The recent rise in the “criticality” of fluorspar has appeared to bolster the prospects of several fluorspar projects around the world (see “Industrial Minerals – Have they finally gone critical?”).

Ahead of the pack is the Lost Sheep Mine in Utah, USA. In Germany, steps are being taken to re-open the Käfersteige mine. In Australia, the much surveyed Speewah fluorspar deposit looks set for another lease of life, while a new process to recover fluorine from aluminium smelter waste maintains momentum.

Elsewhere, restarts are also projected for closed mines in Canada and Kenya, although each have experienced false dawns in recent years.

Title Image Fluorspar Tunnel Vision: View from within and from outside (inset top right) the recently constructed portal ramp at the Lost Sheep Mine, Utah, USA, in development by Ares Strategic Mining Inc., in mid-July was nearing the targeted fluorspar mineralised zone; (inset bottom right) the Speewah Fluorite Project site East Kimberley region, Western Australia, hosting an inferred resource of 27.2m tonnes of fluorspar, under development by Tivan Ltd. Both projects are to have presentations at Fluorine Forum 2024, Ulaanbaatar, 14-16 October. Courtesy Ares Strategic Mining, Tivan Ltd.

Go to Fluorspar Supply & Demand: French Riviera Review for a full report on Fluorine Forum 2023 including round-up of key takeaways from all the presentations

Ares Strategic Mining – Lost Sheep Mine, USA

Ares Strategic Mining Inc. is progressing its mineworks installations at the Lost Sheep Mine, in the Spor Mountain district, Utah, approximately 214km south-west of Salt Lake City.

In mid-July 2024, the ramp portal was nearing fluorspar mineralisation zones, and installation of the ventilation system was underway.

Site clearance, equipment and worker facilities have been constructed at the Lost Sheep mine area, while Ares is also constructing a lump metspar plant at its 50-acre industrial site at Delta, Utah.

Ares’ fluorspar progress: (left) Portal ramp construction underway; (right, & l-r) James Walker, CEO & President, Ares Strategic Mining Inc., Niklas Lüdemann, Head of Region North America, Cremer Erzkontor, Roberto Wurst, Executive Director, Cremer Erzkontor, Chris Edkins, Managing Director, Cremer Erzkontor North America Inc.; Cremer Erzkontor North America has entered into a sales partnership (MOU) with Ares. Courtesy Ares Strategic Mining

The company also recently paid in full for a new flotation plant to supply high grade acidspar, the plant is expected to be delivered to the site later this year.

Ares is working with Provo Mining to ensure that mine and plant operations are set to start later this year, with mining permits and authorisations already completed.

Total production capacity with the two plants running is envisaged at 50,000 tpa fluorspar, and will represent the USA’s sole source of fluorspar.

James Walker, CEO, Ares Strategic Mining will be presenting on the Lost Sheep Mine at

Deutsche Flussspat – Käfersteige mine, Germany

On 20 June 2024, Deutsche Flussspat GmbH (DFG) announced the successful completion of a financing round to enable preparatory work for the reopening of the Käfersteige fluorspar mine, Pforzheim, south-west Germany (near Stuttgart).

The mine, exploiting what is often described as “Europe’s largest fluorspar deposit” was started in 1935, and latterly operated by Bayer AG until 1996.

DFG Managing Directors Peter Geerdts (left) and Simon Bodensteiner outside the entrance of the closed Käfersteige fluorspar mine, Pforzheim, south-west Germany. Courtesy DFG

Deutsche Flussspat is aiming to bring the mine back into production and supply 40% of the German industry needs, particularly for envisaged EV battery requirements.

The successful financing was made possible by the participation of MBG Mittelständische Beteiligungsgesellschaft Baden-Württemberg GmbH (Mittelständische Beteiligungsgesellschaft) and S-Kap Unternehmensbeteiligungs GmbH & Co KG (the investment company of Sparkasse Pforzheim Calw) as silent partners of DFG. Refinancing for the investors was secured by L-Bank – Staatsbank für Baden-Württemberg.

DFG is currently in the general approval process for the reopening of the mine, including a voluntary environmental impact assessment for the first phase – dewatering of the currently flooded mine for technical, geological and economical studies. First rehabilitation work on mine infrastructure will be starting in summer 2024.

