Oil & Gas Market | Barite | Bentonite | Pollucite/Caesium Formate | Gilsonite

While it wasn’t quite the usual fizz and excitement of our annual in-person event in Houston where we bring together the great and the good of the world’s oilfield minerals industry for a networking and knowledge extravaganza, our virtual version earlier this year, Oilfield Minerals & Markets Forum 2021 ONLINE 26 May, was the next best thing under the circumstances and turned out to be a good day at the “home office”.

Hopefully, next year we can continue where we left off in 2019 (mark your diaries: Oilfield Minerals & Markets Forum 2022, Houston, 23-25 May 2022 – see link for details).

CALL FOR PAPERS

Complimentary registration for Speakers

Please contact: Mike O’Driscoll [email protected]

Leading experts and attendees across the global oilfield mineral supply chain ensured an excellent day spent presenting and discussing key trends and developments impacting the industry. Our virtual Roundtable Networking Session also emphasised the need for continuing first hand communication across the market.

The oilfield market for industrial minerals remains a significant consumer for a range of minerals: a primary market for several (eg. barite and bentonite), as a secondary market for many (eg. calcium carbonate, potash), and a niche market for some rare minerals (eg. Gilsonite, pollucite).

However, the sector overall has reached a critical point in its evolution with the advent of alternative energy development.

This, combined with the ongoing covid-19 pandemic and its impact on markets and logistics during 2020-21, ensured there was plenty to discuss online this year, and, all being well, sets up the next in-person Forum in May 2022 as a must-attend event for all those involved.

What delegates thought about Oilfield Minerals & Markets Forum 2021 ONLINE

“It was extremely interesting, the market is evolving, even though it has suffered badly in 2020, and we are now looking forward to an upturn in our industry. At least with the conference we were able to keep a track of new applications and new markets to look into. Thank you for arranging such a high quality meeting and it’s always a pleasure to see new and old faces.”

Valentin Cardon, Head of Communication & Marketing, Poittemill, France“The very efficient and effective way you both organised the programme and timing of the presentations was perfect. The agenda was certainly sufficient to cover the important themes and aspects of the oilfield market outlook.”

Michael Redman, Director, KGCS Trading, Spain“Great forum today. I know it’s tough running everything virtual versus getting everyone together and I thought it was well put together in the way it accommodated everyone in all time zones.”

Calvin Loa, Managing Director, Mekong Minerals, USA“Really enjoyed, and great slate of speakers.”

Joe Gocke, Consultant, USAFree Oilfield Minerals & Markets Forum 2021 ONLINE Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations plus access to live recording maybe purchased.

Please contact Ismene Clarke T: +44 (0)7905 771 494 [email protected]

Industrial minerals & the oilfield market

Mike O’Driscoll, Director, IMFORMED, UK

Kicking off proceedings, Mike O’Driscoll underlined the important role of a wide range of industrial minerals (at least 36 types) in the oilfield market emphasising the supply chain from mining, processing, logistics, to market application.

