Review of Oilfield Minerals & Markets Forum 2023, Houston, 9-11 May

And a new format announced for 2024!

Industrial minerals remain essential ingredients to all oil and gas drilling operations. While the large volume workhorse minerals such as barite, bentonite, and silica sand are in constant demand, different drilling requirements and challenging environments demand performance from a range of specific industrial minerals in albeit smaller volumes, but of nonetheless vital importance.

Title Image Bentonite Blast: A mine blast conducted by Bentonite Performance Minerals LLC at one of its bentonite mines in Wyoming; inset top right: Unloading imported barite at Bulk Dock 1 Port of Corpus Christi. Courtesy BPM; Port of Corpus Christi Authority

Maintaining supply of quality grades of these minerals to the market is an ongoing challenge, since many sources are limited in commercial development, compete with other consuming markets, and maybe remote from their customers. Optimum development of specific mineral processing and logistics is key to running an efficient and economic supply chain.

A most stimulating three days of networking, discussion, and excellent presentations on this industry took place earlier this year at Oilfield Minerals & Markets Forum 2023, Houston, 9-11 May – these are reviewed below.

What our delegates had to say on the 2023 Forum

“Excellent presentations and speakers.”

Juan Luis Prieto, Managing Director, Baramin, Mexico“Overall solid programme, with good coverage for other minerals besides barite”

Alastair John, Well Construction Fluids Bulk Chemicals, SLB, USA“Enjoying some good discussions around barite, supply chain, and oilfield chemicals outlook at the IMFORMED Forum in Houston. Really appreciate sharing the subject info and presentations. Please keep me updated on any future events.”

Justin Gauthier, US Business Strategist, AES Drilling Fluids, USA“This was my first experience to visit this conference: much information and a nice gathering, meeting in one place and interacting, thank you for the nice management.”

Shankar Lal Daruka, Managing Director, Daruka & Company (Mica) Pvt Ltd, IndiaFree Oilfield Minerals & Markets Forum 2023 Summary Slide Deck Download here (right click “Save link as”)

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

ANNOUNCING, WITH A NEW FORMAT…

Full Details Here

In its ninth year, we are now broadening the scope of the event to incorporate the wider barite market outside the oilfield market, ie. including supply and demand for chemical and filler grade barite.

This exciting initiative is the result of agreement reached with The Barytes Association for IMFORMED to now manage an annual conference devoted to all aspects of the barite industry. The association will hold its annual General Assembly at the same venue prior to the Barite & Oilfield Minerals Forum.

This unique conference will bring together under one roof the major players across the global barite and oilfield mineral supply chain, from producers, processors, and traders to logisticians, financiers, and end use consumers.

2023 FORUM REVIEW

OVERVIEWS

Introduction: Industrial minerals & the oilfield market

Mike O’Driscoll, Director, IMFORMED, UK

Mike O’Driscoll reviewed the different industrial minerals used in the oilfield applications, highlighting as examples barite, bentonite and frac sand consumption in the USA, which had recorded rises during 2022 over 2021.

Notable was that over 75% of the USA’s barite consumption was imported.

Looking at the big picture forecasts from the likes of the International Energy Agency, US Energy Information Administration, and BP Outlook, while fossil fuel demand is expected to decrease from 65% in 2019 to 20%-50% by 2050, demand for natural gas is expected to remain relatively steady after an initial dip.

Attention was also brought to the potential market outlook for drilling for geothermal energy sources as part of the transition to new energy.

Oil & gas supply demand outlook

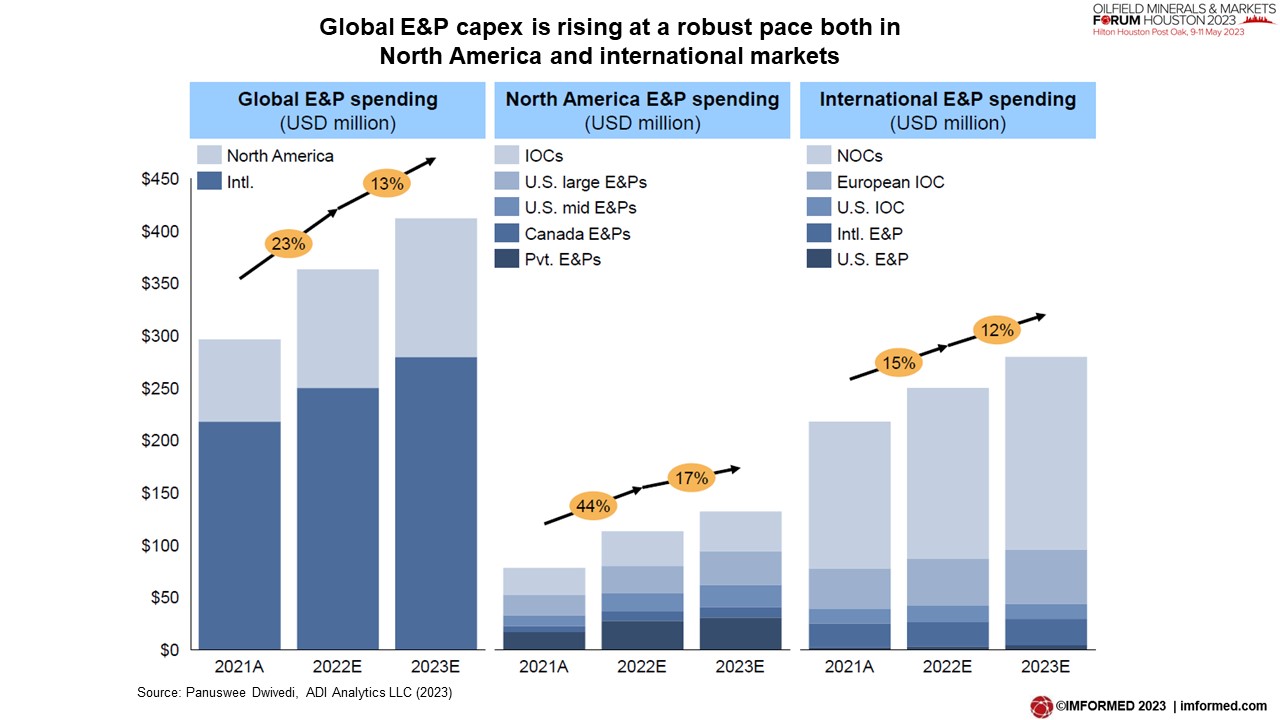

Panuswee Dwivedi, Project Manager, ADI Analytics LLC, USA

As ever, ADI Analytics provided a fine overview on the outlook for the oil and gas market. Key messages included:

- Global E&P capex is rising at a robust pace globally and gas supply growth is prioritized over oil in the US

- Shale 3.0 can position the US as a supplier of sustainable energy, but top-tier shale acreage is running out

- China’s re-opening, recession risks, and Russian oil supply cuts will keep oil prices in low $80s through 2024

The energy transition: a reality check

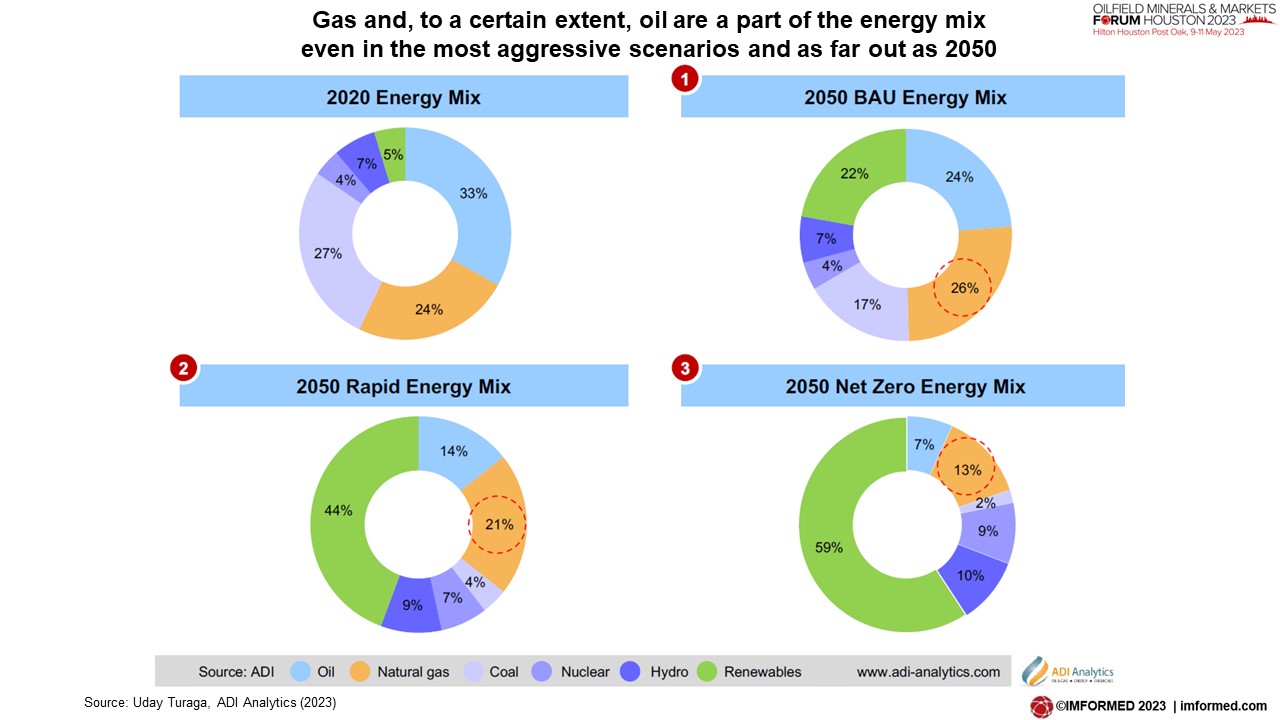

Uday Turaga, CEO, ADI Analytics LLC, USA

The second overview from ADI Analytics spotlighted the issues around the energy transition and some insight in what it might really mean for the oilfield market.

Key insights outlined by Turaga included:

- The role of policy in accelerating energy transition should not be underestimated

