Review of MagForum 2023, Baveno, Italy

The shores of beautiful Lake Maggiore at Baveno hosted the largest and most successful MagForum to date. Some 230 international attendees from across the supply chain of the magnesia raw materials industry gathered in late May to network and learn of the latest market trends and developments.

Certainly, there was a sense of “back to normal” among the delegates, as we welcomed back attendees from China, Japan, and Asia, who until now had been limited in their travel plans owing to pandemic ramifications.

Indeed, there was an equal sense of hunger to reconnect and get on top of the leading themes of the day, notably strategic sourcing, market diversification, decarbonisation, energy transition, and market trends (full review of presentations below).

The conference was preceded by an excellent visit to the olivine mining and processing operations of Nuova Cives at Vidracco (see below) before a wonderful networking Welcome Reception, sponsored by Lehmann&Voss&Co. at the Grand Hotel Dino, in Baveno.

What delegates thought about MagForum 2023

Visiting the olivine mine of Nuova Cives was one of the highlights. This annual event brings together the best in the magnesite industry. It was fantastic to catch up with our long time partners and also have the chance to connect with new customers and suppliers.

Niklas Lüdemann, Head of Region North America, CREMER ERZKONTOR, USAExcellent programme and venue. The market outlook presentations and Roundtables were great.

Altug Cakmur, CFO, Turkmag, TurkeyIt has been a great experience getting to connect with my colleagues from around the world at MagForum! It’s a pleasure to catch up with our customers and getting more insights to the global magnesia market. Looking forward to next year!

David Torres, Global Marketing Manager Minerals, RHI Magnesita, USAFree MagForum 2023 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 [email protected]

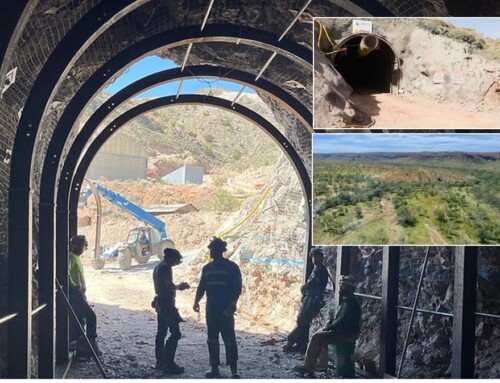

Field Trip: Nuova Cives

Leading European olivine producer Nuova Cives is located at Vidracco, in the Italian region of Piedmont, about 40km north of Turin.

The company is family-owned and has been active for >60 years in exploitation, processing and trading a wide range of olivine products for a variety of markets including steel, foundry, refractories, abrasives, filtration, and filler applications.

There are two mines: “Bric Carlevà” and “Finero”, the latter hosting higher quality grades for refractories and manganese steel applications.

The plant in Vidracco conducts primary and secondary crushing, separation of waste materials, enrichment, tertiary and quaternary crushing, screening, and classification.

Total plant capacity is 600,000 tpa olivine, while current output is about 200,000 tpa olivine ranging from aggregates, sands, to micronized sizes.

The visit was rounded off by a superb traditional Italian lunch hosted by Nuova Cives, to whom we are indebted for putting on such a fabulous MagForum Field Trip to kickstart this event.

Welcome Reception sponsored by Lehvoss Group; far right: The Welcome Address: “Celebrating 120 years of serving the magnesia market” delivered by Dr Alexander Sunder, Global Director Magnesia & Minerals, LEHVOSS Group, Germany

ANNOUNCING…

FULL DETAILS HERE

FORUM REVIEW

OVERVIEW | ALTERNATIVE FUELS | SUPPLY CHAINS

Magnesia supply overview

Mike O’Driscoll, Director, IMFORMED, UK

Mike O’Driscoll provided an overview of world magnesite reserves and supply, also underlining other important magnesia mineral sources such as kieserite, brucite, and olivine.

He reflected on the shrinking number of primary refractory dead burned magnesia (DBM) producers, and even fewer fused magnesia (FM) producers existing outside China.

Most are now captive producers with natural magnesia sources, and integrated with a refractories producer/owner. There are very few independents, which are all synthetic sourced producers.

Notable is that obviously the overseas activities of Magnezit Group, Russia, are somewhat challenged at present.

Also, the long-established seawater magnesia producer Premier Periclase Ltd, Republic of Ireland, remained idled under administration at the time of MagForum 2023. However, days later it was acquired on 6 June 2023 by Meridiam and Gyrogy, which intend to redevelop the industrial site “…and over time transform it into a modern, mixed-use industrial campus offering low carbon energy solutions.”

