Review of IMFORMED Rendezvous, 8-9 April 2019, Paris

You can’t beat Paris in the Springtime, and you would be hard pushed to beat a more enthusiastic and knowledgeable crowd discussing the future and fundamentals of the industrial minerals business in Paris last month.

The inaugural IMFORMED Rendezvous held at Les Jardins du Marais, 8-10 April, brought together attendees from across the global supply chain of industrial minerals, buzzing with anticipation to gain informed insights as to the future of the industry.

They were not disappointed. A superb two-day programme had leading experts present, postulate, and project on a wide range of key aspects of the industry integral to understanding the market, what drives it, and what the future may hold.

The quirky, oasis-like character of the Les Jardins du Marais, hidden in one of Paris’s well-known Bohemian quarters crammed with restaurants and bars, added to the event’s uniqueness and hosted the convivial evening Welcome Reception.

The following evening reception was hosted by lead sponsor Imerys at the beautiful Éléphant Paname, Paris’s Centre of Art and Dance, and with its exquisite cuisine and fine wine, was most memorable and gave delegates a chance to see a little more of city.

Theme was excellent and well constructed. Very informative and engaging. Presentations were excellent, extremely topical and thought provoking.

Mick, Commercial Director, LKAB Minerals, UKThere is high demand for a forum such as this for both established participants and for newcomers to the industry covering both new and established minerals and markets.

Richard Flook, Mosman Resources, AustraliaExcellent programme for a new person in the procurement process of a consuming company. The Briefings on Basics flowed very well, excellent overviews of each step in the process.

Glenn McIntyre, Managed Fire Shape Technology, HarbisonWalker International, USAThis conference was highly informative as well as important for networking with adjacent industry peers. We got some commercial leads, but more importantly we got some important market intelligence beyond our local markets.

Aditya Newalkar, Executive Director, Maharashtra Minerals Corp. Ltd, IndiaFor more pictures, programme, attendees, and feedback click here

“Plus ça change, plus c’est la même chose”

Introducing the first IMFORMED Rendezvous with “Industrial minerals: what’s it all about?”, Mike O’Driscoll, Director, IMFORMED, referenced one of the great literary Parisians, Jean-Baptiste Alphonse Karr (1808-1890) and his famous epigram Plus ça change, plus c’est la même chose – “The more things change, the more they stay the same”.

A most fitting statement, and very much the central theme of the Rendezvous – the future and fundamentals of the industrial minerals business.

O’Driscoll touched on strengthening trends in strategic minerals, Chinese mineral supply overreliance, recycling, processing, and logistics innovations, as well as the changing corporate landscape, new resources, and anticipating the next growth trend through market knowledge.

Innovations in the extreme

Leading off the Keynote opening session was Chris Parr, S&T Director Refractories, Abrasives & Construction, Imerys, France, with “Innovations in materials for extreme environments”.

“The world of specialties is transforming processed minerals to materials that contribute essential properties and performance to a wide variety of applications” said Parr.

Parr outlined the key aspects of the supply chain from mine to mineral to material, before highlighting innovations in materials and applicative science and giving examples of how to generate value in extreme environments, such as thermal resistance in space shuttle launch pads, corrosion resistance in municipal sewers, abrasive resistance in wheel grinding, and 3D printing of ceramics.

He concluded that innovations in materials and applicative science requires a closer cooperation throughout the value chain than has been seen in the past.

“Different levers can be actioned throughout the chain of mine to material to deliver properties for new applications or improved performance in existing applications. Innovation doesn’t imply a large technology leap to be successful.” concluded Parr.

