Oilfield Minerals & Markets Forum 2019 Review

A high profile panel of expert speakers covering drilling fluids, barite, proppants, logistics, and processing and some 130 leading decision makers from the global oilfield mineral supply chain gathered in Houston last month to participate, learn, and enjoy at IMFORMED’s Oilfield Minerals & Markets Forum 2019, 10-12 June at the Hilton Post Oak.

As Jagger and Richards sang, “It’s only Rock ‘n’ Roll (But I like it)”, so also could this lyric be applied to this now well established Forum with its evident bonhomie, easy networking, and not least the excellent ‘50s Rock ‘n’ Roll themed Welcome Reception sponsored by Excalibar Minerals LLC.

This was my first year attending the conference and I can’t begin to tell how much information and gifted knowledge I was able to bring back with me.

Jennifer Benefield, Sr. Category Specialist, Halliburton, USAWell thought out and valuable programme, and well organised. I’m a believer in consistent improvement, but can’t think of anything to improve, everything was great!

Serra Sarp, General Manager, Barit Maden Turk AS, TurkeyGreat programme content with knowledgeable presenters, comfortable venue with ability to hold meetings, app a very good idea.

Jason Lilly, USA Supply Chain Manager, Qmax, USACompliments to your organisation for an exceptional conference in Houston. All are doing a fantastic job. Your focus on logistics is important to the industry, well done.

Martin Faubion, Logistics Manager, Pacific Services Inc., USAFor more pictures please go to Gallery

For Summary Slide Deck of programme, attendees, feedback go here

Outlook for oil and gas, and drilling mineral demand

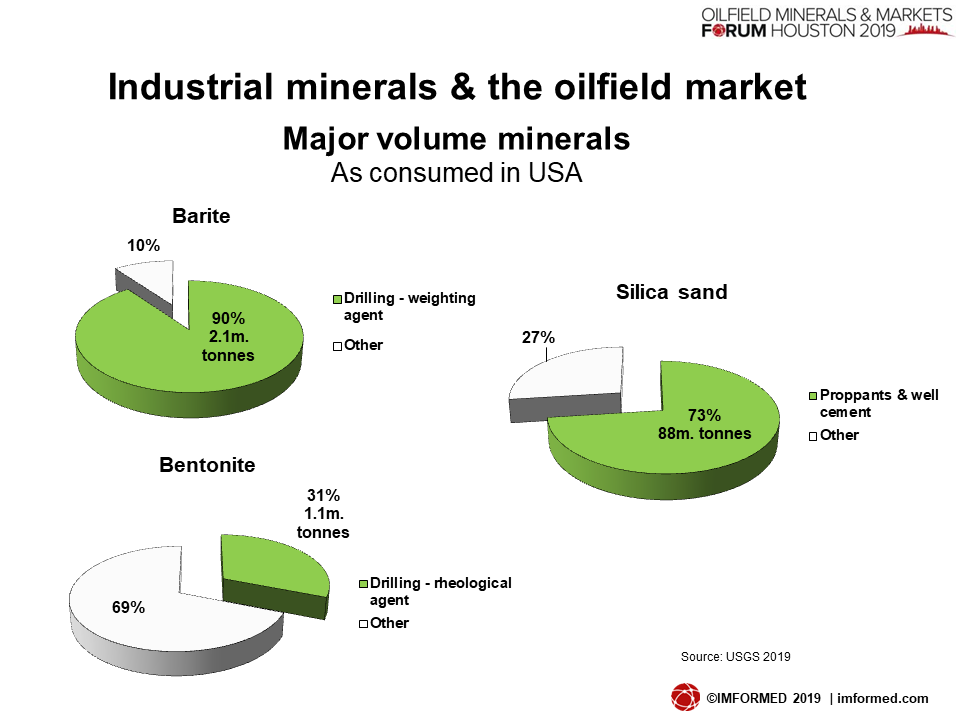

Mike O’Driscoll, Director, IMFORMED, UK, opened proceedings with a reminder overview of the role and importance of industrial minerals used in the oil and gas market, from the workhorse minerals of barite, bentonite, and silica sand, to the fine tuning minerals such as mica, graphite, and lignite.

