Oilfield Minerals Forum 2016 Review

Despite the cautious rally of oil prices in recent weeks the oil industry has remained depressed. In such downturns it is often imperative to glean market knowledge as never before.

So perhaps it was no surprise that last week’s Oilfield Minerals & Markets Forum Houston 2016 organised by IMFORMED with a packed programme of expert speakers, attracted a strong attendance from across the oilfield mineral supply chain.

It’s well organised and covers relevant areas. Great articulation by presenters. A great place to connect with customers, suppliers, and competitors.

Richard Zieike, VP Technology, Unimin, USAGood turn out and interesting speakers. Very friendly and professional.

Michael Allen, President, ST Equipment & Technology, USA

With the market poised to start recovery in the near future – perhaps late 2016 at best, or mid-2017 at worst – 130 attendees from 16 countries turned up to draw on high level analysis, discussion, and networking in the oilfield minerals sector at the charismatic Houstonian Hotel, 5-7 June 2016.

Following a most enjoyable reception sponsored by leading oilfield mineral processor Excalibar Minerals LLC, 19 presentations over the next day and a half covered key aspects of oilfield mineral demand, drilling fluid developments, logistics, borates, potash, proppants, and barite.

Legends of the Oil: two experienced players of the barite market catch up at Excalibar Minerals’ sponsored reception, Brian O’Connell, Halliburton (left) and John Allen, Anglo Pacific Minerals (right).

Mineral demand outlook

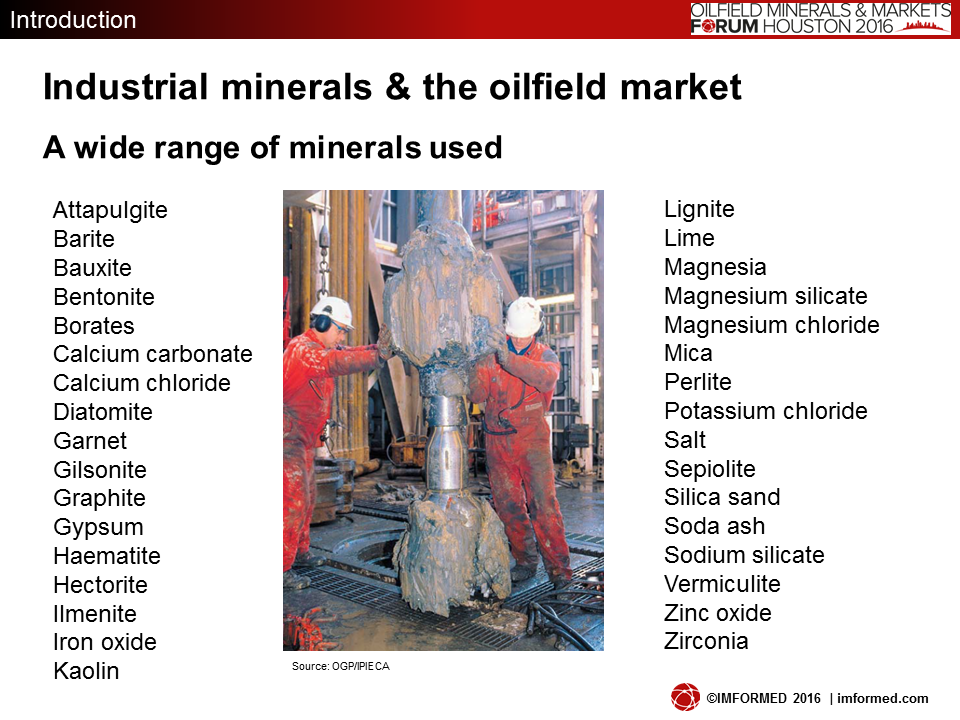

There are over 30 different industrial minerals used in oilfield applications for drilling, stimulation, completion, production, well cementing, and surface preparation and cleaning.

Most minerals also serve other markets, although the fortunes of barite and to some extent bentonite, are very much tied to the oilfield sector’s performance.

Mike O’Driscoll, Director, IMFORMED opened the Forum with a look at the big picture of future energy demand, the outlook for oil and gas production and consumption and its impact on the future requirements for industrial minerals used in the oilfield sector.

