Mineral Recycling Forum 2021 ONLINE Reviewed

EU Critical Minerals | Refractories | Ceramics | Graphite | Bauxite | Magnesia | Mining Waste | LIBS Sorting

The latest trends and developments in recycling industrial minerals were presented and discussed at IMFORMED’s Mineral Recycling Forum 2021 ONLINE on 9 February.

Title Picture Mountains of Magnesia: the serpentine tailings pile at Baie Verte, Newfoundland, 850 x 600 x 150 metres, hosting some 50m tonnes grading 39% MgO; BAIE Minerals is looking to recycle the tailings, targeting the growing MgO board market. Courtesy BAIE Minerals

Ten presentations by leading experts covering European Commission action, graphite, alumina, refractories, ceramics, magnesia-tich mine tailings, and laser spectroscopy sorting, provided valuable data and topics for discussion for a worldwide online audience active in the development and applications of mineral recycling.

“This would be difficult to improve on. You had steel producers, refractory producers, new technology developers, academics, government officials and experts presenting and sharing current info on very relevant real time topics. Well done!”

Bill Porter, National Manager USA & Canada, PRCO America, USA

“Really enjoyed the session and was very well hosted.”

Andrew Spinks, Managing Director, EcoGraf Ltd, Australia

“Congratulations, it was a very well organised and good Forum. The roundtable session was a very good idea.”

Werner Odreitz, Managing Director, REF Minerals GmbH, GermanyTalking (and smiling!) heads at the Breakout Roundtable on Refractories – an informal networking session following the presentations

Overviews: New era for recycling | EC Critical Raw Materials Action Plan

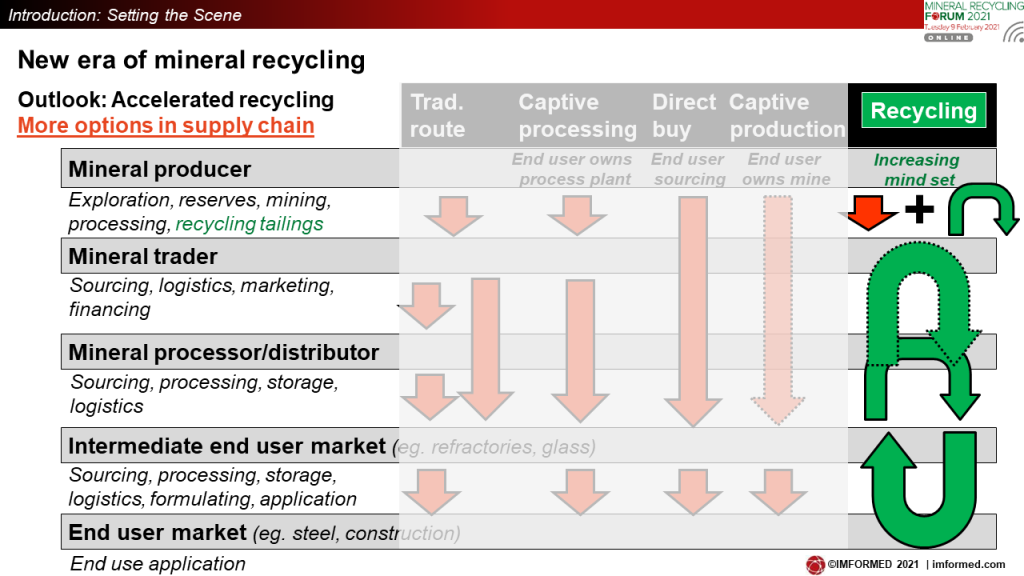

Mike O’Driscoll, Director, IMFORMED opened proceedings by observing a new era of mineral development and sourcing strategy upon us, which is to include an increasingly significant role to be played by mineral recycling.

This has largely been an inevitable development, but which has been particularly spotlighted and advanced by the Covid-19 pandemic since early 2020, prompting a mineral sourcing strategy rethink and accelerated mineral recycling.

Key drivers for the increase in mineral recycling were outlined by O’Driscoll’s “Rule of Six”:

- Limited primary sources: shortage of commercially developed “critical” mineral resources and processing plants

- Source overreliance: risky overreliance on supply/trade from limited overseas source

- China in change: supply issues, range of factors.

- Emergence of hi-tech growth markets: to become mainstream, particularly in the energy sector (eg. Li-ion batteries, EVs, solar, wind), and thus demand for respective critical minerals (eg. lithium, graphite, rare earths).

- Recycling technology more economic/established: from esoteric, expensive sideshow, to mainstream processing line; opportunities sensed and sought after

- Environment: saving the environment, drive for the “Circular Economy” gathering momentum

While challenges remain to be met across the supply chain, the uptick in mineral recycling is going to involve much more of the following:

- The “new normal”: recycled raw materials becoming a regular supply chain option for mineral buyers

- Government action: input in policy, support, and finance from governments and regional organisations

- Primary mineral producer mindset: miners increasingly involved in recycling tailings and other waste sources to offer wider product range (including blends?) with a favourable “green” label on their portfolio

- Opportunities: to process minerals from waste; to innovate, develop and supply sorting and processing technology and equipment to recyclers

- Economic alliances: between waste sources (mineral product end users) and recyclers, new logistic chains

- Supply chain co-operation: in modifying end product formulations to ease end-of-life recyclability and enhance market application