For a review of Simon Bodensteiner’s presentation at Fluorine Forum 2023, plus all other presentations Click Here

Tivan – Speewah Fluorspar Deposit, Australia

In early June 2024, fluorspar developer Tivan Ltd signed a Strategic Alliance Agreement with Japanese trading house Sumitomo Corp. that provides a framework for negotiation of a binding joint venture agreement for the development, financing and operation of the Speewah Fluorite Project in the East Kimberley region of Western Australia.

The Speewah Project, located 100 km south of the port of Wyndham, is the largest, highest grade vanadium in titanomagnetite resource in the world as well as hosting an inferred resource of 27.2m tonnes of fluorspar.

Tivan is focused on development planning for a mining and processing operation to produce acid grade fluorspar. A Pre-Feasibility Study with Lycopodium is expected to conclude in July 2024. If successful, this would be Australia’s only fluorspar mine.

Under the joint venture, Sumitomo will be appointed as the sole distributor and agent to market and distribute Speewah’s commercial grade fluorspar product in Asia, with prescribed tonnage reserved for Japanese consumers.

Brendon Nicol, Process Manager, Tivan Ltd will be presenting on the Speewah Fluorite Project at

ABx – ALCORE Project, Australia

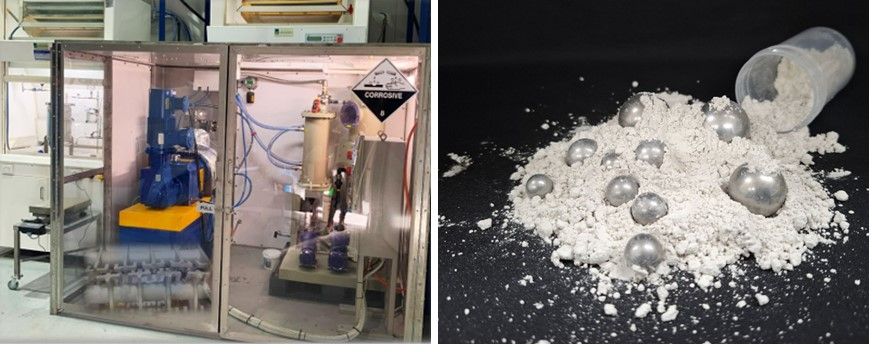

Tivan is not the only player developing a fluorine source in Australia. Also in early June 2024, ABx Group (also developing bauxite and rare earth deposits) announced the latest round of independent analysis of recovered fluorine samples from further test runs of its 83%-owned subsidiary ALCORE’s bath pilot batch reactor.

The ALCORE process for producing aluminium fluoride comprises: the recovery of fluorine from waste materials, eliminating the need to use fluorspar, and the use of bauxite and/or dross (a waste from casting of aluminium) as the source of aluminium, instead of aluminium hydroxide.

ALCORE was able to achieve a maximum of 93% fluorine recovery in the latest processing test runs. According to the company, this level of fluorine recovery would “very likely be sufficient” in a commercial plant.

Australian fluorine in recovery: (left) ALCORE’s pilot plant for recovery of fluorine from aluminium waste; (right) solid product after the recent test run achieving 93% fluorine recovery. Courtesy ALCORE

The reactor is operating at the ALCORE Technology Centre on the NSW Central Coast and has been designed for the recovery of fluorine from ‘excess bath’ (an aluminium smelter waste) to produce hydrogen fluoride.

Since the bath pilot batch reactor was commissioned in October 2023, ALCORE has conducted many test runs, each typically involving approximately 10kg total of bath and sulphuric acid. ALCORE has reported steady increases in fluorine recovery, previously achieving a maximum of 80% in a single stage, and 88% with further processing.

The next step is to use the latest results to refine the continuous pilot plant reactor configuration design and tune the operating conditions.

Canada Fluorspar – St. Lawrence fluorspar mine, Canada

The beleaguered St Lawrence fluorspar mine operated by Canada Fluorspar Inc., closed since February 2022, was reported earlier in the year to be aiming at restarting in 2025, with new owners Fluorspar Holdings Pte Ltd pledging to invest C$100m over the next three years to restart and expand the site.

