MagForum 2019 Review – a market in transition?

A sunny Bilbao beckoned the leading lights of the world magnesia market to gather and discuss the industry’s latest trends and developments at IMFORMED’s MagForum 2019, at the Occidental Bilbao during 13-15 May 2019.

Over 200 attendees from across the magnesia minerals supply chain enjoyed the sumptuous Welcome Reception kindly sponsored by MAGNA–Timab Magnesium, partaking in the fine food and drink of this delightful part of Spain.

A fantastic event. We had a great opportunity to find partnerships, players, and distributors worldwide. Presentations were fantastic and contemporaneous about new processes, world magnesia production and markets.

Salvelino Nunes, Technical Manager, Buschle & Lepper, BrazilCongratulations on an excellent MagForum once again enjoyed by all. The presentations covered a wide range of subjects with, for me, a unique experience of taking part in a vote from our mobiles on likely magnesia prices in a year’s time being shown on the screen. Organisation was good and a plenty of time to have discussions during the coffee and lunch breaks. Look forward to the next MagForum.

Dr Ian Wilson, Consultant, UKExcellent organisation and programme. I learned a lot and was able to make many great connections.

Jenny Warburton, General Manager, HarbisonWalker International, China

From mine to steel mill

Mike O’Driscoll, Director, IMFORMED, UK, opened with a brief introduction on the diversity of magnesia by source, grade, and markets before highlighting recent developments in China, the industry response to supply challenges, steel market outlook, and corporate movements.

“While recovering to some extent, it is still a mixed bag, some uncertainty remains over future Chinese supply and there is continuing interest in developing alternative sources outside China. Trends in the refractories industry to evaluate use of new and alternative materials and product formulations will continue as will increased refractory recycling and use of recycled material.” concluded O’Driscoll.

O’Driscoll also suggested that sluggish steel market growth in the West may increase magnesia diversification into speciality markets, pushing alternative processing and calcining technologies, while better steel prospects in Asia will lure refractory player investment and supply opportunities.

All the latest trends & developments in India’s refractories industry covered at

Indian Minerals & Markets Forum 2019, 18-20 November, Mumbai

Speakers include:

Refractory raw materials supply & demand in India

Hakimuddin Ali, Chairman Imerys India & Director Business Development & Strategy, Africa and Middle East, India

Overview of supply and demand of India’s refractories

Sameer Nagpal, CEO-Refractories, Dalmia OCL Ltd, India

Influencing factors impacting India’s refractories market

Anirbandip Dasgupta, Senior Executive Officer, Indian Refractory Makers Association, India

Refractory recycling market and products in India

Vatsal Dhandharia, Proprietor, Global Recycling, IndiaOther speakers & full details here

The worldwide push to green the economy and industry should drive innovation in magnesia and refractory processing technology to conserve energy and perhaps change its energy source mix in using more electric power.

Guillaume Bonnet, Commercial Director, Magnesitas Navarras (Magna), Spain, presented “Magna: From the mine to the steel mill” reviewing Magna’s history and development of magnesite deposits to date, now wholly-owned by Groupe Roullier, and planning to celebrate its 75th Anniversary in 2020.

Bonnet explained how research and innovation are at the heart of Magna´s strategy as it focuses on sustainability the efficient use of energy and natural resources.

In 2018, Magna sold a total of 280,000 tonnes of all products, of which refractories were almost 80%. Magna’s Spanish operations, including feed from its new Borobia mine, produced 200,000 tonnes of dead burned magnesia (DBM) in 2018, and 240,000 tonnes of mixes.

In Brazil, Magnesium do Brasil (50% owned by Groupe Roullier), produced 50,000 tonnes of caustic calcined magnesia (CCM) in 2018. However, with a new 30,000 tpa capacity Polysius vertical shaft kiln and new 36,000 tpa capacity mixing plant, refractory sales in 2019 are estimated at 36,000 tonnes.

