Seen & Heard in Halkidiki: MagForum 2024 Reviewed

Supply | Decarbonisation | Refractories | Chemicals | Nickel-Cobalt Processing | Wastewater | Agriculture

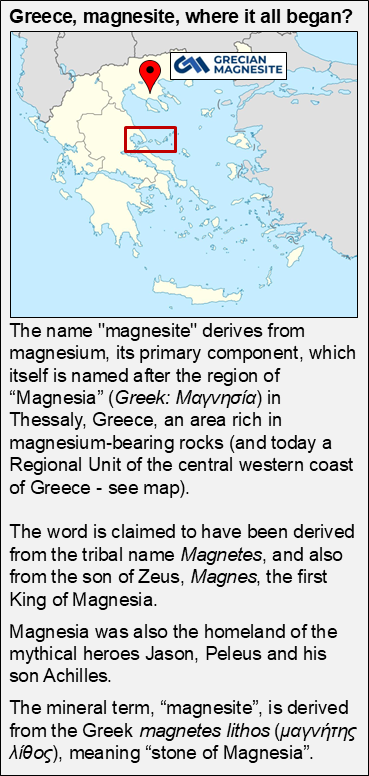

For IMFORMED’s 8th annual MagForum conference, the premier meeting for global supply and markets for magnesia minerals, we went back to the birthplace of “magnesia”, Greece (see inset), and specifically to Halkidiki, where Grecian Magnesite was celebrating the company’s 65th Anniversary, although its magnesite mining history there dates back to 1913.

Title image Ore so Vein: The cryptocrystalline magnesite vein stockwork, hosted by dunite, is easily observed at one of the working pits at Grecian Magnesite’s Yerakini mine, Halkidiki, Greece, site of the MagForum 2024 Field Trip. About 500,000 tpa of dunite and magnesite is co-extracted, feeding three rotary and one shaft kiln with a total combined calcination capacity of about 180,000 tpa.

MagForum 2024 brought together over 200 attendees representing leading players in the supply and demand for magnesia minerals to The Pomegranate Wellness Spa Hotel, Halkidiki, 13-15 May 2024.

Following the conference, which covered a wide range of key topics relating to magnesia production, decarbonisation, and market application (reviewed below), delegates enjoyed a superb visit to the Yerakini operations of Grecian Magnesite, an art museum inspired by the historic magnesia workings and community, concluding with a delightful Greek lunch by the beach.

For the latest in magnesia market developments, don’t miss…

Confirmed Speakers | Early Bird Rates

FIELD TRIP SPACES LIMITED – BOOK NOW!

Delegate Feedback on MagForum 2024

Outstanding venue, a really nice combination of presentations across our industry. MagForum allows me to speak to producers, distributors, and suppliers across many applications. The addition of the Roundtables has been great.

David Martin, Industrial Business Director, Premier Magnesia LLC, USAThis event brought the global magnesia community together for four days of informative presentations, panel discussions with experts and excellent networking opportunities.

Ibrahim Karakurt, Sales Manager, Lehmann&Voss Nederland BV, Netherlands

MAGFORUM 2024 REVIEW

OVERVIEWS | GREECE | TURKEY

Magnesia production & sources: an introduction

Mike O’Driscoll, Director, IMFORMED, UK

Following a warm Welcome Address from Dimitris Portolos, Managing Director, Grecian Magnesite, which formally opened the conference, Mike O’Driscoll set the scene with a brief summary of world magnesia production and trade.

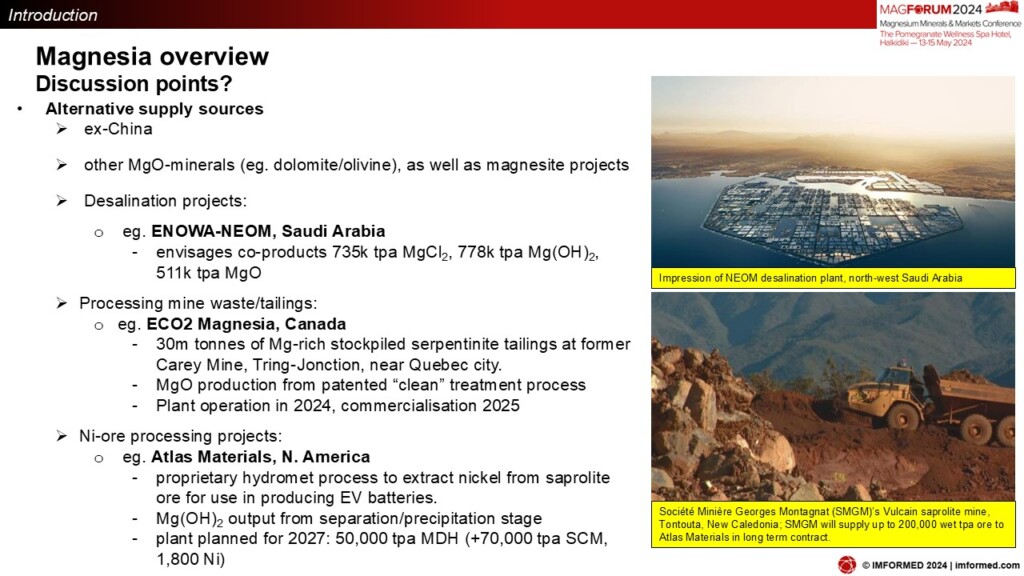

In particular, he drew attention to the shrinking group of dead burned and fused magnesia producers worldwide, the latest planned reforms in China’s supply sector, increased activity in decarbonisation, carbon capture, and recycling, and an evolving raft of mineral and metal projects offering alternative sources of certain magnesia grades.