O’Driscoll highlighted some of the general trends including: renewed optimism in world exploration activities anticipated for 2019/20, the challenges and expectations of the improving outlook for Argentina’s Vaca Muerta shale play, and revived prospects of shale development potential in Australia.

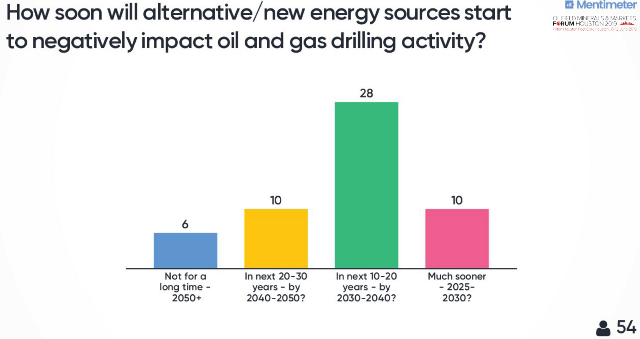

While most forecasts acknowledged the increasing share of primary energy demand being met by renewables, up to 15-20% by 2040, oil and gas would nevertheless remain accounting for some 50% of energy demand, with gas increasing its share to >25%.

“Oil and gas market outlook” by Uday Turaga, CEO, ADI Analytics Inc., USA, provided an excellent big picture take on the market concluding:

• Supply-demand fundamentals point to an oil price in the $70s

• US natural gas will continue to be cheap and is helping commoditise LNG markets

• Oil and gas capital spending will rise but the industry is getting more cost efficient

• Private equity seems to be continuing unabated

• the M&A market has slowed down creating opportunities for oil majors

• There is considerable opportunity to export U.S. oil and gas but renewables are a real threat

Paul D. Scott, Drilling & Completions Fluids Specialist, ConocoPhillips, USA, presented “A drilling fluid specialist’s perspective on essential drilling minerals” and considered that current drilling activity could be best described as bipolar or a “a tale of two extremes” with unconventional and conventional projects.

Service and supplier company trends were highlighted, including less vertical integration than historical norms, smaller companies seem to be taking market share from majors – especially in the unconventional areas, and some operators are buying drilling fluids wholesale or direct from suppliers in unconventional areas.

Scott underlined the significance of the trend to more water-based and oil-based drilling fluids: “I anticipate that the relative WBM to OBM ratio will change somewhat over time to more WBM than is used today which will increase relative consumption of minerals – WBMs have higher dilution rates”.

Other mineral demand factors included concerns over adequate mineral supply and quality (particularly bromides), a lack of alternative materials and market-ready sources, and that volume consumption of speciality products, such as fine grain weighting material, is likely to continue to increase.

Other mineral demand factors included concerns over adequate mineral supply and quality (particularly bromides), a lack of alternative materials and market-ready sources, and that volume consumption of speciality products, such as fine grain weighting material, is likely to continue to increase.

Scott also questioned the potential emergence of green fluids technology – “It’s time is near” – which favours increasing use of clay minerals, and “Will recycling weighting material ever be a reality?”

Scott announced that a new edition of API Spec. 13A was soon to be published which will have clearer requirements for test calibration materials, better information on the reference material programme, and delete specs for OCMA grade bentonite.

Elsewhere, API Task Group 8 covering drilling fluid materials is looking to set definitions, specifications and testing procedures for alternative weight material grinds, and a 4.0 SG specification for weighting agents in not being considered.

