Mineral Logistics Forum 2016 Review

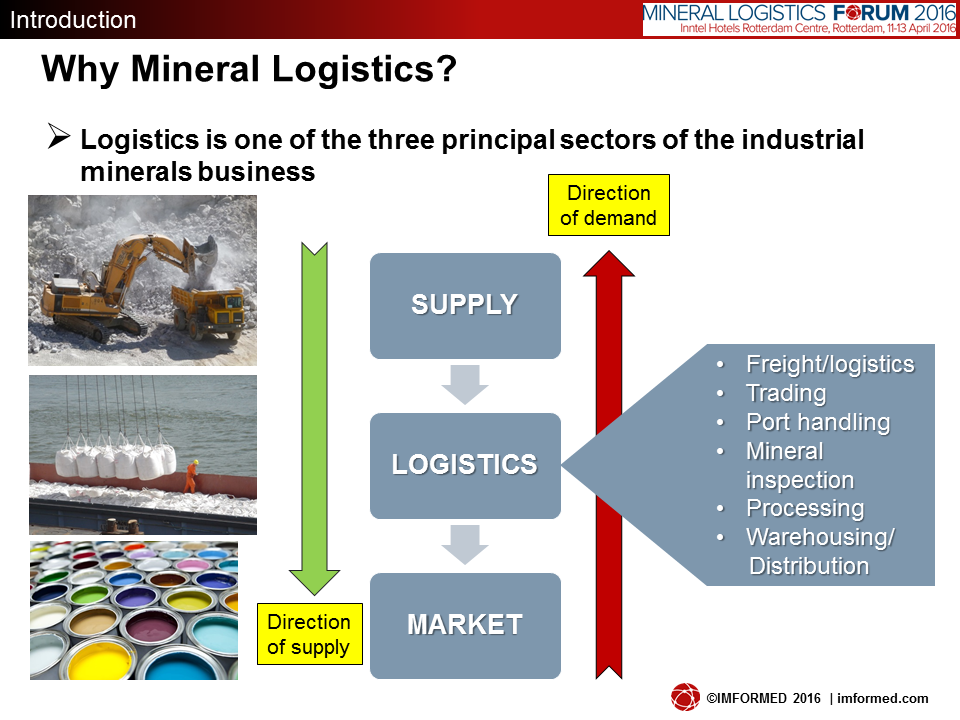

Understanding the logistics aspects of mineral supply chains is crucial to the success of any operation and project.

Those attending Mineral Logistics Forum 2016 in Rotterdam last week were fortunate to be able to hear first hand from nine experts some of the latest trends and developments in supply chain logistics for industrial minerals.

Nice combination of different speakers covering several parts of the supply chain.

Alain Dommisse, Global Supply Chain Director, Solvay Chemicals International, BelgiumThe IMFORMED Forum brings together all players in the entire industrial minerals logistics chain.

Marcel Gorris, Cluster Manager AM&R, Port of Amsterdam Authority, Netherlands

The event commenced on 11 April with a wonderful evening reception at the Royal Maas Yacht Club sponsored by the Rotterdam Port Promotion Council and the Port of Rotterdam.

Jacob van der Goot, Chairman of the Royal Maas Yacht Club and former managing director of ABN AMRO Rotterdam (below right), welcomed international delegates with a passionate address on the history of the Club, the maritime commerce pedigree of Rotterdam and its relevance to the Forum.

Van der Goot introduced Port of Rotterdam’s new Vice President Industry & Bulk Cargo Business, Yvonne van der Laan, who outlined the dry bulk business in Rotterdam and its importance for industrial minerals trade in the port.

