Bauxite, BFA, Andalusite, Magnesite impact | Supply reforms in pipeline

As if 2020 had not dished out enough disruption for one year, suppliers and consumers of Chinese refractory minerals are facing more issues impacting the supply chain in the form of operational closures and a shortage of shipping containers.

Title Picture A mountain to climb: China’s centre of magnesite mining and processing, Haicheng, Liaoning, is enduring a period of wide-ranging environmental inspections, suspensions, and closures as local government officials meet to consider structural reforms to the industry; elsewhere, central Chinese provinces key to bauxite and BFA supply face similar restrictions with high pollution alerts.

The upshot, as well as anticipated supply delays and shortages, is that freight prices are soaring, leading to rapidly increasing mineral prices, which throughout 2020 had until now seen a dramatic decline owing to the drop in demand from export markets hit by the pandemic.

The end of the year also marks some significant moves in respect of supply sector reforms for bauxite and magnesite.

Refractory Minerals Forum 2021 ONLINE

16-17 March 2021Global trends & outlook in supply & demand for refractory raw materials & markets

Let’s keep in contact & conversation! IMFORMED is delighted to announce a new online Forum for the refractory raw materials industry

CONFIRMED SPEAKERS | EARLY BIRD RATES | FULL DETAILS HERE

Winters of discontent

It’s a famililar refrain at this time of year. The onset of the Chinese industrial winter shutdown during the months of October to March was always on the cards, it now being an annual event since its inception in 2017.

Over this period, high energy consuming and high emission plants in particular are ordered to close, or at least markedly reduce utilisation rates. The only variable is to what extent each year, and this differs from region to region.

Naturally, this impacts all mineral processing plants, especially those, such as refractory minerals, involving drying, calcination, and fusion, the refractory brick manufacturing plants, and the plants of their end use market sectors such as in steel, aluminium, cement, glass, foundry.

Unfortunately, 2020 has delivered an additional unforseen negative factor in the Covid-19 pandemic. This has played havoc with consuming markets, supply chains and shipping.

This year’s initial winter shutdown pollution targets in China set by the Ministry of Ecology & Environment (MEE) in September were considered less stringent than those of 2019-20. However, perhaps unsurprisingly, they are already looking unattainable as China’s industrial recovery, and thus emissions, have accelerated markedly since April.

The heavily industrialised Beijing-Tianjin-Hebei region, which covers 28 cities, was aiming to keep emissions from October to December 2020 at the same level as the previous year. But PM2.5 concentrations in October were already registering 52mg/m3, up 15.6% compared to 2019.

Hebei, China’s top steelmaking province which surrounds Beijing, produced 210.8m tonnes of crude steel in the first 10 months of 2020, up 4.1% on 2019. Output in October stood at 20.95m tonnes, up 17%. The province is supposed to be cutting production capacity to enable “ultra-low emissions” to a maximum of 200m tpa by the end of 2020.

The MEE targets were to keep average PM2.5 concentrations in the Beijing-Tianjin-Hebei region at <63mg/m3 from October to December, and then <86mg/m3 January to March 2021. The figure is still more than double China’s official air quality standard of 35mg/m3.

Although large scale industrial closures were seeking to be avoided as China recovered from the pandemic, this now looks unavoidable, and already many plants in industrialised regions are being forced to close under subsequent revised official emergency measures.

NEW EDITION OUT NOW!

IMFORMED’S Refractory Raw Material World Sources Map

Primary world sources & production capacity of key refractory raw materials

Alumina | Fused Alumina | Andalusite | Kyanite | Sillimanite | Bauxite | Chromite | Graphite | Dead Burned Magnesia | Fused Magnesia | Pyrophyllite | Silicon Carbide | Zircon

Contact: Ismene Clarke | [email protected] | +44 (0)7905 771 494

Henan BFA impacted

In addition to the Beijing-Tianjin-Hebei region, the key bauxite and fused alumina producing provinces of Henan and Shanxi are also heavily impacted.

Since October, environmental protection inspections in Henan have been continuously upgraded with ongoing revision of performance ratings of key enterprises and levels of emergency emission reduction.

According to Refractories Window, only Zhengzhou Yufa Abrasives Co. Ltd has been rated as a B level enterprise, with the rest of the companies having lower C and D level ratings.

By the end of November, 17 provincial cities in Henan and the Jiyuan Demonstration Zone had declared orange warnings and level II response of heavy pollution.

China’s four company classifications have differing levels of required response depending on the severity of the pollution alert coded by colour – see below chart.

