Fluorine Forum 2019 Review

The great and the good of the global fluorine raw material supply chain gathered in Prague last month for an excellent three days of high profile presentations, discussion, and invaluable networking.

IMFORMED’s Fluorine Forum 2019, 21-23 October, was held at the centrally located and iconic Alcron Hotel in Prague. Now in its third year, the Fluorine Forum has clearly established itself as the primary annual meeting point for all those active in the fluorine raw materials industry.

The Sepfluor-sponsored Welcome Reception entertained with a fine Czech folk music band as delegates met and mingled on the eve of a busy but most rewarding conference.

“Excellent programme and venue, perfect exchange between participants.”

Erika Utner, Commercial Manager, CHENCO, Germany“Thank you for providing a very well organised event and the opportunity to present to my peers and leaders in the fluorine industry.”

John Zielinski, Category Manager Fluoroproducts, The Chemours Co., USA“Thank you for a great conference. Excellent speakers and attendee list.”

Bill Dobbs, Chief Executive Officer, Canada Fluorspar (NL) Inc., Canada“Well thought discussions and presentations, roundtables gave an opportunity to interact.”

Haridas Sreedharan, President Supply Chain, Navin Fluorine Intl. Ltd, India“Well-rounded programme, well put together, good venue and attendance.”

Malcolm Crawford, Delta Minerals Ltd, UKCLICK HERE FOR Summary Slide Deck (programme, attendees, feedback) & Picture Gallery

