In an interview to mark the 10th Anniversary of Benchmark Mineral Intelligence, and to coincide with the company’s 2024 AGM, Simon Moores, CEO, Benchmark, put some questions to Mike O’Driscoll, Director, IMFORMED, about the evolution of the industrial minerals business in his career.

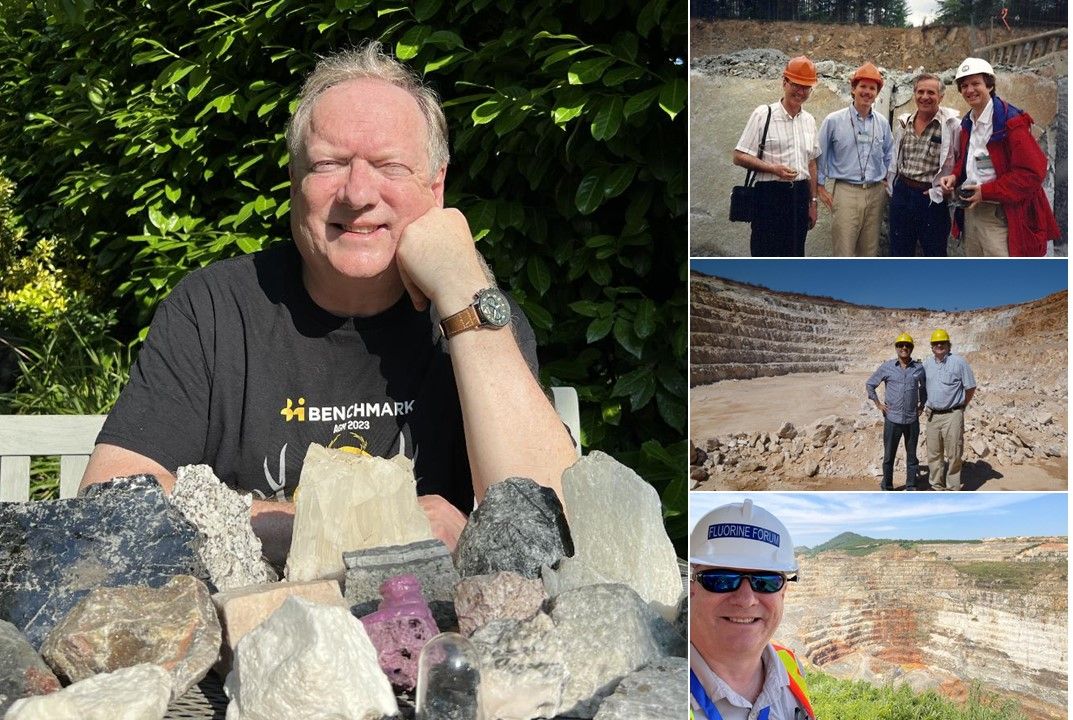

Title Image Rock Steady: Mike with some of his favourite rock samples collected from around the world; Inset top right: learning the trade from experts Tom Newman (middle left) and Danny Hora (middle right) at Kyanite Mining Co., Virginia, 1990; Inset middle right: at the Pedra Preta magnesite mine of Magnesita SA, Bahia, Brazil, 2011; Inset bottom right: at the bismuth-tungsten-fluorspar operation of Masan High Tech Materials, Nui Phao, Vietnam, 2022. Main image courtesy Sharon Thomas

The full text of the interview follows below, which was also published as “Bicentennial Man” in the Benchmark AGM Skyfall Ends special publication.

There is also a video interview with Henry Sanderson, Executive Editor of Benchmark Source, who sat down with Mike O’Driscoll to journey through his extensive career in industrial minerals, spanning four decades and a period of immense change.

To view the video please go to: Benchmark Source: Henry Sanderson talks with Mike O’Driscoll

He’s seen it all…

Mike O’Driscoll’s life in minerals has spanned four decades over two centuries and times of immense change. From the rise of China, to the dawn of the energy transition and the soaring demand for the likes of lithium and graphite.

On a corporate level, Mike has witnessed the big get bigger, the downstream go upstream, and the traders become more specialised.

At Industrial Minerals magazine since 1987, and its longest serving Editor from 1995-2012, he set the foundation for knowledge and networking on a global scale for a spectrum of mineral industries that fell into three categories: industrial, strategic, and critical.

Now at the helm of IMFORMED along with his longstanding business partner, Ismene Clarke, Mike is zeroing in on key mineral markets such as fluorspar, magnesia, mineral recycling, oilfield, and Chinese refractory minerals.