By late November/early December, most fused alumina producers in the main production hub of Sanmenxia, Henan province, were reported to have stopped production until the end of December 2020 at least, while others in Henan were facing reduced utilisation rates.

According to official statistics, in the first half of 2020, China produced about 509,000 tonnes BFA, a decrease of 38.7% from H1 2019, of which about 224,000 tonnes were produced in Henan.

BFA spot prices in early to mid-December were reported as ranging US$650-700/t Ex-works, 95% Al2O3.

Bauxite remains challenged | New reforms put forward

Bauxite availability has been in decline for some time in Shanxi province with the previously large volume mines now exhausted or closed. Any mining of raw bauxite is severely restricted, if permitted at all, and bauxite calcination plants have been using up their stocks of crude Shanxi ore.

Already by August 2020, around 80% of the remaining operational plants in the Xiaoyi district of Shanxi were having to import Guizhou and Henan raw bauxite.

Typical calcined bauxite rotary kiln operation in Shanxi province; many are closed owing to environmental controls, and those that are operating have very limited stocks of primary ore, some are importing bauxite from Guizhou and Henan. Courtesy JSM Refractory Co. Ltd

The 19th Central Committee of the Community Party of China held its Fifth Plenary Sessions in Beijing between 26-29 October to set the outline for the upcoming 14th Five Year Plan 2021-2025 (to be rubber stamped by the National People’s Congress in March 2021).

For its part, the Shanxi Provincial Refractories Association put forward five suggestions for the development of the refractory industry to the Shanxi Provincial Department of Industry and Information Technology:

- Allocation of “refractory aluminous clay” resources (ie. refractory grade bauxite) for refractory companies.

- Give full play to the role of leading enterprises and establish a “Shanxi Refractory Group Co.” through transformation and upgrading and capital co-operation.

- Implement the Shanxi Province Green Building Materials Industry 2020 Action Plan, and increase policy support for key enterprises.

- Build two industrial clusters of refractory materials production around Yangquan and Luliang.

- Persist in green development, create green enterprises, and enhance corporate competitiveness.

Laudable initiatives, which, as anticipated (and feared?) by some market players, appear to largely follow the reforms already underway for magnesite in Liaoning province (see below). They also somewhat echo those first heard for Shanxi bauxite development at IMFORMED’s inaugural China Refractory Minerals Forum back in 2018 (for a review see China minerals supply outlook: Shanghai showdown).

Whether this second drive to initiate a much-needed resumption of Shanxi refractory grade bauxite reserve evaluation and mining actually comes to fruition remains to be seen. However, on current form it may seem unlikely. Shanxi’s calcined bauxite plants will continue to have to rely on input from China’s other key bauxite producing provinces of Guizhou and Henan, which is by no means guaranteed.

Mid-December 2020 calcined bauxite spot prices were reported at US$435/t FOB Xingang, 85% Al2O3; US$495/t FOB Xingang, 88% Al2O3; although early December Ex-works prices had been quoted at US$300-320/t 85% Al2O3.

Andalusite winter production extended

With supply of refractory bauxite threatened, other aluminosilicates are clearly on consumers’ radars such as andalusite. The two minerals are not necessarily interchangeable in every refractory application, but there are specific areas where they may substitute each other.

China has limited sources of andalusite, mainly concentrated in central Xinjiang province in the far west of China, exploited by just two producers. China also imports about 30,000 tonnes andalusite, mostly from South Africa, but also from France and Peru.

Xinjiang Xinrong Yilong Andalusite Co. was originally planning to halt production in late November 2020, as it does most years during the severe winter months in that region.

However, owing to high customer demand from a recovering domestic market and no doubt some influence from the deteriorating bauxite situation, the company was reported to have postponed its winter shutdown for as long as it can operate. Typical output is about 2,000 tpm of 56%, 57% and 58% Al2O3, in 0-1mm,1-3mm, sizes.

Xinjiang Xinrong Yilong Andalusite Co. in the far west of China produces about 2,000 tpm andalusite, and owing to market demand has extended its mining operations into its normal winter shutdown period. Courtesy Yilong Andalusite

Magnesia hit by wide-ranging closures | Provincial supply controls

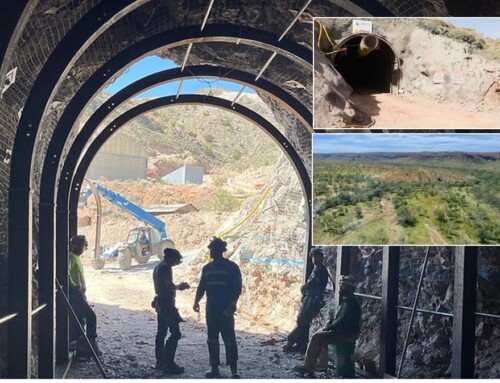

China’s key magnesite production centres in Liaoning province, north-east China have been severely hit by continuing mine and plant closures recently, as the local government targets producers and associated truck traffic not meeting environmental protection standards.