Supply trends, trade & outlook

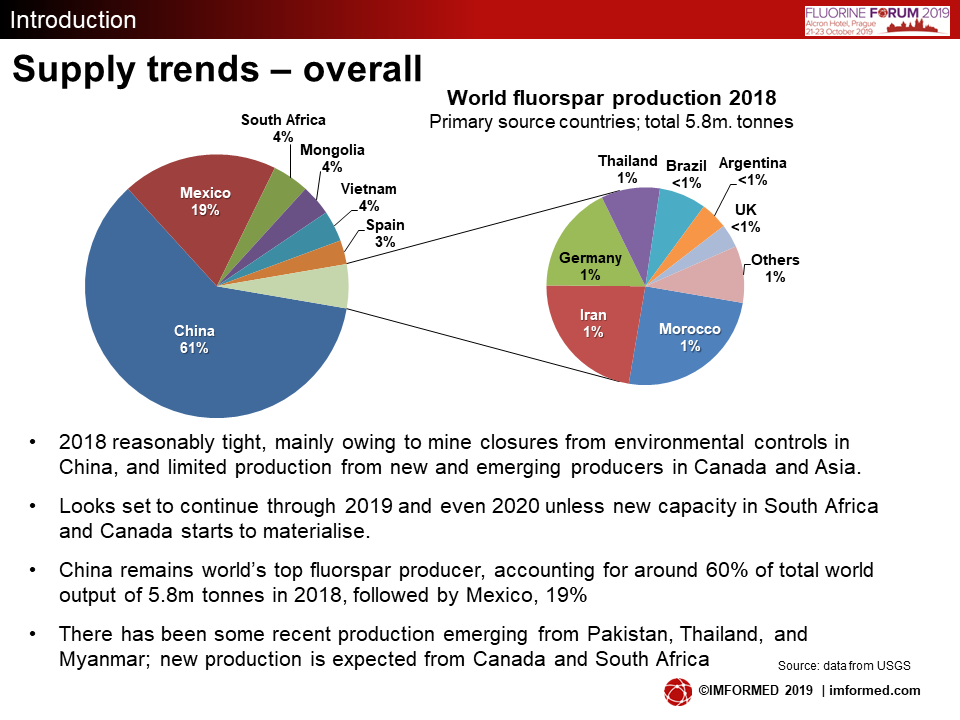

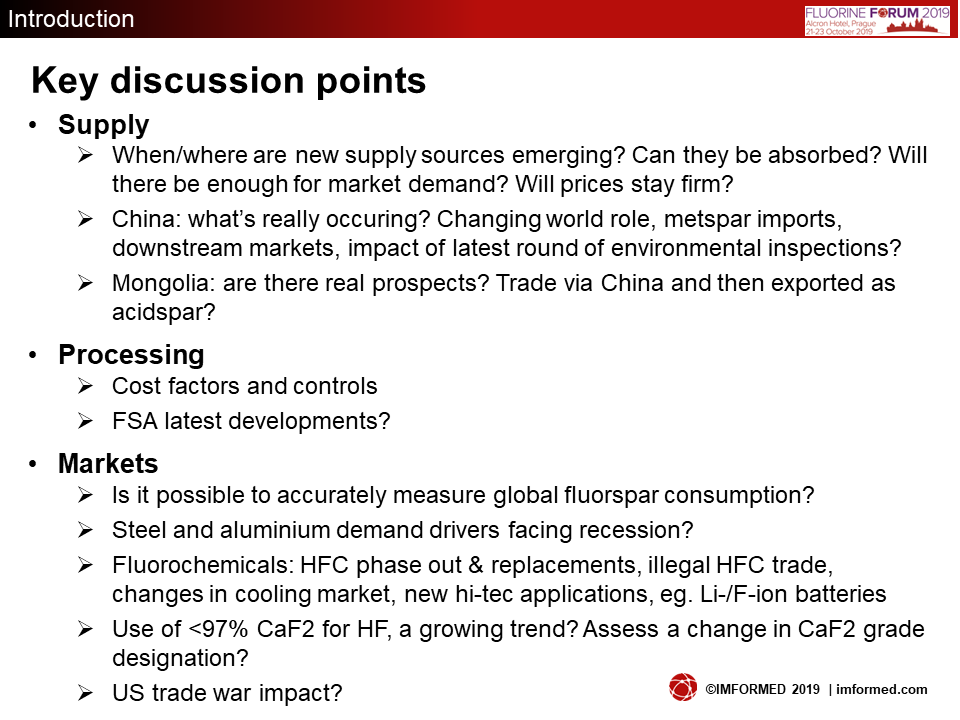

Mike O’Driscoll, Director, IMFORMED, UK, set the scene by highlighting some of the key evolving supply and trade trends, and underlined key discussion points for the next two days.

Oliver Rhode, CEO, Xenops Chemicals GmbH & Co. KG, Germany, presented “Key trends and outlook for the fluorspar market” covering global facts and figures, a focus on China with trade statistics and future trends, pricing and outlook, and new “European” supply alternative for acidspar.

Rhode asked the audience if lessons had been learned over the last decade, noting that many of the key issues and questions in 2009 remain just as apt in today’s market.

Rhode asked the audience if lessons had been learned over the last decade, noting that many of the key issues and questions in 2009 remain just as apt in today’s market.

China’s role in the global fluorspar market has changed significantly, a net-importer of metspar, but not acidspar…yet. “Chinese fluorspar doesn’t have a major impact on global markets anymore. And Mongolia won’t continue China’s previous role in being the leading exporter to global markets.” said Rhode.

“Overall, the fluorspar market remains tight, even when the new producers are running at nameplate capacity next year. There are new projects, but it is not clear when they will start commercial production. And Plan B? sell to China! The biggest threats are a trade war, Brexit, and a global recession” concluded Rhode.

