Boosting CO2 reductions, recycling rates & game changing CCU plants: Constantin Beelitz, President Europe, CIS & Turkey, RHI Magnesita, talked with Mike O’Driscoll, IMFORMED on the company’s accelerating journey in sustainability within one of the most energy-intensive mineral manufacturing industries critical to many end markets.

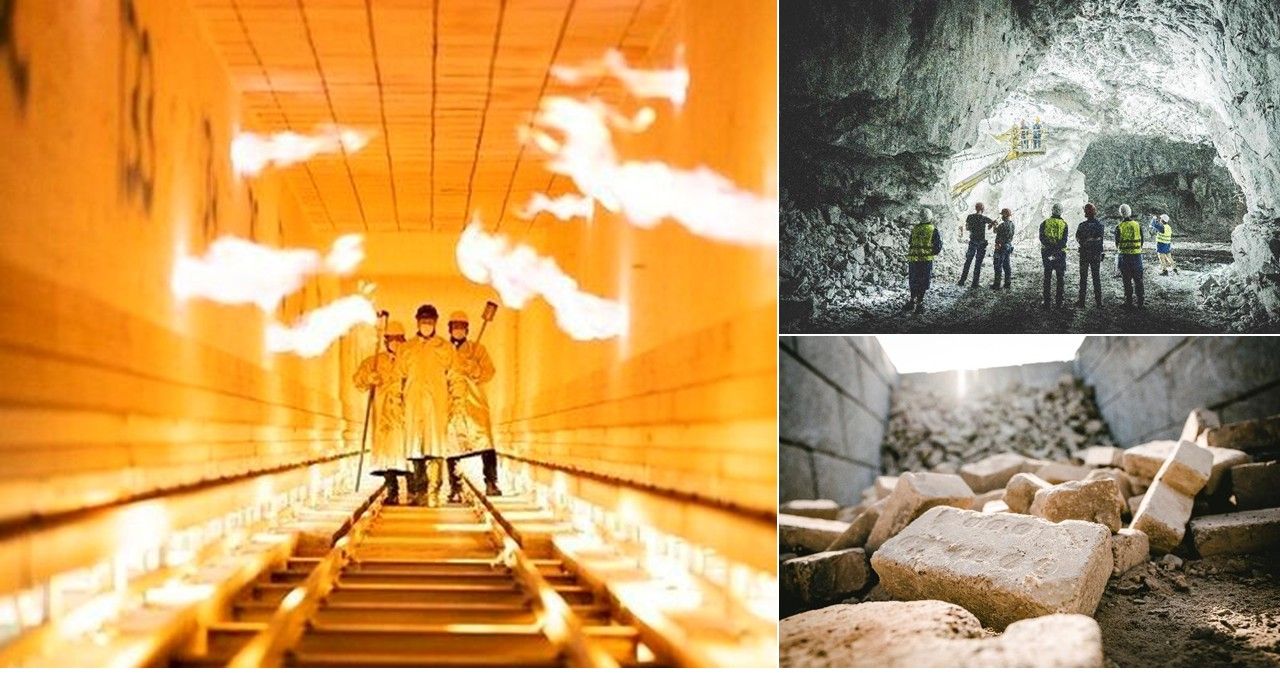

Title Image All fired up: RHI Magnesita is a leader in one of the most energy-intensive industries, whether firing up a tunnel kiln to bake refractory products at Urmitz (main image), or mining and processing the refractory raw material, eg. serpentinite at Breitenau (top right); a new phase of sustainability projects is underway, including pioneering practices in refractory waste recycling (bottom right). Courtesy RHI Magnesita

Business is always sensitive to costs, and it is often the case that things only get done when push comes to shove. So, trying to get a sense of timing: when did RHI Magnesita really start to put sustainability projects into action and embark on this journey?

About five and a half years ago, just before COVID, perhaps 2019, is when we embarked on a clearer step-up of our sustainability journey. Until then, we always had sustainability at the heart of what we did, such as in safety, environmental protection, and recycling.

Doing the incremental work back then we already very clearly understood that not only does it make business sense, but it also makes common sense, to be tackling this. This, I would say is the challenge of the century, which is climate change. And here specifically of course, our contribution is very much centred around the CO2, NOx and SOx emissions.