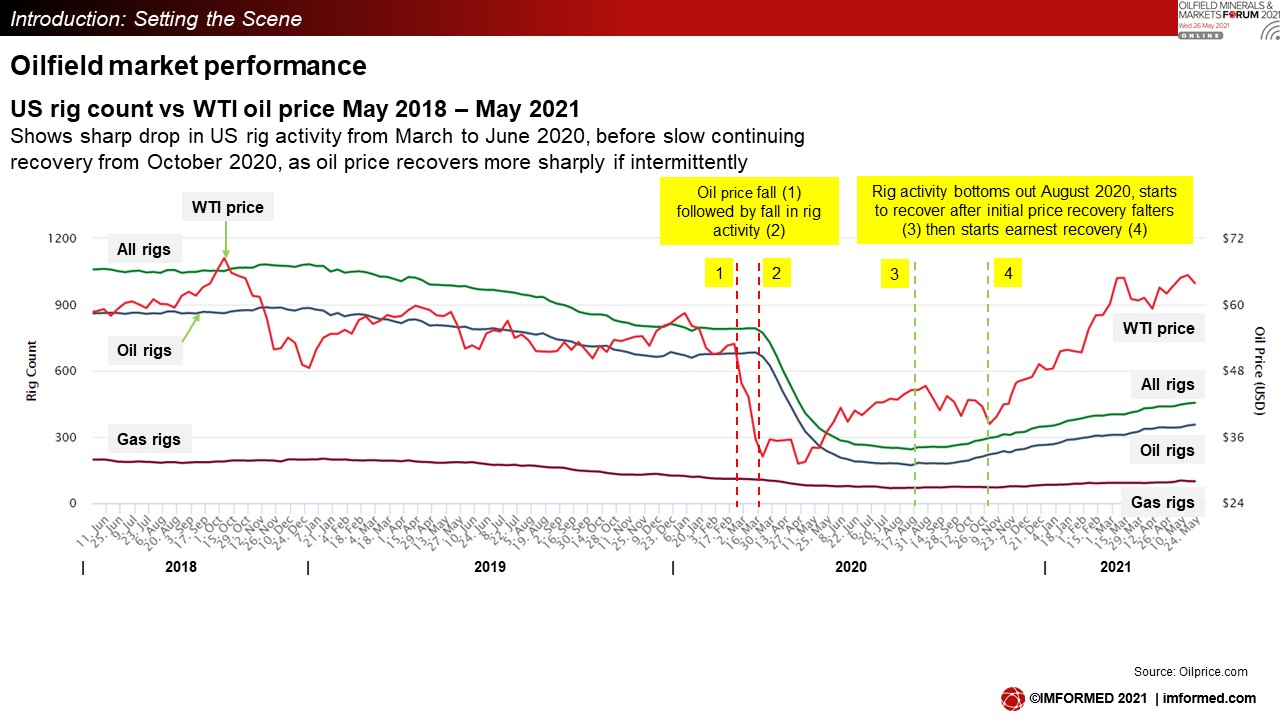

He reviewed the market’s performance illustrated by the US rig count vs WTI oil price during 2018 to 2021, which showed a sharp drop in US rig activity from March to June 2020, before a slow continuing recovery from October 2020 into 2021, as the oil price recovered more sharply if intermittently.

Overall, world oil markets have rebounded from the initial demand shock triggered by Covid-19 – its biggest ever annual decline – but still face a high degree of uncertainty.

Attention was drawn to the International Energy Agency’s (IEA) “Net Zero by 2050 – A Roadmap for the Global Energy Sector” published in May 2021. Claimed as ““The world’s first comprehensive study of how to transition to a net zero energy system by 2050 while ensuring stable and affordable energy supplies”.

In it the IEA states that >400 milestones are required to meet global net zero by 2050. In summary, until the 2030s, spending on oil and gas exploration and production is to remain low and steady; natural gas demand in 2050 to hold up better than oil; demand for gas is expected to rise as feedstock for hydrogen’s role as a clean fuel; and geothermal energy emerging as an area of interest for petroleum engineers.

However, on the flipside, beyond projects already committed as of 2021 “there are no new oil and gas fields approved for development in our pathway”. The energy sector would be based largely on renewable energy; fossil fuel share slightly over one‐fifth by 2050 (down from almost four‐fifths total energy supply today).

It probably comes as no surprise that the IEA Roadmap received a somewhat chilly response from the industry. That said, things are going to change and some positive strategy for the near future will be required.

Oil & gas market outlook

Uday Turaga, CEO, ADI Analytics LLC, USA

Uday Turaga provided a much more detailed and professional overview of the oil and gas outlook, summarised in six main messages:

- Demand growth expectations are supporting oil price increases

- Supply restraints are also supporting oil price increases driving new supply consolidation in the Permian

- Natural gas prices will pick up to ~$3 per Mcf in 2021 but continue to stay around that level