- There’s a lot more to energy transition than the usual suspects

- Carbon capture and storage will be key to energy transition

- Incumbents are underestimating the risks of energy transition

- Oil and gas will play a material role even in a net-zero transition future

OILFIELD ADDITIVES | LOGISTICS

Overview of oilfield chemicals & minerals: demand outlook

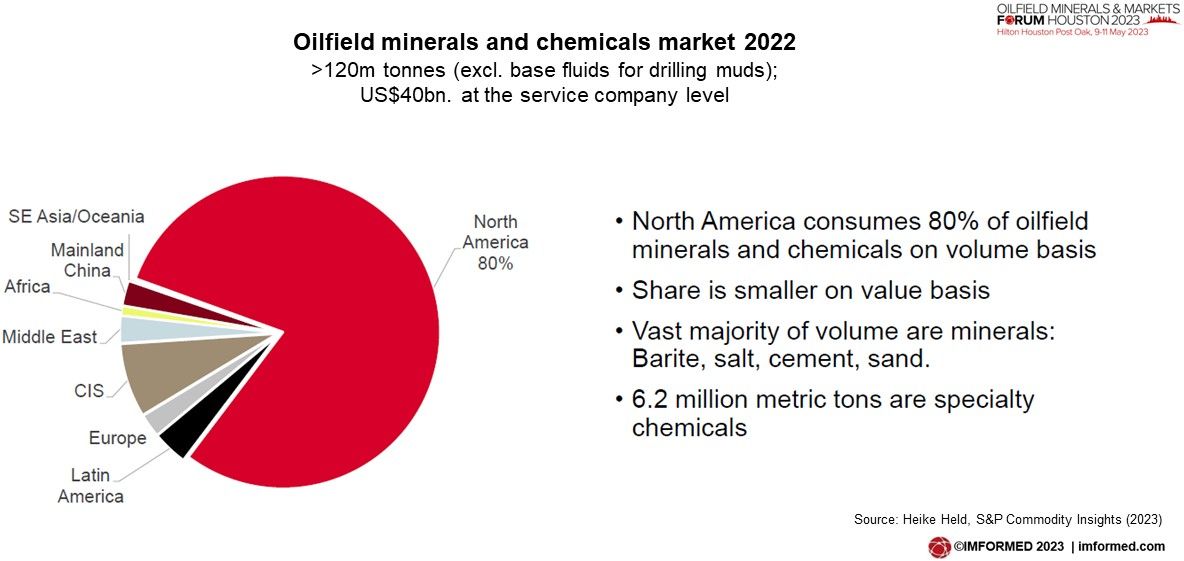

Dr Heike Held, Research & Analysis Associate Director, S&P Global Commodity Insights, USA

Heike Held provided a neat summary of oilfield additives covering an overview of the oilfield minerals and chemicals business, market size, steps of oil production, and function and demand of minerals and chemicals in drilling, cementing, stimulation, and production.

Crude oil price was forecast to be flat through 2026, then trending up as oil production will continue to increase through 2027, then plateau and eventually decline past 2030.

Held concluded that in the longer term, oil production and associated minerals and chemicals consumption will decline. The demand for oilfield minerals and chemicals will be shaped by the demand for downstream petroleum products such as gasoline and diesel.

Port logistics: the jugular for US oilfield mineral imports

Eric Battersby, Trade Development Manager, Port of Corpus Christi Authority, USA

Eric Battersby talked about “The Energy Port of the Americas” at the Port of Corpus Christi (PCC), which is the USA’s leading oil exporting port, and second largest US LNG exporting port.

Some 8.1m tonnes of non-agricultural dry bulk was handled by PCC in 2022, which of course includes significant imports of barite and other minerals through Bulk Dock 1.

Ongoing and future projects at Bulk Dock 1 include:

- Liebherr LHM 550 purchase; delivery and commissioning Q4 2023

- Bulk Terminal Rail Expansion; 4 new 5100 ft. tracks

- Bulk Dock 1 Expansion of Landside Operations; 3.5-acre new storage pad area; 2300 ft. dockside rail

- Bulk Terminal Expansion; new Bulk Dock 2 (export dock) under design; Bulk Dock 4 (import dock) planning phase

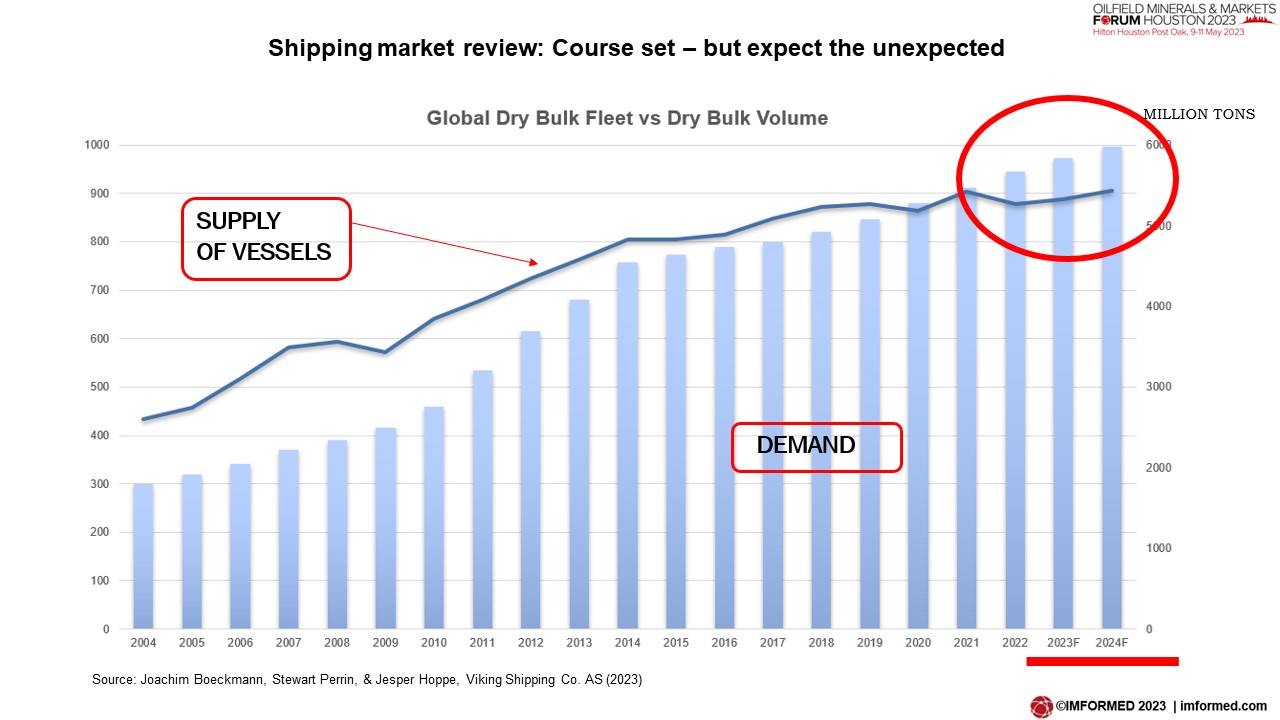

Shipping market review: Course set – but expect the unexpected

Joachim Boeckmann, Chartering & Agency, Stewart Perrin, Managing Director Hong Kong,

& Jesper Hoppe, Managing Director, Viking Shipping Co. AS , Norway

This year’s shipping review from Viking retained its traditional characteristics of both entertainment and informed comment – even if the speakers arrived on stage adorned with traditional horned Viking helmets!

