US output halted as overseas alternatives emerge | India expands

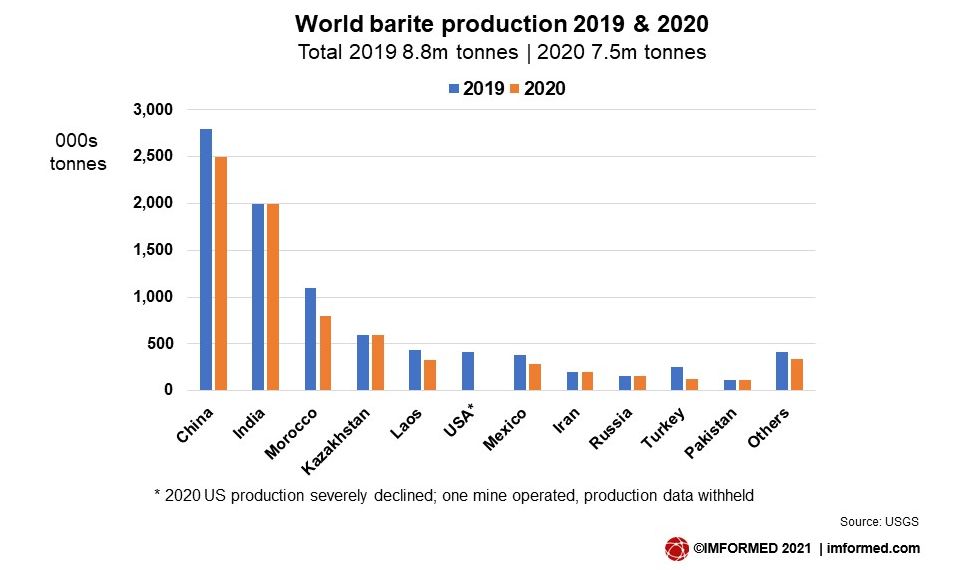

Described as “one of the worst years in recent history” for the oilfield market, it is unsurprising that world barite production was estimated to have decreased by about 15% during 2020.

Title image Digging Deep: The world’s largest barite mine at Mangampet, Andhra Pradesh, India; APMDC is planning to expand production from 3m to 5m tpa, as India strengthens its role as the leading world barite exporter.

According to The Barytes Association almost 70% of global barite consumption is used as a weighting agent in oil and gas well drilling.

The oilfield market, which consumes a range of industrial minerals in vital applications, was severely impacted in 2020 by the pandemic with travel restrictions significantly reducing demand for transport fuels. As a result, producers and traders of barite, the largest volume mineral consumed, saw sales plummet by up to 90% on the previous year.

The European barite market, 50% of which is accounted for by industrial market applications (eg. chemicals, fillers), was somewhat protected from the oilfield downturn (and was even helped a little with increased paint sales owing to home renovation during lockdown), but in the USA more than 90% of barite consumed is for oilfield drilling, so this market was hard hit.

Now we are in Q2 2021 there are clear signs of recovery in the oilfield market as mineral suppliers adjust and strategize for near and medium term business development. Here we take a look at the barite supply sector.

To assess the outlook for the oilfield minerals market IMFORMED has gathered an excellent panel of speakers for our upcoming Oilfield Minerals & Markets Forum 2021 ONLINE 12:00-18:00 BST Wednesday 26 May – Early Bird Rates end Friday 23 April – Full Details Here.

Supply and demand trends for minerals used in oilfield applications

Oil & Gas Outlook | Barite | Bentonite | Pollucite | Gilsonite

In its sixth year, this unique Forum consistently brings together the major players across the global supply chain, from mineral producers, processors, and traders to logisticians, financiers, and end use consumers.

FULL DETAILS

Barite production & trade review

China, India, and Morocco are the world’s leading producers of barite accounting for just over 70% of world output, according to the latest USGS data.

These are also the leading exporters of barite in world trade, followed by the lower volume but important alternative export sources in Laos, Mexico, Turkey, and Pakistan.

With the exception of India, all these major suppliers of barite saw declines in production during 2020 (see chart).

Indeed, the USA, which was ranked sixth largest world producer in 2019, saw severe curtailment in barite production in 2020 (see more below).

Not surprisingly, global barite exports were also down in 2020 from 2019, with China, Morocco and Turkey recording significant export declines of 52%, 67%, and 28%, respectively.

Total 2020 data for India was unavailable, though it also followed this trend. Indian exports to the USA in 2020 dropped >50% from just under 1m. tonnes in 2019 to 411,526 tonnes in 2020.