Logistics and dry bulk shipping reviewed

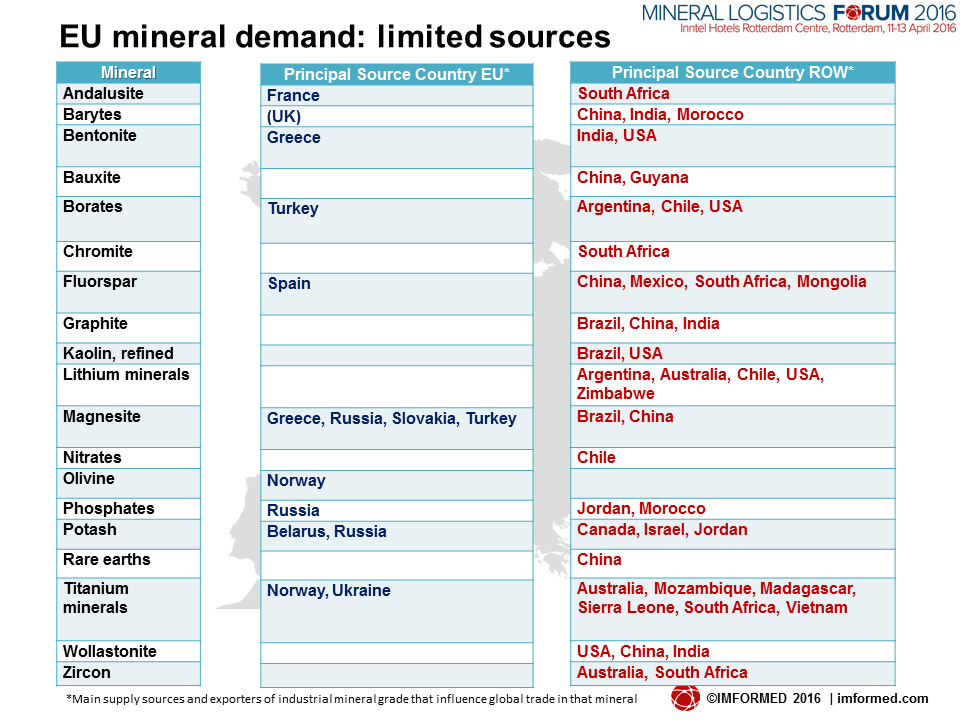

The next day, proceedings got underway with an introductory presentation by Mike O’Driscoll, Director, IMFORMED, emphasising Europe’s reliance on global imports of many important industrial minerals and thus well planned logistic solutions were imperative.

By way of example he commented on the ill-fated Seqi olivine development in Greenland during its bold but brief five-year life.

The current woes and outlook of the shipping market were comprehensively examined in “Dry bulk shipping market trends and outlook” by Marc Pauchet, Senior Analyst, Braemar ACM Shipbroking.

“A shipping market under stress” Marc Pauchet, Senior Analyst, Braemar ACM Shipbroking.

He described a shipping market under stress with all time lows of spot rates, which, in his opinion, will probably continue for at least three years.

Pauchet reviewed freight rates, the share of minerals within the dry bulk market, how owners, China, and India have influenced the market, as well as a look at the individual ship sizes, key dry bulk commodities, growth trends, and China’s the new “silk road”.

Future trends with logistics implications

In “Overview of the importance of industrial mineral logistics”, Ulrich Koester, Managing Owner, Maritime Tecnet GmbH, identified trends in the development of industrial minerals trade which will require logistical support.

These included: minerals recycling and urban mining; Turkish producers targeting Europe; new mineral processing plants in the Middle East; new projects in Canada; and the influence of the dollar and euro on trade strategies and capital investors.

Ulrich Koester, Managing Owner, Maritime Tecnet GmbH, brought into question the traditional role of the distributor

Koester also brought into question the traditional role of the distributor and suggested his “Mineral Cube” – a modular building block system that meets all requirements of suppliers or buyers of industrial minerals. Logistics is just one component of a complete and customised solution for our customers.

Similarly, Albrecht von Kempis, Managing Director, VonKempisResources GmbH, also extolled on some macro trends in “New trends for industrial mineral applications and specifications.” He said “Applications and specifications are part of the mineral supply chain”.

Von Kempis reviewed mining trends over the last two centuries before highlighting the current and future impacts of digitisation, urbanisation, individualisation, ecology, globalisation and mobility.