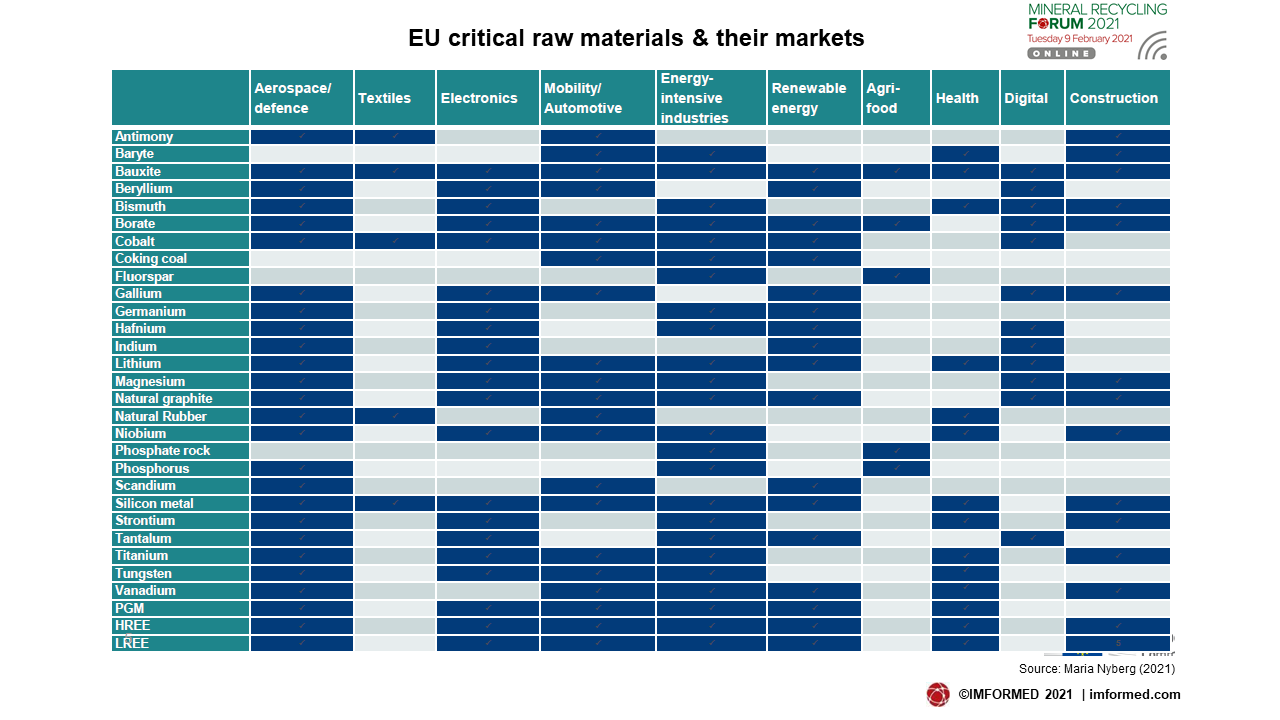

“Critical raw materials resilience: charting a path towards greater security and sustainability –increased circularity and efficient use of resources”, presented by Maria Nyberg, Policy Officer, EC, Directorate-General for Internal Market, Industry, Entrepreneurship and SMEs, Belgium, set the scene wonderfully by outlining the EC’s recently announced Critical Raw Materials Action Plan with special regard to the circular use of raw materials.

Nyberg reviewed the EC’s categorised critical minerals and their consuming markets at present and their forecast demand in 2050, before explaining the ten points of the Action Plan:

- Establishment of the European Raw Materials Alliance (ERC)

- Develop sustainable financing criteria for mining

- Research and innovation on waste processing, advanced materials and substitution

- Map the potential supply of secondary CRM from EU stocks and wastes

- Investment needs for mining projects that can be operational in 2025

- Develop expertise and skills in mining

- Deploy Earth observation programmes for exploration, operation and post-closure environmental management

- Develop research and innovation projects on exploitation and processing of CRMs

- Develop strategic international partnerships to secure CRMs supply

- Promote responsible mining practices for CRMs

Nyberg highlighted two key goals: the mapping of potential supply of secondary critical raw materials from EU stocks and waste and to identify viable recovery projects by 2022; and the successful launch of the ERC on 29 September 2020, which has already attracted more than 200 partners from 30 countries in joining the ERC.

“The ERC is to initially build resilience and open strategic autonomy for the rare earths and magnets value chain, before extending to other critical raw materials.” said Nyberg.

Want to get the latest views and outlook on critical minerals? Join us at

Speakers include:

How will strategic minerals ride the next economic cycle?

Neal Brewster, Chief Economist, Roskill, UK

The security of critical mineral supply chains: the US perspective

Dr Steven Fortier, Director, National Minerals Information Center USGS, USA

Understanding the geopolitics of critical minerals: Are they the same in regard to China, Europe, the USA, and Japan?

Jack P. Lifton, Director, Critical Minerals Policy Institute & Ken N. Santini, Managing Director, Santini & Associates, USA

Creating reference & benchmark pricing for lithium in the 21st Century electric vehicle supply chain

Simon Moores, Managing Director, Benchmark Mineral Intelligence, UK

Transforming strategy into cash in the industrial mineral sector

Miguel Galindo, Managing Director, Strateg-On, SpainFULL DETAILS HERE

Graphite recycling in Li-ion batteries

“Closing the Carbon Loop in Li-ion batteries” by Andrew Spinks, Managing Director, EcoGraf Ltd, Australia, shared his fine insights of EcoGraf’s vertically integrated HF-free battery anode material business supporting the global transition to clean energy and e-mobility.

The business is focused on three key strands: a 20,000 tpa battery graphite manufacturing plant in Kwinana, Western Australia; the Epanko Graphite Project, Tanzania, a 60,000 tpa natural flake graphite mine; and the recovery of battery anode materials, using proprietary EcoGraf™ purification technology.

