Industrial minerals | Refractories | Alumina | Ceramics | Lime | Sorting

Mineral Recycling Forum 2024 Review | Latest insights on evolving sector

Industrial minerals recycling from a wide range of waste streams is now a significantly evolving market sector in its own right.

Whether from mine waste, refractories, construction, ceramics or batteries, a new and alternative source of industrial minerals, be they “critical” or otherwise, is being established across the globe.

Title Image Tunnel Vision: Demolition and collection of spent cement and lime kiln refractories is one of the key sources of recycled refractory raw materials Courtesy REF Minerals.

The latest trends and developments in this exciting sector were spotlighted at IMFORMED’s Mineral Recycling Forum 2024, held earlier this year in Dubrovnik during 22-24 April.

The event was one of the best yet hosting the largest attendance with diverse and insightful presentations sharing recycling developments worldwide for industrial minerals, refractories, alumina, ceramics, lime and sorting technology (full review of presentations below).

Plus networking on the Adriatic Sea in a 16th Century replica trade ship! (special thanks to sponsors Glenn Hunter & Associates Inc. & REF Minerals GmbH).

Next year we shall be moving the event to the western Mediterranean: Mineral Recycling Forum 2025, Cannes, 9-11 April – see link for latest details.

ANNOUNCING

CALL FOR PAPERS!

If interested please contact: Mike O’Driscoll mike@imformed.com

What delegates said about Mineral Recycling Forum 2024

Good programme, excellent venue; provided comprehensive information and improved my awareness of industrial minerals recycling.

Masakazu Iida, General Manager, Research Centre, Shinagawa Refractories Co. Ltd, Japan

Nice programme, lots of beneficial content from magnificent speakers; a big chance to seek new opportunities and to meet new contacts.

Haechang Kwon, Manager Recycling, Foosung Corp., South Korea

A big “THANK YOU” for organising this wonderful event in Dubrovnik again. The venue was beautiful, we heard interesting speeches and there was a lot of room for networking.

Ellen Steger, Director Sales, MMW Hamm GmbH, Germany

I had a blast getting to meet people from other companies to discuss the challenges and accomplishments in mineral recycling both in and out of the refractory industry. Thank you IMFORMED for putting on an amazing conference.

Samantha Garnier, Research Engineer, HarbisonWalker International, USAMissed attending the Forum?

Free Mineral Recycling Forum 2024 Summary Slide Deck Download hereA full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Mineral Recycling Forum 2024 Review

OVERVIEWS

The future for the minerals industry: going where the minerals are greener

Mike O’Driscoll, Director, IMFORMED

The two primary challenges (and opportunities) facing the industrial minerals industry are recycling and decarbonisation – they will dominate the business over the next decade, described by O’Driscoll as the “Missions of our time”.

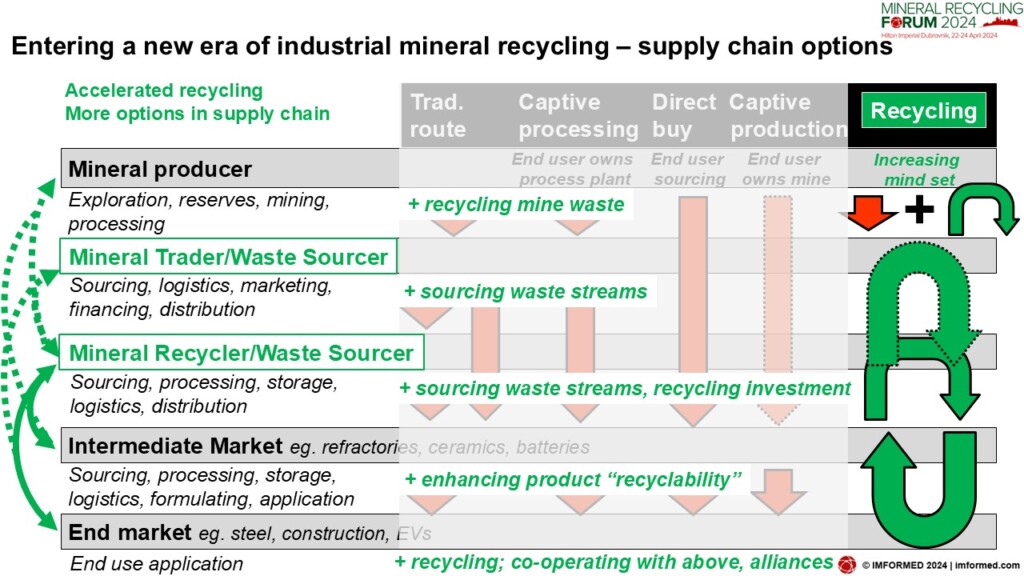

The new era of mineral exploration, sourcing, development, and recycling is now upon us. The main drivers for this were covered, and it was emphasised that tomorrow’s “mining” will in large part be efficient and economic utilisation of today’s industrial waste – primarily mine waste, and also spent end products and their manufacturing waste.

The wide range of markets using industrial minerals was reminded, and all those market sectors are now targeting recycling – but the industry is having to learn how to recycle for each market.

Crucially for the industry, a new supply chain is evolving whereby there needs to be diligent co-operation and partnerships established between the key stages of production, sourcing/trading, processing, and intermediate market and end market consumers – each contributing to permit and strengthen the circular economy of mineral recycling.

