Titanium dioxide feedstock output to remain steady

In expectation of a challenging 2015 and “to drive greater value”, Rio Tinto Plc today announced an organisational restructure, essentially a streamlining in splitting up its Energy business and condensing into four product groups: Aluminium, Copper and Coal, Diamonds and Minerals, and Iron Ore.

One of RBM’s dredge miners at Richards Bay, South Africa. Reserves in this lease area are expected to run out by 2031, and RBM is aiming to approve a new 1.3-1.5m tpa mine site this year for commissioning in 2017. Courtesy Rio Tinto

While Coal joins Copper, Rio Tinto’s uranium business – with operations in Namibia, Australia, and Canada – is shifted into Diamonds & Minerals, which remains headed up by Alan Davies as CEO.

The upshot is that the Diamonds & Minerals’ portfolio now covers diamonds, borates, salt, titanium minerals, zircon, iron ore (Simandou project, Guinea), and uranium – quite a mixed bag, but no real surprise there for those familiar with Rio Tinto’s industrial minerals division history.

Borates and salt operations are administered by Rio Tinto Minerals, and the titanium minerals and zircon operations by Rio Tinto Iron & Titanium.

As a consequence of the restructuring, former Energy chief executive Harry Kenyon-Slaney will leave the business after some 25 years at Rio Tinto.

In reporting its 2014 results on 12 February 2015, Rio Tinto chief executive Sam Walsh acknowledged a challenging year ahead, saying that capital expenditure for the year would decline and the focus would be on productivity, costs and margins.

“With lower commodity prices and uncertain global economic trends, the operating environment remains tough.” said Walsh.

Titanium dioxide market still weak

Rio Tinto reported that the market for titanium dioxide (TiO2) and zircon has shown signs of stabilisation as industry-wide inventories continued their return towards historical levels.

Prices in the TiO2 market remained under pressure throughout 2014 as the industry continued to absorb feedstock inventories from the previous period of high prices.

However, the titanium minerals market may not be out of the woods yet. TZ Minerals International (TZMI) expects market weakness to continue in both the titanium feedstock and TiO2 pigment sectors. The expected period of recovery in 2014 failed to materialise the markets fell further in Q4 2014.

TZMI expects no relief in 2015 from the weak market conditions that have plagued the feedstock industry, particularly for sulphate processed ilmenite which remains in significant oversupply.

Weak pigment prices are expected to continue to dampen any upside to feedstock prices in the first half of 2015. Some operations could be curtailed or idled due to uneconomic operating conditions leading to a rationalisation of supply.

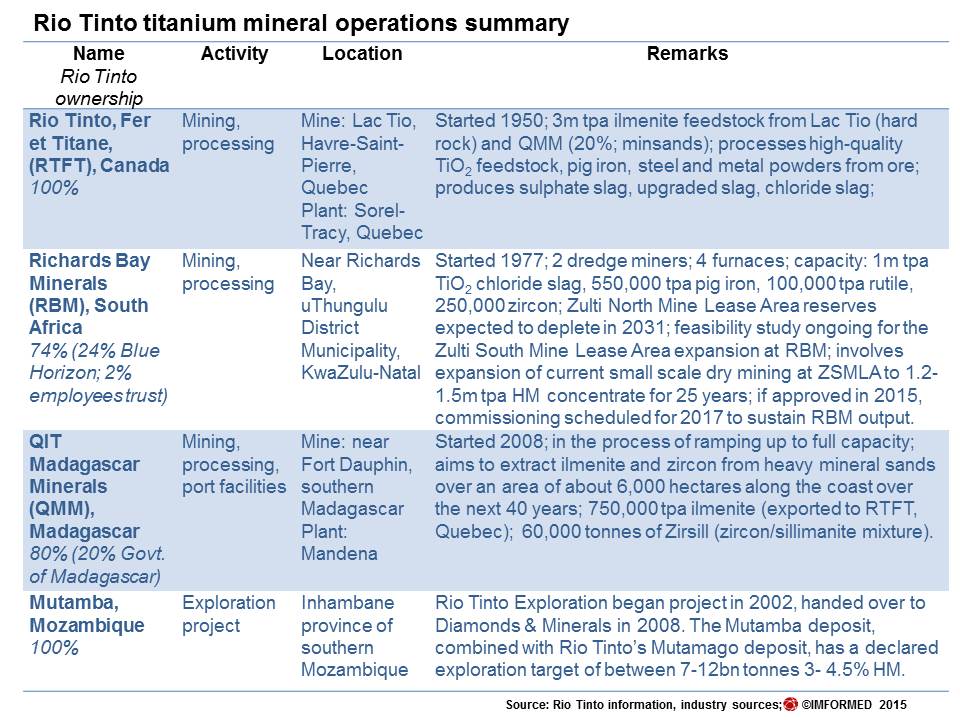

Rio Tinto is one of the world’s main producers of titanium feedstock minerals, accounting for around 25% of world production through operations in South Africa, Canada, and Madagascar (see chart).

In 2014, Rio Tinto’s total TiO2 feedstock production was 1,443,000 tonnes. This was 11% lower than in 2013, owing to depressed market demand.

According to Sam Walsh, Rio Tinto’s output for 2015 is expected to be 1.4 million tonnes.

Logistics key to operations

Rio Tinto’s three titanium mineral operations each comprise some significant logistical aspects.

Rio Tinto Fer et Titane operates an open cast ilmenite mine at Lac Tio near Havre-Saint-Pierre in Quebec, Canada. The crushed ore is transported by train 43km to Havre-Saint-Pierre. From there is it transferred by conveyor to an ore carrier for a 900km journey along the St Lawrence River to the metallurgical complex in Sorel-Tracy, Quebec.

About 20% of the Sorel-Tracy plant’s feedstock is met by ilmenite imported from QMM in Madagascar.

At RBM, South Africa, about 95% of production is exported, with much of the European exports destined for Rotterdam. RBM output is transported 27km by rail from the mine site to the port of Richards Bay.

The port’s multi-purpose, bulk-handling plant is one of the largest plants of its kind in the world. A 26km long conveyor network, designed to handle a wide variety of products, is fully computerised and centrally controlled.

QMM in Madagascar operates a mining complex comprising a floating separation unit connected to a dredger, a mineral separation plant, a storeroom, a power plant and a weir. Mining is via a non-stop dredging process.

Concentrated heavy sand from the first stage is trucked to the mineral separation plant in Mandena for the final separation stages before shipping to RTFT, Canada, from the nearby deep-water Ehoala Port, a public/private partnership between Rio Tinto and the Malagasy government.

Ilmenite produced by QMM is exported from Ehoala Port, Madagascar, a public/private partnership between Rio Tinto and the Malagasy government, to Rio Tinto Fer et Titane’s plant at Sorel-Tracy, Quebec. Courtesy Rio Tinto

Learn about Rio Tinto’s mineral sand supply chain first hand at the Mineral Logistics Forum 2015, 23-24 April 2015, Rotterdam

Andreas Stylidiadis, Manager Logistics Europe, Rio Tinto Iron & Titanium GmbH, Germany, will be presenting “An insight into the supply chain for mineral sands and iron products”

Early Bird Rates saving €125 available for a limited period.

Leave A Comment