It started from the top. It was a very clear priority to our then CEO, and CEO today, Stefan Borgas. Very quickly the whole leadership team rallied behind him.

We’ve got some ambitious targets [for 2025] that were set back then, like for example, the reduction by 15% of our CO2 emission, to reach a 15% recycling rate, and the NOx and SOx to reduce by 10%. Our energy efficiency per tonne should also be improved.

“You think you know a lot about recycling, but you don’t until you actually have understood what a recycling player is doing.” Constantin Beelitz, President Europe, CIS & Turkey, RHI Magnesita. Courtesy RHI Magnesita

We really turned this part of the business into a central KPI. We also link this to our corporate bonus programmes. For example, we’ve had it every year since the start in our incentive systems. Mostly, for example, concerning recycling rate or CO2 reduction.

For example, internally we put a price on a CO2 tonne, changing the way we model cost and then actually reduce some of the costs internally in the RRP system for lower CO2-intensive materials. Now this wasn’t smooth, this was a change in the culture. And although we obviously have a number of people that are passionate about this operation, it wasn’t easy because the cultural change was massive, right?

About one and half years ago, at least from my perspective, that’s when I saw my sales, plant and marketing guys actually not only talking about doing this but really going into overdrive on this idea. Which is great.

OK, maybe the cost of this material is a little bit higher, but it doesn’t matter. I’ll take the same because it’s “more”.

The sort of joint venture that we now have with the Horn Group [MIRECO, 2022] really catapulted both companies into a new area. We learned a lot and understood finally that as a refractory player, you think you know a lot about recycling, but you don’t until you actually have understood what a recycling player is doing.

Also, at the same time, the [end user] industry started to move. In 2019, very little was said about green steel. Now we have at least 10 green steel projects [in Europe], some of them even greenfield, like Stegra in Sweden.

We were 2-3 years ahead because the big wave came about one year after COVID in 2021, especially with green steel.

On the EU Commission side and we were also a little bit ahead in this regard. So that’s why we could really hit the ground running.

Hear the latest on magnesia market trends at MagForum 2025, Salvador, 19-21 May

The challenges of decarbonisation, carbon footprint reduction, & ESG: which strategy for the magnesia industry?

Presented by Renato Ciminelli, Technical & Commercial Director, Mercado Mineral, BrazilFull Details Here

How are your key sustainability targets shaping up now, after some 5-6 years of progressing such a range of initiatives, and what of the future?

We still are on track for our 2025 targets. But if you take a look at the KPIs, we will actually over-achieve the targets. We’re now thinking, OK, what are the next five years? because the 2025 cycle is almost over.

We are looking to have a further sizeable reduction of our CO2 emissions. Over the next five years we want to reduce at least a further 15% and achieve a recycling rate that hits 20%. This is globally, and not only for magnesia products, it’s also across alumina, zirconia, and chrome products, the full range.

We plan to quadruple our recycling rate over the course of six years. Obviously, there will be at some point a natural ceiling, simply because you can only get 30% of spent refractories out of the cycle. So it means that we will save at least a further 15% CO2.

With the recycling rate up to probably 20% globally, it means that in Europe it will be at least 25%. This is where Raptor and Maestro [sorting equipment units developed at MIRECO, presented at Mineral Recycling Forum 2025, Cannes] will help us immensely get a much better yield out of the recycling.

Achieving 3% [increase in recycling] is quite easy to do if you just cherry-pick. But then more and more you realise, OK, I’ve got to get clever, or more technologically advanced, invest a little bit more, and that’s exactly what we will do over the next five years.

Considering the regional context: Europe has always been ahead of the pack in recycling. So with a multinational like yourselves, you’d expect the European-based operations to be up there. But I am pleasantly surprised by the amount of recycling happening in India and also in China, and coming along in South Korea. North America is actually behind, although it’s not surprising when there are less incentives, such as very cheap landfill costs. How do you read this?

North America is behind and also has less regulations in this regard. Also, it’s one of the only large economies that doesn’t have a CO2 price; China and the EU have a CO2 price, and even India has an idea of a CO2 price.

We are clearly pioneering a lot in Europe, but India is doing quite a lot too. Historically they have always been developing some quite innovative ways of recycling. China is starting to catch up in this regard as well. So when you look at the larger regions, it’s more the US that is lagging a little bit behind.