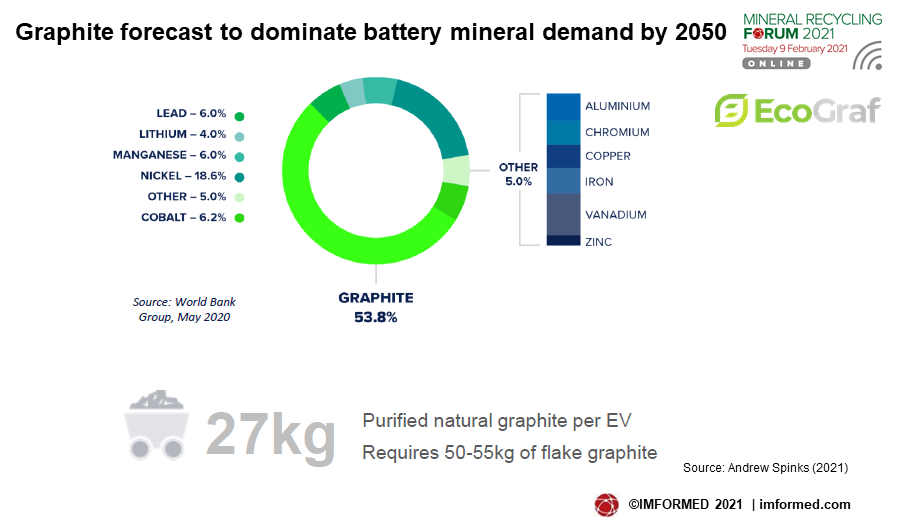

Spinks emphasised the significance of graphite as the leading material by volume required in Li-ion batteries (55% of battery mineral demand by 2050), and the EU as the world’s fastest growing Li-ion battery market with some 24 gigafactories announced to be built with 600 GWh total annual production capacity (= 9-10m electric vehicles (EV) per year).

“The EV market is forecast to drive a +700% growth in natural graphite demand by 2025” said Spinks.

Spinks also brought attention to the EC’s December 2020 new measures announced regarding Li-ion batteries and the Circular Economy in that a minimum proportion of battery content is to be made up of recycled materials.

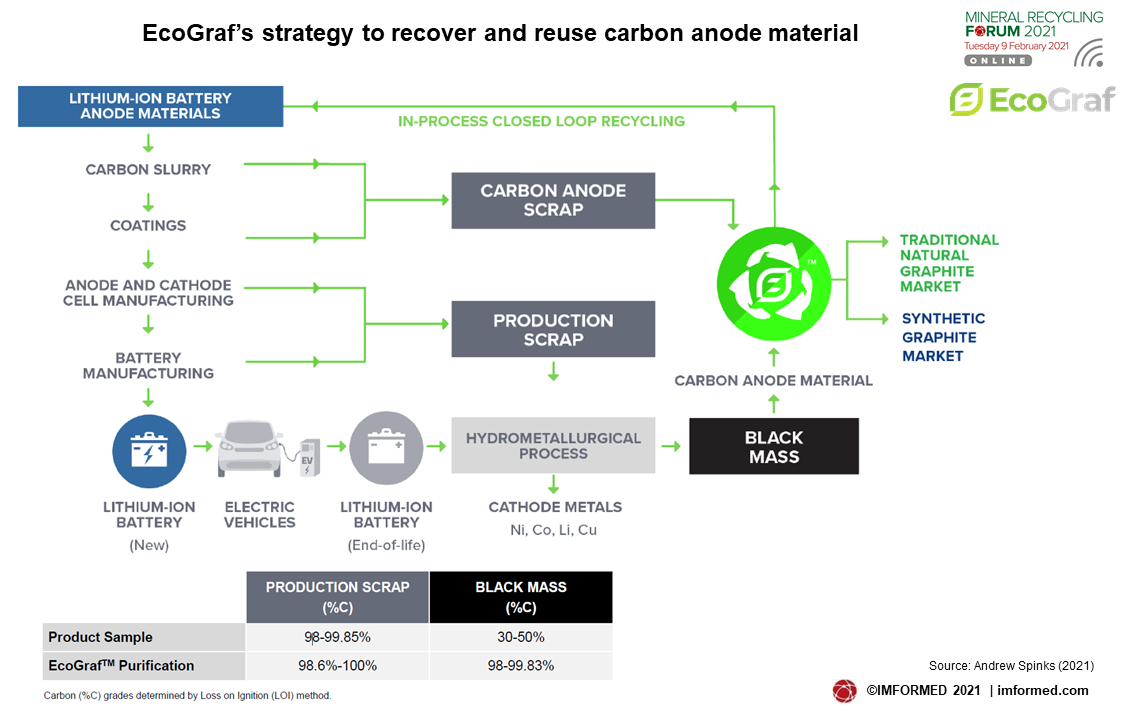

It was reminded that battery recycling efforts have to date mainly focussed on cathode metals, while carbon anode material is currently not recovered. However, with the battery representing >40% of the carbon (CO2) emission footprint of EV production, recycling of carbon anode material has an important role in reducing carbon emissions.

So EcoGraf has developed a cost effective, eco-friendly multi-stage chemical purification, washing and filtration process, that eliminates hydrofluoric acid use, to recover carbon anode material. A provisional patent was lodged for recycling applications in May 2020.

The EcoGraf™ proprietary purification process has now been applied successfully to recycling of both battery production scrap and “black mass” materials (carbon material remaining after recycling high value cathode metals).

The company is now positioning itself to recover and reuse carbon anode material, and to that end, and in keeping with Spinks’ urging that “Collaboration is the solution”, EcoGraf has signed an agreement with South Korea’s largest Li-ion battery recycling group SungEel HiTech Co. Ltd.

Reducing & using processed bauxite residue with the Pedersen Process

Dr David Konlechner, Owner, KON Chemical Solutions e.U, Austria, presented “Pedersen Process Revisited: Changing the colour of alumina production”.

