Seen & Heard in Ulaanbaatar: Review of Fluorine Forum 2024

In what must rank as one of IMFORMED’s most ambitious conference venues to date, we were delighted to hold Fluorine Forum 2024 at the Shangri-La Hotel in Ulaanbaatar, 14-16 October last year.

And what a success is it was, despite the relative remoteness of the venue: 170 international delegates from across the spectrum of the fluorine raw materials supply chain gathered to network and listen to an excellent range of presentations from leading experts summarising the status and outlook for the industry (reviewed in full below).

Title Image Mongolian Fluorspar in Focus: with declining Chinese production and rising demand from growth markets in batteries and semiconductors, perhaps Mongolian fluorspar’s time is now? Pictured here is the mine and new plant of Mongolczechmetall, which delegates visited after the conference.

Special thanks to sponsors and supporting partners Mongolczechmetall, Wayo-Fluorite, Mongolian Minerals, Nahas Mining Energy Resources LLC, and the Mongolian Assoc. of Fluorite Miners for all their support and assistance on site.

We look forward to bringing the fluorine market back to Europe this year!

FULL DETAILS HERE

Welcome Reception, Wednesday evening 22 October

At the wonderful Ristorante Italia, on Isola Pescatori, Lake Maggiore (5min boat ride).

“Excellent and well structured programme, good venue.”

Francesco Latini, Commercial Director Minerals, Orbia Fluor & Energy Materials, USA

“This forum offers us, for many years now, the opportunity to talk to customers, suppliers and others. Many interesting papers were held during the two days and always keep us up to date. We had a wonderful time. We would like to thank you for this great and professionally organised event. We will be there again next year and are already looking forward to exciting topics.”

Carl Spaeter GmbH, Germany

“Good organisation and venue, the Forum helped us to find and meet new customers.”

Li Xiaobo, General Director, Erenhot Yirong Import & Export, China

“Good programme, roundtables and venue; market information included deep insights for different perspectives.”

Kamimura Takumi, Manager, Sojitz. Corp., JapanMissed attending the Forum?

Free Fluorine Forum 2024 Summary Slide Deck Download hereA full PDF set of presentations available for purchase.

Please contact Maria Bernard T: +44 (0) 208 153 0035 maria@imformed.com

Following the conference, delegates were treated to a superb visit to Mongolczechmetall’s fluorspar mine and recently opened flotation plant at Chuluut Tsagaan Del, 145km south of Ulaanbaatar. There are 8 ore bodies hosting 3.6m tonnes fluorspar @ CaF2 43% on average. The company produces 25-25,000 tpa metspar (65-85% CaF2) and 80,000 tpa lower grade. The process plant has a capacity of 200,000 tpa ore, and 64,000 tpa acidspar (>97% CaF2).

UK delegates had a suprise invitation to afternoon tea with the UK Chargé d’affaires, Andy Battson, at the UK Ambassador’s Residence in Ulaanbaatar; and on the last night, supporting partner Nahas Mining Energy Resources kindly put on a delightful and memorable reception in a local Peruvian restaraunt in honour of the memory of Ismene Clarke – many thanks guys!

FLUORINE FORUM 2024 REVIEW

CHINA & MONGOLIA

China fluorspar supply review

Yuan Zhaohui, Secretary General Fluorspar Committee, China Non-metallic Minerals Industry Association, China

Yuan provided a very informative and frank presentation on the situation in China, starting with an introduction to the CNMIA Fluorspar Committee, before focusing on Chinese fluorspar production and demand, market observations and outlook.

The influencing factors impacting China’s fluorspar industry can be summarised thus:

Environmental Protection

- Natural Resources Regions

- Ecological Red Line

- Forestry

- Green mine

Government Policies

- Much higher requirements on mining license renewal

- Temporary and Permanent Shutdowns

- Special inspection for safety production

Resources

- Ore Depletion

- Low grade ores and tailings depleting

- Lack of sizeable new resources

- Ore and product import ex Mongolia

Yuan reported that the number of fluorspar mines had declined sharply: 650 by end-2023, down from >1,200 end-2013. Some mines have expanded capacity when stimulated by high prices, which naturally accelerates the consumption of the resources.

Chinese fluorspar consumption was 6.5m tonnes in 2023, with HF accounting for 75%, followed by AlF3, 15%.

Future trends could see utilisation of tailings and limited low grade resources, and new resources and production moving inland (ie. Inner Mongolia, Yunnan, Xinjiang provinces), although transportation costs would be high.

China’s demand for fluorine resources is at an all-time high and will continue to grow. Under the combined pressure of policy factors and resource depletion, the supply from single type fluorite ore will gradually decrease, and associated fluorite ore options will gradually become the mainstream supply. China’s demand for fluorspar imports will gradually increase.

