Drivers, factors, keys to success

Following on from our earlier analysis of the underlying principles of the industrial minerals business (see Part 1: Overview, structure & key takeaways), here we discover what makes it tick, by highlighting the industry’s drivers, influencing factors, and keys to success.

All these aspects of the market and more will discussed and examined at the upcoming IMFORMED Rendezvous, Les Jardins du Marais, Paris, 8-10 April 2019.

An outstanding programme and invaluable networking opportunities will provide all you need to get a handle on the future and fundamentals of the industrial minerals business, whether an established player or newcomer checking out the market space. Register now online here or contact Ismene [email protected] | T: +44 (0)7905 771 494

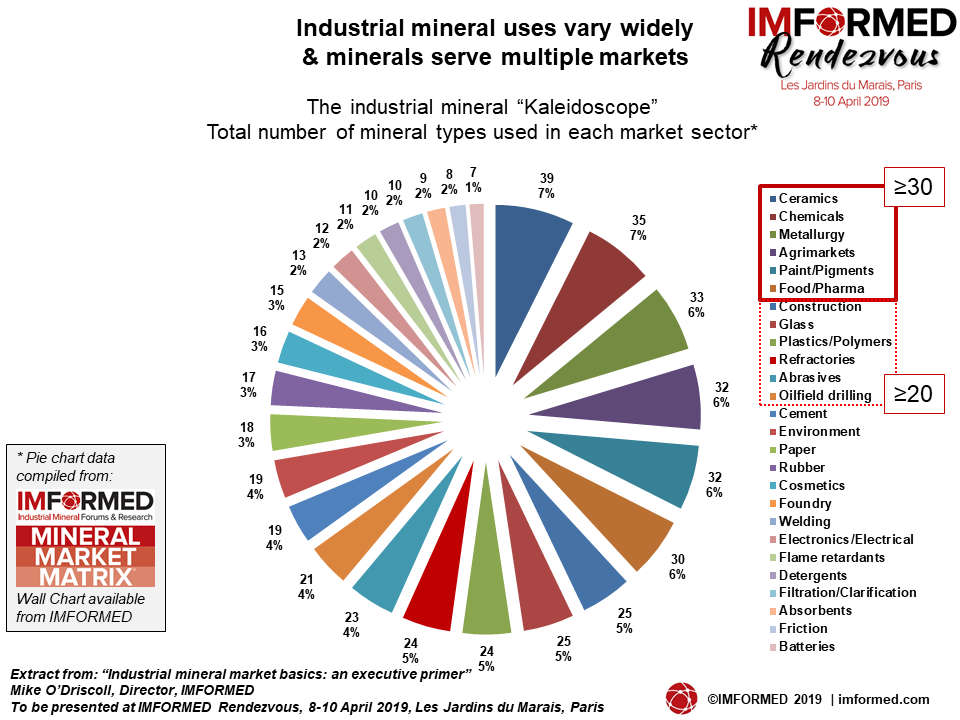

Industrial minerals are used in a wide variety of applications, and each mineral serves multiple markets with tailor-made grades.

Is it therefore possible to identify key market drivers, influences, and requirements to lead an industrial minerals project to success?

IMFORMED Rendezvous Keynotes include:

Mineral innovations for extreme environments

Chris Parr, S&T Director, Refractories, Abrasives & Construction, Imerys, France

The consumer’s viewpoint: taking innovation to 1,200°C and beyond

Gustavo Franco, Chief Sales Officer, RHI Magnesita, Austria

Trends, challenges, and issues for the industry

Catherine Delfaux, President, IMA-Europe & Provençale SA, France

The investment and financing climate in industrial minerals: challenges & opportunities – a private equity perspective

Ryan Bennett, Partner, Senior Advisor, Resource Capital Funds, USA

Critical, strategic and industrial – the minerals leading the next production revolution

Dr Richard Flook, Managing Director, Mosman Resources Ltd, Australia

Industrial mineral processing evolution and trends

Dietmar Alber, Business Development Director, Minerals & Metals Division, Hosokawa Alpine AG, Germany

The evolving role of the industrial minerals trader for tomorrow’s markets

Alex Aizpurua, Raw Materials Business Unit Director, Midegasa, Spain

Mineral logistics developments & innovations

Dave Chanet, Commercial Manager, Control Union, Belgium

Key drivers & influences

To have any value, and any potential for development, an industrial mineral source must be able to economically deliver an acceptable product to a market in demand.