Starting with a most salient reminder, Konlechner revealed that of the 132m tonnes of alumina produced in 2019, mostly by the Bayer Process, to produce 63.7m tonnes of primary aluminium, some 160m tonnes of Bauxite Residue (BR) was generated. In 2016, a mere 3% of BR was recycled and used productively.

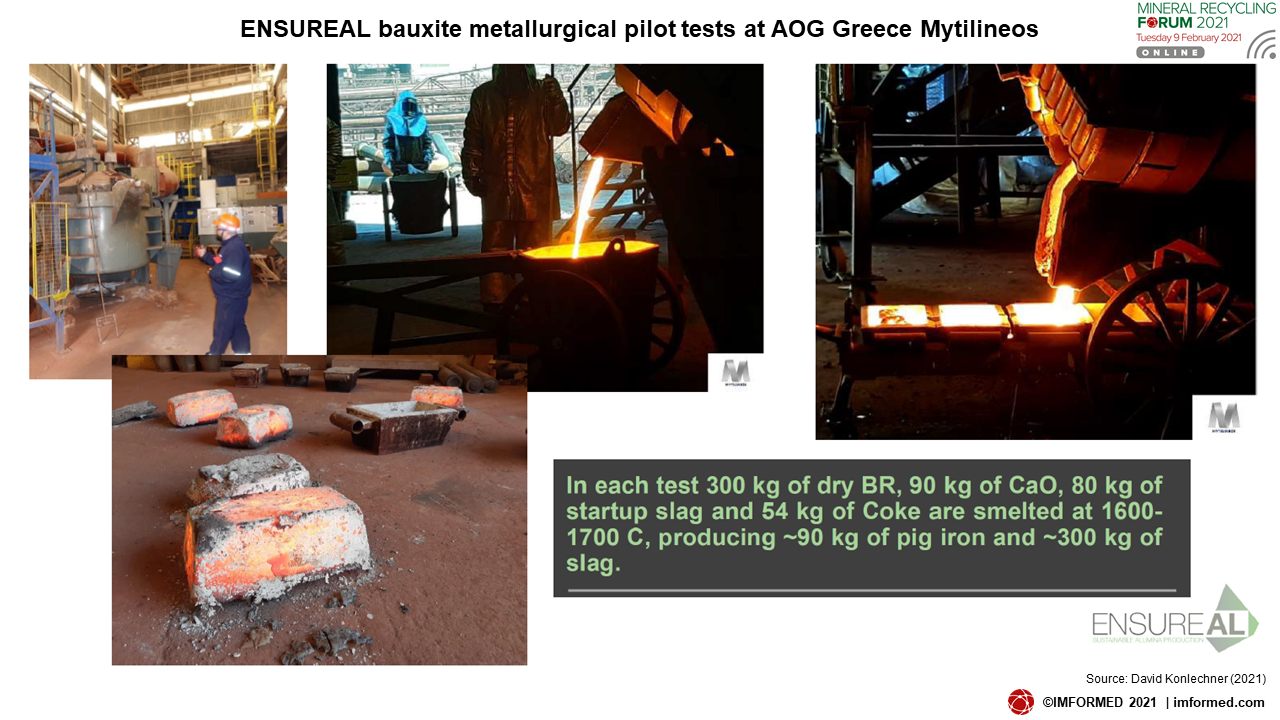

With the EU heavily dependent on imports of bauxite and alumina, the EU-funded ENSUREAL Project was formed in 2017 to prevent waste generation in alumina production by using the Pedersen Process, utilising low grade bauxite, yielding waste products in “grey mud” which could find use in fertilisers and rare earth production.

A wide range of industry, technology, and academic members participate in ENSUREAL, including KON Chemical Solutions, responsible for upscaling the project.

The Pedersen Process has actually been around since about 1915, and which essentially involves the smelting bauxite or another aluminium source; generating a Ca/Al slag; leaching with NaCO3; precipitation with CO2; roasting for Al2O3 production; CaCO3 grey mud as by-product.

ENSUREAL work has focused on re-engineering the metallurgical process, fast testing at small scale, using best recipe for upscaling, and generating a leachable Ca/Al slag.

By 2022, the project is looking forward to having a deeper understanding of chemical process behaviour, having reasonable amounts of sample material available (100 kg range), having life cycle assessment and life-cycle cost analysis, and attaining process and economic concept prefeasibility level (FEL 1.5).

Refractory recycling developments: S. Korea | Spain | Brazil

“South Korea’s refractory recycling status & key challenges to address” was presented by Sangpil Raul Hwang (left, top), Industrial Minerals Trader, Sojitz Corp., Japan, who also introduced co-author Joo Yongdon (left, below), CEO, Korea Material Co. Ltd, South Korea.

Since 2011, Korea Material has been recycling a range of refractory minerals including alumina, chamotte, magnesia, zircon, graphite, and silicon carbide. The company opened its third plant in 2020 at Pyeongtaek.

For its part, leading Japanese trading company, Sojitz Corp., has been working with Korea Material and is diversifying more into mineral recycling and intends to restructure in April 2021

with a new department: Metals, Mineral Resources, & Recycling Division.

