Oilfield Minerals Forum 2018 Review

Whether it was the spirit of Aloha evoked by the Hawaiian-themed Welcome Reception organised by Excalibar Minerals, or the rising oil price supporting a recovery in drill rig activity, the positive buzz surrounding this year’s Oilfield Minerals & Markets Forum Houston made it seem like the good times were back again, and perhaps they are (for Forum summary slide deck and picture gallery click here).

A packed programme covering the latest trends and developments in oilfield minerals supply and demand unfolded over a day and a half giving some 130 international attendees much to discuss during the receptions, breaks, and the newly introduced Roundtable Networking Session.

Sunday night’s poolside Welcome Reception sponsored by Excalibar Minerals was a joyous affair enabling suitably garlanded delegates to network amid the uplifting music of a delightful Hawaiian band and dancers.

Entertainment was also provided by the efforts of certain attendees invited to join in a lively dance routine – much fun, though I think most of us will stick with the day job!

Rig counts no longer clear barometer of activity

The following morning the serious business was tackled, and first up was Uday Turaga, CEO, ADI Analytics Inc., with his “Oil and gas market outlook” presentation.

Turaga’s key messages were:

Turaga’s key messages were:

- Natural gas supply will continue to be abundant and cheap driven by declining well costs

- US producers with OPEC are best positioned suppliers of oil with oil prices likely determined by the

pace of drilling in the US - Although expectations are high, US producers are unlikely to show restraint especially as oil prices push through $60

- Oil growth will be supported by emerging markets but carbon limits and infrastructure limits will drive both fuel and crude exports

- Natural gas demand growth will be eclipsed by pipeline and LNG exports, which will after a long time surpass power and industrial demand growth

- The US is an emerging powerhouse for energy exports and needs to understand linkages with global energy issues.

Turaga also warned that rig counts were expected to remain significantly lower than recent peaks owing to rising drilling productivity, with reductions in completion costs due to longer laterals being conducted. As such, rig counts may no longer be the ideal barometer for rig activity.

A discussion ensued over the potential impact of emerging new energy sources, notably electric vehicles, on the future of oil and gas demand. While Turaga acknowledged the undoubted rise in future EV use, he was sceptical of the overall impact being as much as the hype would let one believe.

In contrast, Claudio Manissero, President, ChemCognition LLC, was of the opinion that the EV impact is somewhat underestimated.

What buyer’s want from their suppliers

In “Sourcing oilfield minerals: knowing your source”, Veronica Brown, VP of Supply Chain, QMax Solutions Inc., made no bones about what QMax expects from its suppliers, be they producers, traders, or brokers.

With its recent acquisition of Anchor Drilling Fluids, QMax is now ranked fourth and fifth largest drilling fluids company in the USA and the world, respectively.

Using barite sourcing as an example, Brown outlined the various supply sources by type before reviewing a most interesting SWOT analysis on the main geographic sources for barite: China, India, Morocco, Mexico, Turkey, and USA.

Brown concluded by explaining how to validate the various source types, and highlighted typical red flags (eg. difficulty answering questions, cannot produce proof of export license, requires letter of credit), and major risks incurred without proper due diligence (eg. buying a $6m+ cargo of useless dirt, paying for cargo that never ships, subjecting your customer to environmental fines).

Can OFS and E&Ps secure frac sand fast enough?

