Review of Oilfield Minerals & Markets Forum Middle East 2018, Bahrain

Courtesy RheoMinerals Inc.

Key takeaways

-

Middle East growth recognised by oilfield service companies

-

Rising power demand drives push for unconventional gas resources

-

Drilling muds a delicate balancing act using minerals

-

Call for global standardisation of drilling barite specs “beyond API”

-

CS Mining Barite expands significantly in Turkey, Morocco, USA, Canada, UK

-

New concepts in mobile processing from Poittemill and ST Equipment & Technology

-

Fracturing activity rising: opportunity for proppant plant development

-

Chinese ceramic proppant capacity crashes from 200 to 15 plants with only 2 producing: domestic demand a challenge, let alone exports

-

“Super pozzolan” materials improve oilwell cements

-

Alternative source of Gilsonite from Iran

“The fact that I am able to come time and again and walk away with new found knowledge keeps me coming back”

Jerry McNamara, VP Operations, RheoMinerals Inc., USA

“Really provided good insight on this market and drivers”

Kumar Chenniappan, Senior Marketing Specialist, MA’ADEN, Saudi Arabia

The Middle East remains a major centre of oil and gas exploration and production, and consequently a significant consumer of a range of oilfield minerals used in drilling, completion, and well cementing.

Crucially, most of the oilfield minerals consumed in the growing oil and gas market in the Gulf Co-operation Countries (GCC) need to be imported.

The leading players and decision makers in this supply chain represent a select group which earlier this month gathered at IMFORMED’s Oilfield Minerals & Markets Forum Middle East 2018, held during 5-7 February 2018, at the InterContinental Regency, Bahrain.

The event led with a lively outdoor evening networking reception hosted by leading Chinese barite producer Guizhou Saboman Imp. & Exp. Co. Ltd.

Middle East a significant market for the future

Mike O’Driscoll, Director, IMFORMED, UK, started proceedings with a review of the oil and gas market, highlighting the main drivers and potential outlook for the Middle East region.

Both Schlumberger and Halliburton were highlighted as identifying solid growth prospects in the Middle East, while regional E&P majors such as ADNOC and Saudi Aramco had clearly stated their intentions to develop unconventional gas resources.

Saudi Arabia plans to be among the first countries outside North America to use shale gas for domestic power generation.

Unconventional gas has been considered the preferred fuel to meet the anticipated high increase in demand for power in the next few years, because of its increased efficiency and cleaner burning qualities compared to other fossil fuels.

Aramco is to spend US$300bn on oil and gas exploration over the next decade; its programme for unconventional gas resources is focused on three areas in Saudi Arabia: the Northwest, South Ghawar, and the Rub’ al-Kha.

Drilling muds: “a delicate balancing act”

In “The complexity and functionality of oil based drilling fluids and their mineral additives”, Michael Tate, Technical Sales Manager, RheoMinerals Inc., neatly dissected the composition and functions of drilling muds, highlighting fluid complexity and the challenge of quality minerals.

“Due to the complexity of maintaining a stable oil-based drilling fluid, sourcing quality mineral additives is imperative in a successful fluid application. The problems arising from using sub-par minerals can cause issues in the fluid to multiply exponentially.” said Tate.

Multiple formulations are used with each base fluid, and additives are used and adjusted based on the properties desired in the final fluid. Abrupt changes in fluid chemistry can threaten fluid stability and can impact the overall success of the drilling operation. “It’s a delicate balancing act.” concluded Tate.

Tate commented on the increased development of boutique clay-free mud systems using polymers, and while acknowledging that most systems would still use clays, it was up to clay suppliers to maintain attractive prices as they now competed more with polymers.

REGISTER HERE!

IMFORMED’s global conference for oilfield minerals supply and demand featuring our popular “Rockin’ Rodeo Reception” and introducing our new After Lunch Roundtable Networking Session

Confirmed speakers

Outlook for oil and gas supply and demand

Uday Turaga, CEO, ADI Analytics Inc., USA

Oilfield mineral demand and outlook in drilling fluids

Veronica Brown, VP of Supply Chain, QMax Solutions Inc., USA

The most common INCOTERMS mistakes that shippers and importers make

John Newcaster, Director Southwest, The Cumberland Group Inc., USA

Logistic challenges: rates rise as demand and regulatory constraints bite

Richard Dodd, President, RDC Logistics, USA

An emerging new frac sand supplier for Asia-Pacific markets

Murray Lines, Managing Director, Stratum Resources, Australia

North American proppants market trends and developments

Joel Schneyer, Managing Director, Minerals Capital & Advisory Practice, Capstone Headwaters, USA