He’s seen it all, he’s done the lot…Benchmark sits down with Mike to put this on the record.

Industrial minerals, critical minerals, strategic minerals… How has the minerals industry changed in your near four decades in the business?

Overall, the obvious changes include cleaner, safer, and more efficient operations of course, more remote control and higher tech processing and quality control involved – this has naturally led to mineral producers being able to supply a range of diverse grades for different markets – crucial to their survival.

There have also been great strides in improving logistical options and systems, thereby allowing more remote sources access to markets. The internet and its global use almost overnight boosted more rapid contact worldwide, thus accelerating awareness of potential new sources and markets.

Most recently, processing developments in parallel with the drive to achieve a Circular Economy and reduce CO2 footprints and reduce overreliance on limited sources, have increased the potential and evolution of mineral recycling – both from mining waste and crucially, end product recycling.

How has the corporate side evolved?

Corporately, there has been much consolidation of the many historic small-medium privately owned industrial mineral producers, more ownership by private equity, and more vertical integration (captive sources owned by end users).

On the trading side, this too changed dramatically from dominance by a few large, multinational players, to many smaller, streamlined and efficient companies, offering a range of services, some focused on specific markets. Although, this is now swinging back slightly to a leading pack of medium-sized players.

Markets-wise, while as long as there remains growing and developing populations, there will always be continued demand for industrial minerals.

China (see more below) remains an important factor in the industry in terms of supply, but now increasingly in consumption. The rising Chinese and Asia Tiger economies of East Asia in the late 1980s-90s is now continuing with India, Indonesia, and Vietnam, and MENA, leading the way for rising mineral consumption. In Europe, from 1989, eastern and central Europe also saw market opportunities expand.

But I remain consistently amazed at the ongoing new opportunities created for mineral demand by advances in R&D in new applications in different markets in my career.

Can you give some examples of gamechangers?

Of course. Three very different examples of massive market gamechangers illustrate how the industry always needs to keep a look-out for the “next market” and its primary drivers:

1.Change in papermaking technology: late 1980s/early 1990s saw papermakers change from the acid-based to the alkaline-based process, thus permitting widespread use of ground calcium carbonate (GCC) at massive volume expense to traditional kaolin use. A huge boon to the GCC industry, while forcing kaolin producers to engineer new products for paper and other applications.

2. Unconventional oil/gas resource development by hydraulic fracturing (fracking): around since 1949, further developed a bit in the 1980s, then come early-mid 2000s there was a phenomenal boom in fracking. This was facilitated by developments in horizontal drilling techniques using massive volumes of improved mineral-based proppants (silica sand, kaolin, bauxite) to exploit much needed cheap shale gas and oil from otherwise earlier unexploitable resources (mainly in N. America, but also elsewhere). Wisconsin was turned into a frac sand mine! Now superseded by West Texas – in the USA the humble silica sand has never looked back.

3. Battery “revolution” as part of energy transition: From the early 2000s it was obvious that a new era for battery development was occurring with R&D and then commercial manufacturing of Li-ion batteries for all kinds of high-tech consumer and industrial devices. This opened up a huge, and ongoing market for a range of minerals (eg. lithium, graphite, nickel, cobalt, manganese) and massively raised awareness (for some) of their vulnerabilities in availability, sourcing and supply chains, leading to the advent of “Critical Raw Materials” and their mainstream recognition by media and state governments (and not just for batteries). The market continues to evolve with new battery chemistries and applications for more minerals (eg. fluorspar, high purity aluminas) and demand for more commercially developed sources.

Fluorspar’s use and demand in Li-ion batteries will be covered among other market trends at

Field Trip to Mongolczechmetall LLC, Thurs 17 Oct.

EARLY BIRD RATES | CONFIRMED SPEAKERS | FULL DETAILS

You were one of the early western mineral experts in China in the early 1990s. What was China like back then and how has China changed?

Since China opened up to world commerce in the mid-late 1980s, owing to its abundance of mineral resources the country continues to be an incredibly significant factor in world mineral supply, especially in influencing global pricing. But there have been major changes.

My early visits to China from 1994 saw much internal travel by car (now all by air); crude mining and processing (now employing modern equipment and technology); very little English spoken, usually by junior staff (now very common, and by senior management); supplying the export market was the priority (not any more, with growing domestic demand); there were few if any city bars/entertainment for overseas visitors. From the mid-late 90s that changed rapidly – KFC, McDonalds popped up in the main cities, followed by bars everywhere. You knew times were changing when a Starbucks was opened in the Imperial Palace!