Logistics: ocean freight, rail and truck

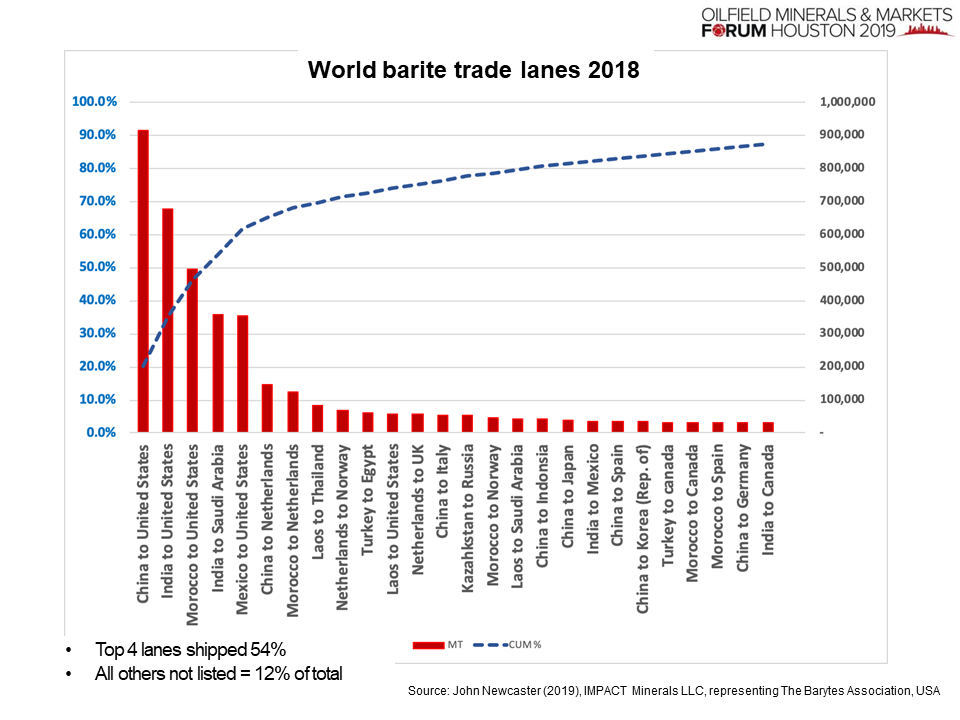

“Shipowners’ unexpected slow start of 2019, will it recover? And what impact will IMO2020 have on freight rates?” by Erik Myklebust, Chartering Manager and Jesper Hoppe, Managing Director, Viking Shipping Co. AS, Norway, reviewed the outlook for ocean freight – a significant factor for the US drilling industry with its 84% net import reliance on barite (2.6m. tonnes imported in 2018); 63% from China, 14% from India, and 10% from Morocco.

Although there continue to be uncertainties prompted by Brexit and the Iran boycott, the most pressing issue appears to be the International Maritime Organisation’s (IMO) 2020 global sulphur cap deadline of 1 January 2020 – “Sulphur 2020”.

The IMO will enforce a new 0.5% global sulphur cap on fuel content from 1 January 2020, lowering from the present 3.5% limit. The global fuel sulphur cap is part of the IMO’s response to heightening environmental concerns, contributed in part by harmful emissions from ships.

However, as emphasised by Hoppe, only a fraction, some 3-4% of ships, have installed the required SO2 marine gas scrubbers (incidentally, generating a potential new market outlet for magnesium hydroxide suppliers; Timab and Nedmag have already formed a development partnership) with less than six months until the deadline. So there is considerable concern over the likely impact of reduced shipping capacity in early 2020.

“Impact on barite and bentonite shippers from changes in North American truck and rail” was authored by Richard Dodd, President, RDC Logistics, USA, and most ably presented by John Newcaster, Principal, IMPACT Minerals LLC, USA.

Dodd’s presentation focused on the strategic and cost impact for oilfield shippers using North America rail and truck networks. It covered rail precision scheduled railroading (PSR), an update on West Texas, Mexico, and Canada rail; railcars update; rail rates trend and negotiation; truck spot market rates, drivers (there is still a shortage in the USA), regulations; and concluded with a useful freight invoice post audit.

Dodd underlined that freight complexities impact shippers and generate cost problems – even if pre-audit invoice before payment, there are still errors. He provided a neat detailed breakdown of such charges and the approximate share of the cost value they account for.

