Outside China, production of fused magnesia has usually been in the hands of the few, and those that at least can negotiate half-decent electricity rates – fused industrial minerals are not known as “crystallised electricity” for nothing.

It seems that junior magnesite developers now want in on the fused action as well.

“Crystallised electricity”: fused magnesia production is highly energy intensive, using electric arc furnaces at 3,000degC; most is consumed in refractories, electrical grade in ceramic insulators is a niche market with few suppliers.

Just last month, WHY Resources Ltd, which is evaluating its Record Ridge South Property, near Rossland, south-east British Columbia, announced its Preliminary Economic Assessment as “presuming a conventional open pit mine, a novel hydrometallurgical processing plant, a calcined magnesia intermediate product plant, along with a fused magnesia production plant.” Perhaps the question is in the company name.

Another developer eyeing the possibility of fused magnesia as a “high-tech magnesia product” is MGX Minerals Inc., developing its Driftwood Creek Magnesium Property, also in British Columbia.

In Western Australia, Korab Resources Ltd recently announced that its subsidiary AusMag Pty Ltd had struck a A$6m investment deal with a Chinese investor, “who represents interests associated with the Chinese steel industry”, to help develop its 500,000 tpa raw magnesite project at Winchester, Northern Territory.

Among the project’s objectives is the potential construction of plants to produce caustic calcined, dead burned, and fused magnesia.

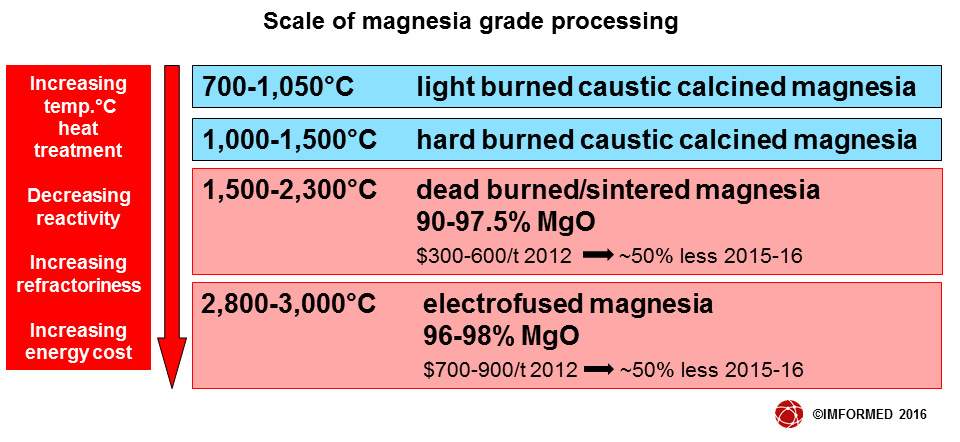

Making the grade

Certainly, with any industrial mineral project development, it’s always worth checking out the options on the project yielding the highest possible quality grades which (usually) command the top prices. This also looks good on the promotion material for investor and potential offtake interest.

But with industrial minerals, and especially magnesite, it’s not always that easy to simply build and switch on a high grade plant and watch the dollars roll in – just ask Baymag, Sibelco (Qmag), and RHI for example. And those companies have been eating and breathing magnesite for decades.

Baymag, which mines magnesite in Radium Hot Springs, British Columbia, commissioned its state-of-the-art Exshaw, Alberta 14,000 tpa fused magnesia plant in 1989. However, owing to lack of market demand, it has been mothballed for most of its life.