65 years in the world of magnesia: review of milestones & challenges

Pantelis Vetoulas, Commercial Manager, Grecian Magnesite, Greece

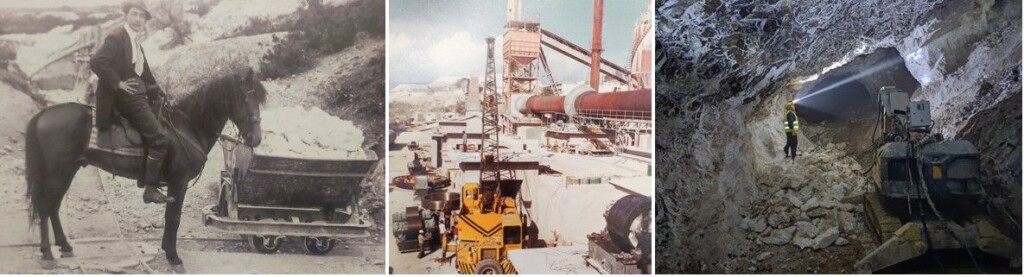

Vetoulas started at the beginning: “Our mining history dates back to 1913, when the young mining engineer, John Lambrinides, grandfather of our CEO, Dimitris Portolos, was appointed as the first Greek General Manager of the Yerakini mine. Grecian Magnesite was established in 1959.”

From there we were taken through the 65 years of the company’s development and growth, and how it has switched from traditional selective mining to sustainable mining practices. The Yerakini mine is the oldest active mined deposit in Greece.

Along the way, and illustrated with some remarkable images, the pioneering company adapted to the challenges of installing new equipment (eg. in 1976, laser-based photometric ore sorters – the world’s largest installation at that time), diversifying product and market range (now at 200,000 tpa total combined capacity of 60 different grades of CCM, DBM, refractory masses, magnesium carbonate and dunite), the Chinese “invasion” of low cost European magnesia imports of the 1980s-90s, and acquisitions (eg. in 1993, the first Greek company establishing a fully owned subsidiary company in Turkey – Akdeniz Mineral Kaynaklari).

Left to right: 1918, John Lambrinides, grandfather of current Grecian Magnesite CEO, Dimitris Portolos, General Manager of the Yerakini mine; 1970s, installation of 2nd and 3rd rotary kilns; December 2021, opening of the “Green” KOUTZI UG mine project, Evia. Courtesy Grecian Magnesite

Magnesia supply trends and outlook

Alison Saxby, Research Director, Project Blue, UK

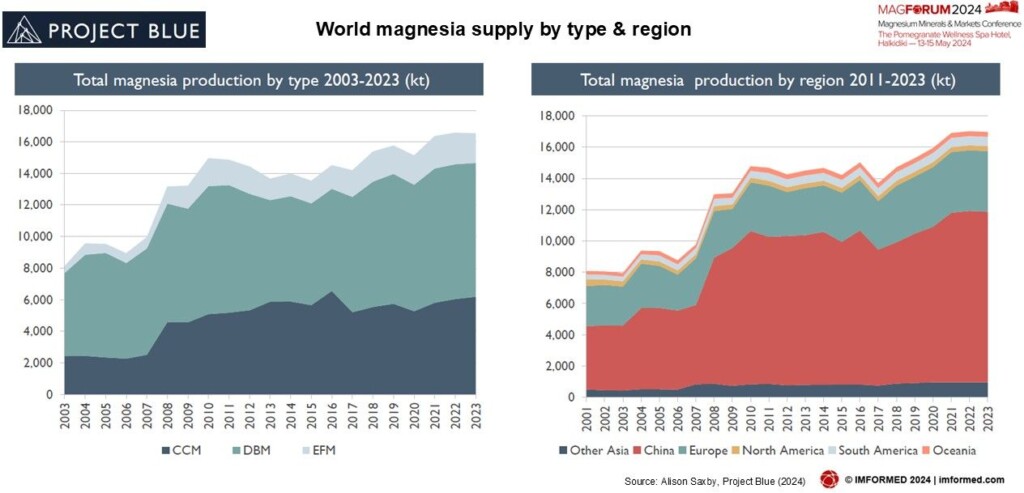

Saxby provided a full summary of the magnesia market covering types of magnesia and sources, magnesite ore – shifting patterns, supply of refractory and caustic calcined magnesias, global trade.

She concluded highlighting the key narratives in the industry:

- China: still central to the global magnesia industry

- Steel industry: magnesia refractories playing a key role with the move to EAF, especially in China

- Energy Transition: investment in different technology, fuels and decarbonisation

- Barriers to entry: for rest of world entrants to supply the market, such as financing and permitting of new mines

- Geopolitics: invasion of Ukraine; US Inflation Reduction Act; Critical Mineral strategies; disruption to trade routes

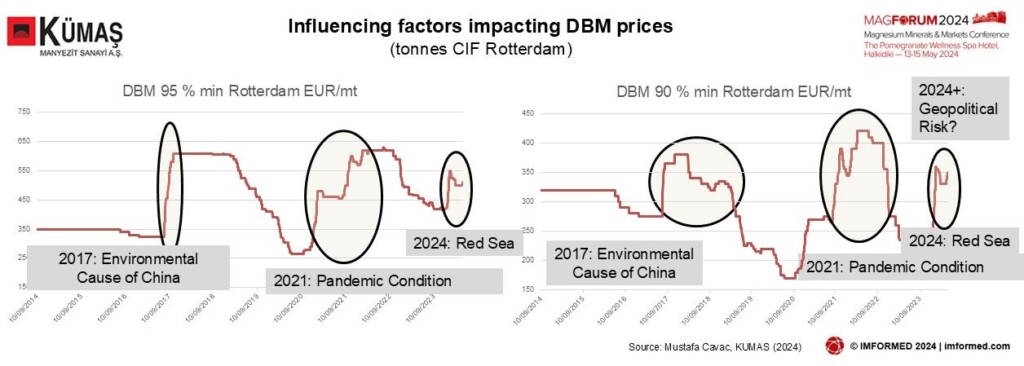

Turkey a key source of world magnesia production & the role of Kumaş in today’s challenging market

Mustafa Çavaç, Marketing & Sales Manager Raw Materials, Kumaş, Turkey

Çavaç presented on Turkey as a key source of world magnesia production and the role of Kumas, describing the company’s capacity, product range, and outlook for CCM products.

