IMFORMED-Tractus Asia Webinar Reviewed

The industrial minerals sector has been rocked; first, by the US-China trade war, its ensuing political tensions, and then by the pandemic.

Last week 150 attendees signed up to a webinar on Wednesday 22 July organised by IMFORMED and Tractus Asia to learn about recent market developments, potential strategies to mitigate risk and take advantage of opportunities, with a focus on M&A.

Chaired by John Evans, Managing Director, Tractus Asia, two informative presentations by Mike O’Driscoll, Director, IMFORMED and Richard Smith, Head of Corporate Finance, Tractus Asia, were followed by an extended Q&A Session as many questions and comments were put to the panel.

The Market & Fallout

Mike O’Driscoll reviewed the key elements of what makes the global industrial minerals business tick before highlighting the main effects of the pandemic on the mineral supply chain and end user markets, concluding with some thoughts on major trends going forward.

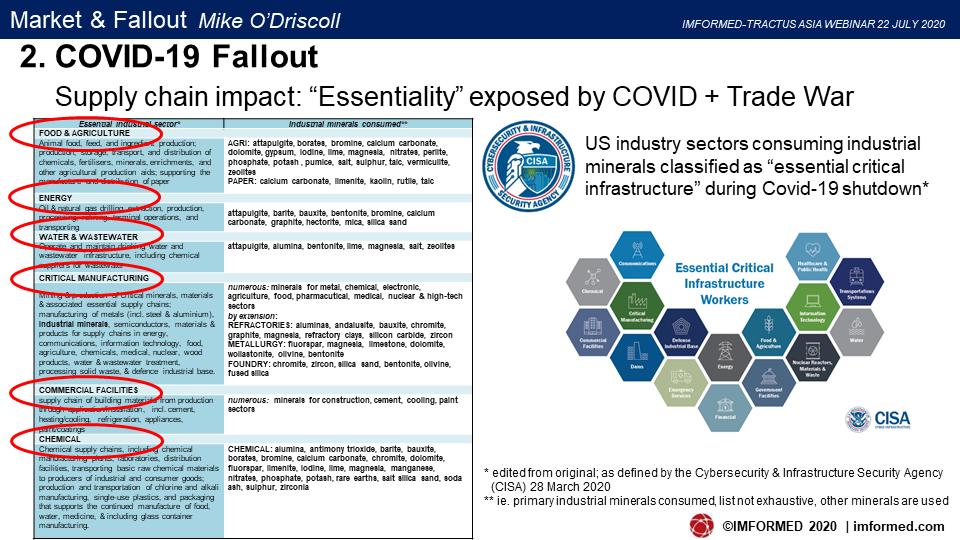

How the “essentiality”, and in some cases, the “criticality”, of industrial minerals was sharply exposed by the US-China trade war and then COVID-19 was examined, along with the main mineral supply chain options for buyers and the long-standing overreliance on China as the world’s leading source of industrial minerals.