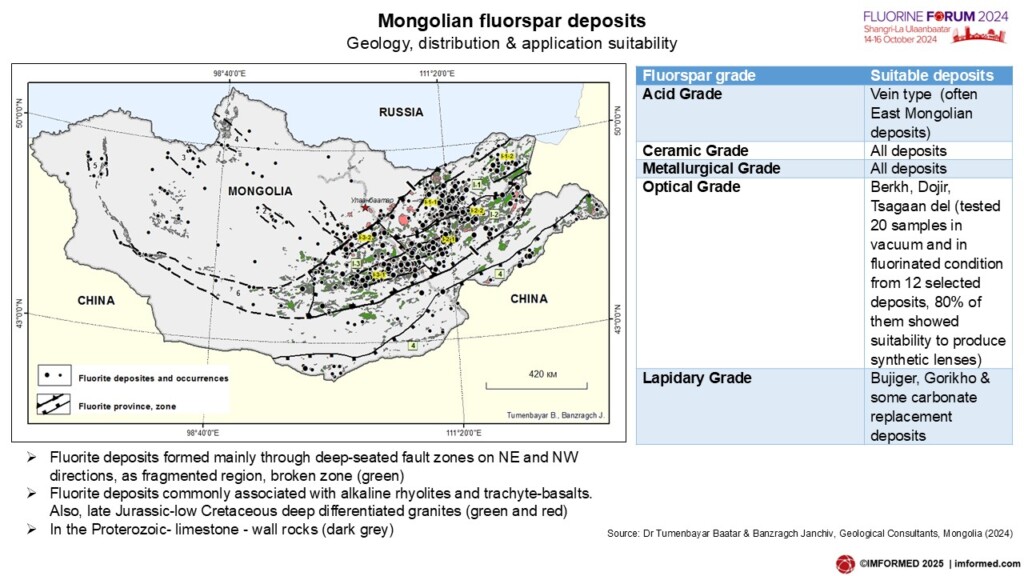

Mongolian fluorite deposits and their geochemical characteristics

Dr Tumenbayar Baatar & Banzragch Janchiv, Geological Consultants, Mongolia

Dr Baatar began by describing how fluorite is a widely distributed mineral in Mongolia, before focusing on commercial type of fluorite deposits, their regional distribution, geology, and geochemical composition, concluding with production and perspective.

The geology of Mongolia is very favourable for the formation of fluorite deposits and the country hosts about 700 known fluorite occurrences and deposits. About 35-40 of these are exporting material. This is expected to increase in the future.

Most deposits are open pit mines, and near future exploration will be conducted underground, abandoned deposits will be evaluated for reopening.

The quality of fluorite and concentrate is often very pure (small concentrations of As, S, P, Si, CaCO3, Al) compared with other countries’ resources.

Only 30% of deposits are exporting concentrate, soon the number of processing plant will increase and the quality of fluorite for export will improve. The mining of fluorite as a by0product not yet started.

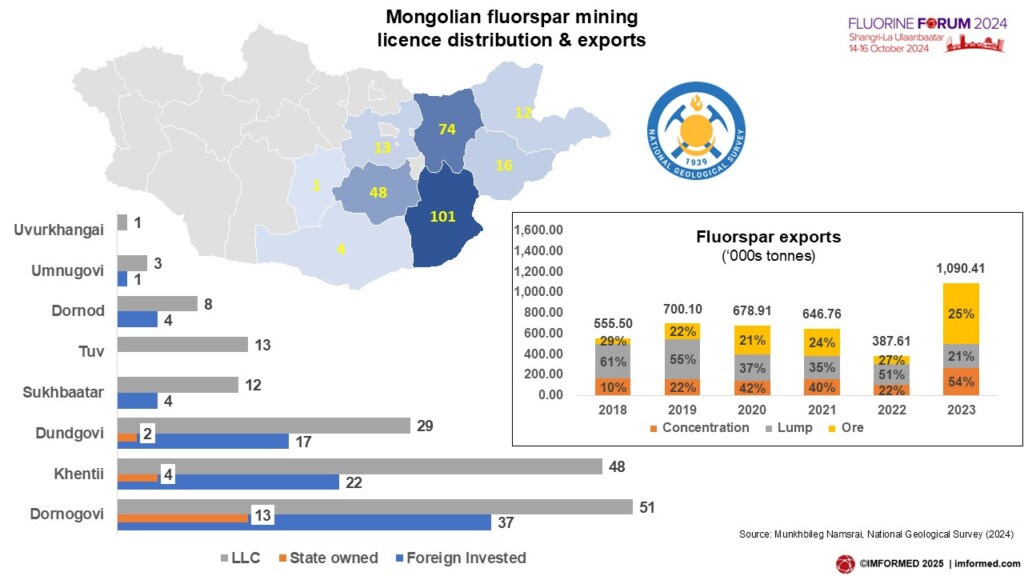

Current conditions & prospects of fluorspar deposits & occurrences in Mongolia on geological basis

Munkhbileg Namsrai, Head of Mineral Resources Study, National Geological Survey, Mongolia

Namsrai began by outlining the mission of Mongolia’s National Geological Survey – “ensuring the national sustainable development of the country by implementing state policies in the mineral resource sector in accordance with geoscience-based information” – and the latest mineral policies.

Mongolian fluorite occurrence and distribution was examined: 157 deposits, 549 occurrences, and 35.9m tonnes of resources.

Mining licences (the majority in Khentii and Dornogovi provinces, in the east of the country), logistics, and the exploration, production and export of Mongolian fluorspar was summarised.