Smart solutions and no going back

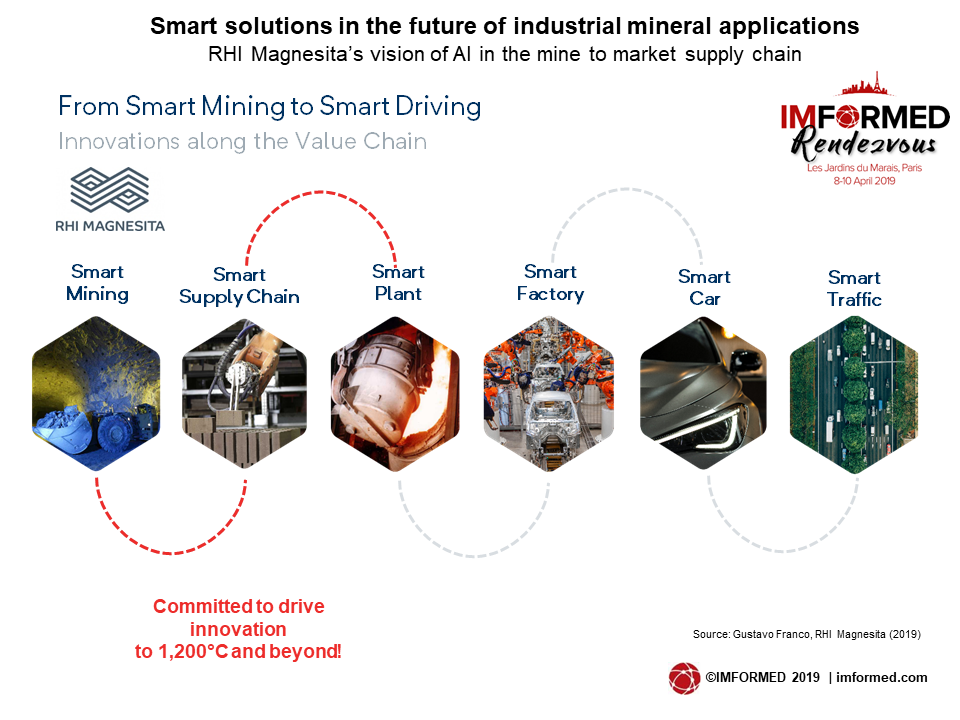

From a major world supplier of minerals, to one of the leading consumers, Gustavo Franco, Chief Sales Officer, RHI Magnesita, Austria presented “Taking innovation to 1,200°C and beyond” .

He briefly reviewed the “success or failure” of the RHI Magnesita story, indicating that the group was “almost there”, and with vertical integration of raw material supply expanding and now covering around 70% and 50% of the group’s basic and overall raw material needs, respectively.

Franco continued the theme of applications for extreme environments by illustrating the part refractories play in manufacturing the range of metals and plastics used in automobiles.

He commented on the emergence of smart technology for homes and cars, and postulated how such smart technology would, and should, contribute to innovations along the value chain from “smart mining” through to “smart cars” and “smart traffic”.

Examples illustrated included: in the supply chain, artificial intelligence (AI)-supported algorithms continuously improving a demand and production plan; in the steel plant, more automated process optimisation such as tracking steel ladle wear in real time, AI analysing data and triggering automated orders; and in mining raw material, with real data and estimated data feeding an algorithm after each blast, generating a digital twin mine (3D mapping) and a self-optimised mining plan.

Franco reminded delegates that RHI Magnesita was committed to drive such innovation and forecast that the company would be manufacturing refractory bricks containing sensors within the next one to two years.

Franco also touched on pollution in China and climate control, and ways in which we can help reduce the carbon footprint.

He concluded with a call for the industry to face a new reality of no going back for three key factors: “The world is continuously changing due to modern technology and focus on resources and environment. This will not revert! Raw Materials are perceived more precious than they used to be a few years ago. This will not revert! The real added value of raw materials to the refractory industry are: quality, stability & availability! This will not revert!” said Franco.

Gustavo Franco, Chief Sales Officer, RHI Magnesita will be presenting “The Future of the Magnesia World” and part of our Keynote Discussion Panel at MagForum 2019, 13-15 May 2019, Bilbao – details here