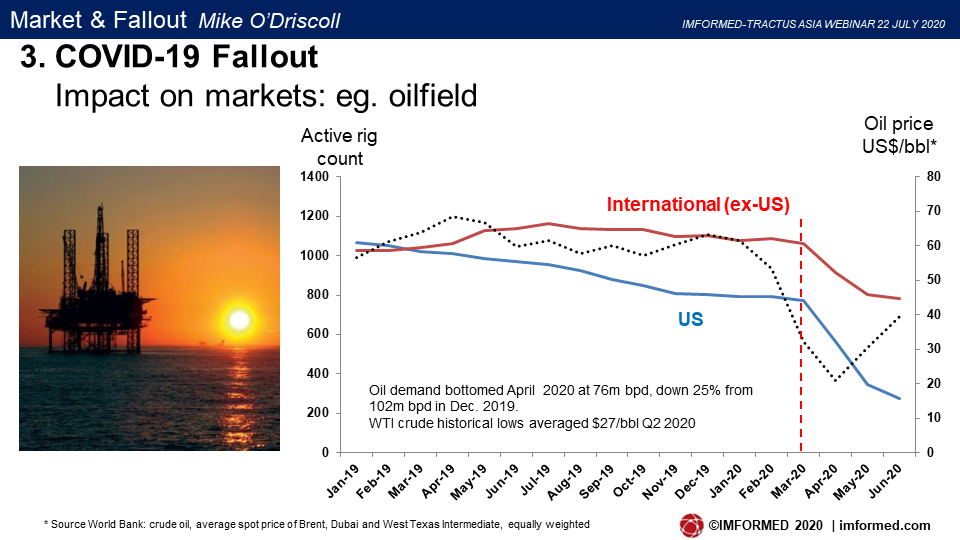

The impact of COVID-19 on the main driver of mineral markets, GDP, and more specifically ramifications for the steel and oilfield sectors were highlighted as examples.

Overall, there will be a slow recovery in H2 2020, and perhaps if no second wave, some accelerated momentum in Q1 2021.

There will be, and perhaps already is taking place, a revision of supply chain strategies and raw material sourcing.

We shall likely see more policies and drive from governments and regions (eg. EU) to stimulate resource development and security, with infrastructure projects to stimulate economies from COVID recession, including an increase in mergers and acquisitions as companies restructure to survive.

While China will remain a key factor in the minerals business domestically and overseas, there will be a certain amount of “decoupling” attempted, eg. India’s steel industry has already announced a “no China” policy of procurement for refractories.

The situation has stimulated more mineral development of new sources worldwide to lessen China overreliance and improve resource supply security. This may be accompanied by more vertical integration by end user companies.

Equally there will be an acceleration in the evolution of the mineral recycling sector. “Recycled raw materials from waste will become a ‘normal’ supply chain option for mineral buyers.” said O’Driscoll.

“At the same time, as well as a proliferation of recyclers, more primary mineral producers will become active in recycling tailings and other waste sources to offer wider product range (including blends?) with a favourable “green” label on portfolio” O’Driscoll added.

Recent examples announced this year include:

- LKAB – REE, fluorspar, gypsum, phosphorus from iron ore tailings

- Norsk Hydro/Univ. Pará – low-C cement from bauxite residue

- Nutrien/Arkema: anhydrous HF (replacing fluorspar) from phosphate processing FSA waste

