Since its restructuring and new management announced in January 2021, we have been reporting on the evolution of Essen-based global mineral distributor Cofermin Group.

In this latest follow-up article we focus on the management and role of Cofermin’s chromite division, Cofermin Chrome, established in 2015.

Title Image Chromite Horizons: One of South Africa’s leading sources of speciality grade chromite is Tharisa Minerals’ shallow open pit mine situated on the Western Limb of the Bushveld Igneous Complex near Rustenburg, North West province. In 2021 Tharisa mined 5.38m tonnes of chromite ore (up 8.2% on 2020) which yielded a total of 1.5m tonnes chrome concentrates (up 12%), with speciality grades (chemical, foundry) making up 24.2% at 364,600 tonnes. Courtesy Tharisa

The Cofermin Group handles a wide range of industrial minerals used in many different end user markets. Certain of these minerals provide more of a challenge in sourcing and trading than others, and chromite definitely falls into this category.

Chromite, or “chrome” ore, as the traded ore is commercially termed, is one of those industrial minerals which has a relatively limited range of uses, but nevertheless is an essential ingredient for important primary manufacturing sectors: ferroalloys and steel, foundry sands, refractories, and chemicals (see Chromite Capsule below).

These mineral consuming markets are also served by other Cofermin mineral products, so there is a good synergy here for the group.

However, another important characteristic of chromite is that, despite a clearly global consumer market, the choice of worldwide commercially developed chromite sources is extremely limited.

Therefore, with availability and prices highly influenced by end use market performances as well as the prevailing production capacity (among other impacting factors such as logistics), the chromite market is especially challenging.

At the helm of Cofermin Chrome, Managing Directors: Tim Scholten (left) and Michael Neeb (right).

But all this is nothing that recently appointed Managing Director Tim Scholten and his team at Cofermin Chrome cannot handle.

Indeed, they are also able to draw on the experience of “King of Chromite” Cofermin veteran, Bernhard Krüger, who celebrated his 60th work-anniversary in May this year (see Bernhard Krüger, “King of Chromite”, celebrates his 60th work-anniversary at the sharp end).

Tim Scholten joined Cofermin as Head of Sales for Cofermin Chrome in September 2020, after working as raw materials trader at a large corporation for several years.

Somewhat in keeping with the chromite market, the period during which he started at Cofermin was highly turbulent as the Covid-19 pandemic was moving towards one of its high points.

Since then matters have not become that much more relaxed, rather the opposite. In April this year Tim was promoted to the position of Managing Director.

From the 1 January 2021 all four founding partners of Cofermin (Ralf Ossen, Dr. Pawel Golak, Bernhard Krüger and Tim Geldmacher) moved onto the Group’s newly established Supervisory Board.

Their managerial responsibilities and duties have been transferred to their successors, the new management team comprising: Bettina Bohnen (Commercial & Risk Management, HR and Organisation), Michael Neeb (Operations, Sales and IT), Andreas Pabst (Strategy, Business Development and Marketing), as managing directors, and Jens Massenberg, as the Group’s Chief Financial Officer (Finance, Controlling and Compliance).

For details and more on the Cofermin Group please see earlier articles:

Cofermin evolves: talkin’ ’bout a new generation

M!NERALS now one of Europe’s largest industrial mineral suppliers

Bernhard Krüger, “King of Chromite”, celebrates his 60th work-anniversary at the sharp end

“Beyond Commodities”: Successful start for Cofermin’s new magnesia arm IMagine

Cofermin has the right “chemistry”

IMFORMED interviewed Tim Scholten at Cofermin Chrome on its role & outlook

What was the rationale behind the formation of Cofermin Chrome in 2015?

We decided to consolidate various chrome sourcing, distribution and strategic marketing activities in the Group into one entity.

Do you have any physical assets, such as processing/storage etc.?

We work with dedicated partners, both in Europe and abroad to dry, dedust and re-bag as per individual customer requirements.

What are your key business activities? Any recent developments/plans?

Sale of Chromite sand and other chrome related products such as lumpy and concentrate. Due to the changing environment since the beginning of the pandemic we have to adapt to new developments and changes quickly (logistics etc.).

What is the typical annual volume and value of chrome products handled?

When looking at our entire portfolio, sourcing from various countries and considering all the different grades and qualities we deal with, then we typically distribute >50,000 tpa.

What are the main chrome products that you handle, main sources, and their key markets (type & geography)?

Several types of chromite sand, mainly from South Africa. Furthermore we have also been sourcing lumpy chrome from Pakistan and concentrates, eg. from Zimbabwe, Pakistan, Turkey for quite sometime now.

Chromite sand is mainly supplied into the foundry and refractory industry and lumpy as well as concentrates are supplied into the metallurgy, refractory and chemical industry.

What are the key market drivers of the business? How do they influence supply/demand factors?

Demand from the foundry and refractory industry and especially demand from China.

Strong demand from China pulls availability out of the market and tends to drive prices up in markets outside of China.

What are the main influencing factors and challenges for the chrome business right now, and how has/is Cofermin responding to them?

Since the beginning of the pandemic, supply chains have been interrupted and logistics from South Africa have become much more difficult.

That changes the business model in that you have to plan much more ahead. Current times are very dynamic and parameters can change from day to day.

Due to the changes in the market, the logistics and supply situation, we have adapted our stock management which better enables us to meet our customers’ demands.