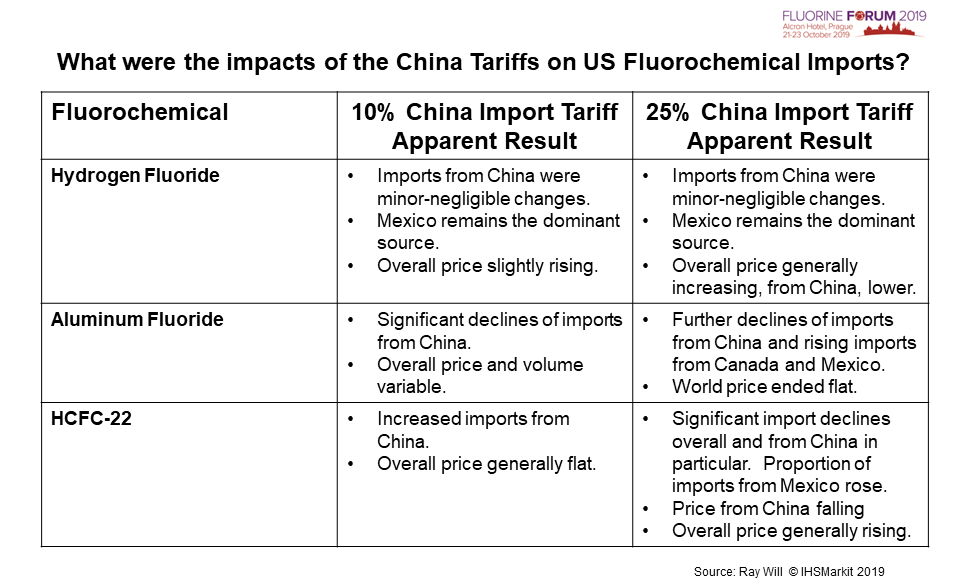

In “Trade & tariffs: Where we’ve been and where we might go”, Ray Will, Director of Specialty & Inorganic Chemicals Consulting, IHS Markit, USA, examined the impact of US-China tariffs and trade, and Brexit on fluorspar and fluorochemical trade.

Will brought us up to date with the latest on the US-China trade tariffs issues and its impact on HF, aluminium fluoride, and HCFC-22 (see below).

Will also pointed out that Brexit may well be consequential for UK-EU trade since most of the UK’s HF imports are from Europe, most of the UK’s acidspar exports are to Europe, and most of the UK’s PTFE trade is with Europe.

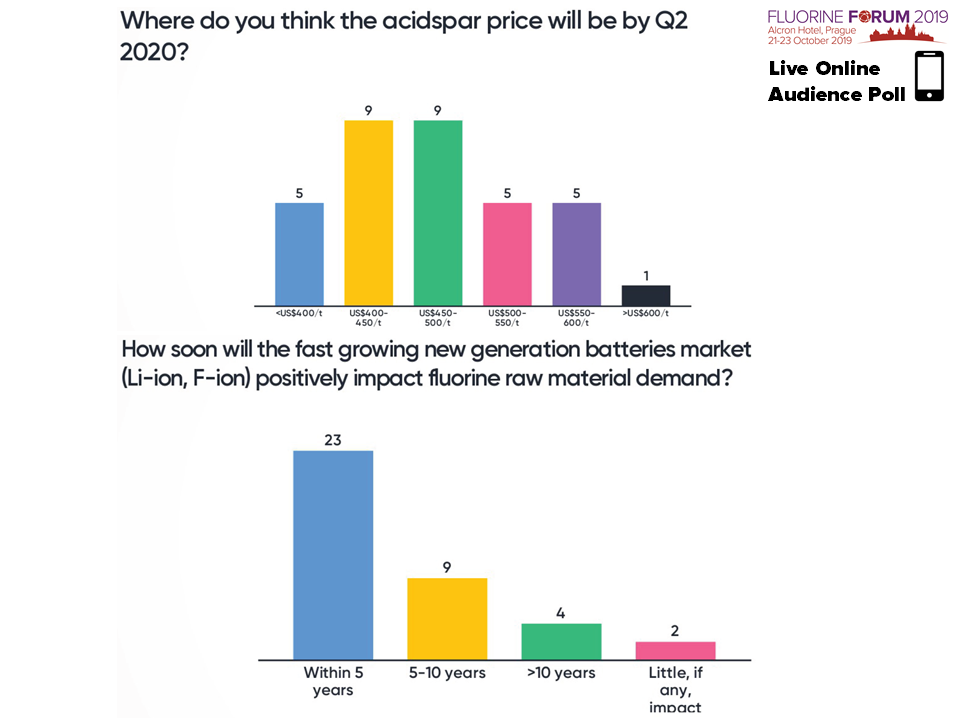

Just before the conference broke for morning coffee, delegates were invited to participate in our now regular, and very well-received, live online poll – a short period of gauging the audience’s feedback on certain topical market questions, it was insightful and fun. See below for some of the results:

Mining & processing | Fluorsid seeks fluorspar sources

“Cost factor trends in fluorspar processing” by Ashok Shinh, Ashok Shinh Consultancy Ltd, UK reviewed cost trends on acid grade fluorspar, hydrofluoric acid and aluminium fluoride.

Shinh commented that global economic growth is set to moderate in the near term, with GDP growth falling to around 3% p.a. and Chinese GDP is projected to slow to around 6%.

Shinh commented that global economic growth is set to moderate in the near term, with GDP growth falling to around 3% p.a. and Chinese GDP is projected to slow to around 6%.