Overall though, India has in recent years strengthened its position as a leading barite exporter, surpassing China for the first time in 2018 with 2.2m tonnes exports (China 1.2m), and again in 2019 with 1.9m tonnes (China 1.1m).

Typically, >90% of barite sold in the USA is used in the drilling of oil and natural gas wells. The USGS estimated that domestic consumption of barite decreased by an estimated 45% in 2020.

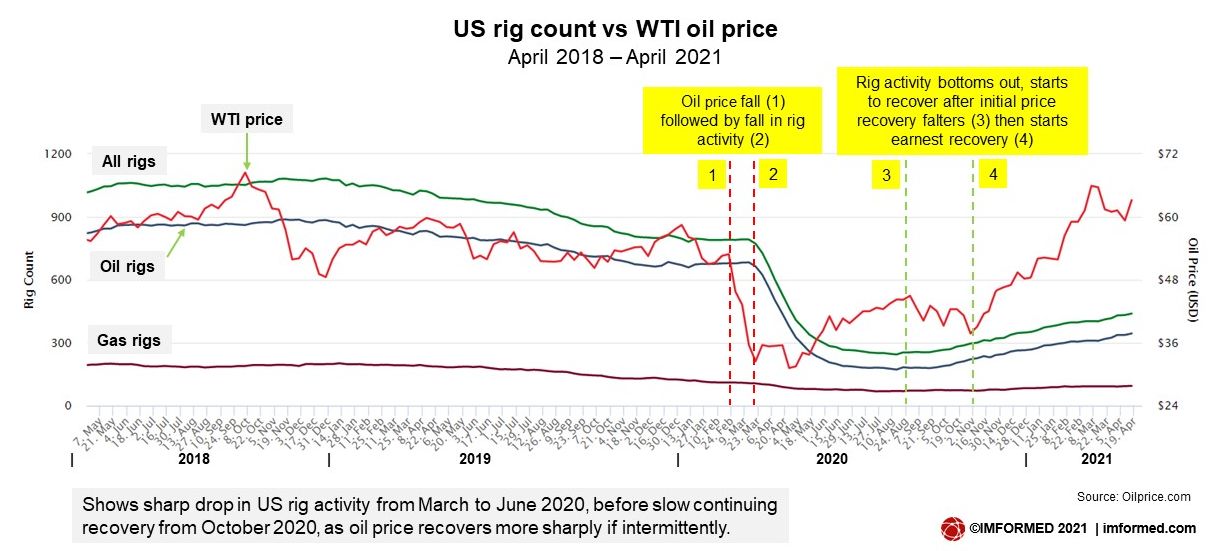

The US oilfield market, onshore but also offshore in the Gulf of Mexico which consumes the majority of barite imports, was clearly hit during the pandemic in 2020 (see rig count chart) although commentators are sensing some signs of recovery.

The chart shows the sharp drop in US rig activity from March to June 2020, before the start of a slow continuing recovery from October 2020 as the oil price recovered somewhat more rapidly.

According to the USGS, during 2020 an estimated 1.3m tonnes of barite from domestic production and imports, was sold by processors operating in seven states.

This clearly illustrates the impact of the downturn in oilfield activity from previous years, when levels attained were 2.3m tonnes in 2019, and 2.4m tonnes in 2018.

The USGS also reported US barite imports for consumption were down 41% from 2019 to 1.5m tonnes in 2020 (2.5m 2019, 2.4m 2018, 2.4m 2017). Imports from India fell >50% in 2020; from China down 73%; and from Morocco down 91%.

Leading US barite import source countries during the period 2016-19 have been China, 47%; India, 20%; Morocco, 14%; Mexico, 12%; and other, 7%.

But it should be noted that the last few years have seen alternative barite sources emerging for the US market: from Thailand (50,000 tonnes imported 2020); Vietnam (38,000 tonnes imported 2019); Laos (120,000 tonnes 2019), and Pakistan (10,000 tonnes 2019). Note also that barite exported from Thailand and Vietnam is actually sourced from mines in Laos, some material maybe processed in the port country.

These sources, and others from Mexico and Peru, while having experienced a difficult 2020 with much reduced sales, are expected to show more activity in the future.

South-East Asian sources of barite are emerging as a stronger force in world exports, such as this deposit being mined in Laos, then processed and exported via Thailand. Calvin Loa of Mekong Minerals Co. will be presenting on this topic at the upcoming Oilfield Minerals & Markets Forum 2021 ONLINE 26 May. Courtesy KIA Energy Co.

There is also some interest in unlocking alternative barite sources as by/co-products from base metal projects.