From ship to storage

Claus Ohlmeyer, Dep. Mgr. Business Unit Building Products & Minerals, Haver & Boecker OHG, kept the attention of the audience with several educational videos in “From ship to storage: evaluating the full chain of minerals handling.”

Claus Ohlmeyer, Dep. Mgr. Business Unit Building Products & Minerals, Haver & Boecker OHG, provided an excellent review of a range of ship unloading systems.

Ohlmeyer provided an excellent review of a range of ship unloading systems, storage and mixing solutions, and bagging and dispatch options for industrial minerals.

Of interest were his comments on various storage silos, including a central cone silo which could store several different products.

Vienna: Europe’s inland logistics hub

Moving into the hinterland of Europe, Friedrich Lehr, Managing Director, Wiener Hafen Management GmbH outlined the functions and benefits of Vienna in “Vienna: Europe’s inland multi-mode logistics hub for minerals”.

Vienna “a pulsating logistics interface in central Europe”, Friedrich Lehr, Managing Director, Wiener Hafen Management GmbH

Described as “a pulsating logistics interface in central Europe”, Lehr highlighted the facts and figures for Hafen Wien including its handling of 8m tonnes of goods transhipment, and 480,000 TEU in its container port.

The port has 600,000 TEU transshipment capacity, 70,000 m² warehousing and open-air storage, and a crane for transshipping up to 84 tonnes. Lehr underlined Vienna’s location at the heart of Europe including direct waterway to Asia‘s growing markets.

Papermaking minerals

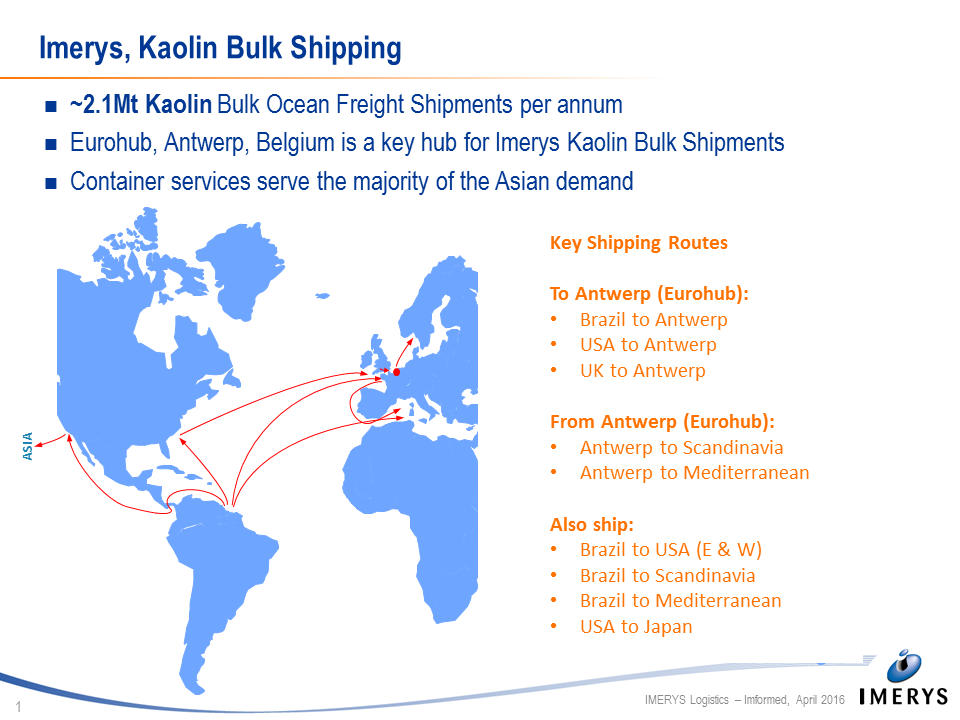

In “Imerys bulk shipping”, Joost van Moorsel, Senior Logistics Manager, Imerys (below) explained that although Imerys’ overall overseas logistic chains are dominated by packed, containerised shipments, bulk shipping is significant for two key minerals, kaolin and ground calcium carbonate (GCC), especially for the paper industry.