Answering questions about supply, Bonnet said: “Customers for the non-refractory magnesia market would like more EU suppliers.”

Uptick in magnesite ore trade – a new supply scenario emerging?

In her excellent “Global supply of magnesia in 2019: A new landscape for the next decade?” Alison Saxby, Director, Roskill Holdings, UK, reviewed the types of magnesia and sources, shifting trade patterns, and supply trends for CCM, DBM, high grade DBM, fused magnesia (FM), China, with thoughts on the future supply situation.

Of interest were Saxby’s comments on the increasing trade in magnesite ore: “Still small scale in overall magnesite supply, but some in reaction to shortages in Chinese magnesia supply.”

In particular, attention was drawn to Pakistan exports which have increased from 6,000t in 2014 to 80,000t in 2018, mainly to India but also to Greece and China in 2018, and are forecast in total to reach 95,000t in 2019.

In particular, attention was drawn to Pakistan exports which have increased from 6,000t in 2014 to 80,000t in 2018, mainly to India but also to Greece and China in 2018, and are forecast in total to reach 95,000t in 2019.

With regard to China, Saxby thought that Chinese supply may “normalise” by 2020, and said: “CCM and DBM sources are coming back on line in China, inspections will still take place and supply disruptions will occur, and maybe more are planned in the future.”

In conclusion, Saxby said: “China will remain the most significant magnesia supplier, and its domestic market will continue to grow, albeit at lower rates. There will be opportunities for ROW producers, especially HGDBM producers and potential growth of magnesite direct ore shipment.”

Magnesia consumption in steel & lime production

“Can we survive without magnesite?” by Jose Cruz Zirion, Procurement & Logistics Director, Sidenor, Spain, was a superb analysis of the Spanish steelmaker’s application of magnesia refractories in its processes.

Sidenor, which produces specialist steels and is the market leader in Europe, has a total meltshop capacity of just over 1m tpa steel from two Spanish plants, the main one at Basauri (EAF, continuous casting), and the other at Reinosa (EAF, ingot casting).

The company consumed just over 11,000t of refractories in 2018, of which 84% were magnesia-based.

“Ladle refractories consists of MgO-C bricks at the hot face (wear lining) and high alumina or burned magnesia bricks behind (permanent lining).” said Zirion.

Zirion acknowledged the industry’s use of alternatives to magnesia: some steelmakers use alumina based materials or dolomite in the wear lining of the ladle. But said: “For high quality applications, alternative products imply changes in parameters of the steel production process and, possibly, will affect the performance of the material. So, for special steel manufacturing, the current magnesia-based refractories are really a good choice in terms of general performance.”

“Refractories in lime production” by Wes Gabler, Global Category Manager, Procurement, Lhoist, USA, reminded the audience with a useful video clip of Lhoist’s activities in mining and calcining huge volumes of carbonate rocks in the Europe and the USA, before outlining the group’s refractories used in some 150 kilns.

Gabler examined the range of main kiln types used by Lhoist with a special focus on refractory use by the preheater rotary kiln (PRK) and parallel flow regenerative kiln (PFRK).

Both kilns require refractories of DBM purity of min. 95% MgO, the PRK requiring 100-150t in the burning zone and the PFRK requiring 350-400t in the preheater and burning zones.

Gabler highlighted the impact of issues such as high raw material prices owing to the Chinese situation, limited availability outside China, high delivery times, increased global demand across all industry, supplier consolidation, reduced competition in refractory producers, and environment concerns.

“Lhoist supports China’s attempts to make their supply chain sustainable.” said Gabler.

Gabler saw industry opportunities in quantifying magnesia properties against substitute materials; improving sorting and disposal of spent refractories for recycling; increasing supply sustainability and value through existing and new supplier development; and ensuring prolonged lifetime of refractories.

