MagForum 2016 Review

Austria is host to some wonderful scenery and culture, but it is also the home of the modern magnesia industry, and thus Vienna was a most fitting venue for IMFORMED’s inaugural magnesium minerals and markets conference MagForum 2016, 9-11 May 2016.

RHI’s Weissenstein magnesite mine, Austria

Last week 130 international attendees across the entire magnesia supply chain from producers to end users gathered at the new Meliá Hotel, Vienna, to engage, learn, and enjoy three days of magnesia-infused business networking and discussion.

“Congratulations to you for the MagForum organisation which was excellent. This was a great and very informative event. Long life to MagForum.”

Erwan Gueguen, Director R&D Europe, Magnesita, Belgium“We would like to express to you our great gratitude on being part of the this fantastic Forum in Vienna, it was well organised, great discussions, great food, and moreover great business opportunities have reached MagnesiumUSA Inc. thanks to this Forum.”

Val Tkachenko, CEO & President, MagnesiumUSA Inc., USA“I have been involved for the last 17 years in many international forums and conferences, and I have to admit that you have raised the standards for the rest of the pack, with the success of the first MagForum.”

Michael Tsoukatos, Director of Business Development, Grecian Magnesite, Greece

By common consent MagForum 2016 delivered just what the market wanted. Here’s a taste of what was on offer.

RHI celebrates 135 years at Veitsch

Almost 80 delegates braved an early start on the Monday to take in a superbly organised visit by RHI AG to the world’s oldest magnesia refractory plant at Veitsch, Styria.

In 2016, the Veitsch plant celebrates its 135th anniversary. Carl Spaeter, a German industrialist discovered the Veitsch magnesite deposit in 1881, which went on to produce magnesia for refractories.

The original mine at Veitsch ceased in 1968 owing to the high silica content of the raw material. The plant now consumes more than 180,000 tpa of raw materials, including dead burned and fused magnesia grades mostly from RHI’s facilities but also from the Netherlands, China, and Mexico.

Happy Field Trippers after a wonderful lunch and plant tour at RHI’s Veitsch plant. Courtesy RHI

Today, the Veitsch plant is state-of-the-art equipped, many production lines are automated by use of robotics. The plant has undergone a major €18m upgrade scheduled for completion in 2016. This investment will improve productivity as well as product quality and reduce environmental impact.

The Veitsch plant employs about 250 people, has an output of about 220,000 tpa refractories (ceramic-bonded bricks, carbon-bonded bricks, and mixes) and exports to more than 100 countries, with steel and cement industries being the key customers.

Delegates returned in good time for a most convivial Welcome Reception hosted by RHI on the top floor of the Meliá Hotel, providing a wonderful view of Vienna at sunset from Austria’s tallest building.

Magnesia outlook discussed

Following an introduction to MagForum 2016 by Mike O’Driscoll, Director, IMFORMED, and a Welcome Address from Andreas Kriegl, Head of Raw Material Supply, RHI AG, Austria, proceedings got underway with a lively Keynote Discussion Panel on China, magnesia supply and markets.

The panellists were Andreas Kriegl, Head of Raw Material Supply, RHI AG, Austria; Otto Levy, Chief Operating Officer, Magnesita Refratários SA, Brazil; Michael Tsoukatos, Business Development Director, Grecian Magnesite SA, Greece; Dr Richard Flook, Managing Principal, Mosman Resources, Australia; and Dr Hans-Jürgen Klischat, Head of Research & Development/Quality Management, Refratechnik Cement GmbH, Germany.

China, magnesia supply and markets were discussed by the Keynote Panel

There was no surprise in that China dominated the first part of the discussion, with a common recognition that the domestic magnesia industry required consolidation.

Michael Tsoukatos drew attention to the impending issue of the EU granting China Market Economy Status (MES) and how it would negatively impact Europe’s magnesia industry. A public questionnaire on the issue had resulted in a majority vote against (this was followed on 12 May by the European Parliament formally voting against by an 83% majority).

Also highlighted was the need for the magnesia industry to increase its market size by developing more applications, especially in the non-refractory market sector.