This has resulted in a tightening of supply, particularly of “mid-grade” 95% MgO grades, and prices are rising each week.

Huang Runqiu, China’s new Minister of Ecology and Environment visited Liaoning early December to urge that “environmental protection and vertical reform goals and tasks must be fully completed, and provide solid institutional guarantees for the in-depth fight against pollution and building a beautiful China.”

The Dashiqiao district is nearing the end of an intensive “100-day tackling of comprehensive rectification” of the industry initiated on 22 September.

Apparently, those companies with incomplete environment licence certificates have had their water and electricity disconnected to ensure they stop production for “rectification”. A large number of dead burned (DBM) and fused magnesia (FM) producers have had to close.

On 27 November, the Department of Ecology & Environment of Liaoning Province announced its revised air pollution controls and response to the heavy pollution during autumn and winter.

And during 11-12 December, Huang Runqiu, China’s Minister of Ecology and Environment visited Liaoning to research and advise on “environmental protection vertical reform”. Appointed in April 2020, as well as a politician, Huang is also a geologist.

Overall, more than 8,000 magnesia kilns were investigated resulting in 111 companies ordered to close, 94 companies have been suspended for rectification, and 588 companies have been promoted to meet environmental standards.

On 3 December 2020, an environmental law enforcement experience exchange meeting was held in Dashiqiao to implement comprehensive management of pollution in the magnesite industry. This to facilitate the “Opinions of the General Office of the People’s Government of Liaoning Province on Promoting the Sustainable and Healthy Development of the Magnesite Industry” (Liaoning Administration Office (2020) Order No. 33).

This has included the implementation of online monitoring facilities of magnesia plants, high-altitude video and working conditions monitoring. By early December, 229 magnesia plants in Dashiqiao City were equipped with 342 sets of online monitoring equipment. So far, 249 magnesia companies were found to meet 2021 emission targets.

In Yingkou, the Yingkou Emergency Management Bureau has recently reported its investigations: 22 mining companies have completed comprehensive rectification. Among them, 16 mines have completed comprehensive remediation and are now permitted to operate; 53 mines have been suspended pending remediation work; 47 mines have been closed.

The Yingkou Emergency Management Bureau at work examining magnesite mines in the Yingkou district, Liaoning province.

Magnesite mining with explosives has been banned for some time, and while companies have been attempting to mitigate raw ore supply shortages by using mine excavators, even this looks set to cease soon if not already.

According to Andy Zhang, Director, Southern Minerals International, there are indications that there could be a prohibition on all magnesite mining and sale of raw magnesite from 1 January 2021.

Not surprisingly, this has driven FM and DBM producers rushing to purchase all available raw magnesite resulting in drastic price increases.

Estimates for raw magnesite pricing mid-December stood at: 47.2% MgO US$138/t (up 80% in the last month); 47.0% MgO: US$92/t (up 50%); 46.8% MgO: US$61/t (up 21%).

The final two months of the year has seen the latest moves from the Liaoning provincial government in progressing its reform programme for the magnesite industry, “in order to optimise the supply of magnesite resources and promote the replacement of production capacity in related fields”.

Feedback was requested from industry and the public on the local government’s “Draft Measures for the Provincial Total Management of Magnesite Resources in the Province and Measures for Capacity Replacement in the Province’s Magnesite Flotation and Magnesium Industry.”

The new measures, to be controlled at provincial and municipal levels, are aimed at magnesite ore (≥35% MgO) mining, stock ore supply, and low-grade magnesite resources, including tailings, “rubble (rock wool)”, ore mixtures and other resources.

A “total control coefficient” of provincial annual magnesite supply is to be calculated based on factors such as the implementation of environmental control indicators.

By 15 December, the Liaoning government had announced that it is now strictly forbidden to increase the production capacity of magnesite flotation and magnesia production plants, and to prepare any new production lines.

The full conclusion to these reforms will be keenly awaited by the global magnesia industry to see how it may shape the future of Chinese magnesia production (and thus export supply).