Key areas to watch will be the growing demand for gas as the future fossil fuel of choice, particularly from the Asia Pacific region, and with this an expected increase in shale gas development, not only from North America, but also from China and the Middle East.

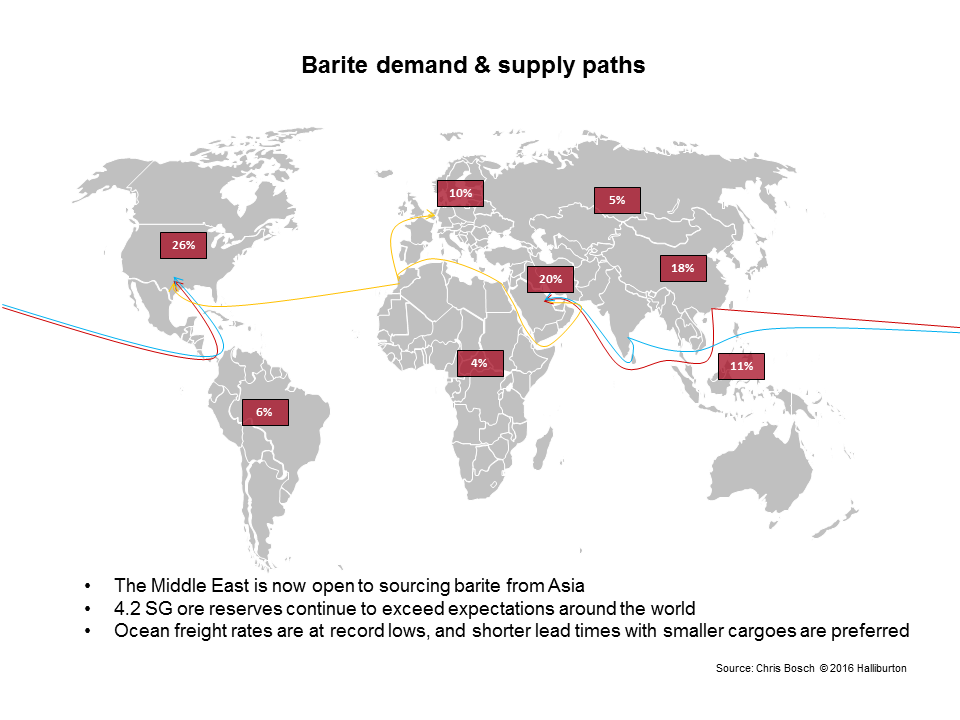

“The Middle East rig count has been stable, with 50-60% of barite demand met by China” Chris Bosch, Category Manager, Halliburton Baroid.

Chris Bosch, Category Manager, Halliburton Baroid, presented “Oilfield mineral consumption trends” with a strong focus on barite, the main weighting agent in drilling muds.

With the market decline, Bosch estimated barite consumption in drilling would hold about a 70-75% share of total barite demand in 2016 (down by some 10% from say 2012).

Notable trends included increased investment in mining and production activities in China to optimise supply capabilities; Morocco has continued to expand capabilities to produce 4.2+ material, and is now ranked as the world’s no.2 producer after China; and 4.2 SG deposits are being mined effectively in new areas and improved technology has changed the narrative.

In “Drilling and drilling fluid developments”, Brian Teutsch, Product Line Director, Drilling & Completion Fluids, Baker Hughes Inc., covered equivalent circulating density (ECD) and weighting agents, wellbore strengthening materials versus lost circulation materials, and challenges and opportunities in drilling unconventional resources.

Teutsch outlined the debate over the pros and cons of increased viscosity in drilling fluids, and said that on balance smaller particle size weighting agents were “in”, and that on this topic “the market had spoken”.

“Smaller particle size weighting agents are in” Brian Teutsch, Product Line Director, Drilling & Completion Fluids, Baker Hughes Inc.

In the high demand for lubricants in drilling unconventionals, Teutsch showed that demand for graphite as a lubricant in drilling fluids had declined in contrast to non-mineral lubricants.

Logistics

As ever, logistics remained a common denominator throughout the Forum: Bosch reminded that logistics costs made up about 22% of the delivered price of barite.