- Rio Tinto: scandium oxide from ilmenite processing waste

Opportunities & Recovery Strategies

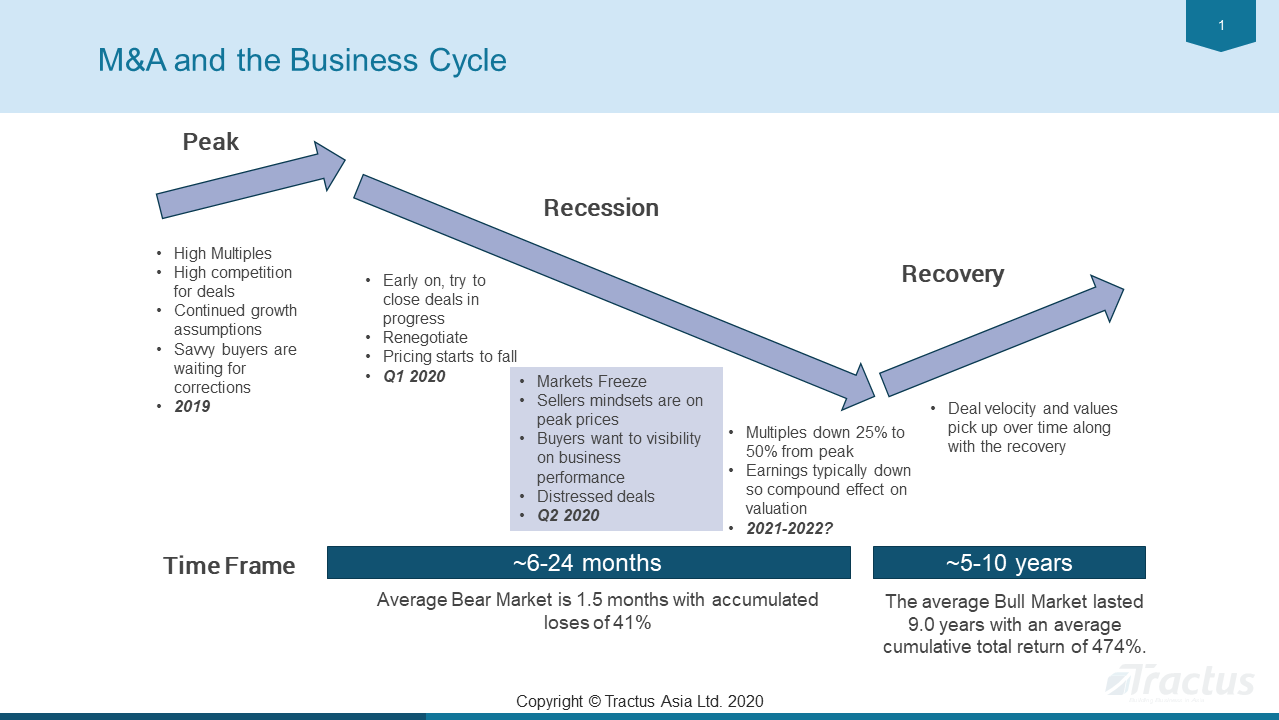

Rick Smith shared Tractus Asia’s view on the economy, outlined unique factors of the downturn, implications for M&A, commented on China, concluding with opportunities for small and medium-sized enterprises.

A “fairly pessimistic view” on the near-term outlook for the global economy was outlined, although some countries are managing better than others.

Global trade and political tensions are not expected to go away anytime soon while economic growth projections are dropping rapidly.

However there are unique factors to this downturn which may see a relatively fast recovery to M&A, these include:

- Stock market at or near all time high

- Borrowing rates at 50-year low

- Corporates are cashed up

- Private equity firms are cashed up

In general, downturns offer excellent opportunities for M&A. After an initial period of focus on costs, risk mitigation and protecting the business, firms will then turn their attention to growth.

Organic growth is very tough in slow markets since you will need to take business from a competitor. “In today’s environment, most growth will be driven by M&A. Interestingly enough, downturns provide opportunities on both the Buy and Sell side.” said Smith.

China will remain too important to ignore, and we expect an active M&A market in China.

