Being designated a “critical mineral” in the EU and more recently in the USA has certainly assisted fluorspar’s standing as an exploration target.

However, those already in the market have known for some years now that mine closures and production capacity reductions in the West combined with China becoming a net importer, a growing consumer, with its domestic supply sector diminishing, mean that alternative and new sources of supply are needed.

Title Image Expanding fluorspar horizons: a view across the Shine Us mine and plant site of Gobishoo LLC, Dundgobi province, Mongolia; a new 35,000 tpa acidspar processing plant was commissioned in 2020. Courtesy Gobishoo.

With just one week to go until IMFORMED’s Fluorine Forum 2021 ONLINE, Wednesday 20 October, covering the latest trends and developments in fluorine raw material supply and demand, we report on the latest news of emerging potential supply from Mongolia, the USA, Canada, and Greenland.

Fluorspar Supply | AlF3 | Steel | Refrigerants | Semiconductors | HF | Li-ion Batteries

Expert Presentations | Networking | >80 already registered (see here)

FULL DETAILS HERE

Confirmed speakers

Alcore: aluminium fluoride production in Australia

Dr Mark Cooksey, CEO, ALCORE Ltd, Australia

Steel production outlook in a world of low carbon

James F. King, Steel Industry Consultant, UK

European HFC refrigerants market and F-gas alternatives

Barbara Gschrey, General Manager, Öko-Recherche, Germany

Fluorocarbon products as critical enablers in the production of semiconductor materials and IC devices

Dr Robert Syvret, Chief Scientist, Electronic Fluorocarbons LLC, USA

Hydrofluoric acid and downstream market outlook

Samantha Wietlisbach, Director Minerals Research & Analysis, IHSMarkit, Switzerland

Supply chain resilience in the Acidspar-HF-Lithium Ion Battery chain

Kerry Satterthwaite, Division Manager Strategic Minerals, Roskill, UK

Lost Sheep Mine: ramping up to become the sole US fluorspar supplier

James Walker, Chief Executive Officer, Ares Strategic Mining, Canada

Fluorspar mining trends & outlook post-Covid

Peter Robinson, Chairman, Fluorsid British Fluorspar, UK

Gobishoo: a new source from Mongolia

Established in 2005 as a private company by Ch. Ganbaatar, Gobishoo LLC is ramping up to serve Asian and European markets with acidspar and metspar grades.

In May 2020 Gobishoo commissioned its 35,000 tpa acidspar plant, which consumes a raw feed of 100,000 tpa fluorspar ore.

The company mines and processes at the same location, at the Shine Us mine in Dundgobi province (also spelt Dundgovi = Middle Gobi), in south-central Mongolia about 245km south of Ulaanbaatar.

The mining license covers around 150 hectares, exploiting an approx. 30m tonne fluorspar deposit using surface and underground mines. The “current shelf” mined hosts 700,000 tonnes reserves, “leading to” 4.5-5.0m tonnes. The Gobishoo ore grade is around 18-40% CaF2.

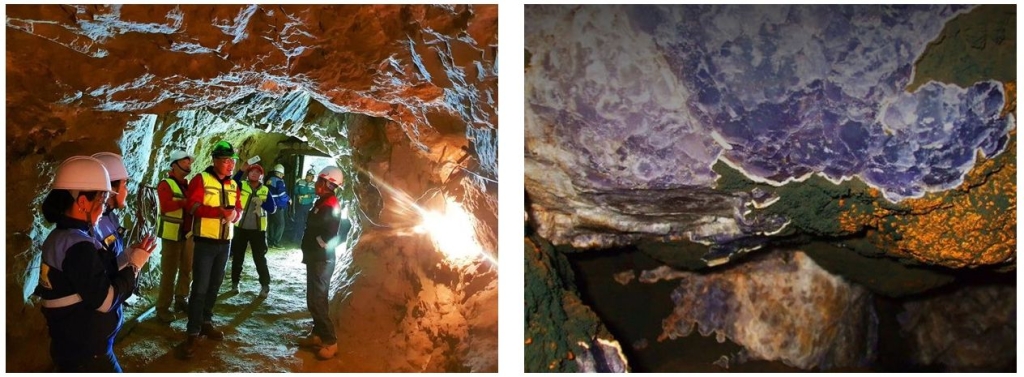

Underground at Gobishoo’s Shine Us mine, which is currently exploiting a “shelf” of 700,000 tonnes fluorspar Courtesy Gobishoo

Gobishoo, which employs 200 full-time staff on a year-round operation, claims that both the flotation and gravitation processing methods it uses allow for a reduction in water usage below the industry average.

Final products are washed acid and washed metallurgical grade fluorspar grades, in 10, 30, and 50mm lumps. Grades offered include: 97%+ CaF2 acid grade; 85% to 95% CaF2 metallurgical/ceramic grade; and 80% to 85% CaF2 metallurgical grade.

