Testing times sustain market turmoil, but outlook positive

2020-21 was all about coping with COVID-19 and responding to the pandemic’s ramifications and the subsequent recovering market demand. While 2021-22 has seen a continuation of this trend, also thrown into the mix has been the tragic Russia-Ukraine conflict which has compounded the situation further.

In short, the industrial minerals industry is experiencing another period of intense challenge faced with shortages in supply availability combined with ongoing logistical issues.

Title image Green mining in Greece Grecian Magnesite operates fully integrated mining operations in Greece and Turkey with production capacity of 200,000 tpa CCM and DBM; pictured here is its plant complex at Halkidiki, north-east Greece; in response to market demand the company has recently developed a new green underground mine at Koutzi, Evia, and launched a new dunite-based product for refractory and other markets. Courtesy Grecian Magnesite

But, on the positive side, demand remains strong, and growth markets, particularly for “critical raw materials” appear to be soaring, while prospects for industrial mineral development are receiving a boost. All the latter of course, are tempered by the increasing development and adoption of environmental technology and protocols in decarbonisation and energy conservation.

IMFORMED is once again both honoured and delighted to be invited to write the introduction to Mining Engineering’s annual review of industrial minerals in its July 2022 issue.

Bill Gleason, Editor, ME writes: “Mike O’Driscoll, director and cofounder of IMFORMED Industrial Mineral Forums and Research provides a great overview of the sector, writing in part, ‘the industrial minerals industry is experiencing another period of intense challenge, faced with shortages in supply availability combined with ongoing logistical issues. But on the positive side, demand remains strong and growth markets, particularly for critical raw minerals, appear to be soaring.’ ”

Russia-Ukraine War: ceramic clay impact

At the time of writing we are on Day 110 since Russia invaded Ukraine with sadly still no end in sight. As a result, industrial mineral supply chains and markets in Europe continue facing widespread disruption and uncertainty.

A significant knock-on effect has been severe disruption to an already stressed logistics sector across Europe and beyond, experiencing increasing shipping prices.

The ramifications of the conflict have impacted several important industrial mineral markets. The country hosts a range of important industrial mineral resources and has long been an important consumer of minerals for its refractories, steel, glass, cement and ceramics manufacturing (for more details see in-depth report: Industrial mineral supply disruption: Ukraine crisis).

The stand-out minerals which are produced and exported in volume are kaolin (particularly the important ceramic ball clays of the Donbas region), the titanium minerals ilmenite and rutile, and zircon – one of Europe’s few sources of these minerals.

There is also noteworthy production of fused alumina, silicon carbide (centred in Zaporizhzhia), graphite (Zavallya), and kyanite (by-product of titanium-mineral mining at Vilnohirsk) – these minerals are of great interest to the refractories market, and for graphite, also the emerging lithium-ion battery market, though their export volumes have been at small to moderate scale.

Of all the minerals produced in Ukraine, it is the ceramic clay supply sector which is going to have the most severe impact on European (and perhaps other) consumers.

VESCO is Ukraine’s largest ceramic ball clay producer, which under normal circumstances has some 900,000 tonnes of clay grades available; VESCO sold 2.4m tonnes of clay in 2020, exporting about 84% to 18 countries. The largest consumers were ceramic tile manufacturers in Spain, accounting for >26%; this market sector, dependent on these white-firing clays, is now urgently assessing alternative options. Courtesy VESCO

Ukraine is one of the world’s leading suppliers of high quality ceramic clays, also called ball clays. The majority of deposits (some 360m tonnes of kaolinite resources) are concentrated in the Donbas region, near Donetsk, eastern Ukraine. These clays are highly suitable for porcelain tile production as they exhibit high plasticity, high whiteness, and low water absorption after firing.

Some of Europe’s leading ceramic mineral supply groups have established operating subsidiaries in the Ukrainian clay sector, such as Sibelco, Imerys, AKW.

Although USGS data indicates kaolin production in Ukraine to be 1.6m tonnes, the country’s ball clay production has been reported at levels of 4m tpa.

Indeed, almost 5m tonnes of ball clay was exported by Ukraine in 2019, ranking as the world no.1 accounting for 81% of all such exports.

The main export destinations, mostly through the port of Mariupol, but also via Olbia and Mykolaiv ports, are the dominant ceramic tile producing centres of Spain and Italy, and also Poland and Turkey.

Clearly, and of critical concern for the tile market, ceramic tile manufacturers in these countries have now had their supply of unique ball clay terminated for the foreseeable future.