The presentation gave the audience a slight look back, current status of the market, the important factors, a future view, concluding with some precautions.

The outlook was presented as:

- A presently softening market – not driven by demand.

- China is the big question – much depends on the Chinese economy, politics and international growth ambitions.

- Voyage effeciency, port delays and congestion are all significant factors, plus…

- Changing of trade-patterns.

- Russia-Ukraine war

PROPPANTS | BENTONITE | ATTAPULGITE

Frac sand market outlook

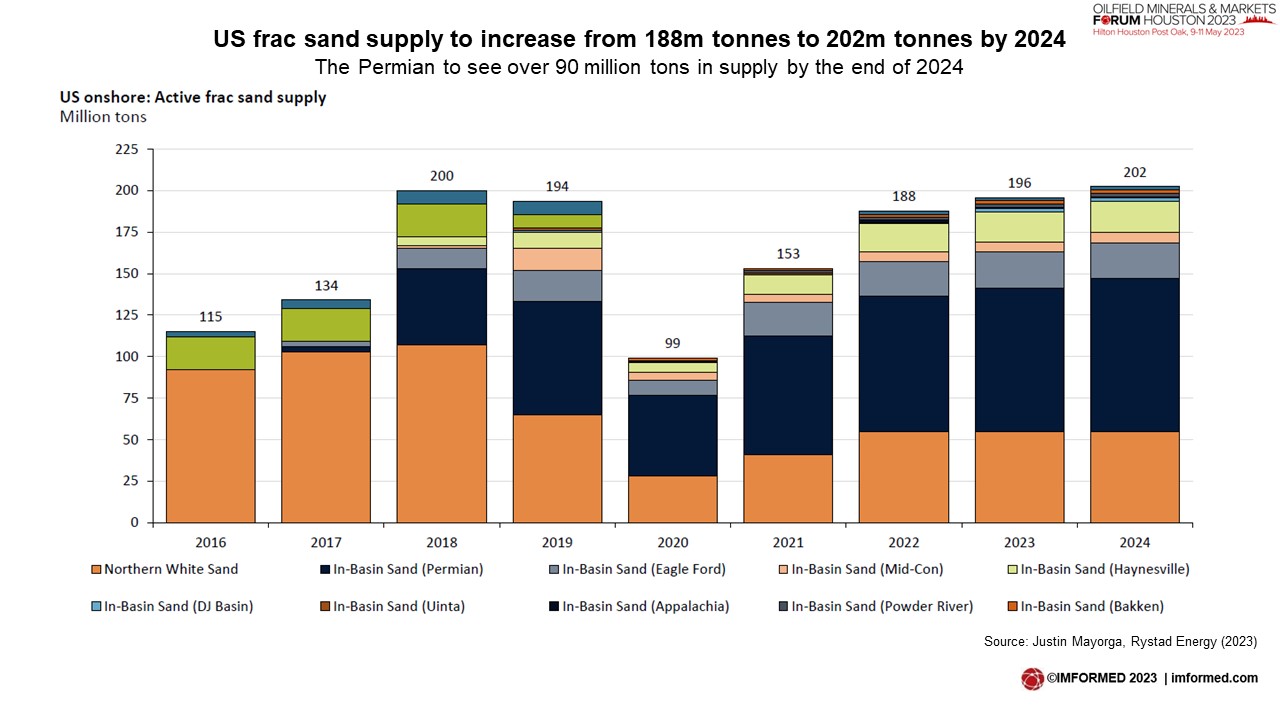

Justin Mayorga, Vice President – Shale Supply Chain Research, Rystad Energy, USA

This presentation focused on the US Land sector, looking at drilling and pressure pumping activity, and the proppant market.

Key takeaways included:

- Permian basin continues to be the activity hot spot as rigs slightly rise, remains the sole basin where upside remains present

- Despite softness, frac activity set to remain strong as discipline continues

- Drilling expected to recover in later part of 2023 into 2024 within natural gas basins

- Oil basins expected to remain strong as DUC replenishment will be required for 2024 activity

- Proppant loadings and intensities continue to increase as lateral lengths continue to stretch

- US frac sand supply to increase from 188 million tons to 202 million tons by 2024; The Permian to see over 90 million tons in supply by the end of 2024