Adriatic Metals Plc, UK, through wholly-owned Bosnian subsidiary, Eastern Mining d.o.o., owns 100% of two concessions over the Veovaca and Rupice Au-Ag-Pb-Zn-Ba deposits in Bosnia & Herzegovina, which make up its Vares Project.

Work to date indicates the Vares Project comprises probable reserves of 2.94m tonnes grading 26% barite, mostly in the Rupice deposit (planned underground mine). Adriatic Metals envisages production of 165,000 tpa barite concentrate with a strategy to sell direct to the oilfield market.

The Vares Project is undergoing work on a DFS and financing, all being well envisaging construction starting late 2021 and commissioning in late 2022. Should it come to fruition, this would make it Europe’s largest barite producer.

Find out the latest on barite market supply and demand

Confirmed Speakers

Bulk buying barite: an independent perspective

Joe Gocke, Consultant, USA

The global barite market: review and outlook

John Newcaster, Director, IMPACT Minerals LLC, USA

Chinese barite supply developments

Rita Hu, General Manager, Guizhou Saboman Imp. & Exp. Co., China

Laos barite supply & future projects

Calvin Loa, Managing Director, Mekong Minerals Co. Ltd, USA

Barite processing: Extending life of assets through equipment wear reduction

Santiago Carassale, Category Manager – Mined Products, Halliburton, USA

USA: barite mine activity demise

US barite production all but ceased in 2020, with most domestic barite mining and processing facilities idled. The USGS reported just one company in Nevada active in mining barite, and thus 2020 US production data has been withheld to avoid disclosing company proprietary data.

In 2019, US production had increased >6% to 414,000 tonnes, the third annual increase after several years of declines. Most production came from Nevada and a single mine in Georgia.

Nevada’s 2019 barite production came from five operations, though one operation only sold from stockpiles. They shipped 389,914 tonnes valued at $46.3m, a 5% increase from 2018. Mine production was 522,884 tonnes, a 40% decrease from 2018.

The majority of Nevada crude barite is ground in Nevada and then sold to drilling companies in central and western US, and Canadian oilfield markets.

While mine production and processing was almost nil during 2020, reports by the Nevada Bureau of Mines and Geology showed that the previous year had already witnessed a start in decline of output.

M-I SWACO, a subsidiary of Schlumberger, was the largest Nevada barite producer in 2019, and is thought to be the only operation processing in 2021. The company shipped 204,119 tonnes of ground barite from its Battle Mountain grinding plant in Lander county. This was a 10% decrease from 2018. The material shipped came from 201,397 tonnes mined at the Greystone Mine, a 69% decrease from 2018.

The other Nevada barite players active in 2019 as reported by the Nevada Bureau of Mines & Geology included:

National Oilwell Varco’s (NOV) Dry Creek jig plant and Osino grinding plant (NOV’s Big Ledge Mine closed in 2014 with subsequent production coming from stockpiles)

Baker Hughes Oilfield Operations Inc.’s Argenta mine and plant, and Slaven Mine

Baroid Drilling Fluids’ (subsidiary of Halliburton) Rossi Mine, jig plant and the Dunphy mill facility, the largest barite grinding plant in North America; the mine was temporarily closed end of 2015 and the mill facility was temporarily closed in 2016, though it did ship barite in 2018; Baroid had proposed an expansion of the Rossi which would extend mining operations and surface exploration for an additional 8 years. The BLM issued a record of decision approving the project in September 2019, and a reclamation permit was issued.

Progressive Contracting Inc. a local contract miner, not a mainstream barite producer, shipped 53,637 tonnes of barite processed from 80,677 tonnes produced from the Maggie Creek Mine (also referred to as the Carlin Mine) in 2019.

Baroid’s state-of-the-art Dunphy Plant, Nevada, completed in 2014 and currently mothballed, consists of two 85-in Williams Crusher Mill Systems, capable of processing 50 tpa barite ore. There is also an automated 800 tpd packaging system for bagged material. Santiago Carassale, Halliburton, will be presenting on barite processing at Oilfield Minerals & Markets Forum 2021 ONLINE 26 May. Courtesy The Mouat Co.

Though BLM-approved, it seems unlikely that Baroid will start expanding the Rossi Mine until the market recovers more fully, if at all. Moreover, there is speculation that Baker Hughes and Baroid facilities maybe put up for sale.

Most recently, in April 2021, leading barite processor and distributor CIMBAR Performance Minerals Inc., acquired Baker Hughes’ drilling grade barite plant at Corpus Christi, Texas, and has started ramping up production.