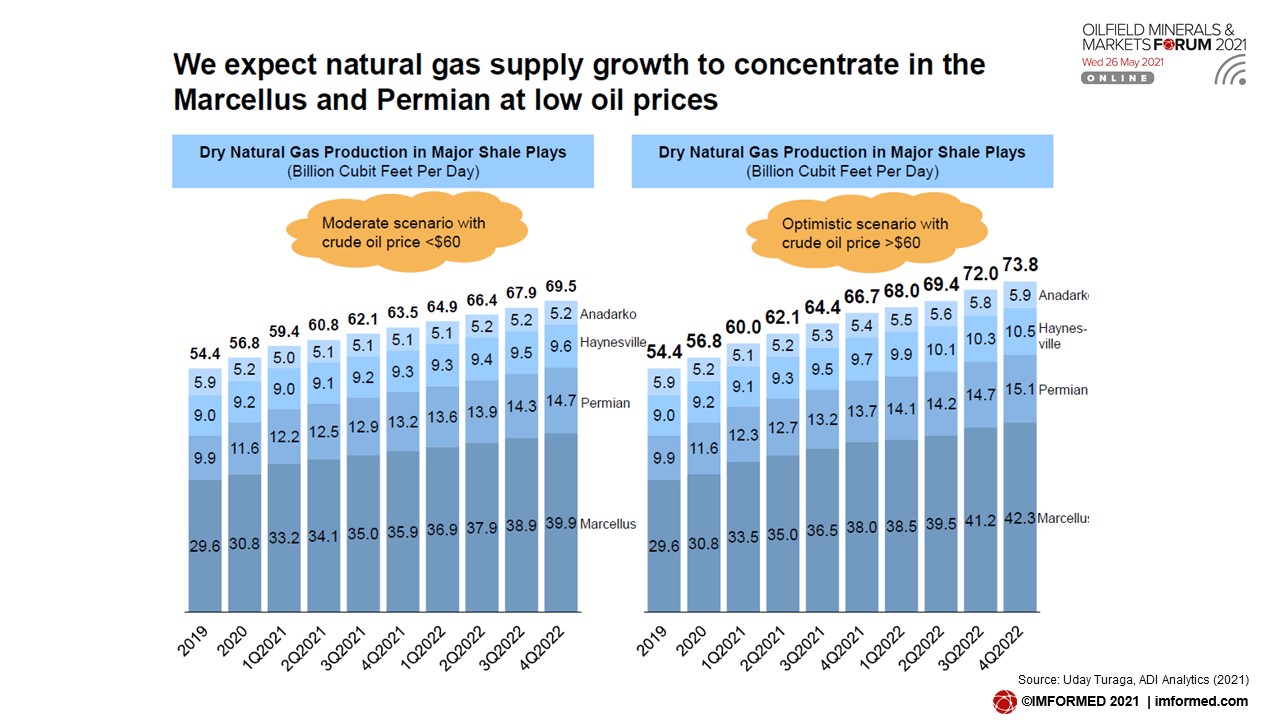

- Shale gas supply growth will be led by Marcellus and Permian with new growth in Haynesville while LNG will drive demand

- E&P capex will rise in 2021 albeit from an all-time low with growing emphasis on digital and ESG

- Broader sustainability risks are sufficiently serious for oil and gas operators to seriously consider new initiatives

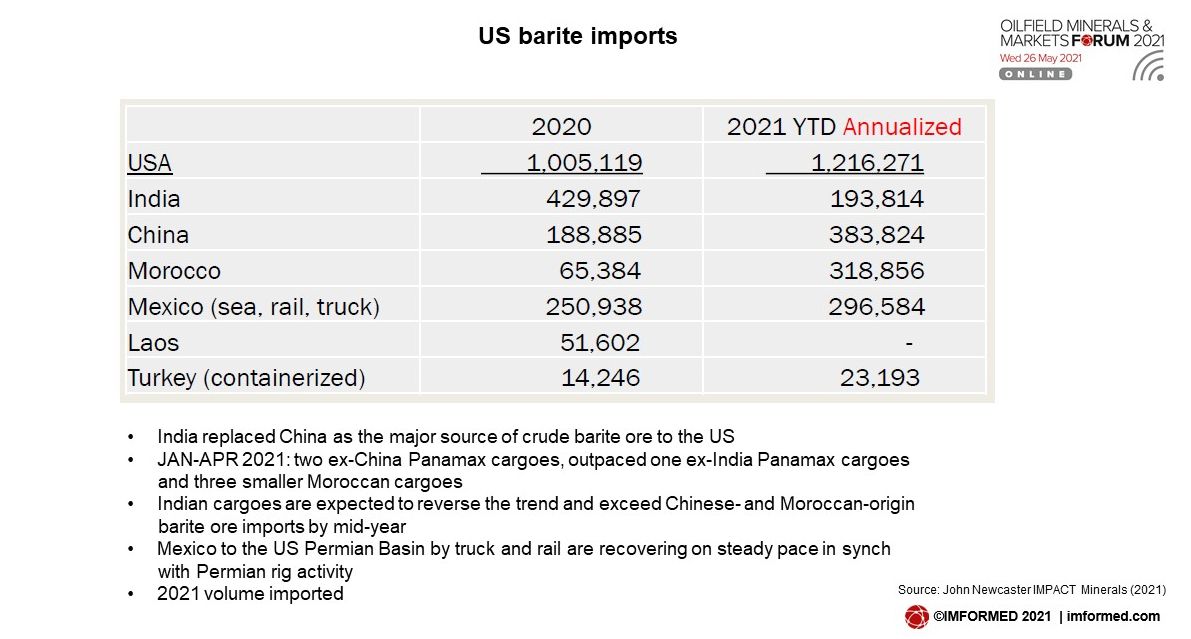

Barite market trends: major developments over the last 12 months

John Newcaster, Principal, IMPACT Minerals LLC, USA

John Newcaster reviewed the key trends shaping the barite market sector. The presentation covered a range of important aspects including:

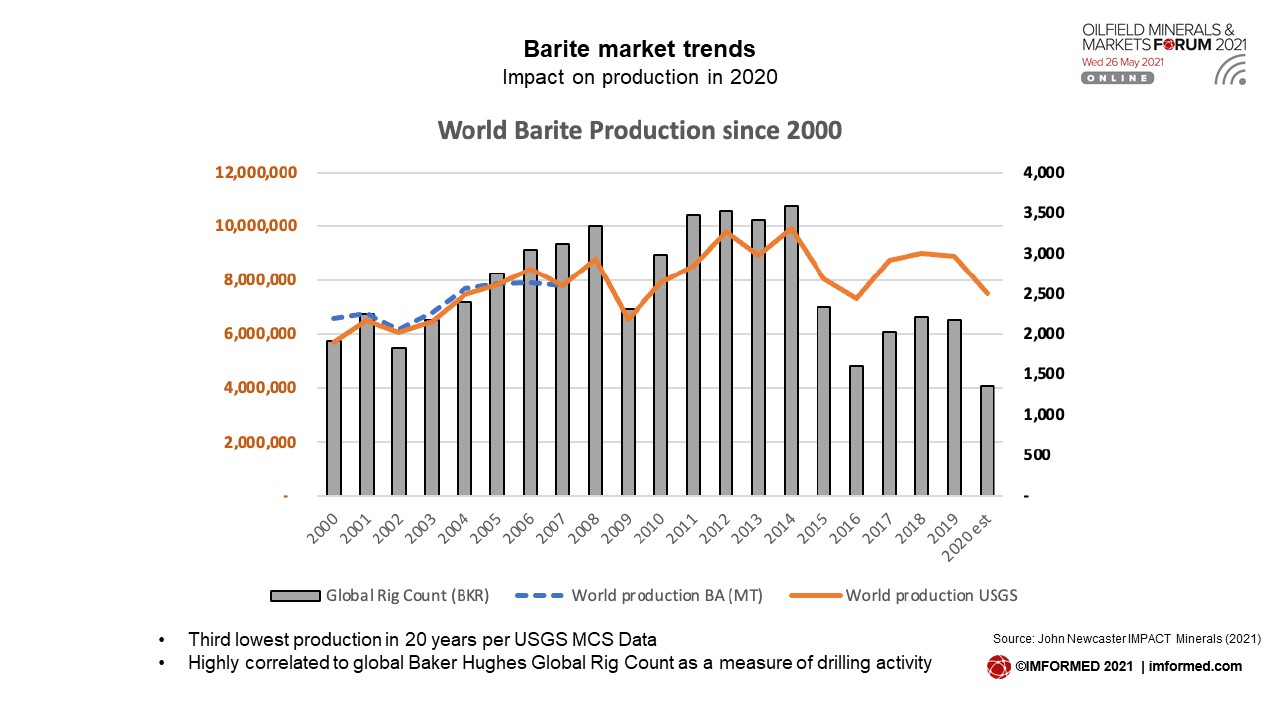

- Overall, global barite production slowed in 2020

- Slow recovery of barite demand in 2021 from slow recovery in drilling activity

- Saudi Arabia planning a higher offtake in 2021

- Indian state government tender resulted in modest upward global market cost

- Freight increases impacting all barite supply chain costs

- Global dry bulk and container freight drives landed costs of barite shipments

- US domestic barite production in a state of near hibernation

- US politics casts uncertainty on oil and gas

- API 13A Standards Committee work underway on new grades

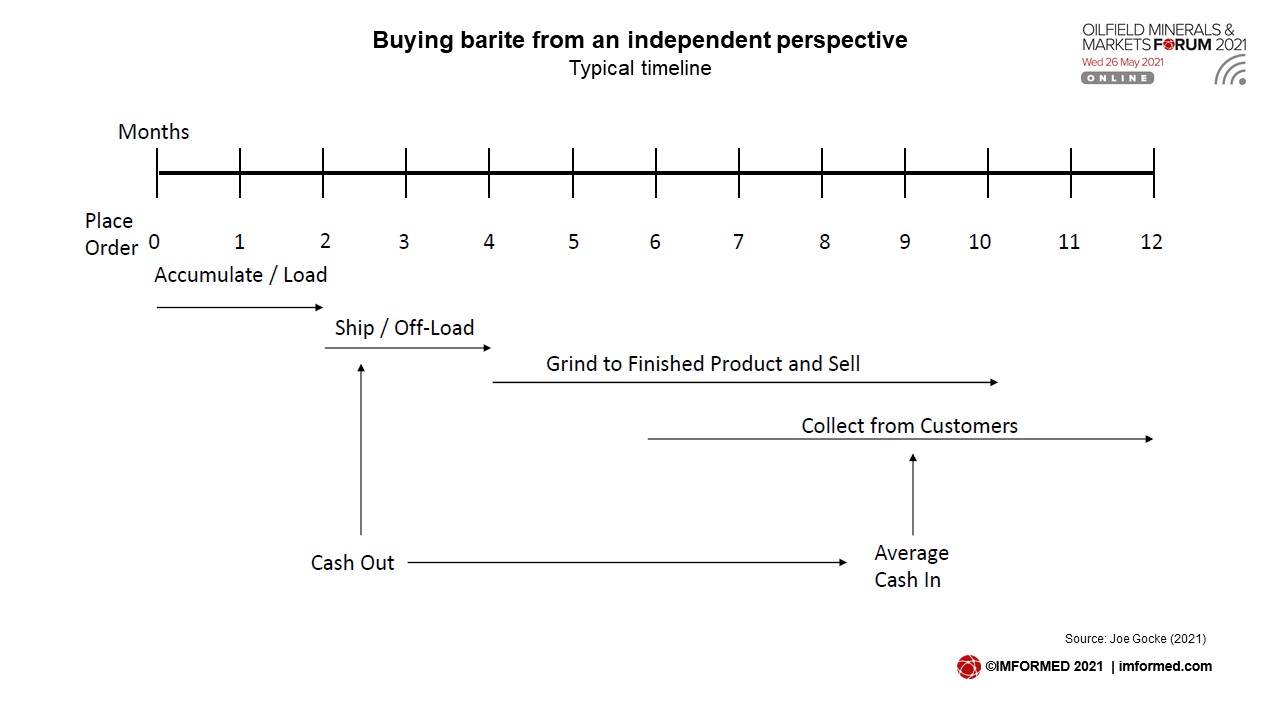

Bulk buying barite: an independent perspective

Joe Gocke, Consultant, USA

This was a view from the sharp end of barite supply: Joe Gocke highlighted the challenges and key practices in bulk buying barite. He started with underlining the “great tension” in inventory management between the three primary functions of reliability to customer, operational efficiencies, and carrying costs.

The key decisions are: When to schedule? What to buy? And how much to order?

Plenty can go wrong such as in scheduling delays owing to weather, at terminals with open births/equipment, geopolitical, pandemics, and demand uncertainties.

Gocke discussed shipping volume decisions, grades, trade offs with “time is money”, optimal solutions and considerations in how much to order, vendor diversification, and supplier vetting.

Laos’s barite developments & future projects

Calvin Loa, Managing Director, Mekong Minerals Co. Ltd, USA

Laos has been one of several “new kids on the block” for world barite supply, and Calvin Loa presented an excellent round-up of developments to date.

Loa covered Laos at a glance, an overview of a Laotian barite mine, current developments, and the future outlook.

Laos opened up in 1990s and joined the WTO in 2013. It is one of fastest growing economies in the world, at +8% YOY and a +4% YOY target to 2025.

