Seen & Heard at Fluorine Forum 2023

Market Review | Logistics | China | Mongolia | New Sources | Batteries | Welding | Fluoropolymers

It was the Fluorine Forum that broke our attendance record: Fluorine Forum 2023, at Mandelieu-La-Napoule, 16-18 October 2023, was IMFORMED’s largest event to date for the global fluorspar market.

Some 200 attendees networked and listened to a packed programme of expert speakers covering the key aspects in fluorine raw material supply and demand (full review of presentations below).

Title Image Mongolian Steps: (main image) Mongolczechmetall LLC’s fluorspar operation at Chuluut Tsagaan Del which completed its new processing plant in September 2023, and will host the Field Trip of Fluorine Forum 2024 on 17 October.

For latest report on potential new sources of fluorine supply see: “Fluorspar developers see the light”

It was truly a buzzing atmosphere (with somewhat added frission provided by fans of the Rugby World Cup taking place in nearby Marseille and Nice), with non-stop networking and client meetings participated by the global fluorine fraternity keen to communicate with each other, and very much welcoming the significant contingent of Chinese and Mongolian attendees.

We are now gearing up for this year’s Fluorine Forum 2024, Ulaanbaatar, 14-16 October, which already promises to be another high profile unmissable event for the fluorine community, with a visit to the operations of Mongolczechmetall LLC’s at Chuluut Tsagaan Del, hosting one of the newest acidspar plants in Mongolia, on Thursday 17 October – EARLY BIRD RATES AVAILABLE FOR A LIMITED PERIOD!

What our delegates thought about Fluorine Forum 2023

Thanks for the excellent and well organised Fluorine Forum 2023 in Cannes. Great presentations and exchange of information with other delegates from the fluorspar industry was extremely valuable. We also had many opportunities to introduce our fluorspar company. It was our first IMFORMED event, but certainly not the last. We look forward to the next Fluorine Forum in 2024 in Ulaanbaatar!

Hasan Firat, Export Manager, Keles Mining, TurkeyCongratulations on the great success of the Cannes Fluorspar conference. We are looking forward to seeing you in Mongolia.

Cassie Yan, Sales Manager, Do-Fluoride New Materials Co. Ltd, ChinaThe Koura team had a great time in Mandelieu-La-Napoule meeting with other producers and consumers of fluorine. Massive thanks to IMFORMED; yet another fantastic event!

Kerry Satterthwaite, Director Business Intelligence, Koura, UKFree Fluorine Forum 2023 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Find out all the latest on fluorine raw material supply & markets at

Confirmed Speakers | Early Bird Rates | Full Details

Confirmed Speakers | Early Bird Rates | Full Details

Confirmed Speakers

Benchmark Breakfast Briefing: Fluorine in the Battery and EV age

Jessica Roberts, Head of Forecasting, Benchmark Mineral Intelligence, UK

Fluorspar supply & demand overview

Maximilian Court, Product Director – Battery Chemicals, Benchmark Mineral Intelligence, UK

Fluorspar & HF processing: trends & cost curves

Project Blue, South Africa

Mongolian fluorite deposits and their geochemical characteristics

Dr Tumenbayar Baatar, Independent Consultant & Geochemist & Banzragch Janchiv, Geologist, Mongolia

China fluorspar supply review

Xinhua Liao, President, Fujian Haojingda Industry Co., Ltd & China Non-metallic Minerals Industry Association Fluorspar Committee, China

Lost Sheep Fluorspar Project, Delta, Utah: Progress & Outlook

James Walker, CEO, Ares Strategic Mining, Canada

Tivan Ltd: Introducing the Speewah Fluorite Project

Brendon Nicol, Process Manager, Tivan Ltd, Australia

Pakistan’s fluorspar production progress: first acidspar plant development

Shahid Hamid Jafri, CEO, Perfect Associates, Pakistan

Hydrofluoric Acid: Accelerating the e-mobility journey – Asian Supply and Demand outlook

Samantha Wietlisbach, Director Minerals Research and Analysis, S&P Global Commodity Insights, Switzerland

Challenges & opportunities faced by Western fluorspar miners from the renewable energy revolution

Peter Robinson, Managing Direct, Fluorspar Ventures, UK

Production of aluminium fluoride from fluorosilicic acid by neutralisation with hydrated aluminium oxide

Dr Alexey Morozkov, JSC “NIUIF”, PhosAgro, Russia

Steel market demand & outlook

Project Blue, UK

The making of fluorine-containing materials for OPTICALization: starting from fluorspar

Dr Dexi Weng et al, Managing Director, Dexyan Global Poly Research Institute, USA

Fluorine Forum 2023 Review

Overviews

Fluorspar market overview

Mike O’Driscoll, Director, IMFORMED, UK

The conference introduction concluded with O’Driscoll providing a brief overview of the fluorspar market and indicating key points for discussion during the conference.

These included a whistlestop world tour of supplier news covering potential new sources of supply and restarts, as well as market topics such as China acidspar price hikes, Far East HF trade, F-gas phase out, and the growing Li-ion battery market for fluorine products.

With an expected rise in phosphoric acid capacity to meet LFP (lithium iron phosphate) battery demand, O’Driscoll questioned whether this would facilitate an increase in its waste by-product fluorosilicicacid (FSA) – and thus increased availability of an alternative source of fluorine?

FSA is a proven (and growing) alternative source feedstock to fluorspar to produce hydrofluoric acid (the precursor to fluorochemical derivates essential to LIB, ie. LiPF6 and PVFD used as electrolyte and binder, respectively).