However, there have been several false dawns surrounding this project and the market awaits with interest to see how the latest plans unfold.

Sofax Fluorspar Kenya – Kimwarer, Kenya

Another potential restarter is the fluorspar mine at Kimwarer, Elgeyo Marakwet county, Kenya, formerly operated by Kenya Fluorspar Co., the sole producer of fluorspar in Kenya, which closed in 2016 owing to a drop in demand for fluorspar and low mineral prices.

In recent years there have been several attempts to rejuvenate the operation, which at its peak produced >100,000 tpa fluorspar. However, ongoing issues of land compensation and ownership have dogged the process.

A new operating company appears to have been established and media reports from Kenya now indicate that operations maybe be restarted before the end of 2024.

In February 2024, Soy Fluorspar (UK) Ltd, Fujax UK, and Fujax East Africa signed a three-party agreement worth Ksh4.8Bn (US$35m) with the Kenyan government to enter into a 25-year lease to occupy the government-owned land and resume operations on the idled fluorspar mine. The government will retain a stake of 15% in the company, which it took over in 2018.

The new operating company is Sofax Fluorspar Kenya Ltd, and, according to its Facebook page, is “operator of the 25 years concession at Kimwarer…integrated mining and processing of fluorspar to acid grade of 97% CaF2.”

It was reported 1 July 2024 that according to Salim Mvurya, the Cabinet Secretary for Mining, Blue Economy and Maritime Affairs, the mining of fluorspar will resume within the next six months.

How fluorspar green was my valley?: (left) The former Kenya Fluorspar Co. mining in Kerio Valley, Kimwarer, Elgeyo Marakwet county, Kenya; closed in 2016, but at its peak produced >100,000 tpa fluorspar. A UK-based consortium is looking to restart the operation; (right) The official handover ceremony on 29 June 2024: CS Mining Hon. Salim Mvurya, PS Mining Elijah Mwangi, and Directors of Sofax Fluorspar. Courtesy Sofax Fluorspar

Find out the latest on fluorspar supply & markets | Don’t miss out! Early Bird Rates available for a limited period

Confirmed Speakers

Benchmark Breakfast Briefing: Fluorine in the Battery and EV age

Jessica Roberts, Head of Forecasting, Benchmark Mineral Intelligence, UK

Fluorspar supply & demand overview

Maximilian Court, Product Director – Battery Chemicals, Benchmark Mineral Intelligence, UK

Fluorspar & HF processing: trends & cost curves

Project Blue, South Africa

Mongolian fluorite deposits and their geochemical characteristics

Dr Tumenbayar Baatar, Independent Consultant & Geochemist & Banzragch Janchiv, Geologist, Mongolia

China fluorspar supply review

Xinhua Liao, President, Fujian Haojingda Industry Co., Ltd & China Non-metallic Minerals Industry Association Fluorspar Committee, China

Lost Sheep Fluorspar Project, Delta, Utah: Progress & Outlook

James Walker, CEO, Ares Strategic Mining, Canada

Tivan Ltd: Introducing the Speewah Fluorite Project

Brendon Nicol, Process Manager, Tivan Ltd, Australia

Pakistan’s fluorspar production progress: first acidspar plant development

Shahid Hamid Jafri, CEO, Perfect Associates, Pakistan

Hydrofluoric Acid: Accelerating the e-mobility journey – Asian Supply and Demand outlook

Samantha Wietlisbach, Director Minerals Research and Analysis, S&P Global Commodity Insights, Switzerland

Challenges & opportunities faced by Western fluorspar miners from the renewable energy revolution

Peter Robinson, Managing Direct, Fluorspar Ventures, UK

Production of aluminium fluoride from fluorosilicic acid by neutralisation with hydrated aluminium oxide

Dr Alexey Morozkov, JSC “NIUIF”, PhosAgro, Russia

Steel market demand & outlook

Project Blue, UK

The making of fluorine-containing materials for OPTICALization: starting from fluorspar

Dr Dexi Weng et al, Managing Director, Dexyan Global Poly Research Institute, USA