He considered that cost pressures on fluorspar processing should ease in the near term, translating into some softening of fluorspar prices. However, in the longer-term a tighter supply/demand balance for acid grade fluorspar should support a rebound in prices.

“The softening of acid grade fluorspar costs will feed into and impact hydrofluoric acid and aluminium fluoride productions costs. Prices for both these products should also ease in the near term.” said Shinh.

“Fluorspar mining in Europe: mineral waste (tailings) management in a National Park” by Peter Robinson, Chairman, British Fluorspar UK Ltd, UK, began with a significant announcement regarding Fluorsid’s future strategy in the fluorspar market.

“The market is approaching an imbalance between raw material demand and supply” intoned Robinson, before bringing the audience up to date with Fluorsid’s recent expansion activities and its ultimate aim for strengthened integration.

“Fluorsid is now a substantial fluorochemical company, and arguably the consumer of 5-11% of the acidspar market” said Robinson.

The group is to embark on exploration and development of fluorspar mining capabilities in order to improve its security of raw material supply, seeking captive sources in Europe and overseas – a prospect in South America is under development.

Robinson warned that the “usual” lead time of some ten years to start up a new fluorspar mine was too long, and Fluorsid would be seeking smaller scale, low cost projects, using semi-mobile plants, with 2-3 years lead time, and at the 50-75,000 tpa fluorspar level.

Robinson reviewed the processing at British Fluorspar, UK, where 1,310 tpd of polymetallic ore is processed at the Cavendish plant, explaining the importance and rewards of tailings processing, and reminding that in the overall cost of processing, “cost of recovery is King”.

“Fluorspar mining in the Czech Republic” by Vít Kučera, Managing Director, Fluorit Teplice s.r.o., Czech Republic, neatly provided a brief history of mining activities, market and a look into the future for the Czech Republic.

Fluorspar was produced between 1957 and 1993 at an average of 45,000 tpa, most deposits, hosting steeply dipping fluorspar veins, were located along the north-west border of the country, the main ones being Moldava and Harrachov.

The ore was processed at Teplice using two flotation lines each with 17 cells and using dense media separation to process metspar.

However, the 1990s saw major changes – Chinese imports, domestic industry restructuring, declining use of metspar in steel plants, HF manufacture ceased – which eventually closed the mines in 1995.

However, the 1990s saw major changes – Chinese imports, domestic industry restructuring, declining use of metspar in steel plants, HF manufacture ceased – which eventually closed the mines in 1995.

There remains a tailings processing project at Proboštov, potentially for the cement industry, and exploration licences at Moldava and Kovářská.

Fluorit Teplice s.r.o. based on site of the original flotation plant is active in trading and processing fluorspar, dead burned magnesia and other minerals, with a capacity of 50,000 tpa.

Of significant interest is the attention (by European Metals) to the potential development of Europe’s largest and the world’s fourth largest non-brine lithium deposit at Cínovec, combined with Skoda’s plans for future EV production, which may yet revive mining prospects in the Czech Republic (and surrounding region – see Johannes Scheruhn’s comments below).

Vietnam & China | All change for the new & the old

In presenting “Nui Phao: Striving to be the best-in-class supplier”, Tony Fitzgerald, former Sales & Marketing Director, Masan Resources Group, Vietnam, offered delegates more than an inkling of what they would be lucky enough to see first hand by attending next year’s event: Fluorine Forum 2020, Hanoi, 12-14 October 2020.

Fitzgerald took us from the first identification of the polymetallic ore deposit at Nui Phao in 2000, through to plant ramp up and commercial production in 2015, to operational efficiency and cost optimisation in 2017.

Key to the project’s success has been meeting a raft of community needs and compliances, such as successfully resettling >900 families as part of progressive resettlement to Equator Principles & IFC guidelines, as well as adhering to some of the strictest wastewater discharge standards in the world – above some EU standards.

It was clearly a period of much lesson learning: “You need an intellectually curious technical processing team – you constantly try to refine your processes. You have to be prepared to fail.

It is obvious, but you can never take the customer for granted. Requirements continue to change and evolve.” said Fitzgerald.

“The development of China’s fluorite industry” by Usman Khan, CEO, Kcomber Inc., China, covered prices of Chinese fluorochemicals, fluorspar production, consumption, prices and trade, and outlook trends.