Overview and outlook for the barite supply market

In-basin sands: changing the game for proppants and industrial applications

Dave Frattaroli, Executive VP, Higher Roller Sand Inc., USA

The Barytes Association, UK

Chinese barite supply, and the recent impact of environmental controls

Rita Hu, General Manager, Guizhou Saboman Imp. & Exp. Co. Ltd, China

Exploration and development of barite at Surprise Creek, British Columbia

Rene Bernard, Director, Mountain Boy Minerals Ltd, Canada

Evaluation of drilling grade barite: methods and mineralogy

Andrew Scogings, Consultant, Australia

Oilfield well cements: raw material demand

Claudio Manissero, President, ChemCognition LLC, USA

Separation technology for oilfield minerals: solutions for testing and mobility

Steve Gray, Consultant, ST Equipment & Technology LLC, USA

A revolutionary new concept in oilfield mineral milling: Mobility and Modularity

Jean-Francois Maréchal, Managing Director, Poittemill, France

Barite: specification overhaul | CS Mining expands

“Sustainable specifications for drilling grade barite: A question of balance” by John Newcaster, Director Southwest, The Cumberland Group Inc., debated whether the industry should accept a one size fits all barite specification (as is currently the API Specification 13A).

Key topics discussed included specifications for density, carbonates, iron, heavy metals, and reward for better stewardship.

Newcaster analysed the barite density grade shift progression in the US/Canada market to today’s “4.10 – the volume default, sub-4.10 gaining visible traction; 4.20 ‘premium grade’ for offshore”, while lamenting that “most other markets remain 4.20 for no technical reason.”

Newcaster called for a standardisation of drilling barite specs “beyond API” by globalising best practices, modifying when compelled by local and regional circumstances, and all balanced with risk-based assessment.

This would engender best practice procurement processes and drive barite exploration in the right direction, while attracting benefits of sustainability, cost, and a cleaner environment.

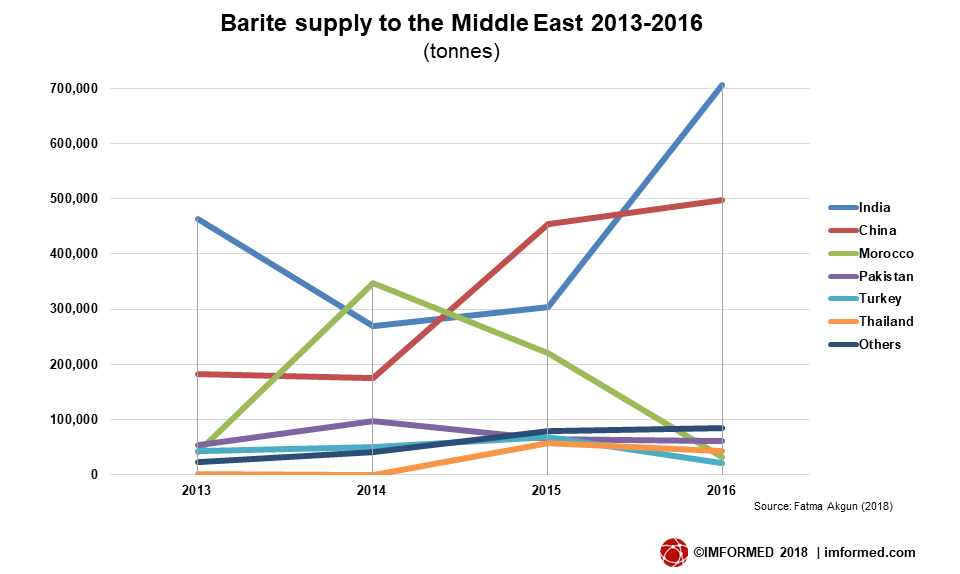

Fatma Akgun, Deputy General Manager-Business Development, Ado Mining, presented “Barite supply from Turkey and Middle East markets” reviewing the significant growth of CS Mining’s Barite Group now formed of nine companies located in Turkey, Morocco, Canada, USA and the UK.

The group has a combined barite mining capacity of 500,000 tpa, processing capacity of 300,000 tpa, and grinding and packaging capacity of 600,000 tpa.

Recent developments include the expansion of crushing and enrichment facilities at Baser Mining, Turkey, and a third mill added to Ado Morocco in 2017, while a third micronised mill was added to Baser in 2018. Ado Mining also opened offices in Calgary, Houston and Great Yarmouth, UK in 2017.

In 2019, the founder company of CS Mining Barite Group, Ado Mining, will be celebrating its 25th Anniversary.

