market growth

Several influencing factors have ensured a buoyant oilfield market for minerals in the short to medium term.

Not least, is that in the US many wells in recent years remain drilled but uncompleted (DUC), ie. they were drilled but not brought into production before the COVID-19 shut down, thus allowing production initially to be increased while rigs sat largely idle.

Olivier Le Peuch, CEO, Schlumberger, points towards elevated commodity prices tightening supply conditions to continue owing to capital discipline, consistent OPEC policy implementation, and supply dislocation from Russia – all accelerating short-cycle investment in North America.

In the international market short-cycle investments are set to accelerate with the seasonal rebound in Q2 2022, and more strongly in H2 2022, led by the Middle East and key international offshore basins.

Also, energy security as a growing priority is expected to drive further capacity expansion and support additional long-cycle development projects, exploration activity, and brownfield rejuvenation programs.

Schlumberger sees the second half of the year shaping up to be particularly strong, primarily by the international markets, led by the Middle East and key offshore basins.

Offshore activity is already growing sequentially and visibly year-on-year, and is expected to benefit from secular growth in both shallow and deep water environments as the acceleration of infill drilling and tieback developments combine with a resurgence of exploration drilling during the summer, and with an acceleration of long-cycle development projects ahead of 2023.

“We are seeing operators preparing, planning and being ready for accelerating their gas supply to the world market, internationally and in North America as well. I think this is touching all aspects of exploration, development, and production of gas. Unconventional gas internationally in the Middle East, particularly, is getting significant support for regional consumption.” said Le Peuch.

It is widely accepted that North American oil and gas will be critical in the coming years. Chris Wright, CEO, Liberty Oilfield Services Inc. commented: “Tight oil and natural gas markets, coupled with geopolitical tensions in many key oil and gas producing regions, have all eyes on North American supply. North America is well-positioned to be the largest provider of incremental oil and gas supplies to power the global economy and frankly enabled the modern world.”

Halliburton reported on strong growth in Latin America and the Middle East/Asia offsetting the winter weather impacts in Europe. In North America, group revenue grew 37% year-on-year with the acceleration of both drilling and completions activity.

Jeff Miller, CEO, Halliburton said: “We expect oil and gas demand will grow over the near and medium-term, driven by economic expansion, energy security concerns and population growth. Current oil supply tightness and commodity price levels strengthen my confidence in the accelerating multiyear upcycle and very busy years ahead for Halliburton.

Most investments will be directed primarily towards short-cycle activity in the near and medium-term, development over exploration, shale, rather than deep water.”

Halliburton also expects international activity to gain momentum in the second quarter, led by the Middle East and Latin America, and further accelerate in the second half of the year.

While it is generally recognised that in the long term fossil fuels’ contribution to the world’s total energy demand will decline, oil and gas will still represent an estimated 30-50% share in 2050 (compared to 65% in 2019) according to the BP Energy Outlook published in March 2022 (see chart).

Frac sand supply tightens

Halliburton reported that hydraulic fracturing activity surged in March 2022 after winter weather and supply chain disruptions occurred earlier in the quarter.

“Halliburton’s hydraulic fracturing fleet remains sold out and the overall market appears all but sold out for the second half of the year. The market today presents several positive elements, previously absent in North America, and they give me confidence in the continued strength of this market over the coming years.” said CEO Jeff Miller

Tight sand supply has resulted in Halliburton sourcing frac sand from Wisconsin when local mines were down in the Permian.

Primary Vision has estimated that the US oilfield market will end April at around 285-290 active frac spreads, with another 10 expected to be added in May.

Other indicators include the number of oil and gas drilling permits issued by the Texas Railroad Commission, which reached an all-time high of >1,100 in March, with the Permian Basin reportedly seeing over 900 horizontal drilling permits.

The uptick in frac activity is also evidenced by Union Pacific reporting its frac sand and downhole piping railcar volumes are rising.