In spite of China’s continuing dominance in magnesia world trade, there remains growing interest in developing alternative sources ex-China, including a resurgence in other magnesia mineral sources such as dolomite, serpentinite, olivine, and dunite.

Meanwhile, established ex-China magnesia producers (and some consumers) are strengthening resources, capabilities, and vertical integration for supply security.

IMFORMED is very much looking forward to catching up with the global refractories market at the upcoming UNITECR 2023, Frankfurt, 26-29 Sept. Please drop by our Stand M9 for a chat, we would love to meet you.

Mike O’Driscoll will be presenting:

“Squaring the Circle: Challenges & Opportunities in Recycling Refractory Minerals”

09.00 Thursday 28 September, Room: Horizont, Session: Raw materials – Secondary Materials IIPlease also join us at the “Recycling of Refractories” Panel Session at 10.00. See you there!

Alternative fuel source: Biomass use in magnesite calcination

John Robert McFarlane, Owner, AlbionDesign GmbH, Switzerland

John McFarlane started by explaining who uses biomass, what they are burning, before going on to other areas of interest, future sectors, competition and fungibility (the ease with which two fuels can be blended together, ie. co-firing with fossil fuel and biomass), material availability, and competition from the power sector.

Before biomass use, certain questions must be asked such as: Is it cheaper than anthracite/petcoke? Do you have additional costs for polluting? Have you made stakeholder promises?

One EU magnesite producer was referenced which is already using biomass in CCM production, and McFarlane sees more fungibility with biomass in CCM calcination.

Based on petcoke and biomass prevailing prices, McFarlane concluded that using biomass fuel was more economic than using petcoke with regard to emission costs (see below).

Refractory mineral supply chains: Zero China & Cold Peace?

James Devlin, Managing Director, China Mineral Processing Sales Europe, UK

James Devlin’s talk was a reality check on just how the refractory and other markets are highly over-reliant on Chinese mineral supply, such as magnesia, bauxite, high alumina, graphite, and silicon carbide.

He reviewed China’s dominance in certain refractory minerals supply, before commenting on the impact of macro events, such as the pandemic and the Russia-Ukraine war on mineral supply chains, concluding: “Be careful who you rely on! Be aware of what else could possibly go wrong.”

Devlin considered future issues to impact supply chains as including: “Rogue Russia”, “Maximum Xi Jinping”, water stress, energy stress, and inflation.

He reported that in March at the IMFORMED Mineral Recycling Forum: “I still found that few people seriously thought about these issues.

Maybe they psychologically just don’t dare to. With Covid and Ukraine, I fully expected industry participants to be very aware of what more could go wrong.”

With that, Devlin underlined the significance and potential impact of the ongoing China-Taiwan issue.

China’s minerals supply chain is hostage to limited maritime ocean transport routes. Its maritime export routes are defined by Taiwan – which is in “a highly inconvenient” location since China’s main export shipping lanes pass through the narrow (130km wide) Taiwan Strait, and thus critical to world shipping. Also, narrow passages to either side of Taiwan limit access to the Pacific Ocean.

“Most commentators believe that a disaster is neither certain, nor currently imminent (ie. before 2027), and in the meantime we co-exist in a state of ‘Cold Peace’, or as some call it, ‘Cold war – Version 2’”. said Devlin.

But he warned that any maritime problem would at the very least massively extend Chinese mineral supplier lead times and in the worst case, could terminate supply completely – leading to both very high prices and an overall shortage of product.

Devlin concluded: “Geographical diversity and reliability of the transportation supply chain is fundamental and critical. Customers need to diversify supplies geographically and structurally away from multi or single source Chinese dependence”.

During this “Cold Peace”, companies need to build resilience and reduce excessive dependencies in mineral supply chains from China in any event.

SUPPLY: ITALY | TURKEY | PAKISTAN

Italian olivine for industrial applications including CO2 sequestration

Dr Sabrina Bonetto, Assoc. Professor, Dept. of Earth Sciences, Univ. of Turin, Italy

Dr Sabrina Bonetto started with a review of olivine bearing rocks, olivine mineral groups, and their main industrial applications, before explaining how they can play a major role in our society by capturing CO2.

Olivine bearing rocks are common in a number of belts and complexes worldwide, eg. basalts, ophiolites, magnesites, and “orogenic peridotite massifs” – these were examined in detail.