Trends, challenges, & competitiveness

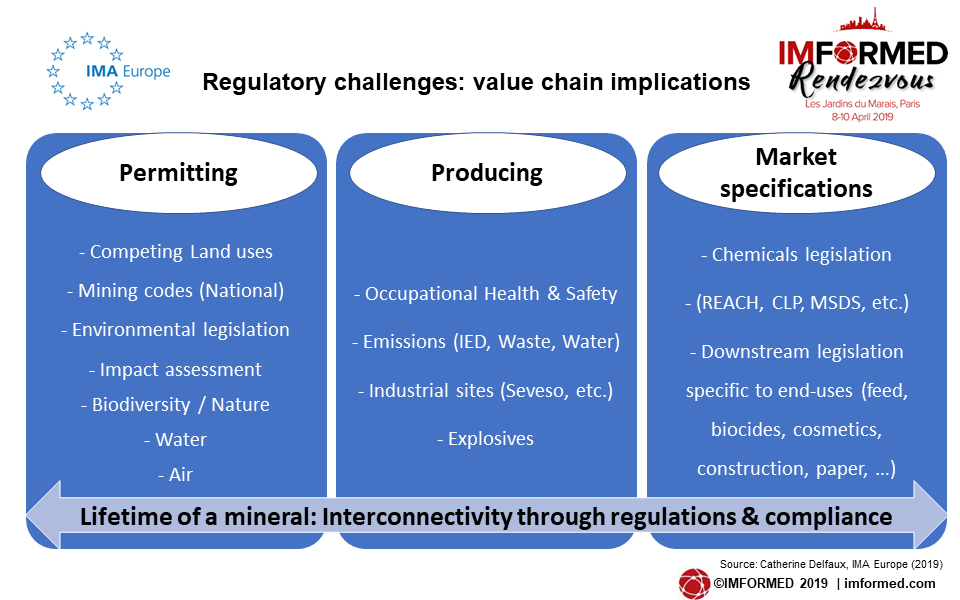

In “Trends, Challenges & Competitiveness for the Minerals Sector”, Catherine Delfaux, President, IMA-Europe & CEO, Provençale SA, France set out to reveal the leading societal trends, regulatory developments & challenges , and competitiveness facing the industry.

Delfaux highlighted key societal trends stemming from the Paris agreement, population and city growth patterns, performant and connected buildings, and sustainable development goals.

Regulatory concerns for the industry arose from the complexity of multiple regulations, complexity along the value chain, circularity for industrial minerals, and criticality for industrial minerals.

And the key issues in industry competitiveness were a CO2 carbon neutral industry, energy, availability/accessibility of minerals, innovation and new market developments, and digitalisation.

Delfaux concluded that there are multiple mineral sector challenges with consequences along the value chain and that cooperation along the value chain is a must and that innovating is key to sustain the minerals business.

On transition to a carbon neutral economy , Delfaux made clear that minerals are needed for the energy transition and infrastructure grid, minerals are innovating process mineral efficiency and contribute to the circular economy and CO2 emission improvements .

“While the minerals sector is pro-active and responding to societal challenges, more actions and communication is required to targeted audiences.” said Delfaux.

Financing industrial minerals

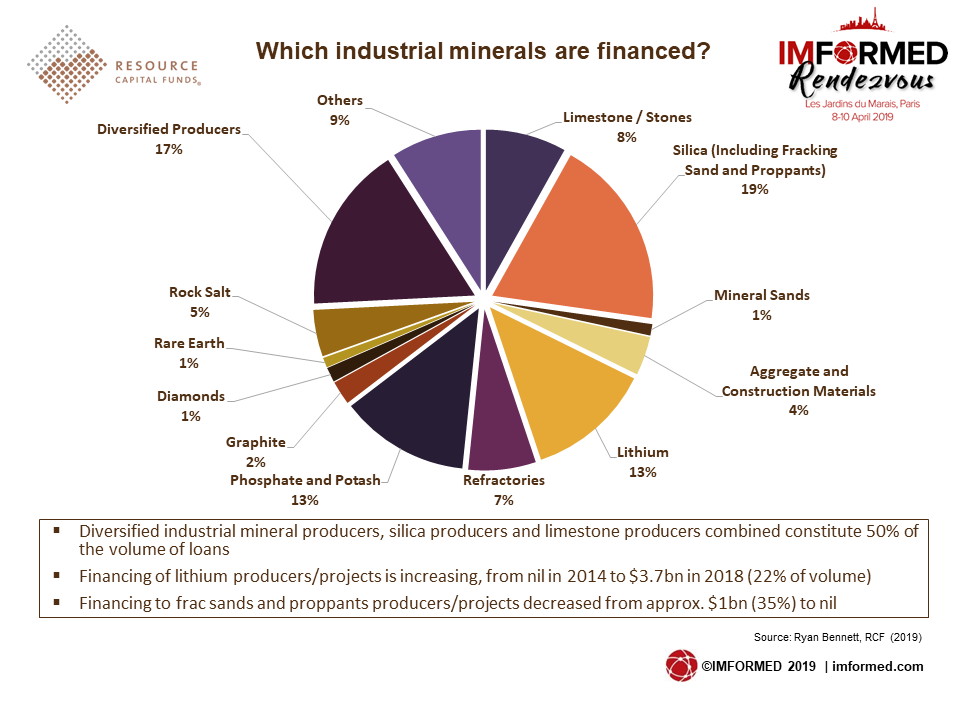

“The investment and financing climate in industrial minerals: challenges & opportunities – a private equity perspective” by Ryan Bennett, Partner, Senior Advisor, Resource Capital Funds, USA, presented a clear and refreshing look at industrial mineral risks, financing, and exit strategies, with some great examples, concluding with Bennett’s the good, the bad, and the ugly.