The Fluorspar Market: Setting the scene for change

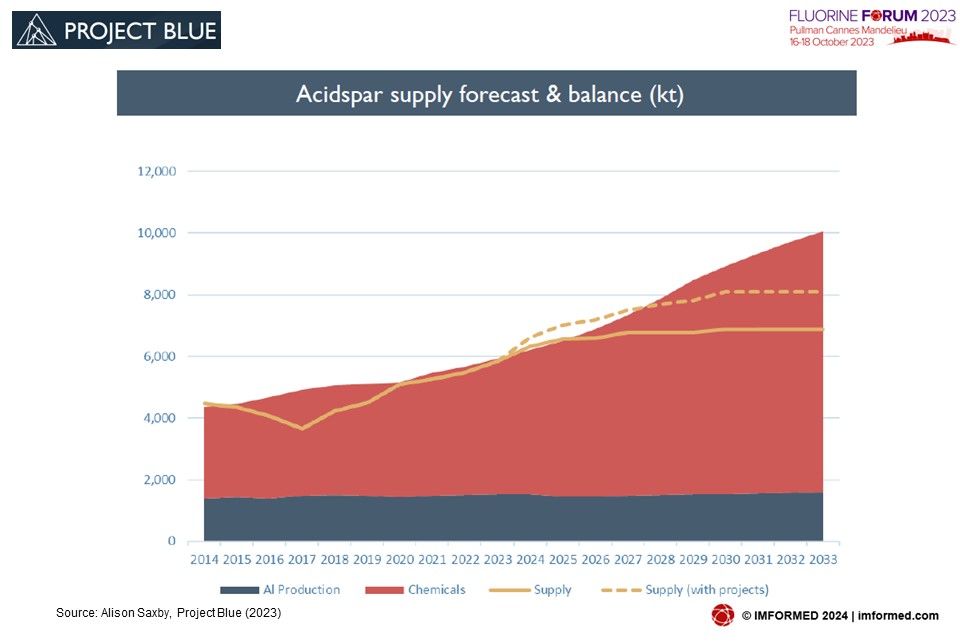

Alison Saxby, Research Director, Project Blue, UK

Saxby covered demand for metspar and acidspar in 2023 in the steel, aluminium, and fluorochemicals markets, before looking at the supply side of new projects and existing players, key narratives shaping the industry, restructuring of the traditional fluorspar market, and new markets and future demand.

On the future for acidspar, Saxby considered that demand growth remained positive in 2023 despite it being a tough global economic year. Future growth will be underpinned by the EV industry and is forecast to continue with greater upside due to fluorine use in Li-ion batteries.

Beyond 2028, rapid growth in demand will require additional new projects or the restart of other operations to come online, on top of known projects in the pipeline.

The state of mineral logistics: shipping market review

Robert van Muiden, Managing Owner, RoBuLog – Rotterdam Bulk Logistics, the Netherlands

Van Muiden divided his talk into Global and European issues regarding mineral logistics. He highlighted the main factors impacting the shipping market in recent times, including the aftermath of the Suez blockade and the two “lost” years of the Covid-19 pandemic, which are still being felt globally today.

More recently the Russia-Ukraine war has also played its part in disrupting logistics supply lines and increasing energy prices.

Since 2021/22, as a result of the above, there have been rapid global changes in existing shipping patterns, impacting first global container freights, then followed by dry bulk.

In Europe, Van Muiden highlighted the impact of the low river levels of the Rhine as affecting continental logistics.

CHINA MARKET | MONGOLIA SUPPLY

Fluorochemical industry new development trends in China

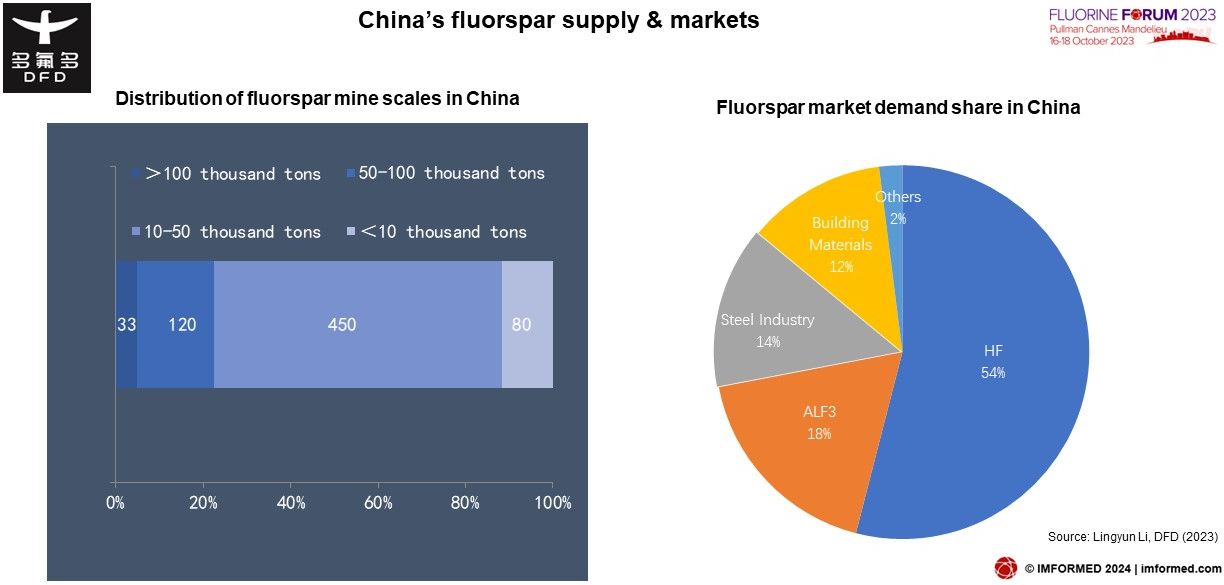

Lingyun Li, Vice Chairman, Do-Fluoride Chemicals Co. Ltd, China

Lingyun provided an overview of the Chinese fluorspar market followed by a focus on the situation of FSA and the latest DFD technology.

China’s fluorspar sector is characterised by dispersed production, a low reserve-to-production ratio, and ever tightening environmental protection policies. Lingyun outlined Chinese fluorspar production, trade and demand.

Producing AHF from FSA has benefits in reducing consumption of fluorspar reserves, reducing environmental pollution, and offsetting the rapid rise of fluorspar prices. DFD is now commissioning a 30,000 tpa AHF from FSA plant with an “effective fluorine recovery of 90%”.