Frustrating traders and consumers alike, magnesia prices have been increasing weekly with fewer producers operating. It has been estimated that the price of Chinese DBM rose by about 30% since the new round of environmental control activities were implemented in October 2020. One Chinese player commented: “The problem is, even if you want to pay for it, you couldn’t get the order. Because the suppliers are waiting for a new round price rise.”

Early December spot prices for DBM grades were reported at US$400/t Ex-works 97% MgO, US$340/t Ex-works 95% MgO, US$200/t Ex-works, 92% MgO; FM, US$550/t Ex-works, 97% MgO, US$410/t 96% MgO.

By mid-December, these had increased: DBM98 US$610/t DBM97 US$460/t; DBM95 US$350/t; DBM92 US$238/t; DBM90 US$230/t; FM97 US$630/t; FM96 US$538/t (all Ex-Works).

The chart below from the Northeast Asia Magnesia Exchange indicates the trend in DBM and FM pricing since mid-2020; a steady decline as export market demand drops due to the pandemic, followed by a sharp uptick from late October as pollution controls kick in.

As Cathy Wang, Director, Refractories Window, reported recently, October 2020 appeared to be a turning point for magnesia, as prices stopped falling and gently increased before rising sharply in November and December (see below).

MagForum 2021 Amsterdam

28-30 June 2021

Keep up with the latest trends in magnesia supply & demand

Visit to Nedmag’s operation at Veendam Thursday 1 July

CONFIRMED PAPERS | EARLY BIRD RATES | FULL DETAILS HERE

Freight costs rise with container shortage

Compounding the interruption and uncertainty over mineral supply from China has been the steadily worsening freight situation, ie. rising freight rates, shortage of containers, port congestion, and delayed shipping.

It is considered by some that the situation is likely to continue until February 2021, possibly even through April 2021.

Container freight rates in particular have soared: one mineral trader suggested it had increased by 7-10 times from March 2020 for China to Europe.

The Wall Street Journal reported that container freight rates have soared to a ten-year high. The average spot-market price to ship a 20-foot container from Asia to Europe hit $2,091 early December, surpassing the $2,000 mark for the first time since May 2010. The rate has more than doubled from $1,029 at the end of August.

By 10 December, Drewry’s composite World Container index had risen 0.5% to $3,451.32 per 40ft container.

The impact of the pandemic on shipping throughout the year has seriously upset container traffic, creating shortages of empty containers or having them stranded in various ports.

Added to this is rising demand from the public’s increased rate of buying consumer goods (especially with Christmas pending) as they endure national lockdowns and spend on home buying rather than on banned and restricted holidays and travel.

UK ports have been especially hit, not least with the ongoing debacle over UK-EC Brexit trade negotiations creating heightened uncertainty for businesses already stockpiling to mitigate fall-out from the fast approaching UK post-Brexit transition period expiry date of 31 December 2020.

Outlook: Bleak Mid-Winter…and Spring?

The Chinese Year of the Ox (12 February 2021) is apparently characterised by Chinese astrologers as being hardworking and methodical, “when we will fully feel the weight of our responsibilities”.

Indeed. In light of the world and economic situation this appears most apt. There is no doubt that challenging conditions are to extend into 2021, certainly for first quarter, and maybe the first half.

Clearly, the good news has been the advent of a series of Covid-19 vaccines, already being rolled out and it is hoped that this will have a positive impact on the world economy.

China is already pushing ahead from its economic recovery period, while Europe and North America appear on the road to recovery despite early 2021 uncertainties.

With ox-like devotion, methodical hard work combined with clear and decisive strategies will be required to shape and secure mineral trade in 2021 and beyond.

As has already been reported by IMFORMED (see New era of mineral exploration, sourcing & development dawns), key among the decision-making will be new and changing strategies for mineral supply chains and mineral sourcing. Such sentiments have been further prompted by these latest refractory mineral issues in China. Expect some interesting developments for 2021. Watch this space…and attend our Forums!

Mineral Recycling Forum 2021 ONLINE 9 February 2021

Refractory Minerals Forum 2021 ONLINE 16-17 March 2021

MagForum 2021, Amsterdam, 28-30 June 2021 – Field Trip: Nedmag, Veendam

China Refractory Minerals Forum 2021, Dalian 26-27 October 2021 – Field Trip: Haimag, Haicheng

CONFIRMED SPEAKERS | EARLY BIRD RATES

Thanks for the great article Mike. I am currently preparing my presentation for your Refractories Forum on the effects of climate change and circular economy on refractory minerals and the next few decades are going to be even more dynamic.