However, Bonetto noted that many are often concentrated in areas of difficult exploitation, eg. peridotites correspond to important tectonic features, and basalts are concentrated in large bands of volcanic chains.

There has been an increase in studies in Europe and Asia for the identification of peridotite and ultramafic rock for the storage of CO2.

Bonetto briefly described the results of two projects: CO2 injection in peridotitic and basaltic rocks in Iceland in the Carbfix project; and injection into basalt in Washington state, USA.

Turkmag: DBM from Erzurum (eastern Turkey) to the World

Altuğ Çakmur, CFO, Turkmag Madencilik San. Ve Tic. AŞ, Turkey

In a most impassioned and well-illustrated presentation, Altuğ Çakmur outlined the founding and development of Turkmag since 1998, with its modern facilities established in the Askale district of Erzurum in 2006, followed by DBM production in 2011.

Turkmag owns 8 mines, and exploration is expected to extend reserves.

There are three processing plants with a combined capacity of 280,000 tpa. Annual DBM capacity is 100,000 tpa, producing 85-90 grades.

The company employs 400, and is the leading employer in Erzurum.

Pakistan: a new source of natural caustic calcined magnesia

Adnan Essa, Managing Director, Pak Minerals & Refractory Industry, Pakistan

Adnan Esser highlighted some facts about Pakistan, including that it is the world’s third largest milk producer, and hosts a huge dairy industry, ie. a good market for CCM in animal feed.

Esser also noted that the magnesia wallboards market in the MENA region has witnessed significant growth in recent years, another major outlet for CCM.

Pakistan and Afghanistan have large resources of very high grades microcrystalline (cryptocrystalline) magnesite resources, although they are located in remote areas. The company has access to all main Pakistan deposits, owned, and with long term commercial agreements.

Pakistan Magnesite & Refractory Products (PAKMAG), owned by Jawed Akther & Partners, has installed close to Karachi the only processing and CCM calcination plant in Pakistan, and in collaboration with GANMAG, has created a new reliable and competitive CCM source under the PAKMAG Brand.

Two new milling plants can produce and guarantee 325 mesh/45 microns (passing 97%), and 200 mesh/75 microns (passing 90%).

Calcination is done in two gas-fired kilns, with 20,000 tpa capacity. Final CCM grades range 85-97% MgO, with Ni and Fe extremely low.

CARBON CAPTURE & UTILISATION

Developments for magnesia-minerals in carbon capture & sequestration

Pol Knops, Chief Technical Officer, Paebbl, Netherlands

Pol Knops described how the “new market” of carbon capture & sequestration (CCS) has actually been around for a while, but now there was a host of new companies developing technology and prompting new sales for olivine and dunite producers.

The three main CCS concepts were examined along with their respective pros and cons: Geological, Ocean, and Mineralisation.

Future CCS developments are being driven by increased research, CO2 prices, product replacement, and niche products derived from CCS.

Knops outlined Paebbl’s approach: “We turn CO2 into carbonate rock, like nature does. Just a lot faster. Our proprietary process helps accelerate and scale a natural process using heat and pressure.”

The resultant products are carbonate rock and amorphous silica which can supply industrial markets, such as concrete and paper; “But they are CO2-storing and over time CO2-negative. We call it Re-stored Carbon™”. said Knops

Paebbl’s CO2-negative output minerals can be used as functional fillers in a variety of products, eg. construction materials, paper products and polymers.

“We’re doing product development in all of these areas and expecting to launch the first product in 2023.” said Knops.

Scaling ocean carbon dioxide removal with low-carbon magnesium hydroxide

Jason Vallis, VP Operations, & Omar Sadoon, Supply Chain Operations Manager, Planetary Technologies, Canada

Jason Vallis began by reminding of the concerning global warming projections, before explaining about the ocean acidification process and demonstrating that Ocean Alkalinity Enhancement (OAE) is “The planet’s best chance to scale CO2 removals”.

OAE is a process that enables the ocean to safely capture excess atmospheric carbon and store it for 100,000 years. By adding an antacid, such as magnesium hydroxide, to seawater, this neutralises CO2 and reduces harmful ocean acidity.

Planetary Technologies is developing an electrochemical cell to produce low chlorine, low cost alkalinity and Green Hydrogen (producing magnesium hydroxide from ultramafic mine tailings), and an Ocean CDR Tech Platform to deploy that alkalinity safely to remove and store carbon.

The company is in the process of trialling projects using magnesium hydroxide located in Hayle, UK, and in Halifax and Vancouver, Canada.

