Secondary Raw Materials to become more mainstream source for buyers

There is a sense that the recycling of industrial minerals in Europe is about to take a quantum leap during the next 5-10 years, boosted by European Commission and other initiatives, rising primary raw material costs, and the evolution of processing technology.

This trend has sparked increasing interest among certain mineral processors to invest in and develop production lines dedicated to recycling industrial mineral containing industrial wastes, or Secondary Raw Materials (SRM). We expect this sector to grow significantly over the next ten years.

Recovery of steel slag by Harsco Metals & Minerals for re-use in markets such as construction, fertiliser, and filter media. Courtesy Harsco Metals & Minerals.

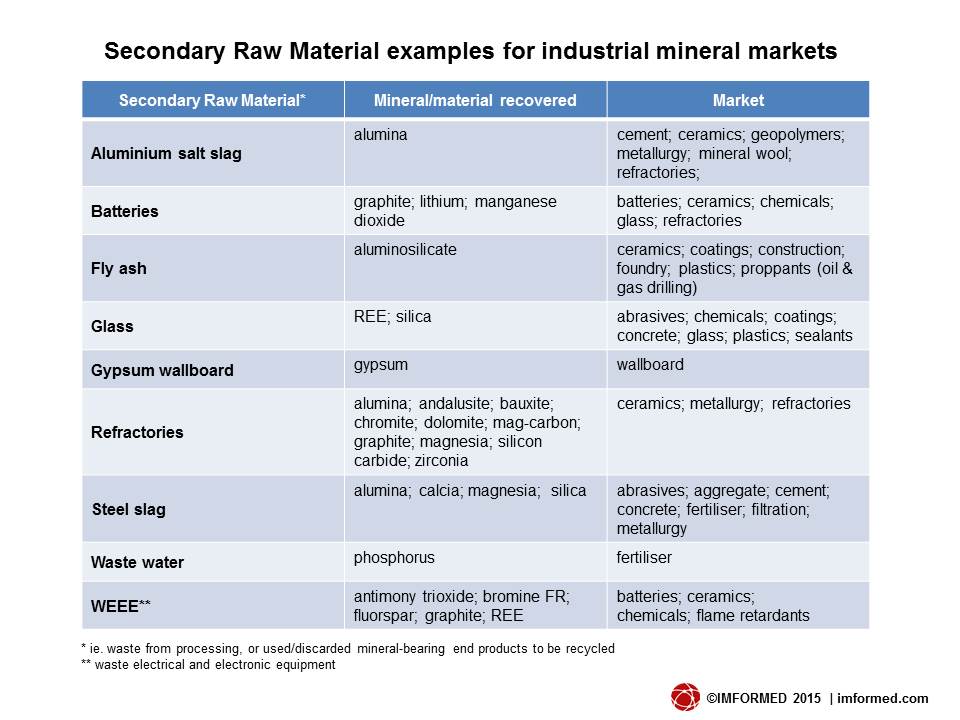

Leading SRM for industrial mineral markets include spent refractory bricks, steel slag, aluminium salt slag, fly ash, glass, construction products, and waste water.

Recycling of some these SRMs, particularly glass, fly ash, and slag, has already been well researched and established for some years, while others like refractory bricks and aluminium salt slag have been initiated, but have been held back to a certain extent by technical and economic factors, until relatively recently.

However, the level and sophistication of their recycling is now seeing a distinct uptick and these sectors are set for expansion.