Ceramic proppants: trends in North America & India

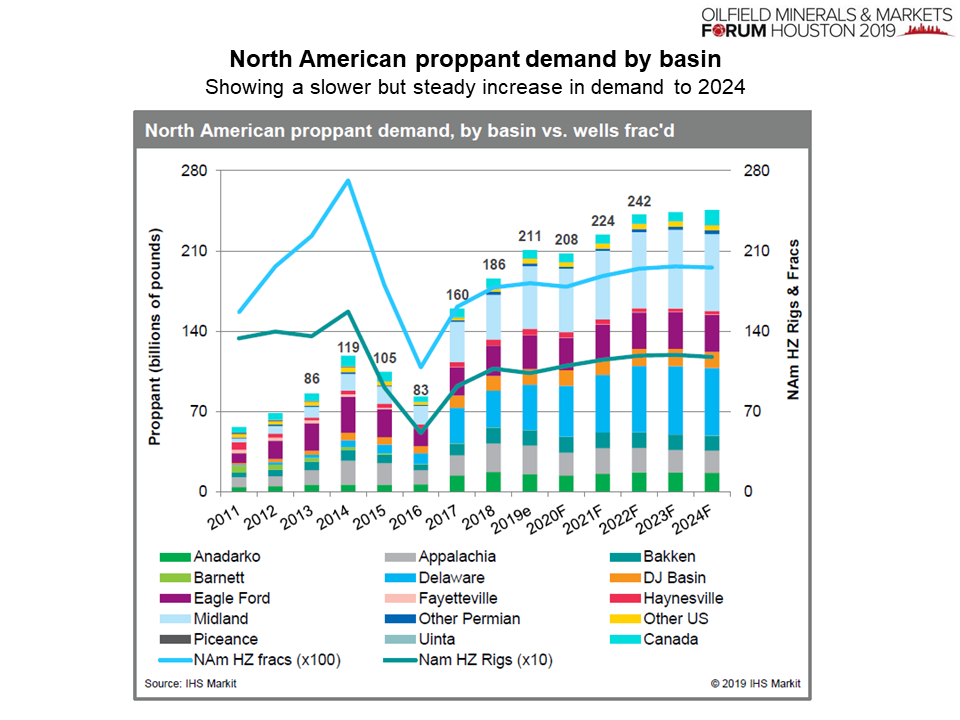

“North American proppant market outlook” by Samir Nangia, Managing Director Capital Markets , and Brandon Savisky, Senior Research Analyst, IHS Markit, USA, provided a fine review of the North American proppant market trends and factors.

Key trends for H1 2019 have included “an immediate shift to survival of the financial and operational fittest in a lingering state of

Key trends for H1 2019 have included “an immediate shift to survival of the financial and operational fittest in a lingering state of

Nangia deemed supply and demand dynamics as not as favourable in the regional/in-basin markets as they are for the Northern White Sand (NWS) market since companies have made appropriate supply reductions for NWS facilities rather than in-basin plants.

Also trending are some signs of stagnating drivers of frac sand demand, such as lateral length and proppant density flattening.

“Despite the short term temperance of overall activity that continues to be principally driven through the Permian Basin, IHS Markit anticipates a resilient 7% CAGR from 2018 demand to 2022 for the North American Market” said Nangia.

“Ceramic proppant development, production & market in India” was authored by Ajay Kumar Dasgupta, Managing Director, Hallmark Minerals (I) Pvt Ltd, India, and presented by Abhishek Dasgupta, Consultant, Australia.

Dasgupta described the main types of proppants before focusing on the range of grades produced by Hallmark in Pune, India, which are high strength, intermediate strength, lightweight, and resin coated grades, based on Indian abrasive grade bauxite as feedstock raw material.

Hallmark’s ceramic proppant manufacturing process was outlined including raw material formulation, micronising, pelletising, drying, pre-screening, sintering, cooling, final screening, storing, packing, and dispatch.

India imports 82% of its oil needs and aims to bring that down to 67% by 2022 by replacing it with local exploration, as well as renewable energy, and indigenous ethanol fuel. The oil and gas industry is expected to attract US$25bn in investments in exploration and production by 2022. ONGC has already drilled a total of 21 wells in 18 blocks for shale gas and oil.

“The Asia Pacific proppants market is expected to see a healthy rise due to the presence of immense shale gas reserves and hydraulic fracturing projects.” said Dasgupta.

Hallmark’s 10,000 tpa plant has already sold product to Indian ceramic proppant users such as ONGC and Focus Energy. The next step is to seek partners to establish a joint venture to upgrade the current plant from 10,000 to 20,000 tpa, and possibly set up a new plant producing 100,000 tpa in a different location.

Barite market outlook: World | Mexico | South America | Canada

John Newcaster, Principal, IMPACT Minerals LLC, representing The Barytes Association, USA, presented an excellent “Global barite market overview”, comprising the importance of barite, production trends, trade lane trends, pricing trends, supply-demand drivers, and the future.

