Critical minerals challenge & outlook covered at IMFORMED Rendezvous 2021 ONLINE 14 April

To those in the industry this is nothing new. But it is one thing for the experts to know about something important, and quite another for the wider populous and their respective governments to grasp, let alone then respond to, the key factors impacting the industrial minerals industry and thus primary consumer markets.

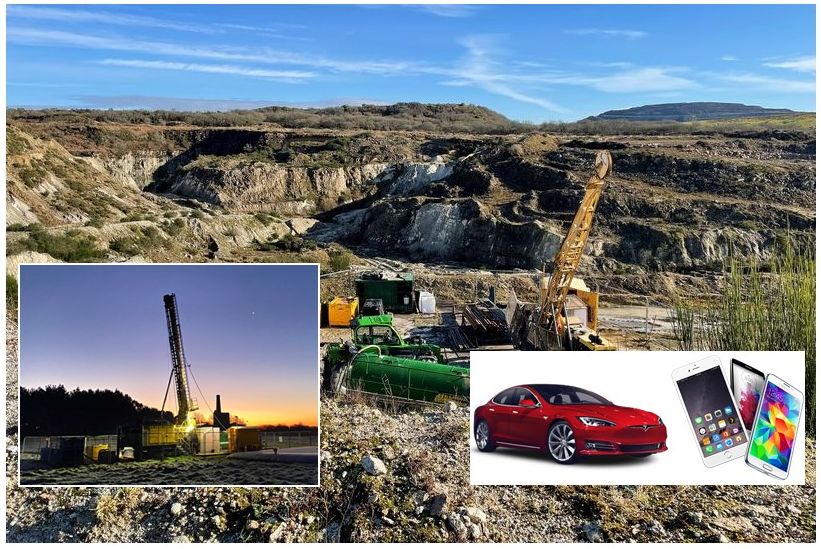

Title image Cornish Lithium Ltd’s Trelavour hard rock lithium project near St Austell is looking to extract lithium from mica minerals within the granite underlying Cornwall, south-west UK. The project was accelerated in December 2020 following successful production of nominal battery-grade lithium hydroxide. Inset Cornish Lithium is also evaluating exploitation of lithium-enriched geothermal waters at its United Downs project in Cornwall. Such projects are now finding favour with government drives for a domestic CRM supply chain. Courtesy Cornish Lithium

Of course, we are talking about the so-called “Critical Minerals” or “Strategic Materials” – there are several well-used phrases, let’s stick with “Critical Raw Materials” (CRM) – which have started to migrate more frequently into the headlines of leading mainstream media, in hard print and online.

“U.S. Steps Up Efforts to Counter China’s Dominance of Minerals Key to Electric Cars, Phones”

Wall Street Journal, 3 October 2020

“Quad tightens rare-earth cooperation to counter China”

Nikkei Asia, 11 March 2021

“Mission critical: Governments have identified commodities essential to economic and military security”

The Economist, 3 April 2021

“Britain on the offensive in race with China for crucial rare-earth minerals”

The Times, 5 April 2021

To be fair, some of these publications and others have at least previously acknowledged the situation with the odd article on certain CRM, mostly rare earths, and more recently lithium.

However, recently evolving geopolitics, especially with US-China trade issues, the Covid-19 pandemic, and rapidly emerging new generation hi-tech consumer markets which have high visibility for both governments and the general public (environment, new energy sources, electric vehicles, new mobile phone systems), have brought CRM into much sharper focus and improved understanding creating newsworthy discussion across the general media.

“At last!” and “About time!” many will declare. But the next bit – actually doing something about it – is perhaps less clear, and reveals that more understanding is required to meet future market demand – the processing of CRM in particular.

Which is why CRM, its challenges, and outlook feature strongly in our upcoming conference next week: the IMFORMED Rendezvous 2021 ONLINE 14 April.

Presenting at the IMFORMED Rendezvous 2021 ONLINE 14 April 11:30-18:00 BST

How will strategic minerals ride the next economic cycle?

Neal Brewster, Chief Economist, Roskill, UK

The security of critical mineral supply chains: the US policy perspective

Dr Steven Fortier, Director, National Minerals Information Center USGS, USA

Understanding the geopolitics of critical minerals: Are they the same in regard to China, Europe, the USA, and Japan?

Jack P. Lifton, CEO, Jack Lifton LLC & Ken N. Santini, Managing Director, Santini & Associates, USA

Creating reference & benchmark pricing for lithium in the 21st Century electric vehicle supply chain

Simon Moores, Managing Director, Benchmark Mineral Intelligence, UK

Critical Minerals Roundtable Breakout host Alison Saxby, Managing Director, Roskill

Industrial minerals outlook: crucial global trends & developments

Logistics | Critical Minerals | CO2 + Energy Challenges | Next Economic Cycle | Mineral Pricing | From Strategy to Profit | Grinding & Classifying Developments | Beyond Mineral Trading

For established players seeking new horizons and newcomers evaluating industrial minerals

FULL DETAILS

Book online here or contact Ismene ismene@imformed.com +44 (0)7905 771 494

Global initiatives start ball rolling

Already a number of national and regional organisations have recently established or renewed studies and action plans on CRM in order to alert their governments and industry in general (eg. European Commission (EC), US Geological Survey, British Geological Survey, Natural Resources Canada, Geoscience Australia ).