Clearly, at least from my perspective I think in Europe we’re still very much at the forefront in pioneering refractory recycling, specifically when you talk about technological solutions here. Using laser induced breakdown spectroscopy and the hyperspectral imaging cameras is quite advanced.

We can now start to sort pieces that are 16mm, something that with a human eye you can not distinguish in sorting refractory recycling.

RHIM’s latest recycling developments introduced late 2024: (Left) MAESTRO – Mobile Automated Efficient Sorting Technology for Recycling Operations, designed to transform how RHIM handles recycling at scale. (Right) RAPTOR – Refractory Automated Precision Technology for Optimized Recovery, advanced automated sorting equipment for recycling. Courtesy RHI Magnesita

We have also been tracking the partnership between RHIM and MCi Carbon, and the CCUpScale Project. Can you summarise where you are with that, and do you see RHIM rolling out such technology, not just to other refractory plants, but maybe to magnesia calcination plants?

We are considering lots of different options and nothing is off the table for us. We have a very promising solution with MCi, because this one works very well for our process and the raw materials we have in the area [serpentinite, Austria].

But it doesn’t mean that there are not lots of other very credible and viable options. For example, the cement industry is utilising technology from Calix Ltd [another Australian-based process technology developer].

However, the really unique point with MCi is that it’s not just carbon capture and storage, it’s also carbon utilisation. It turns the carbon into an actual valuable net zero or CO2 negative product, that can be used, for example, either in the cement industry as an additive or in the pulp and paper industry.

This is the mindset change, because you turn a cost case, which the CO2 is for the moment in Europe, into a business case because you can sell these materials on the open market.

So where do we stand? Well, until about 18 months ago we’ve done everything that we can in the lab, and it really works well on a small scale. We are now in the process of almost finishing a larger scale pilot plant called “Myrtle” in Australia [on Kooragang Island, Newcastle, New South Wales]. This will be capable of capturing about 1,000 tpa of CO2.

We can now really run the process with the raw materials we will use to be capturing the CO2, the serpentinite. And with that we can produce on a larger scale those value adding CO2 negative products in order to provide to potential prospective customers as trial materials in their process.

This will probably be towards the end of the year, and we can then move forward with the engineering and the approval for the first industrial scale pilot, which we will build in Hochfilzen, Austria. This plant will probably capture at least 50,000 pa of CO2. We’re seeing if it could capture more.

(Left) In April 2024, MCi Carbon celebrated its Myrtle Foundation Ceremony, marking the beginning of construction of the Myrtle CCU pilot plant, capable of capturing about 1,000 tpa of CO2, and central to RHI Magnesita’s CCUpScale project; in January 2025, the project received a €3.8m fund provided by the Austrian Climate and Energy Fund, supported by the Austrian Ministry for Climate Action, Austrian Research Promotion Agency (FFG) and the Australian Department of Climate Change, Energy, the Environment and Water (DCCEEW). A decisive step toward the construction of the world’s first CCU industrial scale pilot plant for the refractory industry in Hochfilzen, Tyrol, which is planned to be operational at RHIM’s facility in 2028 (Right, artist’s impression). The plant will capture, convert, and utilise 50,000 tons of CO₂ annually to produce CO₂-negative mineral value-added products. Courtesy MCi Carbon, RHI Magnesita.

And yes, like you said, we are very much seeing great potential once we have this industrial scale pilot working in Austria, to then actually scale this up, not only internally at RHI Magnesita, but also provide this to the refractory industry in the form of a licenced model. Come two or three years, this will really be a game changer.

But it comes with a cost to invest in this, looking at probably €100 million or more. So a huge investment right now. It’s very clear that some of it has to be supported by funding such as from the EU and Austria. At the beginning of this year a grant [€3.8 million] from the Austrian Government will help us with the engineering and the preparation of the plant development.

We have got to be clear; this investment will cost money and therefore will also be leading to a higher cost of product.

Thinking about your end customers or the end user: they’re in the same “boat”, they need to be seen to be in, and they’ve got to understand, the recycling circle – everyone has to buy into this for it to be successful. What is your sense of the response/expectation from them?

Exactly, that’s the point. Maybe let me also come back. So we have a lot of ongoing dialogue specifically with the government. With the EU and the government we embarked upon this already about 18 months ago. With customers it’s now we’re starting to embark on it. We’re lagging a little, but you know in all honesty I think we’re quite pioneering with regard to recycling.