Akgun then proceeded to give an excellent all round review of global and Middle East rig activity, also covering trade in barite to the Middle East, and barite exports worldwide from Turkey, concluding with some assumptions of the future of the energy sector.

New concepts in mobile processing units

The afternoon’s processing session was notable for its hosting of two presentations on innovative concepts in mobile units for oilfield mineral processing.

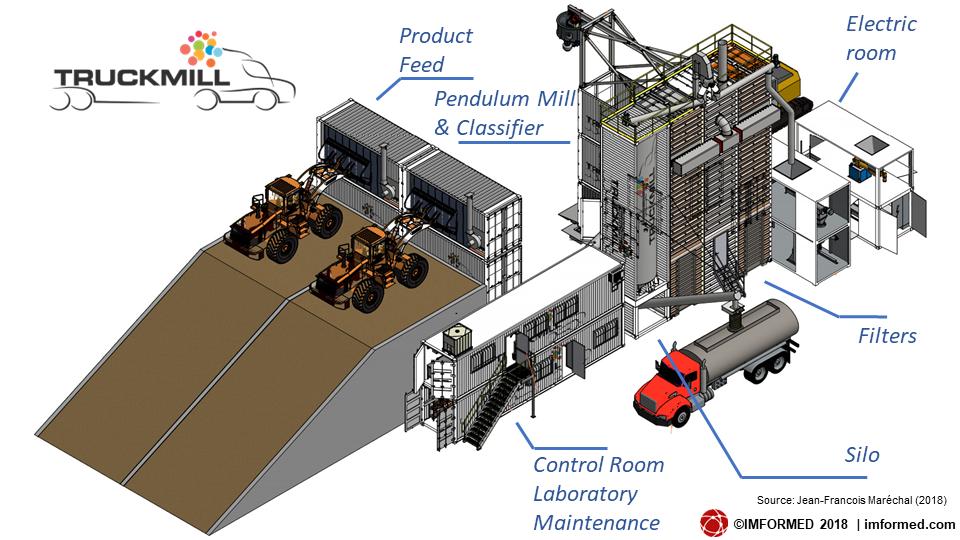

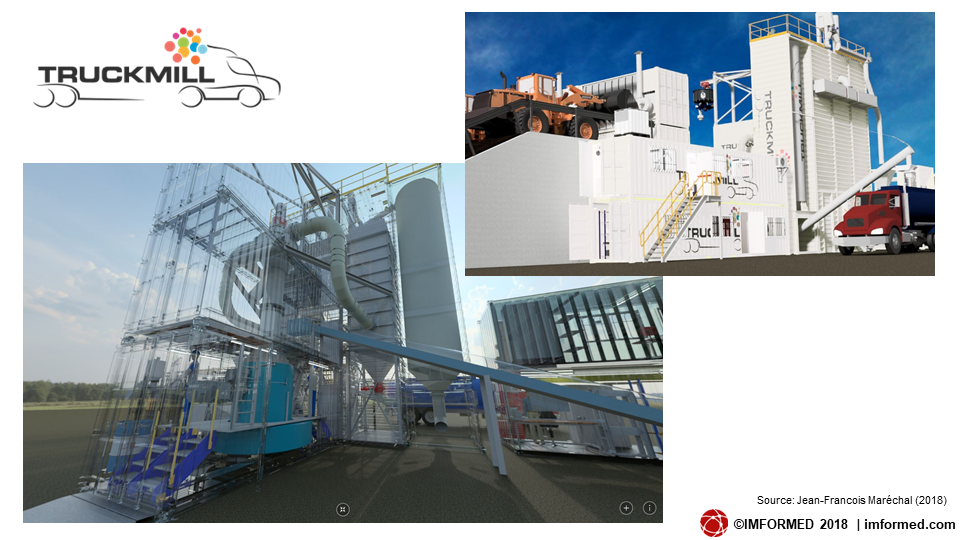

Jean-Francois Maréchal, Managing Director, Poittemill, presented “A revolutionary new concept in barite and bentonite processing: Mobility and Modularity” as the future of barite and bentonite processing.

Maréchal explained how Poittemill, in partnership with Steinbock Minerals Ltd, had worked over two years in developing a modular and mobile drying-grinding installation branded Truckmill, based on the Pendulum Roller Mill PM8 installation.

Each part of the installation is supplied in containers which are pre-wired, pre-cabled, and pre-connected to be adapted with other containers. Some 10-12 containers in total may comprise the finished mobile plant.

Benefits include no need for building or structures, no packaging, reduced assembly time of 5-10 days, in essence, a turn-key plant. Essentially an easy to set up, short investment, “plug in and play” installation for mineral processing needs.