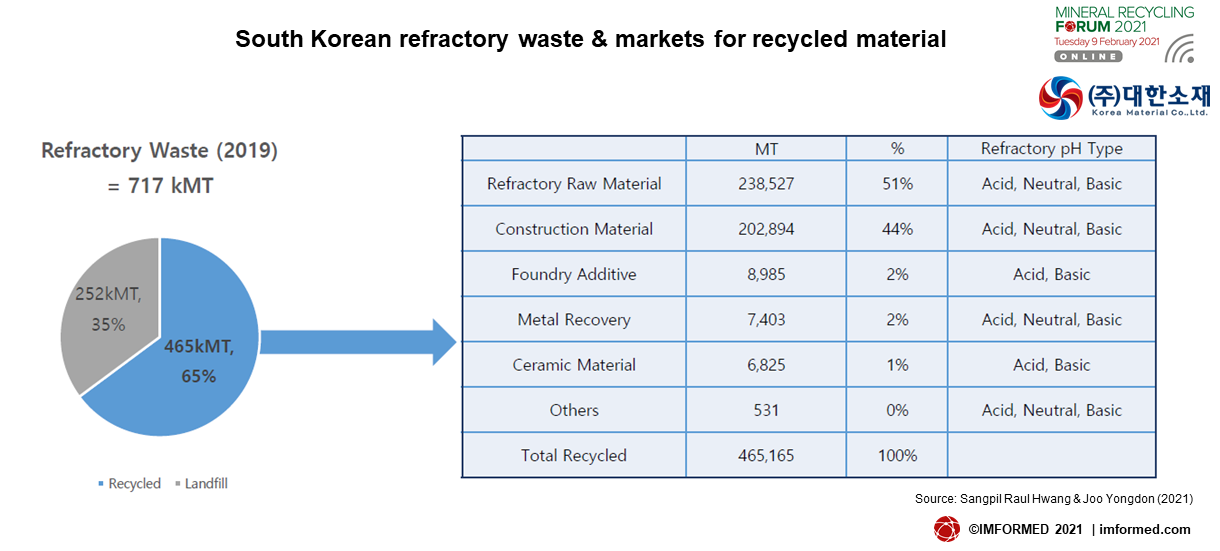

Hwang provided an excellent summary of the South Korean refractory industry, which produces almost 500,000 tpa refractories, and imports just over 200,000 tpa, mainly from China.

In 2019, refractory waste amounted to just over 700,000 tonnes, of which 35% was landfilled and 65% recycled into a range of market applications (see chart).

South Korea’s refractory recycling rate has increased from 33% in 2013 to 65% in 2019, somewhat boosted by increased landfill and waste disposal costs initiated since 2018.

Hwang explained how recycling refractories had shown benefits with lower expansion and shrinkage in products, price competitiveness (10-20% lower), and reduced dependency on imported materials.

However, challenges remain such as the persisting stigma about recycled materials; difficulties with controlling consistent chemical composition; costs of recycling, difficulties in acquiring waste recycling permit; lack of support from the government; and changing regulations that limit the recycling capacity based on warehouse capacity rather than actual processing capacity.

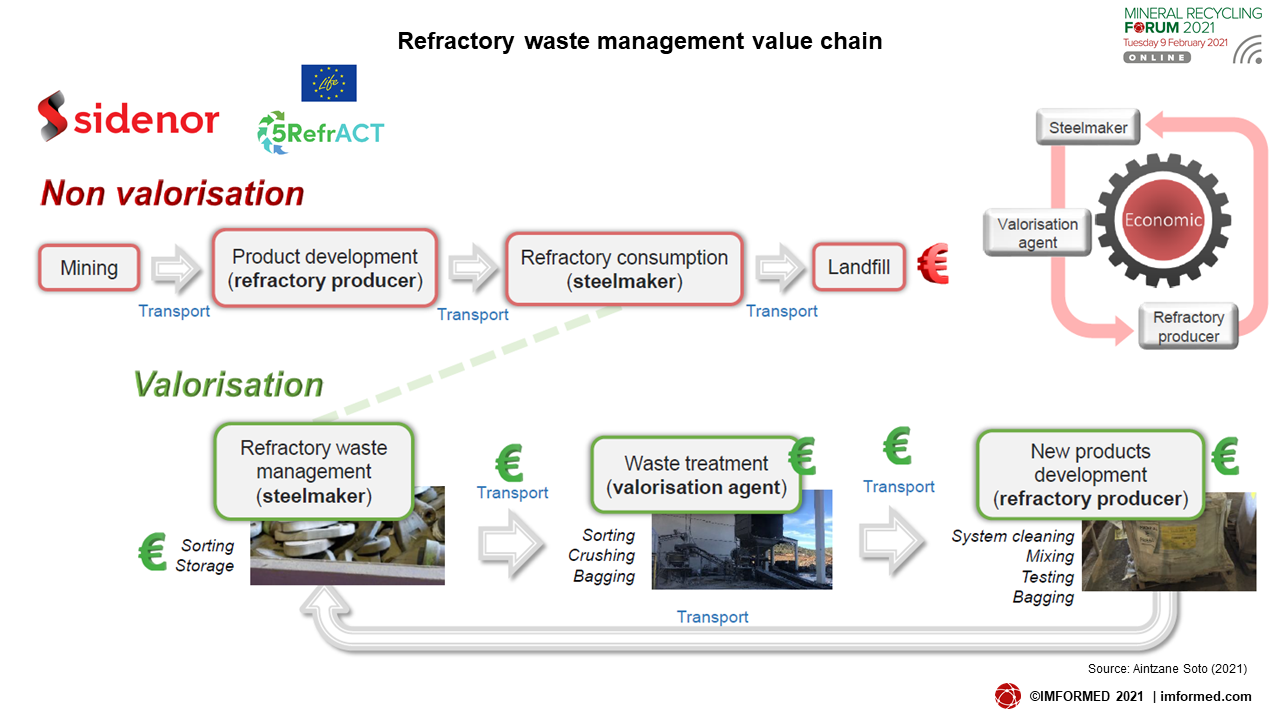

“Requirements for implementing Circular Economy in the refractory waste management of a steel plant” by Aintzane Soto, R&D Process Engineer, Sidenor, Spain, updated us with Sidenor’s impressive pioneering work in refractory recycling.

