My introduction to last year’s IM Annual Review of Mining Engineering concluded with a pointer to the challenges facing the industrial minerals sector in developing and employing carbon emissions reduction, energy conservation, and recycling practices for a sustainable future (see Industrial Minerals Review 2021-22: Testing times sustain market turmoil, but outlook positive).

Throw in further critical raw material (CRM) developments, the energy transition, and continuing geopolitical hotspots, then we have the chief factors that started to shape the industry in 2022 and its near-medium future.

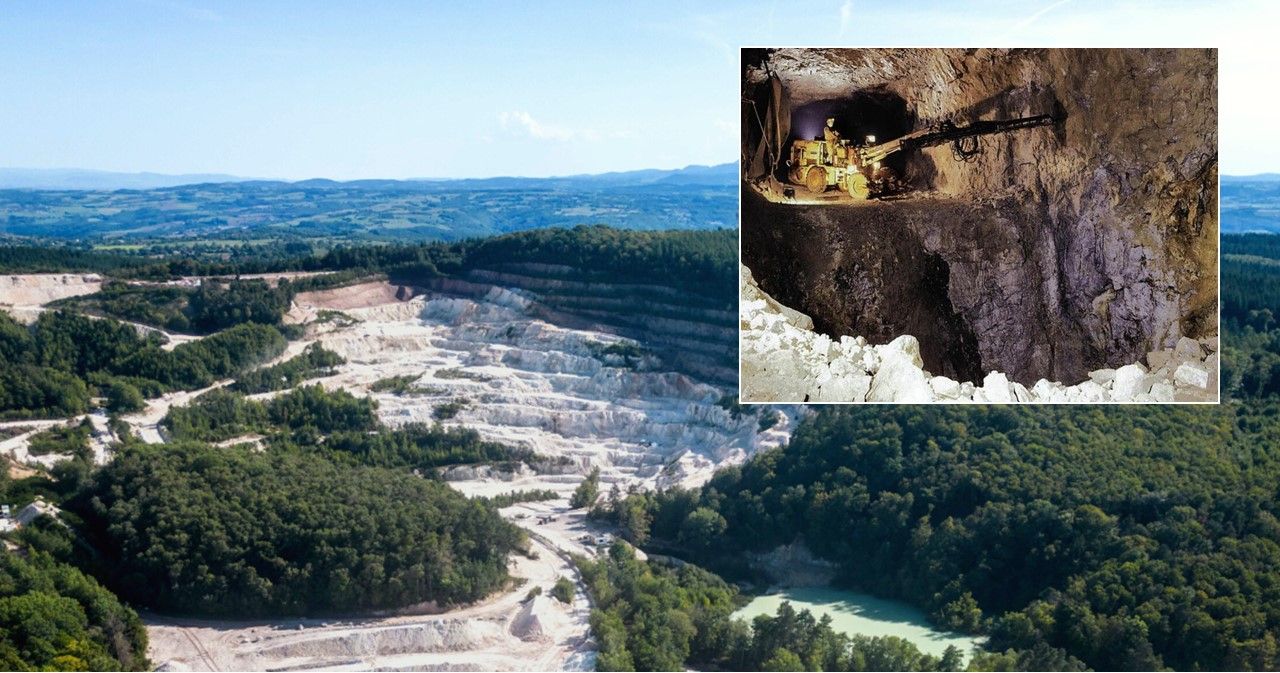

Title Image Industrial Minerals Go Critical | The fast evolving EV Li-ion battery sector envisaging a raft of new manufacturing locations throughout Europe has sharpened interest in developing European lithium, graphite, and fluorspar sources: Paris-based multi-national industrial minerals group Imerys joined the lithium mineral development sector in late 2022 and plans to become a major player in the European lithium market; its EMILI project at the Beauvoir kaolin mine in central France (main image) is targeting 34,000 tpa lithium hydroxide production starting in 2028; on 29 June 2023, Imerys and British Lithium announced a strategic partnership to accelerate development of the UK’s “largest lithium deposit”, producing 20,000 tpa battery-grade lithium carbonate equivalent from Cornish granite. Courtesy Imerys.

Inset image: the Käfersteige fluorspar mine, Pforzheim, south-west Germany, prior to its closure in 1996; Deutsche Flussspat is now looking to bring it back into operation by 2030 – the company will be presenting on this at Fluorine Forum 2023, Cannes, 16-18 October. Courtesy Geological State Office of Baden-Württemberg.