It was generally considered that with the current supply overcapacity in magnesia, there was little room for new sources coming on stream in the near future. However, end users would always welcome evaluation of new and especially high quality magnesia raw materials.

While it was hoped that “Good times should follow bad times” and that market recovery was eagerly awaited, the general consensus was that this would come to fruition later than sooner, and not until 2017.

Global supply review

In “Asia-Pacific magnesia supply round-up”, presented by Dr Richard Flook, Managing Principal, Mosman Resources, and co-authored by Dr Ian Wilson, Consultant, the audience was taken on a tour of the region’s magnesia production by country after a summary of the regional economic context, somewhat dominated, as it is, by China.

Richard Flook highlighted China’s use of magnesia cement in large infrastructure projects

Regarding India’s outlook, Flook posed the question of whether the country’s forecast growth would be met by imports or domestic production of steel and refractories.

Also highlighted was China’s use of magnesia cement in large infrastructure projects and whether this could be a growth market for magnesia.

A late addition to the programme was Christopher Zhao, Chief Investment Officer, Hejun Capital, and his topical presentation “Outlook for changes in China’s magnesia export quota policy and magnesia products trade with Europe”.

Zhao examined the background of China’s economy, China’s export quota policy, magnesia trade past and future, merger trends, and the Northeast Asia Magnesia Materials Trading Center.

China has seen a vast increase in company mergers: in 2015, there were over 2,692 reorganisation issues on China’s stock market, an increase of 39.6% compared with 2014. Zhao expects mergers in the magnesia industry, including “some companies with vision are even beginning to purchase European companies.”

Christopher Zhao expected mergers in the magnesia industry

Kerry Satterthwaite, Division Manager – Carbon & Chemicals, Roskill Information Services Ltd covered production, international trade, major players, and trends in “Europe/Middle East/Africa magnesia supply round-up”.

With some interesting trade diagrams Satterthwaite demonstrated that EMEA magnesia supply is important in a number of markets worldwide.

Across the Atlantic now with “Magnesium compounds in the Americas” by E. Lee Bray, Mineral Commodity Specialist, US Geological Survey. Bray documented the producers of the Americas, highlighting the different magnesia raw material sources such as olivine, salt flats and brines, and potassium magnesium sulphate.

New & alternative sources

Despite the prevailing market conditions, there are several magnesia development projects underway, with quite a few in Australia. In “What it takes to bring a successful magnesite project to market”, Paul Rix, Director, Archer Exploration Ltd provided a reality check-list for such developers before outlining Archer Exploration’s objectives for the Leigh Creek Magnesite Project.

Paul Rix provided a reality check-list for developers.

The Leigh Creek deposit hosts 435m tonnes @ 41.4% MgO and Archer envisages mining 125,000 tpa crude ore to produce around 50,000 tpa low grade dead burned magnesia. Potential customers have been identified and the company is in advanced discussions with ABC and Arrium for toll processing.

Alternative magnesia sources were also examined. “Bischofite production in Ukraine: an alternative source of magnesium chloride” by Roland Rivera Santiago, Vice President, MagnesiumUSA Inc. outlined magnesium chloride production from Poltava, Ukraine.

The operation has a capacity of 10,000 tpm magnesium chloride brine which can be refined to high purity. Market applications include construction, foods, domestic cleaners, de-icing, solar panels, gas drilling, while research is being conducted in agriculture and human health uses.

Roland Rivera Santiago: “Poltava bischofite has been used in various ways domestically, but has had no major international presence.”

Thermolith SA has been Greece’s sole olivine producer (about 40,000 tpa) in Mount Vourinos, north-west Macedonia since 2002. Thomas Valalas, Managing Director, Thermolith SA presented “Olivine: production & market applications” and explained olivine’s use as slag conditioner, EBT filler sand, foundry sand, sand blasting, and refractory raw material.

Valalas demonstrated the proven benefits of using olivine with DBM in refractories and discussed research in new markets such as CO2 sequestration, soil enrichment, fertiliser, and land remediation from acid pollution.