“The development of China’s fluorite industry” by Usman Khan, CEO, Kcomber Inc., China, covered prices of Chinese fluorochemicals, fluorspar production, consumption, prices and trade, and outlook trends.

The fluorochemical industry consumes the largest proportion of fluorspar in China (50%), followed by metallurgy (25%), construction (15%), and others.

The Chinese fluorspar industry is aiming at a large scale standardised and centralised, integration. To this end, the Fluorspar Industry Development Association has been established and industry standards have been published. China’s 13th Five Year Plan (2016-20) has included a plan for development of China’s fluorochemical industry.

“China’s fluorspar market update” by Liao Xinhua, Chairman, CNMIA Fluorspar Committee, China, provided a more detailed review of Chinese fluorspar supply and demand conditions.

The supply sector has continuing challenges such as: mining license renewal delays, temporary and permanent shutdowns, closure of most small-sized mines, unsustainable utilisation of low-grade ores, and many mid-/large-sized mines are now entering ore depletion phase.

There were just 251 mines by the end of 2018, down from >1,200 in 2013. All of the fluorspar mines are closed in Xinyang, Henan (200,000 tonnes capacity), Guangde, Anhui (300,000), and Qilianshan, Gansu (350,000).

Moreover, there is a lack of new sizable mines and resources and raw ore is being imported from Mongolia. Some new resources have been discovered in the south-west and north-west regions but production and transportation costs would be high.

“The impact of China to the world fluorspar industry has changed from a major fluorspar exporter and being downstream fluorochemicals import-dependent, to an exporter of the downstream fluorochemicals and importer of fluorspar.” said Liao.

Refrigerant market: trends & transitions

“The evolution of refrigerant gas and the role of Chemours in the market” by John Zielinski, Executive Buyer Fluoroproducts, Chemours, USA, reviewed Chemours fluorochemical products and the UN’s sustainable development goals before highlighting the environmental challenges driving industry transitions, ie. the recent global Kigali Amendment: HFC Phase-Down and the earlier Montreal Protocol: R-22 Phase-Out.

“The evolution of refrigerant gas and the role of Chemours in the market” by John Zielinski, Executive Buyer Fluoroproducts, Chemours, USA, reviewed Chemours fluorochemical products and the UN’s sustainable development goals before highlighting the environmental challenges driving industry transitions, ie. the recent global Kigali Amendment: HFC Phase-Down and the earlier Montreal Protocol: R-22 Phase-Out.

“Although not fully ratified by all signers of the Montreal Protocol, the belief is that Kigali will ultimately be fully ratified and set the direction for the global refrigerant market.” said Zielinski.

Most instructive for the attendees was a very neat explanation in determining the nomenclature of the myriad refrigerants eg. R-134a, 1234yf.

The evolution of refrigerant technology was outlined. “Selection of refrigerants for the future will need to balance performance (capacity and efficiency), safety and sustainability, and total cost of system ownership.” said Zielinski.

“Changes in refrigerant use and its impact on the air conditioning and refrigeration markets” by Andrea Voigt, Director General, European Partnership for Energy & the Environment, Belgium, reminded how we must not take the function of cooling for granted, with its critical use throughout everyday life and industry.

Voigt explained the 4 main pillars of the EU F-Gas Regulation: Sectoral bans; HFC phase-down; Competence; and Containment, before reviewing how it worked and if is it working. HFC emissions have been decreasing since 2014, with expected emission savings of 71 Mt CO2-eq by 2030, in addition to the first F-Gas regulation.

During the small phase-down steps in 2016/17, refrigerant prices spiked in response, partly owing to a lack of awareness and anticipation, panic reactions when the 2014 stockpile was gone and with the looming 2018 step-down, plus illegal imports.

Overall, Voigt considered that there was no need to replace F-gas compounds as long as there were many other low GWP refrigerants in the pipeline.

HF & FSA | Battery market & FSA-sourced HF emerging

“New fluorite mining and downstream activities in Saxony and Eastern Europe” by Johannes Scheruhn, General Manager, Scheruhn Minerals and Chemicals GmbH, Germany, introduced Scheruhn Minerals & Chemicals and the Fluorchemie Group, before relating historic mining in Thuringia and Saxony, why there is new mining in eastern Germany, and new downstream activities.