“The refractories industry needs to reposition itself” said Gustavo Franco, Chief Sales Officer, RHI Magnesita, Austria during the MagForum 2019 Keynote Panel Session, which also included Dr Michael Frei, Managing Director, Refratechnik Holding GmbH, Germany, Alison Saxby, Director Operations, Roskill Information Services Ltd, UK, Michael Tsoukatos, Development Director, Grecian Magnesite SA, Greece, moderated by Mike O’Driscoll, Director, IMFORMED, UK

How do we see the magnesia “society”?

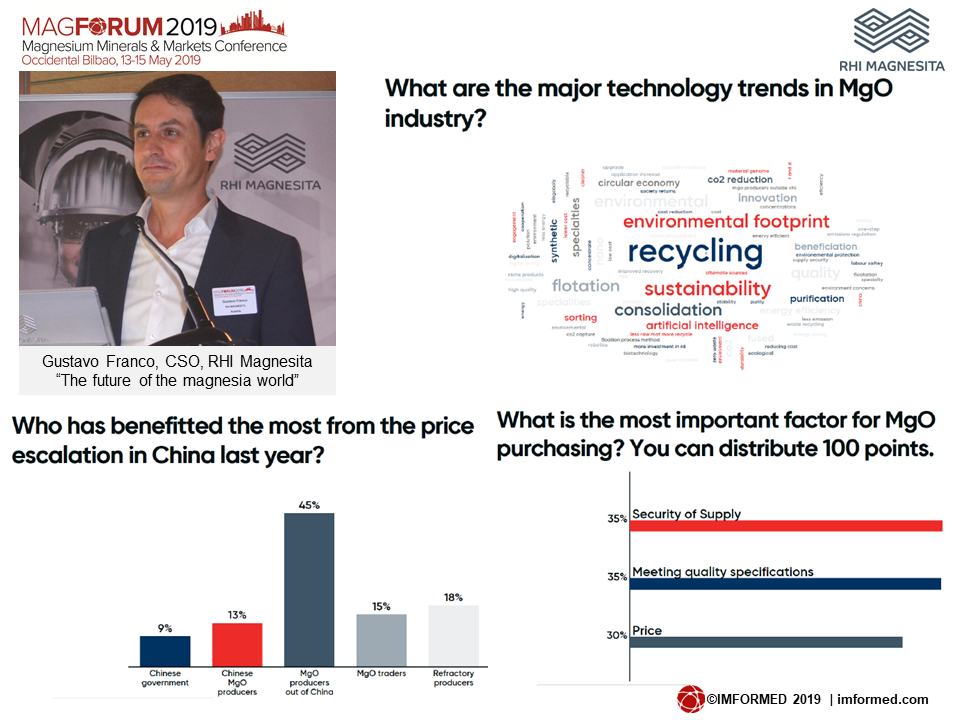

“The future of the magnesia world” by Gustavo Franco, Chief Sales Officer, RHI Magnesita, Austria, reviewed the latest developments at RHI Magnesita, including the “ongoing” negotiations on the proposed acquisition of Kumas, before taking a somewhat philosophical but entertaining view on the future of the magnesia industry.

Franco looked at the world as an interaction of society and available resources, with demography, economy and technology as influencing factors. He then focused on the magnesia “society” from three different angles: market, financials, and technology.