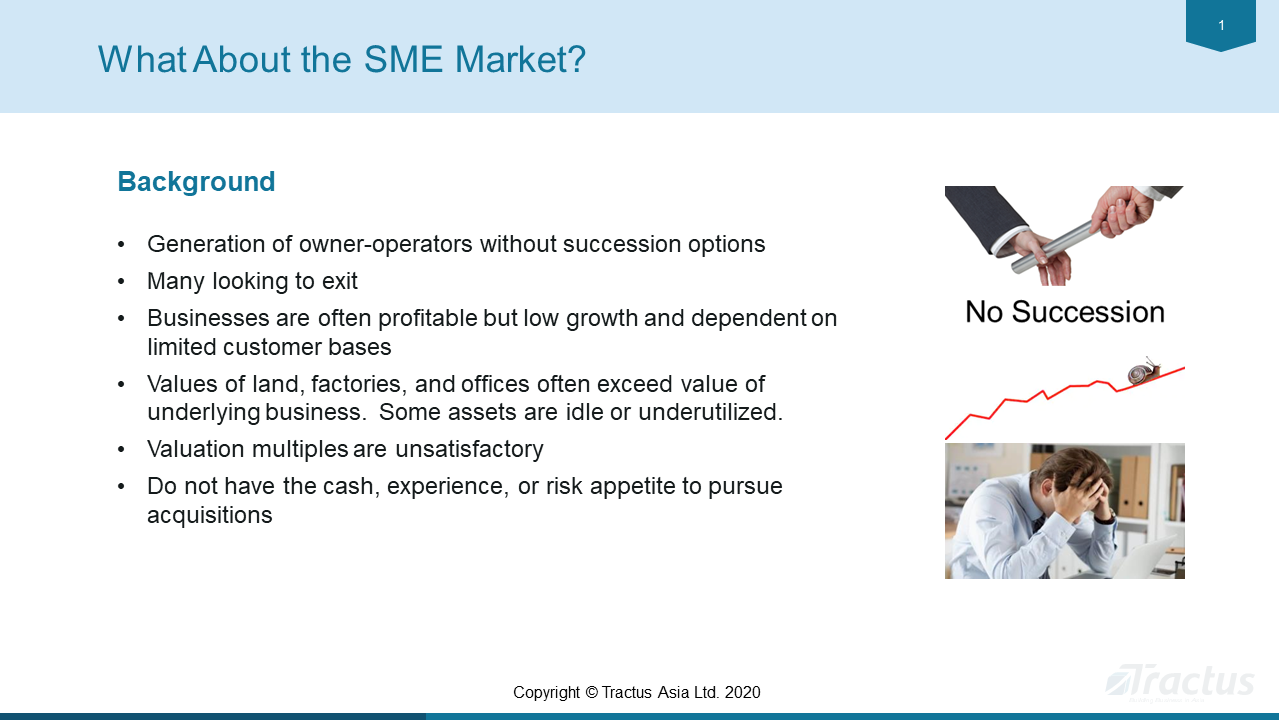

Smith concluded: “SMEs do not need to be bystanders or targets in terms of M&A.”

Access to Free Webinar Presentation Downloads CLICK HERE

Industrial Minerals: The Market and Fallout

Mike O’Driscoll, Director & Co-owner , IMFORMED Industrial Mineral Forums & ResearchOpportunities and Strategies for Recovery

Richard Smith, Head of Corporate Finance, Tractus AsiaAccess to Webinar Video CLICK HERE

Q&A Session: selected questions and answers from Mike O’Driscoll

How naïve are the politicians on the total supply chain process?

Well, maybe it’s more a case of ignorance rather than naivety; certainly the industrial minerals industry as a whole can do better to educate and raise awareness of its rationale, importance, and role in the economy and everyday living. At the same time, mineral resource distribution and sourcing needs to be underlined, and supply chains and logistics understood. With better communications between industry and governments, then we can be better prepared to deal with such crises, and indeed run the industry and meet market demand more efficiently and in a sustainable fashion.

Recycled materials are priced higher than the basic Can you share your views on perspectives for MgO (DBM, FM)? Market will recover by 2021? How do you see India as a refractory market? Many are looking for alternatives [ie. in raw material sources] to China, is it possible to get better product and value other than China? If there is a relatively rapid recovery next year, do you feel there are enough alternative sources of many minerals outside China to satisfy demand in short term, or are buyers going to have to return to China and continue to rely on supplied from there? Understand that Russia has many reserves of magnesite: do you think any large scale mining activities might start in the near future? What would be the challenges? How the industrial minerals market recovers and shapes itself for the future will be examined and discussed in detail by a range of expert speakers at next year’s IMFORMED Rendezvous, 12-14 April 2021, located in the beautiful beach side Grand Hotel Huis ter Duin (Noordwijk), Amsterdam. We already have an excellent panel of confirmed speakers and still have opportunities for sponsors and exhibitors. We look forward to seeing you in 2021! Tractus has nearly 25 years of experience helping companies expand their business across Asia, advising industrial mineral companies on entering Asian markets with both sales and investments, and assisted in structuring their operations in Asia for success. For more information please visit the Tractus website or contact: John Evans, Managing Director john.evans@tractus-asia.com | Richard Smith, Head of Corporate Finance richard.smith@tractus-asia.com

Great question, and underlines a long-standing “stigma” in the recycling sector. In the past this was very much the issue, but now is less so with more economic recycling processing and better alliances and partnerships between waste sources and recyclers. Advances in processing technology, especially in sorting, have greatly contributed to more competitive recycled materials. Improvements in all this must and will continue.