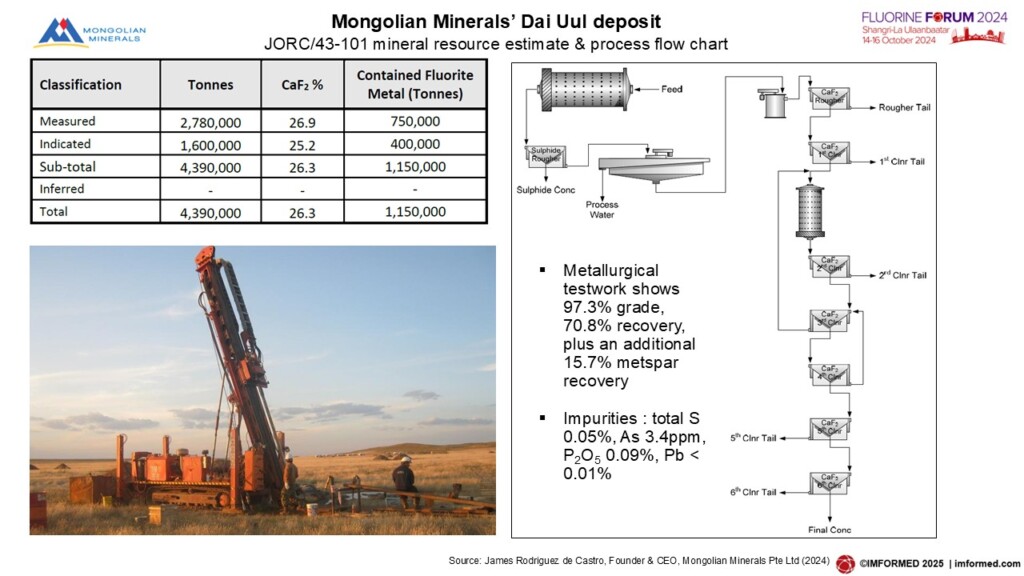

Development & outlook for the Dai Uul Fluorspar Project

James Rodriguez de Castro, Founder & CEO, Mongolian Minerals Pte Ltd, Hong Kong

Rodriguez de Castro briefly outlined Mongolia’s two main fluorspar producing regions before explaining why it was “Mongolia’s time” for fluorspar:

- Long track record as one of the world’s leading fluorspar producers

- High quality material with favourable impurity profile (low arsenic, phosphorus, and lead), compatible with existing HF plants worldwide

- Conveniently located to supply Chinese, South Korean, Japanese, Indian, Gulf, and other Asian markets as Chinese production declines

- The EV market is likely to drive expansion of global demand.

Mongolian Minerals is developing fluorspar deposits in Mongolia with five mineral licences (3 mining and 2 exploration) and claims it is well positioned to add to and replace existing Chinese fluorspar supply as demand expands.

The company’s leading development, the Dai Uul deposit, is “ready for exploitation” and hosts 898,600 tonnes B & C category reserves, and 1,150,000 tonnes measured and indicated resources.

Dai Uul is planned to have a processing plant which upgrades ore from 25-60% grade up to commercial acid-grade fluorspar, with a metspar by-product. Production is envisaged as 65-90,000 tpa (100,000 tpa process capacity), Mongolian Minerals intends to optimise the mine design as soon as the final size of the project is known.

Mongolia & its role in the fluorine industry

Ehab Eltayeb, Business Developer, Nahas Mining Energy Resources LLC, Mongolia

In this short presentation, Eltayeb outlined challenges in fluorspar logistics, investment opportunities and how to invest in Mongolia.

Regarding logistics, the main considerations are:

Challenges:

- Rail capacity: limited infrastructure and congestion at key border crossings like Zamyn Uud, lead to delays and increased costs.

- Port congestion: Seasonal congestion at Chinese ports adds delays and handling costs.

- Costs: High logistics costs due to multimodal transport, insufficient rolling stock, and transshipment fees.

Solutions:

- Rail Expansion: Completing planned railway links, especially from the Gobi region, to reduce bottlenecks.

- Modernising terminals: Upgrade border and port facilities with more cranes and rolling stock to enhance capacity.

The key areas requiring investment include:

- Mining technology: need to upgrade technology for deeper exploration

- Advanced systems and technology for sorting

- Flotation plants: more flotation plants needed to meet international demand for high-purity fluorspar.

- Boost production of acid-grade fluorspar, used in the chemical industry.