Locating mining in the circular economy: industrial minerals recycling & decarbonisation

Dr Florian Anderhuber, Director of Energy and Climate, Euromines, Belgium

After outlining the role of Euromines, Anderhuber covered regulatory expectations influencing mineral recycling by explaining the latest with the EC’s Green Deal, the Critical Raw Materials Act, and “Regulatory horizontalization” – the merging and bringing together different ESG-streams and expectations on processes, products, transparency and trade-offs.

He then proceeded to explore options in minerals mining, decarbonisation and circularity. These included: the use of tailings in re-processing, carbon storage, and alternative construction materials; turning CO2 into a resource, with carbon capture and utilisation (CCU).

Anderhuber considered the future as CAPEX-intensive with huge potential, rethinking the role of mining, a key to a deep sustainability transition.

Financing waste to industrial mineral value assets

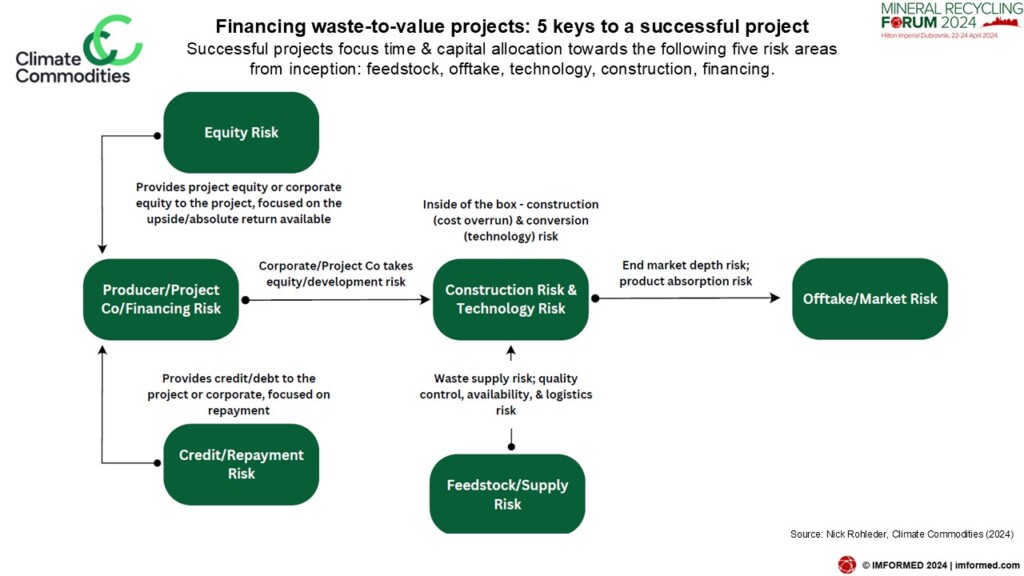

Nicholaus Rohleder, Co-Founder, Climate Commodities, USA

Rohleder started with five keys to successfully financing waste-to-value projects. Successful projects focus time and capital allocation towards the following five risk areas from inception: feedstock, offtake, technology, construction, financing. “The capital is there, but structure is the key.”

In structuring the feedstock contract, he outlined key risk considerations and understanding tipping fees, before covering managing multiple suppliers and counterparty credit risk, and structuring offtakes, providing some examples.

Other elements covered included: mitigating technology risk, securing cost estimates and managing construction risk, structuring the engineering, procurement, and construction (EPC) contract, and accessing capital – structuring for success and scale.

For more detail please see: Nick Rohleder’s article “From Byproduct to Benefit: A Comprehensive Guide to Financing Industrial Minerals Waste-To-Value Projects”

LIME | ALUMINA | SORTING

Lhoist circular solutions for lime-based waste

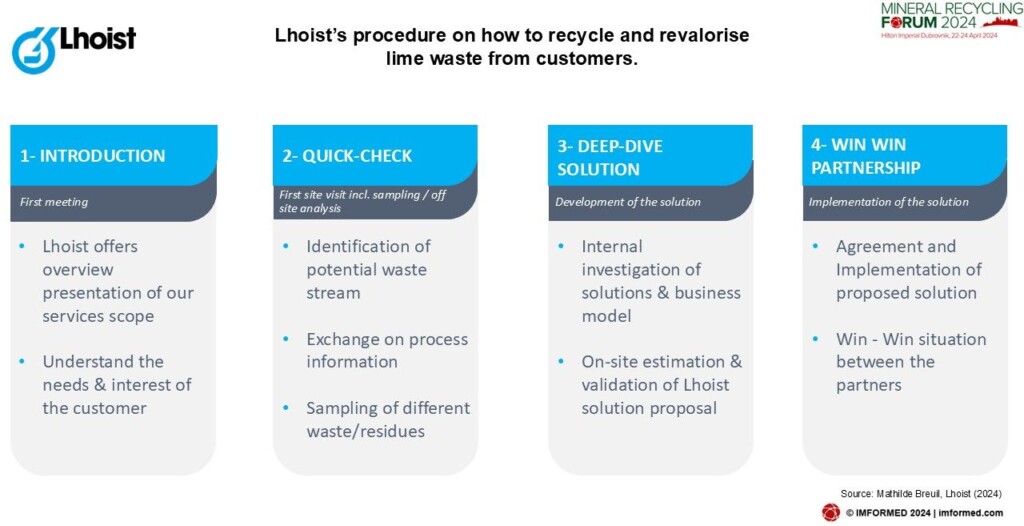

Mathilde Breuil, Lithium Market Development Manager, Lhoist, Belgium

What the circular economy means for Lhoist was explained, along with solutions on how to recycle and revalorise lime waste from customers.