As indicated in the above chart, industrial minerals are absolutely essential in the manufacturing of all kinds of products. Thus, the performance of the mineral consuming market drives industrial mineral demand.

In a nutshell: no market = no mineral demand = no mineral development.

Broadly speaking, industrial mineral market trends are shaped by:

A. Primary demand drivers which impact the overall market performance in the world, country or region, including:

• Economy

• Population

• Development

• Urbanisation

• Geopolitics/International relations

B. Key influencing factors, but specific to the trade of certain minerals, markets, and regions, including:

• Resource to market proximity – Logistics

• Specific market demand trends – new & existing

• Limited world resource distribution/”Criticality” of minerals

• Overreliance on imports

• China

• Pricing

• World events

Each of these points can merit an article or conference on their own. However, here we just want to show a few examples.

Most industrial mineral markets follow GDP performance which is usually a reliable indicator of market outlook.

Infrastructure development and urbanisation are primary drivers for industrial mineral markets, hence the growth in demand in China and India (check out Indian Minerals & Markets Forum 2019, 18-20 November 2019, Mumbai), and other Asian countries.

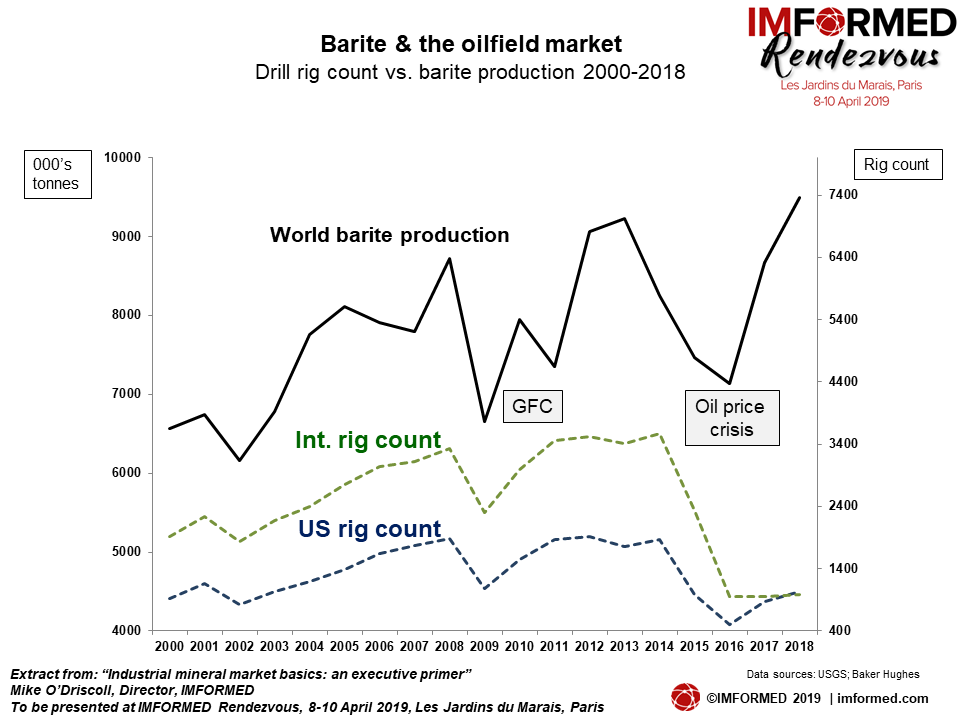

A classic example of market performance mirroring mineral demand can be seen in the use of minerals in the oilfield sector, such as frac sand as a proppant in hydraulic fracturing and barite as a weighting agent in drilling muds (its major application, latest trends and outlook to be discussed at Oilfield Minerals & Markets Forum Houston 2019, 10-12 June).