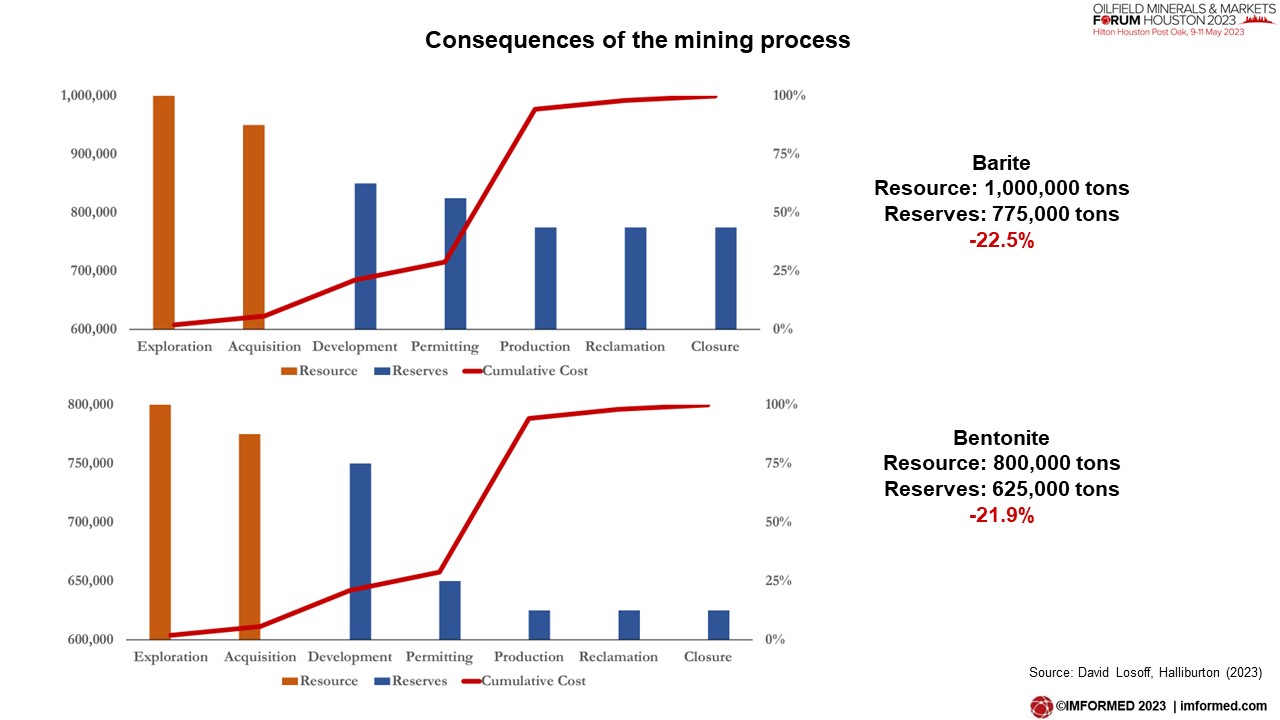

Optimising the oilfield minerals value chain: barite & bentonite mining overview

David Losoff, Senior Mining Engineer, Halliburton, USA

In a very well illustrated presentation, David Losoff took us on a whistle-stop tour through the key elements and challenges in mining, exploration, acquisition, development, permitting, production, reclamation, and closure with regard to “typical” barite and bentonite deposits.

He showed how the process of optimising a mineral deposit from start to finish impacted the final total reserve estimates and cumulative costs.

Attapulgite supply and usage in oilfield applications

Thomas Cortner, International Sales Manager, Active Minerals International LLC, USA

Attapulgite is a clay composed primarily of the mineral palygorskite, along with traces of smectite, quartz, and dolomite. Global deposits of attapulgite are rare, and the US is by far the largest producer.

Its gelling and binding characteristics make attapulgite a popular additive in drywall compounds, agricultural suspensions, zeolite beads, and drilling fluids.

Attapulgite is used as a thickener or rheology modifier in water-based drilling fluids, offering two distinct features: exceptional tolerance to salts, and a unique rheological profile.

Thomas Cortner explained how Active Minerals, based in Georgia, mines, processes and distributes its attapulgite, for which it maintains 20 years of proven reserves.

WEIGHTING AGENTS 1: ILMENITE | BARITE

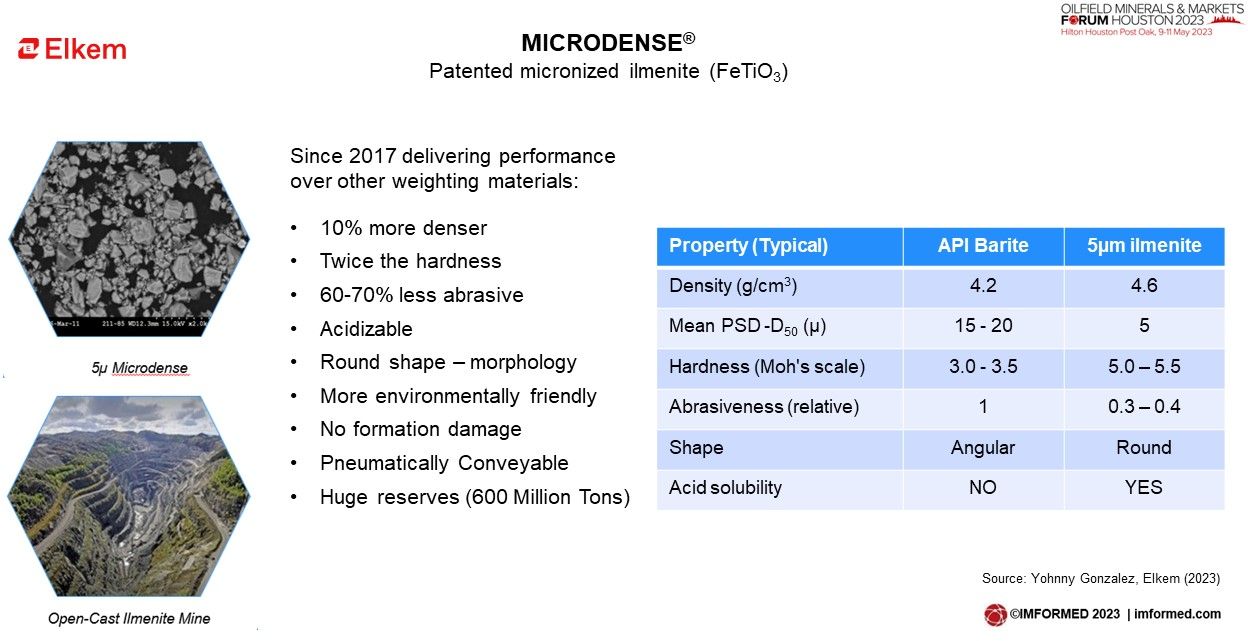

MICRODENSE™- A new building block to achieve operational efficiency in drilling & completion operations

Yohnny Gonzalez, Business Development Manager Americas Oilfield, Elkem ASA, USA

Yohnny Gonzalez demonstrated how MICRODENSE™ applications can be a new “building block” to enhance operational performance, field productivity and to help improve existing drilling fluids using conventional weighting materials.

Gonzalez explained the conventional approach to weighting materials based on availability, compatibility and low unit cost, and why alternative weighting materials have not been effective.

That is, until Elkem introduced MICRODENSE™, a patented micronized ilmenite (FeTiO3) produced in Norway, from a huge 600m tonne reserve.