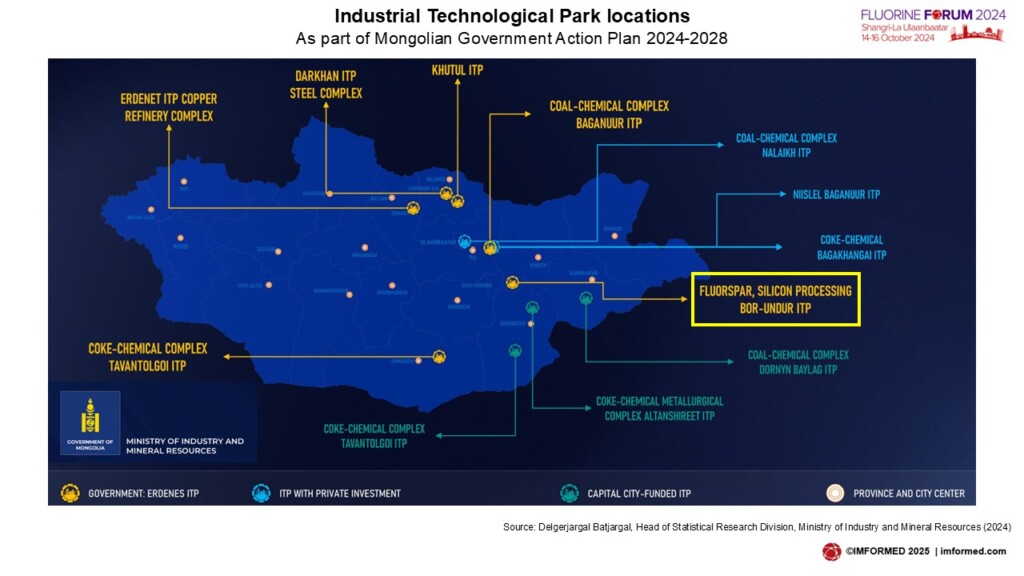

Government policy in the industry & mineral resources

Delgerjargal Batjargal, Head of Statistical Research Division, Ministry of Industry and Mineral Resources, Mongolia

Batjargal covered the economic contributions of Mongolia’s minerals sector, mineral resource policies, the mining commodity exchange, and regulation and ownership of mineral licences.

The government’s 2024-2028 Action Plan for 14 “mega-projects” was also highlighted, which includes a fluorspar and silicon processing facility to be developed at the new Bor-Undur Industrial Technological Park.

POTENTIAL NEW SUPPLY SOURCES

Bringing fluorspar back to the USA

James Walker, CEO, Ares Strategic Mining, Canada

Walker reminded that the USA is totally reliant on fluorspar imports, and in 2022, the US Government classified fluorspar as both a strategic and critical mineral, which has led to a faster permitting period and increased funding for fluorspar projects such as that of ARES Strategic Mining in Utah.

About 70-75% of fluorspar imported to the USA is used to produce HF, while 15–20% is used as a flux in aluminium and steel, and the remaining in other uses such as glass and ceramics.

Since the USA produces around 80m tpa steel, this translates to around a 725,000 tpa fluorspar requirement.

ARES’ planned production at its fully permitted Lost Sheep Mine in the Spor Mountain area, Utah is 50,000 tpa of acidspar with other fluorspar projects on the horizon in Canada.

The 50-acre processing facility at Delta is around a 1 hour drive from mining operation. In 2025 the metallurgical lump plant is expected to be assembled.

Key challenges that ARES has faced include construction and plant assembly setbacks, capital requirements and delays, and global market fluctuations for critical minerals affecting investments.

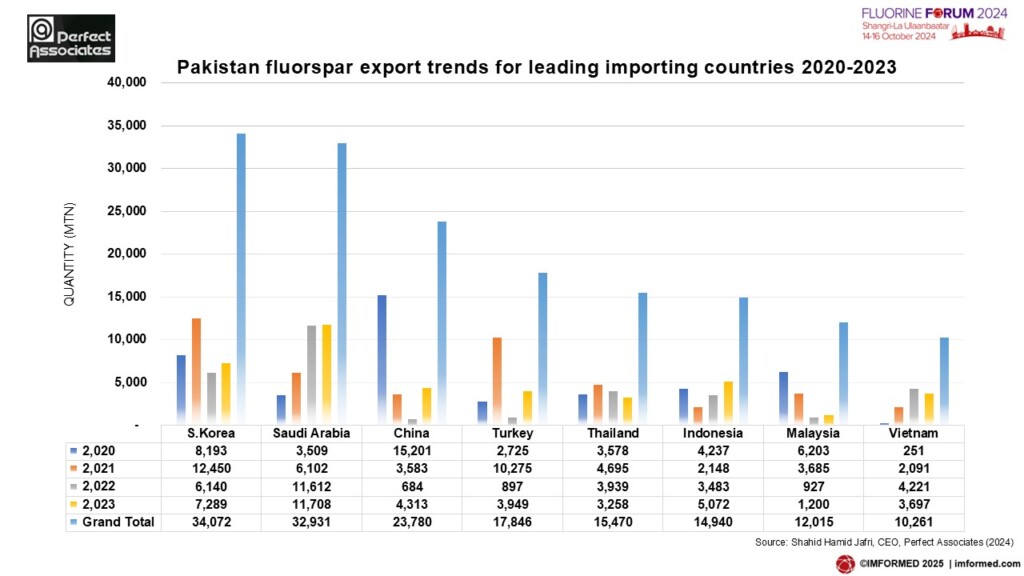

Pakistan’s fluorspar industry: Emerging trends, future prospects & unlocking potential for acidspar plant development

Shahid Hamid Jafri, CEO, Perfect Associates, Pakistan

Jafri described the main fluorspar resource-rich regions of Pakistan: Azad-Kashmir, Gilgit-Baltistan, Khyber-Pakhtunkhwa, and Balochistan, and placed fluorspar into the context of the country’s overall mineral resources.