Steps to achieving this include transparency and communication, development of partnerships and collaborations, and synergies between Lhoist markets and applications.

Three examples were discussed:

Industrial wastewater treatment – Europe: specific treatment of filter cakes from metal precipitation and reuse in another application at Lhoist.

Pulp and paper – Europe, Latin America: precipitated calcium carbonate mixed with virgin dolomite to supply agriculture market

Sugar cane & ethanol production – Latin America: vinasse residue is rich in organics and phosphorous compounds, if mixed with lime, it’s an efficient fertiliser for sugarcane fields.

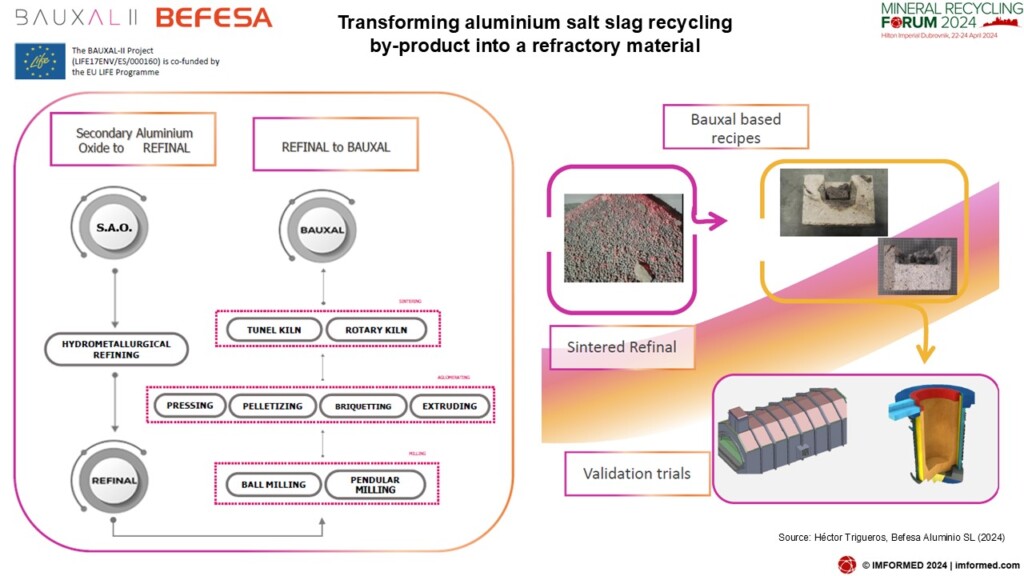

BAUXAL II: Transforming aluminium salt slag recycling by-product into a refractory material

Héctor Trigueros, R&D and Project Engineer, Befesa Aluminio SL, Spain

Trigueros summarised Befesa Aluminio’s role as European leader in recycling aluminium wastes: salt slag and spent pot lining recycling of 480,000 tpa in four plants and primary and secondary dross and scraps recycling of 200,000 tpa in three plants.

He explained the generation of salt slags from secondary aluminium smelting and their subsequent processing into ammonium sulphate, oxides, and salts, and highlighted the opportunity of developing a “secondary aluminium oxide” composed of 60-70% alumina for use in cement, mineral wool, ceramics, and soil stabilisation, plus a “secondary bauxite” composed of >60% alumina.

The EU-funded project LIFE BAUXAL II was then outlined, focused on valorisation of aluminium by-products as an alternative raw material for refractory grade bauxite.

It was noted that bauxite had increased in economic importance as an EU critical raw material from 2020 to 2023, which has helped drive the project, with the industrial goal of substitution of 20% of the European demand of refractory grade bauxite by recycled material.

Hydrometallurgical refining of secondary aluminium oxide produces REFINAL, which is then milled, briquetted, and calcined to produce BAUXAL, which is being trialled in aluminium, iron and steel refractories.

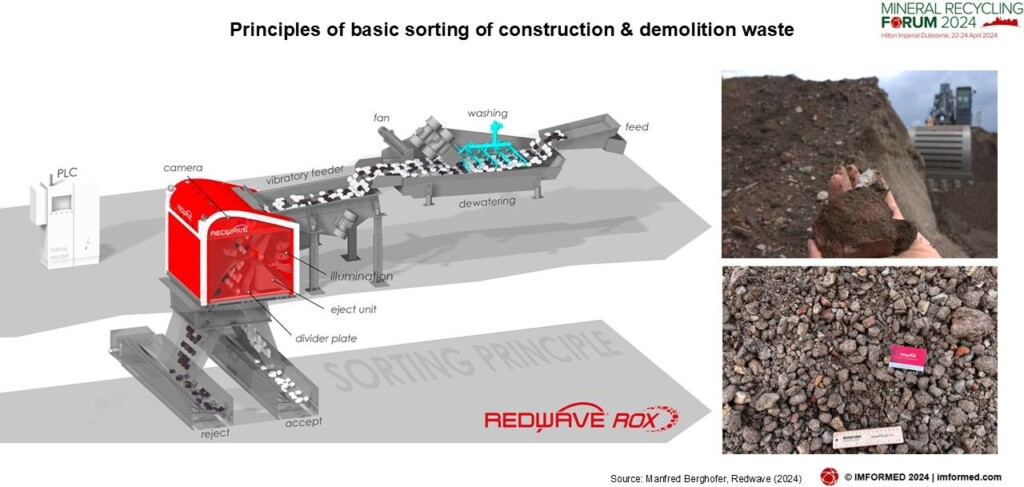

Smart sorting for a sustainable future: REDWAVE ROX’s sorting technology in C&D waste management