Can I be cheeky and economic and refer you to my recent report? Magnesia in Question: China & World Trends Discussed

With India’s growing population, range of infrastructure development projects, growth in refractory markets of ceramics, glass, cement, but above all its ambitious steel capacity projections (in 2018 India took over Japan as no.2 steel producer in world, retained in 2019), the country has massive potential for large volume future refractory demand. Further demonstrated by overseas companies such as Krosaki Harima, RHI Magnesita, Imerys, investing in Indian refractory and refractory material producing plants.

The quick answer is “Yes”; while in the past 2-3 decades, China always scored over undercutting western rivals (and still can to a certain extent), the trend today is far more discerning by western buyers, in that they are prepared to pay more for demonstrated consistent quality and volume availability, and stable pricing, rather than simply low prices; that said, in reality we might see a mixed response, of some Chinese supply bolstered by western alternatives.

Another good Q, and sits nicely with the former Q: This of course depends on which minerals for which markets, each have their own market dynamics. But in the main, the answer is yes for most minerals imported from China. Exceptions might be barite, where some more sources may need to be developed quickly (and some have been) for large volume supply (COVID-19 impact aside!), and fused magnesia (very few non-captive sources in the West), and other fused minerals (BFA, SiC) where energy costs in the West may still outstrip Chinese energy costs (although these are rising, and environmental controls are hitting output).

Yes, Russia ranks no.2 in hosting world magnesite reserves (after N. Korea and before China). Pretty much most Russian magnesite development is under Magnezit Group, which since 2016 has embarked on a series of large scale investment projects to expand mining and processing which will come to fruition during 2020-24 (see Magnesia in Question: China & World Trends Discussed where these are highlighted). While most output will be consumed in-house, if there is demand and opportunity to supply overseas customers I am sure Magnezit would consider this (thus also likely negating viability of overseas magnesite development in Russia). Challenges include logistics mainly owing to remote locations of main reserves, as well as investment in suitable mining engineering and processing technology.

IMFORMED would like to thank all those that participated in the webinar, and especially the Tractus Asia team for its co-operation in putting together the event, hosted from Singapore, Bangkok, and London.

COMING IN 2021

FULL DETAILS HERE

For established players seeking new horizons & newcomers evaluating industrial minerals

Critical Minerals Policy | Mineral Pricing Strategy | CO2 Reduction | Port Logistics | Rare Earths | Lithium | Ti-minerals & TiO2 | Graphite | Bauxite | Paint Pigments Market | Ceramics Market | Exploration | Africa | Processing Developments | Mineral Lab Testing

I have some doubts about the realistic impact on any mineral supply chain, although it may vary per continent resp. country.

In the northwestern European ports it is business as usual, some minor delays, but the mainports operate 24/7 as always.

But, as said, it might differ, like in S Africa, Brasil, Mexico and some US ports but only at an acceptable level.

I underline that there is a true sentiment to get rid of old tight Chinese supply sources, although I do not see that mining in E.U countries will suddenly be made more flexible and liberal, if any real projects are in view at this moment. Still feel the pain of the known turndown of the Storuman project in Sweden.

Nevertheless, exciting times for industrial minerals, but wasn’t that always the case ? 😉

Many thanks your valued comments Rob. Yes, the logistics sector always finds a way to adapt to such situations. Agree that EU will remain a challenging environment for greenfield mineral projects, though we may see (hope for?) some “fast track” outcomes for critical minerals perhaps, as in the recent US govt. declared policies (and in EU maybe for lithium in Serbia, lithium/fluorspar in Germany/Czech Rep.), otherwise it will be a case of seeking sources further afield.