During 2020-2023, almost 250,000 tonnes of fluorspar was exported from Pakistan with an average of almost 61,000 tpa. Most of the high grade fluorspar (CaF2 > 85%) was exported to European countries and Egyptian steel plants. Most low grade (<85%) was exported to South Korea, Saudi Arabia, China, and Turkey as leading destinations.

However, there are several hurdles to growing Pakistan’s fluorspar industry, such as:

- Short term approach: of some traders/exporters whose target is to clear out their stockpiles of inferior quality fluorspar, then close down.

- Freight cost impact: South Asia to European markets (European/Western customers insistence on importing only high grade fluorspar).

- No market for majority of Pakistan fluorspar reserves: ie. low grade reserves <CaF2 60%. For every one tonne of medium to high grade Fluorspar (CaF2 75% min) there is almost 10 tonnes of low grade fluorspar. Most of this is exported to China at discount prices just to recover the costs of mining or is washed by using specific gravity washing tables to extract the maximum medium to high grade fluorspar that can be extracted.

- Shortages: in government support and priority, finances, and technical knowledge.

Jafri proposed a way forward in order to eliminate the trust, quality and inconsistency in supply issues between the customer and the exporter: the importer/customer can start a JV with an already established local mining company, or set up their own office, which can act as their representative for all their mineral needs.

The Khyber Pakhtunkhwa and Balochistan regions host fluorspar deposits that have been successfully tested as suitable for acid grade production.

Challenges & opportunities faced by Western fluorspar miners from renewable energy revolution

Peter Robinson, Managing Director, Fluorspar Ventures, UK

Robinson introduced Fluorspar Ventures Ltd which is developing a new UK renewables project linking

- traditional fluorspar mining

- crystal specimen collection

- brownfield land regeneration

- redevelopment of traditional underground fluorspar/lead mining

The aim of the project is to re-establish fluorspar supply from traditional resources with low geopolitical risk and good transport logistics. The project is under development with first fluorspar production anticipated during 2027.

Robinson considered that rules of origin and desire for non-Chinese fluorspar supply could increase demand in European nations for homegrown fluorspar and fluorine-based products, but chemical and energy transition production technology has to move fast to catch up with Asian nations.

Redevelopment of fluorspar deposits in stable jurisdictions is necessary to mitigate geopolitical risk, with better transport logistics to fluorochemical manufacturers and just in time delivery. This principally applies to Europe.

The ability to shorten development time of both brownfield and greenfield fluorspar projects to utilise the small-scale deposits in Europe and elsewhere is critical to securing raw material supply to support the transition to renewable energy. Smaller deposits with low environment/community impacts should have quicker permitting pathways.

Combining crystal collection (low-cost entry into small scale vein structures to extract crystals) with industrial fluorspar production allows mine operators to bring small scale projects into production quickly which is important in this period of low demand.

MARKETS: BATTERIES | CHEMICALS | HF

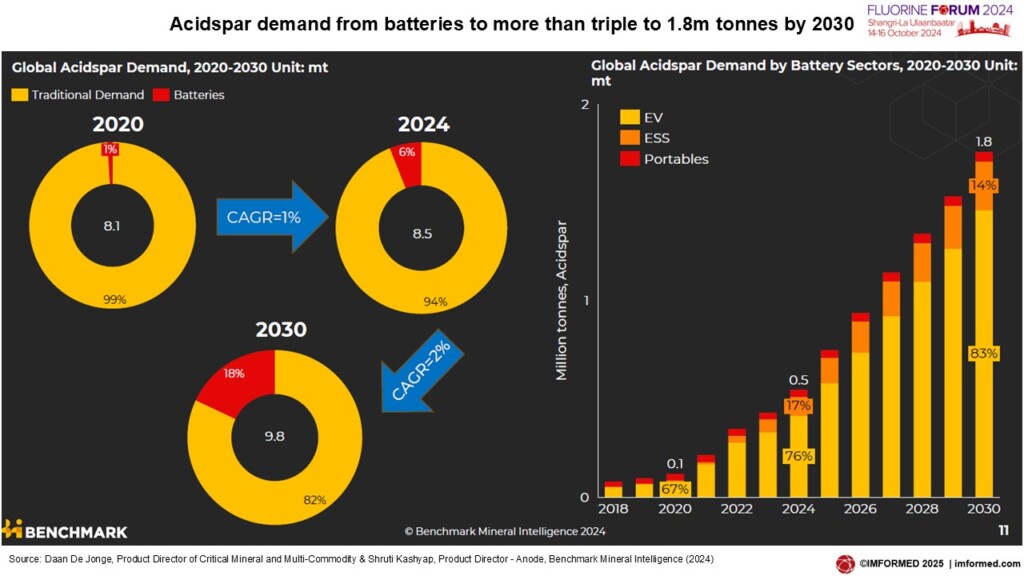

Benchmark Breakfast Briefing: Fluorine in the Battery and EV age

Daan De Jonge, Product Director of Critical Mineral and Multi-Commodity & Shruti Kashyap, Product Director – Anode, Benchmark Mineral Intelligence, UK

De Jonge and Kashyap kicked off early on the second day with a Breakfast Briefing covering all you needed to know about fluorine in the context of EV batteries.