Manfred Berghofer, Head of Global Sales – Mineral sorting, Redwave, Austria

REDWAVE delivers sorting technology for the recycling and mining industry, and in particular serves the following waste sectors: minerals, construction and demolition waste, glass, metal, plastic and foam, paper, and textile.

The main aims of successful sorting are to save resources, upgrade product quality, reduce process costs, and reduce landfill costs.

Sorting is according to colour, material and chemical composition by near-infrared reflectance spectroscopy (NIR) and X-ray fluorescence spectrometry (XRF), and size and shape by laser sorting.

Berghofer proceeded to illustrate sorting processes with examples from construction and demolition waste, refractory waste, incinerator bottom ash, and minerals such as talc, quartz, borates, and feldspar.

Sourcing refractory minerals from China?

Or interested in China’s refractory market?

Don’t miss…

CONFIRMED PROGRAMME | VISIT TO HAIMAG | EARLY BIRD ENDS 9 SEPT.!

RECYCLING REFRACTORIES: OVERVIEW | NORTH AMERICA

“Ahead of Time”: Closing the material loop from demolition to circular products

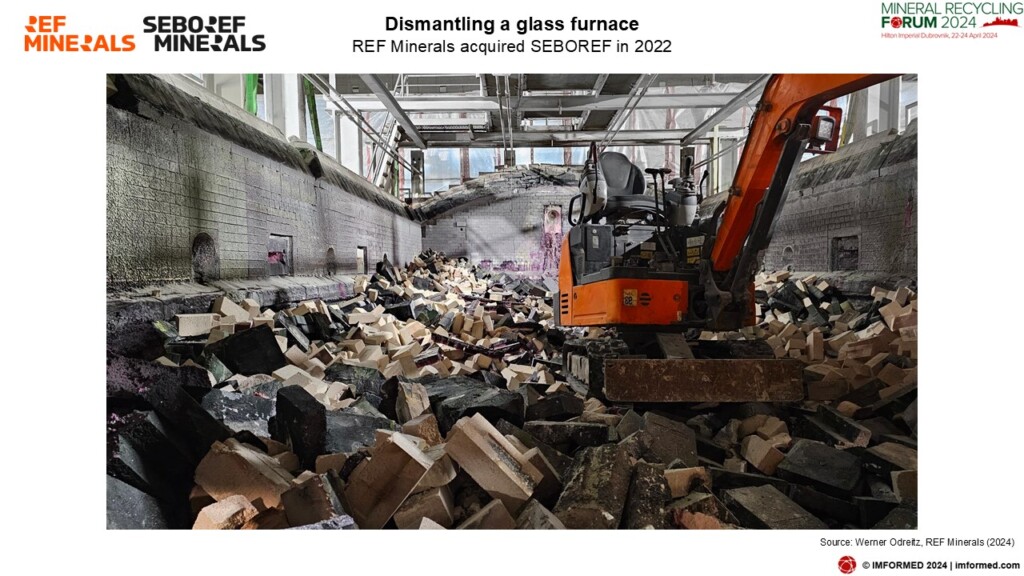

Werner Odreitz, CEO, REF Minerals, Germany

Odreitz underlined the recent evolution of REF Minerals which provides circular raw material recycling solutions, in particular for the glass, glass fibre, refractory and ceramic industries.

The company recycles about 50,000 tpa at two plants, one in Riga, Latvia and one in Duisburg, Germany. Czech demolition company SEBOREF was acquired in 2022, and a second processing plant is being built in Dolní Rychnov.

The main recycled products are zircon, zirconia, AZS, alumina, alumina-chrome, chrome oxide, and magnesia. The company operates in some 60 countries.

Odreitz explained REF Minerals’ activities in dismantling glass & glass fibre aggregates, sorting refractory debris, waste management & disposal services, cleaning of materials, processing circular raw materials, sales & distribution of recycled materials, and SEBOREF.

Recycling refractories in the Americas

Nelson White, CEO, Glenn Hunter & Associates, USA

As the leading refractory recycler in the USA, White was keen to point out that “secondary raw materials are changing in the Americas” and that Glenn Hunter & Associates (GHA) is leading the way.

Based in Delta, Ohio, GHA started operations in 1985 recycling refractories and producing secondary raw materials for the glass, steel, non-ferrous metals, and cement industries.