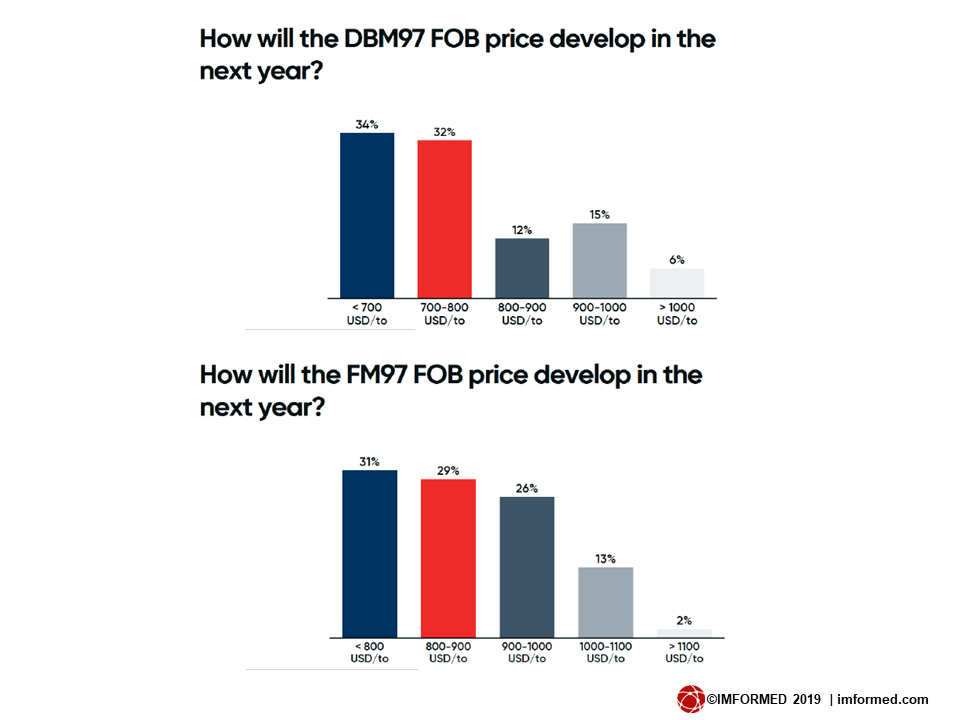

Franco then smartly turned the spotlight on the audience and their take on the magnesia society by asking a series of topical questions to which delegates could respond via their mobile phones on an audience interaction app.

The results were both informative and entertaining – see charts.

“Recycling”, “sustainability”, and “environmental footprint” dominated the audience-generated word-cloud, while magnesia producers outside China were the clear beneficiaries of escalating prices in China.

Security of supply and meeting specifications just edged over pricing as the main concerns for purchasers, as future DBM prices were largely estimated to be US$<700-800/t and for FM US800-1,000/t.

The market outlook, Franco urged, should perhaps be about the future interaction between the magnesia society and the available magnesia resources.

Franco identified several factors shaping the future:

• Application of 4.0 tools to resource mapping and product specifications

• Special application prices will rise

• Stability of supply and long predictability will succeed

• Quality requirements will increase

• Environment-friendly becoming a must

• Major investments to ensure availability to high purity magnesia

Sumptuous Sundowner: The Day 1 Evening reception was held at the Bilbao Sailing Club, and sponsored by RHI Magnesita.

Keys to success

“Fundamentals of the magnesite business: key factors for success” by Nicolás Gangutia, Managing Director, Ganmag, Spain, was a very comprehensive dissection of the three pillars of the industry summarised as “knowing the market, listening to the stones, and feeling the process”.

Armed with these fundamentals one can then understand the costs in the magnesite business and navigate through regulations and compliance.

Gangutia underlined: “And the big mistake? Due to a high prices trend – 6 years in the last 30 years – is to go to compete against Chinese qualities and prices without market knowledge and no R&D.”

Another key element was his call to “Listen to the stones”: “The differing behaviour of magnesite host rock and impurities is more important than the quality of the magnesite.” said Gangutia.

Raw material and energy costs were analysed in-depth: “A good energy cost for DBM one step is >€40/t MgO; a bad energy cost for DBM one step is >€55/t MgO.” said Gangutia.

Every country or region has its own environmental legislation regarding pollutant and CO2 restriction. Gangutia reminded that the key question is how to adapt the production to overcome these difficulties at the lowest cost.

New synthetic sources: Australia | Jordan

“The EcoMag synthetic magnesia products” by Dr Tam Tran, Chief Technology Officer, EcoMag Ltd, Australia, outlined the status and objectives of EcoMag’s 80,000 tpa Hydrated Magnesium Carbonate project at Karratha, Western Australia.