Jesper Hoppe, Managing Director, Viking Shipping Co. A/S, and Morten Petersen, Managing Director, Viking Shipping Co. (Hong Kong) Ltd, reprised their informative and entertaining double act in “Shipping costs: never so low since the age of the Vikings”.

The audience was reminded of the total imbalance of cargo demand and fleet supply at present, with scrapping to reach the same level and deliveries this year. No recovery in the freight market is expected during 2016 or 2017.

For mineral suppliers, while on the one hand the situation of record low freight rates is attractive, Hoppe and Petersen urged careful due diligence on the choice of shippers owing to the high rate of bankruptcies and business failures occurring in the market.

Richard Dodd, President, RDC Logistics, presented “Logistical challenges and solutions for oilfield minerals” looking at managing channels and costs in US rail, truck, barge, ports, import bulk, and ocean containers.

Vikings take the stage on the shipping outlook, with not much improvement expected for freight rates in the next 1-2 years: Jesper Hoppe & Morten Petersen, Viking Shipping Norway.

Dodd gave an example of a dry bulk West Coast delivery comprising up to 23 different cost components: mineral/vessel 8 components; port of entry stevedoring/port 6 components; rail to destination 6 components; and destination 3 components.

Dodd also pointed out the ramifications of the impending SOLAS Container Weight Verification Requirement, effective 1 July 2016, where a container must be weighed before loading to ship.

Borates & Potash

“Borates in oilfield applications” by David Schubert, Principal Scientist, US Borax Inc., highlighted the use of mineral borates and refined borates in the oilfield sector.

Borates have many functions in different applications including: drilling and completion (drilling fluids, oil well cement set retardant, well and reservoir logging, sour gas scavenging); stimulation (hydraulic fracturing fluids); enhancing oil recovery (water flooding profile control, alkaline surfactant flooding).

In fracking fluids, the single largest use of borates in oilfield, borates are used as crosslinking agents to produce rheological fluids. The borates form “self-healing gels” that recover viscosity after high shear.

“K Man”, Jeff Blair, VP Sales & Marketing, Intrepid Potash presented “Potash and its role in oil and gas production”

Introducing himself as the “K Man”, Jeff Blair, VP Sales & Marketing, Intrepid Potash presented “Potash and its role in oil and gas production”.

Blair explained how KCl is used to combat the problems of having swelling clay in hydraulic fracturing fluids. Its key properties are: great cation exchange; small size of the K+ ion; low hydration number; good water weight; relatively inexpensive; environmentally friendly; and pH neutral.

Evidence from frac treatments by Halliburton and in Western Siberia showed that a frac solution containing 7% KCl was preferable.

Proppants

The principles of hydraulic fracturing and proppants were described by Pickard Trepess, Managing Director, FracPT FZE in “Developments in proppant selection for hydraulic fracturing.”

Trepess explained that there is a trend away from using ceramic proppants to frac sands. Under high pressure environments (7-10,000 psi) frac sand fails and starts to crush. However, the crushed proppant can help keep slipped fractures open.

Trepess demonstrated that a prevailing “nanoDarcy environment” favours continuous use of frac sand rather than expensive ceramic proppants.

“There’s no ‘k’ in frac” Pickard Trepess, Managing Director, FracPT FZE.

Paul Williams, Vice President of Technology and Innovation, ArrMaz presented “Reducing silica dust with proppant coating technology” and explained how respirable silica dust created during shipping and transfer of frac sand is driving the need for improved innovations.

OSHA PEL (permissible exposure limit) for respirable crystalline silica dust was revised downward on 23 March 2016, and the current PEL is 0.1 mg/m³; OSHA announced the PEL will be lowered to 0.05 mg/m³ effective 23 June 2016.

ArrMaz has developed a new silica sand coating technology called SandTec. SandTec works by applying a microscopic monomeric coating on the sand proppant which controls dust and lowers fines generation by reducing attrition whenever proppant is transferred.

As the US ceramic proppant industry idles capacity awaiting market recovery, Jim Flowers, VP Sales, Marketing and Innovation, Imerys, presented “Manufacturing ceramic proppant during the downturn”.

Flowers questioned whether spherical proppants were the future: “There is a physical limit on how round and how tightly sieved a product can get. The more spherical and smooth the pellet the more likely to encounter flowback issues. Are we reaching the limit of spherical proppants today?”