Several case studies of use of MICRODENSE™ were spotlighted in the Arabian Gulf, Sakhalin, and Guyana, before a range of potential opportunities were outlined including replacement of 4.2SG barite from limited sources and better formation productivity.

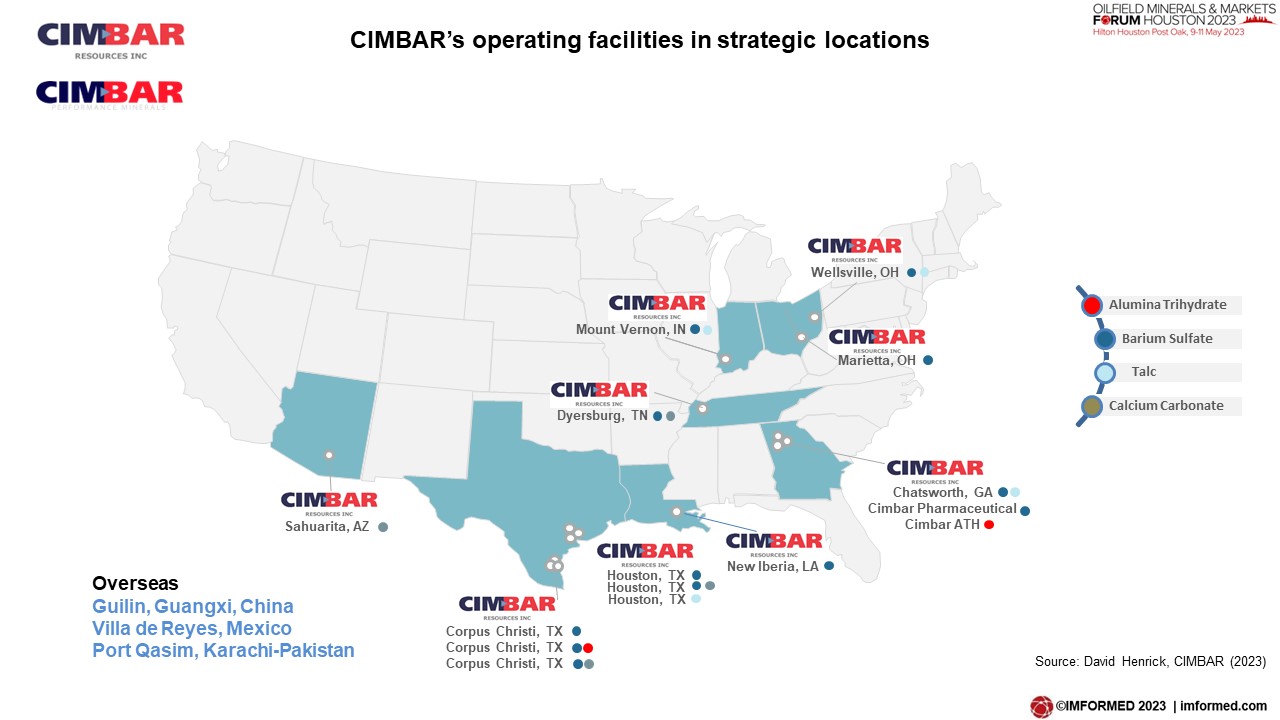

A new chapter in barite supply

David Henrick, President Oil & Gas Business Unit, CIMBAR Resources Inc., USA

David Henrick outlined the development and activities of CIMBAR Resources – a global leader in the delivery of performance mineral-based additive solutions across multiple markets and industries specialising in barium sulphate, calcium carbonate, and alumina trihydrate.

CIMBAR operates 17 production sites in the USA, Mexico, China and Pakistan.

Henrick went on to highlight the company’s acquisition portfolio since 2019, including the 2022 acquisition of leading US barite importer and processor Excalibar Mineral Resources.

Henrick said: “CIMBAR views the oil and gas market as a required source of energy for at least the next 50 years. We are investing in providing continuous reliable supply of barite to the industry.”