Kashyap started with a look into how and why fluorine is used in Li-ion batteries (mostly in the electrolyte) before going on to demonstrate that this market demand for fluorspar is expected to grow as the battery industry develops.

Acidspar demand from the battery market is expected to more than triple to 1.8m tonnes by 2030, with the majority of demand (83%) from EVs.

She noted that the supply of fluorspar along with midstream and downstream products is limited to meet growing demand requirements, and although developing alternative sources of fluorine such as phosphate rock waste and recycling are emerging, these will not be sufficient to combat imminent supply shortages for fluorspar.

De Jonge concluded the briefing with a detailed review of the macro trends and factors shaping the outlook for the types of batteries of the future and their demand patterns.

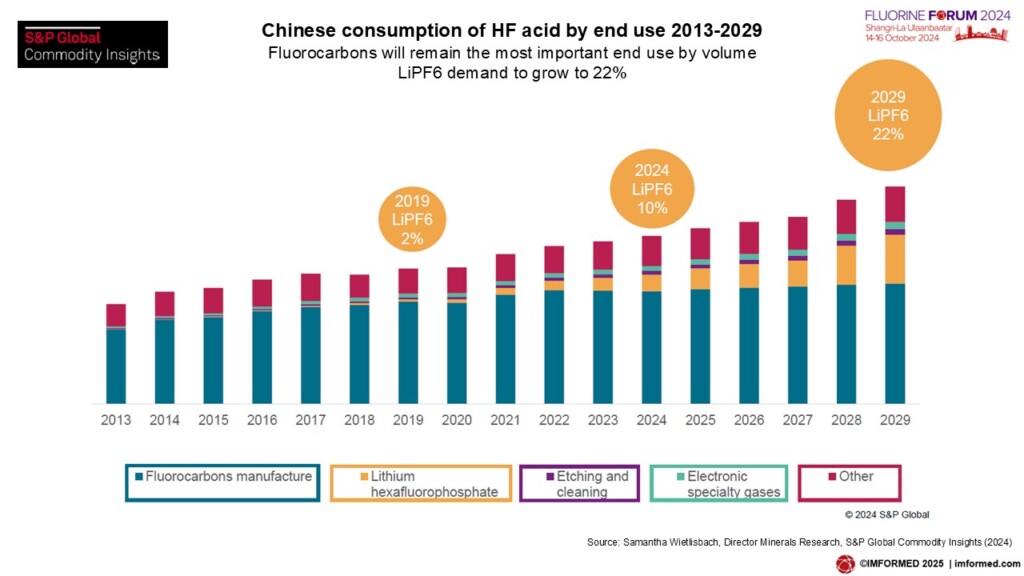

Hydrofluoric Acid: Accelerating the e-mobility journey – Asian Supply and Demand outlook for Li-ion batteries and inorganic fluorine chemicals

Samantha Wietlisbach, Director Minerals Research, S&P Global Commodity Insights, Switzerland

As usual Wietlisbach presented another excellent detailed review and outlook for fluorine chemicals.

She showed how fluorine chemicals are used in hydrogen fuel cells, Li-ion batteries, and photovoltaic applications, and illustrated how China is the major refiner and producer of fluorine Li-ion battery critical materials.

Fluorspar trade and HF demand was reviewed before a strong focus on the Li-ion battery market.

In China, demand for PVDF in energy transition applications will be the dominant sector by 2028, while in domestic HF consumption, although fluorocarbons demand will remain high at 55%, demand for LiPF6 (Li-ion battery electrolyte) will increase from 10% in 2024 to 22% in 2029.

Wietlisbach concluded that while the E-mobility journey is straightening out, there are still “many bumps in the road”, and that the market should expect continual evolution of speciality chemicals.

Fluorspar & HF supply through an economic lens

Alison Saxby, Research Director, Project Blue, UK

Saxby covered general economic drivers, global supply of acidspar and HF, costs facing acidspar and HF producers, and a look at why fluorspar is economically critical to world governments.

