Direct sourcing of Chinese high grade fused and dead burned magnesia

One of China’s leading magnesia producers, Liaoning Jinding Magnesite Group Co. Ltd (JDMG), has named Jinding USA (JDUSA) its exclusive magnesia sales agent and exporter for North, Central and South America.

JDUSA, based in Pennsylvania, was recently established by James Piraino, its President, formerly Chief Operating Officer, North America of Magnesita Refratários SA.

JDMG’s Huaziyu magnesite mine near Dashiqiao, Liaoning, one of two sources producing in total some 1m tpa of very high quality magnesite. Courtesy JDMG

The initial focus will be on supplying premium grade fused magnesia (96-98% MgO), and this will be followed by high grade dead burned magnesia.

JDMG owns high quality magnesite reserves and has production capacities of 200,000 tpa fused magnesia and 120,000 tpa dead burned magnesia.

The new company claims that through such an innovative partnership, refractory manufacturers in the Americas will for the first time have access to high volumes of superior quality magnesia products while achieving significant cost-savings associated with a direct selling approach.

James Piraino, President, JDUSA, told IMFORMED: “We recognised the opportunity to better serve refractory clients in the Americas leveraging a model that has proven effective in China for more than 100 years – bringing them premium quality, consistent magnesia direct from JDMG.”

“The supply channel that JDUSA creates will deliver consistent, superior products that refractory manufacturers in the Americas can rely on to improve performance and achieve cost savings.” said Piraino.

Certainly, there has always been a healthy debate in securing raw material supply for end users between direct sourcing and the use of traders to source, market, and distribute the material.

In direct sourcing, consumers seek to satisfy themselves by interfacing directly as much as possible with their prospective sources, with more of a hands-on approach regarding relationships, sampling and testing, and ultimate purchasing.

But employing the services of traders can be advantageous in providing a buffer against certain risks in the process, particularly regarding logistics, trade tariffs, and associated issues, as well as providing a range of potential sources to assess with which they have perhaps already close relationships.

“This is an important day in the history of JDMG and a big step forward as we expand our business to international markets. We are famous for producing premier fused magnesia for the Chinese refractory industry. We are very excited about the formation of JDUSA and look forward to growing our customer base in the Americas through JDUSA.” said Shixu Qin, chairman of JDMG.

JDMG a major magnesia player

JDMG has a rich history of nearly one hundred years of operation, it was established in 1918, and is one of the world’s leading magnesite producers.

Located in the primary magnesite mining area of Dashiqiao-Haicheng, Liaoning province in north-east China, JDMG is logistically well located just 10km from the Shenyang-Dalian highway, 7km from Harbin-Dalian highway, 7.5km from the north-east railway, and, crucially for exports, just 35km from Bayuquan port.

JDMG owns three deposits which it is exploiting with open pits: Qingshanhuai (magnesite), Huaziyu (magnesite), and Chenjiapuzi (dolomite).

Total proven reserves of magnesite and dolomite are reportedly 1.2bn, accounting for about 30% of the country’s total reserves, and 80% of that of the Dashiqiao region.

JDMG’s plant hosts 2 rotary kilns for dead burned magnesia (DBM), up to 40 electric arc furnaces for fused magnesia (FM), and 12 kilns for caustic calcined magnesite (CCM).

Annual production capacities have been reported as:

| Product | Capacity (tonnes) |

|---|---|

| Magnesite | 1,000,000 |

| Dolomite | 300,000 |

| Caustic calcined magnesia | 200,000 |

| Dead burned magnesia | 120,000 |

| Fused magnesia | 200,000 |

| Magnesia-carbon bricks | 30,000 |

| Burned magnesia brick | 30,000 |

| Unshaped refractories | 30,000 |

| Unshaped refractories | 30,000 |

| Magnesium salts/chemicals | 1,000 |

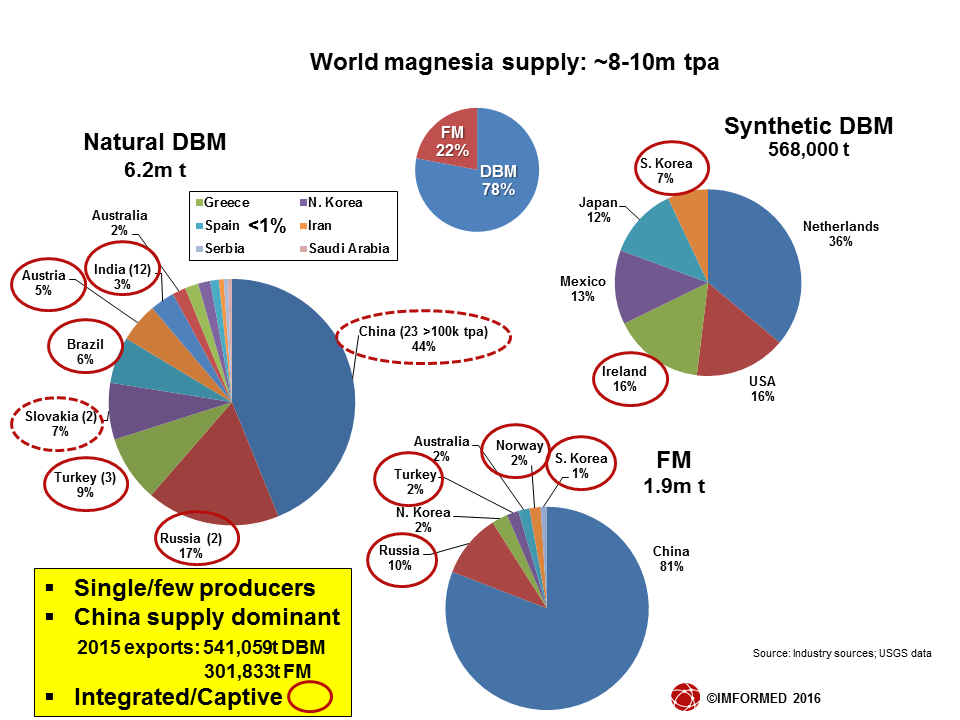

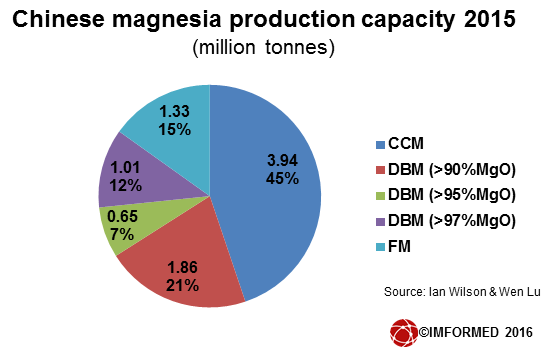

As can be seen from the accompanying charts, China is the world’s largest producer of magnesia grades and plays an influential role in world trade in dead burned and fused magnesia (44% and 81%, respectively). China produced about 17.4m tonnes of magnesite in 2015.

Of note is that the majority of natural DBM and FM producers are integrated or captive producers, ie. owned and operated by large companies which also produce magnesia-based refractories.

Most Chinese magnesia producers are integrated, and JDMG is no exception, although is one of the smaller producers of refractory products.

There are several magnesite project developers which are entertaining ideas of potential fused magnesia capacities, although these are unlikely to come to fruition soon, if at all: see Fused magnesia projects: are they all crystal clear?

JDMG has production capacity for 200,000 tpa fused magnesia; here fused magnesia ingots are left to cool prior to breaking up and sorting, as has been started top left. Courtesy JDMG

High grade fused magnesia for refractories

The impurities in magnesia and fused magnesia play a very important role in refractory applications.

Depending on the CaO and SiO2 content (C/S ratio) a series of secondary crystalline components are formed with different melting points.

The C/S ratio ensures that the melting point of the secondary components are in the same range as magnesia. A C/S ratio of ≥2.0 ensures the best physical and chemical properties of the brick.

JDMG has one of the largest deposits of magnesia in China with a C/S ratio ≥2.0. The availability of such magnesia, either as dead burned or fused, is becoming increasingly rare.

JDMG fused magnesia premium grades typically contain 96.0-98.0% MgO, 0.5-2.2% SiO2, 0.5-0.9% Fe2O3, C/S 1.65-2.00, and bulk densities ranging 3.35-3.50 g/cm3.

Leading magnesia and refractory producer RHI AG was also attracted to the high quality of JDMG’s magnesite reserves.

Experienced observers of the magnesia market may recall RHI AG embarking on a 83:17% joint venture (Liaoning RHI Jinding Magnesia Co. Ltd) with JDMG in 2006 to construct a US$50m, 100,000 tpa plant to produce high purity DBM and FM as feedstock for RHI’s refractory plants at Bayuquan and Dalian.

One of the main target markets for JDMG’s fused magnesia will be in mag-carbon refractories for the steel industry where quality problems are becoming more frequent with an apparent growing shortage of consistent quality supply of fused material.

JDUSA reports that refractory suppliers are utilising higher grade materials for the most demanding mag-carbon applications, such as ladle slag lines, getting good performance from early trials, but having trouble repeating such performance as bricks fail prematurely owing to inconsistencies in fused magnesia.

JDUSA sees the outlook for the refractory industry recovering from the current downturn by 2017, and start to grow between 2-3% annually.

World magnesia supply and demand, plus fused magnesia trends and outlook were covered in presentations at this year’s inaugural MagForum 2016, 9-11 May 2016, Vienna.

For an in-depth review of the conference, plus pictures, programme, attendees, and feedback go to MagForum 2016

Graphite supply and demand outlook – how will the rise in battery demand impact graphite availability for refractories? Find out at

Graphite Supply Chain 2016, 13-15 November 2016, Newport Beach, LA

Speakers include:

Refractories: Global trends and the future for graphite’s biggest market

Dr Paschoal Bonadia Neto, Mineral Technology Manager, Mineral Technology Centre, Magnesita Refratários SA, Brazil

The evolving use and applications of graphite in the foundry industry

Richard Clark, Senior Technical Specialist, Morgan Advanced Materials, USA

North America review of graphite supply & demand

Stephen Riddle, CEO, Asbury Carbons, USABOOK NOW !

Early Bird Registration Ends 31 August 2016

Registration enquiries: Ismene +44 (0)7905 771 494

ismene@imformed.com

Leave A Comment