Lao Barite spent ten years developing to enter the world barite market. Starting in 2008 by looking for gold, copper, and other minerals; then manufacturing cement for the local market through a JV with Siam Cement Group in 2015; then entering the barite market in 2018.

There is a total estimated “geological resource” of 45m tonnes, including 4.3 SG barite grades with low impurities, to be exploited by six planned open pits with a production capacity of 30-50,000 tpm.

“We had strong growth for our first 2 years to market” said Loa. Then in 2020-21 the company focused on internal development. This included appointing exclusive sales agents (A-Chem Resources Pte Ltd) in the Middle East and North America, a new jig plant, two new spiral washers, two new powder mill facilities, and using an additional port at Nghi Son.

New rail networks under construction will greatly improve Lao barite’s export potential, especially to smaller volume customers at Fangcheng, Guangxi, in southern China. Quality upgrade facilities are under for development of higher grade barite for other industries.

Barite processing: Extending life of assets through equipment wear reduction

Santiago Carassale, Category Manager Mined Products, Halliburton, USA

In this presentation Santiago Carassale first considered the main elements of barite sourcing versus barite processing, concluding that “throughput is King” with its inputs of wear, production per hour, and feed-in size.

Carassale then examined the main concerns driving process decisions:

- System design assumptions: What were the equipment design assumptions? Based on what kind of mineral spec was the equipment designed?

- Feed-in size: What are the max and min feed-in size ranges?

- Expected production rate

- What the mine has in store for us? Mineral characterisation

There are two main concepts usually driving process decisions with regard to raw material selection that usually are tied in together: wear and hardness.