The project has access to Australia’s largest solar salt bitterns stream (from Dampier Salt) and proprietary technology and is looking to produce a unique range of speciality magnesium products: high purity ~99.5% (MgO at 99%); hydrated magnesium carbonate (HMC); caustic calcined and hard burned magnesia (CCM/HBM); magnesium hydroxide (MDH); hydrotalcite (HDT); and magnesium citrate, lactate, and other organic esters.

Primary regulatory approval has been received and a bankable feasibility study is complete, with commercialisation as the next stage. 2019 will see detailed engineering and financing feasibility studies, geotechnical study, construction design finalisation, final regulatory approvals, and debt and equity raising. Plant operation is expected in 2020.

Tran said: “In time, EcoMag expects to be involved in developing materials for pollution control, air filtration, waste water processing, carbon capture, hydrogen storage, next generation batteries, lightweight building materials, and active coatings.”

From Australian salt bitterns to the Dead Sea in Jordan. “Development and outlook for Manaseer magnesia – ManMag” by Ahmad M. Samara, Sales Manager, Manaseer Magnesia, Jordan, revealed the rejuvenation of Jordan’s magnesia source.

Using Dead Sea brines and local limestone, ManMag has a production capacity of 60,000 tpa magnesia products. The plant will be switching to natural gas by the end of 2019.

CCM is in production now, and commissioning of high grade, 98% MgO DBM production is expected in June 2019, with commercial production end-2019/early 2020.

Established natural sources: Spain – potential | China – continued uncertainty

“Spain’s magnesite resources, production and markets” by Manuel Regueiro, Chief of External Affairs & Communication, Geological Survey of Spain, provided a reminder of the country’s importance in Europe’s magnesia supply market.

Regueiro looked at the geology and mining, production and consumption, uses, reserves and resources, and future trends for Spanish magnesite.

Spain has immense magnesite resources of almost 600m. tonnes. “Environmental concerns in China will continue to affect production and prices. This might be an opportunity to enlarge the European magnesite market, in which Spain could be a leader.” postulated Regueiro.

“Chinese magnesia supply and price trends” by Vincent Wong, Business Manager, Refractories Window, China, was much anticipated by the audience and Wong did not disappoint. A well structured overview of Chinese magnesia supply and price trends provided an excellent picture of the current situation.

Wong considered that there is still production overcapacity in China; a “temporary capacity recovery” lifted the overall supply volume in Q1 2019 while the dynamite ban has not been as bad as 2018.

Producers are retaining enough stocks currently, leading to a lowering of prices; while high quality magnesite supply still faces shortages and high purity magnesia price remain high.

Wong reiterated China’s new pledge for two central government environmental inspection periods (April-May, Oct-Nov) every year for four years, and along with local government inspections, this is likely to disrupt future supply with increasing costs and supply shortages.

“Inspections will last into the long term, the key point is how the regulations are implemented.” said Wong.

Indeed, and combined with the now regular annual winter industry shutdown Nov-Mar, China’s magnesia industry looks set to face three regular hits each year.

The Liaoning industry’s consolidation with integration to the single entity Liaoning Magnesite Co. Ltd (Liaoning Lingmei) is continuing, and Wong said: “If companies do not join

On production developments, more than 3m. tpa of new flotation capacity has been commissioned with a further 7m. tonnes in construction. Other new capacities include PRCO’s new mine in Tibet (1m tpa magnesite); Jiachen’s capacity expansion in Liaoning (1m. tpa high purity DBM); and West Magnesium (salt lake magnesia for high purity FM/DBM).

Wong forecast that the supply situation might meet “huge uncertainties in certain periods”, with prices declining or weak in the coming two months against oversupply market status, but with the possibility to increase again later in 2019.