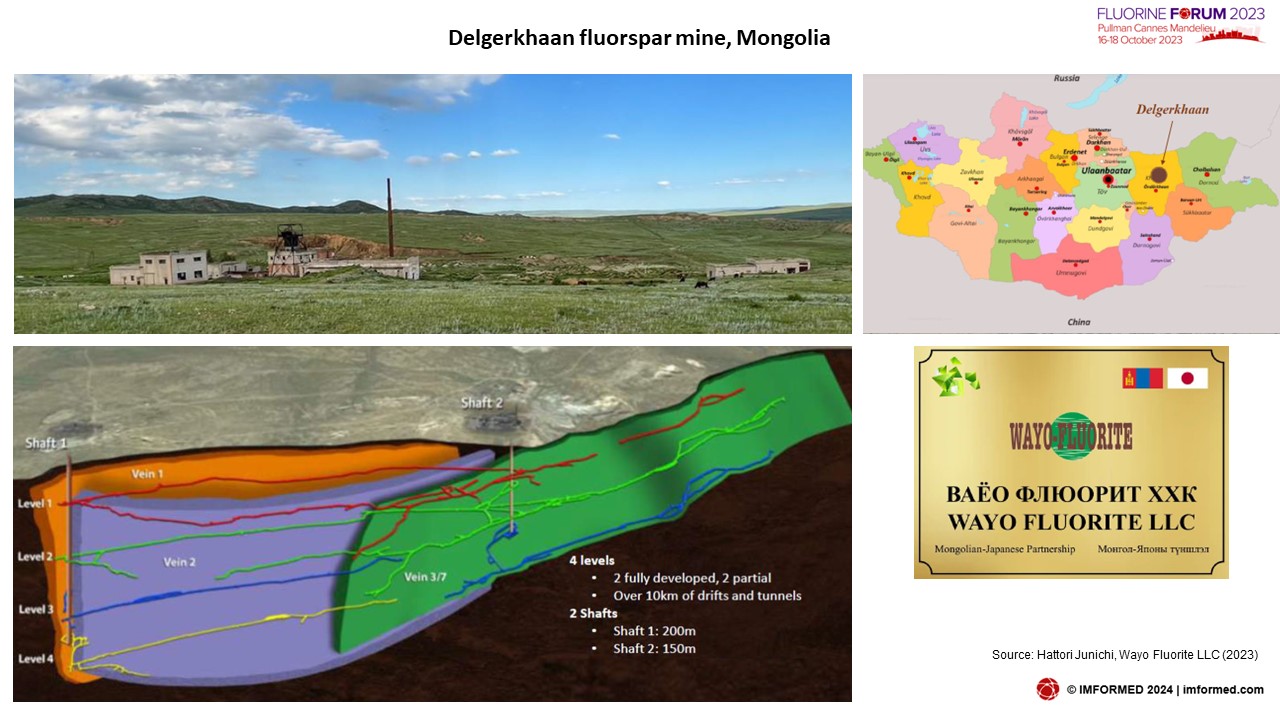

Development of the Delgerkhaan fluorspar deposit, north-east Mongolia

Hattori Junichi, Chairman, Wayo Fluorite LLC, Japan

The Delgerkhaan mine is located 450km east of Ulaanbaatar near Berkh city, Khentii Province. The deposit hosts an indicated resource of 6.6m tonnes @33.7% CaF2; extremely low sulphide content, low phosphorus, and low arsenic.

Discovered in 1954, the mining operation started in 1962 (under the USSR), and achieved peak production of 170,000 tpa in the late 1980s, with over 200 employees. During 1962-2003, 900,000 tonnes of ore reserves were mined.

The mine is now owned by Wayo Fluorite LLC (70% Japanese, 30% Mongolian) and is under recommissioning. Resource re-estimation and a feasibility study is ongoing, laboratory scale beneficiation testing has taken place in Germany, an accurate mine planning is underway, with an estimated start-up of operation in 2024.

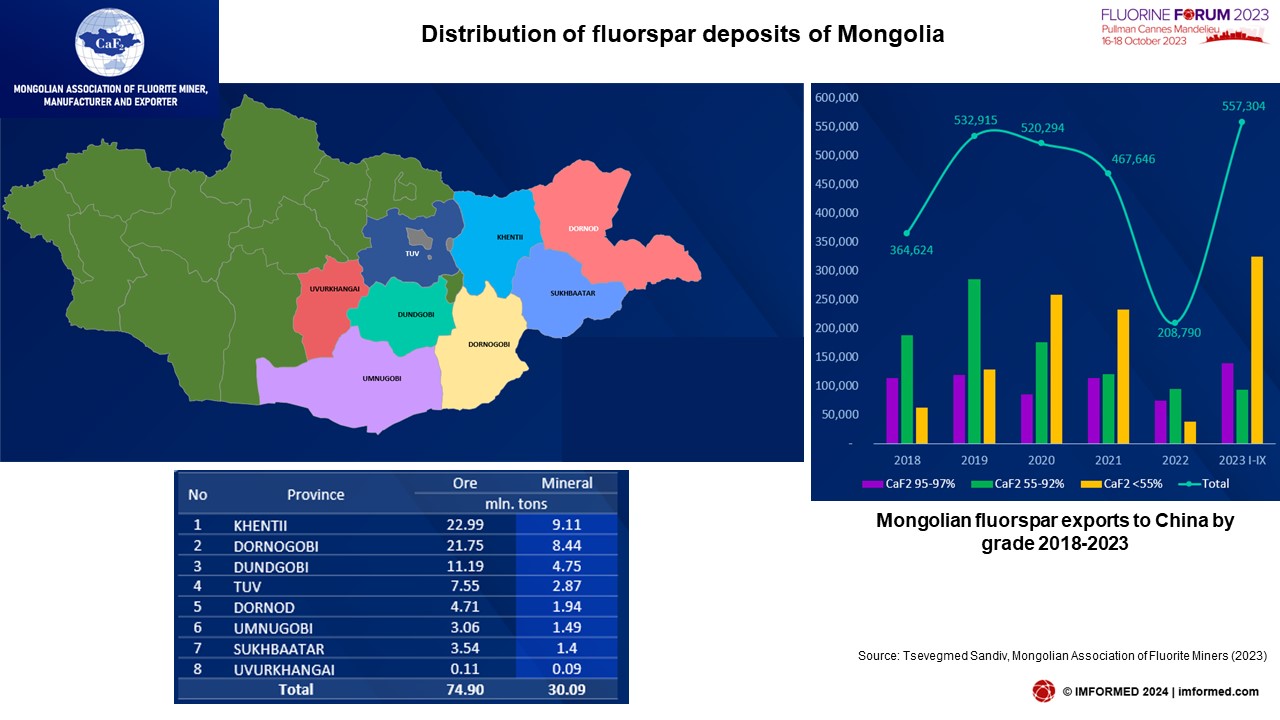

Mongolia’s fluorspar sector prospects & objectives

Tsevegmed Sandiv, Vice Chairman, Mongolian Association of Fluorite Miners, Mongolia

Sandiv started by outlining Mongolia’s development policy 2021-2050, and underlining the importance of mining to the country’s economy, international co-operation, and the main Mongolian border “ports” for mineral export markets, including the following specific for fluorspar: Gashuunsukait, Zamin-Uud, Bichigt, and Khavirga.

There are some 220 fluorspar deposits in Mongolia, with fluorspar reserves totalling 30m tonnes, and all concentrated in the south and east of the country.

Production and exports (mostly to China) have increased markedly since 2017/2018, and total exports of almost 600,000 tonnes in 1H 2023 had already peaked well over the last five years’ levels.

