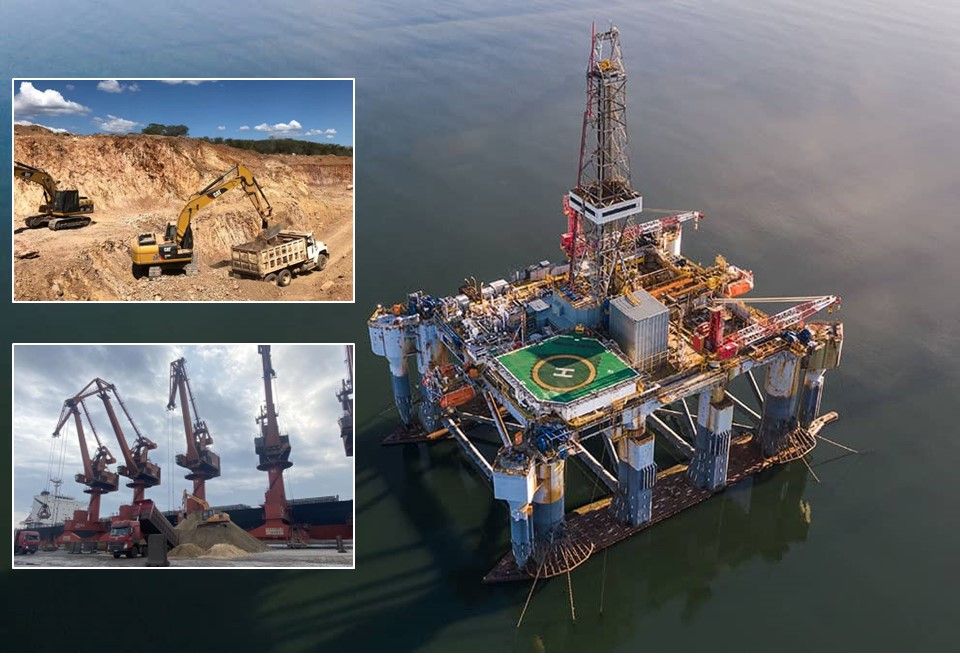

Barite | Bauxite | Frac sand | Leonardite | Logistics | Sourcing | China | Morocco | Mexico

The New Year rise of oil prices should come as some reassurance to suppliers of industrial minerals to the oilfield market, having faced headwinds and depressing news over the last three years or so. But there are mixed messages regarding the longevity of such price levels through to 2024.

Keen oilfield market watchers will certainly include CIMBAR Resources Inc., which on 1 December 2022 completed its acquisition of the USA’s leading independent importer and processor of drilling grade barite, Excalibar Minerals LLC, from Newpark Resources Inc.

Excalibar, with processing plants in Houston (below) and Corpus Christi, Texas, and New Iberia, Louisiana, imports >500,000 tpa of drilling grade barite for the US oilfield market. The USA is the world’s largest importer and user of barite, importing 1.7m tonnes in 2021.

The deal massively strengthens CIMBAR’s existing barite portfolio; the company also supplies calcium carbonate, alumina trihydrate (ATH), and post-consumer recycled mineral-based fillers to a range of markets from multiple production sites in the USA, and in Mexico, China, and Pakistan.

As we enter the second week of the New Year, oil prices appear to be steady to slightly rising with West Texas Intermediate (WTI) breaking the $75/bbl barrier and Brent edging past the $80/bbl mark (11 January 2023).

Goldman Sachs recently indicated that solid growth in global oil demand is set to drive oil prices to above $100/bbl in 2023, and possibly could trade at $105/bbl Q4 2023.

This echoed the International Energy Agency’s December 2022 report, which forecast world oil demand to rise by 2.3mb/d in 2022 and a further 1.7mb/d in 2023, commenting “As we move through the winter months and towards a tighter oil balance in 2Q23, another price rally cannot be ruled out.”