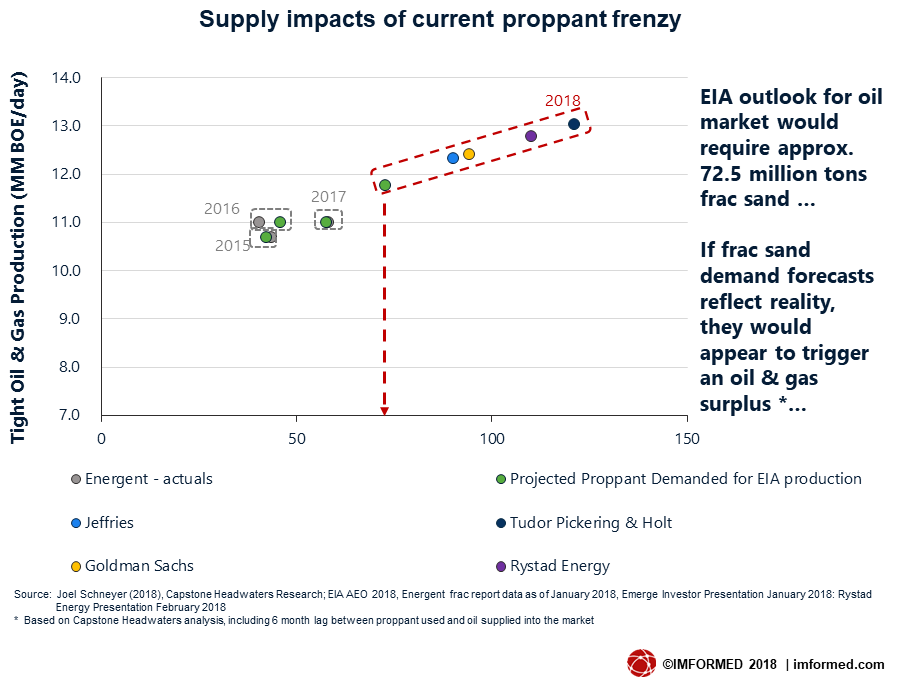

“North American proppants market trends and developments” by Joel Schneyer, Managing Director, Minerals Capital & Advisory Practice, Capstone Headwaters, was a comprehensive review of the proppant sector covering demand drivers, sand supply, market metrics and reflections.

Schneyer highlighted some key factors transforming the proppant landscape, including: the threat of new entrants being very high; E&Ps increasingly on record as interested in self-sourcing (eg. Antero and Encana); no barriers for any industrial sand mine to offer proppant-grades; increasing pressures by sand companies to enter into long take-or-pay contracts; many producers report being sold out; logistics (trucking shortages & rail issues) increasingly impede delivery; and will construction aggregates and river sands in the Mid-Continent, Denver-Julesburg have high enough crush strengths?

Attention was also draw to the Permian Basin where, with seven mines of a combined 15m tpa capacity already online now, some 48m tpa in total is expected from 14 new Permian mines in 2018 alone.

Schneyer concluded with mention of the US Energy Information Administration Outlook for the oil market which stated that it would require approximately 72.5m tons of frac sand. Schneyer contended: “If frac sand demand forecasts reflect reality, they would appear to trigger an oil and gas surplus” (see chart above).

The in-basin sand source concept was the topic of the next talk “In-basin sands: changing the game for proppants and industrial applications” by Dave Frattaroli, Executive VP, High Roller Sand Inc.

Frattaroli explained the concept of in-basin sand sources and emphasised that it was a “true cost elimination, not a margin squeeze”, mainly due to lower costs of logistics.

In-basin sands can be loosely defined as “truck direct to the well pad” comprising typically 100 mesh sand that is “good enough”.

With increasing in-basin sand capacity coming on stream over the next two years industrial (ie. non-proppant sand) customers of traditional Northern White 100 mesh will experience better availability of supply.

The bottom line is that frac sand market recovery is ahead of the rig count, essentially the market is doing more with less, and for lower cost.

Frattaroli sees most industrial sand growth in the “fine fraction” of 40/70 and 100 mesh, increasing from 45-50,000 s.tons in 2017 to 80-90,000 s.tons in 2018.

“2018/2019 will see significant capacity improvements in Northern White, and in-basin sands, but not to the publicly announced levels. Completions technology is still changing – other plays and other proppants will become important, changing the logistics and supply landscape. 100 mesh proppant prices will stabilize in 2018, and come down from these lofty heights in 2019/2020 –but not in a crash.” said Frattaroli.

“2018/2019 will see significant capacity improvements in Northern White, and in-basin sands, but not to the publicly announced levels. Completions technology is still changing – other plays and other proppants will become important, changing the logistics and supply landscape. 100 mesh proppant prices will stabilize in 2018, and come down from these lofty heights in 2019/2020 –but not in a crash.” said Frattaroli.

Turning to potential proppant markets outside North America, “Asia-Pacific proppant scene under the spotlight” by Murray Lines, Director, Stratum Resources, Australia, reviewed hydraulic fracturing activity and prospects in Australia, South East Asia, China, and India.

Lines emphasised that key factors influencing proppant demand included the oil price and logistics. In Australia, significant production of shale gas is at least a few years away and faces challenges of drilling costs and its ability to compete with coal seam gas, plus the anti-frack lobby.

Australia’s shale gas resources are remote, so production may face less environmental opposition than operations in the more populated areas where coal seam gas is currently being developed.

India has relatively low estimated reserves of recoverable shale resources, but the estimates may increase with better mapping.

Regarding China, there are large reserves of recoverable shale gas, and horizontal drilling and fracking have been conducted successfully. Development in China will hinge on newer exploration equipment.