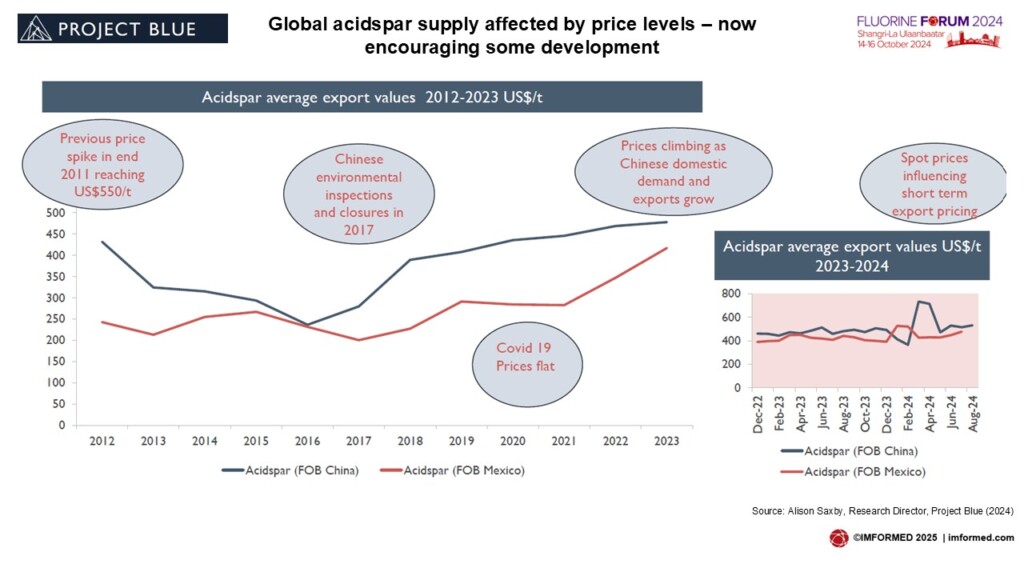

In reviewing acidspar, Saxby observed that global acidspar supply had been affected by price levels, which are now encouraging some development.

A breakdown of costs for acidspar production by country was illuminating, with a “typical medium sized” Chinese producer incurring some 41% share of costs from mining and processing, and labour at 24%.

Key takeaways included:

- China – still so central to the global fluorspar industry

- The energy transition – fluorspar is playing a critical role

- Climate change – the transition through to HFO

- Proposed total ban on PFAS in Europe

- Increasing electronic grade HF production

- New supply – projects aiming to meet future demand

Fluorite market & technology change in Japan

Hattori Junichi, Chairman, Wayo Fluorite LLC, Japan

Hattori explained how Japan relies on imports for all its supply of fluorite materials, with the typical breakdown by market share as: metspar 26,000 tonnes, acidspar 22,000 tonnes, hydrofluoric acid 97,000 tonnes.

Demand for high purity hydrofluoric acid for semiconductor applications (from around 20% to 25%) is increasing, fluoroplastic applications are increasing slightly. Although there is a decrease in applications for gasoline-powered vehicles, there is an increase in applications for fluoroplastic films for electric vehicles and semiconductors.

In recent years, the high-precision processing of semiconductors using nanoscale design rules has led to a dramatic increase in the required cleanliness of wafers and wafer processing environments. As a result, conventional RCA cleaning is no longer sufficient, and there is a growing demand for cleaning using high purity hydrofluoric acid and dry processes using HF.

However, Hattori noted that the manufacture of high purity hydrofluoric acid, which is essential for the semiconductor industry, is changing from processing acidspar to a method of purifying conventional hydrofluoric acid of around 5N purity through a distillation process.

MARKETS: STEEL | ALUMINIUM

Fluorspar’s key role in the steel industry: current status & outlook

Lungile Skhosana, Analyst, Project Blue, South Africa

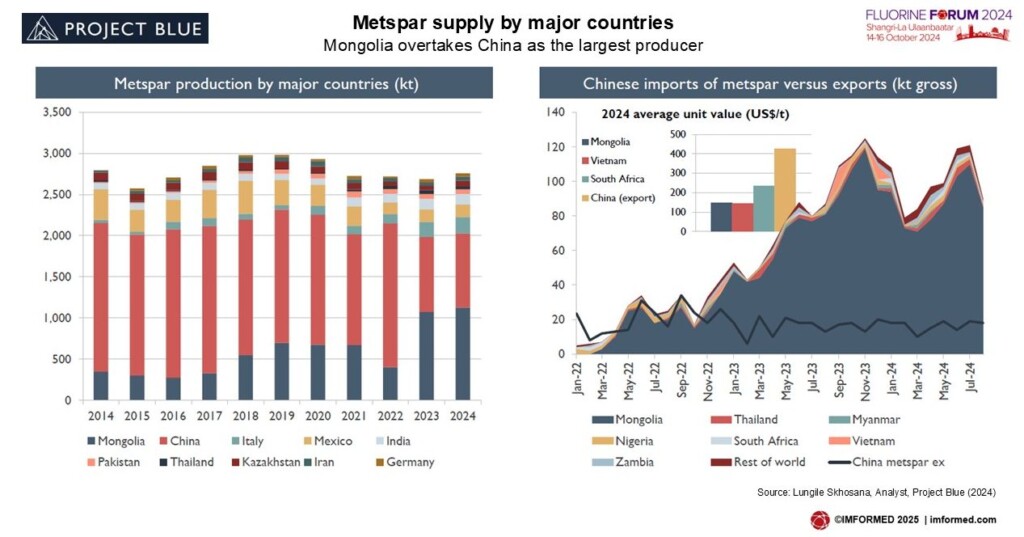

Skhosana provided an excellent review of fluorspar in the steel market. She covered the global fluorspar market 2024 (global metspar market, metspar supply), recent news in the steel industry (crude and stainless steel supply, Chinese steel supply), and supply outlook (the green steel race, steel and stainless steel outlook, metspar outlook).

Mongolia has overtaken China as the largest producer of metspar, producing >1m tonnes metspar in 2023 (Chinese metspar output also declined).