What changed about specific minerals?

From the early 1990s, the advent of more value-added or semi-processed industrial minerals (as opposed to crude ore) sourced from China dominated the world market (especially for aluminas, barite, bauxite, fluorspar, magnesite, silicon carbide, talc, wollastonite).

This was encouraging (but not always successful) for foreign investment in Chinese (and later South East Asian) mineral operations, and a plethora of traders evolved at the same time.

In particular, a trend developed in establishing foreign mineral processing JVs in key ports to add value to exports, welcomed by western consumers (not so much by the European processors of imported minerals!). This also marked the demise of the huge, unwieldy Chinese state-owned trading organisations with which western buyers had until then to deal with exclusively.

Despite initially mixed quality, the high volume, lower cost Chinese exports successfully penetrated western markets, and put many western mineral producers out of business – especially when Chinese grades improved in quality consistency.

What was one of the biggest drags on this China megatrend?

But Chinese mineral pricing and supply availability was often unpredictable, not helped by the Export License & Quota system employed by the government in 1994, which encouraged a horse-trade in export licenses and widespread smuggling (and via “Third Countries” to avoid anti-dumping procedures).

2016-17 marked a sea change in China, mainly owing to the growing influence of Xi Jinping over China’s policies and strategies, resulting in an ongoing range of factors (eg. controls on plant inefficiencies, pollution, corruption, and explosives; industry sector reforms; trading policies – Export License System disbanded in 2017, but rare earth and graphite quotas persist) which have in general, although laudable in part, negatively impacted China’s ability to maintain its mineral supply dominance in certain sectors.

While nevertheless remaining an important source of minerals, the situation in China has forced many western consumers to seek additional/alternative sources outside China (and thus – a good thing – encouraging mineral project development elsewhere).

China is now importing minerals for its own expanding domestic markets (eg. a net importer of fluorspar since 2017, unthinkable a few years earlier).

For all the latest in trends and developments for Chinese refractory minerals, don’t miss

Field Trip to Haimag- Haicheng Magnesite Group, Thurs 24 Oct.

EARLY BIRD RATES | CONFIRMED SPEAKERS | FULL DETAILS

What was your first mineral love and why?

I guess it had to be diatomite – and not just because it’s an essential filter agent for beer brewing! It was the topic of my first feature article at Industrial Minerals magazine, but also (as I realised later) it typified some of the key characteristics of industrial minerals: very important for a range of very different market applications (filtration in brewing, winemaking, swimming pools; used in cat litter; refractories; toothpaste; oilfield drilling; insulation; various fillers).

Diatomite requires different process routes for these uses, eg. calcined or non-calcined; has very limited worldwide sources of commercial production. And interestingly, the “mineral” is actually composed of millions of fossilised diatoms (oceanic algae) made of silica compressed into a rock called “diatomite”. All round, a joy for the economic geologist!

You were editor of Industrial Minerals magazine for 17 years and you gave the start to the careers of many mineral professionals. Why was IM so special?

I am very grateful for my 26-year period at IM, and realised early on that it enabled a very unique career path: maintaining an interest in minerals/earth science but which was applied (journalistically and analytically) to the ongoing commercial development and supply of minerals used in everyday manufacturing and consumer end products worldwide.

Moreover, it meant regularly interfacing with senior management and influential market players around the globe – thus highly developed communication skills and rapport building, along with reputation for expert knowledge, was absolutely key.

It was hard work with deadlines and pressures, but was important, tangible, rewarding and above all fun!

IM attracted a core of certain types to work there successfully in such an atmosphere, which engendered a great team bond, ethos, and staff longevity that was the envy of other company departments. Thus, when I became Editor in 1995 I ensured that I continued to foster, recruit for, and where possible improve that environment.

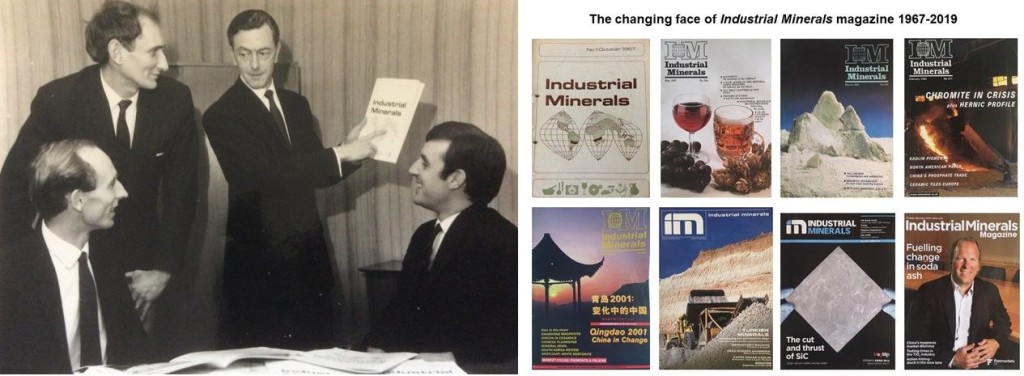

To see how IM magazine began and flourished, and “Where are they now?” for IM staffers, please see “So, farewell then Industrial Minerals magazine…”