Turkey is ranked second in world magnesite ore production in 2023, after China, and Kumas hosts the largest magnesite reserves in the country (164m tonnes cryptocrystalline magnesite), with 44 licensed magnesite mines.

The impact on magnesia prices in recent years owing to the pandemic, China, conflicts and geopolitics was discussed.

Kumas’ production capacity for CCM is 110,000 tpa (63% share of total Turkish CCM capacity), for DBM is 760,000 tpa (43%), and for FM, 40,000 tpa (100%).

Future Kumas projects include sustainability, direct marketing substructure for CCM, investment in new capacity and sorting technology, and net zero carbon production.

Mg METAL, SPINEL & CALCIUM ALUMINATE

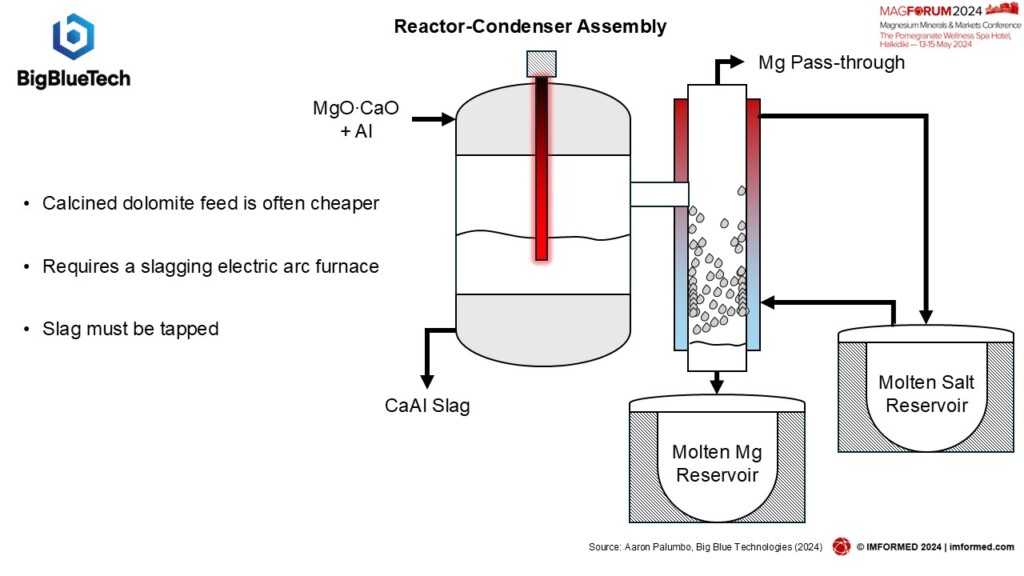

Advancing the use of MgO for the co-production of Mg metal, spinel, & calcium aluminates

Aaron Palumbo, CEO, Big Blue Technologies, USA

Big Blue Technologies (BBT) has been developing and scaling Mg production technologies for 10+ years with: University of Colorado at Boulder, Garrison Minerals, US Dept. of Energy, NSF, State of Colorado, Novelis Inc., UHV Technologies, and Ecosphere Ventures.

In identifying viable technology as the limiting factor, BBT has developed an “aluminothermic approach” using a reactor-denser assembly to produce magnesium metal and magnesium-calcium aluminate from naturally sourced (magnesite or dolomite) magnesia and aluminium scrap.

BBT’s process benefits include a continuous production method, low labour intensity, high energy efficiency mitigation of thermal stress on materials, fully electrified using the lowest energy-consuming chemistry available, and value-added co-products to offset the relatively high price of scrap aluminium.

A single full scale plant using BBT’s technology is envisaged to produce 20,000 tpa Mg metal, 40,000 tpa spinel, and 60,000 tpa calcium aluminate.

BBT has been conducting collaborative spinel product development and testing work with Refratechnik, although market demand is limited. Calcium aluminate process and product development is ongoing, and forecast market demand allows for continued scale-up.

CARBON REDUCTION

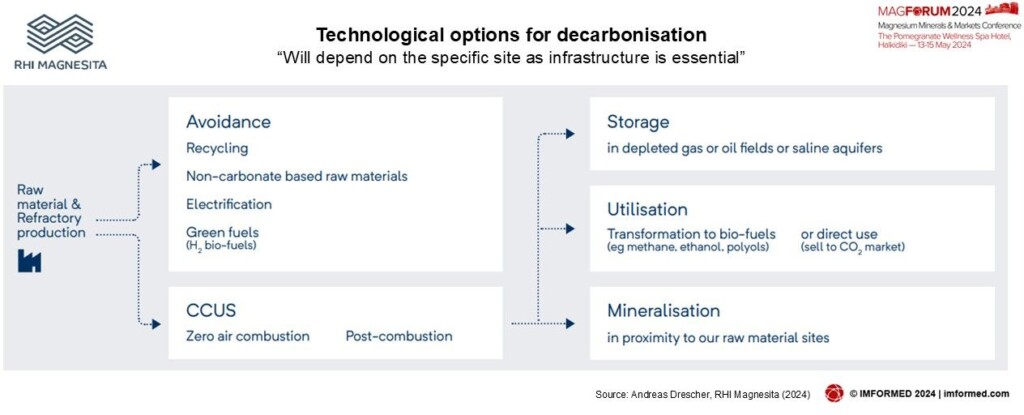

Decarbonisation developments & objectives

Andreas Drescher, VP Decarbonisation, RHI Magnesita, Austria

This presentation covered RHI Magnesita’s global carbon emissions, hydrogen as an alternative non-fossil fuel, electrification, CCUS and CCU-mineralisation, and the company’s options for decarbonisation and global frameworks.