Carassale outlined some of the methods known to understand process implications with wear and hardness when using different equipment set ups such as jaw crusher, HPGR, and ball mills.

Changing the sourcing mindset for a process driven mindset will enable: longer equipment life; higher ROI; enhancements on equipment productivity; reduction on carbon footprint; geological and geotechnical approach as an evolution to current mining practices; higher focus on higher end technology Capex.

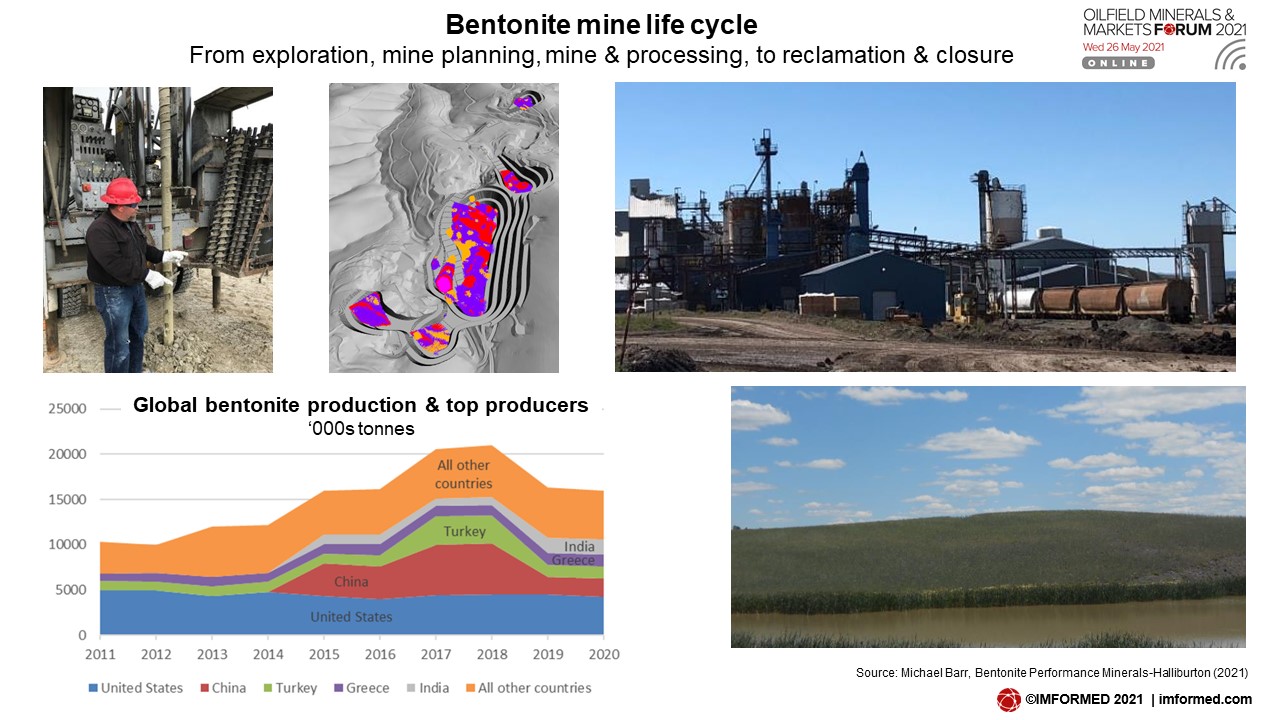

Bentonite from a supplier’s perspective: overview & bringing a source on-stream for the oilfield market

Michael Barr, Mineral Resource Coordinator, Bentonite Performance Minerals-Halliburton, USA

Going upstream to the point when an oilfield mineral resource is considered for development was the topic for Michael Barr’s presentation, using bentonite as an example.

Barr covered bentonite data and trends, chemistry of bentonite, geology of bentonite deposits, life cycle of mining projects, and the Baroid and Halliburton Industrial Products Service Line.

The USA remains the world’s leading bentonite producer, and has maintained reasonably consistent production levels since 2011.

Barr explained how bentonite’s unique chemistry facilitated its role in oilfield drilling where it is used to: cool and lubricate the drill bit and tooling; suspend cuttings; transport cuttings to the surface; create hydrostatic pressure; apply filter cake; create stability; and is environmentally safe.