This trade represents about 2.7m tpa of contracted bulk ocean freight shipments for Imerys, and is dominated by kaolin accounting for about 77% of the shipments.

The Eurohub in Antwerp, Belgium is the central facility for Imerys’ European bulk logistics for kaolin and GCC, mostly sourced from the Americas, although some kaolin is shipped from the UK, and GCC from Greece and Turkey.

Van Moorsel concluded by raising some concerns for the future including a lack of innovative approach by suppliers, mainly in shipping and rail; congestion in South American discharging ports; introduction of road taxes in European countries; and availability of qualified staff in some regions.

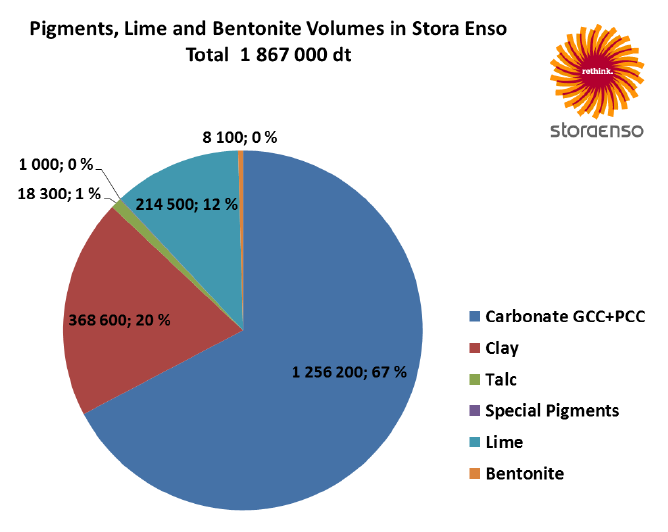

Ilari Valkeinen, Vice President Purchasing, Stora Enso (below) delivered an entertainingly frank presentation “Minerals in Paper” highlighting Stora Enso, the paper industry, logistics at Stora Enso, challenges, which pigments are used and why, and a take on the future.

Valkeinen said: “I want to underline co-destiny, in competitive bulk-business markets with our suppliers and sub-suppliers – not forgetting the role of end customers, you, as individuals and decision makers.”

Regarding outbound logistics, Stora Enso handles some 15m tpa in trucks, and 6m tpa in Ro-Ro ships and containers; inbound logistics, including minerals, account for about 2m tpa in Lolo or slurry boats and silo trucks.

Valkeinen could not help but illustrate the irony, and importance of logistics, of transporting minerals from the “middle of nowhere” (eg. Brazilian kaolin mines) to a paper plant, also in the “middle of nowhere” (rural Scandinavia).

Stora Enso consumes just under 2m tpa of GCC, PCC, kaolin, lime, talc, and bentonite sourced from Europe and North and South America.

In conclusion, Valkeinen said: “Logistics and quality in logistics plays an important role in the direct and possible indirect cost of minerals.”