Leading frac sand producer US Silica (USS) reported continuing positive market conditions and expects to deliver “an even stronger financial quarter with great results in Q2”.

USS’s frac sand and logistics businesses remained effectively sold out in Q1 owing to strong well completion demand, particularly in West Texas, and expect the same for Q2 with a 10% increase in sequential tonnes produced from operational efficiency gains. Like Halliburton, USS supplemented local sand capacity with Northern white sand to assist customers.

Bryan Shinn, CEO, USS said: “We’re going to continue to see strong demand over the next several quarters, so that will help keep the market tight. Overall, 2022 is setting up to be a very promising year…strong customer demand and constructive commodity prices should continue to support higher pricing and improved margins for sand proppant.”

On frac sand prices, Shinn explained that USS was trying to be “very sustainable” in its pricing and profitability: “While we could go out and sell sand for $50 or $60 a ton on the spot market, our preference is to go to our existing customers and perhaps renegotiate the entire contract, get it extended, and instead of selling some number of tons to them at $50 or $60, I’d rather just raise their price to $30 or $35 for the next three or four years. Basically to us, it’s the same margin but it gives them the ability to have more sustainable prices.”

Liberty Oilfield Services, the second largest US fracking services company, warned that demand for fracking services will outpace availability, but adding that it has no plans to build new frac fleets. Courtesy Liberty Oilfield Services

However, it will not be all plain sailing. Challenging issues constraining supply remain, such as labour at the mine sites across the Permian, trucking, and rail logistics.

Liberty Oilfield Services, the second largest US fracking services company, warned that demand for fracking services will outpace availability, but adding that it has no plans to build new frac fleets.

In 2020, Liberty enhanced its services by acquiring Schlumberger’s hydraulic fracturing business OneStim, which included two large frac sand mines in the Permian Basin, and also bought PropX with wet sand handling and delivery solutions.

The company reported frac sand supply tightness in southern oil and gas basins, including the Permian, Eagle Ford, and Haynesville.

Chris Wright, CEO, Liberty said: “While many E&Ps directly source sand, we’re seeing a reversal of that trend as no E&P can hope to match the scale and sophistication of Liberty’s supply chain. Available frac capacity is nearing full utilisation and demand has increased.”

Wright reminded that seven years of underinvestment in oil and gas production capacity has been accompanied by an even more dramatic drought in investment in new frac fleet capacity. The brief 2017 to 2019 upcycle involved redeploying fleets built earlier in the decade, with relatively modest new fleet construction.

According to Wright, much of that older equipment has now been scrapped. “The emerging cycle is likely to last longer and be characterized by a much slower and more modest rise in active frac fleets.” said Wright.

New proppant capacity supply

On US frac sand supply, some additional capacity is expected onstream in 2022 involving some 15 plants with a combined total of 15m tpa frac sand, all in-basin.

These include: in the Haynesville (Performance Proppants, Cyber Square); Permian (Hi-Crush, Nomad Proppants, ProFrac); Eagle Ford (Live Oak Silica Sands); Marcellus (Antero); and Bakken (Asgard Hazen).

Regarding US ceramic proppant supply, which although taking very much a drop in volume demand from its heady peak a decade ago, is nevertheless still required, and will see a new supplier of intermediate, high strength, and ultra high-strength proppant grades in the form of a rejuvenated US Ceramics LLC (USC).

USC, formed in 2019 out of Imerys’ former Oilfield Solutions division, has two ceramic proppant plants in Wrens (250,000 tpa proppant capacity) and Andersonville, Georgia (100,000 tpa), each hosting rotary kilns, producing kaolin-based lightweight ceramic proppants.

USC has just been acquired by First Bauxite LLC, developer and producer of high quality non-metallurgical bauxite at Bonasika, Guyana.