Drescher emphasised that the applied technological options will depend on the specific site as infrastructure is essential, and also that site-specific CO2 frameworks vary greatly by region and are subject to ongoing development and changes.

He concluded: “With a few exceptions, decarbonization efforts will lead to a net cost increase as regions outside Europe lack a supporting CO2 price regime from today’s perspective. Process emissions (46% of total Scope 1 emissions) can just be tackled with CCUS and is deemed feasible in the medium term in EU and US.

We see mineralisation as a CCU option for us to decarbonise less costly and less dependent on infrastructure.”

With CCU, CO2 is captured and transformed to a new product. RHI Magnesita’s target is to install first a 50,000 tpa plant in Austria in 2028, commencing industrial testing from 2025.

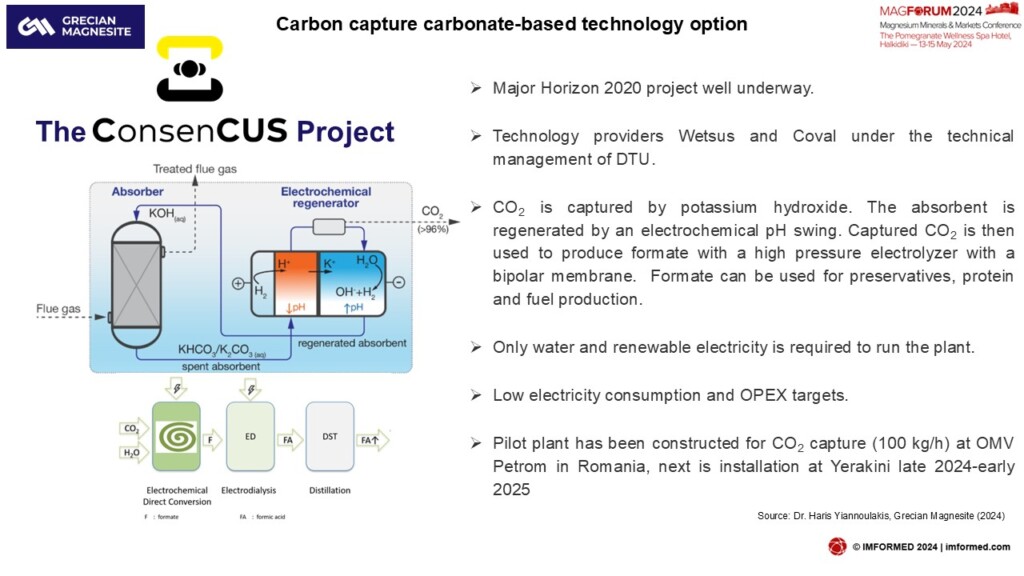

Lowering the environmental footprint of magnesia products: alternative materials & CO2 capture

Dr. Haris Yiannoulakis, R&D Manager, Grecian Magnesite, Greece

Yiannoulakis outlined why and how the magnesia sector is making efforts in reducing CO2 emissions to prepare for 2030 and beyond.

End-product carbon footprint information (Scope 1-2-3) is becoming a pre-requisite, which is adding further pressure for specific emission reductions.

Alternative fuels and materials play an important part in strategies. However, this will not be sufficient, and the sector will ultimately be faced to employ some form of carbon capture/separation.

Grecian Magnesite has made significant efforts to partially replace pet coke with sustainable biomass, which now contributes 25% on energy basis in total (near 80% for CCM production, and 15% or more for DBM, where pet-coke remains the main fuel). There are plans to further intensify biomass utilisation and introduce NG/LNG.

Dunite production is restricted to minimal processing, and increased rates in recycling DBM filter dust and old stockpiles at Yerakini contribute to lowering the company’s carbon emissions.

Grecian Magnesite has been looking into carbon capture by chemical absorption through a series of funded National and EU Research projects using amine-based and carbonate-based capture techniques (Nanocap, CoCCUS and ConsenCUS).

A pilot plant has been constructed for CO2 capture (100 kg/h) at OMV Petrom in Romania, and next up is installation at Yerakini late 2024-early 2025.

Magnesium oxide production with sustainability and CO2 reduction

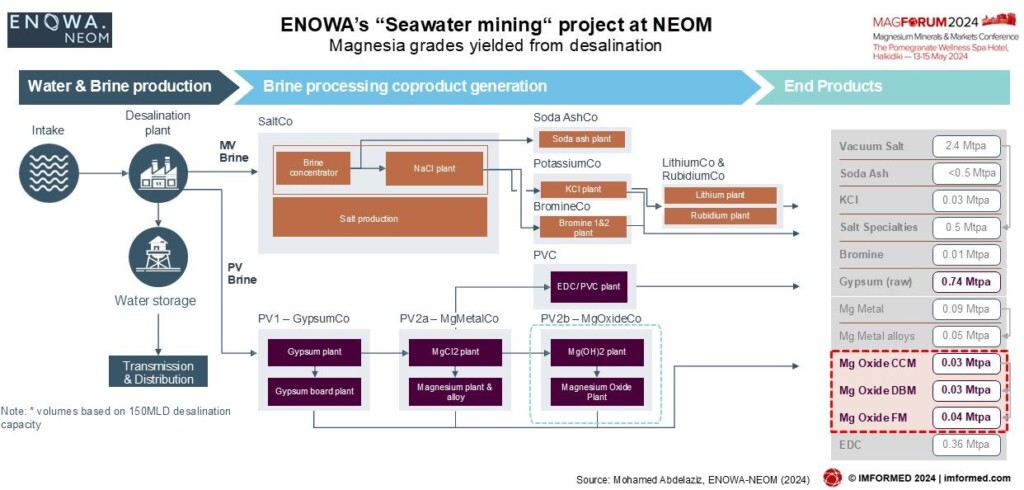

Mohamed Abdelaziz, Project Manager Water, ENOWA-NEOM, Saudi Arabia

Abdelaziz started by explaining the vision and objectives of the ambitious NEOM initiative: an international project, a new green city home to new economies and thriving businesses, and strategically located at the “crossroads of the world” in north-west Saudi Arabia.