NEW SOURCE POTENTIAL: ITALY | GERMANY | SOUTH AFRICA | AUSTRALIA

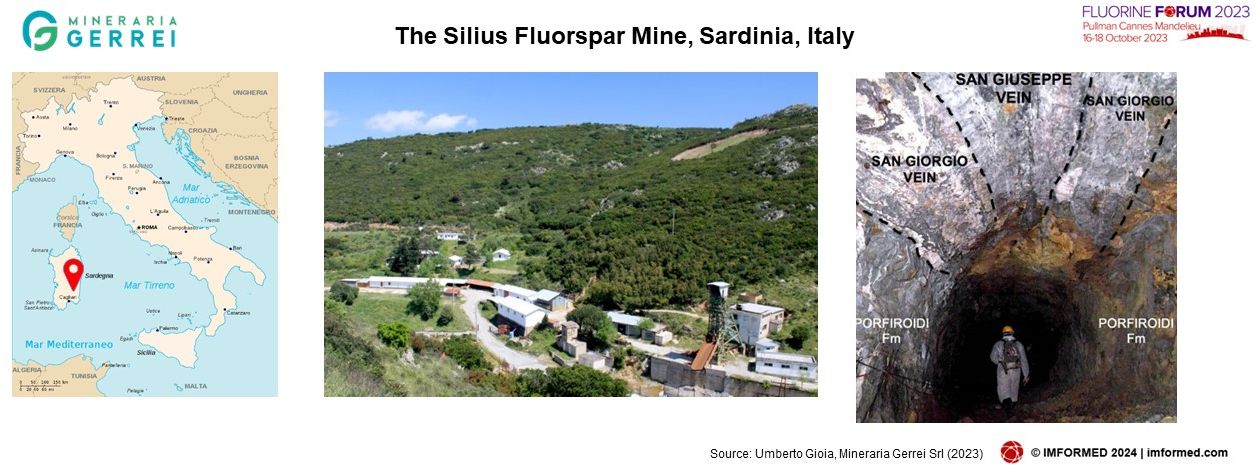

Rejuvenating the Silius fluorspar mine, Sardinia, Italy

Umberto Gioia, Managing Director, Mineraria Gerrei Srl, Italy

The Silius mine is in south Sardinia, Italy, 50km north-east of Cagliari International Airport and Cagliari International Container Terminal.

Regarding certified resources, there are 2.1m tonnes measured resources (average grade 32% CaF2, 3% PbS) and 1.2m tonnes from unexploited upper mine panels (review of previous 30% cutoff grade). Fluorspar veins are typically 3-6 metres wide (and up to 18 metres).

Since 1952, over 11m tonnes of fluorspar ore has been extracted and nearly 4m tonnes of acidspar produced in 50 years of operation, peaking in 1971 with 450,000 tonnes fluorspar ore, until its closure in 2007. The average historical fluorspar grade was 35%.

From 2007, the subsequent process of mine privatisation was delayed by EU rules on tender claims and complex environmental impact assessments. Eventually, a new mining license was awarded to Mineraria Gerrei in 2023.

As well as additional fluorspar ore zone potential, extensive studies and analysis performed by University of Naples over the last 10 years have identified attractive rare earth element concentrations.

Mineraria Gerrei has conducted a 3D survey of underground shafts/tunnels and surface mining areas and structures, updated the ore body model, and is developing a circular economy approach to re-opening the mine, and planning a new flotation plant.

The company is envisaging a 220,000 tpa crude ore mine, yielding 70,000 tpa acidspar and 7,000 tpa lead concentrate, potential for an extra 20% capacity expansion, with a 12 year mining licence, and €45m investment.

Re-opening the Käfersteige Mine in Pforzheim, Germany

Simon Bodensteiner, Managing Director, Deutsche Flussspat GmbH, Germany

Bodensteiner commenced by explaining the rationale behind re-opening the Käfersteige Mine in Pforzheim, Germany. This was mainly supported by the emerging battery market with EU-battery capacity expected to grow beyond 1,000 GWh/a in 2030.

Such a rise in battery manufacturing has resulted in a forecast fluorspar requirement approaching 375,000 tpa, representing a 65% demand growth for fluorspar in Europe. Without extra domestic fluorspar sources, it was estimated that the EU would have to rely on 87% demand being met by imports.

Deutsche Flussspat GmbH (DFG) plans to mitigate this by producing 100,000 tpa fluorspar from the Käfersteige Mine. Its resource potential, claimed as underexplored, has been ignored for some time: 1.95m tonnes “Historic Resource” @ 50% CaF2, 1,100m strike length with an average thickness of 9.5m; and 10,150 tonnes fluorspar concentrate per vertical metre at lowest mine level.

DFG has identified an exploration target in the mine above 500m, of >5m tonnes at 50% CaF2, and maintains that the flooded mine workings are in excellent condition.

Deutsche Flussspat GmbH (DFG) plans to produce 100,000 tpa fluorspar from a re-opening of the Käfersteige Mine, south-west Germany; (left) underground mining by Bayer AG, which closed the mine in 1996; (right) DFG staff at work restoring the workings. Courtesy DFG