Newcaster kicked off with a reminder that barite is listed as one of the 35 US critical minerals, and informed the audience of the 4 June 2019 publication of a Federal Report detailing strategy and plans that involve all agencies in increasing discovery, production, and domestic refining of critical minerals.

Newcaster kicked off with a reminder that barite is listed as one of the 35 US critical minerals, and informed the audience of the 4 June 2019 publication of a Federal Report detailing strategy and plans that involve all agencies in increasing discovery, production, and domestic refining of critical minerals.

In 2018, almost 77% of barite was consumed in oilfield drilling (the rest in chemical and filler applications).; China, India and Morocco remain the top three supply sources, accounting for 65% or total world production.

The US net import reliance remains at near all-time high levels (84%) with primary barite sources India surging, China declining, Morocco and Mexico in strong supporting roles, and Laos becoming a factor.

Regarding India, Newcaster reported on the latest tender (first since 2017) which concluded in March 2019, and continued flexibility in transfer pricing for participating exporters with a goal of 2,200,000 tonnes in 12 months. Indian exports have increased since the new tendering process started.

Learn about the latest trends and developments in India’s mineral markets at

Indian Minerals & Markets Forum 2019

18-20 November 2019, MumbaiField Trip to Gujarat mineral operations of Ashapura

Confirmed speakers | Early Bird Rates

Also noted was the dramatic rise in significance and prominence of Mexican barite supply to the USA since 2014, fuelled by proximity to the US Permian Basin activity, as well as low cost of production and freight.

Another significant trend in the USA has been the considerable shift to consuming 4.1 SG at the expense of 4.2 SG barite; in 2011 the latter accounted for just over 60%, by 2018 this had fallen to just 10%.

Newcaster concluded: “Barite is the only economically viable weighting agent in drilling fluids. However, improved technology and unconventional drilling requires less barite per well drilled. Nevertheless, there remains strong demand as far as we can see.”

The lively discussion that followed included comments on the latest US tariffs threatened against Chinese imports, with barite now reinstated on the list, which could hamper future US oilfield drilling activities (heavily reliant on Chinese barite imports).

Indeed, following the Forum, on 25 June, the American Petroleum Institute argued at US Trade Representative hearings that the US oil and gas industry “cannot quickly find new sources of key drilling supplies targeted on the latest tariff list such as barite”.

“Mexican barite and oil & gas markets overview” by Paloma Ruiz Maté, Director General, CIMBAR Mexico & Latin America, Mexico, was a most comprehensive report on Mexico’s oil and gas outlook and barite industry.

Since the Energy Reforms’ adoption in 2013, the Mexican government has auctioned and awarded numerous oil and gas blocks to foreign companies in so-called bid rounds. However, following his 1 December 2018 inauguration, new president Andres Manuel Lopez Obrador has announced aggressive measures to reassess the 2013 Energy Reforms, thereby prompting a mixed outlook for the industry.

Since 2017, Mexico has been the world’s sixth largest barite producer (almost 400,000 tonnes in 2018), and exports 90% of production. For local consumption, barite is mainly delivered to companies located in the north-east and south-east part of the country.

Barite mining in Mexico maybe divided into four zones, and it is the north-east zone around Coahuila and Nuevo Leon, which traditionally has hosted the most productive mines – underground, mantle and vein deposits, between SG 3.7 and 4.05. It has the closest proximity to the US market.

The top three exporting producers are Baramin, Cimbar Loma Negra, and Minerales y Arcillas, and the main export market, mostly by truck, is the USA (>90%; smaller volumes go to Cuba, Columbia, Spain).

First announced at last year’s Oilfield Minerals & Markets Forum, Cimbar Performance Minerals’ new joint venture with Loma Negra (Cimbar Loma Negra, based at Muzquiz, Coahuila), has a capacity of 250,000 tpa.

“We have already doubled the production capacity of the milling operation at Muzquiz, Coahuila, with plans to triple that capacity by mid-2020. The mining operation has increased production as newer and larger mine equipment has been put into production over the last year.” said Ruiz.