ENOWA is the energy, water and hydrogen subsidiary of NEOM, responsible for seawater desalination, water recycling and brine processing.

Objectives of brine valorisation for sustainable and green products, and the mineral resources of seawater were explained, with estimates of mineral production from “seawater mining” by desalination – including magnesium chloride, magnesium oxide, magnesium hydroxide, and magnesium metal.

Abdelaziz outlined ENOWA’s proposal of a secure supply CCM and DBM and renewably produced FM with stable energy prices, including a “decarbonisation pathway” utilising renewable energy, CCU, green hydrogen and other alternative fuels.

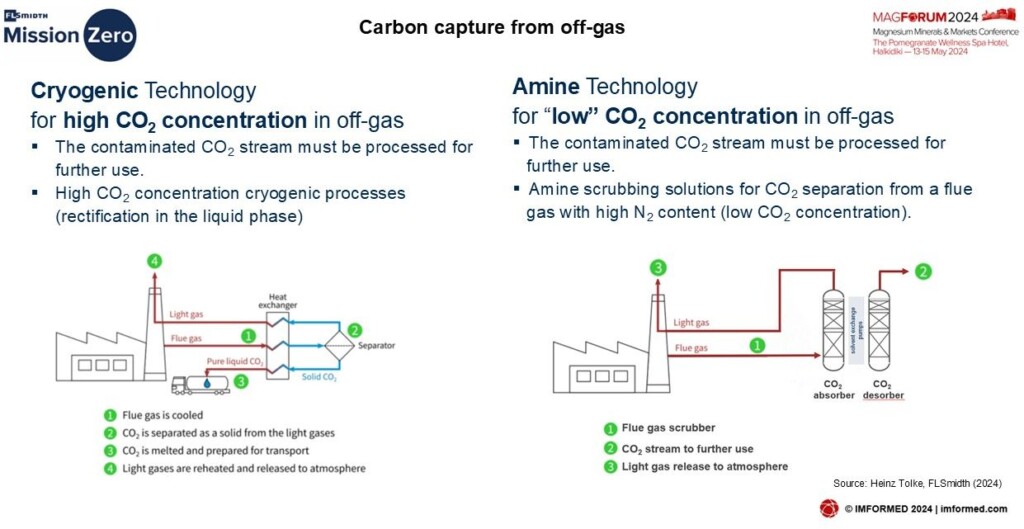

FLSmidth: Ready to support your carbon reduction targets

Heinz Tölke, Global Manager – Technical Sales Support, FLSmidth, Germany

Tölke explained FLSmidth’s role in the mining value chain, with activities particularly in mineral processing with sustainability, innovation and technical knowledge.

Methods that can be used by the cement industry to transition to green, were used to demonstrate similarities with the magnesia industry.

Plant audit methodology, and detail in conversion to alternative fuels was outlined with examples, and a discussion of carbon capture from off-gas techniques.

Decarbonisation in the magnesia industry will be a key topic at MagForum 2025, Salvador, 19-21 May

Confirmed speakers include:

The challenges of decarbonisation, carbon footprint reduction, & ESG: which strategy for the magnesia industry?

Renato Ciminelli, Technical & Commercial Director, Mercado Mineral, BrazilTransforming legacy mine tailings into high-purity MgO: a low-carbon innovation in magnesium production

Olivier Dufresne, Chief Executive Officer, Exterra Carbon Solutions, Canada

MARKETS 1: REFRACTORIES | CHEMICALS

Hybrid aluminosilicate lining of rotary kiln for production of DBM

Nikolas Mathios, Sales Manager, Mathios Refractories SA, Greece

Mathios presented a case study in collaboration with Grecian Magnesite: to increase the refractory lining service life of Rotary Kiln No.3, mainly used for DBM production, and measuring 90 x 3 metres.

The main challenges were:

- Tilting, and edging of aluminosilicate bricks in calcination zone

- High thermomechanical stresses in kiln tyre zone, which accelerate the refractory bricks failure

- Combined high thermomechanical stresses, high abrasion and thermal shock in the nose ring leads to frequent failures

The benefits were a significantly increased performance in:

- Calcination zone from 6-24 months with the previous refractory lining to >48 months with hybrid andalusite based LCC rings and andalusite bricks

- Tyre area from 6-12 months with magnesia- spinel bricks to >36 months with hybrid andalusite based LCC 6 rings

- Nose Ring from 2-6 months up to 24 months with new design, anchoring scheme and application of andalusite based LCC

View of application of hybrid refractory lining in the calcination zone of Grecian Magnesite’s No.3 DBM rotary kiln, using fired andalusite bricks and andalusite-based LCC rings, every 10 metres, resulting in a lifetime of >60 months. Courtesy Mathios Refractories