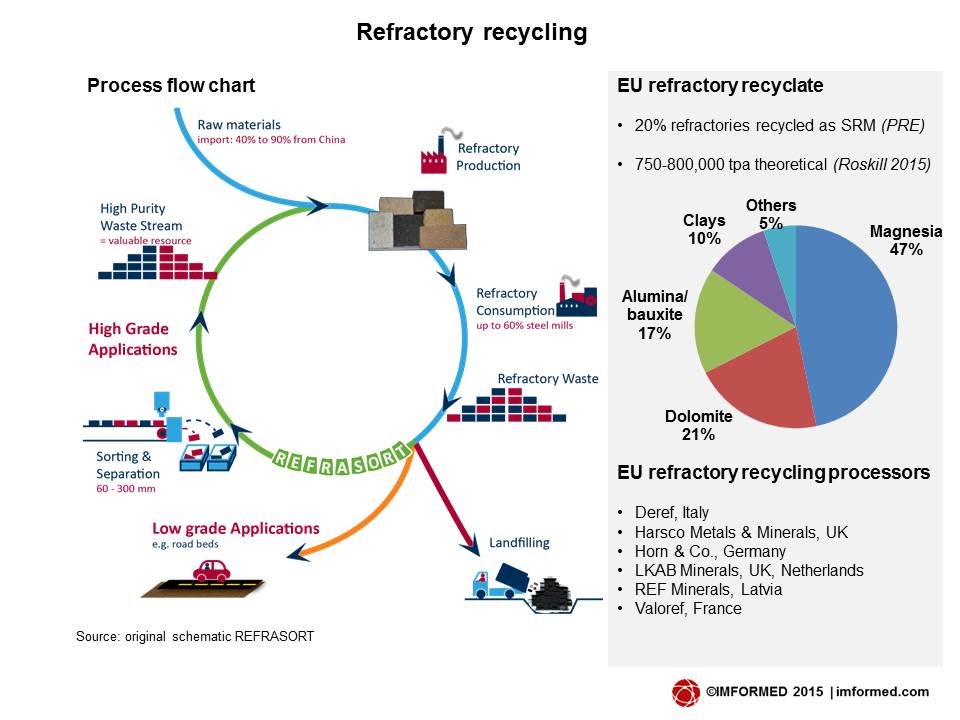

Recycling of spent refractories is being pursued with particular vigour, with refractory majors such as RHI AG, Austria declaring raw material substitution and recycling as an integral part of its Strategy 2020.

Meanwhile, refractory recycling processors are upgrading and expanding their facilities, such as Horn & Co. Group, in Germany, employing an automated sorting system supplied by Secopta GmbH, based on laser-induced breakdown spectroscopy (LIBS); and new plants, such as LKAB Minerals’ Moerdijk refractory recycling facility in the Netherlands, which opened in May 2015 after just seven month’s construction.

Horn & Co., LKAB, RHI, and Secopta are all presenting at IMFORMED’s

Mineral Recycling Forum 2016, 14-15 March 2016, Rotterdam

Welcome Reception Sponsor: LKAB Minerals

Sponsor: Horn & Co.

Another example, pulverised fly ash, generated from coal-fired power stations and municipal incinerators, has seen much use in cement, concrete and some filler applications over the years.

Recently, however, certain companies have been developing its use in other markets, such as EKO Export Inc. in Poland, importing and processing fly ash from Russia, Kazakhstan and Ukraine for casting, ceramics, and plastics (distributed by Mine Feuerfest); and LWP Technologies in Australia using fly ash in the manufacture of ceramic proppants for hydraulic fracturing of shale gas wells.

In China, rising demand for alumina has seen fly ash evaluated and used as an alternative source to bauxite. In October 2014, China’s first commercial plant for alumina extraction from fly ash by the limestone sintering method was brought on stream in Ordos, Inner Mongolia, by Inner Mongolia Mengxi High-Tech Group Co. Ltd. with 200,000 tpa capacity.

Recycling drivers – EC and other initiatives

If you have a few days or weeks to spare, one can wade through the swelling mass of websites and documentation dedicated to pushing forward the whole movement for increased recycling of SRMs and minerals.

The common denominator of course is the continuing evolution of sustainable development of natural resources and our striving to recycle as much as possible to help the environment.