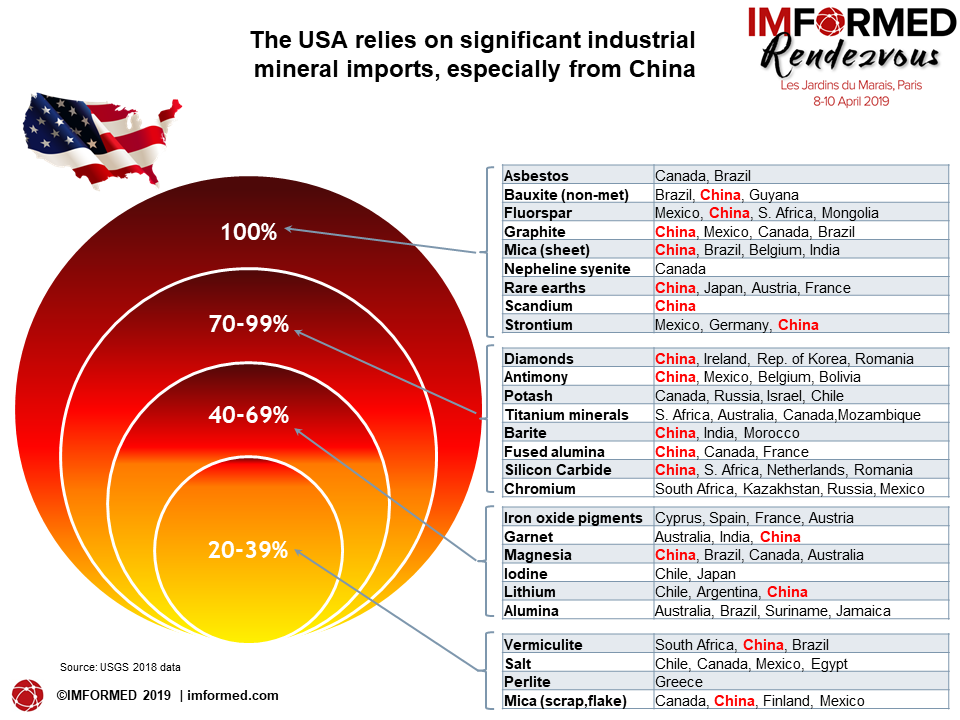

International trade relations can also have a major impact on industrial minerals trade, as evidenced by the ongoing US-China trade talks and recent import tariff legislation.

For example, after industry lobbying, crucially for the US oilfield industry, barite was excluded; and for the US refractories industry, the following refractory minerals were excluded from imposed new tariffs: bauxite, brown fused alumina, graphite, magnesite (fused, caustic and dead burned), silicon carbide, tabular alumina.

However, most other minerals remained on the list, including andalusite, chamotte, dolomite, fused silica, kaolin, mullite, quartzite, sillimanite, zircon.