However, the January 2023 Short-Term Energy Outlook just out by the US Energy Information Adminstration (EIA) is somewhat less gung-ho. The EIA forecasts Brent will average $83/bbl in 1Q23 and stay relatively flat through 2Q23, averaging $85/bbl, and then decline through the end of 2024. Brent is expected to average $83/b in 2023 and $78/b in 2024, down from $101/b in 2022. WTI is forecast to generally follow a similar path, averaging $77/bbl in 2023 and $72/bbl 2024.

While the US total active rig count (6 January 2023) remains lower than the rig count at the same time in 2019 prior to the pandemic, 772 compared to 1,075, respectively, it is nevertheless 184 rigs higher than the rig count this time in 2022, indicating some measure of recovery in activity.

Find out about the latest trends & developments in the oilfield minerals market

FULL DETAILS HERE

Oilfield minerals market in 2022

Last year IMFORMED was delighted to resume in-person events after a two-year absence and this included a much-awaited return to Houston for Oilfield Minerals & Markets Forum 2022, which took place 23-25 May 2022.

What our delegates said about last year’s Forum…

“Excellent programme and roundtable networking. This face-to-face meeting is required to keep the business updated.”

Lonnie Broussard AES Drilling Fluids, Purchasing & Distribution Manager, USA“As expected you put on a fantastic Forum. It proved most informative. I believe your efforts provide a very worthwhile experience for all attendees.”

Tom Eisenman, General Manager, Superior Weighting Products, USA“Programme very interesting, high value for networking and getting latest market information.”

Raymond Ding, Managing Director, Wuxi Ding-Long Mineral Co. Ltd, China“The interaction between groups is exceptional. Brings all together in a great atmosphere.”

Albert Wilson, COO, CIMBAR, USA“Good programme and venue; great to be part of many valuable interactions, including difference perspectives presented.”

Alistair John, Category Manager-Well Construction Fluids Bulk Chemicals, Schlumberger, USAFree Oilfield Minerals & Markets Forum 2022 Summary Slide Deck Download here

While pandemic ramifications precluded the attendance of many delegates, especially from Asia and the Far East, the successful event attracted 80 leading senior management players from across the world active in the oilfield mineral supply chain.

A panel of experts presented on a range of highly topical subjects fostering much discussion and food for thought. The highlights are summarised below.

Oil & gas market outlook

Panuswee Dwivedi, Analyst, ADI Analytics LLC, USA

The key messages imparted by Dwivedi included:

- Oil’s resurgence will continue subject to demand growth and producer discipline

- US light tight oil production may reach pre-pandemic levels by late 2022 or early 2023

- Natural gas will benefit from global demand growth and continued US competitiveness

- US industry has grown increasingly gas dependent supporting domestic demand

- Natural gas is key to the energy transition but must improve its green competitiveness

- The energy transition will be complicated and expensive considering maturity of fossil fuels

The Biden Administration’s view on oil and mining: a reality check

Chris Greissing, President, Industrial Minerals Association – North America, USA

Greissing outlined how the Biden Administration’s position on key issues was difficult follow over the first 17 months.

He offered a reality check revealing that President Biden is “allowing environmental activists dictate his Administration’s policies on mining and oil/gas extraction. The result: schizophrenic policy decisions from this Administration.”

IMA-North America members’ response to the question of their greatest challenge was unequivocally “mine permitting”. Some members have been waiting 15-20 years for a permit, whereas in Canada and Australia it can be just 2-3 years.

Greissing proposed some reforms of the US permitting process to include:

- All permits must be reviewed within a 2-year period

- Establish certainty with a language to prevent future administrations from pulling permits without significant financial penalties to the US Government; to prevent the practice of sue/settle agreements in litigation.

- To give the Critical Minerals List actual meaning; currently there is no ability to streamline processes for being able to develop the mineral; no economic incentives in place to promote its development

The minerals supply chain from an oilfield service company perspective

Alastair John, Category Manager-Well Construction Fluids Bulk Chemicals, Schlumberger Ltd, USA

John provided an overview of Schlumberger followed by a focus on well construction fluids, minerals in well construction fluids, minerals source selection criteria, and mineral key challenges and opportunities in 2022.