The addition of the CIMBAR Corpus Christi barite operation expands the company’s footprint to supply its oil and gas customers in all the land drilling regions in the USA, and in particular, in south and west Texas.

This follows the March 2021 announcement by CIMBAR that it had reached agreement with TOR Minerals International Inc. to purchase TOR’s high grade barite (and alumina trihydrate (ATH); both for filler markets) manufacturing assets located at Corpus Christi, Texas.

In addition to barite, CIMBAR is a leading supplier of talc, ATH, magnesium hydroxide and post-consumer mineral-based fillers processed at 12 plants in the USA, with additional production sites in Mexico, China, and Pakistan.

Also presenting on 26 May

Confirmed Speakers

Oilfield market outlook: where’s it heading?

Uday Turaga, CEO, ADI Analytics LLC, USA

Bentonite from a supplier’s perspective: overview & bringing a source on-stream for the oilfield market

Michael Barr, Mineral Resource Coordinator, Bentonite Performance Minerals-Halliburton, USA

Gilsonite used in oilfield applications

Craig Mueller, Chief Commercial Officer, American Gilsonite Co., USA

Pollucite and cesium formate fluids in oilfield drilling: supply, processing & demand

Siv Howard, R&D Manager, Sinomine Specialty Fluids, USA

India: expanding production & exports

In India, the majority of the country’s barite reserves are concentrated in the state of Andhra Pradesh and their exploitation and processing is administered by the state-owned Andhra Pradesh Mineral Development Corp. Ltd (APMDC).

The Mangampet barite deposit in Kadapa district is the single largest deposit in the world and according to the APMDC accounts for 95% of India’s barite reserves. The 2.25km2 deposit comprises some 50m tonnes of remaining reserves of barite suitable for a range of market applications.

In March 2021, the APMDC announced the proposal of a revised INR1bn (US$13m) mining plan for its huge Mangampet barite mine to increase production from 3m to 5m tpa, perhaps indicative of reinforcing India’s growing dominance in world barite supply, especially over China in recent years.

APMDC has extended the Mangampet mining contract with the existing company for another five years.

The state government is anticipating at least INR10bn(US$133.4m) in revenue from Mangampet barite sales during FY21, and not least from export sales.

On 25 January 2021 the APMDC started its annual tender bidding process for export sales of 1m tonnes of A Grade (drilling grade 4.25 SG), 200,000 tonnes of B Grade (drilling grade 4.10 SG), and 1m tonnes of C+D+W Grade (lumps, waste), for export, captive consumption for oil well drilling in India, and overseas for buyers registered in India.

The auction concluded in March 2021 with the following companies known to have succeeded in securing various volumes and grades: Rescom Holdings (UAE), Gimpex Pvt Ltd (India), Emprada Mines and Minerals (India), and Varshini Enterprises (India; an associate company of US-based Rock Fin Minerals).

The concluded auction results ended up 25%-30% higher than the initial reserve prices set by APMDC, which were: A Grade INR4,425(US$59)/t; B Grade (US$43)/t; C+D+W Grade INR1,640(US$22)/t.

Emprada Mines & Minerals, India, has steadily increased barite exports from just 7,000 tonnes in 2015 to 300,000 tonnes in 2020. Courtesy Emprada Mines & Minerals

Emprada Mines and Minerals LLC is headquartered in Austin, Texas but operates a processing plant in Kadapa, India (similar to Rock Fin Minerals, based in Houston, with its Indian associate Varshini Enterprises).

Over the last few years the company has steadily increased its share of India’s barite export market, rising from just 7,000 tonnes in 2015 to 300,000 tonnes in 2020. Emprada has six grinding units with a combined production capacity of 15,000 tpm.

Vikram Akepati, CEO, Emprada Minerals LLC said: “Yes, 2020 was definitely a bad year for everyone, but we have enough contracts on hand and hopefully that will keep us busy for the rest of the year. We have reached 300k in barite export and are now one of the leading suppliers out of India.”

Outlook: cautious recovery while industrial markets look attractive

The outlook for barite is not without some signs of recovery in the oilfield sector, though following the severe 2020 downturn one might argue that the market can only go up.

Barite traders and suppliers report that business is “slowly starting to pick up but obviously from an extremely low bar in 2020”.

Youssef Laghzali, Sales Manager, Broychim Group, Morocco commented: “There was some sort of pick up at the beginning of this year for the US Gulf of Mexico, hoping this will be confirmed in the second quarter of the year. Our new Safi plant is currently fully operational and performing well.”