Using the classic economic bentonite districts of Wyoming as a case study example, Barr went through the typical life cycle of a bentonite mine:

- Identify and Explore

- Acquire Rights

- Permit Exploration

- Drill and Develop a Resource

- Develop Mine and Reclamation Plan

- Permit Mine & Reclamation Plan

- Execute Plan

- Reclamation

- Closure

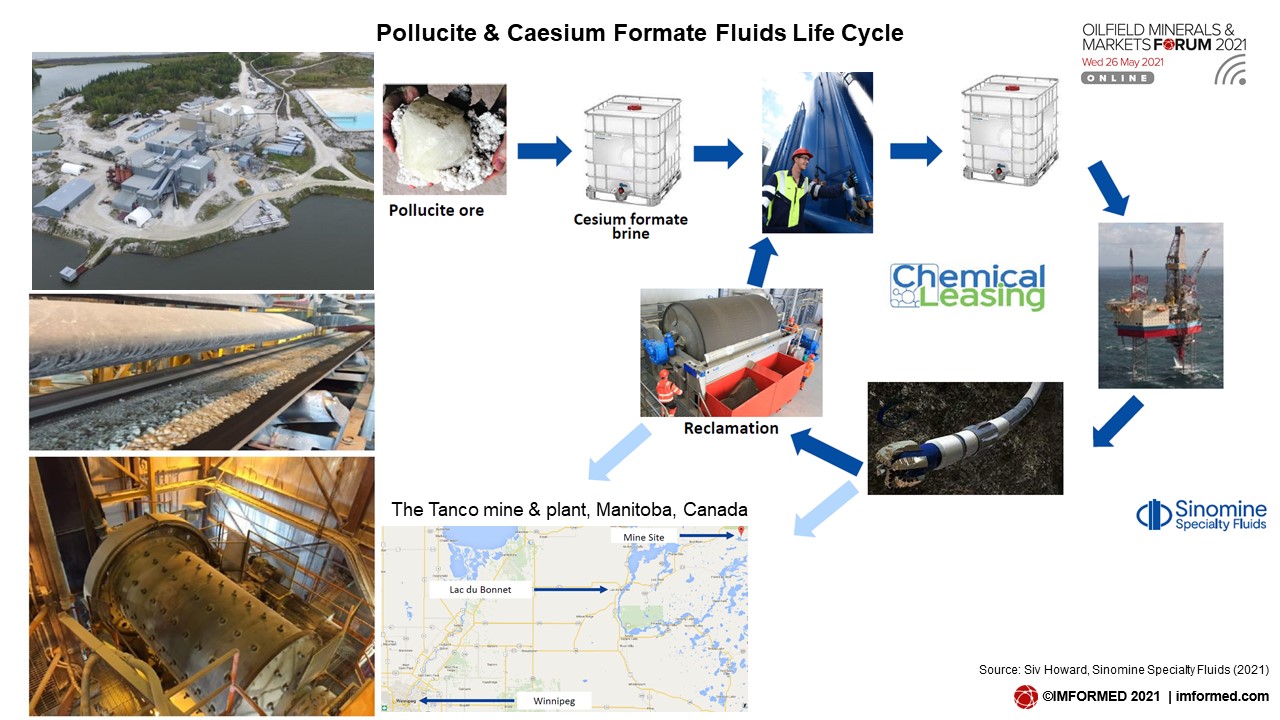

Pollucite & caesium formate fluids in oilfield drilling: supply, processing & demand

Siv Howard, R&D Manager, Sinomine Specialty Fluids, USA

Sinomine Specialty Fluids has been the world’s leading caesium formate fluids supplier to the oil & gas industry since 1999 explained Siv Howard.

Headquartered in Aberdeen, Scotland, UK, Sinomine owns and operates the TANCO mine in Manitoba, Canada, with sales offices and stock points strategically located around the world.

Formerly Cabot Specialty Fluids, since June 2019 the operation has been part of Sinomine (Hong Kong) Rare Metals Resources Co. Ltd, which is part of Sinomine Resource Group (public company). The acquisition has enabled access to additional reserves and mining expertise.

Howard went on to explain the pollucite/caesium formate supply chain, the main properties of caesium formate, how it is processed from pollucite ore, and its application in the oilfield market.

Caesium is a limited resource and caesium formate fluids are rare and costly. The fluid is supplied according to a leasing model while Sinomine retains ownership and stewardship of the fluid. Some 8,000 tonnes of caesium formate fluid are on lease every year, and after use on the drilling rig, the fluid is recovered and recycled.

Caesium formate has unique properties that enable challenging applications, especially in HPHT and ultra-HPHT environments in drilling and OH completion applications.

It has completely displaced zinc bromide as a clear brine completion fluid in the North Sea, its largest volume regional market (70%; there is limited use in the GOM).