“Hi Mike, I just received my copy of Mining Engineering, and after reading the excellent intro realised it was written by you. Nice concise summary and all read true to what I have found the situation to be. Well done.”

Murray Lines, Managing Director, Stratum Resources, Australia

Critical Raw Materials up front & center

There has already been much reported on specific CRM developments, including a recent update on US CRM by Steven Fortier et al published in Mining Engineering May 2023.

Perhaps most significant from a big picture standpoint, is the accelerating activity from government and state organisations across the world, as well as the mainstream media, as they seek to understand and compile data on their respective CRM resources and supply chain risks.

Indeed, even the recent G7 Hiroshima Communique included reference to a “Five-Point Plan for Critical Mineral Security”.

Ahead of the pack here is the European Commission (representing 27 countries) and the USA, although others, notably Canada, Australia, Brazil and India are also getting their acts together, with the likes of the UK and France as latecomers finally joining the party.

The EC had a very busy 2022 launching a revised CRM list, notably adding feldspar and manganese, and in March 2023 an ambitious Critical Raw Materials Act. The latter introduced a new category of “Strategic Raw Materials” (SRM), important for technologies that support the twin green and digital transition, and defence and aerospace objectives (this includes REE and battery grade lithium, manganese, and natural graphite).

“We are experiencing a global race for the supply and recycling of critical raw materials.” urged Thierry Breton, Commissioner for the Internal Market, EC.

The EC’s CRM Act aims to provide the EU with tools to ensure access to a secure and sustainable supply of CRM, stating that not more than 65% of the EU’s annual consumption of “each SRM at any relevant stage of processing” is sourced from a single third country. Moreover, benchmarks are set for EU annual SRM consumption to be met by at least 10% extracted in the EU, at least 40% processed in the EU, and at least 15% from EU recycling.

Most welcome to EU mineral developers will be the Act’s promise to reduce administrative burden, simplify permitting procedures for EU CRM projects, and support access to finance. Too good to be true?…Let’s see.

Certainly, EC President Ursula von der Leyen laid it on the line at the World Economic Forum in Davos January 2023, as she unveiled the CRM Act: “The next decades will see the greatest industrial transformation of our times – maybe of any times.”

The US Inflation Reduction Act, signed into law on August 16, 2022, has also been instrumental in focusing minds on CRM supply, although how much it will influence upstream US CRM development remains to be seen .

Certainly downstream activity is already emerging, with the likes of Ford Motor Co. recently signing several lithium supply agreements with a focus on material that will be eligible under the IRA, securing supply from SQM, Albemarle (both in Chile), as well from three North American projects in development.

The flip side to all this of course, is that certain CRM-rich countries may take steps to reinforce control over their supply, such as Chile in its April 2023 announcement of plans to nationalise its lithium industry.

Energy & environment top priority

The greatest impact on the future of the industrial minerals industry will be climate change and the steps taken by industry and consumers alike to mitigate against this.

There are several strands to this which certain companies in the sector have already started to address in recent years, and it would be fair to say that the pandemic lockdown periods of 2021-22 have helped companies reassess and re-strategise their “green” priorities.

“Energy transition” is the big buzz word top of the agenda of mineral companies as they strive to switch to alternative energy sources to reduce their CO2 footprints, eg. using electrical mining equipment, or consideration of other fuels for processing operations.

Mining and processing is an energy intensive industry so this will take time to develop the optimum solution. With rising petcoke costs, mineral plants using kilns for drying and in particular for widespread calcination operations, such as in bauxite, magnesia, doloma, and lime production, will, or should, be evaluating alternatives to fossil fuels.

For example, in 2022 Grecian Magnesite started using a new burner system using biomass accounting for 10% (by energy basis) for its thermal power demand; this is set to increase to 20% in 2023, and 40% by 2024. This was part of its participation in BAMBOO, an EU-funded project developing new technologies for energy and resource efficiency.

The company is also looking to switch from fossil fuels to LNG use, which would not only result in the reduction of CO2 emissions by at least 40% and improve energy efficiency by at least 8%, but render flue gas desulfurization unnecessary as well (poses question on future of FGD scrubber minerals?).