You gave Benchmark’s CEO, Simon Moores, his first job as Assistant Editor in 2006. What was that experience like?

Ha! A loaded question. Actually, it was an enjoyable interview. By then I certainly knew the type of candidate required for the rigours of IM work. I could see that Simon fitted that mould for sure, even though (back then) he may have been a bit “rough around the edges”, and I could tell some of his answers to my questions were a bit “economical with the truth”.

But he could communicate, was enthusiastic, and frankly, interesting and someone you felt you could work with.

As with all jobs, both employer and employee only really know about themselves when they get into it for a few weeks/months. Simon joined at one of those unfortunate times when several long-standing staff members left at the same time, and there was a heavy and tight schedule – at one period, it was just the two of us. You get through that successfully in one piece, then you know it’s the right person in the right place (he still needed to brush up on proof-reading…probably still does!).

Your business, IMFORMED, has taken mineral events and networking to the next level. Can you explain how you did this?

I’m not sure if “next level” is a bit too grand, but we’ll take it!

Actually, as Simon may have also experienced, starting off IMFORMED was relatively easy in that we continued to work like we always had, but with the massively refreshing benefit of doing it how we wanted, and at a much faster pace, especially in decision-making and execution of tasking. The two of us (myself and Ismene Clarke) had worked together on IM for 15 years, so with our experience and rapport with clients we had a great starting base.

I think the key, at the beginning, was to focus on doing events where our knowledge and client base was strongest.

Then ensure several key yardsticks for each event: a great location, a strong and interesting programme (annually evolving where appropriate), ideally if possible a Field Trip, ensure plenty of time/platforms for networking, and above all maintain a “personal touch” and communication with our clients. It seems to have worked.

You’ve always been a big proponent of getting out there, seeing stuff and getting your hands dirty. Why is this and what does it take to properly analyse a mineral market?

It’s the only way to really ensure you’re getting it, ie. market understanding from all aspects.

Interviewing/meeting face-to-face in the office/conference is still the best way to glean key information and understanding of the market, as well as build up the all-important rapport with your client. The more contacts you make, the better – but ensure you have all the bases of your market’s supply chain covered, ie. not just say producer, but also processing, trader/logistics, market buyer side.

The next step, getting upfront and personal and “getting your hands dirty”, say doing a mine/plant tour, is essential to really appreciate, as well as educate yourself on the topic in hand. You have a reputation to make and maintain – get out there to where it all starts from and where it’s made and used.

Crucially, you also have the face-to-face at the same time, but it’s usually in a more relaxed (and frankly, more interesting) environment for both of you, and often with client staff that have more knowledge on what they’re talking about!

You glean much, much more in my experience – on the bus/car there and back, around the mine/plant, bar/dinner afterwards, it’s a shared experience which also starts a more personal professional relationship that becomes invaluable as your career progresses.

You also quickly appreciate that you’re in a privileged position – you find out that actually not many people in the market have had that personal visit that you had. You’re now on your way to being that unique market expert.

You’ve established relationships with cross sections of the industrial minerals space across the world. What are your 3 top tips for building and maintaining those industry relationships?

1. Market knowledge: research your subject thoroughly; know what you’re talking about; who’s who; keep on top of news/developments; know your own product/service and its relevance/potential to your client

2. Acquisition: get contacts from range of sources incl. websites, news, articles, papers, social media (LinkedIn is very powerful); but above all meet/speak with them especially at events and private meetings; never be afraid to make contact, even if it is just to introduce yourself and your company.

3. Maintain rapport: try not to lose contact, easily done, always file their contact details for easy reference.

What is your advice for anyone in the minerals business to be successful?