The move allows USC to expand its product lines to a full portfolio of ceramic proppants, from its original lightweight grades, using kaolin, to now include intermediate and high strength, and a patented Ultra High Strength Proppant, all produced with FBX’s high grade bauxite (for a full review of FBX/USC please see First Bauxite acquires US calcination plants).

Indian barite tender yields higher prices

After silica sand used as a proppant in hydraulic fracturing, barite is the largest volume industrial mineral used in oilfield drilling, consumed as a weighting agent in drilling fluids.

China is the world’s largest barite producer (an estimated 2.8m tonnes produced in 2021, according to the USGS), followed by India (1.6m), and Morocco (1.1m), which together account for 75% of world supply. Most barite (85-90%) is used in oilfield drilling.

India’s barite supply is dominated by state government-owned APMDC production from its Mangampet mine in Andhra Pradesh, which claimed production of 2.7m tonnes in 2021/22.

In 2021, the USA imported 1.7m tonnes of barite. Since 2017, US barite import sources have been China, 41%; India, 28%; Morocco, 14%; Mexico, 13%; and other, 4%.

India’s barite supply sector is dominated by state government-owned production from Andhra Pradesh, which claimed production of 2.7m tonnes in 2021/22.

Andhra Pradesh Mineral Development Corp. (APMDC) pushed back to late April 2022 its annual tender for barite sales to processors and exporters, partly because one company still had 200,000 tonnes outstanding from its 2021 tender.

On 22 April, APMDC announced a record revenue from its auction of A (4.25 SG), B (4.10 SG), C and D grades for 2022.

1m tonnes of A Grade was sold at INR6,691(US$87.5)/tonne, an increase of US$27/t from 2021; 3m tonnes of B grade sold for INR5,225(US$68.3/t), up by US$24.5/t; 2m tonnes of C+D grades also received increased prices.

APMDC Vice Chairman and Managing Director VG Venkata Reddy was reported as notifying that the prices will be in force for three years, and maybe increased after reviewing prices in the international market.

Nigeria kickstarts barite production

In an effort to wean itself off imports of barite for its oil and gas drilling industry, Nigeria has reformed and upgraded its domestic barite supply sector.