The impact on metspar from megatrends to 2050 was highlighted:

- Urbanisation – the continued growth of cities is one of the main drivers of growth for metspar through its use in steel.

- Demographic shifts – will continue to shape economic growth trends for metspar, specifically through growing demand for steel products and cement in construction.

- Climate change – The move to decarbonise the steel industry could cause some demand destruction for metspar. In cement, the addition of metspar lowers kiln temperatures, so its use could increase more widely.

- Technological breakthroughs – have some potential to redraw the metspar demand landscape as the steel industries move to green steel and increased DRI with hydrogen power. This could reduce demand for metspar in the longer term.

- Resource scarcity and energy security – metspar is relatively rare in economic resources at current price levels. China, the world’s biggest consumer, faces the most significant supply risk.

- Geopolitical power shifts – China has built a leading steel industry. The steel industry in China is at a potential ceiling and will shift industry growth to other regions, likely in SE Asia.

Production of aluminium fluoride from low-grade aluminium-containing raw materials

Dr Aleksei Morozkov, Deputy Director Dept. of Science and Technology, JSC “NIUIF”, PhosAgro, Russia

After providing a brief profile of NIUIF, Morozkov explained the formation of fluorine-containing waste in wet phosphoric acid production before looking at industrial methods for fluorosilicic acid disposal.

Experimental data confirms the possibility of obtaining aluminium fluoride (AlF3) from fluorosilicic acid (20-22 wt%) and Al2O3⋅nH2O (1<n<3).

AlF3 obtained from Al2O3⋅nH2O (1<n<3) corresponds to first grade AlF3 in all respects except the sulphate content.

To obtain AlF3 from Al2O3⋅nH2O (1<n<3) corresponding to the highest grade, it is necessary, in addition to purification from sulphates, to reduce the calcination temperature of AlF3 to reduce the pyrohydrolysis reaction of AlF3, which will reduce the content of free aluminium oxide and accordingly increase the content of the main component.

In the future, it is possible to consider Al2O3⋅nH2O (1<n<3) obtained by acid processing of nepheline concentrate as a replacement for aluminium hydroxide of metallurgical quality for the production of AlF3 from fluorosilicic acid.

Many thanks & hope to see you at Fluorine Forum 2025 in Baveno!

We are especially indebted to the support and participation of sponsors Mongolczechmetall, Wayo-Fluorite, Mongolian Minerals, Nahas Mining Energy Resources LLC, and the Mongolian Assoc. of Fluorite Miners, supporting partners, speakers, and delegates for making Fluorine Forum 2024 such a success, and ensuring a fruitful and most enjoyable time was had by all.

We very much look forward to meeting you again and repeating the experience at Fluorine Forum 2025, Baveno, Lake Maggiore, 22-24 October – we already have a full panel of confirmed speakers | Early Bird Rates available for a limited period!

Registration, Sponsor & Exhibit enquiries: Maria Bernard T: +44 (0) 208 153 0035 maria@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

A small party of delegates enjoyed a pre-conference visit to the spectactular Terelj National Park, via a stop at the impressive Chinggis Khan Statue.

Missed attending the Forum?

Free Fluorine Forum 2024 Summary Slide Deck Download hereA full PDF set of presentations available for purchase.

Please contact Maria Bernard T: +44 (0) 208 153 0035 maria@imformed.com

Don’t miss out!

Confirmed Speakers

Confirmed Speakers

Life Synfluor: circular economy applied to fluorine chemistry

Michele Lavanga, Special Projects Director, Fluorsid, Italy

Fluorspar supply & demand outlook

Alison Saxby, Research Director, Project Blue, UK

Fluorspar usage in cement production

Hakan Tamer, General Manager, Tamer Mining, Turkey

China’s fluorspar supply, demand & market review

Eileen Hao, Managing Director, Australia Minerals & Resources, Australia

Unlocking Silius’ geological potential: reserves upgrading of Europe’s largest fluorite deposit

Simone Cirinei, Mining Geologist, Mineraria Gerrai, Italy

Fluorspar’s future: Northern Mexico’s untapped deposits

Alberto Ramos, Managing Director, Grupo MIRASA, Mexico

Scaling-up HF-free production of fluorochemicals: New routes towards Li-ion battery electrolyte salts

Dr Gabriele Pupo, CEO, FluoRok Ltd, UK

Fluorochemicals review and market outlook

Samantha Wietlisbach, Head of Inorganics and Minerals Research, S&P Global Commodity Insights, Switzerland

HF in new energy applications

Oliver Rhode, Director Business Development, Alkeemia SpA, Germany

Production of fluorine from phosphate rock mine waste

Fluoralpha, Morocco

Nuclear renaissance & the impact on the fluorochemical value chain

Chris Potgieter, Director Business Development, BFluor Chemicals (Pty) Ltd, South Africa

New developments in AHF purification

Julian Mache, Technology Manager Fluorine, BUSS ChemTech AG, Switzerland

Fluorochemicals with irreplaceable applications in semiconductor materials processing

Dr Robert Syvret, Owner, Fluorine Chemistry and Technology, LLC, USA

HF & AlF3 from aluminium smelter waste

Dr Mark Cooksey, Managing Director & CEO, ABx Group Ltd, Australia