Bennett went through a typical financier’s due diligent checklist, from geology, exploration, and mineral resources to country and political factors, and reminded of the lack of transparency of industrial mineral pricing and the importance of markets and logistics.

It may take 15-18 months for financing a project and the industrial minerals space is not an easy market to enter. “But does it need to continue this way?” contested Bennett. Certainly, the industry could do a better job to educate investors.

Ryan outlined several factors on why PE is good for industrial minerals, including most fund lives are 10+ years, they afford long hold periods and stability with committed funds, creative investment structures, sophisticated investors, experience in industry – input into strategy, and leads to development of assets.

“Industrial minerals represent 10-12% of the total volume of loans to the mining industry. There is opportunity for private equity on a selective basis. However, recent industrial minerals M&A activity has been largely confined to lithium and phosphate.” said Bennett.

Minerals leading the next production revolution

Dr Richard Flook, Managing Director, Mosman Resources Ltd, Australia, presented a very comprehensive take on minerals for the future in “Critical, strategic and industrial – the minerals leading the next production revolution”.

Flook insisted there were just two main take-away messages: “The only constant is change” and “We will continue to be living in a material world”, before examining mega trends, materials engineering, energy, China, other trends, and the industrial minerals industry.

engineering, energy, China, other trends, and the industrial minerals industry.

Impacting the future of mineral markets is a new era of emerging technologies including driverless vehicles, artificial intelligence (AI), photonics, 3D printing and contour crafting.

Flook highlighted graphene and other new materials, the emergence of new energy from solar and batteries, and opportunities afforded by changes in China.

The profitability of industrial minerals, market development and innovation, understanding global supply chains, and specifications and performance were also discussed.

“The centre of economic gravity is shifting east and south. We should be preparing for the Indian and then African century.” said Flook

India’s key industrial minerals, markets, their drivers and outlook will be discussed at Indian Minerals & Markets Forum 2019, 18-20 November 2019, Mumbai – details here

Back to basics

The afternoon of the first day offered delegates the option of participating in concurrent roundtable discussions themed on China, Finance, and Recycling (see above) and/or a session of presentations devoted to outlining the fundamentals of the industrial minerals business.

The latter provided an excellent forum for both those needing a refresher and newcomers to the industry alike; the highly informative talks revealed some often overlooked aspects and home truths of the industrial minerals world.

“Industrial mineral market basics: an executive primer” by Mike O’Driscoll, Director, IMFORMED, UK, provided a concise and informed assessment of the key elements of the industry’s structure, drivers, influencing factors, and opportunity targets.

“Industrial mineral exploration and mineral resources” by Anton Geldenhuys, Principal Resource Consultant, CSA Global Pty Ltd, South Africa, was a fine review of exploration techniques, collecting data, modelling and estimation, and things to consider in due diligence of industrial mineral projects.

“The JORC Code: Reporting exploration results & mineral resources” by Dr Andrew Scogings, Executive Consultant, Snowden, Australia, superbly explained about public reports and the JORC Code, what should be included in exploration results, and factors specific to reporting industrial mineral resources.

“All you ever need to know about industrial mineral logistics” by Clive Kessell, Director, Coastalwise, UK, gave an entertaining whistle-stop tour of all the main components and factors, with examples, impacting the logistics of getting minerals from mine to market.

Complementing Kessell’s talk, “Common Incoterms mistakes and the risks to a mineral purchase” by John Newcaster, Principal, IMPACT Minerals LLC, USA, raised degrees of both awareness and anxiety in the audience with an excellent briefing on INCOTERMS’ basics and benefits, followed by common mistakes in misapplication and understandings, supported by some alarming examples.

Processing trends & development

“Industrial mineral processing evolution and trends” by Dietmar Alber, Business Development Director, Minerals & Metals Division, Hosokawa Alpine AG, Germany, looked at processing finer grades and utilising lower energy, and special particle size distributions.

Alber reviewed various milling systems for industrial minerals according to their fineness and energy consumption, including the latest key steps in ground calcium carbonate processing to cope with high quality markets.