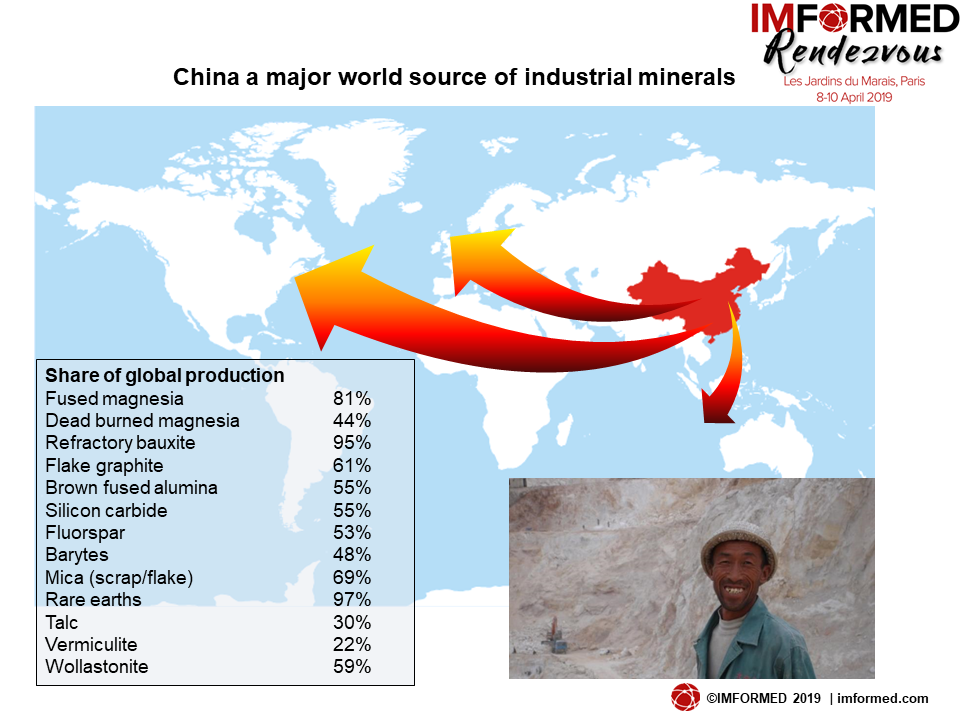

Import reliance & China

A look at the imports of industrial minerals by the USA and Europe usefully serves to illustrate the influencing factors of not just international trade relations, but the reliance (and increasingly an issue, the overreliance, which enhances the mineral’s “criticality”) of these regions on limited sources of mineral supply, notably China.

The exercise also underlines the importance of logistics to ensure mineral supply reaches its intended markets.

Already well into 2019, China’s mineral supply squeeze continues to challenge world refractory (and other) producers, and from most indications 2019 Chinese Year of the Pig is likely to live up to its name.

A range of factors arising in 2017 and spilling into 2018 significantly compounded the shortage of key refractory (and other) mineral exports from China vital to the world’s refractory manufacturing sector (for a review please see China’s refractory mineral supply – a New World: review & outlook; and In the Media).

The situation created real problems for refractory manufacturers requiring the likes of dead burned magnesia (DBM), fused magnesia (FM), calcined bauxite, graphite, and fused alumina.

China is well known as the world’s primary source of many industrial minerals. What is fundamental to understand is that despite past supply bottlenecks occurring over the last two decades, these were short-lived. This time it’s serious, it is not a cyclical phase. The fall-out is unlikely to be temporary for many Chinese mineral and end manufacturing operations.

Unfortunately for the global refractories industry, where certain regions, especially India, have relied almost entirely on raw material supply from China, the crisis continues apace into 2019 and the world market must react and adapt to the new world of Chinese refractory mineral supply.

Certainly, some of the larger western refractory producers will seek to do what they can to secure and “stabilise” as much as possible mineral supply from their favoured sources in China – and Refratechnik is demonstrating one way of achieving this with its joint venture to develop a 100,000 tpa DBM flotation plant at Pailou, Haicheng, partnering with Haicheng Guotian Mining and Yingkou Jinlong Refractories.

However, the situation in China has boosted prospects for alternative raw material sources outside China, sparking both expansions at existing operations as well as development of new projects.

New industrial mineral developments

There are a number of exciting new industrial mineral projects underway:

First Bauxite Corp., funded by Resource Capital Funds, continues to develop its Bonasika, Guyana bauxite deposit for refractories and ceramic proppants. Mine and wash plant construction is underway, and expected on-stream end-2019. The company is already shipping raw ore to ARCIRESA, Oviedo, Spain for calcination and sales.

Bautek Minerais Industriais is also developing a refractory bauxite deposit, in Goiânia, Brazil. The company is looking to produce 1m tonnes of raw bauxite, feeding a milling plant in Barro Alto, GO; and 3,000 tpm calcination plant in Jundiaí, SP. Another 6,000 tpm calcination plant is planned in 2020 at Barro.

Australian Bauxite Ltd is evaluating a refractory bauxite deposit at Penrose, NSW, Australia, and has already commenced mining at its Bald Hill bauxite mine in Tasmania, selling fertiliser grade bauxite, with cement grade shipments planned during Q2 2019.