Barite market trends: analysis of the global and US markets 2022-2023

John Newcaster, Oil & Gas Advisor, The Barytes Association, USA

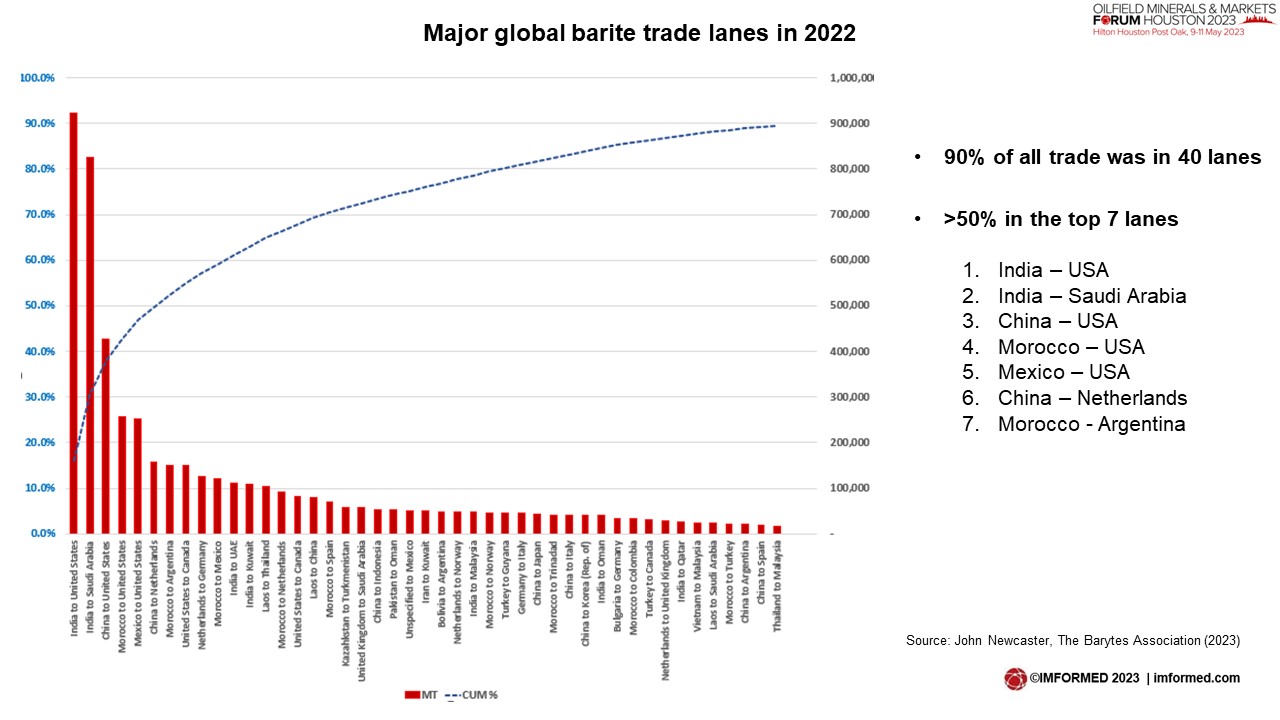

John Newcaster provided a very comprehensive and informative overview of barite demand drivers, oil and gas demand, rig counts and footage drilled, supply trends, supply lanes, sources and consumers, cost trends, and government and geopolitical influences.

Newcaster underlined that drilling activity still drives barite production, and that “Barite’s future is drilling’s future, and drilling’s future is fossil fuel’s future”.

While Newcaster acknowledged that there is strong evidence of climate change and global warming, he emphasised that the causes, rate, best remedies and degree of fossil fuels’ contributions are “unsettled science”, and provided several examples.

He concluded: “Fossil fuels may or may not be the problem, but they will continue to play a critical part in improving people’s lives.”

WEIGHTING AGENTS 1: MOROCCO | NIGERIA

Broychim and Morocco barite supply update

Youssef Laghzali, Sales Manager, Broychim, Morocco

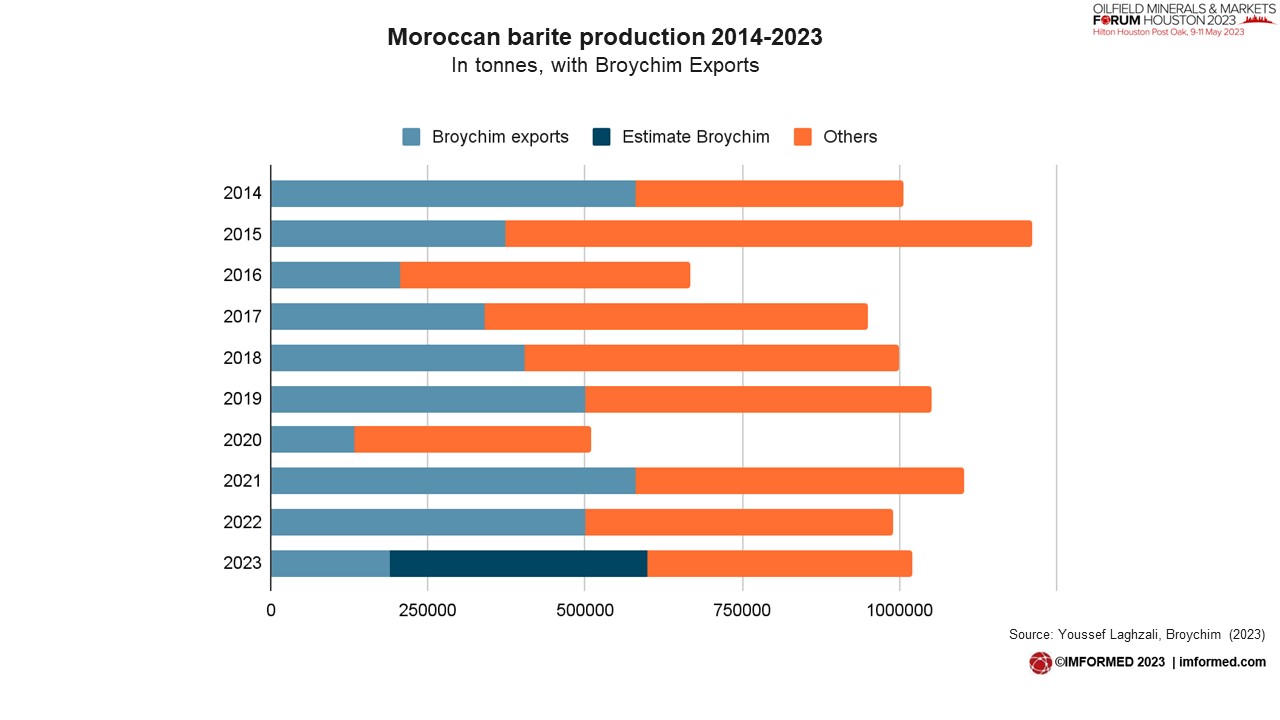

Youssef Lagzhali presented on Broychim, the Moroccan leader in barite exports, Morocco’s positioning in the industry over the years, an update on Morocco’s port developments, and the latest on Broychim’s mines.

Since 1982, the Broychim Group has expanded in many ways undertaking vertical integration of the value chain, with entities from mining to inland transport and logistics, and most recently a shipping agency for more control over loading operations inside the ports.

Moroccan barite production is stable at around the 1m tpa, and Broychim accounts for about 50% each year in exports. US imports of Moroccan barite maintained a steady level in the 300,000s tonnes during 2012-2017, but in 2022 went over 500,000 tonnes.

Lagzhali summarised important port developments in Nador, Safi, Agadir, and Jorf Lasfar, as part of the country’s overall infrastructure vision for 2030.