He introduced rod-shaped proppants, which Imerys has been producing for some years now, exhibiting higher porosity, around 45%, higher conductivity and “built-in” flowback control due to its packing arrangement.

Flowers tracked the rise and fall in US proppant demand over the last few years, with forecasts showing much reduced future demand in 2016-18, especially in ceramic proppant consumption at around 0.6-0.8bn lbs (compared to 3.4bn lbs in 2014).

One particular factor of interest is the amount of drilled uncompleted (DUC) onshore wells in the USA, standing at some 8,150. Flowers said this inventory represents six months of completion activity (based on 2015 monthly average), and means US producers can react quickly to recovery, with the Permian Basin expected to remain the most active in the short- mid term.

Dr David Henson, President, LWP Technologies LLC, related the development of fly ash-based proppants by LWP in Brisbane, Australia.

“New generation ceramic proppants” by Dr David Henson, President, LWP Technologies LLC, related the development of fly ash-based proppants by LWP in Brisbane, Australia.

LWP’s 3,000 tpa pilot plant in Brisbane was commissioned in August 2015 and has produced ceramic proppants tested at 12,000 psi. The company has sold its first licence to convert bauxite-based proppant facilities to fly ash-based proppant processing in India.

Later this year, LWP is aiming to complete production of porous and ultra-lightweight proppants.

The theme of ceramic proppant manufacturing continued with Joe Roettle, Global Sales Manager, Ecutec Barcelona SL in “A comprehensive look at ceramic proppant types and processes”.

Roettle underlined the key factors of the ceramic proppant processing: “recipe”, sintering, and shaping, and explained the stages of milling, mixing and pelletisation, screening, and sintering,

Barite

Day 2 was devoted to the barite sector covering supply from Morocco, India, and China as well as developments in processing.

Imane Moudnib, Marketing Manager, Broychim presented “Morocco’s barite supply”, showing that the country now accounts for 14% of world barite supply, producing 1.2m tonnes in 2015, and is now second after China (40% of world production).

Imane Moudnib, Marketing Manager, Broychim presented “Morocco’s barite supply”, showing that the country now accounts for 14% of world barite supply.

With 6m. tonnes of barite reserves and five mines, Broychim has grown steadily as a major supplier of barite since 2002, and in 2014 installed its third grinding plant at Safi.

Broychim’s barite exports grew to 54% (400,000 tonnes) of Morocco’s total barite exports in 2015.

In addition to drilling grade barite, Broychim is active in chemical grade barite, calcium carbonate, manganese ore, and zinc ore.

A review of APMDC’s barite mining activities was kindly presented by Raj Settipalli, as Vice President of The Barytes Association (also Chief Executive Officer, RockFin Minerals).

The state of Andhra Pradesh holds more than 90% of India’s barite reserves, and within the state APMDC holds almost 98% of the reserve.

In 2015, India slipped to fourth position after China, USA & Morocco, and accounts for 11% of global supply. Temporary disruption at the Mangampet mine resulted in a decline in supply in 2015.

Grades produced include 50% A grade (API 4.2), 15% B Grade (API 4.1), and 35% Low grade (< 4.1).

APMDC is aiming at a 3m. tpa production rate for FY2016, and to 5m. tpa over the next two to three years.

Moving to barite processing, Steve Gray, Consultant, ST Equipment & Technologies LLC presented “Triboelectrostatic separation: new developments in barite beneficiation”.

Gray explained triboelectrostatic separation as an environmentally responsible and water-free process with which to beneficiate minerals. STET has proven separator applications with barite, talc, calcium carbonate, potash, and fly ash.

“Triboelectrostatic separation as an environmentally responsible and water-free process with which to beneficiate minerals” Steve Gray, Consultant, ST Equipment & Technologies LLC.

Benefits include a small physical footprint, dry process, low energy, environmentally friendly, high production rate (40-50 tph), particle separation of <1-500 microns, and easy operation.

In a slight departure from barite, Charles Landis, Executive Vice-President, Technology Development, HPPE LLC, presented “Advances in biopolymer chemistry and selected applications in the oilfield.”

In this he described functions of biopolymers and their synergies with minerals in oilfield applications, such as using levan as a lost circulation material enhancer with calcium minerals.