Sidenor is a market leader in European special steel long products as well as an important supplier of cold finished products; the company sold 660,000 tonnes steel products in 2019, and consumed 11,000 tonnes of refractories.

Soto explained how Sidenor has evolved its management of refractory waste recycling through the LIFE 5RefrAct Project, which started in 2018, focused on developing high value added refractory materials incorporating a significant amount of refractory waste.

“The challenging goal has been to increase the potentially recoverable fraction including the magnesia masses.” said Soto.

Sidenor has successfully worked with Magnesitas Navarras to develop 9 new magnesia-based refractory products incorporating 70% recycled material, and with Refralia, 12 new alumina-based refractory products incorporating 65% recycled material.

Soto explained how Sidenor utilised laser-induced breakdown spectroscopy (LIBS) technology to sort waste material, and concluded the project resulted in 1,878 tpa less waste being sent to landfill.

While there were clear positive outcomes, such as attaining very high valorisation of MgO masses from tundish, challenges remain such as the remoteness of the valorisation agent facilities increasing transport costs, and insufficient environmental and technical awareness by end users that makes it difficult to sell a recycled product.

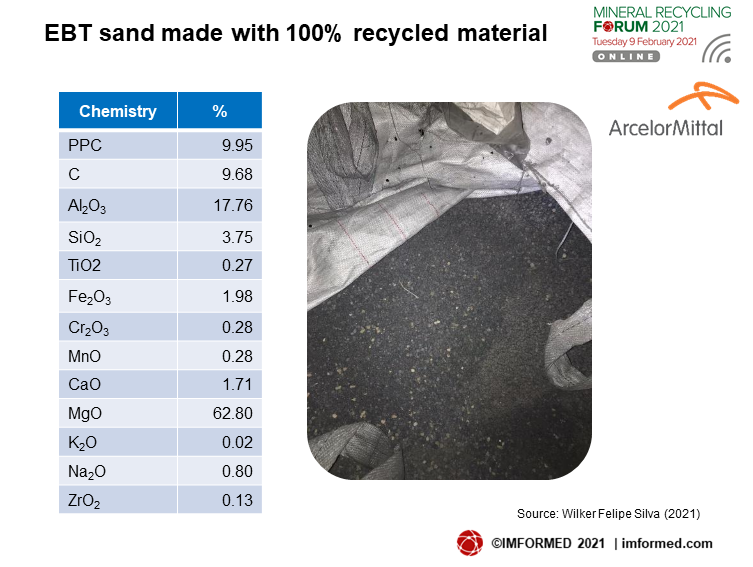

Wilker Felipe Silva, Refractory Purchasing Manager, ArcelorMittal Brasil SA, Brazil presented “Refractory recycling developments” which introduced methodology to reuse and recycle refractories with a focus on eccentric bottom taphole (EBT) sand used in electric arc furnaces.

Silva reviewed the overall industry strategy to reduce the specific consumption of refractories, summed up by the following actions known as the “3 Rs”: Reduce the wear rate; Reuse refractory material; Recycle refractory material.

Analysing the refractory matrix is important in recycling refractories, and Silva also explained in detail the cutting process for refractory bricks, and crushing process for castables, in the recycling process.

Silva concluded by sharing the successful lab test results of an EBT sand developed by ArcelorMittal Brasil using 100% of recycled refractory material which has significant potential for hot testing in the EAF.

Mineral waste utilisation for ceramic & construction products

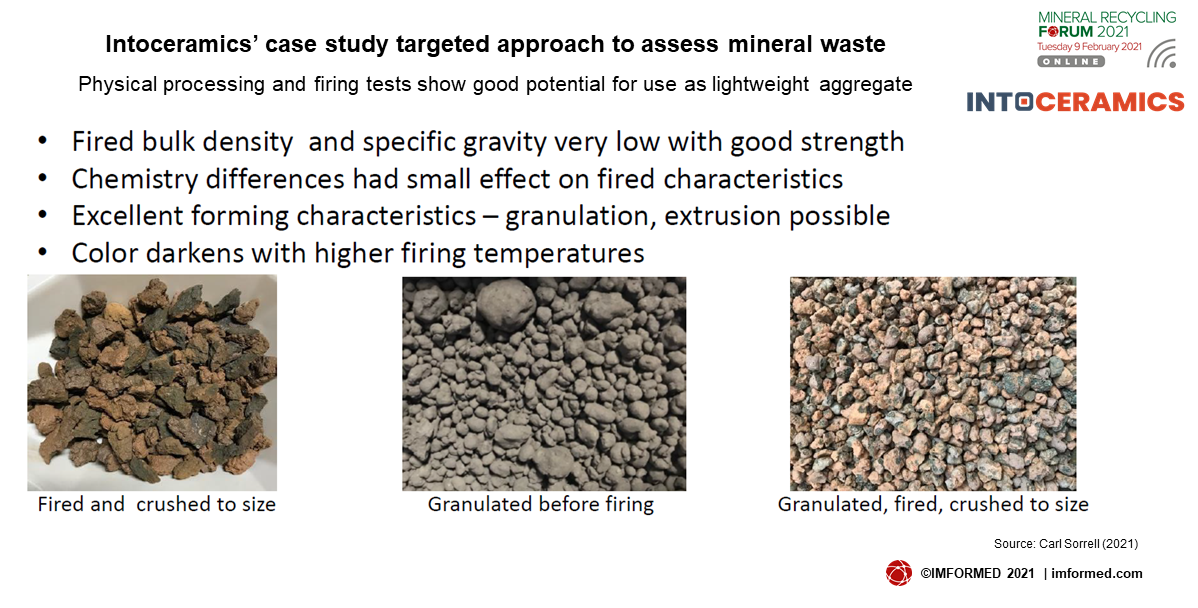

“Mineral waste streams in ceramic construction products: Potential & limitation” by Carl Sorrell, Vice President, IntoCeramics, OPF Enterprises LLC, USA, looked at the magnitude of mineral waste generated, the limitations of the material, concluding with a targeted approach.