Alber reviewed various milling systems for industrial minerals according to their fineness and energy consumption, including the latest key steps in ground calcium carbonate processing to cope with high quality markets.

Processing solutions and trends for talc, graphite, quartz and silica, and flame retardants were examined.

“There is a continuous strong trend towards finer grades and into submicron range by dry and low energy processing. There is also a trend to much bigger sized production capacities/plants, and to master tailored particle size distributions and ‘shaping” of particles’ said Alber.

“Fine grinding & classifying: a new concept in mobility & modularity” by Jean-Francois Maréchal, Managing Director, Poittemill, France, introduced his company’s new Truckmill concept – a mobile modular drying and fine grinding system.

“Fine grinding & classifying: a new concept in mobility & modularity” by Jean-Francois Maréchal, Managing Director, Poittemill, France, introduced his company’s new Truckmill concept – a mobile modular drying and fine grinding system.

Based on Poitemill’s Pendulum Roller Mill PM8, each part of the installation is supplied in containers which are pre-wired, pre-cabled, and pre-connected to be adapted with other containers. Some 10-12 containers in total may comprise the finished mobile plant.

Benefits include no need for building or structures, no packaging, reduced assembly time of 5-10 days, in essence, a turn-key plant. Essentially an easy to set up, short investment, “plug in and play” installation for mineral processing needs.

Innovation in trading & logistics

“The evolving role of the industrial minerals trader for tomorrow’s markets” by Alex Aizpurua, Raw Materials Business Unit Director, Midegasa, Spain, was a comprehensive and well-illustrated review of how industrial minerals trading has evolved, and must evolve for the future.

Current trends impacting the market were examined and shown to contribute to an unstable environment. “The traditional way of working

Aizpurua went on to outline the new profile of today and tomorrow’s buyer and how the new trader must now be flexible and creative. “Be different, think out of the box and be proactive and up to date, don’t forget the personal relationships.” concluded Aizpurua.

In “Innovation and logistics”, Dave Chanet, Commercial Manager, Control Union, Belgium, focused on mineral stockpile volume determination, using drones and field inspection, and inspection and reporting.

Chanet showed how Control Union and Wageningen University researched semi-automated volume calculation for bulk cargo using LIDAR technology (light detection and ranging).

Chanet showed how Control Union and Wageningen University researched semi-automated volume calculation for bulk cargo using LIDAR technology (light detection and ranging).

A project using drones to successfully inspect mineral stocks at the dry bulk terminal OVET Terneuzen was also reviewed as was the Peterson Vessel Performance Centre, which offers solutions for vessel compliance.

Refractories | Glass

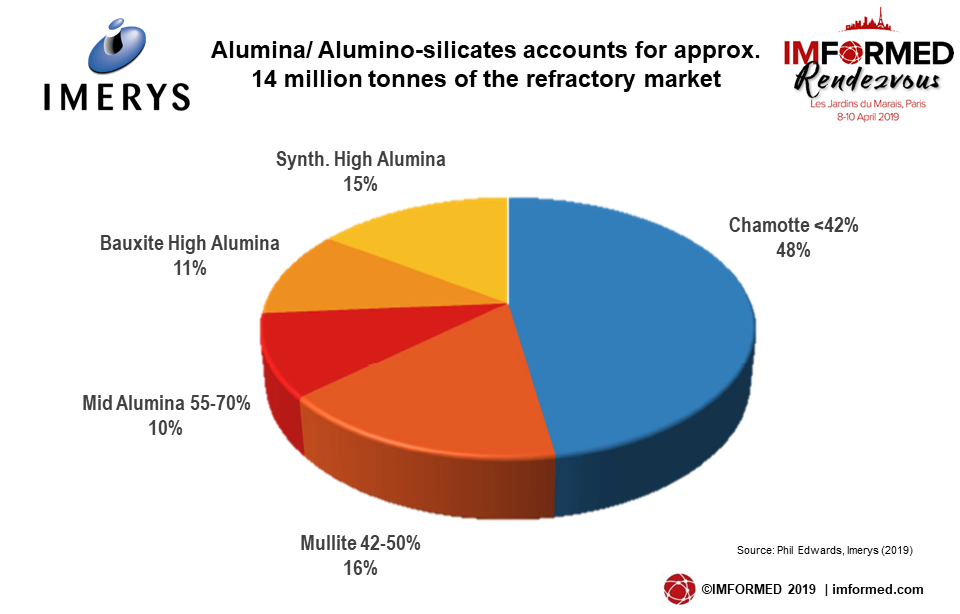

“Survival of the fittest: alumino-silicate minerals and their place in refractories” by Phil Edwards, Refractory Market Director, Refractories, Abrasives & Construction, Imerys, France, highlighted the context, market drivers, and applications of alumino-silicate minerals in refractories.