Scheruhn underlined a number of drivers, such the EU Resource Risk Assessment, trade wars, and climate agreements, which have shifted focus onto a new outlook involving new downstream industries, specifically Li-ion batteries (LIB) in EVs.

Scheruhn underlined a number of drivers, such the EU Resource Risk Assessment, trade wars, and climate agreements, which have shifted focus onto a new outlook involving new downstream industries, specifically Li-ion batteries (LIB) in EVs.

LIB use an electrolyte comprising the fluorine containing compound LiPF6. By 2040, some 100-153,000 tonnes of LiF will be required to meet LiPF6 demand. This has prompted the potential of “new mining” in eastern Germany for fluorspar and lithium.

This has been given added impetus by Chinese battery making giant CATL starting construction of a €1.8bn plant at Erfurt, Thuringia, expected on stream in early 2022.

Also of significance, in nearby Poland, announced in June 2019, South Korean group Foosung is to build Europe’s first LiPF6 plant in Kędzierzyn-Koźle, starting up in 2021.

“HF from Fluorosilicic Acid (FSA): challenges and opportunities” by Datta Umalkar, Technical Consultant, Chenco GmbH, Germany, reviewed the importance of HF and emphasised that the economics of the HF production process depends heavily on fluorspar price, with around 60% of production cost attributed to fluorspar.

Umalkar detailed the alternative production process of HF from FSA, concluding that the FSA process has more pros than cons: FSA is more economical, more environment friendly, and further R&D will make it far more competitive than fluorspar.

“FSA will be more attractive to new investors than current HF manufacturers. The new producers of HF are more likely to be from the phosphate fertilizer industry rather than stand alone producers.” postulated Umalkar.

“A new proven technology to recover Anhydrous HF from FSA” by Bob Welch, Sales Director, New Chemical Products LLC, USA, was a very engaging insight into a relatively new company in Russia which has developed highly efficient processes to recover high purity AHF from depleted UF6 and to extract 100% AHF from 25% hexafluorosilicic acid.

A 250 tpa plant was completed in mid-2018 and results sent to various institutions including the Russian Council of Science and Technology. In September 2019, agreement was reached to build a large scale plant to recover AHF from DUHF.

A 250 tpa plant was completed in mid-2018 and results sent to various institutions including the Russian Council of Science and Technology. In September 2019, agreement was reached to build a large scale plant to recover AHF from DUHF.

Multiple patents have been filed and received for New Chemical Products’ FSA-to-AHF process, and the results of further development and testwork should be ready by Q2 2020.

There followed a spirited discussion on the potential of FSA-sourced HF, with a few delegates, including Peter Robinson, British Fluorspar, questioning the likelihood of its fruition, and pointing to the lack of such plants active today, and whether fluorspar producers should be worried.

These views were met with a strong riposte from Olivier Ruffiner, Buss ChemTech, advising that China had four such FSA plants in operation with another to come on stream at the year’s end, and possibly another in 2020.

Kerry Satterthwaite, Roskill, also countered that the Florida phosphate majors are very much keen on FSA development and that, in her view, “fluorspar producers should be worried!”.

Fluorochemicals | Aluminium fluoride

In “India: An emerging market for acid grade fluorspar”, Bimlesh Jain, Executive President (Corporate), Gujarat Fluorochemicals Ltd, India, introduced his company and parent group before outlining why India is an emerging market and will expect to see increased fluorspar consumption (among other industrial minerals – all under the spotlight at IMFORMED’s Indian Minerals & Markets Forum 2019, 18-20 November, Mumbai – click link for details).

India is the fastest growing economy with an GDP growth of 6.9% in FY2018-19 and one of the major manufacturers of refrigerant gases, fluorochemicals and fluoropolymers.

Increase in acid grade fluorspar consumption is expected to be 16% in 2019 over 2018. Fluorochemicals, especially for agrochemicals and pharmaceuticals demand growth, and fluoropolymers will substantially add to the requirement of fluorspar in addition to refrigerant gases.

GFL is producing about 18,000 tpa of fluoropolymers, with a past YoY growth of 25% and has plans for a PTFE plant. China is India’s biggest competitor in this sector, with its domestic fluorspar sources, while India relies on imports.