Sorrell put into perspective the same of mineral waste generation by revealing that some estimated world annual mineral production of 18-20bn tonnes generates around 88-89bn tonnes of waste ore, rock and tailings (not including stone, sand and gravel production).

He noted that the estimated 44bn tpa of bricks and leading ceramic products manufactured, could perhaps consume around 50% of mineral waste generated.

However, there are important limitations to be aware of in using such waste in ceramic products: such as chemical composition (iron and silica sensitive ceramics), waste materials must be compatible; further treatment of the material maybe required; and of course, logistics, eg. virtually all brick manufacturing is located very near the raw material, and often captive, source, to keep costs down.

Sorrell concludes that use of mineral waste streams in ceramic products is feasible, but requires a targeted approach that may comprise four phases in a stage gate process:

Phase 1 Is it possible?: Analytical and ceramic processing testing; laboratory samples

Phase 2 Does it make sense? Market potential; formulation, physical processing and testing with other materials if needed; high level capex/opex; environmental & regulatory issues

Phase 3 Pilot process: prove process at larger scale with full properties testing; design facility; capex/opex at high accuracy

Phase 4 Build and start-up

A case study was described whereby Intoceramics evaluated mineral waste produced at a rate of 30,000 tpa by a company that was deemed unsuitable for backfill and expensive to landfill. Following a targeted approach it was found that although the material was unsuitable for brick, tile, or other traditional ceramics, it had very good potential for use as lightweight aggregate in many applications.

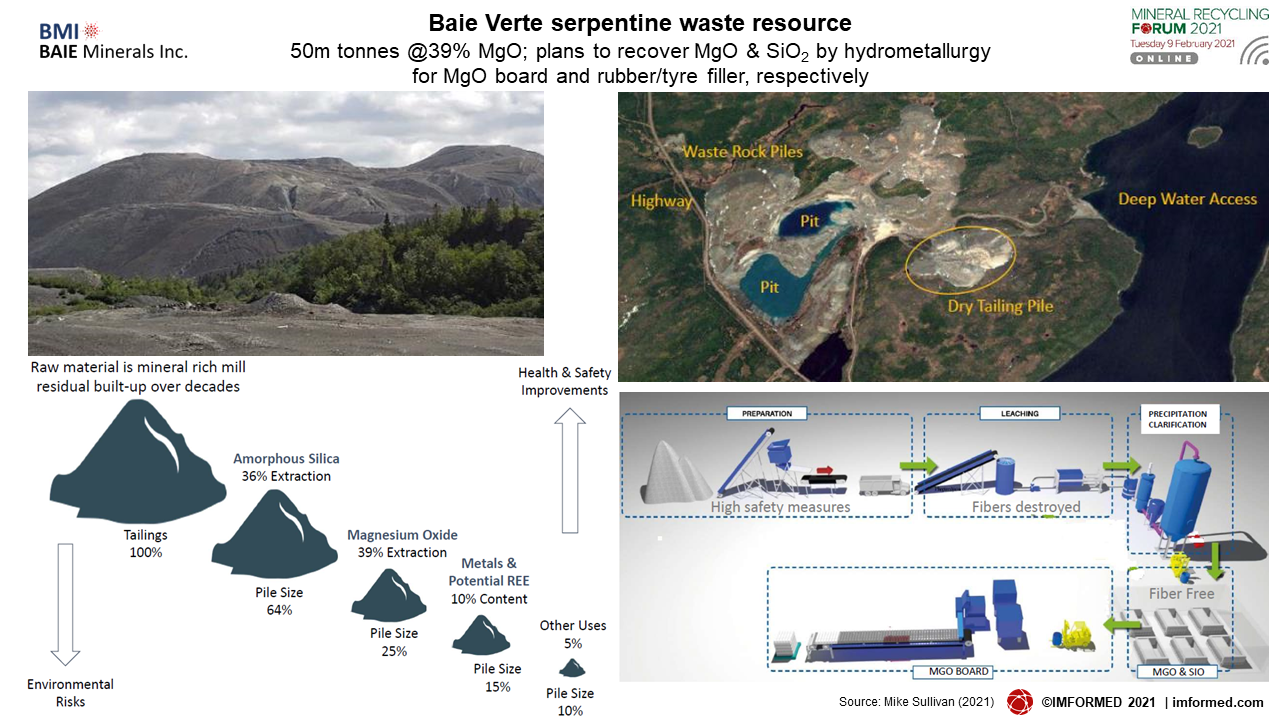

J. Michael Sullivan, President & CEO, BAIE Minerals Inc., Canada, also talked about recycling mineral waste, and in this case, the often delicate issue of reprocessing asbestos mine tailings, in “Reclamation & repurposing tailings as a source of low-risk MgO supply for construction market”.

BAIE Minerals Inc. (BMI) has what is described as a large-scale, potentially “world-class” mineral resource, with high mineral concentration, and “de-risked”, ie. low risk from an exploration/mining/supply perspective.

The resource comprises pits and dry waste serpentine rock piles and tailings from a former asbestos mine located at Baie Verte, on the west coast of Newfoundland. Asbestos production commenced in the 1963, and ceased in 1990.

The tailing pile dimensions are approximately 850 metres long, >600 metres wide, and 150 metres high; holding approximately 42m cu. metres, or about 50m tonnes grading 39% MgO, 36% SiO2.

The mine site has year round access to major roads, deep water, power, water and communications, and has been extensively evaluated with environmental assessments Phase I, II, & III completed.