Borates from USA to Europe

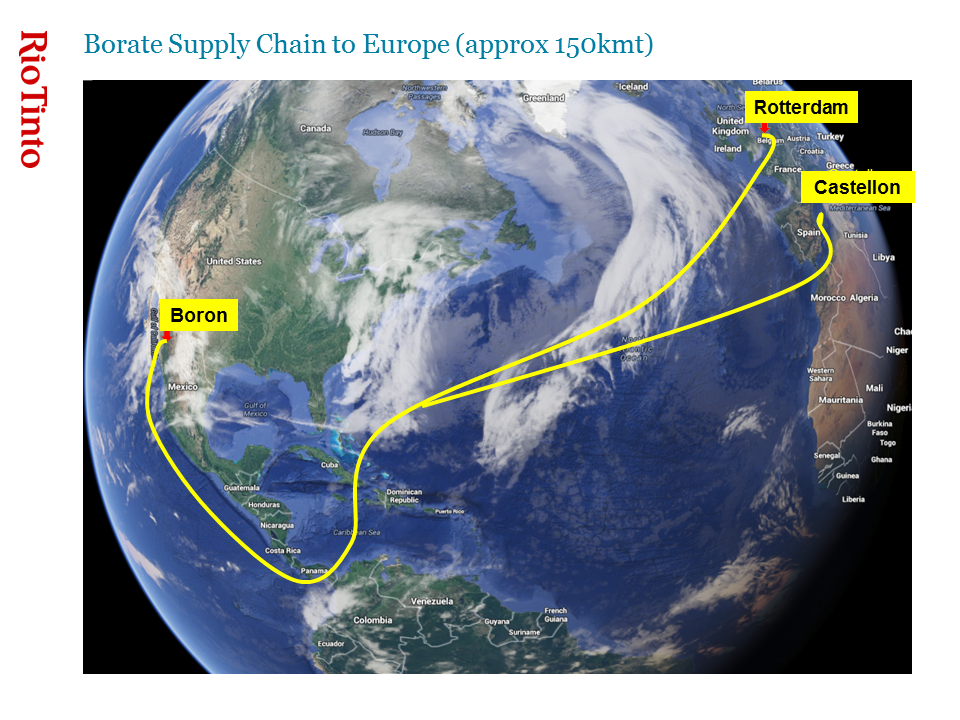

In “Borates supply to Europe: logistics considerations”, Miguel Galindo, General Manager Sales & Supply Chain EMEA, Rio Tinto Minerals (below), provided an overview on RTM’s global supply chain and footprint, product handling characteristics, the borate supply chain to Europe, current market demands on supply chain from customers, suppliers, shareholders and society, concluding with RTM’s strategic answer: the SIOP process.

RTM supplies about one third of the global market for refined borates under the 20 Mule Team Borax brand from one mine in California, which produces about 1m tpa. The company has processing and shipping facilities in California, China, Malaysia, France, Spain, and the Netherlands.

Galindo explained RTM’s borates supply chain to Europe, representing about 150,000 tpa, from the mine at Boron, California by train to the port at Wilmington on the West Coast, then shipped south to the Panama Canal, and then across the Atlantic to Rotterdam, and also Castellon, Spain.

Galindo said: “Supply chain delivery is an integral part of RTM Value Proposition to its customers. Demands on working capital, lean processes, and greater efficiency will continue to increase, so will the demand for information and transparency to all stakeholders involved.”

Riding the wave

Immediately following the Forum, delegates were invited to enjoy a thoroughly invigorating fast RIB ride down the River Maas, courtesy of Ssp, which as well as being highly entertaining was also instructive in showing off the vast size of the Rotterdam port area and its facilities.

Delegates were able to relax later with a comforting drink at the Finale Drinks Reception, also courtesy Ssp.

Field Trip: Rotterdam Bulk Terminal, European Bulk Services

The day after the Forum, delegates were able to fully appreciate first hand some of the aspects highlighted in the presentations by visiting the mineral terminals of Rotterdam Bulk Terminal and European Bulk Services in the port of Rotterdam.

IMFORMED is delighted with the success and positive feedback from delegates on Mineral Logistics Forum 2016, and is already looking forward to planning Mineral Logistics Forum 2017 with delegates’ comments and suggestions in mind.

Indeed, we have already begun taking bookings for sponsorships and exhibits, and offers of presentations have been accepted. Please do not hesitate to contact Ismene Clarke for the former, and Mike O’Driscoll for the latter.

Ensure you don’t miss out on news and updates for Mineral Logistics Forum 2017

A special thank you again to all of our speakers, sponsors, exhibitors, Field Trip hosts, and attendees for making the event such a success. We hope to see you again soon.

For more pictures of Mineral Logistics Forum 2016 please go to Gallery

Missed attending Mineral Logistics Forum 2016?

For programme, attendees, pictures, and feedback please go to Past Forums.

A set of presentations (as PDF) maybe purchased: Price £500 – please contact:

Ismene Clarke, T: +44 (0)208 224 0425; M: +44 (0)7905 771 494; E: ismene@imformed.com