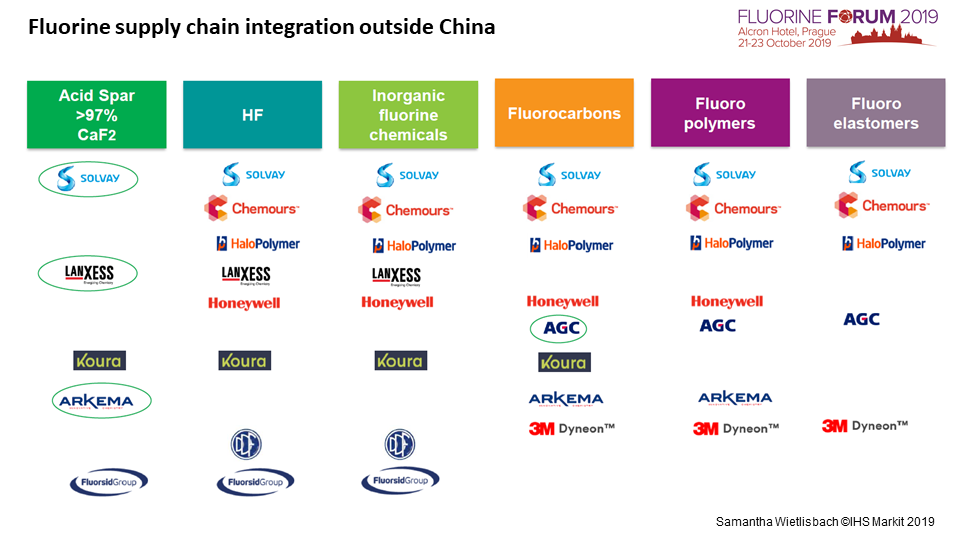

“Downstream markets for fluorochemicals, through to fluoropolymers and fluoroelastomers” by Samantha Wietlisbach, Principal Analyst, Chemical, IHS Markit, Switzerland, was as ever a detailed dissection of the fluorspar supply chain, fluorocarbons, fluoropolymers, fluoroelastomers, and level of integration in the fluorochemical chain.

“Downstream markets for fluorochemicals, through to fluoropolymers and fluoroelastomers” by Samantha Wietlisbach, Principal Analyst, Chemical, IHS Markit, Switzerland, was as ever a detailed dissection of the fluorspar supply chain, fluorocarbons, fluoropolymers, fluoroelastomers, and level of integration in the fluorochemical chain.

The AAGR 2018-2022 globally for fluoropolymers is considered to be about 4% for PTFE and around 5% for others, mostly consumed in the chemicals market.

For inorganic fluorochemicals, the Li-ion batteries and catalysts markets hold promise, with an AAGR of around 4-5% globally, but these are much smaller volume markets.

The outlook for fluoroelastomers with an AAGR of 2.4%, is heavily dependent on growth in automotive and aerospace markets.

Wietlisbach also commented on the vertical integration of certain fluorochemical groups outside China including Koura, Solvay, Lanxess, and Fluorsid. This trend may continue as consumers seek to minimise security risk over raw material sourcing.

Adam Coggins, Analyst, Roskill, UK, presented “Aluminium fluoride and aluminium: 2019 trends and outlook to 2029”, examining the industry sectors, drivers, and future prospects.

Coggins demonstrated the cost breakdown of AlF3 production commenting that the main cost components were the raw materials, ie. fluorspar and alumina trihydrate, accounting for 41% and 24%, respectively.

While demand for air travel is expected to grow strongly over the next 20 years, led by Asia Pacific region, it is the automotive sector which holds most promise for increased demand for aluminium, with hybrid and EV sales to exceed ICEs by 2029.

EV sales have grown by 26% p.a. since 2010, compared to 3% in total vehicle sales, and market penetration by EVs is forecast to reach 29% in 2025 and >50% in 2029.

Thank you, and see you at Fluorine Forum 2020!

As ever we are indebted to the support and participation of all of our sponsors, exhibitors, speakers, and delegates for making Fluorine Forum 2019 such a success.

We very much appreciate all the completed feedback forms and please continue to provide us with your thoughts and suggestions.

We look forward to meeting you next year at Fluorine Forum 2020, Hanoi, 12-14 October 2020.

CALL FOR PAPERS | SPONSOR EXHIBIT OPPORTUNITIES | SUPER EARLY BIRD

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Leave A Comment