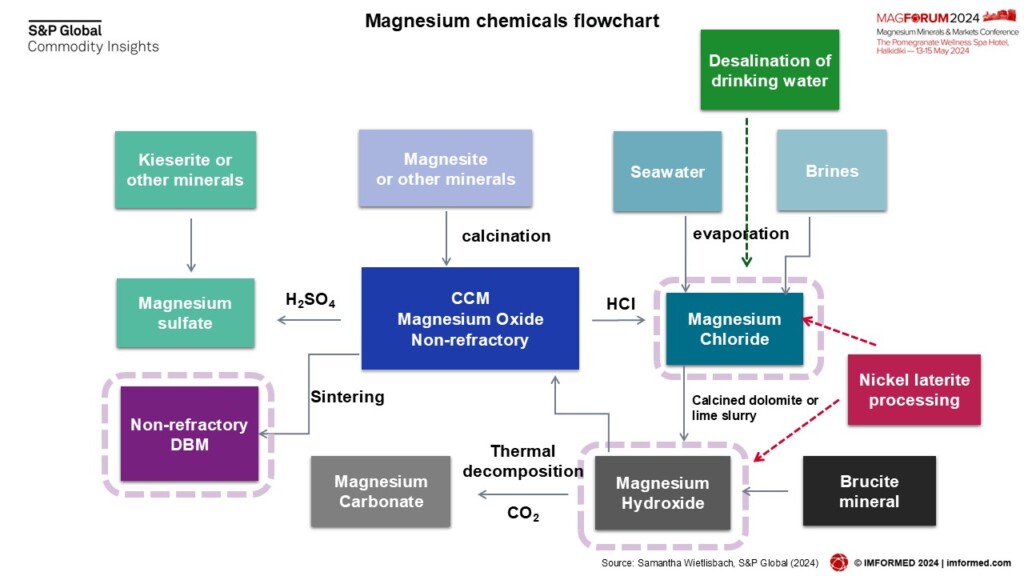

Magnesium chemicals: review & outlook of downstream supply & demand

Samantha Wietlisbach, Director Minerals Research and Analysis, S&P Global Commodity Insights, Switzerland

Wietlisbach began with an overview of the sources and supply of magnesia chemicals, reminding that 86% of magnesium chemicals are derived from magnesite and other minerals and how Western Europe MgO capacity has decreased by >200,000 tpa over the last four years.

Of interest were a couple of recent additions to synthetic sources of magnesia chemicals: processing of magnesium-rich nickel laterites and some huge projects aiming to use bitterns, at desalination plants, especially in NEOM, Saudi Arabia, and several projects in Australia and Spain.

Markets were then examined in detail, including magnesia in leather tanning, and magnesium chloride and magnesium hydroxide consuming markets.

- leather tanning chemicals forecast consumption growth is 1.4% AAGR over next 5 years

- magnesium hydroxide flame retardants growth is projected for 3% in Western Europe for 2023-28, driven by public transport, and E-mobility charging infrastructure

- magnesium chloride growth in deicing will be dependent on winter severity in Western Europe and North America, and also the trend toward low chlorine magnesia cements.

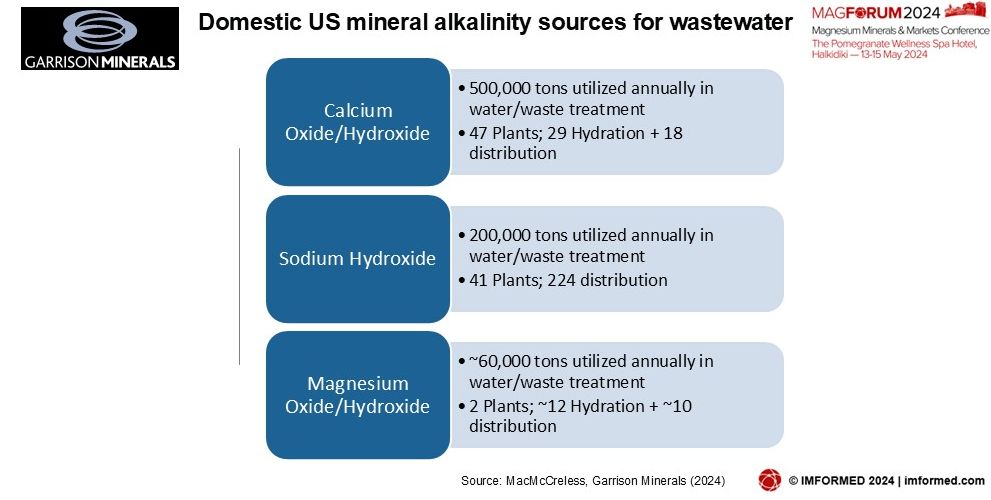

Magnesium hydroxide in wastewater treatment: an effective alternative to traditional alkalis

Mac McCreless, Managing Director, Garrison Minerals, USA

The demand for pH adjustment and alkalinity in water is set to continue to increase according to Mac McCreless: “Due to increased nutrient loading, reduced discharge limits, and geographic footprint limitations, we have observed a direct correlation between increased chemical usage in wastewater treatment processes.”

McCreless reviewed the domestic US alkalinity sources for wastewater: lime, caustic soda and magnesia/magnesium hydroxide before outlining the role of Garrison Minerals in this market sector:

- Quit shipping liquid MgOH2

- Efficient particle reduction when necessary

- Stabilised slurry

- Develop uniform testing procedures

- Formulations utilising MgOH2

- Non-thermal drying

- Improving hydration efficiency and speed

Chemicals & refractories market demand will be covered at MagForum 2025, Salvador, 19-21 May

Confirmed papers include:

Overview and outlook for the CCM and downstream chemicals market

Samantha Wietlisbach, Head of Inorganics and Minerals Research, S&P Global, SwitzerlandHigh purity seawater magnesia manufacturing, specifications & speciality markets

Willyan Doim, Product Strategy Manager, Buschle & Lepper, BrazilThe future of magnesia refractories for steelmaking: game-changing innovations to reduce MgO-C brick specific consumption

Daniele Fonseca de Lima, Marketing & Technology Director Advanced Refractory South America, Vesuvius, Brazil