Refractory magnesia and markets

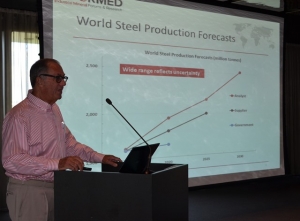

In “Refractory market drivers: outlook for magnesia” Ted Dickson, TAK Consultancy, explained the main influences on refractory demand, the structure of the market, and world refractory production trends.

Ted Dickson: ““If steel production forecast to 2020 is achieved…about 1.3 million tonnes of magnesia more than current demand [will be required].”

Regarding steel, given an average magnesia consumption per tonne of steel of about 4kg, 2015’s decline in steel production implied a loss of about 240,000 tonnes of magnesia. There could be a further loss of magnesia demand of 32,000 tonnes for 2016.

But Dickson also presented an optimistic view: “If steel production forecast to 2020 is achieved there will be an increase of 330 million tonnes

Dickson concluded that the rest of 2016 is expected at best to remain stable with the full year possibly a little lower than in 2015. Recovery is hoped for in 2017 with longer term growth in the region of 2-4% per annum.

Sonja Larissegger, Technical Marketing Manager, RHI AG presented “High purity magnesia raw materials for refractories” focusing on the properties, advantages and disadvantages of high purity magnesia, and the process of manufacturing dead burned magnesia from seawater at RHI’s operation in Drogheda, Ireland (formerly Premier Periclase Ltd).

Using such high purity synthetic magnesia, consuming an average 44bn litres/hour seawater to yield 10 tph DBM, Larissegger demonstrated that refractories have 30-50 % longer lifetime and an appreciable cost reduction.

Sonja Larissegger focused on the properties of high purity seawater magnesia

Another important refractory magnesia is fused magnesia, the topic of Asım Bilge, Production Engineer, DBM & FM Production Dept., Kümaş Manyezit San. AŞ, in “Fused magnesia: trends and global outlook”.

Bilge described the global fused magnesia market, demand, and prices, the effect of the global economy, and Kümaş’ fused magnesia activities.

With its third and fourth fused magnesia furnaces coming on stream in 2015, Kümaş now has 40,000 tpa fused magnesia capacity. This year the company started its electrical grade fused magnesia powder plant. Kümaş has ideal raw magnesite for the production of electrical grade FM with very low iron oxide content for high temperature applications.

Bilge concluded that “fierce” price competition of Chinese FM products continues, and there are no expectations of a market recovery in near future, while demand will continue to increase for higher quality FM grades.

Non-refractory markets

One of the primary trends at present is the quest for diversification into non-refractory magnesia markets while the refractory industry is suffering with the steel slowdown. MagForum 2016 ensured that this sector was given due attention.

Sibel Hizlan emphasised just how long it takes to properly evaluate magnesia use for cement board manufacture

Sibel Hizlan, General Manager, AK ALEV presented “Modelpan: a new generation of magnesia building boards” explaining how exhaustive research was required to evaluate the use of light burned caustic calcined magnesia (CCM) with perlite and other additives in manufacturing cement boards for construction applications.

AK Alev uses CCM produced by Kümaş. The cement boards, which the company started selling in mid-2015, are fireproof, easy to install, lightweight, flexible, and durable. A new cement board plant is now being built closer to Kümaş’ operations, while AK Alev is pursuing the US market.

“The use of magnesia in welding applications” by David Fedor, Global Consumable Chemicals Manager, Lincoln Electric Co., revealed all that you wanted to know about magnesia and welding but were afraid to ask!

A most comprehensive presentation explained the different welding processes and materials consumed, including DBM used mainly in submerged arc welding (SAW).

Lincoln consumes around 15-20,000 tpa DBM worldwide in welding applications. Natural magnesite grades are generally favoured (synthetic grades host boron which is not always welcome), and magnesia flux specifications range 85-94% MgO. Special attention must be paid to levels of carbon, phosphorus, and sulphur which must be as low as possible (max. 0.04% C, 0.01% P, 0.01% S).