A. For someone say developing a mineral project, the primary objectives to achieve are:

- Reserves: High quality, sufficient volume, accessible

- Marketable grade: Mineral must meet market specifications

- Consistency: In grade spec. and volume availability

- Market demand: Essential to have market & knowledge of it

- Financing: Funding for all aspects of project

- Processing: Ensure correct & complete process route

- Logistics: Secure optimum logistics system & routes

- Flexibility: Awareness to diversify products & markets

B. If you are referring to say a reporting/analytical/marketing role in the minerals business, then I would say you need good knowledge of the market sector, many good contacts, awareness of trends and developments and adapt to them accordingly, and above all have great communication skills.

At IM, in each new recruit’s starter pack we had “The Power of P10” to assist them on their road to success:

- PLAN plan and prepare diligently ahead of schedule

- PRIORITISE prioritise your workload intelligently, think ahead

- PANORAMA be aware of all editorial, event, marketing synergies

- PROSECUTE execute tasks efficiently and professionally

- PERSEVERE be tenacious and endeavour to see tasks through

- PERCEIVE assimilate, analyse, understand, ascertain, solve

- PRAGMATIC be realistic in planning, task timings, make deadlines

- PERFORM internally, externally be your best for IM and yourself

- PARTICIPATE in the IM team, at events, visits, in the marketplace

- PRIDE in becoming a recognised expert at work and in the industry

I am sure you can adapt this to the world of Benchmark!

Benchmark is now 10 years old. What does the next 10 years look like for the minerals industry in your eyes.

I think the minerals industry is going to be dominated by two factors: the energy transition (and with it CO2 reduction) and recycling.

Both have challenges, but also great opportunities in development of new mineral sources and grades for new applications, a new evolving supply chain structure for recycling, and with it R&D in processing and increasing the recyclability of products.

You have seen many mineral careers flourish, what do you think are the top traits that makes an individual stand out as a mineral analyst?

It’s been mentioned here and there above. But the following would be key:

- Flair for analysis and getting to grip quickly with the topic

- Appreciation of effort and detail required to get information accurate and up to date

- Maintenance of 2. regularly at consistent high quality (often the hardest thing)

- Personable character will open doors and help communications with market, and team mates

Acknowledgements

Thanks to Simon Moores for instigating the interview, it was a very good and enjoyable exercise; also special thanks to Rob Colbourn, Henry Sanderson, and Gabriel Holland at Benchmark for ensuring a smooth interview, production and design for print and video publication.

Great article, even greater man !!

This interview provides a compelling retrospective on his distinguished career in the industrial minerals industry. Here are some thoughts and observations on the interview:

Rich Career Overview: Mike O’Driscoll’s extensive career spanning four decades provides a thorough perspective on the evolution of the industrial minerals sector. His observations on changes in technology, market dynamics, and geographical influences offer valuable insights into how the industry has transformed over time.

Evolution of the Industry: The interview highlights significant shifts, such as the rise of China as a major player in the global minerals market and the impact of technological advancements on mining and processing. O’Driscoll’s observations about the move towards more efficient, environmentally friendly practices and the growing importance of mineral recycling are particularly relevant, reflecting broader trends in sustainability and resource management.

Impactful Changes: The examples provided of game-changers, such as shifts in papermaking technology, the fracking boom, and the battery revolution, illustrate how technological and market developments can profoundly impact mineral demand and industry dynamics. These examples are well-chosen and effectively convey the transformative nature of these changes.

China’s Evolution: O’Driscoll’s reflections on China’s growth and its shifting role from a major exporter to a significant consumer and importer of minerals provide a nuanced understanding of global market trends. His experiences from the 1990s to the present day offer a unique perspective on how China’s integration into the global economy has influenced the minerals sector.

Personal Insights: O’Driscoll’s personal anecdotes and reflections, such as his early fascination with diatomite and his experiences as editor of Industrial Minerals magazine, add a personal touch to the interview. These insights not only highlight his deep expertise but also his passion for the field.

His advice for success in the minerals industry, whether in project development or analytical roles, is practical and grounded in experience. The “Power of P10” framework for new recruits is a particularly useful tool, emphasizing the importance of planning, prioritizing, and perseverance.

Simon Moores’ interview at the time of joining IM is superb to know about himself.

I am reading IM since 1992, no other substitute is found. Only Mike can again publish such a type of monthly magazine on minerals.

With Mike best wishes!

Regards.

Bharat Bhinde

+91 9925025927.

Dear Bharat Bhinde – what can I say? But very warm thanks for your wonderfully kind words and observations about my recent interview article with Simon Moores. Thanks also for being such a loyal reader of IM while it lasted. Of course, I was only one part of the IM team, we were supported by many fine editorial, advertising, and marketing staff over the decades.