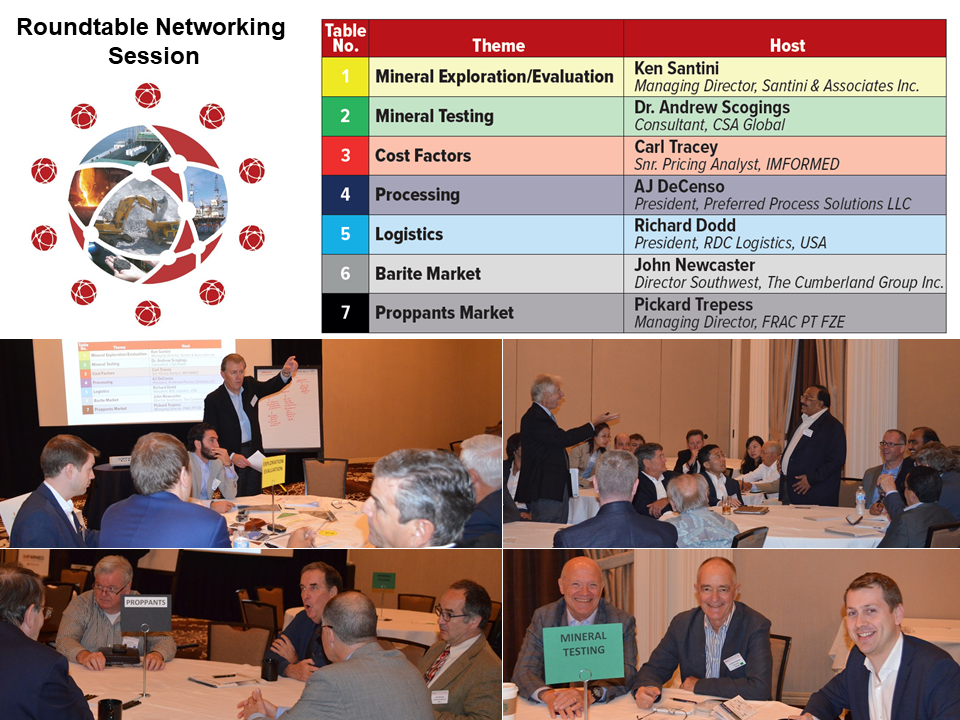

Roundtable Networking Session

The Roundtable Networking Session was a new addition to the Forum and was well attended and received.

Delegates took their after-lunch coffee in a relaxed, informal networking and discussion session, to share and gain insightful knowledge from their peers as well as getting to know each other and their respective companies’ activities.

Roundtables were themed and table discussions led by Table Hosts carefully selected for their expertise (see below).

“Last mile” logistics accounts for over 33% of the final landed cost

“Dynamically optimizing a barite distribution network” by John Newcaster, Director Southwest, The Cumberland Group Inc., neatly threw into sharp relief the importance of logistics for the oilfield minerals sector.

With the North American drilling market consuming 1.5-3.0m tpa of barite, Newcaster explained how a variety of controllable and uncontrollable factors determine the optimal distribution network and how these factors can change rapidly making “yesterday’s optimal network today’s sub-optimal network.”

With the North American drilling market consuming 1.5-3.0m tpa of barite, Newcaster explained how a variety of controllable and uncontrollable factors determine the optimal distribution network and how these factors can change rapidly making “yesterday’s optimal network today’s sub-optimal network.”

However, despite “last mile” logistics accounting for over a third of the final landed cost Newcaster considered that few understand the huge last mile impacts on cost and margin while obsessing over raw material and grinding costs.

“Failure to react and make timely changes to the network results in negative margin impact.” said Newcaster.

Newcaster went on to explain how analytical tools, such as simulation technology primed with the appropriate key inputs, can be applied to optimising distribution networks, such as by refining rail car and/or truck fleet usage and adding trans-load network nodes.

Richard Dodd, President, RDC Logistics, continued the logistics theme with “Logistic challenges: rates rise as demand and regulatory constraints bite” offering a superb overview of rail, truck, barge, and port trends and issues for the oilfield sector.

Dodd reviewed the North American railroad situation, the vast majority of railroad companies are now privately-owned, operating as common carriers; and shrinking from 56 in 1975 to just 8 in 2018 (ie. Class 1).

Dodd reviewed the North American railroad situation, the vast majority of railroad companies are now privately-owned, operating as common carriers; and shrinking from 56 in 1975 to just 8 in 2018 (ie. Class 1).