There are many and varied relevant organisations and initiatives, but leading examples include the European Commission’s Raw Materials Initiative, launched in 2008, with one of its three Pillars being “Resource efficiency and supply of ‘secondary raw materials’ through recycling”.

Allied to this are other recent EC projects, such as “Moving towards a circular economy”, on which the EC is expected to present “an ambitious circular economy strategy in late 2015”; in April 2015 the EC published an interim “Circular Economy Strategy Roadmap”.

There is also the EC’s “A resource-efficient Europe”, described as a “Flagship initiative of the Europe 2020 Strategy”.

But the mother of all EC’s projects appears to be “Horizon 2020”: this mammoth undertaking has been described as the biggest EU Research and Innovation programme ever, with nearly €80 billion of funding available over 2014 to 2020. Seen as a means to drive economic growth and create jobs, Horizon 2020 has the political backing of Europe’s leaders and the Members of the European Parliament.

One of the Work Programmes of Horizon 2020 is “Climate Action, Environment, Resource Efficiency and Raw Materials”, to help increase European competitiveness, raw materials security and improve wellbeing.

One of the main focus areas is waste, supporting the transition towards a more circular economy, where the waste generated in one industry becomes a SRM for another industry.

IMA-Europe, the influential umbrella association for Europe’s industrial minerals industry, has also been playing its part by launching “Imagine the Future with Industrial Minerals 2050 Roadmap” in September 2014.

IMA-Europe estimates that at present up to 60% of all minerals consumed in Europe are recycled along with the glass, paper, plastics, or concrete in which they are used.

The Roadmap envisages a zero-waste business model in 2050, with a greater trend towards the formation of industrial clusters and industrial integration, to allow waste from one process to

become a valuable raw material for another. This would translate to a 20% improvement in recycling of industrial minerals.

Another area seeing increasing activity is the founding of various consortium-based projects and bodies tasked with researching and developing process flows and technology for specific SRM recycling.

Examples include:

- GtoG (GypsumToGypsum) transforming the European gypsum demolition waste market to achieve higher recycling rates of gypsum waste

- Mud2Metal recovery of critical metals from the bauxite residues (red mud) of the primary alumina refining industry

- P-REX Phosphorus Recovery & Energy Efficiency sustainable sewage sludge management fostering phosphorus recycling and energy efficiency

- ProSUM Prospecting Secondary raw materials from the Urban Mine and Mining waste will deliver the First Urban Mine Knowledge Data Platform, a centralised database of all available data and information on arisings, stocks, flows and treatment of waste electrical and electronic equipment (WEEE), end-of-life vehicles (ELVs), batteries, and mining wastes.

- RARE³ the KU Leuven Research Platform focusing on advanced recycling and reuse of rare earths and other critical metals

- REFRASORT automated sorting of spent refractories for high grade recycling

- WEEE Forum a platform for producer responsibility organisations to take on the challenge of electrical and electronic waste in Europe by fostering ideas and sharing best practices

Issues to be addressed

But it’s not likely to be plain sailing for all these schemes. It was notable that in April 2015, IMA-Europe, on behalf of 11 other major European industrial mineral and metal trade associations sent a signed detailed letter to the EC expressing their support for the circular economy initiatives but at the same time outlining their concerns over the handling and interpretation in certain areas.

These included the existence of technical, economic and environmental limitations, and sector specifics and local contingencies. The signatories warned against the pitfalls of a generic and non-integrated approach, emphasising the importance of recognition of full product life-cycles and trade-offs.

Another thorny issue is that of the regulatory framework in dealing with waste. The EC itself has acknowledged: “There is often a huge gap between the letter of the law and the regulatory reality when it comes to waste markets.”

This prompted the EC earlier this year to issue a consultation on the functioning of waste markets in the EU (which closed 4 September 2015); the aim being to obtain a better understanding of the nature and the extent of regulatory failures causing undue distortions to EU waste markets for recycling and recovery.