Broychim accounts for nearly 50% of Morocco’s barite exports and in 2019 opened a new 20,000 tpm barite plant at the port of Safi, hosting two grinding units, crushing, washing, and jigging units. Courtesy Broychim

Naturally, with Biden’s moves to limit future oilfield drilling in the USA barite consumers are perhaps understandably cautious about the near term outlook.

However, so far in 2021, there have been mostly positive waves emanating from leading players and forecasts in the oilfield market:

“Oil demand is to recover to 2019 levels no later than 2023”

Olivier Le Peuch, CEO, Schlumberger, 22 January 2021

“As we look ahead to the rest of 2021, we remain cautiously optimistic that the global economy and oil demand will recover from the impact of the global pandemic. We expect spending and activity levels to gain momentum through the year as the macro environment improves, likely setting up the industry for stronger growth in 2022.”

Lorenzo Simonelli, Chairman & CEO, Baker Hughes, 21 April 2021

“The first quarter marked an activity inflection for the international markets, while North America continued to stage a healthy recovery. I expect international activity growth to accelerate, and the early positive momentum in North America gives me confidence in the activity cadence for the rest of the year.”

Jeff Miller, Chairman, President and CEO, Halliburton, 21 April 2021

Mid-April 2021 saw oil prices surge almost 5% in response to a revised monthly oil demand outlook from the International Energy Agency (IEA), with Brent crude at $66.58/b and WTI $63.15/b.

World oil demand is expected to expand by 5.7m barrels a day in 2021, with total consumption at 96.7m b/d. Demand declined last year by 8.7m b/d.

In its annual Global Energy Review 2021 published 20 April, the IEA forecasts global overall energy demand is set to increase by 4.6% in 2021, more than offsetting the 4% contraction in 2020 and pushing demand 0.5% above 2019 levels. Almost 70% of the projected increase in global energy demand is in emerging markets and developing economies, where demand is set to rise to 3.4% above 2019 levels.

However, despite an expected annual increase of 6.2% in 2021, global oil demand is set to remain around 3% below 2019 levels. Natural gas demand is set to grow by 3.2% in 2021, propelled by increasing demand in Asia, the Middle East and the Russian Federation. This is expected to put global gas demand more than 1% above 2019 levels.

Certainly, many barite suppliers have upped their profile and potential in serving the lesser volume but higher value “industrial markets” for barite, eg. chemicals, pharmaceuticals, fillers in paint, plastics, rubber, and radiation shielding, in order to offset the downturn in oilfield market sales.

This is exemplified by CIMBAR’s recent acquisition of TOR Mineral’s high grade barite plant (see earlier), and the strategic switch to focus on pharmaceutical grade barite development by the formerly named barite deposit developer Voyageur Minerals Ltd, now called Voyageur Pharmaceuticals Ltd.

Voyageur (which presented at Oilfield Minerals & Markets Forum 2018) is now focused on becoming a fully-integrated pharmaceutical company by creating USP (US Pharmacopeia) grade minerals, and is developing its Frances Creek, British Columbia barite project into a source of barium radiographic contrast media. A Preliminary Economic Assessment is ongoing, and work to date demonstrates that 98.6% BaSO4 can be produced to make USP grade barium sulphate.

Not all barite deposits are high quality enough for industrial markets, but those with access to such grades will certainly be re-evaluating their reserves to see how far they can pursue these lucrative but lower volume markets.

Recent work by researchers at Purdue University, Indiana (Prof. Xiulin Ruan pictured below), in evaluating barium sulphate-based white paint to help reflect sunlight and assist reducing global warming hit the media headlines recently and would certainly have pricked up a few ears among the barite community (see “The whitest paint is here – and it’s the coolest. Literally.”). The material used was a very fine grain size (d50= 0.4 micron) synthetic barium sulphate.

Independent barite consultant, Peter Huxtable commented: “White barite world output is probably around 0.5m tonnes and will cover a wide variety of actual colour whiteness. Resource is limited, and most comes from China, Morocco, and Turkey. That total would include blanc fixe which is re-precipitated barite. There has been a lot of work at acid washing of off-white

Paint is already one of the leading industrial applications for high whiteness barite, and although it’s perhaps early days until more work is conducted, a new radiative cooling paint market for barite appears exciting.

Generally speaking, with US mine production idled, emerging alternative sources are going to play an increasing role in global barite supply, while India and Morocco may continue to take export market share from China.

“Customers across the globe are looking at Indian and Moroccan barite as the better options [compared to China] in the given market scenario.” commented Vikram Akepati, CEO, Emprada Minerals LLC.