“Barite developments in South America” by Santiago Carassale, Category Manager-Mined Products, Halliburton, USA, looked at the international drilling outlook, the South America barite market, the Vaca Muerta unconventional play, and the Baroid footprint in Vaca Muerta.

Barite mining in South America over the past 30 years has been mainly focused in Peru, Bolivia, Argentina, and Brazil, and primarily for domestic demand.

However, over the last 15 years reserves have been depleted with some small developments in Chile. Brazil, Argentina and Colombia started importing powder or ore to support their operations in country but challenges include inadequate logistics infrastructure, outdated or inadequate grinding capabilities in country, and cross-border risks.

However, over the last 15 years reserves have been depleted with some small developments in Chile. Brazil, Argentina and Colombia started importing powder or ore to support their operations in country but challenges include inadequate logistics infrastructure, outdated or inadequate grinding capabilities in country, and cross-border risks.

In Brazil, demand has shifted to Rio De Janeiro for offshore operations, while in Argentina demand has grown substantially since shale exploration began, and prior to 2017 there were very few processing plants for imported material.

The centre of attention are the shale gas plays in the Vaca Muerta in the provinces of Neuquen and Mendoza, which have been compared to the Eagle Ford in the USA.

In 2013, Halliburton started importing barite into the region, then in 2017, in a joint venture with logistics company Sea White SA, started to develop a barite processing plant.

The plant, located at the port of Bahia Blanca, Buenos Aires province, has a production capacity of 144,000 tpa of barite and bentonite, 40,000 tonne storage area, and utilises two 56” roller mills, an automated crusher with stacker belt for proper blending and segregation, four semi-automated baggers for super sacks, and one fully automated small bags unit. The operation can supply up to 12,000 tpm by truck, and a 2,000 tonne stock point is to be commissioned Q4 2019.

“Barite as by-product from the polymetallic Palmer Mine Project, Alaska – a potential new, price competitive US source” by Darwin Green, Vice President Exploration, Constantine Metal Resources Ltd, USA, introduced the audience to the Palmer Project in Alaska.

Located near Skagway, the Palmer Project is a JV with Dowa, Japan’s largest Zinc company (49%), and primarily development of a high grade copper-zinc resource. There are two high grade deposits of copper-zinc-silver-gold hosting high concentrations of barite ranging 24-35%.

Green noted that barite recovery from sulphide ores is “uncommon but not unchartered” and cited examples including the recovery from sulphide ore tailings at Buchans Mine, in Newfoundland (by Barite Mud Services Inc., see Barytes developments continue amid Baker Hughes-Halliburton merger).

The process, which could produce 2.89m tonnes of barite over life of mine (270,000 tpa), requires flotation from copper and zinc tailings, which produces a higher purity end product, but is more complicated and expensive than conventional separation.

Metallurgical work has indicated barite recovery of 91.1% to a clean, high-grade barite concentrate with a high SG of 4.44. The barite concentrate meets all specifications for oilfield drilling.

With a good logistical location and connections, target oilfield markets could be Western Canada , Williston Basin, US/Canada, North Slope, Alaska.

Underground exploration plans are in permitting, and the company plans to start a major underground programme in 2020.

Green extolled on the project being “…closer to Western and Central North American markets than competitors, it will produce a drill-rig ready barite powder, a premium high SG product, and become a strategic domestic source with potential for decades long mine life.”

Processing: dry separation & fine grinding

“Water-free electrostatic processing of oilfield minerals” by Kyle Flynn, Director, Business Development, ST Equipment & Technology LLC, USA, took the audience through STET’s Tribo-electrostatic Dry Separation Process, results for upgrading barite to drilling grade, Dry STET Process Flow Sheet vs. Wet Flotation Process, and a CAPEX-OPEX comparison.

The STET Separation is effective at upgrading low-grade barite to drilling-grade by removal of low density silicates. A full-scale separator is now operating at Ramadas Minerals, Kodur India.

The STET Separation is effective at upgrading low-grade barite to drilling-grade by removal of low density silicates. A full-scale separator is now operating at Ramadas Minerals, Kodur India.

The key features include: dry process, low emissions, no chemicals added, low energy consumption (1-2 kWh/ton feed), high rate (up to 40 tph for STET model M42), and simple operation.