Vallis concluded: “The time is now. Scaling Ocean CDR means scaling low-carbon alkalinity production, and magnesia is an ideal alkalinity product for OAE. To scale quickly, we need lots of magnesia. We are prepared to be a committed partner in decarbonising magnesium production.”

Transforming CO2 from magnesite production into added-value construction products

Dr. David Konlechner, Owner, KON Chemical Solutions eU, Austria

David Konlechner considered the economic and legal impact of CO2 emissions, and demonstrated how magnesia production was a “low hanging fruit CO2 source.”

It was underlined that there was a need in solving the CO2 challenge together – ie. throughout the source to end user chain – by starting with easy-to-capture CO2, considering logistics, sharing benefits, and with the CO2 source and sink next to each other.

Konlechner then introduced the Carbon4Minerals project which is developing next-generation carbon capture technology to produce saleable mineral products, and several different carbonation processes were described.

In conclusion, Konlechner said: “CO2 will drive industries’ decision-making in the upcoming decades. Technologies grow but a clear and fair framework is needed, starting with low hanging fruits of CO2 from enriched off gas streams. Logistics must be considered in business planning. “

Day 1 Reception, a beautiful evening on the bank of Lake Maggiore, sponsored by RHI Magnesita (team shot right), fine food, and well dressed speakers Peter Holland, Cermatpro, & Glenn “Inter Milan” McIntyre, HarbisonWalker.

REFRACTORIES | JAPAN | BRUCITE

Refractory grade magnesia: market review

Ted Dickson, TAK Industrial Minerals, UK

Ted Dickson covered the traditional consuming markets for refractories, estimating total world consumption at about 35m tonnes, and total consumption of magnesia in refractories some 10m tonnes.

Future trends noted to influence refractory demand include:

- Decarbonisation of steel industry

- Slower growth in steel production, notably in China

- Potential reductions in cement production as alternatives developed to reduce CO2 emissions

- Increase in recycling of refractories

- Reducing supply chain distances

Dickson focused on steel market trends, and observed: “Significant growth in electric steelmaking tripling by 2050, but that still leaves over 1 billion tonnes of steel with blast furnace production of liquid iron and BOF furnaces.”

While BOF steel typically uses 10kg refractories per tonne of steel in Europe, 15kg in China, EAF typically consumes 5kg per tonne of steel.

Therefore, there maybe a reduction in total refractories consumption. But as Dickson pointed out, this might be: “Less of a factor for magnesia, which is used extensively both in EAF and BOF as well as in ladles and tundishes but not in liquid iron production or transport.”

Regarding the cement sector, Dickson said that if cement is replaced by low carbon alternatives, consumption of all refractories including magnesia will decline as cement production declines.

Japan MgO market update | Thermal conductive MgO filler | MgO approaches for the environment market

Kazuaki Hamada, Director, Shotaro Hida, Assistant Manager, Tokyo Sales Section Magnesia Division, Isamu Fujikawa, Marketing & Planning Dept. Magnesia Div., Ube Material Industries Ltd, Japan

As has become a very professional and entertaining tradition at MagForum, Ube presented another well structured presentation delivered by a team of expert speakers.

The presentation covered a Japanese magnesia market update, features of MgO filler and examples of application to electric vehicles, and a new challenge for environmental contributions by MgO.

The latter included: improved rust prevention performance of lead and chromium-free anti-corrosion paint for steel bridges; decreasing the waste (of sand) from circulating fluidised bed boiler; and plant immunity-inducing agrichemical for tomato wilt disease.

Hamada provided a review of Japan’s steel and refractory trends, including magnesia trade and Ube magnesia sales. Refractory production recovered somewhat from the 2020 low during the pandemic, from 862,000 tonnes to 949,000 tonnes in 2022, but not yet back to the high of just over 1m tonnes in 2018.

Ube’s DBM sales marked a similar pattern, falling in 2020 by 27% from 2018, recovering up 6% in 2022. It was noted that magnesium hydroxide for FGD sales were unaffected by the pandemic.

Fujikawa explained the benefits of Ube’s MgO as a thermal conductive filler in electronic devices and components of EVs, eg. battery, engine control unit, and steering wheel heater.

Hida outlined how MgO in coatings on steel on bridges can provide an anti-corrosion property.

Brucite, huntite, & hydromagnesite: sources & supply

Dr Ian Wilson, Ian Wilson Consultancy, UK

Ian Wilson was unable to attend MagForum 2023 owing to illness, and it greatly saddens us to report that he died shortly after the event in early June.