Regarding magnesia developments these include expansions and upgrades at: Turkmag, Turkey (Cihan Group), Askale, eastern Anatolia – a second rotary kiln 2019-20; Demireller Mining AŞ, Turkey – purchased 90,000 tpa rotary kiln and plans DBM production; JORMAG (Manaseer Group), Al-Safi, Jordan – recent start-up of CCM and planning DBM production.

Greenfield magnesia projects include AusMag (Korab Resources), Winchester, NT, Australia; Thessally Resources, Huandot, NT, Australia; Leigh Creek Magnesite Pty Ltd, South Australia; EcoMag, Western Australia; MGX Minerals Inc., Driftwood Creek Magnesium Project, Brisco, BC, Canada; Karnalyte Resources, Wynyard Potash Project, SK, Canada; Magnésie du Rif, Boudkek, Morocco (these and other magnesia market developments will be covered at MagForum 2019, 13-15 May 2019, Bilbao).

SepFluor’s mine concentrator nearing completion in January 2019; the Nokeng Fluorspar Mine is looking to come on-stream this year producing 180,000 tpa acidspar, 30,000 tpa metspar. Courtesy SepFluor

SepFluor has almost completed construction of its Nokeng Fluorspar Mine in South Africa and official handover of the mine from the EPC contractor is expected to take place early April 2019. Total acidspar production for 2019 is estimated at 106,000 tonnes and 62,000 tonnes of the 40% forward sales at fixed pricing has been committed in FY 2019 (SepFluor is Welcome Reception sponsor to Fluorine Forum 2019, 21-23 October, Prague).

Canada Fluorspar is apparently looking to 2019 for a ramp-up in production. The company appointed new CEO Bill Dobbs in August 2018. Early August 2018 saw its first commercial shipment of 4,700 tonnes leave Marystown port, Newfoundland, for Houston, USA, while recent tests have been conducted by consumers in Europe.

ALCORE Ltd, a wholly owned subsidiary of Australian Bauxite Ltd, is developing a plant to produce aluminium fluoride for Australasian aluminium smelters. Most recently the ALCORE laboratory was completed to lock-up stage ahead of schedule and well within budget, at Berkeley Vale, NSW. Funding is in place to complete Stage 1, followed by up to five months of production.

On 4 February 2019, Hudson Resources Inc. announced that commissioning had been completed and production ramp-up commenced at its White Mountain Anorthosite mine in Greenland. The calcium feldspar mine is permitted for 50 years and Hudson is expecting to start shipments to US glass, filler, and coatings customers via Charleston, South Carolina. Anorthosite has potential as a replacement source of alumina, and has already been developed as feedstock raw material for mineral wool production by Paroc in Finland (acquired by Owens Corning early 2018).

Hudson Resources has just started ramp-up to production at its 27m tonne anorthosite resource in Greenland; Hudson has a 10 year supply agreement with one of the world leaders in E-Glass fibre glass production. Courtesy Hudson Resources

Keys to success

Each of the above projects will have been, and perhaps still are undergoing required due diligence to bring them to fruition. Imperative to an industrial mineral project’s success are the following factors:

• Reserves: High quality, sufficient volume

• Marketable grade: Mineral must meet market specifications

• Consistency: In grade spec. and volume availability

• Market demand: Essential to have market & knowledge of it

• Financing: Funding for all aspects of project

• Processing: Ensure correct and complete process route

• Logistics: Secure optimum logistics system & routes

• Flexibility: Awareness to diversify products & markets

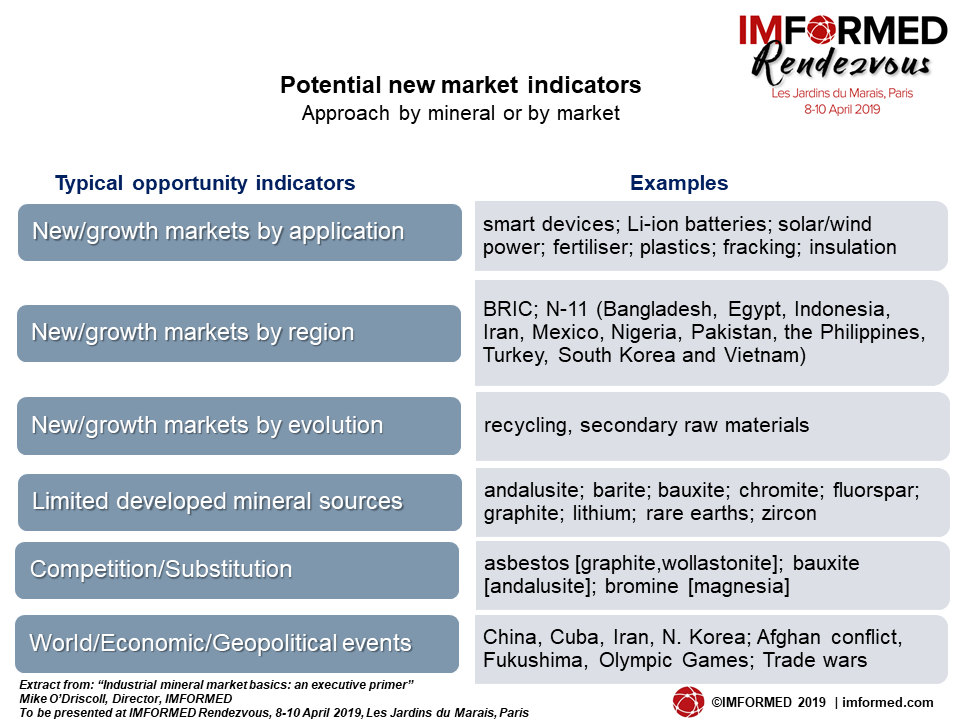

New markets investment

Seeking new markets and looking to diversify are the essential mantras of the industrial minerals producer.

The approach to this maybe by mineral, market, or by geography – each influenced by factors described earlier.

A great example of new/growth markets by application is the evolution of lithium-ion batteries and smart devices. Here industrial minerals are in demand in several vital components and new generation battery manufacturers are already placing high demands on raw material supply.

“Those who control these critical raw materials and those who possess the manufacturing and processing know how, will hold the balance of industrial power in the 21st century auto and energy storage industries.” Simon Moores, Managing Director, Benchmark Mineral Intelligence at a recent US Senate Hearing. Courtesy US Senate

At an outlook hearing for the US Senate Committee on Energy and Natural Resources on 5 February 2019, Simon Moores, Managing Director, Benchmark Mineral Intelligence stated: “We are in the midst of a Global Battery Arms Race in which the US is presently a bystander.”

The advent of electric vehicles (EVs) and the emergence of battery energy storage has sparked a wave of LIB megafactories being built (of 70, only 1 is in the US, and more than half in China).

“The supply of lithium, cobalt, nickel and manganese to produce the cathode for these cells, alongside graphite to produce battery anodes, needs to rapidly evolve for the 21st century. However, the scaling up of these chemically engineered materials, which are not commodities, is a major challenge for the industry.” said Moores (listen to Simon Moores talk about “Battery evolution & supply chain – what does it mean for industrial minerals?” at the IMFORMED Rendezvous, 8-10 April 2019, Paris).

And regarding industrial mineral input to LIB it’s not just lithium in the cathode and graphite in the anode:

• High purity alumina (HPA; sourced from bauxite, aluminas, aluminous clays) is used in surface coatings for LIB separators and electrodes (speciality alumina producer Alteo has recently joint ventured with Ginet Group for China’s battery market to form Alteo-Ginet (Suzhou) Lithium Battery Material Technology; five companies are developing kaolin sources in Australia to produce HPA).

• Fluorinated electrolytes (sourced from fluorspar via HF) are used to achieve higher voltage and energy density

• Flame retardant coatings (using aluminatrihydrate (ATH) sourced from bauxite; magnesium hydroxide (MDH) sourced from magnesia) are required fro LIB battery cell packs in EVs and other domestic appliances

The material is just EXCELLENT

I am using it as text material for class work of my students at Mexico City

Many thanks Armando, that is great to hear. Let me know if you need any of the slides in ppt. Kind regards, Mike

Excellent material and mind blowing facts. Could you please share the ppt? Thanks.