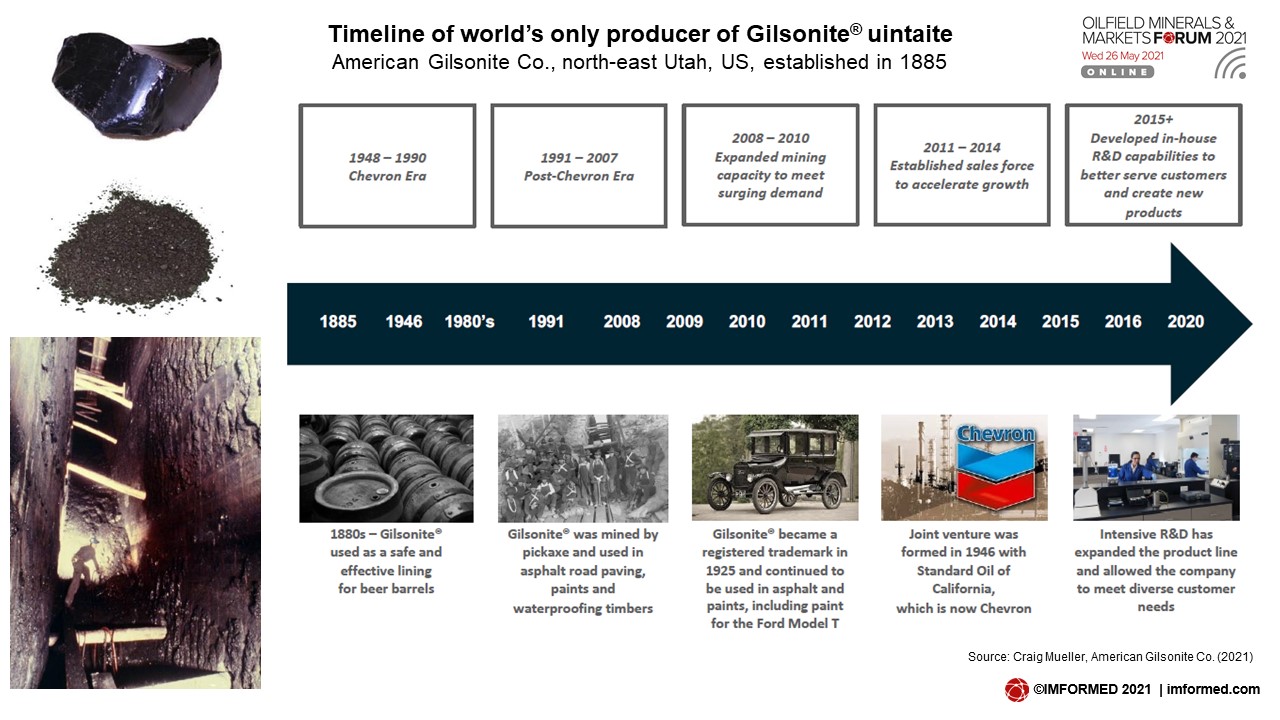

Gilsonite used in oilfield applications

Craig Mueller, Chief Commercial Officer, American Gilsonite Co., USA

Craig Mueller presented on another intriguing niche oilfield mineral, Gilsonite – a glossy, black, solid hydrocarbon resin, similar in appearance to coal or hard asphalt, with global applications across multiple industries, including oilfield.

Gilsonite® is American Gilsonite Co.’s (AGC) trademark brand name for uintaite, a naturally occurring hydrocarbon resin, found only in north-east Utah, USA.

Mueller highlighted the properties and geological formation of Gilsonite before reviewing the development of Gilsonite in the USA from the 1880s.

Reserves are formed in parallel, near-vertical fractures and hand-mined in underground shafts using pneumatic jack hammers, to depths of 500-1,400+ft. AGC has a production capacity of about 130,000 tpa.

The material finds use in a range of diverse market applications including inks, paints, asphalt, foundry; in the oilfield sector it is used as a loss circulation material, a wellbore stabiliser, and in well cementing improving zonal isolation and eliminating gas migration.

Thank you and hope to see you in 2022!

Under these challenging conditions for home and business at this time, we are indebted to the support and participation of our sponsors Baramin, and all our partners, speakers, and delegates for making Oilfield Minerals & Markets Forum 2021 ONLINE such a success, and ensuring a fruitful and convivial time was had by all.

We are grateful for all the completed feedback surveys and please continue to provide us with your thoughts and suggestions.

We very much look forward to meeting you again, hopefully in person, at Oilfield Minerals & Markets Forum 2022, Houston, 23-25 May 2022.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 [email protected]

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 [email protected]

Free Oilfield Minerals & Markets Forum 2021 ONLINE Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations plus access to live recording maybe purchased.

Please contact Ismene Clarke T: +44 (0)7905 771 494 [email protected]

Announcing for 2022…