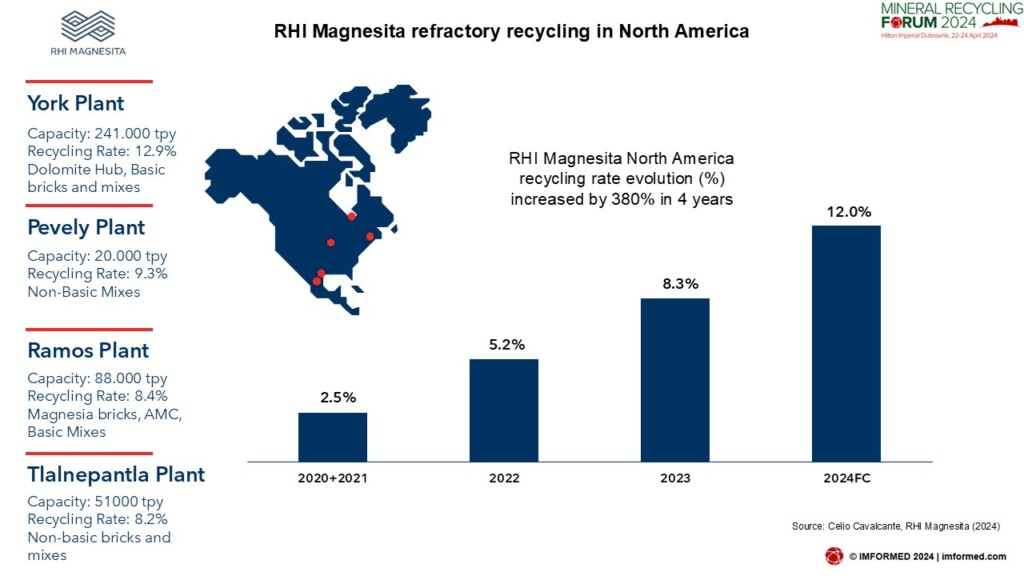

Overcoming challenges of recycling in North America: the transformation of a maturing recycling market

Celio Cavalcante, Head of M&S, R&D and Sustainability NAM, RHI Magnesita, USA

Cavalcante summed up the current situation in North America as follows:

USA: Maturing challenging market: logistics, cost, lack of demand

Canada: Lack of refractory production, logistics and environment

Mexico: Several smaller players with established relationships

The steel industry in North America was described as “resilient…and holding despite headwinds”. New and planned steel mills were highlighted as was the sustainability outlook for US steel in general which will help drive the young but growing recycling sector.

RHI Magnesita has four refractory plants in North America with recycling rates ranging 8-13% (see chart). The company is recycling on-site over 2,500 tpa in the USA, and is concentrating in developing products with four third party processing partners.

Cavalcante emphasised that partnership is needed between refractory producer and processor to develop refractory grade Circular Raw Materials from spent refractories.

The main requirements in terms of capabilities are:

- Manual sorting

- Primary crushing

- Demagnetizing

- Drying

- Secondary crushing

- Storage

Challenges will continue from costs in both processing and especially logistics (US$90/tonne), but the new steel mills were noted to be seeking “hybrid business cases” for more sustainable operations.

Reclaiming the future: Unlocking the technical, economic, & operational potential to integrate recycled mineral streams into North American refractory production

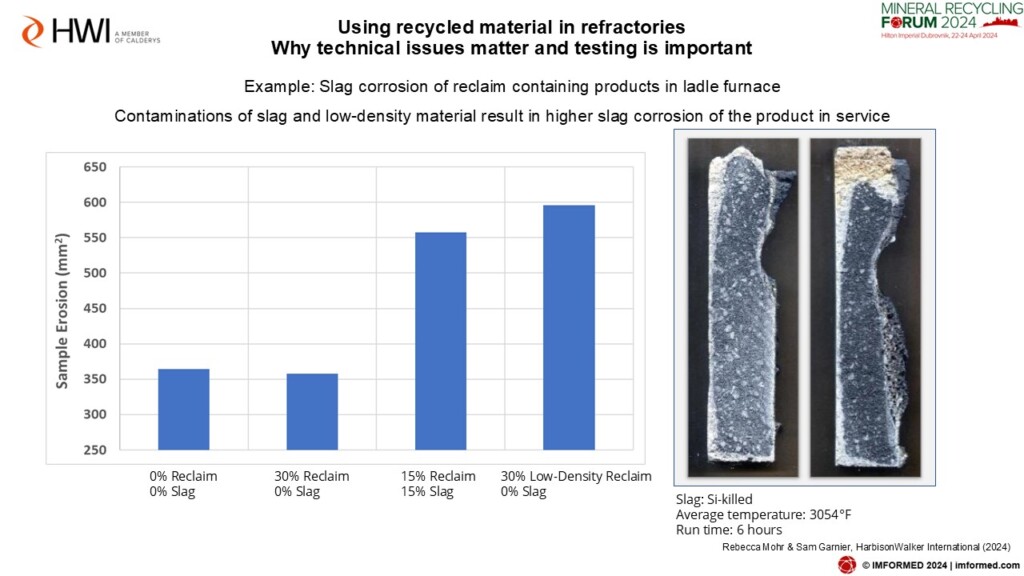

Rebecca Mohr, Strategic Marketing Manager-Recycled Materials, & Sam Garnier, Ceramic Research Engineer, HarbisonWalker International, USA

Mohr highlighted that the refractory recycling experience of HWI was strengthened in 2023 when Calderys and HWI were acquired by a privately owned company and merged to form the Calderys Group (HWI becomes the Group’s brand for the Americas).

The legacy Calderys Secondary Raw Material Program involved global SRM procurement growing through >150 suppliers, with 50% from 15 suppliers in the EU and India.

HWI is defining strategic target streams, developing recycling technology, and partnering with recyclers to develop continuous, reliable streams for North America (NA).