MARKETS 2: AGRICULTURE | SPECIALITY | HYDROMETALLURGY

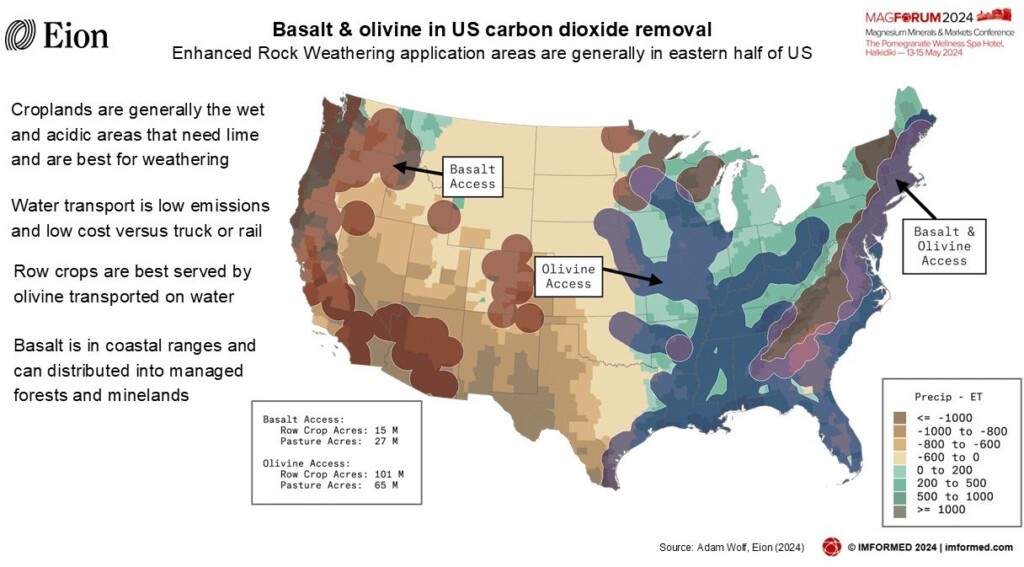

Mg-Silicates in land-based carbon dioxide removal from quote to cash

Adam Wolf, Chief Innovation Officer, Eion, USA

Wolf emphasised that the climate transition will require gigatons of annual carbon dioxide removal (CDR) to achieve net-zero and keep the Earth below 1.5°C – both carbon reduction and removal will be required.

Of the CDR solutions in the market today, Wolf considered that Enhanced Rock Weathering (ERW) has the fastest scale potential, the most co-benefits, and permanence of direct air capture at half the cost. ERW speeds up a natural process by applying safe, abundant minerals to the soil for permanent, scalable CDR.

A representative LCA (life cycle assessment) for olivine was explained, as were the logistics supply chains for basalt and olivine in the USA, before analysing the measuring and verification procedure for olivine use and its “carbon credit journey”.

The costs of using basalt and olivine were discussed, and Wolf introduced the role and activities of the Enhanced Weathering Alliance.

Speciality applications of ultra-high surface area magnesium oxide

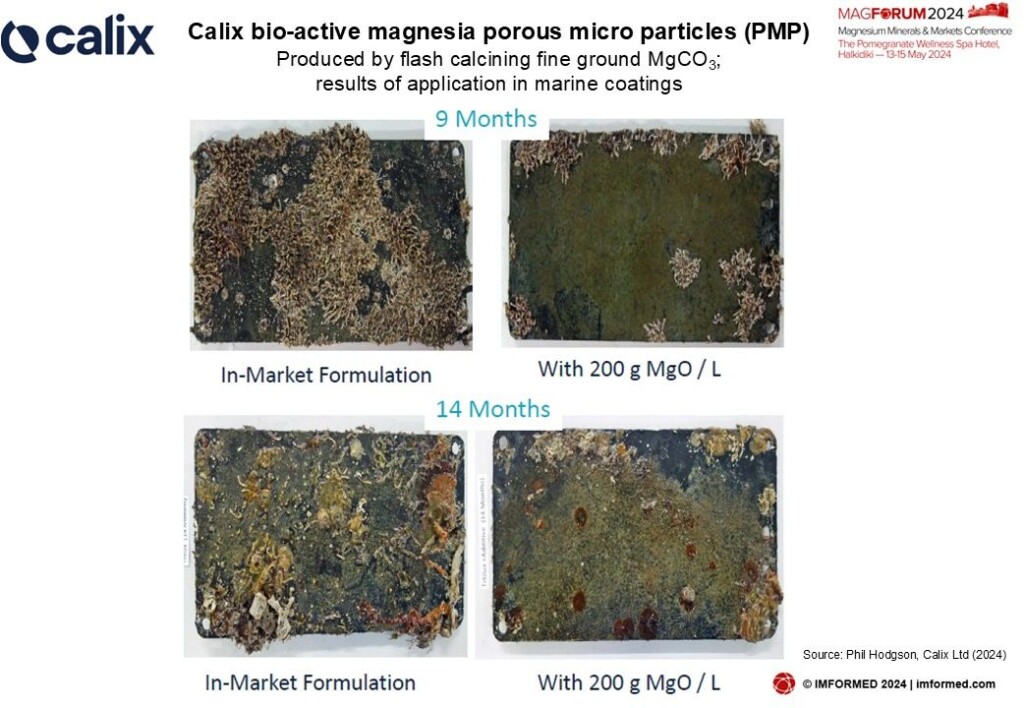

Phil Hodgson, Managing Director & CEO, Calix Ltd, Australia

Hodgson first described Calix’s core platform technology of its patented flash calcination, which is now utilised in several industries with added benefits of CO2 capture and renewably-powered, before going into more detail on specific market applications, notably:

- magnesium Hydroxide Liquid “MHL” for water biotreatment and aquaculture

- progressing the biotech business in developing novel magnesium oxide materials with high to ultra-high surface area and bio-activity for use in crop protection, marine coatings, and health applications.

Regarding the biotech sector, Hodgson considered that anti-microbial resistance (AMR) “…is a big deal, and will only get bigger.”

Bio-active MgO and derivatives look like they have high potential to solve AMR and have high potential for applications in huge markets such as agriculture, coatings, and health. Calix is already developing “Next Generation” bio-active porous micro particles (PMP).