He noted that with the 2017 Permian boom and Bakken rebound, carloads have started to balance with car supply, leading to an increase in railcar leases.

On trucking, Dodd warned the audience to “fasten your seatbelt”, as he examined the high demand for trucking services, with spot market rates “through the roof” and carriers refusing freight, and negotiating contract revisions.

On inland barging, Dodd said that while rail had captured much of the market volume and many barges were chasing little demand, there was an uptick in the market, and forecast that balanced barge supply-demand was perhaps 2-3 years away.

Mineral additive opportunities in well cements

Turning to an important market application for minerals in the oilfield sector, Claudio Manissero, President, ChemCognition LLC presented “Oilfield well cements: raw material demand, challenges and opportunities”.

Manissero outlined cementing as a critical step in well completion, highlighting the main functions of cementing, ie. zone isolation and segregation, stability of formation, corrosion control, and improvement of pipe strength.

Cement classes were explained, with the majority of cement used in oilfield being Type H & G (80% of usage), the rest is spread out among different types with Class A and C comprising bulk of remainder.

Manissero described the key properties, raw materials (including heavyweight additives such as barite, haematite, ilmenite, silica sand; lightweight additives/extenders (to decrease slurry density) such as bentonite, diatomaceous earth, pozzolans), and challenges for oil well cements.

Manissero described the key properties, raw materials (including heavyweight additives such as barite, haematite, ilmenite, silica sand; lightweight additives/extenders (to decrease slurry density) such as bentonite, diatomaceous earth, pozzolans), and challenges for oil well cements.

There could be new opportunities for new and alternative cements being considered for oilfield use, these include: clinkered cements (eg. calcium aluminate), calcined cements (eg. magnesium cements) and non-clinkered cements (eg. fly ash, slag, glass cements).

Also highlighted were new opportunities for a range of mineral additives, such as: magnetite, bauxite, and boron frit for heavyweighting; calcined expanded slate, pumice, pelletized expanded slag, sintered pulverised fly ash, vermiculite, perlite for lightweighting; magnesium salts, fluorates, and borates as retarders; and the increasing use of caustic calcined and dead burned magnesia in shrinkage control.

With Day 1 concluded amid much food for thought, delegates unwound at the superb “Rockin’ Rodeo Reception” reception hosted by BASO Global which also incorporated the now regular “Buckin’ Bronco” activity for those brave enough.

Barite: processing & testing

In “Separation technology for oilfield minerals: solutions for testing and mobility” Steve Gray, Consultant, ST Equipment & Technology LLC, explained the background and benefits of STET’s unique dry processing process using tribo-electrostatic technology.

He also demonstrated the successful implementation of an STET M24 separator operating since February 2017 at Ramadas Minerals Pvt. Ltd’s barite grinding plant near Kodur, India. The plant is now routinely producing 4.1-4.2 SG product barite from low-grade 3.8 to 3.9 SG feed ore from APMDC’s Mangampet mine.

He also demonstrated the successful implementation of an STET M24 separator operating since February 2017 at Ramadas Minerals Pvt. Ltd’s barite grinding plant near Kodur, India. The plant is now routinely producing 4.1-4.2 SG product barite from low-grade 3.8 to 3.9 SG feed ore from APMDC’s Mangampet mine.

To improve testing facilities for customers, STET has also developed a Benchtop Separator available in Boston, MA, since December 2017, pilot scale evaluation testing in Needham, MA, and a containerised mobile pilot scale evaluation test separator.

The increasing mobility trend in processing units was given a further boost by Jean-Francois Maréchal, Managing Director, Poittemill, in his highly visual presentation “A revolutionary new concept in oilfield mineral milling: Mobility and Modularity”.

Maréchal introduced to the audience “Truckmill”, a new modular and mobile drying-grinding installation developed over the last two years.

Based on Poitemill’s Pendulum Roller Mill PM8, each part of the installation is supplied in containers which are pre-wired, pre-cabled, and pre-connected to be adapted with other containers. Some 10-12 containers in total may comprise the finished mobile plant.

Benefits include no need for building or structures, no packaging, reduced assembly time of 5-10 days, in essence, a turn-key plant. Essentially an easy to set up, short investment, “plug in and play” installation for mineral processing needs.

Benefits include no need for building or structures, no packaging, reduced assembly time of 5-10 days, in essence, a turn-key plant. Essentially an easy to set up, short investment, “plug in and play” installation for mineral processing needs.