Any new applications maybe evaluated at the STET Needham lab and pilot plant, and the company has also developed a modular containerised system now available for testing at the plant site.

“New grinding technology for ultrafine oilfield minerals & mobile system” by AJ DeCenso, President, Preferred Process Solutions LLC, USA, introduced screening equipment by Sweco, sorting solutions by TOMRA, in-process particle analysers by Xoptix, and grinding technology by Ecutec Netzsch.

Among the Ecutec Netzsch products was a new mill called the PAMIR Agitated Media Mill. Features include: a horizontal agitated media mill, with high energy density (small footprint), small grinding media (ultrafine PSD), easy and fast maintenance, steep PSD (low fines production), single pass or in closed loop with classifier, and installed power from 22kW-630kW (30 HP-850 HP).

Fine ground barite maybe produced at d98 <6µ, with a mill size of 1000l, at 400HP, a production rate of 4.5 tph, and a CAPEX of €480,000. This compares favourably to using a ball mill for similar and having a CAPEX of €550,000.

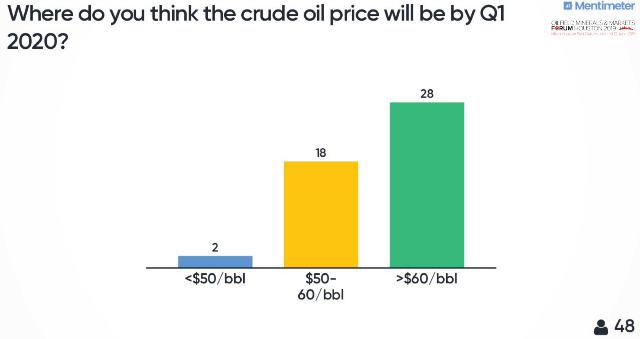

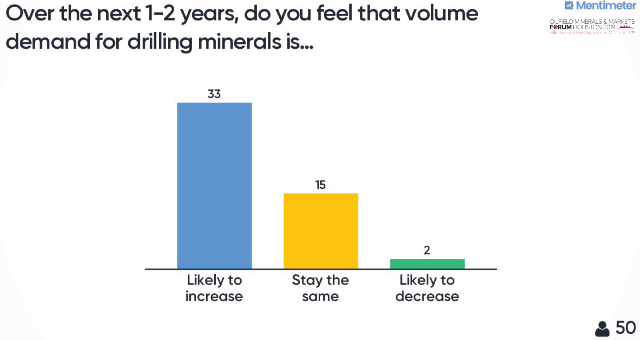

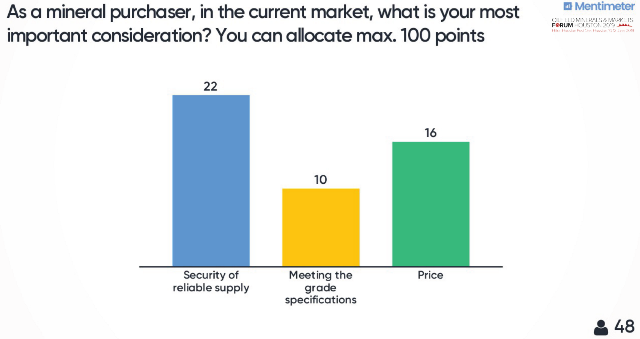

Here’s how our delegates viewed the market outlook!

Our first use of a live audience poll on some general market questions also went down well and we publish those results below – perhaps illustrating a blend of optimism and pragmatism within the industry, certainly, much food for thought.

Thank you, and see you at Oilfield Minerals & Markets Forum 2020!

As ever we are indebted to the support and participation of all of our sponsors, exhibitors, speakers, and delegates for making Oilfield Minerals & Markets Forum 2019 such a success.

We very much appreciate all the completed feedback forms and please continue to provide us with your thoughts and suggestions.

We shall keep you abreast with developments for Oilfield Minerals & Markets Forum 2020.

Meantime, we look forward to meeting you again soon, perhaps at one of our upcoming conferences:

Fluorine Forum 2019, Prague, 21-23 October 2019

Indian Minerals & Markets Forum 2019, Mumbai, 18-20 November 2019

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Leave A Comment