Without a doubt, Ian was one of the legendary geologists and communicators of the industrial minerals world, and had conducted much work in evaluating magnesite and other magnesia mineral deposits worldwide, and was a regular participant at MagForum (see Tribute to Ian Wilson).

Professional to the end, Ian still found time to send in his presentation for the conference! As per usual, a detailed presentation with all you need to know about brucite, huntite, and hydromagnesite…plus squeezing in an illustrated note praising the famous Lanzhou beef noodle dish of Gansu province!

In his stead, without knowledge that it was to be Ian’s swan song, Mike O’Driscoll presented an abbreviated version of his presentation in Baveno.

At MagForum 2022 Noordwijk: Ian in customary full flow presentation mode, and then enjoying repartee with clients and friends from Turkey (l-r: Altuğ Çakmur, Müslüm Karaman, Taha Öksüzogu), and a sundowner with conference chairman Mike O’Driscoll.

HYDROXIDE & SULPHATE | CEMENTS

Magnesium hydroxide & magnesium sulphate: applications review and outlook

Samantha Wietlisbach, Head of Inorganics & Minerals Research & Analysis, S&P Global Commodity Insights, Switzerland

Samantha Wietlisbach presented a very comprehensive review of MDH-magnesium hydroxide (flame retardants, imports and exports, environmental markets) and magnesium sulphate (sources of MgSO4, agricultural markets, plastic markets, ABS).

It was reminded that 86% of magnesium chemicals are derived from magnesite and other hard rock MgO minerals, the remainder from brine, seawater, kieserite, brucite, and other.

In her coverage of MDH markets, Wietlisbach touched on MDH separator coatings in lithium-ion batteries and MDH use in maritime FGD scrubber units.

Key takeaways were:

- Environmental applications for Mg(OH)2 are experiencing good growth, dependent somewhat on caustic price.

- MDH flame retardants are still a niche market for wire and cable, but other Mg mineral FR are a cheap alternative for roofing compounds

- Magnesium sulphate demand for palm oil plantations is levelling off, but there is growth in ABS production >6% per year over the next few years

Magnesia cements: review & recent research & development

Dr Colum McCague, Technical Manager: MPA Cement, Mineral Products Association, UK

Colum McCague took the audience through the basics of Portland and magnesia cements, before going into detail in the various magnesia-bearing cements: magnesium phosphate, magnesium oxychloride (Sorel), magnesium silicate, magnesium carbonate, carbonated olivine (as supplementary cementitious material – SCM), and silica (SCM).

In essence, magnesia cements maybe described as a suitably proportioned and homogeneously prepared mixture of MgO (CCM, DBM or FM) and, if required, other materials (eg. phosphates, chlorides, PC).

Portland based cements dominate the market due to availability of raw materials, versatility of applications, well-established production process.

However, magnesia cements are produced for niche applications eg. rapid repair of concrete structures, 3D printing, flooring, waste stabilisation.

Carbonated magnesia cements are gaining popularity due to their ability to sequester CO2, and olivine is attracting interest as a material for capturing CO2 with useful supplementary cementitious materials as by-products.

Magnesium oxide in the dental investment market

Peter Holland, Managing Director, Cermatpro Ltd, UK

Rounding off the conference, and aptly before lunch, Peter Holland highlighted the use of caustic calcined and fused magnesia used in the ultra-niche low volume, but high value market of dental cements.

A series of entertaining slides and a very useful video showed the intricate investment preparation and process, and just how important, and in demand, are nice-teeth smiles!

Holland acknowledged that the market sector was extremely specialist, but with very few suppliers involved. Magnesia specifications required 96.5-99.7% MgO grades, with very low boron and sulphur contents, and the market size could be a little as 500 tpa.

Thanks & hope to see you at MagForum 2024!

We are indebted to the support and participation of our sponsors Lehmann&Voss&Co., RHI Magnesita, CREMER ERZKONTOR, and Nuova Cives, exhibitors FLSchmidt, REDWAVE, and TOMRA Mining, supporting partners, speakers, and delegates for making MagForum 2023 such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience next year…in Greece! – MagForum 2024, The Pomegranate Wellness Spa Hotel, Halkidiki, Greece, 13-15 May 2024 – Full Details Here.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 [email protected]

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 [email protected]

Free MagForum 2023 Summary Slide Deck Download here

Missed attending the Forum?

A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 [email protected]

ANNOUNCING…

Excellent informative Magforum2023