“Drilling grade barite density: Le Chatelier vs Pycnometer” by Dr Andrew Scogings, Consultant, CSA Global, set out in very clear and concise fashion all one needed to know about measuring the all-important density of barite, and comparing the Le Chatelier and Gas Pycnometer methods.

It was back to school for some, but in an entertaining and most useful way, as Scogings explained barite density, its importance, how mineralogy relates to density, how it is measured, Le Chatelier vs Gas Pycnometer test results, and quality control.

Scogings concluded that Le Chatelier was a robust method with relatively inexpensive equipment, but was very time consuming at around 4 hours.

In contrast, the gas pycnometer was quick and easy to use (around 5 minutes), biased to higher densities, can be automated and free up the operator, a smaller footprint than Le Chatelier, but with relatively expensive equipment.

In contrast, the gas pycnometer was quick and easy to use (around 5 minutes), biased to higher densities, can be automated and free up the operator, a smaller footprint than Le Chatelier, but with relatively expensive equipment.

Scogings found that the exercise threw out some interesting questions, which drew discussion, such as: could the Le Chatelier method be improved by using two separate funnels to add liquid, or dry barite powder? Assuming that drilling muds are mainly water, perhaps water should be used for Le Chatelier tests? Gas pycnometers are already accepted for refractory materials density (ASTM C604). Why not for barite?

His insightful recommendations for the industry included an approach to the API about updating the recommended pycnometers to currently available models, and collaboration between producers and commercial labs to compare different methods and convince the API to add the gas pycnometer as an alternative to Le Chatelier in Specification 13A.

Barite: global supply, China, & potential new sources in BC

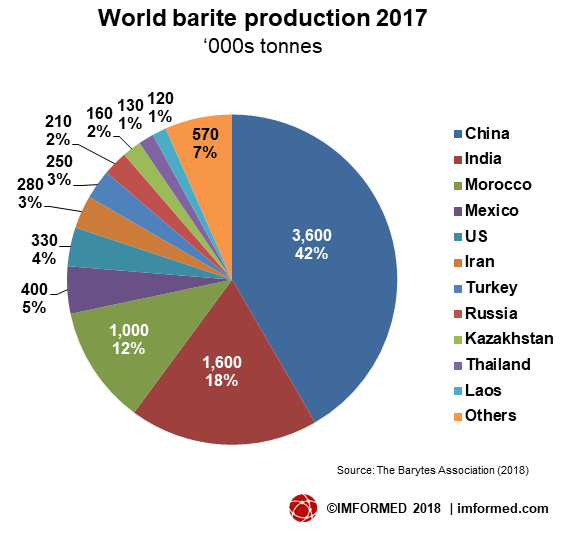

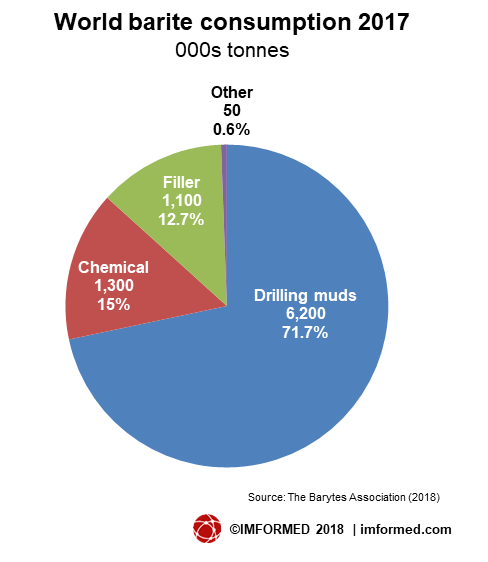

The global supply and demand for barite was reviewed in “Overview and outlook for the barite supply market” by Tammy Oglesby, Inventory & Logistics Specialist, Excalibar Minerals LLC.

Chinese output was seen to recover, also in India and Morocco, while Mexican and Iranian barite production increased in 2017. Output fell in the USA, Thailand, and Bolivia.

Chinese output was seen to recover, also in India and Morocco, while Mexican and Iranian barite production increased in 2017. Output fell in the USA, Thailand, and Bolivia.

The USA remained the top consumer, but still down by 1m tpa from that of 2014, while there was reduced consumption in Europe and the Middle East.

Developing trends include fine ground and micronised engineered fluids for reduced sag in shallow, horizontal wells, less reliance on Chinese barite (50% in 2010, 41% in 2017), increased outputs in Pakistan, Thailand, Laos, Bolivia, and Mexico, and planned new sources in the USA, Mexico, Guatemala, and Canada.