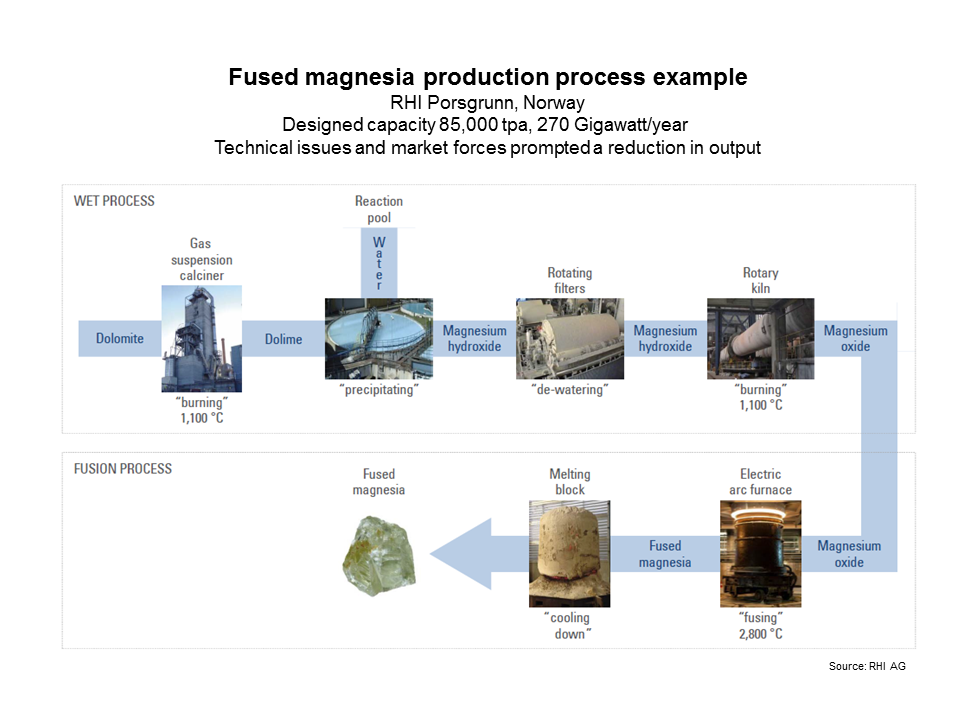

In 2011, leading refractory and magnesia producer RHI AG, Austria, took what was considered to be fair at the time, an enlightened step to reduce its dependence on inconsistently priced and supplied Chinese fused magnesia. RHI built perhaps the world’s single largest fused magnesia plant (85,000 tpa) in Porsgrunn, Norway, fed by an acquired local dolomite-sourced caustic calcined magnesia producer.

The €75m plant opened in late 2012. However, a year on and production was reduced to around 35,000 tpa owing to energy costs and technical issues, which have since been addressed. With the dramatic drop in Chinese fused magnesia prices during 2015, this has further compounded the plant’s position.

In its 2015 results just released, RHI acknowledged that the situation “required a complete write-down of assets amounting to roughly €23m for the plant in Porsgrunn.” But should the market recover, and Chinese fused magnesia prices rise (as has happened in the past), then RHI will be safe in the knowledge of not being dependent on Chinese imports.

Elsewhere, it seems that fused magnesia has retained its flavour for certain established producers, although these most likely represent the fruition and delayed passage of projects initiated some years earlier: Magnezit is pressing ahead with its impressive 50,000 tpa fused magnesia expansion by 2020 at Razdolinsk, Krasnoyarsk Territory, Siberia; in 2015 Kumas’ fused magnesia capacity increased to 40,000 tpa at Kutahya, Turkey; also in 2015, Iranian Refractories Procurement & Production Company (IRPPCO) brought on stream its first fused magnesia plant at Birjand with a 5,000 tpa capacity.

So does it work for some, but not others? Or is it a matter of market timing?

It is notable, that with the exception of IRPPCO, Magnezit and Kumas are major integrated producers of refractory products; as is RHI, and Baymag is owned by refractory leader Refratechnik.

In fact, the majority of world refractory grade fused magnesia capacity outside China is captive to integrated refractory producers, with the exception of Sibelco in Australia, and Industrias Penoles SA de CV, in Mexico.

Banging the world magnesia market drum: Chinese fused magnesia has always influenced world prices and production; here fusing magnesia and hand sorting core break-up in Dashiqiao, Liaoning, China.

Market awareness

Junior developers should heed the warnings of those experienced players that have trodden the fused magnesia path before them.

Special attention must be given to understanding and appreciating not only the technical aspects of the fusion process and its demands on materials and energy, but the structure, demands, and vagaries of a market dominated by refractories for the steel industry, and above all, fused (and other) magnesia supply and demand from China.

How to do this in a cost-effective and concise manner? By attending MagForum 2016, 9-11 May 2016, Vienna.

Our 2-day conference is all about supply/demand trends and outlook for magnesium minerals and markets (see Programme).

The status and outlook for the magnesia market will be discussed by a Keynote panel including senior management from RHI, Magnesita, Grecian Magnesite, and Refratechnik, followed by experts reviewing supply sources and refractory and non-refractory markets for magnesia.

In the context of fused magnesia and new projects, we specifically have:

What it takes to bring a successful magnesite project to market

Paul Rix, Director, Archer Exploration Ltd, Australia

Fused magnesia trends and global outlook

Asım Bilge, Production Engineer, DBM & FM Production Dept., Kümaş Manyezit San. AŞ, Turkey

Refractory market drivers outlook for magnesia

Ted Dickson, TAK Consultancy, UK

There is also the opportunity to visit a state of the art magnesia refractory plant first hand by joining our Field Trip to RHI’s plant at Veitsch on the day preceding the conference.