When you look at the recycling story, we started to talk about this 5-6 years ago with very much your help and passion. And we really saw customers changing their approach more broadly, and there were always customers who were much more open about one and half years ago – “I’m open to recycling products, give it to me, I understand that there is a CO2 benefit.”

So I expect again we shall embark upon this now, and customers will take about one to two years to understand this more systematically.

I see very encouraging signs, most of them are interested, and a number of them are really starting to want to be more involved. But we have got to get to a stage where they’re also willing to pay for it. And this is the challenge we have.

They tell me exactly the same thing about their end customers that we are telling them, it’s the same challenge we have. Ultimately, we have to start to understand that this is a value, and then you generally pay for adding value, and that’s the journey that we’re embarking on now. Clearly, we’re not going to solve it in three months, but we want to ensure that in two years’ time, three years’ time, this is clearly anchored and embedded in the market.

And you said something very important. It takes everybody to be disciplined around this, right? So this is not only our customers, but it also means the refractory industry itself has got to be disciplined with us, otherwise it will be disruptive and then we are at a stage where even the most dedicated player will at some point question whether he will actually be financially viable to invest and continue this path.

And what of other companies in the refractory or other industries also trying to conduct such sustainability pioneering? I’ve not seen too many examples at a similar scale as RHIM, I wonder if that’s just simply down to company size/resources? Or are they still working out which path to take?

Excellent question. I think the answer to this has all the elements. For sure scale is a huge advantage. It is very clearly a requirement for some of these aspects, simply out of a risk diversification perspective.

But it’s also about the mindset and the culture that you have. How serious and how dedicated are you to the sustainability topic? I think you can find different examples within our industry as well. Some of the players are as dedicated as we are. Some of them may be a little bit less. You can also see this already when you think about the transparency of CO2 reporting. For me, one of the key criteria is always that CO2 reporting is only serious when you take all three Scopes into account [Scope 1-3 CO2 measurement). Everything else is not.

Ultimately, it’s a question about the environment that you’re in, so maybe some of the refractory players that are not very active in the European Union might not have this on the agenda as much. Because very clearly here [in the EU] we’ve been forced to do this legally even though we are passionate about this.

But we’re a global player, we’re pushing recycling, we’re pushing CO2 reductions everywhere we are, regardless of the legal structure that we have.

And the last thing: you’ve got to be financially strong enough with the resources to do this right. What we do see is very clearly that the market conditions for the moment are not easy. In Europe, particularly the last two to two and a half years, we’ve seen a steady decline in demand. Steel production, for example, is down by more than 20%.

And your view on sustainability in terms of near/on-shoring raw material sourcing rather than overreliance on traditional, limited, remote sources?

That is super important. That’s also why, for example, specifically in Europe, we finally now have authorities and the public looking at the importance of raw material, we call it backwards integration.

For too long now we have been too reliant on imports wherever they come from. In the European Union we welcome very much the Critical Raw Materials Act [came into force by the EC in May 2024] and the Industrial Green Deal [2023, 2025] where many aspects are being put into place to support regional mining and raw materials development.

Magnesite and magnesia should also be on the critical raw material list. Regional or European defence development, even going into space, will need steel, copper, nickel, titanium, glass – all of this is impossible without magnesite or magnesia. And that’s something that I think is grossly underestimated.

The industry is currently facing some short-term economic headwinds. Has this impacted your sustainability roadmap in any way?

It’s true that the current economic environment presents challenges — inflation, increased raw material costs, and higher energy prices are all putting pressure on margins. As a result, we’ve had to adjust our prices upwards to reflect these realities across the board and are currently finalising these negotiations with all of our customers. That said, our sustainability roadmap remains firmly on track. These short-term pressures do not alter our long-term commitments. We’re continuing to invest in sustainable technologies and circular solutions, because we believe these create long-term value not only for us, but also for our customers.

RHI Magnesita is the Lead Sponsor at IMFORMED’s upcoming MagForum 2025, Salvador, 19-21 May, which brings together the world’s leading players in magnesia minerals supply and demand. Attendees will have the exclusive opportunity to visit RHIM’s extensive magnesite mining and processing operation at Brumado, Bahia. Full details here.