In Spain for example, recent years saw ceramic tile manufacturing transition from mostly red tile bodies, using domestic clays, to white tile bodies, significantly depending on imported white-firing ball clays mainly from Ukraine (70% of requirements).

With Ukraine clay stocks in EU tile plants anticipated to run out in June, the market is scrambling to find alternative clay sources.

And just a footnote: just two days before the 24 February 2022 Russian invasion, the USGS released its updated (from 2018) “2022 US Critical Minerals List”. Potash was one of the industrial minerals removed from the list. Almost 40% of world potash production originates from Russia (20%) and Belarus (17%) – thus many consumers in Europe, MENA and elsewhere are now impacted by supply constraints.

Interestingly, potash also does not make the EU’s latest Critical Raw Materials List.

This simply underlines the important caveat advised by Dr Steven M. Fortier, Director, USGS National Minerals Information Center: “Mineral criticality is not static, but changes over time.”

China: ongoing supply disruption

While the COVID-19 pandemic may have eased in parts of the world, China remains affected, mainly owing to the government zero-tolerance policy which enforces immediate lockdowns in response to any rise in cases.

Unsurprisingly, this has led to widespread disruption in mineral production and exports to world markets owing to continuing intermittent mine, plant, and port lockdowns.

In addition, now in the second year of China’s 14th Five-Year Plan (2021-2025), President Xi Jinping’s anti-pollution drive moves on unabated, with ongoing resource conservation, environmental controls to meet government goals, resulting in mine/plant inspections, disruptions, and temporary and permanent shutdowns.

The now annual Oct-March Winter Shutdown is a major disruption to all energy-intensive operations, eg. all mineral processing, calcination, and fusion.

For example, during January-mid-March 2022, plants within 600km of Beijing were required to close, forcing mineral processors at the important export port of Tianjin to work only at night, and no production, just bagging.

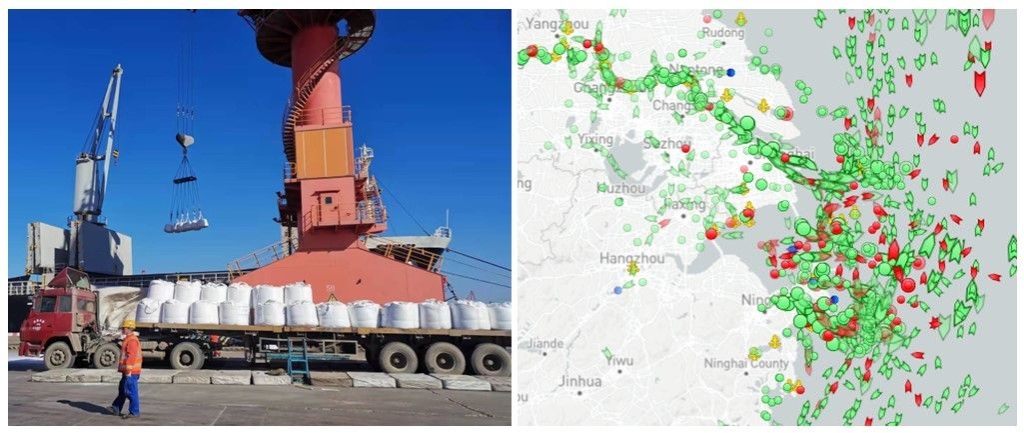

Congestion and interruption to activities at Chinese ports has had a significant impact on mineral export flows from China; (left) refractory mineral exports being loaded; (right) port congestion in the Shanghai/Ningbo area 2 June 2022; on 28 April 2022 Windward stated “24.3% of all container vessels waiting outside ports globally are waiting outside China ports.” Courtesy: Refmin; Marine Traffic

The upshot of the above is that Chinese mineral output and export flow has been interrupted as ports have been incredibly congested, and at time of writing were just starting to open up.

The suspension of port activities has also led to poor loading management (causing delays at Western discharge ports), unsuitable vessels, and extended voyage times of 140+ days. In April 2022, it was reported that 24.3% of all container vessels waiting outside ports globally were waiting outside China ports.

There is no doubt that China will remain an important force in industrial mineral supply to world markets, and its domestic mining sector is busy reforming and modernising with green mining and upgrading plants with new processing technology.