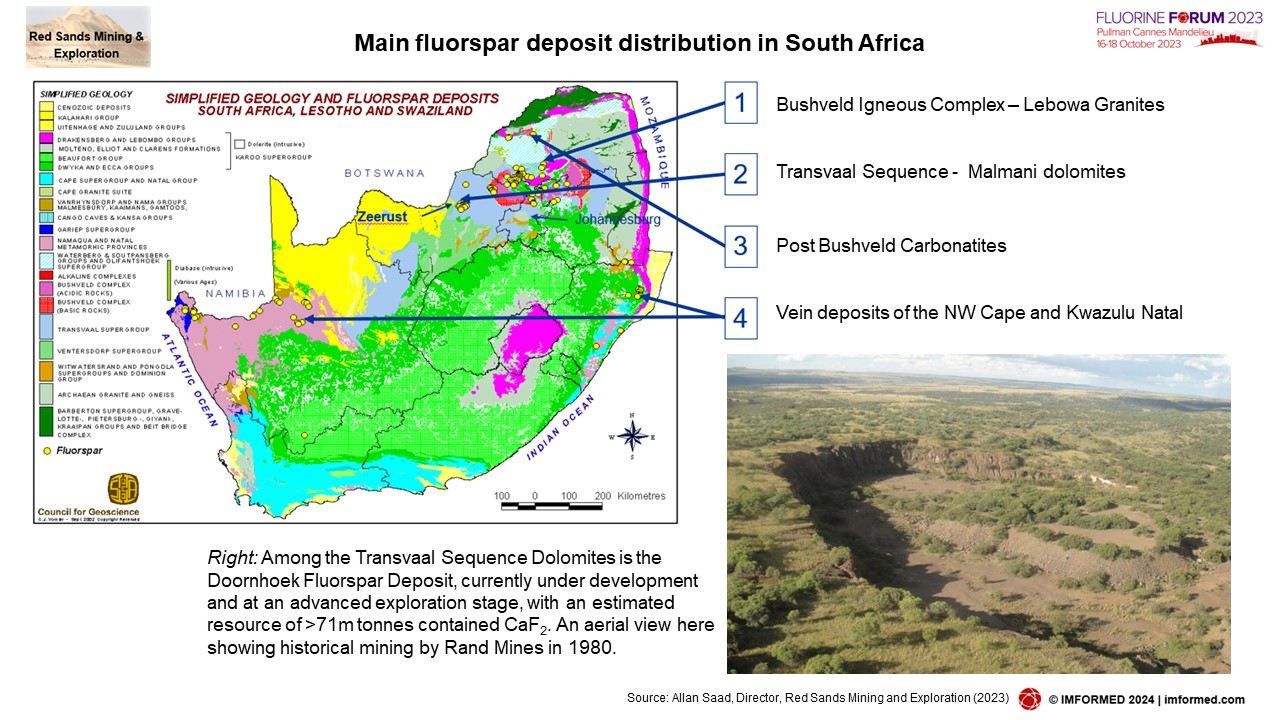

South Africa: the world’s largest untapped fluorspar resource

Allan Saad, Director, Red Sands Mining and Exploration cc, South Africa

Presented by Allan Saad Jnr, provided some background history to mining in South Africa, noting that fluorspar was first produced in the country in 1917.

Saad’s own fluorspar reserve estimates indicate that South Africa hosts the most in the world, at 122m tonnes, representing 36% of world reserves.

Fluorspar in South Africa occurs primarily in four different geological settings:

- Bushveld Igneous Complex – Lebowa Granites

- Transvaal Sequence – Malmani dolomites

- Post Bushveld Carbonatites

- Vein deposits of the NW Cape and Kwazulu Natal

Each setting is unique and each contain significant resources. The deposits associated with the Bushveld are currently the largest producers (Vergenoeg and Nokeng), while the deposits associated with the Malmani Dolomites of the Transvaal Sequence hold the largest undeveloped potential.

Among the Transvaal Sequence Dolomites is the Doornhoek Fluorspar Deposit, currently under development and at an advanced exploration stage, with an estimated resource of >71m tonnes contained CaF2.

An open cast mine development is planned, with a maximum 90 metre depth, and is envisaged to be a major cornerstone in the upcoming South African fluorspar industry.

Saad also shared news of an upcoming fluorochemicals project in South Africa called Project CAPE, with planned development of a 100,000 tpa fluorochemicals plant in Gqeberha, Eastern Cape. The project is to be run by Fluorchemicals South Africa Pty Ltd, with an envisaged start-up in 2028.

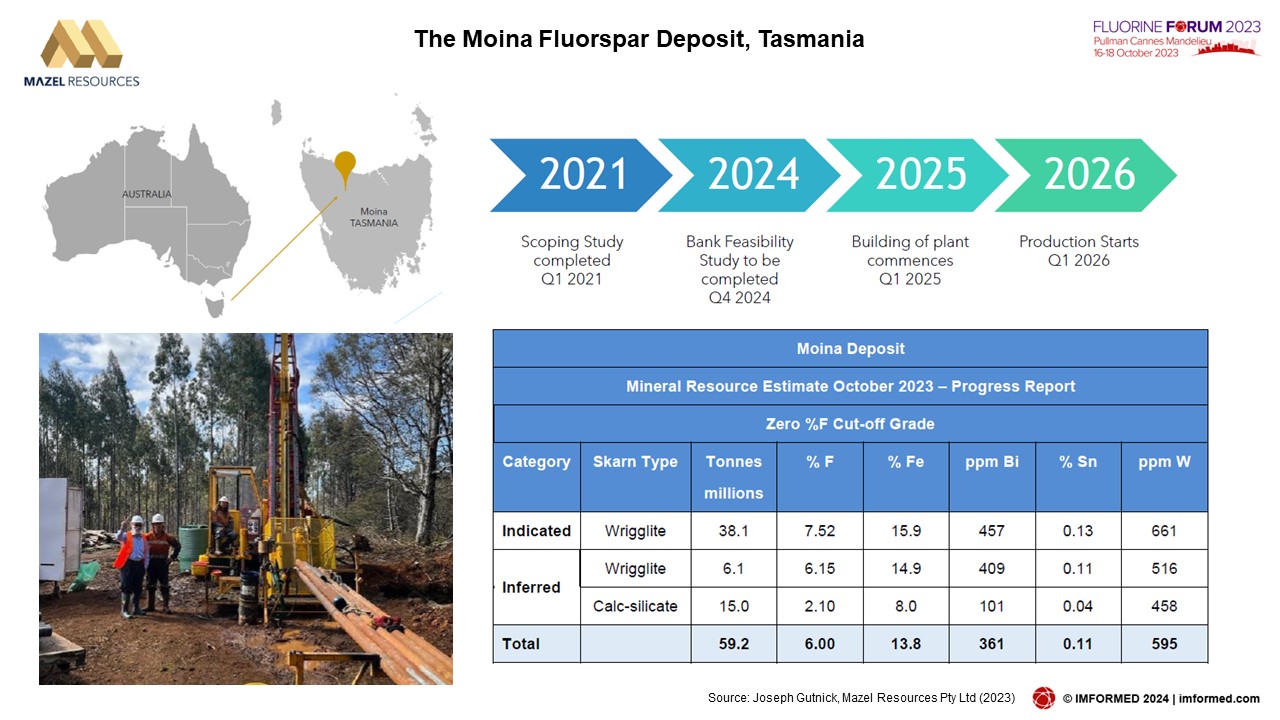

Australia: a new frontier for fluorspar supply from Tasmania

Joseph Gutnick, Director, Mazel Resources Pty Ltd, Australia

Mazel Resources is a privately owned company whose main project is the fluorite, magnetite, tin, tungsten, and bismuth deposit in Moina, north-west Tasmania. The project is 100% owned by Mazel Resources, located 40km from Devonport.

Mazel commenced a drilling programme in 2021, and Mining One has completed a Scoping Study and is to conduct a Bankable Feasibility Study, aiming to update the resource to 100m tonnes. Historical work concluded the deposit hosted a JORC inferred resource of 24.6Mt @16% fluorite, 17.2% magnetite, and 0.1% tungsten.