In “New evaluation approach of processing barite for the oilfield drilling market”, Herve Guicherd, Director Business Development Minerals, ST Equipment & Technology LLC, demonstrated the company’s unique dry separation process using tribo electrostatic technology.

Guicherd highlighted commercial applications in talc, calcium carbonate and fly ash processing, as well as illustrating the successful operation of the STET M24 separator operating at Ramadas Minerals Pvt. Ltd’s barite grinding plant near Kodur, India (see below).

Coming on stream in February 2017, the plant is now routinely producing 4.1 and 4.2 SG product barite from low-grade 3.8 to 3.9 SG feed ore from APMDC’s Mangampet mine.

Guicherd also introduced three innovative options to assist customers with testing their samples: a benchtop separator, a pilot plant, and a new pilot scale evaluation testing unit to be transported by container to the customer’s site.

Courtesy STET

Panel Discussion: Market outlook

Day 1 concluded with a panel discussion addressing issues and trends in the outlook for oilfield minerals in the Middle East region. Highlights included:

Pickard Trepess, Managing Director, FRAC PT FZE, UAE: drew attention to the increasing trend of nationalisation of supply chains in the region, ie. incentives to use local sources, plants, and labour which can offer final price benefits of 5-10% less.

Jean-Francois Maréchal, Managing Director, Poittemill: considered that the market was certainly improving with raw materials seeing increased prices and leading to investments in plant technology and equipment.

John Newcaster, Director Southwest, The Cumberland Group Inc.: agreed that the market was in a good place at the moment, with cautious optimism; drilling activity is up which is a good sign for barite.

Herve Guicherd, Director Business Development Minerals, ST Equipment & Technology LLC: commented on depletion of the barite mines in Nevada, USA, and customers seeking alternative sources.

Proppants: fracturing activity on the rise | China CP capacity crash

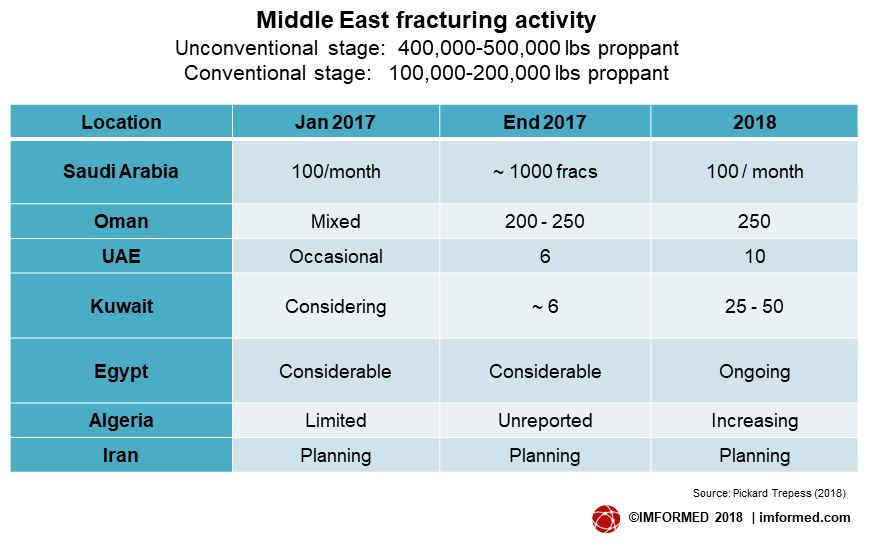

Pickard Trepess, Managing Director, FRAC PT FZE, presented “Proppant utilisation and outlook in the Middle East”, taking the audience through the principles of hydraulic fracturing, explaining why fracturing was taking place, and the level of activity from country to country.

Trepess highlighted Saudi Arabia, Oman and Egypt as the leading centres of activity with Jordan emerging as a newcomer and expected to be active later in 2018. UAE and Algeria is also expected to see more activity.

Trepess noted that Saudi Aramco was now completing 100 stages per month in deep shale treatments, and that there was an opportunity for a resin coated sand plant to be established in the country to meet its anticipated demand.

Indeed, Trepess was particularly passionate about the dearth of proppant plant development in general in the region, which, in his opinion, should have commenced ten years ago: “It’s about time for a ceramic proppant plant. The time is now!”

Regarding local sources of proppant raw material feedstock, Trepess commented: “A lot of local sand is contaminated with carbonate (seashells etc.) and clay. However, suitable silica sand exists in Saudi Arabia and Aramco wants to resin coat local sand.”

For ceramic proppants, local sources of bauxite used for aluminium are reportedly suitable for proppant production and may be exploited since importing material is an expensive option. Trepess noted that India could also be a potential source.