He also outlined the influence of mineral reserves, applications and usage, and external factors on the evolutionary forces now shaping the aluminosilicate market before rounding off with comments on market volatility and “controlling the whip”, sustainability of refractory minerals, and “innovation – working inside the box”.

“Refractory solutions have changed with the understanding of processes, but finished products remain extremely exposed to disruptions in [raw material] trade flows.” reflected Edwards.

“Refractory solutions have changed with the understanding of processes, but finished products remain extremely exposed to disruptions in [raw material] trade flows.” reflected Edwards.

Edwards warned that the ability to understand, adapt and respond to cycles in the refractory market will only become more critical and the supply/order whiplash effect will continue to be one of the key disturbances to supply.

“One day the world of refractories will change unrecognisably due to a new process. At that time, we will adapt. Until then, we cannot forget our job to make continual small steps forward in the chase for efficiency.” said Edwards.

Switching to another primary consuming market for industrial minerals, Tim Smith, Lead Technologist – Refractories, Raw Materials and Compositions, NSG Pilkington, UK, presented “Trends in float glass raw materials”.

Smith introduced glass batch raw materials and then discussed material specifications, trends in glass materials, and in particular, lower iron glass, the carbon footprint, and quality systems. He also described the consequences of poorly specified raw materials.

“Poorly specified, dusty materials can blow into the heat regenerators and cause blockage or swelling and spalling of the ceramic checkerwork pack.” said Smith.

NSG is pushing for its suppliers to adopt recognised quality and environmental systems. Such systems can help reduce losses.

“Trends in raw materials include downward pressure on iron content in architectural glass. The driver for this change is increased regulatory requirements for improved efficiency in glazing to reduce carbon emissions.” said Smith.

Batteries | Fillers | Paper

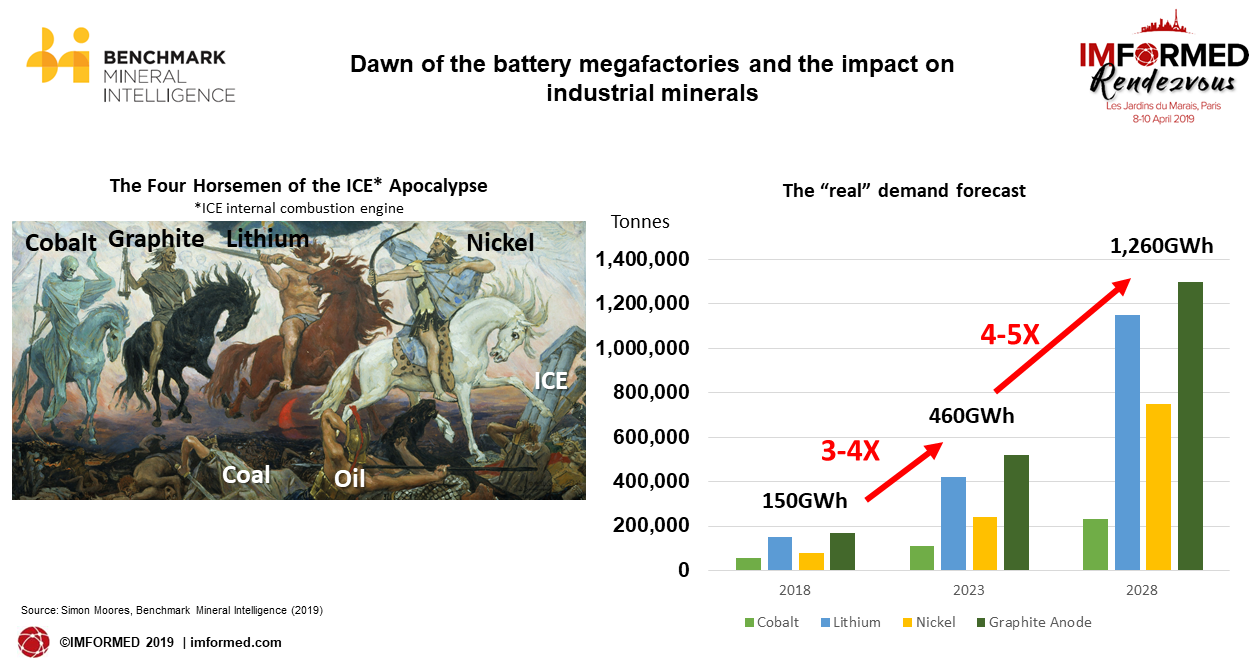

In “Dawn of the battery megafactories and the impact on industrial minerals” by Simon Moores, Managing Director, Benchmark Mineral Intelligence, UK, attendees were delivered a most entertaining and informed outlook for the battery market for minerals.