Chinese barite

Bill Wang, Director & General Manager, Guizhou Sinobarite Mining Co. Ltd provided an excellent overview of the Chinese barite industry in “China’s barite industry status and analysis”.

Owing to many of China’s commercial deposits being mined for over 30 years, much of the best quality material of these mines has already been consumed. The average specific gravity in many producing mines in China today is in the region of 4.10.

Wang said that the majority of Chinese shipments of 4.2 barite ore are blended cargoes of high grade and low grade material, as well as jigged product. Some Chinese barite shipments, owing to the large size cargo of 68,000 tonnes, maybe composed of barite from multiple sources.

While there is an abundance of barite resources in China, many of these mines are undeveloped, difficult to explore or commercially unviable.

Chinese barite production, which dropped 25% to 3m. tonnes in 2015, is forecast to contract by a further 15-20% in 2016, to about 2.5m tonnes.

SinoBarite owns five mines, located at Duyun, and Kaili, Guizhou with estimated total reserves of 4.5m. tonnes, and has a capacity of 400,000 tpa drilling grade barite ore and 100,000 drilling grade barite powder. Almost 200,000 tonnes was exported to the USA, Saudi Arabia, Indonesia, Malaysia, South Korea, and Thailand.

Ian Wilson, Consultant, described a new alliance of Chinese barite suppliers in “Guizhou Gulf Minerals Co. Ltd: the new force in supplying Chinese barite.”

Ian Wilson, Consultant, prepares to present the new force in supplying Chinese barite: Guizhou Gulf Minerals Co. Ltd.

In January 2016, Guizhou Gulf Minerals was joined by Rocky Mountains, Xinshike, and Jun Wang Mining Co. Ltd, and in May 2016 by Yichang Zhongrun Barium Industry Co. Ltd, to export barite from China.

Wilson proceeded to review the extensive range of deposits, mines and plants operated by the companies, for both drilling and chemical grade barite, across Guizhou, Guangxi, Hubei, Hunan and Yunnan provinces.

Guizhou Gulf will mainly use Fangcheng Port for exports of barite, in both bulk and containers, with the port also hosting its office and laboratory.

An area of 2,700 m2 has been rented which will allow for 5,000 tonnes of white barite, while an area of 10,000 m2 will allow 35,000 tonnes of drilling grade barite.

“Chinese barite: how to find opportunities in the downturn” was presented by Rita Hu, General Manager, Guizhou Saboman Imp. & Exp. Co. Ltd.

“Everyone has a plan ’till they get punched in the mouth.”, Rita Hu, General Manager, Guizhou Saboman quotes Mike Tyson in her analysis of essential elements to success.

Using the facilities and operations of Guizhou Saboman as an example, Hu explored the essential elements of technology, cost, ideas, team, and timing, that can lead to opportunities.

With seven mines in south-west China and one in central China, the company produces 400-500,000 tonnes of drilling barite lump, 50-100,000 tonnes chemical lump, and 50-100,000 tonnes white lump.

Using Mike Tyson’s quote: “Everyone has a plan ’till they get punched in the mouth.”, Hu warned that timing in the market was crucial to business success.

Wrap-up

IMFORMED is delighted with the success and positive feedback from delegates on Oilfield Minerals & Markets Forum Houston 2016, and is already looking forward to planning next year’s conference with delegates’ comments and suggestions in mind.

Indeed, we have already begun taking bookings for sponsorships and exhibits, and offers of presentations have been accepted. Please do not hesitate to contact Ismene Clarke for the former, and Mike O’Driscoll for the latter.

A special thank you again to all of our speakers, sponsors, exhibitors, and attendees for making the event such a success. We hope to see you again soon.

Some consolation in the downturn: Juan Luis Prieto, President, Baramin walks off with the Forum Finale Draw Prize, a bottle of Scotland’s Finest. Congratulations! And here’s to better times next year

For more pictures of Oilfield Minerals 2016 please go to Gallery.

For details on the Oilfield Minerals 2016 programme, attendees, delegate feedback, and pictures, please go to Oilfield Minerals 2016.

Ensure you don’t miss any news and updates on the next Oilfield Minerals & Markets Forum: Sign up here