“Chinese barite supply” by Rita Hu, General Manager, Guizhou Saboman Imp. & Exp. Co. Ltd provided an overview of China’s barite resources, production, and exports.

The recent decline in barite exports has been due to oil price, exports from other countries, and domestic consumption increasing.

The most significant factor impacting the Chinese barite sector has been the increasing environmental regulations on mining and mineral production across China. This has resulted in tighter controls, mine and plant closures, and the future may bring further intensified controls.

The most significant factor impacting the Chinese barite sector has been the increasing environmental regulations on mining and mineral production across China. This has resulted in tighter controls, mine and plant closures, and the future may bring further intensified controls.

The main targets for environmental supervision include damage of vegetation and illegal barite mining; for natural barite producers, dust and noise from grinding, wastewater pollution from acid- washing; for precipitated barium sulphate producers, coal dust pollution, wastewater pollution, and waste solid residues from production.

This has resulted in a supply shortage with prices increasing by up to 10%. To enhance sustainability of Chinese barite resources, Hu recommended that the industry “globalise” 4.10 SG as the default standard density specification, and similarly raise the accepted carbonate level from 3,000 mg/l to 5,000 mg/l.

To round off the Forum, two potential new sources of barite under development were introduced, both located in British Columbia, Canada.

“Developing a large, high-grade barite deposit in Canada near a deep-sea port” by Lawrence Roulston, Director, Mountain Boy Minerals, outlined the Surprise Creek project as a large (potential 6m tonnes), high grade barite deposit well located to serve the North American market by rail to Alberta or just 40km to Stewart, a deep water Pacific port.

“Developing a large, high-grade barite deposit in Canada near a deep-sea port” by Lawrence Roulston, Director, Mountain Boy Minerals, outlined the Surprise Creek project as a large (potential 6m tonnes), high grade barite deposit well located to serve the North American market by rail to Alberta or just 40km to Stewart, a deep water Pacific port.

Surprise Creek is a barite-zinc-copper-silver project, recording high grade occurrences of barite at 47-67% in drill core. Two-stage flotation tests have yielded API grade barite at 4.2 SG.

Next steps include further drilling to delineate the extent of the deposit, commencement of permitting and engineering studies, and further metallurgical testing to optimise recoveries. Mountain Boy Minerals is currently seeking a joint venture partner for the project’s development.

“Development of the Frances Creek, BC, barite deposit” by Brent Willis, Chief Operations Officer, Voyageur Minerals Ltd, described its plans to develop its advanced stage industrial grade barite deposit at Frances Creek, BC.

Frances Creek barite grade is high quality, at grades ranging from 96.5% to 99.5% BaSO4 in-situ, after processing it potentially can be sold into the high grade industrial market. Initial drilling has estimated a resource of up to 200,000+ tonnes.

Frances Creek barite grade is high quality, at grades ranging from 96.5% to 99.5% BaSO4 in-situ, after processing it potentially can be sold into the high grade industrial market. Initial drilling has estimated a resource of up to 200,000+ tonnes.

Voyageur Minerals has entered a joint venture with Innovation Metals to use a low cost process to consistently produce grades of 99% BaSO4 for the high end barium markets (eg. paints, pharmaceuticals, blanc fixe).

The company is also evaluating its Pedley Mountain high grade industrial barite deposit, hosting an estimated 117,000 tonnes barite.

Thank you and see you in 2019!

As ever we are indebted to the support and participation of all of our sponsors, exhibitors, speakers, and delegates for making Oilfield Minerals & Markets Forum Houston 2018 such a success.

We very much appreciate all the completed feedback forms and please continue to provide us with your thoughts and suggestions.

As for next year, we can confirm that we have dates for Oilfield Minerals & Markets Forum Houston 2019 at the same venue, Hilton Houston Post Oak on 10-12 June 2019.

We are pleased to say that we are already accepting presentations, sponsorships and exhibits; we shall keep you abreast with developments and look forward to meeting you again soon.

Sponsor & exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

For programme, feedback, attendees, and picture gallery, please go to:

Oilfield Minerals & Markets Forum Houston 2018

Missed attending the conference?

A set of presentations (as PDF) maybe purchased: Price £500 – please contact:

Ismene Clarke, T: +44 (0)208 224 0425; M: +44 (0)7905 771 494; E: ismene@imformed.com

REGISTER NOW FOR

Leave A Comment