But maybe we are seeing the end game for easy low cost Chinese mineral supply. The adverse factors of the last few years is shaping a future likely to see more of a balanced consumption of minerals between China and non-China sources, as global mineral consumers and traders finally appreciate the risks associated with having all their supply eggs in the one China supply basket.

Mineral development boom

So, a positive consequence of the China situation has been the lease of life it has given to industrial mineral project developers outside China, especially those minerals for which China was normally dominant in supply.

In the magnesia market, world leader RHI Magnesita has committed to expanding investment and operations in Brazil, as well as creating a dolomite production hub in Europe. Other players in Brazil, IBAR Nordeste and Magnesium do Brasil are also looking to recoup market share with expansions, while Grecian Magnesite has opened a new underground mine.

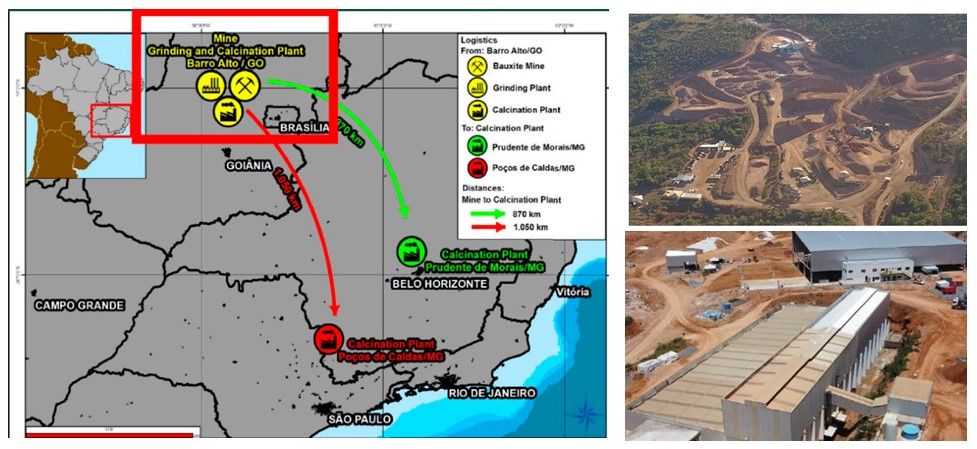

Non-metallurgical bauxite supply, almost monopolised by China, is now seeing two new sources come on-stream: First Bauxite LLC, Guyana (strengthened by its recent acquisition of US Ceramics providing calcination plants; for details see First Bauxite acquires US calcination plants) and Bautek Minerais Industriais Ltda, Brazil (for details see New dawn for Brazilian bauxite).

The planned mine and plant footprint for Bautek Minerais Industriais Ltda: (top right) Bautek’s bauxite is sourced from TGM’s high grade bauxite deposit at Barro Alto, Goiás hosting 200m tonnes of proved reserves grading >55% Al2O3, expected to increase output from 300,000 tonnes in 2021 to 600,000 tonnes in 2023; (bottom right) in March 2022 Bautek started its first new 36,000 tpa rotary kiln, two further kilns planned end-2022/2023, with combined capacity of 140,000 tpa. Courtesy Bautek

Graphite demand is clearly being driven by the EV lithium ion battery evolution, but again, consumers are wanting to look outside China and finding a lot of action especially in eastern Africa and Madagascar, but also Australia, Asia, Scandinavia, and the Americas.

With its investment in Bissett Creek, ON, and recent acquisition of Imerys graphite operations of Lac des Iles, Quebec and Okanjande, Namibia, Northern Graphite could be on course to be North America’s leading graphite producer and the world’s third largest producer outside China.

The future is looking good for industrial mineral development and in general consuming markets are buoyant.

The real challenges will be in trying to maintain logistic supply lines at reasonable rates for at least another year of turmoil in the shipping market, tactfully educating customers as to the prevailing supply situation, as well as developing and employing, as economically as possible, new (and ultimately perhaps legally required in not too distant future) carbon emission reduction, “green” mining, and recycling practices for a sustainable future.

As always, Mr. O’Driscoll’s comments are businesslike and to the point. The above market analysis is interesting. There are no problems with the supply of magnesia products to the market today, prices are relatively stable. Private decisions in Brazil and Russia with the cessation of fused periclase production in Norway only confirm China’s leadership in this market. It would be nice to see in figures the situation for non-metallurgical bauxite, as well as white and brown corundum, as well as tabular alumina. Intrigue in the development of processes and in the decisions that the Chinese leadership will take.

Many thanks comments Lev, good points, much appreciated.Hope all well.