Some of the main challenges for an oilfield consumer include:

- Purchase price inflation: impacts from energy prices, labour costs, currency, included logistics

- Logistics & mobilisation: increased costs, most/all lanes & modes; increased lead time; decreased reliability

- Impacts to inventory: less physical inventory per dollar; growth requires more physical inventory

- Volatile demand/less than ideal forecast

- Competition between O&G versus other industries: changes to supply and demand; impacts from geo-politics, regulatory and commodity pricing events

- Balancing internal, JV, and 3rd party supply

US frac sand market trends & forecast

Joseph Triepke, Founder & Principal Research Analyst, Lium, USA

Triepke gave a very comprehensive review of the frac sand market focusing on the key issues of demand at all time high, local mines catching up after 1Q22 stumble, market still very tight, spot price plateau after big rip, term contracts back, and barriers to entry have never been lower.

His three takeaways were:

- Frac sand market stabilising after 1Q22 panic buying, but still tight and demand will test supply ceilings again into 2023

- Term contracts returning as spot price gains consolidate at multi-year highs

- Watch out for new local mine announcements over next 12 months, supply may start to outstrip demand by late 2023

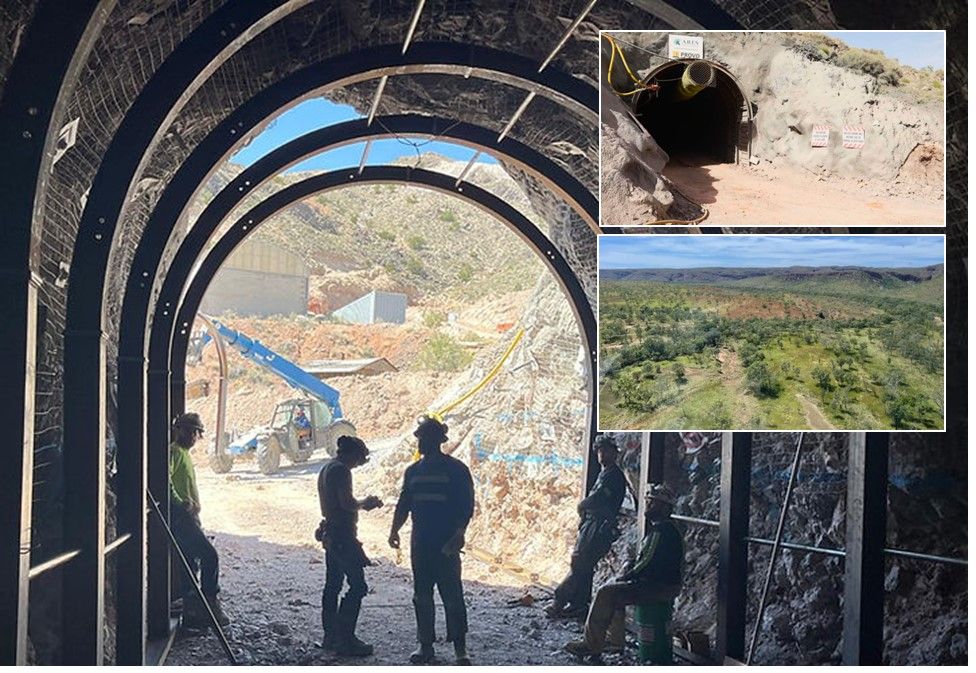

Guyanese Bauxite: It all starts here

John Karson, VP Sales & Marketing, First Bauxite LLC, USA

Karson told the story of the synergies of two companies – First Bauxite and US Ceramics – and how they will benefit the oil and gas industry with a full portfolio of high quality proppants.

Clay-based ceramic proppants provide adequate crush strength for lightweight proppants. To get crush strengths up to and over 30,000 psi, you need a high quality bauxite to add in varying percentages.

First Bauxite has combined its high quality bauxite mine in Guyana (340,000 tpa bauxite capacity) with “the most modern and efficient proppant plant in the world”, by acquiring US Ceramics, based in Wrens, Georgia (see First Bauxite acquires US calcination plants).