Mohr believes the NA refractory recycling demand is about 3.5% with most going to metallurgical products.

The NA sector is characterised by refractory products skewed to higher performance products and use or reclaim has higher technical risks; 50% of NA refractory products are sold into the steel industry and refractory recycling has not been a high priority; relative to ROW, the number of recyclers in NA is limited and transportation costs from source through recycler to plant can collapse the economic benefits.

Garnier then went on to outline how technical issues matter in considering using recycled materials, noting that contaminates, grain size, and porosity are the primary barriers to use of reclaim in high performance refractory products, illustrated with some excellent examples.

The key steps in assessing the economic viability of a reclaim stream were described and Mohr emphasised that “Success depends on win-win partnerships across the industry to develop SRM streams suitable for refractory products”.

RECYCLING REFRACTORIES: EUROPE | JAPAN | CERAMICS | INDIA

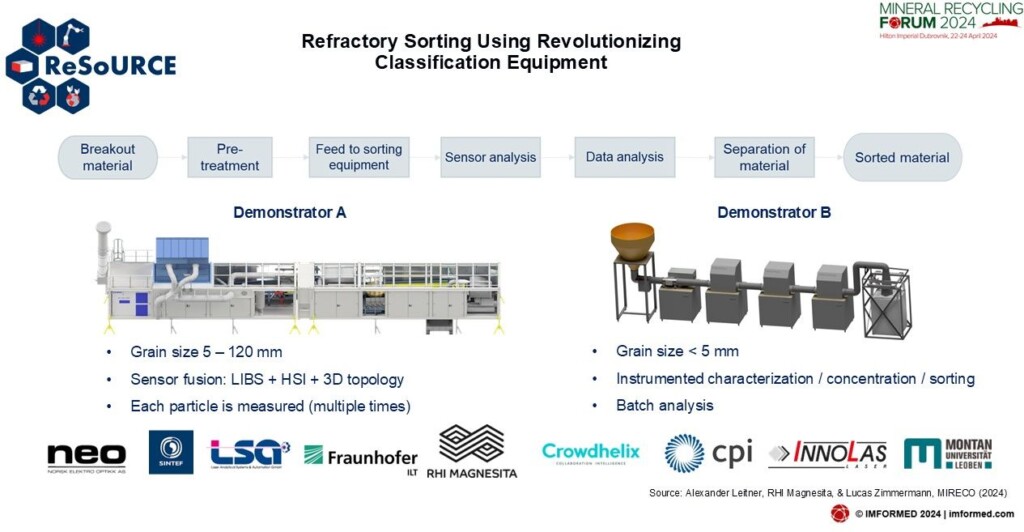

Beyond green boundaries: MIRECO & RHI Magnesita – Pioneers of refractory recycling

Alexander Leitner, Recycling Technology & Innovation Specialist, RHI Magnesita, Austria & Lucas Zimmermann, Head of Project Management, MIRECO, Germany

It was explained how using the synergies of MIRECO together with RHI Magnesita enhanced innovation at each process step along the refractory value chain.

MIRECO’s planned recycling volumes for 2024 were forecast at >190,000 tpa, with the target for 2026 being >270,000 tpa. The actual recycling rate was stated at >98.5%. RHI Magnesita’s target for 2025 is 15%.

Between the two companies are 15 recycling technology projects, >90 recycling product developments, licensing of recycling technologies, and 14 recycling facilities.

The process stages of the Continuous Economic Recycling Optimization (CERO) concept were explained, and with regard to sieve optimization a new initiative in the use of polymer linings substituting steel sieve inserts was shared, with increased benefits in handling, performance, and longer lifetimes.

MIRECO announced its launching in 2024 of a Sorting Academy for refractory waste and an update was provided on the Refractory Sorting Using Revolutionizing Classification Equipment – ReSoURCE project (see chart).

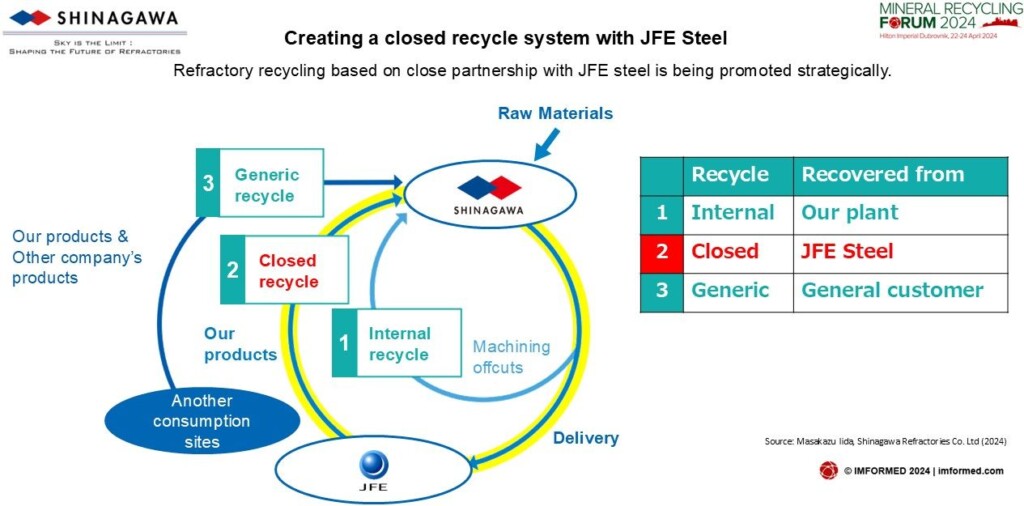

Recent activities of spent refractory recycling in SHINAGAWA Refractories

Masakazu Iida, General Manager of Research Centre, SHINAGAWA Refractories Co. Ltd, Japan

Iida described how Shinagawa Refractories is pursuing the circular economy by promoting recycling, and as well as operating six refractory plants in Japan, Shinagawa Refractories is responsible for refractory construction, maintenance and management in three major integrated steel mills of JFE steel.