In 2025/2026, Mazel is hoping to commence fluorine a 3.5m tpa fluorspar production plant, with a 20 year mine life.

MARKETS: BATTERIES | WELDING | FLUOROPOLYMERS

Fluorspar’s role in electric vehicles and the energy transition

Simon Moores, CEO, & Jessica Roberts, Head of Forecasting, Benchmark Mineral Intelligence, UK

The presentation from Moores and Roberts had three points of focus: technology, critical minerals, and geopolitics.

“We are in the midst of a global battery arms race” and “Lithium ion batteries are at the centre of the global geopolitical vortex” intoned Moores.

It was noted that the lithium ion battery industry faces a 10-12x growth out to 2040, as the advantages of the lithium ion battery are increasing, and that the quality of batteries and EVs are directly linked to the quality of raw materials consumed.

The entire focus of batteries, EVs and the energy transition has shifted to mining and securing the required critical minerals – and fluorspar is now on that radar.

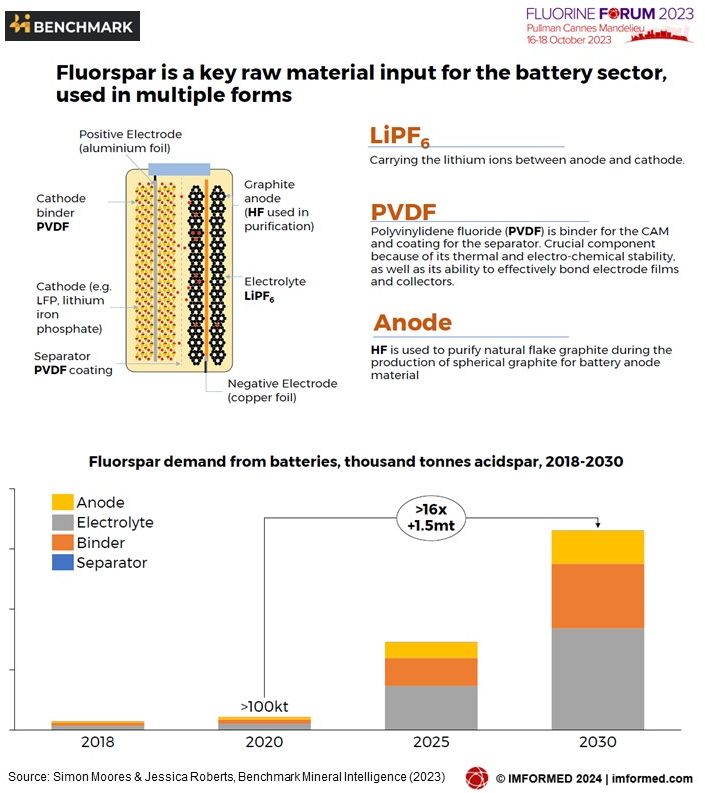

Fluorspar is a key raw material input for the battery sector, used in multiple forms as electrolyte (LiPF6), binder (PVDF), and for HF used to process graphite for use in anodes.

Pure chemicals are needed to produce PVDF and LiPF6; purity is needed to provide thermal and electrochemical stability so that EVs function optimally. Fluorspar’s properties are valuable and not likely to be substituted for use in batteries soon.

Fluorspar use in batteries is expected to grow by 16x by 2030, requiring 1.5m tpa of fluorspar, with the electrolyte salts the largest battery use segment. It was projected that from 2030, about 18kg of fluorspar will be needed for an average EV 40kWh battery.

While delivering an optimistic outlook for fluorspar in Li-ion batteries, Roberts cautioned that potential threats to fluorspar in batteries could be next-generation solid state batteries which have a different anode and electrolyte.

Fluorine: the fundamental element on the path to net zero

Samantha Wietlisbach, Director Minerals Research & Analysis, S&P Global Commodity Insights, Switzerland

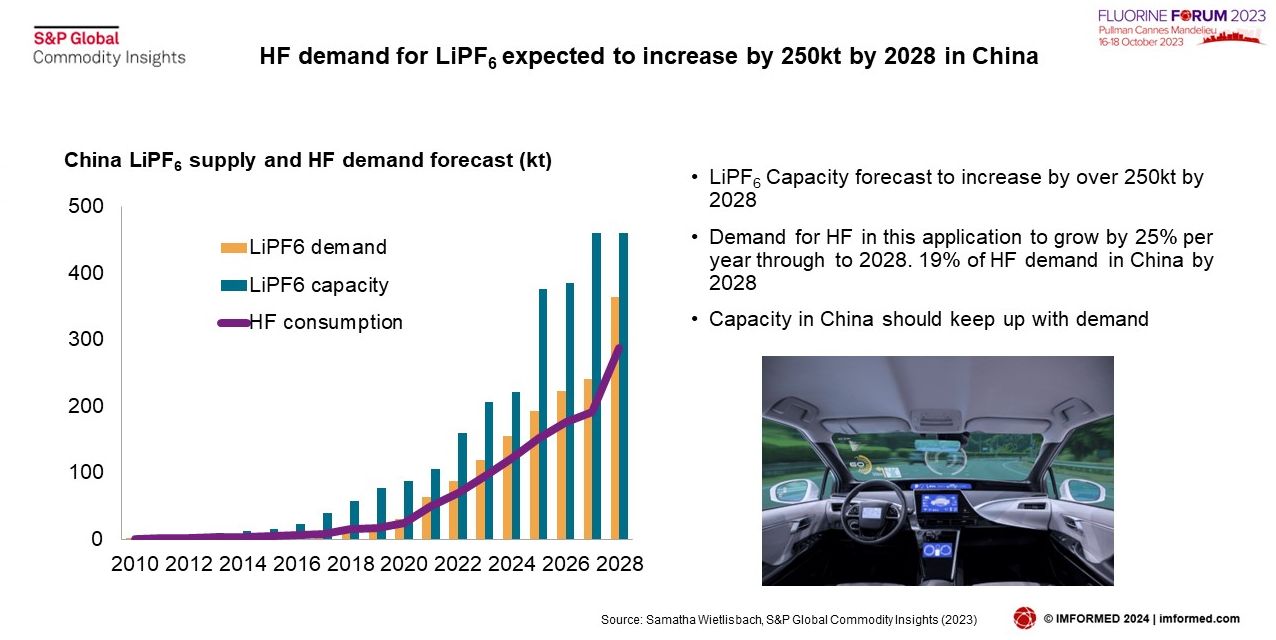

Wietlisbach covered a range of hot topics including: What kind of an element is F? Importance of F in Li batteries and solar panels; round up of HF supply, demand and trade; focus on fluoropolymers and electrolyte salts; level of integration from raw materials through to electrolytes and fluoropolymers for batteries.