US Ceramics’ facilities include the Andersonville plant (200m lbs/yr proppants) whose kiln has a new drive, new burner, new baghouse new Eirich mixers, the ball mill and classifier. While Wrens (500m lbs/yr proppants) has two rotary kilns, the wet milling system, experienced management and workforce. Both plants have natural gas, ample electricity are fully permitted, have rail sidings, silos and pneumatic handling systems.

US Ceramics’ mission is to be the lowest total cost global supplier of quality ceramic proppants.

Leonardite and its use in the oilfield market

Hugh Parker, Sales Manager, Leonardite Products LLC, USA

Leonardite Products is a small vertically integrated mining and processing operation based in Williston, North Dakota, and operates the Stony Creek mine.

Parker explained the history of leonardite and that it is a heavily oxidised lignite sourced from surface and underground coal mines in the USA. Its unique properties allow it to be utilised in the drilling industry, as well as other markets such as agriculture and remediation.

In the drilling market leonardite finds use as a mud additive, temperature stabiliser, minimises thickening, emulsion stabilisation, and reduces gel strength.

Leonardite has greater temperature stability than other thinners, studies have shown exceptional performance in preventing solidification of lime muds at temperatures near 300°F. This mud showed only moderate increase in filtration after being aged 24 hours at 500°F. Lignite has been a major component for use in geothermal drilling due to its positive effect in high heat.

A global shipping storm: Covid and its ramifications

Jesper Hoppe, Managing Director, & Sebastian Syran, Chartering Manager, Viking Shipping Co. AS, Norway

Hoppe summed up the leading factors impacting the status of the shipping market as:

- the impact of Covid-19

- de-containerisation

- the war between Ukraine and Russia

- and escalating commodity and oil prices.

The impact of China’s zero-covid policy caused particular disruption, with 45 cities in lockdown, and heavy congestion in major Chinese ports; vessels coming from non-Chinese ports had to stay at anchorage for a 10-day quarantine.

North American logistics for oilfield minerals

Richard Dodd, President, RDC Logistics, USA

As ever, Dodd gave the conference a comprehensive review of strategic and cost impacts for domestic oilfield rail and truck shippers.

He covered Class I railroad consolidation North America, rail industry statistics, railcars update, and rail rates trends and negotiation; truck spot market rates; and a look at the Freight Invoice Post Audit.

Among many key topics and issues influencing freight rates, Dodd explained about variable rail shipper cost components, which include:

- Base freight rate – distance, geography

- Private vs. railroad “system” rail cars

- Specific rail car type, weight limits

- Rail track weight limitations

- Fuel surcharge

- Load design, dunnage, weight

- Service issues and delays

- Delivery transload costs

- Demurrage

- Cargo damage

- Shipment tracking

Oilfield Barite: The definition of Insanity

Albert Wilson, COO, CIMBAR Performance Minerals, USA

Wilson began his frank and honest presentation with a brief account of where CIMBAR had come from and where it was going “to be the world’s most dynamic industrial minerals company”: most notable in its origin were some major past players such as Thompson Weinman, Cyprus, Baroid, Dresser, and Halliburton. Also noteworthy were its more recent forays into China, Pakistan and Mexico.

Wilson described the North American drilling grade barite market as “insanity”, defined as “doing the same thing over and over and expecting different results” and questioned why sourcing and supplying barite had not evolved.

There has been decades of “low to no profit marketing strategy” of the barite sold into the oilfield market, combined with poorly thought-out barite pricing strategies over generations.

Much of the blame has been on the cyclical nature of the oil and gas markets, and then more recently along comes Covid-19 opening new levels of complexity, compounded by the Russia-Ukraine war and unrestrained rising costs from global barite providers leading to recession.

Wilson concluded with: “If we cannot learn from history, we are destined to repeat it.”

Barite global overview

John Newcaster, Principal, IMPACT Minerals, USA

Newcaster yet again provided his informative take on the barite industry covering: global barite production, global barite demand, how much barite trade is still driven by oil and gas drilling?, impacts of geopolitics, global barite supply, barite trade lanes, key sources and consumers, product costs, freight costs, and an outlook for 2022-2023.