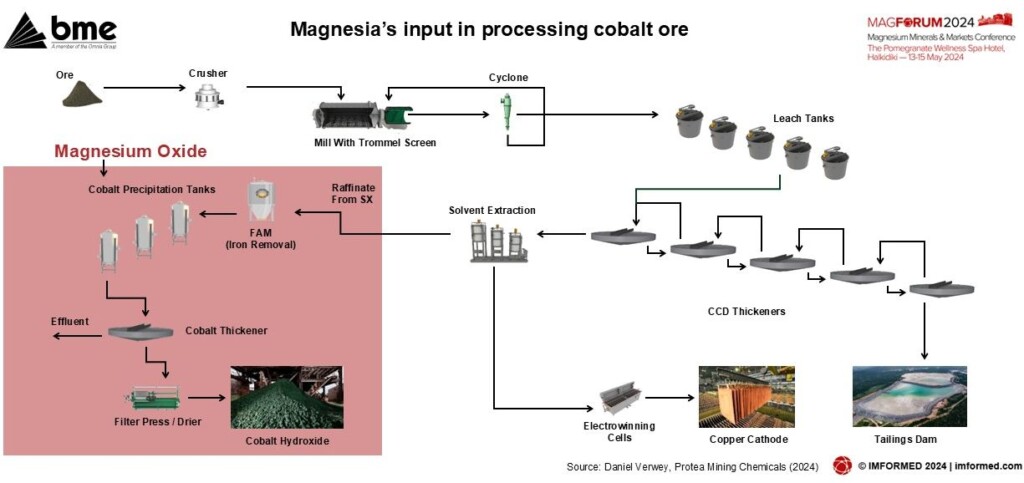

How & why CCM is used for cobalt hydroxide production in the Central African Copperbelt

Daniel Verwey, Technology Manager, Protea Mining Chemicals (now BME), South Africa

Verwey reviewed the importance of cobalt, its supply sources, and use in batteries – a key component of lithium ion batteries improving stability and energy density; as well as applications in super-alloys, catalysts, magnets, medicine, dyes and pigments, and animal nutrition.

Cobalt processing was then examined with a focus on the input of magnesia as a reagent in cobalt hydroxide processing.

A comparison was made with other reagents, showing magnesia’s benefits of lower environmental concern, easier to filter, dose and handle, and imparting up to 45% quality of cobalt.

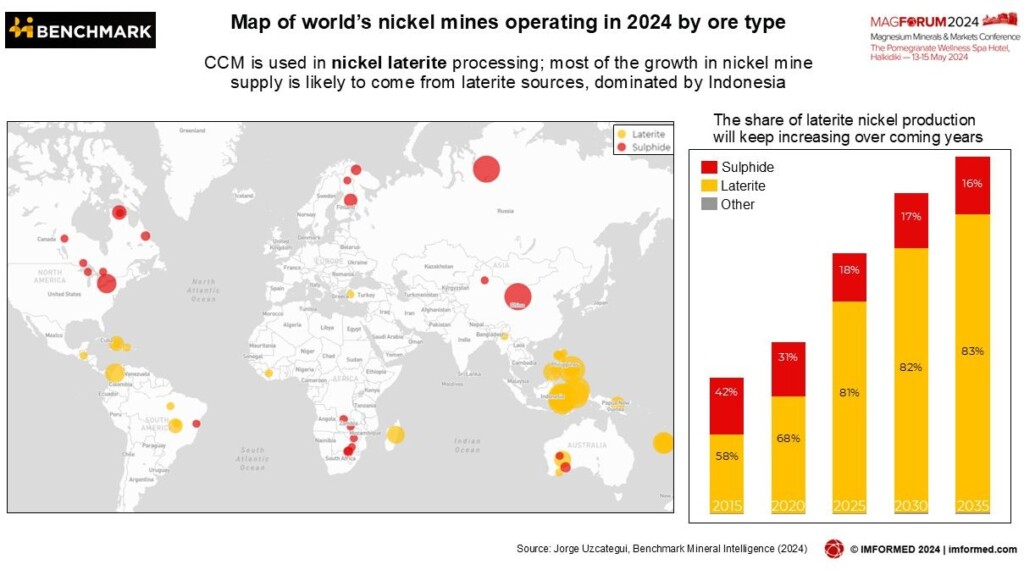

Magnesia use in hydrometallurgy: outlook for nickel and cobalt demand

Jorge Uzcategui, Senior Analyst Cobalt & Nickel, Benchmark Mineral Intelligence, UK

Magnesia is an important reagent in nickel and cobalt hydrometallurgical processing, and according to Uzcategui it will become increasingly more relevant as battery demand grows.

Caustic calcined magnesia (CCM) is a highly reactive form of magnesium oxide (MgO) used as the neutralising agent of choice to precipitate laterite-derived nickel and cobalt in the form of mixed hydroxide precipitate (MHP) from high-pressure acid-leached (HPAL) processing.

The two key drivers for MgO in Ni-Co hydrometallurgical processing are: having the correct grade and consistent volumes available (specifications of CCM); and the market outlook for Ni-Co, particularly for the products necessitating hydromet processing.

Stainless steel continues to be the main market for nickel, but Li-ion batteries will be the key growth driver as the EV market shifts towards higher use of nickel.

Most of the battery suitable supply will come from nickel laterite resources in Indonesia (and Cu-Co projects in the DRC for cobalt).

Demand for MgO in hydrometallurgy will greatly increase with the growing need to recover nickel and cobalt from MHP.

Many thanks & hope to see you at MagForum 2025 Salvador!

We are especially indebted to the support and participation of sponsors Grecian Magnesite, RHI Magnesita, exhibitors FLS, Redwave, REF Minerals, and TOMRA, supporting partners, speakers, and delegates for making MagForum 2024 such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience at MagForum 2025, Salvador, 19-21 May.

Registration, Sponsor & Exhibit enquiries: Maria Bernard T: +44 (0) 208 153 0035 maria@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Missed attending the Forum?

Free MagForum 2024 Summary Slide Deck Download here

A full PDF set of presentations available for purchase.

Please contact Maria Bernard T: +44 (0) 208 153 0035 maria@imformed.com