World capacity for HF was just over 3m tonnes in 2023. Fluorspar is still by far the most important raw material for HF production. 64% of global HF capacity is in Mainland China, and is produced from fluorspar, and 6% or 250,000 tonnes is produced from FSA phosphate rock by-product in China. Producers using fluorspar in the rest of the world account for 29%, and just 1% of HF capacity in ROW from FSA.

LIB electrolyte additives are really starting to drive demand for HF and consequently demand for fluorspar and other fluorine containing minerals.

We have seen that China mined 69% of the world’s fluorspar in 2022, and has 57% of the installed HF capacity. Chinese demand for HF is more than 60% of the total.

New mines in Canada and South Africa are struggling to gain investment. For many years, interest in fluorspar mining has stagnated, many corporations have closed mines, for example, Solvay in Bulgaria and Namibia. The ozone depleting fluorocarbon gases that drove demand for the last 2 decades fail to entice investors in fluorspar mining.

More investment in plants producing HF from the phosphate fertilizer by-product FSA could be a solution, but this technology is still relatively new and still needs to be proven at scale outside Mainland China.

Calcium fluoride and the welding industry

Corwin Miller, Sourcing Manager, Lincoln Electric Co., USA

The basic elements, requirements, and products of welding were explained by Miller before focusing on why fluoride is used in welding.

Calcium fluoride is part of the slag system in most products, and controls viscosity, modifies freezing point, and imparts a low H content with no stable hydrates.

Welding is critical to the mining, chemical, and energy industries, and fluorspar is a critical material to slag forming welding consumables. Ideally, low flotation oil fluorspar is required for the most demanding of welding applications.

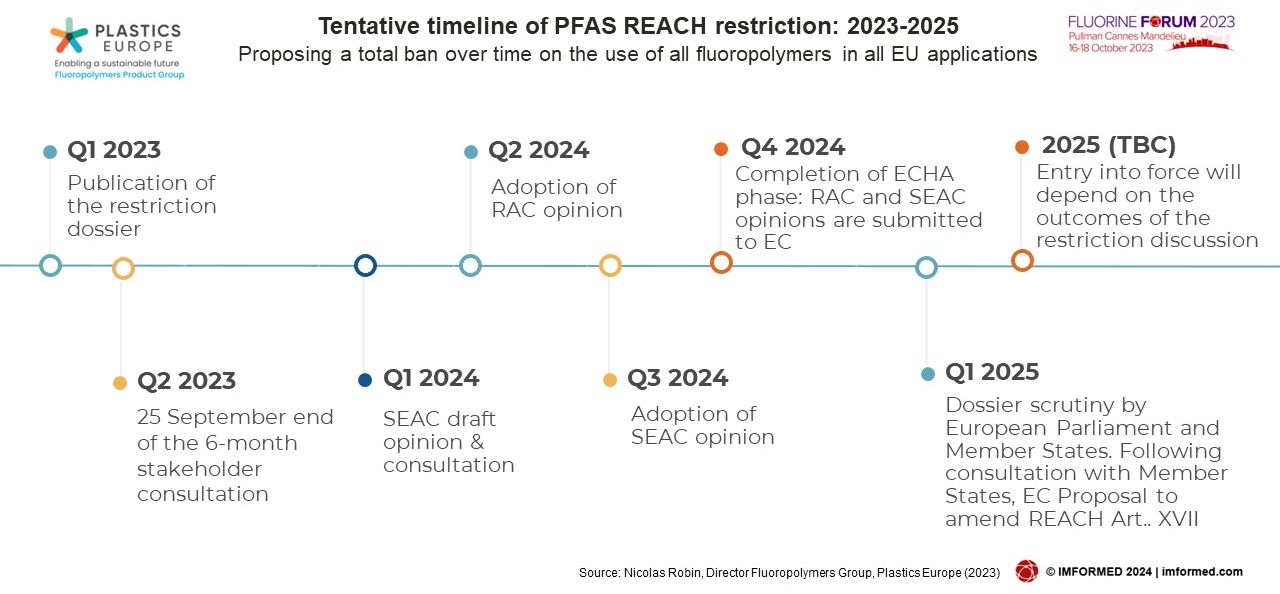

The EU PFAS restriction proposal & its impact on the EU fluoropolymers market

Nicolas Robin, Director Fluoropolymers Group, Plastics Europe, Belgium

The Fluoropolymers Product Group (FPG) represents Europe’s leading fluoropolymer producers and experts, and advocates for a balanced regulatory environment based on scientific facts to ensure that European industries remain competitive and sustainable.

Robin underlined the widespread use of fluoropolymers, and that fluoropolymers are used in critical applications which help to deliver strategic European and industrial objectives and are an enabler of the European Green Deal, E-mobility and digital transition of the European economy and society.

Broadly speaking, PFAS (perfluoroalkyl and polyfluoroalkyl substances) maybe defined as any substance that contains at least one fully fluorinated methyl (CF3-) or methylene (-CF2-) carbon atom (without any H/Cl/Br/I attached to it).

In a legislative move that could have significant consequences for the EU fluoropolymer market, the REACH dossier submitters propose a total ban over time on the use of all fluoropolymers in all applications, planning to enter it into force in 2025, following a period of industry and public discussion, which is currently ongoing.

From some 3,500 ECHA stakeholder submissions of concern (over the proposal) analysed, at least 70% referred to fluoropolymers with most of them proposing a derogation or an exemption of fluoropolymers from the PFAS REACH restriction.

Robin pointed out that the proposal shows no differentiation between PFAS, critical uses are overlooked, alternatives insufficiently assessed, and all PFAS are not the same.

In summary, the FPG believes that a total ban on fluoropolymers is not proportionate and fluoropolymers and applications containing a fluoropolymer should be exempted from the restriction. Robin urged the fluorspar industry to “get involved” and strive for a favourable outcome.

Fluorochemicals – key ingredients in OPTICALization of super-big data world

Dr Dexi Weng, Managing Director, Dexyan Global Poly Research Institute, USA

Weng explained a new concept proposed by himself: OPTICALization – a state, paradigm, or shift from ELECTRONic to PHOTONic (ie. optical) in data processing ways and means. Moreover, he emphasised that fluorochemicals, especially fluorinated polymers, are crucial in OPTICALization.

In particular, Weng focused on the growing use GiPOF (graded-index perfluorinated polymer optical fibre) in the data world.