Refractory recycling is based on a close partnership with JFE steel which is being promoted strategically.

Three examples of recycling projects were explained in detail:

- Hot metal ladle: managed dismantling & quality control based on chemical analysis achieved the stable operation of recycled material-containing brick

- Tundish: colour sorting for crushed grain of monolithic refractories; removal of coloured altered fraction has started.

- Sliding gate plate: reuse by partial replacement; partial replacement of critical zone allows

multiple use of main body.

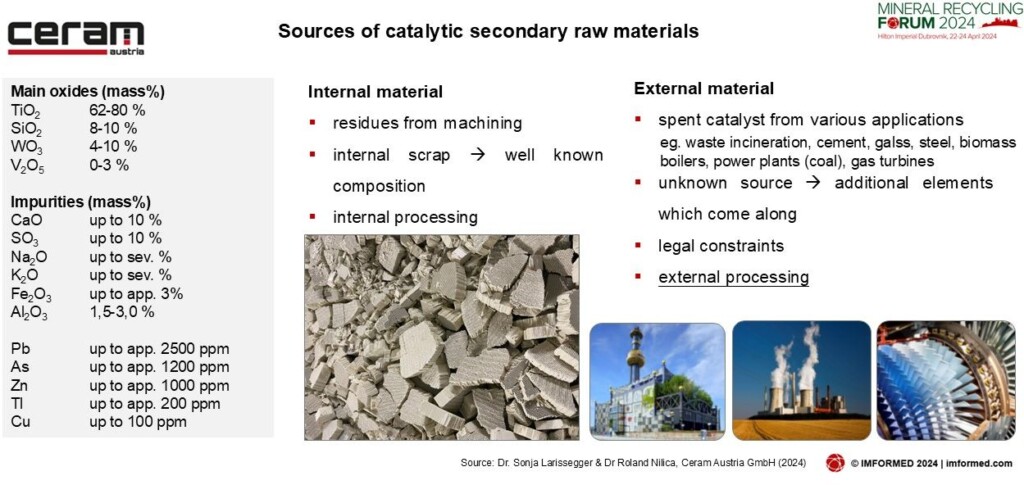

Ceramic Honeycombs: Sustainable production and application

Dr. Sonja Larissegger, Sales Manager Non-Catalytic Honeycombs & Dr Roland Nilica, Head of Research & Development, Ceram Austria GmbH, Austria

The different ceramic honeycomb products were described: SCR (selective catalytic reduction) plate catalyst, ceramic heat exchangers, SCR diesel catalyst, and honeycomb SCR catalyst.

This was followed by an examination of the different categories of catalytic secondary raw materials, and their potential use in catalytic and non-catalytic applications, such as fired scrap for collection and delivery to mineral processing companies, or re-use as aggregate for refractories or building materials.

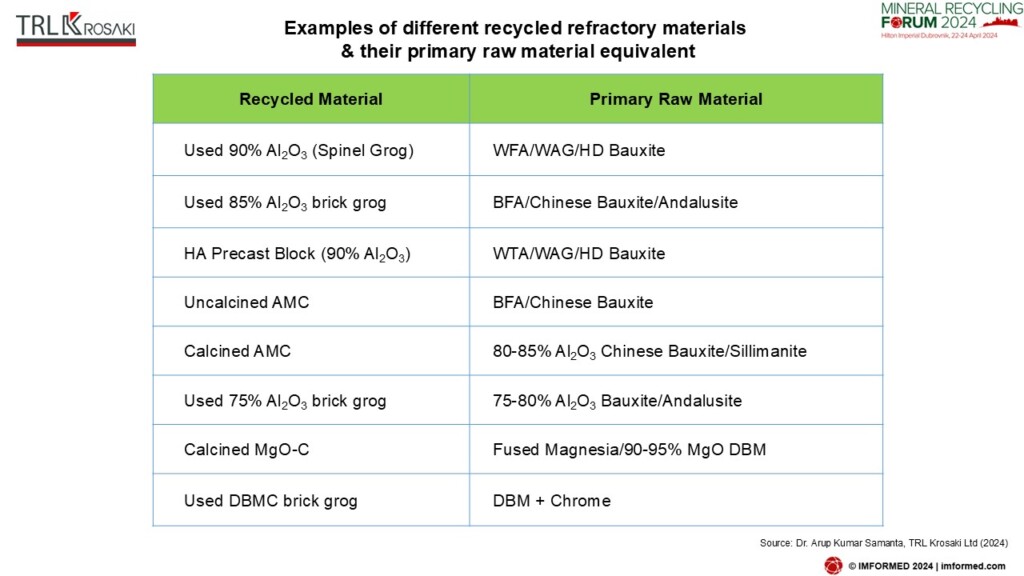

Challenges and opportunities in recycling spent refractories

Dr. Arup Kumar Samanta, VP (Monolithics Technology), TRL Krosaki Ltd, India

Kumar started off with a global overview of the refractory market and refractory recycling, and the main challenges facing the industry in general: raw material security and supply chain management, service and safety, trust and commitment, and lack of talent.