Leading magnesia producer Grecian Magnesite has started using a new burner system using biomass accounting for 10% (by energy basis) for its thermal power demand; other initiatives in its decarbonisation programme include construction of a 1,000kWp PV facility equipped with more than 1.800 bifacial panels expected to cover 100% of the needs of the refractory masses and speciality DBM plant and 6% of the overall Yerakini – Polygyros mining complex. Delegates to MagForum 2024 Thessaloniki will be able to visit GM’s operations. Courtesy Grecian Magnesite.

The other main energy strand in decarbonisation is in carbon capture and utilisation (CCU). While research on CCU has been around for some years, it is only recently that serious projects are getting off the ground and industrial mineral companies are starting to employ such technology.

The added benefit, and potential market opportunity, is that certain CCU projects result in production of some very useful synthetic mineral products.

Leading Australian decarbonisation technology company Calix has already been active in supplying and developing its alternative flash calciner technology to the European cement, lime, magnesite industries, and refractory industries.

Earlier this year leading global magnesia and refractories producer RHI Magnesita signed a long term strategic cooperation agreement with another “cleantech” Australian company, MCi Carbon, “… to achieve its goal of becoming a CO2 neutral business.”

MCi Carbon has developed a mineral carbonation process that captures and converts industrial CO2 emissions into solid bulk materials, including calcium and magnesium carbonate, which can be used in new low-carbon products for construction, manufacturing and consumer markets.

Other companies, such as Paebbl in the Netherlands, are evaluating such proprietary mineral carbonation processes that essentially accelerate and scale a natural process using heat and pressure to form synthetic mineral products. Paebbl utilises CO2 emissions and ground olivine to produce mineral filler products.

Another project using olivine is being developed by Holcim and Eni, with Eni storing its CO2 in olivine, and Holcim using the carbonated olivine as a new low emission raw material for its new “green cement” production.

Thus we are seeing generation of a new market outlet for olivine (and other Mg-silicate materials) as well as producing new mineral products and capturing CO2 at the same time.

A EU Horizon Europe research project called Carbon4Minerals is devoted to developing innovative technologies for CO₂ capture for use in carbon-negative construction products – we will see more such initiatives being rolled out in the near future.

Narrow margins: China remains an important source of industrial minerals to world markets, eg. (left) barite being loaded for shipment at Fengcheng, Guizhou, to Gulf of Mexico oil drilling market. Geopolitics is a real factor in influencing global shipping and trading patterns, as shown by the Russia-Ukraine War; now there is concern over rising tensions between China and Taiwan with commercial shipping relying on maritime access through strategic gaps in island chains surrounding China (right; see blue arrows). Courtesy James Devlin

Geopolitical impact on supply chains

And finally, just a reminder that unfortunately geopolitics is never far away from negatively impacting mineral supply chains – lessons have to be learned from the Covid pandemic and the Russia-Ukraine War.

While the Russia-Ukraine War continues with seemingly no end in sight, and remains impacting logistics, in the eastern hemisphere there are warnings of a potentially more catastrophic impact on global shipping logistics with the simmering of the China-Taiwan stand-off.

A “Zero China” policy regarding mineral supply by most traders and consumers, while tempting, is unlikely and economically ill-advised owing to the country’s industrial mineral wealth for export markets at relatively lower prices (though often cyclical), despite ongoing supply challenges written about previously in this column.

But a “Cold Peace” in the region endures, so companies must now surely build supply chain resilience and reduce excessive dependency on mineral supply from China (or indeed elsewhere in East Asia), ie. being well advised to de-risk and diversify their mineral supply chains. Certainly, a case of hoping for the best, but planning for the worst. Mineral supply is not all about “just in time”, it now needs to be about “just in case”.

IMFORMED is once again both honoured and delighted to be invited to write the introduction to Mining Engineering’s annual review of industrial minerals in its July 2023 issue.

For PDF copy of ME article pages click here

Bill Gleason, Editor, ME writes: “Mike O’Driscoll, director and cofounder of IMFORMED Industrial Mineral Forums and Research provides a great overview of the sector. In a world that is working to meet aggressive timelines to decarbonize, the mining industry will be a key player. At the tip of that spear are the critical and strategic raw materials needed for everything from batteries in electric vehicles to advanced technologies. In the foreword to the Industrial Minerals Review, O’Driscoll notes that in addition to accelerating actions from government and state organizations, downstream activity by corporations is well under way”.