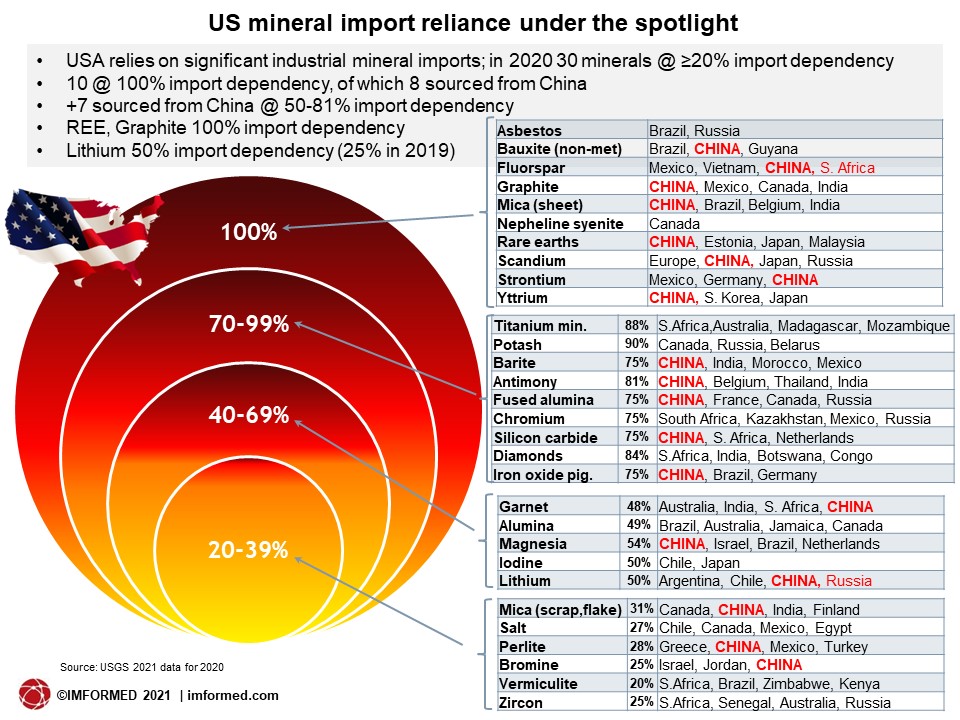

The US government has made a series of Executive Orders since September 2020 to stimulate domestic CRM sources and lessen reliance on imports.

In March 2021, Australia launched its Resources Technology and Critical Minerals Processing Road Map.

These initiatives have been supplemented by international alliances in developing CRM supply chains, such as between the USA and Australia in 2019, and with Canada in 2020, and most recently reinforced by the Roadmap for a Renewed US-Canada Partnership unveiled in February 2021.

Announcing its Action Plan in September 2020, the EC is also looking at strategic CRM partnerships within the EU and with Canada and African countries (for a review of the EC plan and other initiatives please see New era of mineral exploration and development dawns).

The EC launched the European Raw Materials Alliance (ERMA) on 29 September 2020, which now consists of over 450 members, from Greenland to Australia, across the entire raw materials value chain, covering primary raw materials extraction, processing, advanced materials and product design, as well as recycling (this will also accelerate its evolution in parallel to CRM development; see Mineral recycling: New horizons in a new era).

The future is likely to herald more of these strategic inter-state, and perhaps inter-corporate, CRM partnerships.

Waste opportunity: LKAB, Sweden, plans to start extracting apatite concentrate from iron ore mining waste (above) and to process phosphorus mineral fertiliser, plus rare earth elements, fluorine and gypsum. Production is envisaged for 2027. Courtesy LKAB

We are already seeing a growing trend in both streamlining and diversification of corporate mineral development, especially by the larger mining companies, as they look to preserve their core businesses but also develop a CRM strand, eg. Rio Tinto pursuing lithium in Serbia and California (7 April 2021 announced achieving battery grade lithium production at Boron pilot plant processing waste rock), and scandium from tailings in Canada; mineral sands giant Iluka diversifying into rare earths; iron ore leader LKAB also diversifying into CRM from mine waste.

Above all, this will provide a much-needed boost to CRM source development worldwide. This will be especially welcomed in Europe where new mine development has been notoriously hindered by bureaucracy.

In March 2021, efforts to extract lithium in the UK by British Lithium Ltd and Cornish Lithium Ltd were boosted by the UK government’s Integrated Review of Security, Defence, Development and Foreign Policy, which stated priority actions to include exploration opportunities for domestic extraction and processing of CRM.

Other CRM developments across Europe may also benefit from similar examples of government-led drives. Just how many will come to fruition and whether in time to meet market demand remains to be seen.

Join us next week at the IMFORMED Rendezvous 2021 ONLINE to find out!

Leave A Comment