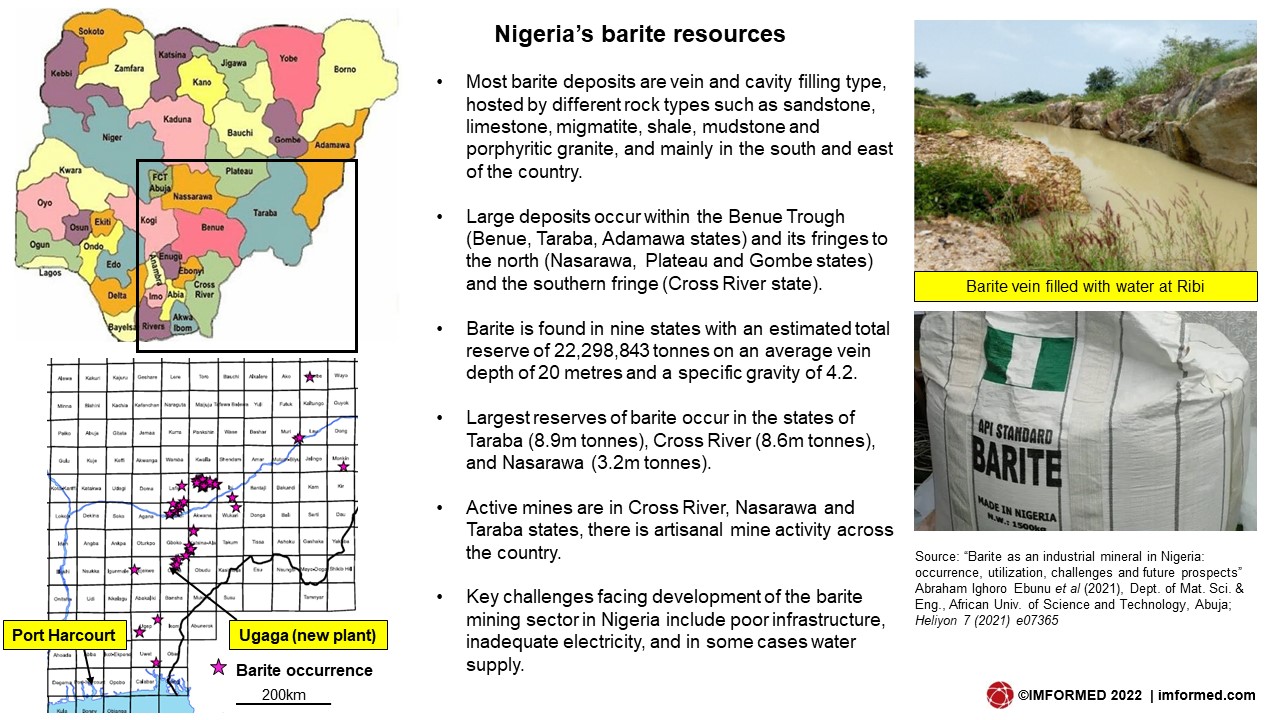

In Nigeria, barite deposits – hosting an estimated total reserve of almost 23m tonnes of 4.2 SG grade – are mainly located in the south and east of the country, with limited mining activities and facing major challenges (see map for details).

In 2020, trade statistics revealed that Nigeria had imported 4,646 tonnes of barite, almost equally sourced from China and Morocco, at a value of nearly US$2m.

Prior to 2020, the only notable large volume imports occurred in 2014 (7,093 tonnes, mostly from China), 2012 (13,678 tonnes, India, USA, UK), 2003 (9,850 tonnes, USA), and 2002 (17,264 tonnes, Morocco, Spain).

However, in July 2020, Minister of Mines and Steel Development, Olamilekan Adegbite, announced that Nigeria would ban the importation of barite to help the country save on foreign exchange.

For some years now, Nigeria has made several attempts to upgrade its domestic barite production to a higher standard and on a commercial scale to meet market demand. Barite is among seven strategic minerals designated for top priority development by the Nigerian government.

Last year seemed to witness a strong drive by the Ministry of Mines & Steel Development to bring this mineral development initiative to fruition at long last.

On 28 October 2021, Adegbite officially launched the “Made in Nigeria Barite” project, with 12 processing companies apparently receiving approval to participate in the scheme.

Earlier in 2021, the Nigerian Content Development and Monitoring Board (NCDMB) approved four firms for the supply of barite: Nishan Industries Ltd, Port Harcourt, Rivers State; Delta Prospectors Ltd, Lafia, Nasarawa State; Ana Industries Ltd, Port Harcourt, Rivers State; and Baker Hughes Co. Ltd, Onne, Port, Rivers State.

This scheme includes an “Open Market Place Portal”, which is intended to connect all stakeholders along the barite value chain to a hub that allows for easy coordination, stocking, effective costing and seamless sale of barite while the Ministry would assume the role of coordinating the entire process.

Central to the project has been development of the “Barite Cluster Processing Plant” at Ugaga, Yala in Cross River state. Located close to barite deposits, raw barite is to be processed in Ugaga to API standard, and then transported 400km to Port Harcourt for sales and export.

The plant is to be operated on behalf of the government by “experienced and knowledgeable experts”.

On 1 April 2022, the Nigerian Government was reported as stating that the country had attained self-sufficiency in barite production, and would no longer need to import the mineral from October this year.

Most recently, Adegbite said that with the ministry’s recent achievement in local barite production which, reportedly, has now met API specifications, Nigeria will soon start exporting barite to African countries.

Ghana and South Africa have been mentioned as potential export markets for Nigerian barite.

Don’t miss out, secure your knowledge of the latest trends and outlook for the oilfield minerals market, network with the leading players at

FULL DETAILS HERE

Leave A Comment