If containing fluorine, the polymer fibre exhibits low attenuation to light, thus travelling longer. He went on to outline fluorination to intermediate to monomer to perfluoropolymer for OPTICALization.

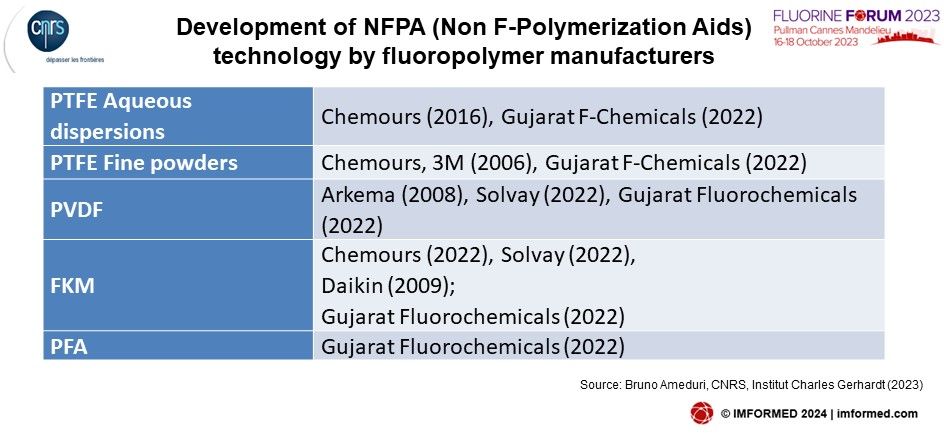

The overall situation of poly- or perfluoroalkyl substances (PFASs) and recycling of fluoropolymers

Bruno Ameduri, Senior Research Director, CNRS, Institut Charles Gerhardt, France

Ameduri covered the issues of PFAS, their main uses, the properties and advantages of fluoropolymers, recycling fluoropolymers, and the mineralisation of fluoropolymers.

Despite the impending REACH PFAS restriction proposal, he reminded that fluoropolymers are:

- Non-toxic

- Non-bioaccumulative

- Non-mobile

- Insoluble in Water

- Stable – Thermally, Chemically & Biologically

- Durable

- Not a Substance of Very High Concern (SVHC)

Nevertheless, manufacturers of fluoropolymers have taken action by seeking new innovations, such as use of Non F-polymerization aids (surfactants) and abatement of technologies reducing PFAS emissions.

Increasing awareness of plastic pollution has prompted much research into plastics recycling. In 2021, 330,000 tonnes of fluoropolymers were produced of which only 3.4% were recycled (most were incinerated, and landfilled).

Ameduri touched on new research in recycling (“unzipping”) PTFE and other fluoropolymers, and mineralization of fluoropolymers by subcritical water.

He concluded that REACH regulators should focus on identifying the specific categories of PFAS that have the greatest risk potential based on toxicity and the potential for exposure…and leave fluoropolymers out!

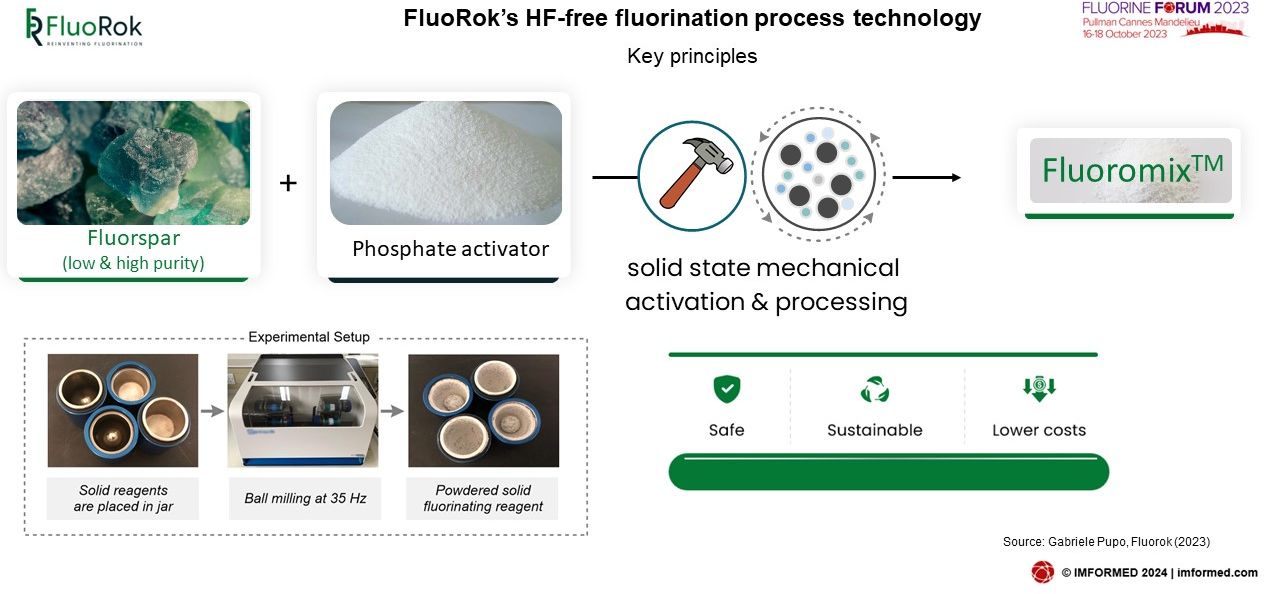

Revolutionising fluorochemical production: developing an HF-free fluorination process

Gabriele Pupo, CEO, Fluorok, UK

The first proof of the concept of a HF-free route to fluorochemicals was found in 2021. A year later Fluorok was established and developed a HF-free process to access fluorochemicals, employing phosphate-based mechanochemical activation.

Some £3m pre-seed investment was achieved in 2022, with kg-scale up completed in 2023, and a roadmap planned to start commercial scale processing by late 2024-2025.

The process is claimed to be compatible with low/high purity mined fluorspar and, crucially for the future, recycled fluorine raw material, such as from HF-derived fluorinated industrial waste streams from PV cell and semiconductor manufacturing.

The end product, FluoromixTM, can find application in Li-ion batteries, fluorinated building blocks and inorganic fluorides.

Many thanks & hope to see you at Fluorine Forum 2024!

We are especially indebted to the support and participation of sponsors SepFluor Limited and Wayo-Fluorite, supporting partners, speakers, and delegates for making this unique event such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience later this year at Fluorine Forum 2024, Ulaanbaatar, 14-16 October.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Free Fluorine Forum 2023 Summary Slide Deck Download here

Missed attending the Forum? A full PDF set of presentations available for purchase.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Don’t miss out! Book Now!