Typical specification for CaF2 97%+ powder is: 98.0% CaF2, 0.4% CaCO3, <0.01% SiO2, 0.20% P, 0.07% S.

Gobishoo can produce 2,000 tpm acid grade powder. Recently secured new funding is apparently available to increase this output to 100,000 tpa acid grade.

Gobishoo commissions its new plant in May 2020 (left), and intends to concentrate on the 90%+ CaF2 grade supplying 24,000 tpa, and 12,000 tpa 85%+ CaF2 grade. Courtesy Gobishoo

Regarding metspar grades, Gobishoo intends to concentrate on the 90%+ CaF2 grade supplying 24,000 tpa, and 12,000 tpa 85%+ CaF2 grade.

Approved to export by the Foreign Trade and Economic Cooperation Department, Ministry Of Foreign Affairs, Gobishoo transports its products in 1 tonne bags in both covered and open rail cars using DAP terms via the border trade hubs of Erlian (also called Erenhot), Inner Mongolia, China and Naushki, Republic of Buryatia, Russia.

The international freight terminal at Choir, Govisümber province, is 100km west of Gobishoo, which enables access to the Trans-Mongolia Railway. Markets served include customers in Germany, India, China, South Korea, and Russia.

In September 2021, Gobishoo announced that it had entered in an exclusive sales agent agreement with Fluorspar Ltd, based in the UK and managed by Stuart Evans, which is looking to pursue market opportunities across Europe and Asia.

Ares progresses Lost Sheep Mine

On 30 September, Ares Strategic Mining Inc. (ASM) filed its NI 43-101 compliant updated Technical Report on its Lost Sheep Fluorspar Project, located near Delta, Utah.

The Lost Sheep Fluorspar Project, is located within a former fluorspar mining district in the Spor Mountain area, Juab county, Utah, approximately 214km south-west of Salt Lake City.

The project is 100% owned and consists of 111 claims over 2,100 acres. It is fully permitted, including mining permits.

The Lost Sheep fluorspar deposits occur as siliceous vein fillings, breccia pipes, disseminated and replacement deposits along faults, fractures in intermediate to felsic volcanic and volcaniclastic rocks. Mineralisation consists of 65-95% fluorite, with montmorillonite, dolomite, quartz, chert, calcite, chalcedony and opal as impurities.

Following surface exploration and a drill programme, five areas have been identified “exhibiting loosely quantifiable tonnages and fluorite grades that qualify as Exploration Targets”: Purple Pit, Little Giant Pit (LGP), Dell No. 5, Fluorine Queen No. 3 and No. 4, and Bell Hill.

The Estimated Exploration Target is 200,000 to 350,000 tonnes at a fluorite grade of 40%-60%.

Drilling the Lost Sheep Fluorspar Project, Utah where mineralisation consists of 65-95% fluorite. It could become the USA’s sole fluorspar producer. Courtesy Ares Strategic Mining

In February 2021, ASM announced discovery of a large unmined zone at the Purple Pit averaging 80% CaF2 confirmed at over 60 metres vertical extent and remains open at depth.

In May, construction work started at the company’s intended plant site in Delta, Utah. The site will host a metallurgical grade lump and briquetting plant to supply the steel industry. The operation will be the only one of its kind in the USA.

The plant site will also include buildings, offices, and bagging facilities. ASM is also readying its rail system to enable it to transport product anywhere in North America.

Alongside the Delta site construction, design and permitting for ASM’s Lynndyl site was expected to get underway, which will host an acidspar flotation facility.

In July, ASM acquired a US$2m fluorspar lump manufacturing facility for its Delta site facilitated by a Profit Sharing Agreement between Ares and The Mujim Group, China.

ASM entered into a strategic partnership with Mujim in March 2020. Mujim is a Shanghai-based fluorspar producer and trader, with production facilities in China, Thailand, and Laos, and claiming 150,000 tpa in sales.

ASM has agreed to pay Mujim US$20/tonne to cover the ongoing technical updates and guidance services relating to the Facility as well as US$10/tonne upon ASM beginning lump production operations and the achievement of agreed upon production targets.

James Walker, CEO, Ares Strategic Mining will be presenting the latest on the Lost Sheep Fluorspar Project at IMFORMED’s

Fluorine Forum 2021 ONLINE Wednesday 20 October

ASM has also secured various offtake agreements, including a two-year 60,000 tpa metspar MoU with Possehl Erzkontor North America Inc.

It should be noted that ASM has not yet completed a Feasibility Study nor a Mineral Reserve or Mineral Resource Estimate at the Lost Sheep Mine.

In a recent statement, ASM said: “Based on historical engineering work, geological reports, historical production data and current engineering work completed or in progress by Ares, Ares intends to move forward with the development of this asset.”