“We are in the midst of a global battery arms race.” said Moores, as he outlined the latest assessment of the startling growth of battery megafactories turning into a race for automotive battery dominance between China and Europe.

Moores highlighted the leading autobattery capacities, locations, and companies before explaining how battery chemistry was influencing raw material requirements and increasing demand for graphite, lithium, cobalt, and nickel – nicely illustrated in his “Four Horsemen of the ICE Apocalypse”.

Moores also drew attention to the contrasting project durations to establish a mine versus anode/cathode and battery plants, ie. 8-10 years versus 1-2 years, respectively. “The battery supply chain lives in different time zones.” said Moores.

“Calcium carbonate fillers and the outlook for plastics and coatings markets” by Samantha Wietlisbach, Principal Analyst Chemicals, IHS Markit, Switzerland, provided a detailed overview and outlook for demand for calcium carbonate in plastics and coatings.

outlook for demand for calcium carbonate in plastics and coatings.

Wietlisbach reviewed the range of calcium carbonate products before focusing on fine ground calcium carbonate (FGCC) and precipitated calcium carbonate (PCC) consumption.

Overall a slow growth of 1-2% is forecast globally for calcium carbonates over the next five years, with a decline in printing and writing paper production at 1.6% per year. But the plastics and coatings markets are important growth sectors.

“Calcium carbonate consumption in coatings is expected to grow at 3.3% up to 2023 with good growth prospects in developing regions.” said Wietlisbach.

“Mineral demand outlook for global paper & packaging markets” by Dr Ian Wilson, Consultant, UK, continued the theme of key filler minerals and markets,.

Wilson took the audience through paper minerals used and their shape and size, detailing kaolin and PCC, the view from paper machine manufacturer Valmet, mineral use by leading paper manufacturer Stora Enso, ending with summaries of the market situation in Japan and China.

Wilson took the audience through paper minerals used and their shape and size, detailing kaolin and PCC, the view from paper machine manufacturer Valmet, mineral use by leading paper manufacturer Stora Enso, ending with summaries of the market situation in Japan and China.

There has been a significant decrease in kaolin imports into Japan from USA and Brazil. Less kaolin is used in coating formulations in Japan, formerly 50% blends with GCC were used, this is now down to 20-30% kaolin.

Despite the sharp decline in papermaking in China, new PCC grades assisting environmental issues are finding a market. “The prospects for these new [PCC] technologies in China are bright and MTI is pursuing more than 20 opportunities in the region for PCC filler and new satellites.” said Wilson.

Thank you, and see you next time!

As ever we are indebted to the support and participation of all of our sponsors, exhibitors, speakers, and delegates for making our inaugural IMFORMED Rendezvous such a success.

We very much appreciate all the completed feedback forms and please continue to provide us with your thoughts and suggestions.

We shall keep you abreast with developments for the next IMFORMED Rendezvous.

Meantime, we look forward to meeting you again soon, perhaps at one of our upcoming conferences:

MagForum 2019, Bilbao, 13-15 May 2019

Oilfield Minerals & Markets Forum 2019, Houston, 10-12 June 2019

Fluorine Forum 2019, Prague, 21-23 October 2019

Indian Minerals & Markets Forum 2019, Mumbai, 18-20 November 2019

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

The content and scope of the presentations were excellent and I was able to make some good contacts.

Rory Allen, Managing Director, Anglo Pacific Minerals, UKExcellent programme and organisation, perfectly balanced for a newcomer like myself learning about the business and meeting players.

Andre Tahon, Exploration Manager, Dal Mining Investment Co. Ltd, SudanA great event especially as it covered the industrial minerals world all the way from exploration and reporting mineral resources through production, logistics and markets, with a timely emphasis on mineral recycling and last but not least, innovation.

Andrew Scogings, Executive Consultant, Snowden, Australia