Sullivan stressed the tailings are not asbestos. The tailings are the waste generated from industrial fibre extraction found in serpentine minerals, and may contain free fibre content of <3% chrysotile structures.

BAIE Minerals envisages utilising the established hydrometallurgical extraction process to recover amorphous silica, magnesia, rare earth and other metals. At the leaching stage all fibres are completely eliminated, all products are 100% asbestos free.

The two primary target markets for recovered minerals are magnesia for magnesia construction boards and precipitated silica in the rubber/tyre industry.

BAIE has identified the magnesia board industry as one of the fastest growing markets in North America. MgO is cost competitive to drywall or cement board, with superior attributes such as lower environmental impact, stronger (impact proof), and resistant to mould, insects, mildew, weather, and fire.

There is also increasing demand for precipitated silica as a filler in tyres to meet environmental and legislative regulations to improve automotive fuel efficiency. The use of precipitated silica in tyre treads is expected to significantly reduce CO2 emission by 45m tpa in the USA alone.

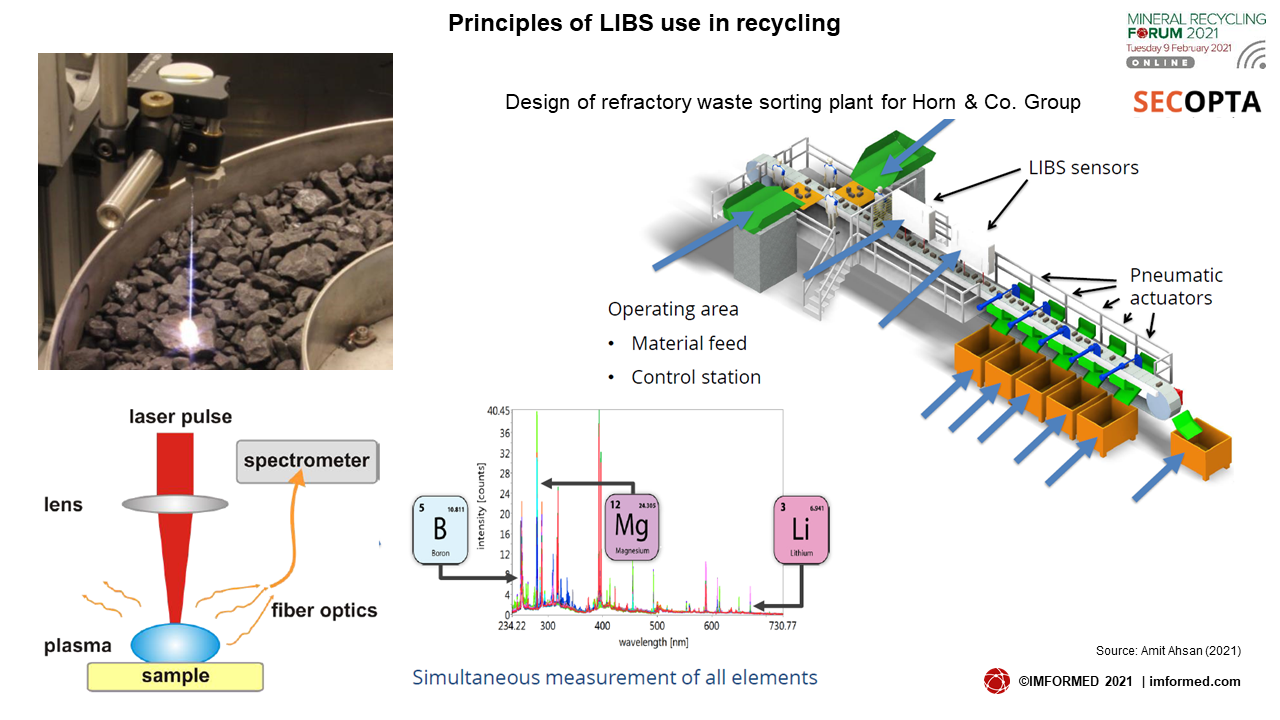

Use of LIBS in recycling

“Use of LIBS in recycling and in steel, refractory and mining industry” presented by Amit Ahsan, Sales Engineer, SECOPTA analytics GmbH, Germany, demonstrated, using neat some video clips, the employment of Laser Induced Breakdown Spectroscopy (LIBS) in helping sort industrial waste for mineral recycling.

In essence, each element has a unique fingerprint. A laser pulse aimed at a spot on the waste sample creates plasma on the sample surface which is analysed in milliseconds providing simultaneous measurement of all elements.

Clear benefits in using this technology include: no sample preparation; multi-element analysis; fast and precise; contactless; nearly non destructive.

LIBS analysis of a typical slag sample may take 1-2 mins, whereas conventional slag analysis take on average 20mins.

A special “Thank You”, and see you again in 2022!

Under these challenging conditions for home and business at this time, we are indebted to the support and participation of all of our partners, speakers, and delegates for making Mineral Recycling Forum 2021 ONLINE a success, and ensuring a fruitful and convivial time was had by all.

We are grateful for all the completed feedback surveys and please continue to provide us with your thoughts and suggestions (please either email us direct or complete our brief survey click here).

We very much look forward to meeting you again at another of our Forums, and of course, hopefully in person as soon as possible. Watch this space for details of Mineral Recycling Forum 2022.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 [email protected]

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 [email protected]

Free Forum Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations maybe purchased.

Please contact Ismene Clarke T: +44 (0)7905 771 494 [email protected]

Coming soon!

Global trends in refactory mineral supply & demand

FULL DETAILS HERE

For established players seeking new horizons & newcomers evaluating industrial minerals

FULL DETAILS HERE – EARLY BIRD ENDS 5 MARCH BOOK NOW!