Davd Fedor: a most comprehensive presentation on welding processes and materials consumed, including DBM.

“Emerging environmental high value applications for magnesia” was led by Akio Ishida, Director & Managing Executive Officer, assisted by Hirohisa Fujiwara, Manager and Kouki Takahasgi, Environment Engineer, Ube Material Industries Ltd.

Developments in new environmental applications were described including the evolution of flue gas desulphurisation in Japan, which is expected to see “expansion subside until 2020”, and “post-FGD” applications in soil and water treatment.

Hirohisa Fujiwara explains emerging environmental applications for magnesia in Japan.

Other growing applications include magnesia treating EAF dust and slag with heavy metal contamination, assisting biodiversity such as through pH control, and addressing the Red Tide issue in fisheries, and toxic waste stabilisation by glassification.

Samantha Wietlisbach, Senior Analyst, IHS presented “Flame retardant & chemical markets” and examined the global capacity of chemical magnesias, regional and end use consumption, CCM supply, demand and outlook, magnesium hydroxide applications, flame retardants, and magnesium chloride and sulphate.

Wietlisbach forecast a 2.7% growth p.a. over the next five years for non-refractory magnesia use, with magnesium sulphate, at 2.2%, magnesium chloride, 2.2%, and magnesium hydroxide, 2.8%.

An area of increasing attraction for magnesia has been hydrometallurgy. Mike Miller, Mike Miller Consulting Services, explained all in “Magnesia: its use and abuse in hydrometallurgy”.

Miller reminded that not all CCM is created equal, and demonstrated the importance of assessing CCM reactivity, before explaining the significance of stoichiometry, magnesia “blending”, solution metal content, temperature, dispersion/mixing efficiency, hydration, and storage for successful hydrometallurgical application.

“The use of magnesite in the production of ceramics” by Eleni Iskou, Sales Manager for Specialities, Grecian Magnesite SA described the development of raw magnesite products specifically for ceramic applications.

Among other properties, the very low iron content of the magnesite ensures the whiteness of the final product, which is being used in ceramic markets in Italy, Spain, Portugal, Greece, and Egypt.

During Q1 2016, Grecian Magnesite brought on stream a new €500,000, 60 tpd milling unit for CCM and magnesite, expanding capacity to 40,000 tpa. Part of the new capacity will be dedicated to processing magnesite to -40 microns for the ceramics market.

“A new magnesite processing technology for CCM & DBM with direct CO2 capture” by Dr Mark Sceats, Chief Scientific Officer and Executive Director, Calix Ltd showed how Calix has developed an “elegant technology” that produces very highly reactive CCM while efficiently capturing CO2.

Mark Sceats explains an “elegant technology” that produces very highly reactive CCM while efficiently capturing CO2.

Calix sources its raw material from the Myrtle magnesite deposit in South Australia, and via a continuous flash calciner produces magnesium hydroxide liquid for the treatment of acids and odours in waste water, and other applications in building products, food, agriculture, and energy.

Calix is active in several market development projects in Australia and Europe, and is investigating second generation technology to develop a DBM product, described as “an existential challenge for the EU Magnesia industry.”

IMFORMED is delighted with the success and positive feedback from delegates on MagForum 2016, and is already looking forward to planning the next conference with delegates’ comments and suggestions in mind.

Indeed, we have already begun taking bookings for sponsorships and exhibits, and offers of presentations have been accepted. Please do not hesitate to contact Ismene Clarke for the former, and Mike O’Driscoll for the latter.

A special thank you again to all of our speakers, sponsors, exhibitors, Field Trip hosts, and attendees for making the event such a success. We hope to see you again soon.

For more pictures of MagForum 2016 please go to Gallery.

For details on the MagForum 2016 programme, attendees, delegate feedback, and pictures, please go to MagForum 2016.

Ensure you don’t miss any news and updates on the next MagForum: Sign up here

Plus also join our LinkedIn Group MagForum

Hi Mike, An excellent summary of the current Mag situation. Very good compilation of the situation. Tks Murray