How do you see the near and medium term outlook for the chrome market?

The current situation is unprecedented, and anyone who is trying to sell you predictions can unfortunately not be taken seriously at this stage – the situation is so fluid.

At this point we emphasise short-term flexibility to be able to respond to changes. Unlike many large corporates in our industry who are busy doing their budget planning for 2023, we have consciously delayed this process for the time being due to the opaqueness of the global geo-political and geo-economic situation.

Chromite Capsule

The availability of chromite (or chrome ore) for non-metallurgical uses is in essence hostage to the fortunes of the ferrochrome and stainless steel industries.

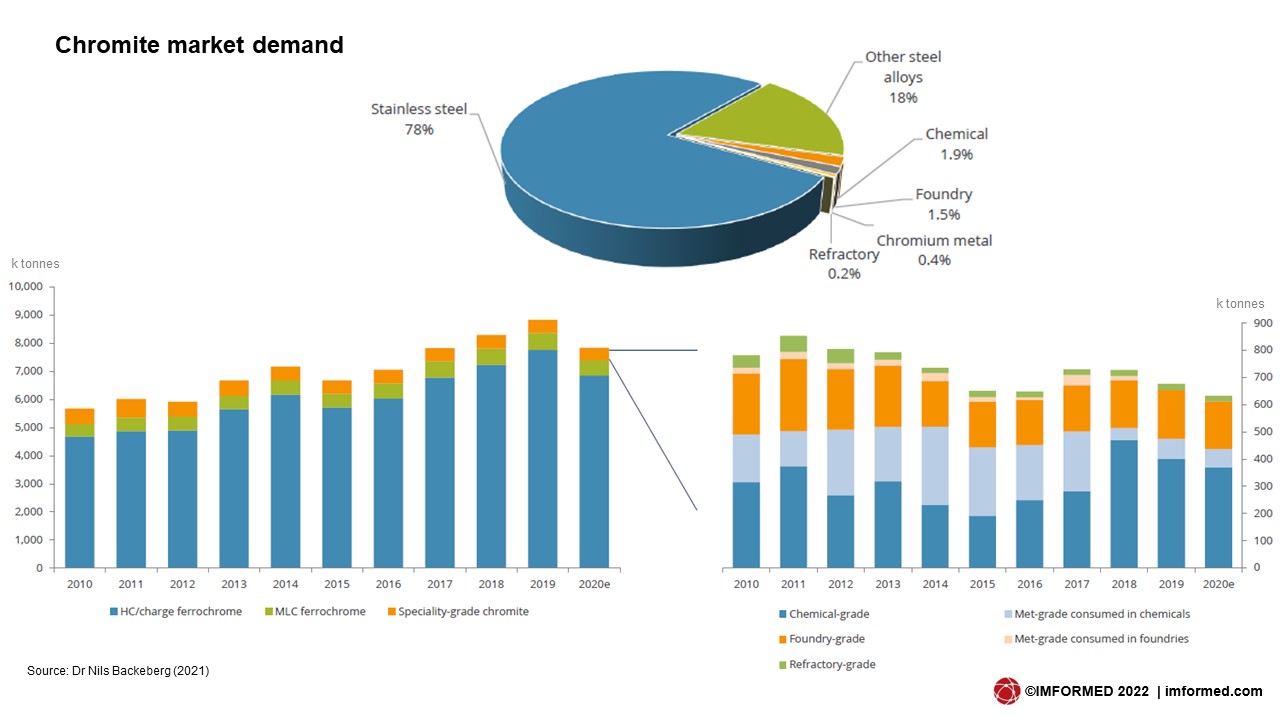

These are the two primary drivers of chromite demand, being the intermediate product and end product, respectively, consuming some 96% of chromite production, and mainly metallurgical grade chromite (40-42% Cr2O3).

Ferrochrome, as High Charge FeCr and Charge Cr, is consumed in steelmaking: 78% stainless steel, 18% alloyed steels. About 0.4% is consumed in chrome metal production.

The remaining 4% or so of world chromite production is composed of higher grade chromite (45-47% Cr2O3), the so-called “special grades”, consumed by three main non-metallurgical markets: chemical, 1.9%, foundry, 1.5%, and refractories, 0.2%.

The largest non-metallurgical market, chemicals, maybe further sub-divided into: leather tanning, 32%, plating, 32%, pigments, 32%, chrome metal, 20%, and wood treatment, 9%.

South Africa is the world’s dominant producer and exporter of chromite, and its large resources of chromite are located in the western and predominantly in the eastern limbs of the Bushveld Igneous Complex (BIC).

The country hosts 70% of the world’s total chromite reserves, which total 7,600 million tonnes. Chromite is mined primarily from the UG2, MG and LG chromite seams.

Other (non-met. grade) chromite sources include: Oman, Pakistan, Philippines, Zimbabwe.

If you enjoyed reading this article…

Like the idea of an objective, well-written and researched article about your company or products?

Perhaps you are pursuing new markets, launching new products and innovations, or just need some profile as you recharge or emerge onto the market?

Let IMFORMED’s experience in writing and reach in markets assist your business going forward.

Please feel free to discuss ideas, options, needs.

Contact: Mike O’Driscoll, Director, IMFORMED

mike@imformed.com

T: +44 (0)1372 450 652; M: +44 (0)7985 986255