Under existing EU rules, waste to be prepared for re-use, recycled or subject to other recovery activities should move freely within the EU, without any unjustified restrictions. However, in some cases regulatory failures resulting from policy and legislative action at EU, national, regional or local level may hinder the efficient functioning of waste markets and fail to ensure the optimal implementation of the waste hierarchy.

Clearly, in tandem with the development of the mineral recycling sector, EU legislation and regulation needs to be clear, coherent, beneficial, and realistic.

What does it all mean for the minerals industry?

Well, to start with, raw material purchasing managers of the mineral consumers are going to see SRMs become a more visible and feasible alternative to primary raw materials. It’s early days, but eventually, SRMs will be on the same menu as primary mineral sources.

Right now, SRMs are unlikely to make a significant dent into sales of primary raw materials, but in the not too distant future their share in the raw material supply market is likely to increase.

For primary industrial mineral suppliers, it’s certainly a sector to keep a watch on, as they may see increasing substitution of their products by SRMs. There may be opportunities here for offering packages of blended SRMs and primary minerals for certain market applications.

The mineral logistics sector, with its traders, distributors, handling, and storage companies, should be viewing this sector as a new growth market with increased demand for transporting SRMs from source to processor to consumer.

Already, certain freight companies are having to adapt systems to accommodate industrial waste transport – this demand is only going to get bigger.

One of the persistent factors influencing the development of SRMs has been the stigma of the recycled end product having been sourced from “waste” – a term that conjures up impressions of material containing dreaded impurities with a toxic glow.

The antidote to this over the years has been the advances in processing technology and quality control systems, both from a technical and economic standpoint, which has enabled the likes of Horn & Co. and other processors to demonstrate to customers that their products are clean, and above all, make specification.

In particular, the advent of laser-induced breakdown spectroscopy (LIBS) used in sensor sorting systems has attracted much interest in the recycling of refractories.

For the end users, the consumer of SRMs, assuming desired raw material specifications are met, it’s a great, green future.

It will lessen high levels of reliance on scarce, threatened, or inconsistently available and priced primary raw material sources; give the buyer a range of competitively priced options; and provide that neat green tick to the company’s environmental strategy of helping sustainable development of the world’s natural resources.

The real trick/challenge of the SRM supply chain

But just a cautionary note: naturally, as with ALL supplies of raw materials to industrial mineral markets, whether primary or SRM, the fundamental requirement is that the material must maintain high consistency in required quality and volume availability.

So just as, say, a silica sand mine supplying a glass plant, needs to maintain its quality and supply of silica sand by continually evaluating and proving its reserves and resource, and perhaps selectively mining, a refractory recycling or aluminium slag recycling processor, in turn, will also have to ensure security of its “resource”.

Obviously, this resource is not a mineral deposit, but is the supply or recovery of a particular industrial waste, the SRM, ie. spent refractories and discarded slag in this example.

So the real challenge for this evolving mineral recycling sector will be in maintaining and securing its supply of SRM so that it can guarantee consistent recycled products to its customers.

Going forward, we are therefore likely to see more alliances, or rather, strategic partnerships (and certainly more competition for them) spring up between SRM providers such as steel, non-ferrous metal, and cement plants, in the case of recycled refractories for example, and the recycling processors.

So hold on to your seats – and your SRMs – it’s going to be an exciting ride over the second half of the decade.

PDF download of this article

All the trends, developments, and challenges facing the mineral recycling sector are to be examined and discussed at IMFORMED’s

Minerals Recycling Forum 2016, 14-15 March 2016, Rotterdam.

Presentations covering some of the topics discussed in this article have already been confirmed, with more to come.

There are attractive Early Bird Registration options and opportunities for sponsorships – please contact Ismene Clarke T: +44 (0)7905 771 494; ismene@imformed.com

This is an ideal and invaluable opportunity to take stock of this important mineral sector of the future.

Leave A Comment