ASM has decided to proceed without established Mineral Resources or Mineral Reserves, basing its decision on past production and internal projections.

Canada Fluorspar: first shipment from new terminal

Late July saw another milestone in Canada Fluorspar Inc.’s (CFI) development of the St. Lawrence fluorspar deposit in Newfoundland when it celebrated the first fluorspar shipment from the new terminal recently completed at Blue Beach in St. Lawrence Harbour.

CFI reactivated the mine in 2017, and it has taken a while to ramp up production with various interruptions.

The arrival of the FWN Paula at St. Lawrence represents the first shipment of fluorspar from the harbour in 31 years. Since 2018, CFI has been loading fluorspar shipments at the Kiewit Cow Head terminal in Marystown.

Canada Fluorspar Inc.’s new marine terminal at Blue Beach in St. Lawrence Harbour received its first vessel, FWN Paula, in late July 2021 for fluorspar loading; the 17 metre draft now permits larger vessels and wider markets to serve. Courtesy CFI

The new Blue Beach marine terminal with its 17 metre draft, permits access to more markets since it can accommodate larger ore carriers than the terminal at Marystown.

Bill Dobbs, President and CEO, CFI told IMFORMED that the “high grade low impurity” label was now being applied to CFI fluorspar, and on the general market situation commented: “We have seen increasing pricing and enquiries as

CFI has invested just over US$400m in the operation over the past five and a half years, and has a production capacity of around 180,000 tpa acidspar. CFI is wholly owned by private equity firm Golden Gate Capital.

Commerce Resources’ REE push could unlock fluorspar

In late September Commerce Resources Corp. initiated a mineral processing programme to determine the final Prefeasibility Study (PFS) design criteria of the front-end flowsheet for its Ashram Rare Earth and Fluorspar Deposit, in Quebec, Canada

The programme has been developed in coordination with the Qualified Persons for the Project’s PFS flowsheet design and will be carried out at Hazen Research, where the conventional base flowsheet has been developed.

Commerce Resources’ exploration camp at its Ashram Rare Earth and Fluorspar Deposit, in Quebec, Canada; a >97% CaF2 sample was produced and sent to a major user for testing. Courtesy Commerce Resources

In December 2020, Commerce delivered a sample of acidspar produced from the Ashram project to an industry major as per their request.

The 0.5kg sample graded >97% CaF2 and was produced by Hazen Research using the front-end beneficiation approach developed at their facilities in Colorado, USA.

Commerce completed a summer drill programme of 2,814 metres of NQ size coring over 12 drill holes at the Ashram Deposit, targeting further delineation of the mineralised body.

Mineral resources at Ashram are reported as:

- Measured: 1.6 Mt averaging 1.77% REO and 3.8% F (7.7%CaF2)

- Indicated: 27.7 Mt averaging 1.90% REO and 2.9% F (5.9%CaF2)

- Inferred: 219.8 Mt averaging 1.88% REO and 2.2% F (4.5%CaF2)

If commercial processing of the rare earths comes to fruition at Ashram, then it is likely that the fluorspar component will be a valuable co-product.

Peter Robinson, Chairman, Fluorsid British Fluorspar will presenting

Fluorspar mining trends & outlook post-Covid at IMFORMED’s

Fluorine Forum 2021 ONLINE Wednesday 20 October

Eclipse Metals’ Greenland cryolite revival?

Eclipse Metals Ltd, Australia is continuing its examination of historical diamond drill core from the Ivittuut cryolite mine district within its exploration licence located in southwestern Greenland.

The Ivittuut open pit mine was the world’s largest producer of the relatively rare fluorine mineral cryolite (Na3AlF6, sodium hexafluoroaluminate).

Aerial image of Ivittuut and the cryolite mine in 1960, showing the working open pit, mine infrastructure, ore and waste dumps and ship loading facilities; Eclipse Metals is evaluating the unmined part of the deposit. Courtesy Eclipse Minerals

Mining commenced in 1855 and continued until 1987 through various stages of production. A total of 3.8m tonnes of ore was mined with an average grade of 58% cryolite.

It was historically used as an ore of aluminium and later in processing aluminium from bauxite. Synthetic aluminium fluoride processed from fluorspar via hydrofluoric acid is now used in aluminium smelting.

Eclipse has received an initial batch of samples from historical drill-core from the project and has submitted this to Perth-based laboratories for chemical and petrological evaluation.

This initial assessment of the core provides a greater understanding of quartz, cryolite and siderite mineralisation within the pit environ and a preliminary understanding of the Gronnedal-Ika carbonatite complex located less than 10km from Ivittuut and only 5km from the port of Gronnedal.

A further surface sampling program has been conducted and additional samples are expected to be despatched in November 2021.

Leave A Comment