The USA remained the world’s largest importer of barite up 60% to 1.65m tonnes in 2021. India was the largest source of imports (33%), followed by Morocco (30%), China (18%), and Mexico (13%).

Newcaster also noted that 2020 was the first time in 20 years that US barite production was under 200,000 tonnes.

Regarding outlook, Newcaster considered that demand would go up in proportion with any rig count gains, while supply would be affected the following:

- Adjustments in sourcing to react to new India prices

- Pakistan exports will increase

- Mexico and Morocco production will be pushed to capacity

- China a wild card

Barite supply developments in China & Mexico

Liao Ying, General Manager, Baribright International Inc., China

Liao Ying presented a review of China’s barite supply status and Baribright’s recent activities in Mexico.

In China, the recent mining industry policies require more environmental protection, which has affected barite mining significantly since 2018.

In the past five years, more than 80% barite open pit mines or small under ground mines in China have shut down gradually, and total production decreased by 65%.

Barite mining in China is facing challenge and uncertainty as barite was not included in the strategic minerals list in the China National Mineral Resources Plan (2021-2025).

Barite production is expected to be kept at the same level of 2021 at 1.7-1.8m tpa, and export will be at 1m tpa, with about 50% for industrial grade barite; drilling grade for domestic market about 200-250,000 tonnes, and for export 350-400,000 tonnes. However, the recent strict pandemic controls created uncertainties in both production and deliveries.

In Mexico, Baribright set up two joint ventures in 2017 and 2019: Baribright-Minar focuses on producing industrial grade barite located in Galeana, Nueov Leon; Barimont Mineria (a JV with CPC Chemical Products Corporation) is mining, concentrating, and grinding API standard barite, located in Sonora.

In 2022, Barimont Mineria was constructing a second beneficiation plant to take total capacity to 250,000 tpa barite SG 4.1, and a second milling plant to take total powder capacity to 150,000 tpa.

Morocco barite developments & outlook

Youssef Laghzali, Sales Manager, Broychim, Morocco

Laghzali started with a brief introduction of Broychim, a family business founded in 1982, celebrating its 40th Anniversary in 2022, and Morocco’s leading barite supplier. In addition to the plant in Casablanca, Broychim opened a new milling plant in Safi in 2018 (20,000 tpm).

Morocco’s main advantage is its proximity, transit time and short lead time. Morocco occupies a central position regarding oilfield markets, being closer to the Americas in the west, and to Europe and North Africa. Reach is primarily oriented towards the Americas, Europe, and Africa, and while Morocco has intermittently delivered to the Middle East, this region remains mainly served by India and China.

Moroccan barite production reaches about 1m tpa and more, except for 2016 and 2020, which were tough years with low oil prices and demand.

Broychim regularly hits takes a 50 -60% market share, and for 2022 logged orders reached a record export volume of more than 700,000 tonnes.

Of significance for future barite export potential are the developments at the ports of Safi, Jorf Lasfar, Nador, Dakhlar, and Agadir.

In early 2022 Morocco experienced a rebound in the market with continued demand worldwide with many spot requests, this is mostly explained by clients needing material with short delivery time.

However, with increased demand comes a scarcity of material driving prices up. Add to that inland transport cost increases, due to regulatory measures and gas, and a general inflation is observed on the whole value chain. With aggressive local competition also driving supply costs up.

Demand also rose following the Indian tender ending with high prices in April 2022, and with it scarcity of high grade material was exacerbated in Morocco, resulting in extended lead times to prepare large orders.

Thank you and hope to see you again in Houston!

Oilfield Minerals & Markets Forum 2022 was a most stimulating and enjoyable conference, and so good to be back seeing each other again face to face.

We are indebted to the support and participation of all our sponsors, exhibitors, partners, speakers, and delegates for making Oilfield Minerals & Markets Forum 2022 such a success, and ensuring a fruitful time was had by all.

We very much look forward to meeting you again at Oilfield Minerals & Markets Forum 2023, Hilton Houston Post Oak, 9-11 May 2023 – Book now for Early Bird Rates & Call for Papers! Full details here.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Free Oilfield Minerals & Markets Forum 2022 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

ANNOUNCING

Leave A Comment