Chemicals market

“Overview of magnesium chemicals market” by Samantha Wietlisbach, Principal Analyst Chemicals, IHS Markit, Switzerland, reviewed the chemical markets for magnesia, magnesium chloride, magnesium sulphate, and magnesium hydroxide.

The CCM market, for non-refractory applications was estimated at >4.3m tonnes in 2018, with construction the largest sector (39%), followed by agriculture (26%), chemicals (14%), environmental (11%), and others (10%).

Total consumption of magnesium chloride was estimated at 1.7m. tonnes in 2018, of which 36% was in construction, mostly Sorel cement.

The majority of magnesium sulphate (74%) is used in agriculture, global production capacity is about 0.9m tonnes MgO equivalent.

Japan is the world’s largest producer of magnesium hydroxide, accounting for 36% world capacity. Global demand is estimated at about 1m. tpa with environmental applications consuming 66%, and flame retardants 10%.

Processing: New flash calcination | Sorting

“The Calix Process: update on applications for very high surface area MgO & direct separation of process CO2 emissions” was an enlightening duet by Dr Phil Hodgson, Managing Director & CEO, & Dr Mark Sceats, Executive Director & Chief Scientist, Calix Ltd, Australia.

Calix’s vertically integrated magnesia business was explained, with its South Australia magnesite mine of 466,000 tonnes proven and probable reserves, and 25 tpa CFC calcination and CO2 separation plant at Bacchus Marsh, Victoria.

The produced material is then shipped to customers’ satellite hydration plants: Calix has three so far, in Victoria, Queensland, and the Philippines.

The company has patented the Calix “Direct Separation” Flash Calciner: a reinvention of the kiln to create nano-active materials at scale, more safely and affordably than incumbent nanotech processes.

The CFC technology heats finely ground minerals (1 to 100 microns) and can control a fast calcination process to create a highly porous product, with nano-scale “honeycomb” structures.

The use of “indirect” radiant heating through the red-hot walls of the reactor tube stops furnace gases contaminating the products, and allows for the efficient, direct capture of CO2 from the processing of carbonate minerals such as limestone or magnesite.

High value applications include as an anti-bacterial agent, in biogas control, water conditioning in aquaculture, and in crop protection. Apart from CO2 capture, Sceats believes there are opportunities for innovation in refractories and ceramics.

“Given grain size, stress and low young’s modulus, we believe there could be a route for flash sintering without coarsening for very high strength products – using low temperature processing, and sintering in minutes. It may bypass the DBM route for magnesia. The magnesia industry needs a way to remove CO2 from the process.” said Sceats.

In “High capacity sorting of magnesite”, Jens-Michael Bergmann, Area Sales Manager Europe, MENA, India, TOMRA Sorting GmbH, Germany, introduced the sensor approach in mineral/ore processing and the different types of sensor methods.

Benefits for sensor sorting magnesite included: profit from preconcentration and early elimination of waste; de-coupling of pre-concentrating and main treatment plant which allows the main plant to be fed at its optimum feed rate and a consistent grade which is increasing performance; increased production rates; reduction of transport costs; turn the grade of sub-economic deposit into an economic one, and increase mine life.

Bergman concluded: “DMS [Dense Media Separation] is not suitable for the removal of dolomite or calcite. Sensor sorting can help to remove various contaminants and the sorter flexibility allows focus on either high product purity or on high recovery.”

Thank you, and see you at MagForum 2020!

As ever we are indebted to the support and participation of all of our sponsors, exhibitors, speakers, and delegates for making MagForum 2019 such a success.

We very much appreciate all the completed feedback forms and please continue to provide us with your thoughts and suggestions.

We shall keep you abreast with developments for MagForum 2020.

Meantime, we look forward to meeting you again soon, perhaps at one of our upcoming conferences:

Oilfield Minerals & Markets Forum 2019, Houston, 10-12 June 2019

Fluorine Forum 2019, Prague, 21-23 October 2019

Indian Minerals & Markets Forum 2019, Mumbai, 18-20 November 2019

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com