“The Good, the Bad, and the Ugly of Chinese ceramic proppants – what happened?” by Viviana Trevino, President, Changqing Proppant Corp. related the astonishing turnaround in the state of China’s ceramic proppant sector where domestic prices have increased by 52% and the number of operational plants have been slashed from 200 to just 15.

The “Good” has been the implementation of new environmental controls and inspections (driven by the “Make our Skies Blue Again” – Air Pollution Prevention and Control Action Plan which has so impacted other mineral sectors: see Dog Days ahead for Chinese mineral consumers?), and the enforced move from coal to natural gas fired plants, although accompanied by a shortage in natural gas.

The “Bad” has been the upshot that owing to the above, just 15 plants out of 200 have survived this crisis resulting in limited ceramic proppant output while at the same time domestic demand has increased and resulted in a 52% increase in awarded in-country bids – this is expected to rise further.

The “Ugly” – where do we go from here?

Trevino revealed that of the 15 surviving plants, only eight have passed their environmental inspections, and only two of the eight plants have continued production through the energy crisis.

This includes CQ Proppant as the second largest manufacturing plant with an expected total output in 2018 of 200,000 tonnes, equally split to serve domestic and export markets. CQ is evaluating the acquisition of another plant in China as well as changing to natural gas fired capacity.

Trevino estimated that the 2018 total output for Chinese ceramic proppant will be 1m tonnes. However, domestic demand is estimated at 1.5m tonnes and rising. Main consumers include Sinopec (500,000 tonnes), CNPC (700,000 tonnes), and others (300,000 tonnes).

Chinese ceramic proppant lightweight and intermediate strength grades ranging 20/40 to 40/70 mesh were priced between US$0.12-0.16/lb in mid-January 2018.

Pozzalans for cement | Iranian Gilsonite

“Natural pozzolanic material and its application in oil well cementing” by Dionysios Kotinis, General Manager, Imerys Minerals Arabia LLC explained the main elements of oilwell cementing and the range and functions of raw materials used.

Kotinis went on to highlight the pozzolanic extender materials used in oilwell cements such as fly ash, diatomite, silica fume, metakaolin, cenospheres, and glass bubbles.

He introduced ImerCrete, a new, natural lightweight “super pozzolanic” additive of volcanic glass origin from Greece which improves workability, durability, and pumpability of well cements.

Imerys Minerals Arabia, a joint venture with Eastern Trading & Contracting Co. (30%), completed its 76,000 tpa pozzolan plant in Rabigh in July 2017.

Gilsonite is a unique natural, resinous hydrocarbon which is commercially produced in very few places, notably the USA and Iran.

Owing to its unique compatibility, it is frequently used to harden softer petroleum products, and is graded by its softening point (a rough measure of solubility) and particle size. The colloidal sized particles produced are “squishy” and aid in controlling fluid loss and well-bore sealing in drilling fluids.

“Iranian Gilsonite supply and application in oilfield markets” by Hamad Nezam Zadeh, Managing Director, Payapa Setak Inc. described “Iranian Gilsonite” as a unique natural hydrocarbon high in asphaltenes and nitrogen compounds, a granular solid that is fully compatible with bitumen.

Payapa Setak Inc. of Iran, with a branch in Dubai, is the main supplier of Iranian Gilsonite (see deposit right) which is used in oilfield drilling applications as well as range of other uses such as foundry, chemicals, inks, coatings, and asphalt.

Thank you and see you in Houston!

As ever we are indebted to the support and participation of all of our sponsors, exhibitors, speakers, and delegates for making Oilfield Minerals & Markets Forum Middle East 2018 such a success.

We very much appreciate all the completed feedback forms and please continue to provide us with your thoughts and suggestions.

We shall keep you abreast with developments for next year’s event and look forward to meeting you again soon.

Meantime, we are preparing for our global oilfield conference Oilfield Minerals & Markets Forum Houston 2018, 6-8 May 2018 at the Hilton Houston Post Oak. Please see link for confirmed speakers and details. Early Bird Rate ends 23 March 2018!

Sponsor & exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

For programme, feedback, attendees, and picture gallery, please go to:

Oilfield Minerals & Markets Forum Middle East 2018

Missed attending the conference?

A set of presentations (as PDF) maybe purchased: Price £500 – please contact:

Ismene Clarke, T: +44 (0)208 224 0425; M: +44 (0)7905 771 494; E: ismene@imformed.com

REGISTER NOW!

Oilfield Minerals & Markets Forum Houston 2018

I really enjoyed reading this blog. I like and appreciate your work. Keep up the good work. Resin Coated Sand