Broychim is evaluating a potential new barite mine at Tinfou, south-east Morocco, grading 92.37% BaSO4 at 4.28SG. The deposit has a potential resource of 1,284,000 tonnes, with the nearest ports being Safi and Agadir.

Nigeria’s barite resources & recent developments: An insight

Mike O’Driscoll, Director, IMFORMED

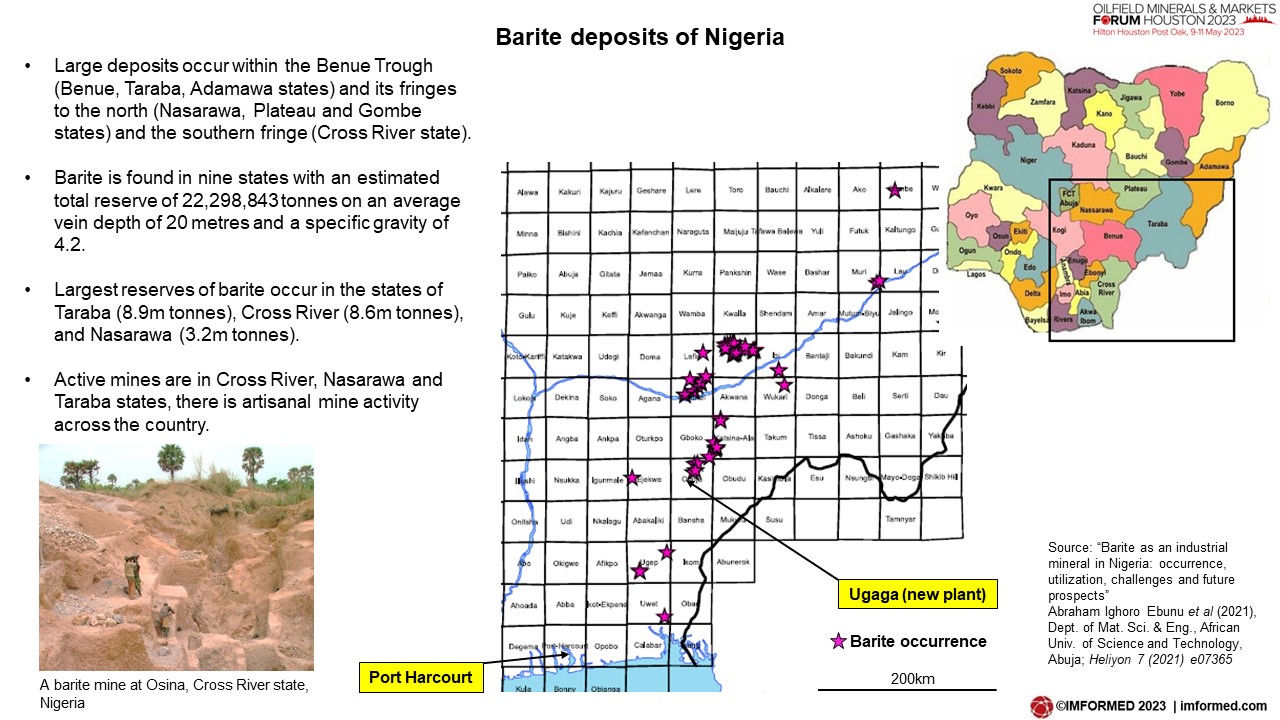

Owing to a late speaker withdrawal, Mike O’Driscoll presented a brief insight into the state of play regarding Nigeria’s barite industry and recent developments.

Nigeria is the largest oil and gas producer in Africa and thus a major market for barite and other oilfield minerals, most of which are imported. The government has banned barite imports and at the same time is attempting to gear up domestic production.

In Nigeria, barite deposits – hosting an estimated total reserve of almost 23m tonnes of 4.2 SG grade – are mainly located in the south and east of the country, with limited mining activities and facing major challenges. These include poor infrastructure, inadequate electricity, and in some cases poor water supply.

Most barite deposits are vein and cavity filling type, hosted by different rock types such as sandstone, limestone, migmatite, shale, mudstone and porphyritic granite.

For some years now, Nigeria has made several attempts to upgrade its domestic barite production to a higher standard and on a commercial scale to meet market demand. Barite is among seven strategic minerals designated for top priority development by the Nigerian government.

In 2021, the “Made in Nigeria Barite” project was launched, with 12 processing companies apparently receiving approval to participate in the scheme.

Central to the project is development of the “Barite Cluster Processing Plant” at Ugaga, Yala in Cross River state. Located close to barite deposits, raw barite is to be processed in Ugaga to API standard, and then transported 400km to Port Harcourt for sales and export.

Nigerian barite has now, reportedly, met API specifications, and Nigeria plans to start exporting barite to African countries; Ghana and South Africa have been mentioned as potential export markets.

Thanks & hope to see you at Barite & Oilfield Minerals Forum 2024!

We are indebted to the support and participation of our sponsors Bastion Industries, Broychim, CIMBAR, IPS, and Superior Weighting Products, supporting partners, speakers, and delegates for making the event such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience next year at our new-look event: Barite & Oilfield Minerals Forum 2024, The Royal Sonesta Hotel Houston Galleria, 5-7 June 2024 – Full Details Here (Click “Save link as”)

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Free Oilfield Minerals & Markets Forum 2023 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

ANNOUNCING, WITH A NEW FORMAT…

Full Details Here

In its ninth year, we are now broadening the scope of the event to incorporate the wider barite market outside the oilfield market, ie. including supply and demand for chemical and filler grade barite.

This exciting initiative is the result of agreement reached with The Barytes Association for IMFORMED to now manage an annual conference devoted to all aspects of the barite industry. The association will hold its annual General Assembly at the same venue prior to the Barite & Oilfield Minerals Forum.

This unique conference will bring together under one roof the major players across the global barite and oilfield mineral supply chain, from producers, processors, and traders to logisticians, financiers, and end use consumers.

Very good papers