The increasing use of recycled material could be an alternative raw material source and drastically improve the industry’s carbon footprint.

However, key challenges in refractory recycling include: high impurities, low recovery, accumulation of dust, limitations of manual sorting, and large investment required for automatic sorting.

Kumar looked at sorting and processing techniques, opportunities for improvement, quality-wise storing of recovered materials, and the process followed to introduce recycled materials backed up with specific examples of materials and products.

He concluded by underlining the importance of selecting the types of refractories where recycled materials can be used along with optimum dose. “In future this material may be considered as an acceptance for final products for a greener world, and therefore maybe called ‘Green Refractory Raw materials’ “.

Hear the latest developments in India’s refractories industry at

IMFORMED is looking forward to attending IREFCON 2024 | Mike O’Driscoll will be presenting on “Refractory recycling: present practices & future trends” | If you are in attendance, please drop by our stand for a chat

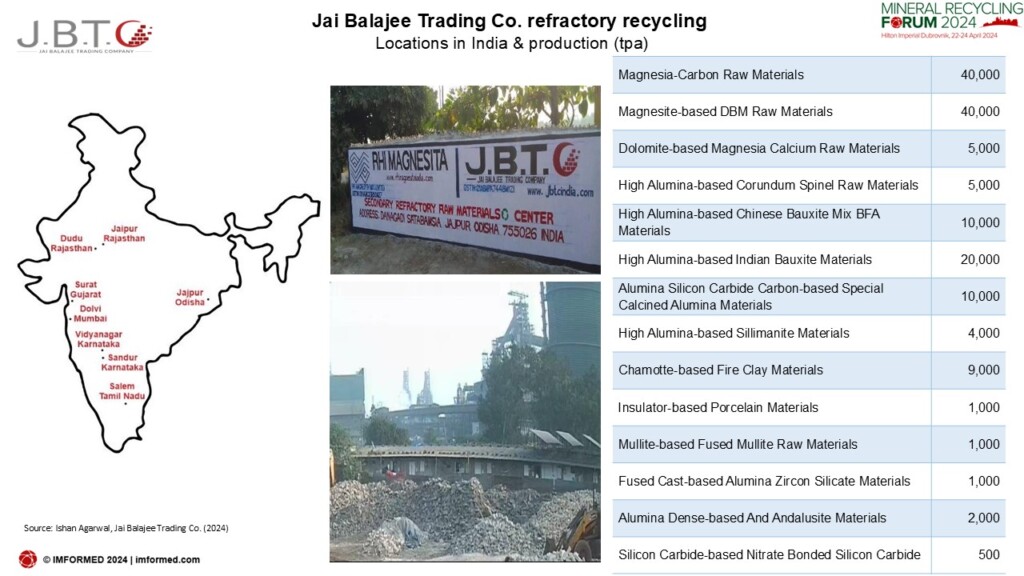

Green refractory developments in India

Ishan Agarwal, Head Operations & Business Development, Jai Balajee Trading Co., India

Jai Balajee Trading Co. (JBTC) has been in the refractory business since 1971 manufacturing silica bricks and high alumina products.

At present, the company operates six “Green Refractory Processing Centres” strategically located across India, including on-site with leading refractory manufacturers such as RHI Magnesita and TRL Krosaki, processing 148,500 tpa in total (see chart).

Two further plants are under construction at TRL Krosaki-JBTC Dolvi Maharashtra, India, and JBTC Jamshedpur Jharkhand, India.

Agarwal described a range of green refractory developments in India including:

Used silica bricks: crushed in grain sizes of 10-50mm and then developed as a substitute for quartzite in blast furnace.

Used alumina bricks from cement kilns: water washed in water polls to remove alkalis and then developed as green alumina raw materials used for monolithic manufacturing

Used magnesia-carbon bricks: crushed in grain sizes 3-12mm and then developed as substitute for EBT mass in CONARC furnace.

Used dolomite bricks: developed as a green dolomite bricks after checking hydration properties through manual chisel process reused in back-up lining of AOD furnace.

Several drivers for boosting India’s refractory recycling include green refractory initiatives being highly appreciated by Indian steel plants as they plan to substitute 100% green refractory products in non-critical areas where heat service temperatures are <1,000C.

The average rate of Green Refractory Products usage in India is about 15-30%, this is expected to increase to an average 25-35% usage owing to instability in virgin raw material prices and frequent interruptions due to environmental restrictions from (much relied upon) Chinese sources.

Making the local press…

Many thanks & hope to see you at Mineral Recycling Forum 2025 in Cannes!

We are especially indebted to the support and participation of sponsors Glenn Hunter & Associates and REF Minerals, exhibitor Euragglo, supporting partners, speakers, and delegates for making Mineral Recycling Forum 2024 such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience next year at Mineral Recycling Forum 2025, Cannes, 9-11 April

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Missed attending the Forum?

Free Mineral Recycling Forum 2024 Summary Slide Deck Download hereA full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

ANNOUNCING